Q What If My Photo Health Card Is Lost Stolen Or Damaged

You can call the ServiceOntario INFOline at 1-866-532-3161. For TTY service, call 1-800-387-5559 to report your lost, stolen or damaged health card.

If the card is a photo health card you will be sent a new one right away but if there are additional changes to your information, like an address change or name change, then you need to visit a ServiceOntario centre.

For information regarding ServiceOntario centres in your area call the ServiceOntario INFOline at 1-866-532-3161.

If you find your reported lost or stolen health card, keep it only until your new photo health card arrives in the mail and then destroy the old health card because it will no longer be valid. Make sure you have your new photo health card before destroying the old health card.

Beware Of Alternative Types Of Health Insurance Or Outright Fakes

Medical discount plans are not insurance

These plans claim to offer discounts for members who use certain doctors, pharmacies and hospitals. Verify these claims with those providers before buying.

While these plans are not insurance, they are regulated by the department. Call our Insurance Consumer Hotline to verify the plan is registered as required by Missouri law.

Bogus health plans

You may see ads on late-night TV, in spam or in junk faxes offering unbeatable low prices on group health coverage. Many of these are unlicensed, illegal operations. You can find out if these companies are legitimate with a quick phone call to our department. As with most products, if a deal sounds too good to be true, it probably is.

Who Qualifies For Coverage

Typically, employees working 30 or more hours per week will qualify for coverage under a groups health plan. However, an employer may offer coverage to an employee working less than 30 hours per week so long as the coverage is being offered to all similarly situated employees. An employer may not discriminate amongst similarly situated employees for any reason, especially for past or current medical issues.

Don’t Miss: Starbucks Medical Insurance

Coverage Unaffordable Or Too Skimpy

If an employer does offer coverage but its not affordable and/or doesnt offer minimum value, the employer would face a penalty if any full-time employees end up getting a subsidy in the exchange.

- An employer-sponsored plan is considered unaffordable if the employee contribution for premiums is more than 9.83% of household income in 2021 for employee-only coverage .

- To provide minimum value, an employers plan has to cover at least 60% of average expected medical costs, and provide substantial coverage for inpatient care and physician services.

If an employers plan is unaffordable and/or doesnt provide minimum value, the employer would face the lesser of two penalty options: $4,060 per employee receiving premium subsidies in the exchange , OR the $2,700 per full-time employee penalty described above.

Consider a business that has 120 full-time employees and offers coverage, but its either not affordable and/or doesnt provide minimum value: If 70 employees get subsidies in the exchange in 2021, the employer would pay a penalty of $243,000 for the year x 2,700 = 243,000, since thats smaller than the alternative penalty calculation .

But if only 20 of the employees get subsidized coverage in the exchange, the employer would pay $81,200 for the year , since thats smaller than the alternate calculation of x 2,700, which would be $243,000.

What Types Of Plans Are Available For Small Businesses

There are several types of health insurance plans a small business owner can purchase. Some plans provide comprehensive major medical coverage, while others provide a very specific, or significantly limited, amount of benefits. The various plans include:

Also Check: Insurance Lapse Between Jobs

How Can I Purchase A Health Insurance Plan

There is more than one way to purchase a health insurance plan. Here are the most popular for small businesses:

- Group health insurance plans: You can buy these plans through the federally run SHOP Marketplace. This was the most popular choice for small businesses in the past, but due to the high costs and lack of flexibility, this is no longer an option for many companies.

- Qualified small employer health reimbursement arrangement : Set up by Congress in December 2016, QSEHRA is becoming an increasingly popular choice for small businesses. Under this arrangement, businesses offer employees a tax-free monthly allowance, and employees then choose and pay for their own health care using that money. The advantages of QESHRA are that it gives employees the flexibility to choose their own plan and its considerably easier to manage from an administrative point of view.

- Association health plans: Small businesses can join with other small companies to buy large-group health insurance . This works in the same way as a normal group health insurance policy.

Q Do I Need To Do Anything With A Deceased Person’s Health Card Or Health Coverage

The health card of a deceased person must be returned to the Ministry of Health and Long-Term Care. You will need to complete a Change of Information and then mail it with the health card of the deceased person to the ministry. You should include a copy of the death certificate. Copies of this form are available by :

- Visiting your local ServiceOntario centre.

- Printing a copy of the form through Forms Online.

- Contact ServiceOntario INFOline at toll-free: 1-888-376-5197 or 416-314-5518

Alternately, you can send a letter to your local ServiceOntario centre providing the deceased person’s name, date of birth, sex and health number. Enclose a photocopy of the death certificate and the actual health card.

Don’t Miss: Starbucks Dental Insurance

Am I Covered For Health Services That I Leave The Country To Obtain

Prior approval by your provincial/territorial health insurance plan may be required before coverage is extended for elective health services obtained outside Canada. Individuals who seek elective treatment out-of-country without obtaining approval from their provincial or territorial health insurance plans may be required to bear the cost of the services received.

What Do I Do If My Address Changes Or If I Lose My Health Card

The provinces and territories, rather than the federal government, are responsible for the administration of their health insurance plans, which includes issuing, cancelling or renewing health cards. You should call or email your provincial/territorial Ministry of Health- the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report.

Also Check: Starbucks Insurance Cost

Other Helpful Facts About Applying For Small Business Group Health Insurance

Youcan offer group health insurance to part-time and seasonal workers if you wish.But it is important to understand, usually you must enroll at least 70 percentof your uninsured, full-time employees. If some of your employees have otherindividual or group health insurance coverage, they dont count toward the 70percent rule.

Andthere is a caveat to the 70 percent rule. If you enroll in small business group health insurance from November 15 to December 15 of the year,the 70 percent participation rule does not apply. You can be approved for smallbusiness group health insurance with fewer than 70 percent of your eligiblefull-time at this time. Applying forsmall business group health insurance during this period may be advantageous ifyou are concerned that one or more eligible employees will refuse healthinsurance coverage and disqualify the company from getting small business grouphealth insurance.

Q What If My Baby Wasn’t Born In Hospital Or Attended At Home By A Registered Midwife

You will need to visit a ServiceOntario centre to register your child for Ontario health coverage.

If you visit a ServiceOntario centre within 90 days of the birth of your child you need to bring :

- confirmation of the baby’s birth, through either a letter from the hospital or attending physician, or a Certified Statement of Live Birth from a provincial office of the Registrar-General

- your residency document

- your identity document

If you visit a ServiceOntario centre more than 90 days after the birth of your child you need to bring :

- your child’s citizenship document

Refer to the question “What documents should I bring when I register?” or to the Ontario Health Coverage Document List for a complete listing of approved documents.

Read Also: Starbucks Healthcare Benefits

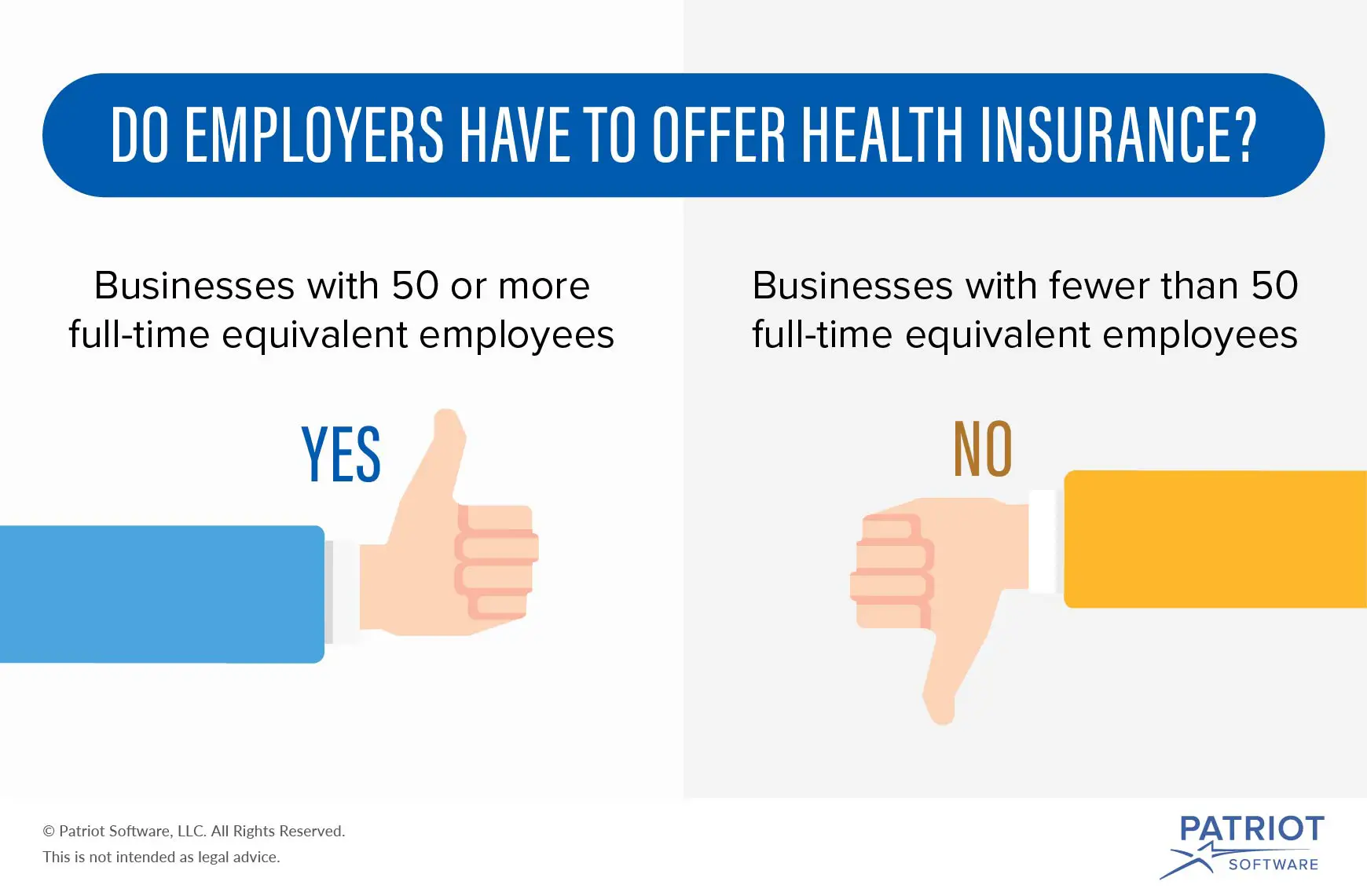

As A Small Business Owner These Are The Requirements You Should Be Aware Of When Offering Health Insurance To Your Employees

- Businesses with 50 or more full-time employees are required to provide group health insurance coverage to their employees. If they don’t, that business is liable for penalties and fines at the end of the tax year.

- Knowing whether or not your organization is required to offer health insurance is one thing, understanding how to go about setting your program benefit up is another.

- If you are required to offer health insurance benefits to your employees, your next steps involve ascertaining whether your small business qualifies for the ACA’s small business healthcare tax credit.

- This article is for small business owners who want to learn more about health insurance requirements, how the ACA affects eligibility and what is forthcoming in 2021.

Since the post-World War II era, when employer-sponsored healthcare benefits were conceived, healthcare, including the regulations surrounding employer-offered health insurance, have evolved, in some cases, drastically changing from year to year. The Affordable Care Act plays a huge role in an employer’s responsibilities, so small business owners need to have a clear understanding of it so they can prepare their businesses for the end of the year and 2021.

Q Am I Still Eligible For Ohip If I Temporarily Leave Ontario

You may be out of the province for up to 212 days in any 12-month period and still maintain your Ontario health insurance coverage provided that you continue to make Ontario your primary place of residence.

To maintain eligibility for OHIP coverage you must be an eligible resident of Ontario. This means that you must :

- have an OHIP-eligible citizenship/immigration status and

- be physically present in Ontario for 153 days in any 12-month period and

- be physically present in Ontario for at least 153 days of the first 183 days immediately after establishing residency in the province and

- make your primary place of residence in Ontario.

If you will be out of the province for more than 212 days in any 12-month period, please refer to the Longer Absences from Ontario fact sheet.

Read Also: Asares Advanced Fingerprint Solutions

Do I Need Private Health Care Coverage When Travelling Within Canada

The portability criterion of the Canada Health Act requires that the provinces and territories extend medically necessary hospital and physician coverage to their eligible residents during temporary absences from the province or territory. This allows them to travel or be absent from their home province or territory and yet retain their health insurance coverage. Within Canada, the portability provisions are generally implemented through a series of bilateral reciprocal billing agreements between the provinces and territories for hospital and physician services. This generally means that your provincial/territorial health card will be accepted, in lieu of payment, when you receive hospital or physician services in another province or territory because the rates prescribed within these agreements are host-province/territory rates. These agreements ensure that Canadian residents, for the most part, will not face point-of-service charges for medically required hospital and physician services when they travel in Canada because the province or territory providing the service directly bills your home province/territory.

Do I Qualify For Health Insurance After I Lose My Job What About My Family

Maybe, depending on the employer. The federal Consolidated Omnibus Budget Reconciliation Act generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage in certain instances where coverage under the plan would otherwise end. COBRA gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for a limited period of time after a qualifying event such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102 percent of the cost to the plan.

For example, if your portion of the health plan premium is $200 per month and your employer contributes $300 per month towards your plan, the total cost of your plan is $500 per month. If you choose to get Continuation Coverage after a qualifying event, it could cost you up to 102 percent of $500 , which is $510, every month. Although some employers choose to subsidize Continuation Coverage, most employers do not, in which case you will be responsible for the entire premium.

Recommended Reading: Can You Add A Boyfriend To Your Health Insurance

Plusthe Equivalent # Of Part

For example, if we have two parttime employees who work an average of 15 hours, that’s the equivalent of 1 full time employee.

What does this mean?

For one, you can’t drop all your full time employees down to part time andavoid requirements.

Also, you could have a lot of part-time employees and still trigger therequirements for coverage . We’ll discuss thislater.

Number Of Employees Matters

To be eligible for small business health insurance, a company must have between one and 50 employees. That is considered a small business for purposes of purchasing group health insurance. If you have more than 50 employees, youll need to:

- apply for large group coverage

- meet group coverage reporting requirements

- meet minimum group health insurance standards

Recommended Reading: Starbucks Part Time Insurance

Labor Department Regulations Are Expected

The health law stipulates that employers with more than 200 full-time workers are required to enroll newly hired full-time employees in a plan unless the employee specifically opts out of the coverage. However, the provision wont take effect until the U.S. Department of Labor issues regulations.

Employees who are unhappy about being required to buy into a company plan could complain to the Department of Labor, some experts say. Its unclear whether such efforts would succeed.

Employment law experts point to a 2008 decision by the Labor Department dealing with state laws that restrict employers from making deductions from workers paychecks without their consent. The department issued an advisory opinion saying that federal ERISA law pre-empted a Kentucky law that required an employer to get an employees written consent before withholding wages to contribute to a group health plan.

Although that decision doesnt have the force of law, it suggests how the Labor Department views such issues, says Cheryl Hughes, a principal at Mercers Washington Resource Group.

This article was reprinted from kaiserhealthnews.org with permission from the Henry J. Kaiser Family Foundation. Kaiser Health News, an editorially independent news service, is a program of the Kaiser Family Foundation, a nonpartisan health care policy research organization unaffiliated with Kaiser Permanente. It was produced with support from The SCAN Foundation.

Employers’ Benefits From Workers’ Health Insurance

Most nonelderly Americans receive their health insurance coverage through their workplace. Almost all large firms offer a health insurance plan, and even though they face greater barriers to providing coverage, so do the majority of very small firms. These employment-based plans cover two-thirds of nonelderly Americans and pay most of working families expenses for health care and about one-quarter of national health spending. Despite employers role in the health insurance market, however, very little attention has been paid to employers motivations for providing health insurance to workers. Why do employers offer health insurance to workers? Is it because workers want it? Because their unions demand it? Or do employers offer health benefits to workers because their productivity and profitability depend on it?

This article makes a case for reassessing the theory. A key flaw in the standard theory is that it ignores the benefits accruing to employers from offering health benefits. According to the conventional view, employees pay the full cost of coverage presumably because they believe that the benefits of health coverage are entirely for themselves. The alternative view that I am investigating posits a business case for employment-based health coverage, acknowledging that employers may want to offer coverage because offering a compensation package composed of both wages and health insurance is more profitable than providing wages alone.

Recommended Reading: Starbucks Insurance Benefits

Do I Need Private Health Care Coverage When Travelling Outside Canada

While travelling within Canada, the portability criterion of the Canada Health Act requires that insured hospital and physician services are covered at host-province/territory rates. When outside the country, coverage is required to be at home-province/territory rates. As a result, health care services received abroad may not be fully covered by a provincial or territorial health insurance plan. For that reason, it is highly recommended that you purchase private insurance before departing Canada, to ensure adequate coverage.

How Much Does Group Health Insurance Cost

Group health policies are usually cheaper than individual health insurance. Keeping that in mind, its not free. Your employer and you will split the bill.

If youre on the other side you might be asking yourself why would I agree to pay for my employees health insurance plan? The answer is simple: monthly costs for most health insurance plans range somewhere between 50 and 150 CAD. In group plans, both parties split the bill as arranged beforehand.

This means that one employee most likely costs around 5,000 CAD on average per year, but in the broader sense of things losing an employee over health insurance would cost much more than simply paying for it.

Recommended Reading: Starbucks Health Insurance Cost