Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Dental Care Cost Without Insurance

The cost of dental care procedures varies between provinces. For example, in Ontario, a dental check-up is $35. In British Columbia, it is $29.50, while in Alberta, it is a steep $67. Provinces publish a suggested fee guide, and insurance companies reimburse based on it. This means that providers within the same province usually have the same price.

To provide an example, see below for the suggested cost of common procedures in Ontario. Prices in British Columbia are generally slightly lower than this. Those in Alberta are generally slightly higher.

| Dental care |

|---|

| $4,500 – $5,500 |

Without insurance you will be paying these prices out-of-pocket. Oral surgery, implants and orthodontics are expensive. They can easily reach several thousand dollars. This is a difficult expense to cover with insurance.

The Affordable Care Act Andamerican Indians And Alaska Natives

For American Indians and Alaska Natives, the ACA will help address health disparities by investing in prevention and wellness and increasing access to affordable health coverage.

The ACA provides American Indians and Alaska Natives with more choices depending on your eligibility and the coverage available in your state, you can:

- Continue to use IHS, tribal, and/or urban Indian health programs

- Enroll in a qualified health plan through the Marketplace

- Access coverage through Medicare, Medicaid, and the Children’s Health Insurance Program

If you choose to enroll in a QHP through the Health Insurance Marketplace plan, you may qualify for special benefits and protections offered to American Indians and Alaska Natives.

RELATED LINKS

Also Check: How Long Can My Dependent Stay On My Health Insurance

Affordable Health Insurance Plans With No Deductible

Health insurance with no deductible is one of the most comprehensive forms of medical coverage. It is available for individuals, families, businesses and self-employed persons that purchase their own coverage and want little or no out-of-pocket expenses coupled with high-quality benefits. Although not all major insurers are able to offer a zero deductible plan, many states have various options either on or off the Marketplace. By eliminating a deductible, benefits can be used quicker and thousands of dollars may be saved.

Mostly available through employer-group plans, there are also some private contracts that offer first-dollar coverage. You can request free quotes on all types of plans at the top of this page. Immediate benefits are usually paid when you buy coverage. There also may be a stated amount of dollars paid for certain claims on non-compliant policies. Often, you will need secondary coverage with these policies since there may be high coinsurance or co-payments. It is important, however, to always consider the plan maximum out-of-pocket expenses .

HMO Plans

Health Insurance With No Deductible

The most common form of this type of coverage is an HMO plan. Instead of the typical amount on large claims sometimes, there is simply no deductible that is required to be met. Coinsurance can vary between 10% and 50%. A PPO or EPO can also have a $0 deductible although they are not as common.

New Marketplace Policies

Oregon Kaiser OR Gold 0/20.

PAST UPDATES:

What Is Catastrophic Health Insurance

Catastrophic health insurance plans are designed for people who are under 30 or meet hardship requirements. These plans have low monthly premiums but very high deductibles. As of 2022, the max deductible and out of pocket expenses on catastrophic plans is $8,700. You pay for most routine medical expenses on your own, but the plans provide coverage in serious emergencies that require significant medical attention.

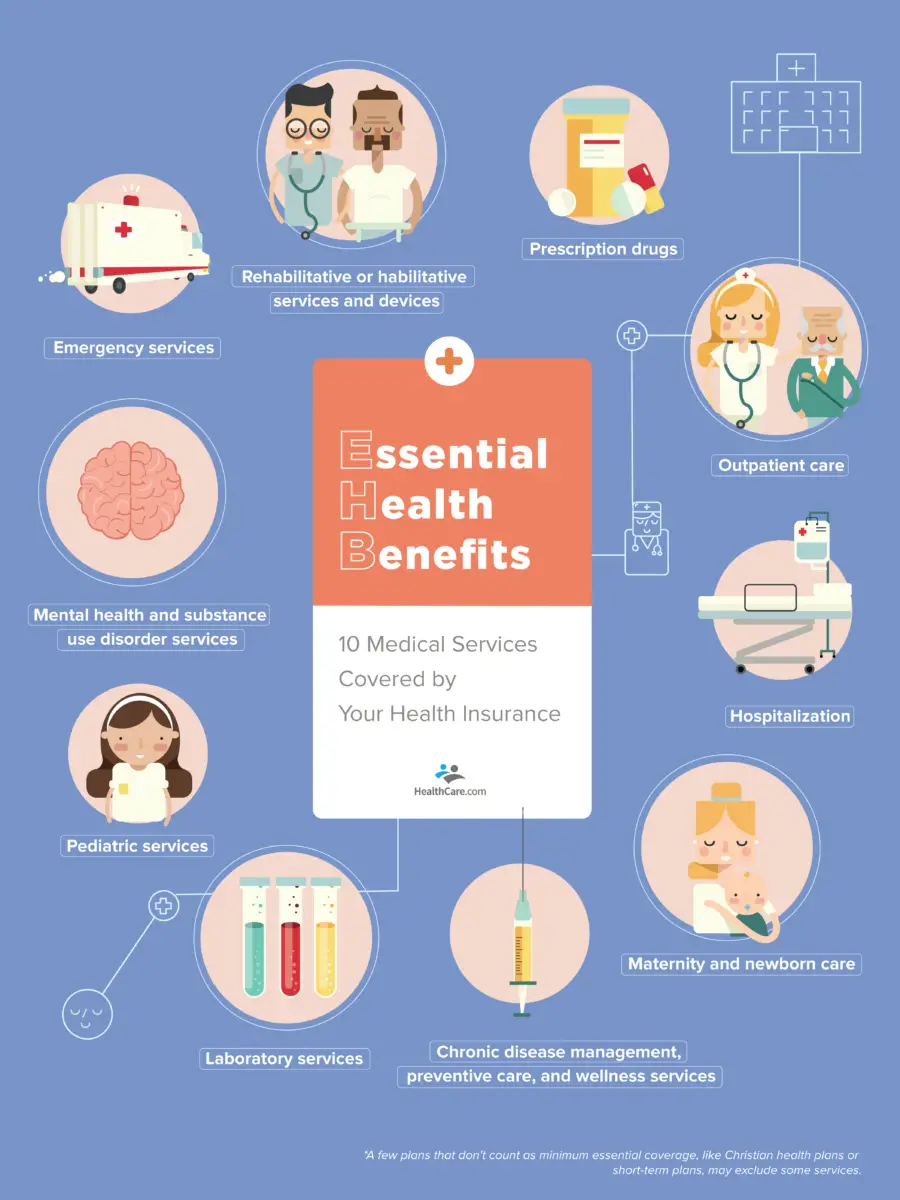

Catastrophic plans cover the same essential health benefits as other Health Insurance Marketplace plans, covering preventative services at no additional cost. You’re also entitled to three primary care physician visits if you purchase a catastrophic plan through the Health Insurance Marketplace.

Recommended Reading: Do Restaurants Offer Health Insurance

How Is Aetna Rated

Trusted ratings and reviews can help you understand how an insurers plans stack up against the competition. See how we rated Aetna.

Overall rating: 4.8

Tammy Burns is an experienced health insurance advisor. She earned her nursing degree in 1990 from Jacksonville State University, obtained her insurance billing and coding certification in 1995, and holds a health and life insurance license in Alabama, Georgia, Iowa, Mississippi, and Tennessee. Burns is Affordable Care Act -certified for health insurance and other ancillary, life, and annuity products. She maintains an active nursing license and practices private-duty nursing.

Burns background as a nurse, insurance biller and coder, and insurance consultant includes infectious disease, oncology, gynecology, phlebotomy, post operative, family medicine, geriatrics, home health, hospice, human resources, management, billing, coding, claims, fixed annuities, group and individual health and life products, and Medicare. Shes always been driven by a desire to help people, spending more than 25 years as a practicing nurse in hospitals, private doctors offices, home health, and hospice. As a nurse, Burns supported patients filing insurance claims with Medicare, Medicaid, and private insurance companies as well as responding to billing questions from confused patients.

If Your Employer Doesnt Offer Health Insurance

Shop your states online marketplace, if available, or the federal marketplace to find the plan that’s best for you. Start by going to HealthCare.gov and entering your ZIP code. Youll be sent to your states exchange, if there is one. Otherwise, youll use the federal marketplace.

You can also purchase health insurance through a private exchange or directly from an insurer. If you choose these options, you wont be eligible for premium tax credits, which are income-based discounts on your monthly premiums.

Recommended Reading: Which Is The Best Health Insurance Company In Texas

Who Pays For Coverage

When you have employer-sponsored health insurance, your employer usually pays part of the monthly premiums and you pay part of the monthly premiums.

In most cases, your employer will pay most of the cost, though it varies. Your share of the premiums gets taken out of your paycheck automatically. That means you dont have to remember to pay the bill each month.

The payroll deduction is usually made before your income taxes are calculated. That means youre don’t have to pay income taxes on the money that you spent on health insurance premiums.

With job-based health insurance, your employer usually doesn’t help you pay cost-sharing expenses like deductibles, copays, and coinsurance.

What Types Of Health Insurance Plans Are Available Anyway

Health insurance can get confusing. Heres a quick breakdown of plans that are typically available through networks:

- Depending on whats available in your area, you may find bronze, silver, gold, and platinum . These levels are broken down by how much you pay versus how much your network pays. Some of these can include:

- Exclusive Provider Organization . This is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in your plans network, except in an emergency.

- Health Maintenance Organization . An HMO usually limits coverage to care from doctors who work for or contract with the HMO. It generally wont cover out of network, except in an emergency. The plan may require you to live or work in its service area to be eligible for coverage.

- Point of Service . With this plan, you may pay less if you use doctors, hospitals, or other healthcare professionals that belong to the plans network. They typically require you to get a referral from your primary care doctor to see a specialist.

- Preferred Provider Organization . You pay less if you use providers in the plans network. You can, however, use doctors, specialists, and hospitals that are out of network without a referral for an additional cost.

Read Also: When Do You Lose Health Insurance At 26

Can I Purchase Dental Insurance Only

Insurers offer stand-alone dental coverage. Our tool lets you shop for dental only plans.

More often, dental is include as a part of a comprehensive private health and dental insurance plan. You can get private insurance with dental care through many employers or by purchasing it on your own. These plans also help pay for prescription drugs, vision care, ambulance services, medical devices, specialists and more. We recommend private health insurance regardless of your province. Provincial public health care has significant gaps. Dental care is a significant one.

Private health and dental insurance is a cost-effective way to ensure you can pay for care.

Want to learn more about public and private health insurance in Canada? Our summary article has answers to all your questions.

Exception: Grandfathered Plans Dont Have To Cover Pre

Grandfathered plans dont have to cover pre-existing conditions or preventive care. If you have a grandfathered plan and want pre-existing conditions covered, you have 2 options:

- You can switch to a Marketplace plan that will cover them during Open Enrollment.

- You can buy a Marketplace plan outside Open Enrollment when your grandfathered plan year ends, and youll qualify for a Special Enrollment Period.

You May Like: What Is A Health Insurance Plan

Can I Get Medical Insurance Today

While you can apply for medical insurance today, your coverage may not start until later. If you need coverage that starts as soon as possible, a short-term plan could start as soon as the day after you apply. These plans have a limited duration and limited medical benefits.

If you need a comprehensive health insurance plan, like an Affordable Care Act plan, you will need to wait until the Open Enrollment Period starts . Even in those time periods, your coverage may not start until the beginning of the next month .

Are There Any Affordable Health Insurance Providers

Finding affordable health insurance doesnt have to be an impossible feat. Its important to know what you want out of your health insurance policy and how much youre willing to pay for it. For those who are budget conscious, finding the right health insurance could prove tricky. You can save money with a thorough health insurance comparison.

To see some health insurance quotes today enter your ZIP code in the FREE search box!

According to an article which appeared in USAToday, the average price for a health policy insurance for an individual in 2009 was $4,824 and for families it was $13,375. That is why getting group health insurance through your employer is always a good option.

Recommended Reading: Can You Have A Baby Without Health Insurance

What You Should Know About Affordable Health Insurance Plans

If youre on a group employer plan, your premium cant cost more than 9.5% of your household income.

- Affordable is defined as no more than 9.5% of your household income: If youre on a group employer plan, your premium cant cost more than 9.5% of your household income. That doesnt include your spouse or dependents.

- Anyone can apply on the Health Insurance Marketplace: The Health Insurance Marketplace is your route to affordable insurance, whether youre shopping for individual coverage, want to apply for Medicaid, or need to compare your options against what your employer offers.

- You may qualify for government assistance: Through the Health Insurance Marketplace, you may qualify for a subsidy, which offsets the cost of your monthly premiums. Depending on your income and demographics, you may qualify for Medicaid or the Childrens Health Insurance Program . If youre 65 or older or have a qualifying disability, you may be eligible for Medicaid.

| Health insurance company |

|---|

| 4 |

Making Health Insurance More Affordable For Middle

The Affordable Care Act has extended health coverage to over 20 million people and has lowered the cost of coverage or care for millions more. But a frequent criticism of the law is that it has not done enough to make coverage affordable for middle-income individual market consumers. The solution to this problem is straightforward. Increasing or eliminating the income cap on the ACAs premium tax credits would ensure that nearly all consumers have coverage options that cost less than 10 percent of their incomes.

About 6 million people purchase individual market plans without premium tax credits, and another 4 to 5 million people with incomes too high to qualify for subsidies are uninsured. Discussions about how to help these consumers are often unduly focused on sticker price premiums. A common assumption is that premiums in the ACA individual market are exceptionally high relative to other health insurance markets, and that solving this problem requires structural change to the ACA.

Expanding eligibility for premium tax credits is better for both consumers and the individual market as a whole than other commonly discussed approaches to making coverage more affordable for middle-income people.

You May Like: Does Colonial Life Offer Health Insurance

Aca Premiums Were In Line With Employer Premiums Prior To Trump Actions

Discussions about affordability challenges for middle-income individual market consumers often start from the assumption that premiums in the ACA individual market are far higher than in other health insurance markets due to severe adverse selection. This impression was reinforced by large premium increases in 2017 .

But in fact, as of 2017 after these premium increases ACA individual market premiums were roughly in line with premiums for employer coverage with similar out-of-pocket costs , a reasonable proxy for the cost of providing private coverage to a broad cross-section of the population. For example, about 60 percent of ACA marketplace consumers lived in states where benchmark premiums for ACA coverage were below or equal to employer premiums, and another 17 percent lived in states where they were no more than 10 percent higher, according to an Urban Institute analysis. Individual market plans often have narrower networks than employer plans, which lowers prices, and so similar premiums indicate that the individual market risk pool was likely modestly weaker, on average. But the data contradict claims that healthy people have largely exited the ACA marketplaces or that the structure of the ACA inherently leads to very high premiums.

What Is A Special Enrollment Period

A Special Enrollment Period is a 60-day window where qualifying individuals and families can enroll in ACA plans outside of the OEP. You could qualify for a Special Enrollment Period if youve experienced specific events, including getting married, having a baby, getting a divorce, relocating, or losing your health insurance.

Federal and state marketplaces can also open Special Enrollment Periods that do not require individual life events. During these extended Special Enrollment Periods, you can also apply for an ACA health insurance plan outside of the Open Enrollment Period.

Read Also: Who Qualifies For Health Insurance Subsidies

Health Insurance For Canadian Retirees

Canadas government health insurance coverage is the envy of many parts of the world. Still, there are a number of services such as prescription drugs, semi-private or private hospital rooms, and paramedical services like chiropractic care and ambulance transportation, that are not covered.

While employed full-time, many Canadians are in the fortunate position of having company-provided health and dental insurance to help offset the costs of these services that fall outside the provincial and territorial government plans.

Canadians reaching the age of 60 who have not already left the workplace are eligible for retirement pension and may choose to stop working. While its thrilling to reach the next chapter in ones life, there are some less exciting new challenges. One of those challenges is finding personal health insurance coverage to pick up where government plans leave off.

Annual Costs And Premiums

The first thing youll likely notice when purchasing insurance is the annual cost, or the sum of your monthly premiums. The principal cost associated with coverage is the premiumthe amount you pay every month for the coverage, which could be subsidized by your employer or the government, says White.

Recommended Reading: How To Get Health Insurance As A Business Owner

No Insurance Should Not Be An Option

I once met a man who chose not to purchase health insurance. He said, I work out. I eat well. Thats my insurance.

I often wondered what he thought would happen if he tore an ACL playing touch football, or got hit by a drunk driver.

Unless youre extremely wealthy and can afford to pay for a medical catastrophe that comes your way, forgoing insurance altogether is not advised.

Even the most healthy among us fall and break their arms, get into car accidents, or come down with life-threatening diseases.

A visit to the emergency room for even a minor issue could leave you with thousands of dollars in medical bills.

The costs of surgery could run in the tens of thousands of dollars.

While the Affordable Care Act no longer has a tax penalty for not having coverage, insurance provides peace of mind.

What About An Hdhp With A Health Savings Account

A high-deductible health plan, or HDHP, can be any one of the types of health insurance above HMO, PPO, EPO or POS but follows certain rules in order to be HSA-eligible. These HDHPs typically have lower premiums, but you pay higher out-of-pocket costs, especially at first. They’re the only plans that qualify you to open a health savings account, or HSA, which is a tax-advantaged account you can use to pay health care costs. If youre interested in this arrangement, be sure to learn the ins and outs of HSAs and HDHPs first.

Read Also: Will Health Insurance Pay For A Service Dog