How Do You Reach Your Out

Your deductible is part of your out-of-pocket maximum . This is the most youll pay during a policy period for allowed amounts for covered health care services.

Other cost-sharing factors that count toward hitting your out-of-pocket maximum:

- Copayments: Fixed dollar amounts of covered health careusually when you receive the service. .) Your plan determines the price of your copay and whether its owed before or after you meet your deductible.

- Coinsurance: You likely wont pay coinsurance, calculated as a percentage of shared costs between you and your health plan, until your deductible is met. Typical coinsurance ranges from 20 to 40% for the member, with your health plan paying the rest.

Your premium and any out-of-network costs dont count toward your out-of-pocket maximum.

Once your deductible and coinsurance payments reach the amount of your out-of-pocket limit, your plan will pay 100% of allowed amounts for covered services the remainder of the plan year.

What Expenses Go Toward An Out

Most health costs go toward your MOOP, but not all of them. Those excluded are as follows:

- Any service your plan doesnt cover

- Service and care from out-of-network providers

Timing can be crucial. Lets say you have a $2,500 deductible, an $8,000 out-of-pocket max and 20% co-insurance. In January 2022, youre involved in an accident and rack up $20,000 in medical bills.

Youll hit your calendar year out-of-pocket maximum once you pay $8,000. Your insurer pays for the rest and will continue to shoulder covered expenses until the year ends.

However, the only expenses your insurance provider would shoulder above your MOOP are those incurred within the month if the same accident happened in December.

What Applies to Your Out-of-Pocket Max

In addition to the type of plan you purchase, where you get your health insurance also affects how much deductible or MOOP you have. Remember, you dont always have to buy your policy from the marketplace.

You may qualify for Medicare, Medicare Advantage or Medicaid. You may be eligible for health insurance sponsored by your employer.

An excellent strategy to determine the best health insurance plan for you is knowing how much you can afford to pay if you experience a major medical emergency.

How High Can Out

Although deductibles and out-of-pocket maximums vary by plan, all plans that meet Affordable Care Act standards set a yearly limit on how high out-of-pocket maximums can go. This year, the IRS defines high deductible health plans as those having a deductible of at least $1,400 for individuals or $2,800 for families. For 2022, out-of-pocket maximums cant surpass $7,050 for an individual plan and $14,100 for a family plan. Costs incurred for out of network health care services do not count towards these figures.

Recommended Reading: Who Accepts Bright Health Insurance

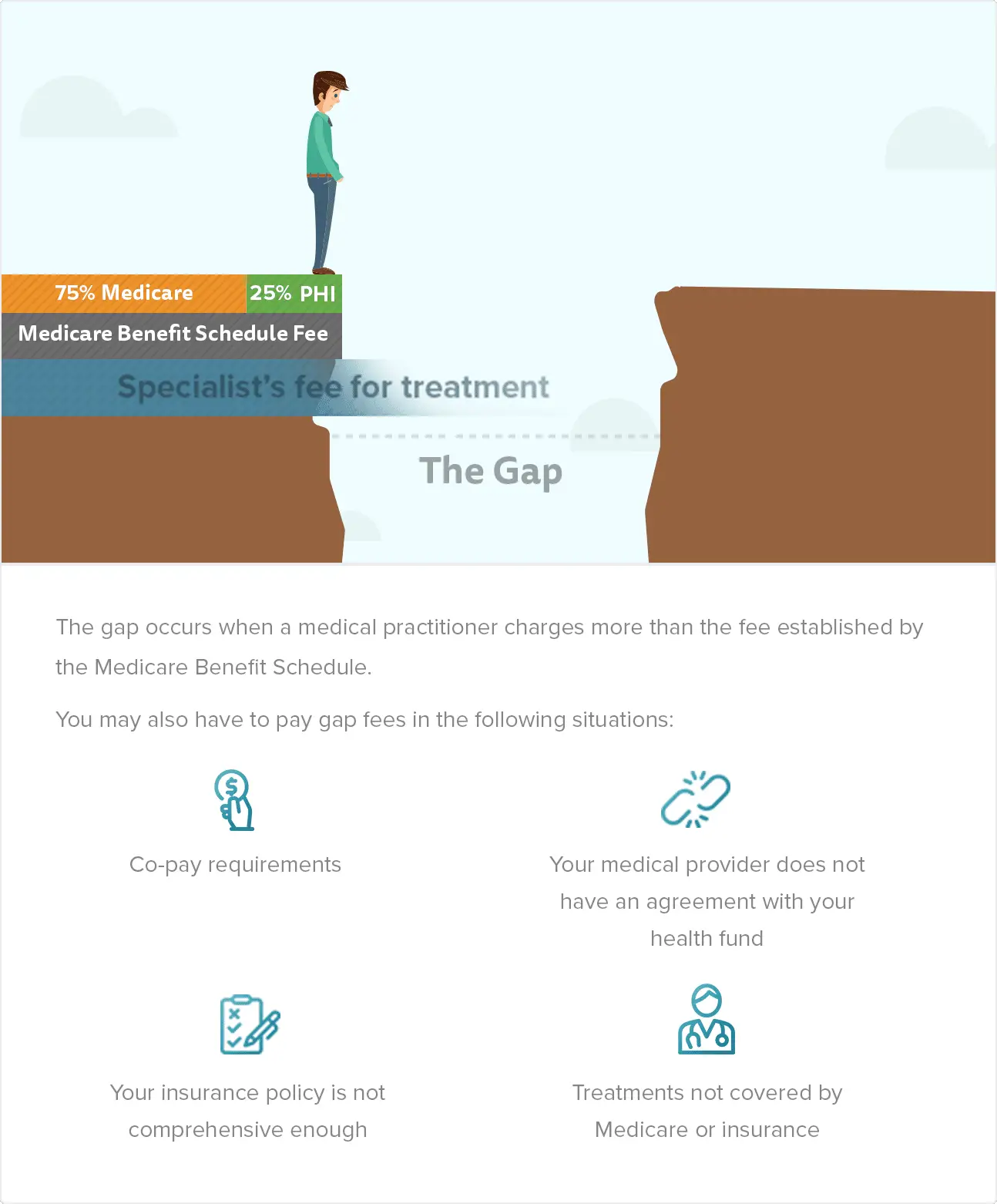

Bupa And Medicare Will Pay

If your specialist charges the MBS fee

Specialist charges

MBS fee covered by Bupa and Medicare

What you pay out of pocket

If only the MBS charge is applied, this should result in $0 out-of-pocket

This chart displays the range of out-of-pocket costs experienced by Bupa members in your state for this major surgical procedure item number. Your potential out of pocket cost for the specialist performing this major surgery/treatment is shown in blue on this chart.

These costs relate to your medical specialist only. Please check your hospital cover to see what youre covered for and ask your specialist about any other cost that may be associated such as an anaesthetist.

Please note that there may be variances to the range set out above. It is calculated on the basis of the most common outcomes. This is based on our internal data analysis of average outcomes experienced by Bupa members over the course of a 12 month period, and will vary from state to state.

If your specialist uses the Bupa Medical Gap Scheme

Specialist charges

Together, Bupa and Medicare pay

What you pay out of pocket

The costs you pay and how youre covered for things like your accommodation, use of the operating theatre, medication in hospital, or prostheses are separate. Please see our Important Information Guide, or Health System Guide for more information about this.

If your specialist doesnt use the Bupa Medical Gap Scheme

Specialist charges

MBS fee covered by Bupa and Medicare

What you pay out of pocket

What Happens When You Reach Your Deductible

After spending enough to hit the deductible, your insurance company generally starts to split costs with you through copayments or coinsurance. A copay works as a fixed cost for a specific service, like $15 every time you fill a prescription for a brand-name drug. Coinsurance is the percentage of the cost that you and your insurer each have to pay. For example, a 20% coinsurance means you will have to pay 20% of the final medical bill and the insurance company pays 80%.

Once a new year starts, your spending resets and you will need to reach the deductible anew for your insurance to cover costs.

Recommended Reading: Does Health Insurance Cover Birth Control Pills

Do Most People Meet Their Out

How you use your health plan and what you need coverage for both matter when it comes to meeting your out-of-pocket maximum:

- If youre generally healthy and only get your annual check-up, you may not even meet your deductible. Your health plan pays for most preventive care, so youd have few costs.

- If you need a lot of medical care thats not routine then your medical bills could add up. In this case, its possible you could reach your out-of-pocket maximum.

The out-of-pocket maximum is the most youll pay in a plan year before your plan starts covering your care. Its important to understand how an out-of-pocket maximum works with the rest of your health plan, including the deductible, coinsurance, and copay . When choosing a health plan, make sure you consider all these factors, as well as your expected health needs.

Maximum Out Of Pocket Information

To find your maximum-out-of-pocket limits, 1, select Benefits from the left navigation menu, and view your Summary of Benefits under Health Plan Documents.

Most Optima Health plans limit the dollar amount you will have to pay during your plan year. The maximum-out-of-pocket amount or limit is the total amount you and/or your dependents will pay out of pocket for Copayments, Coinsurance, and Deductibles during a plan year. Your specific maximum amount is determined by your plan benefits and can be found on your Optima Health FaceSheet or Schedule of Benefits in your Evidence of Coverage or Certificate of Insurance.

Depending on your health plan, Copayments, Coinsurance, and Deductibles you pay for certain services count toward this amount. Your specific plan may have separate maximum amounts for in-network services and out-of network services. Some out-of-pocket expenses do not apply to the maximum amount. A list of health services that do not count toward your maximum amount is listed on your FaceSheet or Schedule of Benefits. For those services, you will still have to pay your Copayments, Coinsurance, and Deductibles even after you have reached your maximum amount.

Should you have any questions or believe you are entitled to a refund for an overpayment against your maximum amount, please contact member services at the number on the back of your member ID card.

1Registration is required to access your account features.

Also Check: Who Can Purchase Health Insurance Through The Marketplace

What Happens After My Out

You may wonder if youll still have cost sharing, such as copayments, after youve met your out-of-pocket maximum.

As mentioned, you may owe copayments or coinsurance for covered medical services, and these types of cost sharing expenses count towards your out-of-pocket cap. Once youve reached your yearly limit, your insurance generally pays 100% of covered medical expenses. So, you wont owe further cost sharing for the rest of the year.

What Is The Difference Between A Health Insurance Deductible Vs Premium

A health insurance premium is what you pay to have health insurance, while a deductible is what you spend on health care services before your health plan chips in money.

Both play a role in how much you pay for health insurance. A lower deductible typically comes with a higher premium and vice-versa. If you want to pay less for health insurance, choosing a high-deductible health plan , which generally has lower premiums, is a way to save money upfront.

Read Also: What Area Of Group Health Insurance Is Regulated Under Erisa

How Much Does An Mri Cost Out

The cost of an MRI depends on the type of procedure and where you have it . For example, the national average cost for an MRI of a lower extremity’s joint was between $185 and $301 in 2022, while an MRI of a brain averaged from $301 to $487. These estimates only account for a single visit, and they don’t include physician fees if you need a referral.

Moving And Relocation Expenses

Moving expenses, according to the IRS, are costs the taxpayer incurs as a result of relocating for a new job or transferring to a new location. However, the TCJA eliminated the deduction of moving expenses for tax years 2018 through 2025, except for members of the military on active duty who move as the result of a military order.

Members of the armed forces can use IRS Form 3903 to claim the cost of moving expenses as federal income tax deductions.

Active-duty members of the U.S. military can deduct moving expenses if they incurred them in response to a military order that requires a permanent change of station. The expenses that qualify include the cost of packing, crating, hauling, in-transit storage, and insurance.

If the government provides and pays for any of your moving or storage expenses, you should not claim these expenses as a deduction on your taxes.

You May Like: What Is A Good Cheap Health Insurance

How Much Is A Typical Deductible

The average health insurance deductible is between $1,902 and $4,786 for plans purchased on the health insurance marketplace. Those who get their health insurance through an employer typically have lower deductibles, and the average deductible is $1,644 for covered workers.

However, there is a full range of possible plans with different deductible amounts. On one end, there are no-deductible health insurance plans where the cost-sharing benefits of your insurance policy begin right away. In contrast, high-deductible health plans mean that you’re responsible for a large portion of your health care costs before the insurance company contributes.

Deductibles can also vary based on the number of people in the household who are covered. In these cases, deductibles are tracked both by individual and by family. If an individual reaches their deductible, the cost-sharing benefits begin for that person only. If the family deductible is reached, cost-sharing benefits begin for everyone in the household.

Counts toward your deductible

- Amount spent on covered doctors, treatments and health services

- What you spend on copayments or coinsurance

Excluded from your deductible

- Amount spent on monthly insurance bills

- Spending for out-of-network services or other uncovered health services

How Much Does Managing Chronic Illnesses Cost Without Health Insurance

Because it can be so expensive to manage a chronic illness, those without insurance have been found to seek treatment far less than those with insurance. The ADA, for example, found 60% fewer doctor visits and 52% fewer medications in people with diabetes without insurance. But that comes with a price: 168% more visit to the ER than a person with insurance.

For those suffering from depression, the costs are just behind diabetes as the second most costly condition, according to the American Psychological Association. Another 21% of medical expenses are directed toward obesity-related illnesses. As you can see, chronic illnesses can be expensive.

Don’t Miss: What Is A Health Insurance Plan

How Much Is A Typical Out

For those who have health insurance through their employer, the average out-of-pocket maximum is $4,039.

The out-of-pocket maximum for plans on the health insurance marketplace is usually higher than plans through an employer. However, the federal limit on an out-of-pocket maximum prevents it from becoming too high. In the current year, the out-of-pocket maximum can’t be higher than $8,700 for an individual and $17,400 for a family for all insurance plans on the health insurance marketplace according to the final HHS rule. The federal limit is updated annually by the Department of Health and Human Services .

Counts toward your out-of-pocket max

- Payments toward deductible

- What you spend on copayments or coinsurance

Excluded from your out-of-pocket max

- Amount spent on monthly insurance bills

- Spending for out-of-network services or other uncovered health services

Is It Good To Have A $0 Deductible

If you anticipate to require substantial medical treatments throughout the coverage term, health insurance with a $0 deductible or a low deductible is the best alternative. Even while these plans are often more costly to acquire, you may end up paying less in the long run since the insurers cost-sharing benefits kick in right away.

Read Also: How Much Is Health Insurance In Indiana

Does The Deductible Apply To The Out

First, its important to understand how to meet your deductible. Preventive care services like annual checkups are often provided without an additional consumer cost via health plans, and therefore dont contribute toward meeting your deductible. Although it varies by plan, prescription drugs might count toward a separate prescription benefit deductible. Costs of hospitalization, surgery, lab tests, scans, and some medical devices usually count toward deductibles.

In-network, out-of-pocket expenses used to meet your deductible also apply toward the out-of-pocket maximum.

The monthly premium does not apply to either the deductible or out-of-pocket maximum, meaning that even if you reach your out-of-pocket maximum, youll still have to continue paying the monthly cost of your health plan to continue receiving coverage from your insurance company.

Services received from out-of-network providers also dont count toward the out-of-pocket maximum, nor do some non-covered treatments and medications. Once the out-of-pocket maximum is met, policyholders should not have to pay any costswhether thats copayments or coinsurancefor any and all covered in-network medical care.

| Deductible vs. out-of-pocket maximum: What counts? | |

|---|---|

| Counts | |

|

|

|

I Am Now Unemployed How Can I Find Health Insurance

Health coverage options are available for people who have recently been laid off or lost their employer sponsored health insurance benefits:

- Granite Advantage Health Care Program: Medicaid Expansion coverage for no or low income individuals, ages 19-64

- Childrens Medical Assistance

Granite Advantage/Medicaid

You can enroll in the Granite Advantage Program or other Medicaid Programs if you are low or no income and need health coverage. There are also Medicaid programs available for children, pregnant women, and the medically frail.

- Learn more about the Granite Advantage Program

- Enroll in the Granite Advantage Program or Medicaid coverage through NH Easy or HealthCare.gov.

- There are several Medicaid Managed Care plans to choose from. Do your research to make sure that the plan you choose includes your preferred medical providers.

Health Insurance Marketplace

You can purchase medical and dental plans for yourself and/or your family on HealthCare.gov.

- How do I know if I qualify for the Marketplace outside of the Open Enrollment Period?

- HealthCare.gov provides Special Enrollment Periods for people who may have recently lost their employer sponsored health insurance coverage.

- You can apply for the SEP 60 days before they know their coverage will end and 60 days from the date you lost coverage.

- If you do not apply 60 days from the date your health insurance terminated, you will not be able to take advantage of the SEP.

Need Help?

Also Check: Can You Add Spouse To Health Insurance

What Does It Mean To Have A $0 Deductible

Having zero-deductible car insurance means you selected coverage options that don’t require you to pay any amount up front toward a covered claim. For example, say you opted for collision coverage with no deductible. If you have a covered claim for $1,500 in repairs, your insurer would reimburse you the full $1,500.

What Counts Towards The Out

Three types of out-of-pocket expenses count towards your out-of-pocket maximum:

-

Annual deductible

Your monthly premium does not count towards your out-of-pocket maximum. Even if you hit your out-of-pocket limit, you still need to continue to pay your premium.

The out-of-pocket maximum also excludes services that arent covered by your health plan. For example, if health insurance doesnt cover an emergency room visit, then it wont begin to do so even after you reach the out-of-pocket limit.

Similarly, whether or not the cost of preventive services and prescription drugs count towards the out-of-pocket maximum will depend on how your health plan covers this type of care to begin with.

And check out our study on where people pay the most for an Obamacare health plan.

You May Like: Where Can I Purchase Affordable Health Insurance

Cheapestepo/hmohealth Insurance Plan In Texas

Your healthcare preferences and needs can help you determine the type of plan to purchase. In Texas, most plans are Health Maintenance Organization plans. The state also offers Exclusive Provider Organization plans.

HMO plans usually require you to stay in your provider network to have services covered, but they often have lower premiums. EPO plans are similar to HMO plans, but unlike HMOs, they may not require a referral to see a specialist.

MoneyGeek found that the cheapest Silver plans for each plan type are:

- HMO: The MyBlue Health Silver 405 plan offered by Blue Cross and Blue Shield of Texas. The average 40-year-old will pay $390 per month.

- EPO: The Friday Silver plan offered by Friday Health Plans. The average 40-year-old will pay $431 per month.

Also Check: Does Insurance Cover Baby Formula