Write A Marketing Plan Packed With Ideas & Strategies

Starting and running an insurance company requires aggressive marketing which is why you insurance sales men and women are always on your neck to buy one insurance cover or the other especially if you live in the United States of America.

So to stay afloat in the insurance industry, you must be ready to spend good cash in marketing, advertising and promoting your insurance products. Your marketing and advertising departments must regularly come out with new innovations and products that can catch the attention of your potential clients.

It is for this reason that when you are drafting your marketing ideas and strategies for your insurance company, make sure that you create a compelling personal and companys profile which must include the profile of your board of directors and management team.

The truth is that if you have honest, trustworthy and successful professional in your board, customers can easily trust you with their hard earned money. In some countries trust is one of the key factors that is hampering the growth of the insurance industry.

Here are some of the platforms you can utilize to market your insurance policies

Small Business Health Options Program Marketplace

The Small Business Health Options Program Marketplace – also known simply as SHOP – helps small businesses provide health coverage to their employees. While the SHOP Marketplace was previously only open to employers with 50 or fewer full-time equivalent employees, starting in 2016, some states may make the SHOP Marketplace available to businesses with up to 100 employees. If you have more than 50 employees and don’t know if you can use the SHOP Marketplace, contact your state Department of Insurance or the SHOP Call Center.

The SHOP Marketplace – which is also open to non-profit organizations – allows you to offer health and dental coverage that meets the needs of your business and your employees. SHOP offers flexibility, choice, and online application and account management. You can enroll in SHOP any time of year. Theres no restricted enrollment period when you can start offering a SHOP plan.

Businesses that offer health coverage through the SHOP Marketplace may be eligible for the small business health care tax credit.

Get The Necessary Legal Documents You Need To Operate

The insurance industry happens to be amongst the industries that are highly regulated in the United States of America and of course all over the world. If you are considering starting an insurance company, then you are expected to meet the legal documents requirements as stipulated in the constitution of your country.

These are some of the basic legal document that you are expected to have in place if you want to start an insurance company in the United States of America

- Certificate of Incorporation

- Insurance Policy

You May Like: How To Get The Health Insurance

Discuss With An Agent To Know The Best Insurance Policies For You

The fact that you are starting an insurance company means that you must not be found wanting when it comes to buying all the required insurance policy covers for your business. Besides, it is safe to state that it is impossible to start an insurance company in the United States of America without ensuring that you have the basic insurance policies in place as stipulated by the regulating body.

Here are some of the basic insurance covers that you should consider purchasing if you want to start your own insurance company in the United States of America

- General insurance

- Business owners policy group insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

You May Like: How To Enroll In Health Insurance

Know Your Major Competitors In The Industry

There are several leading insurance companies in the world whose businesses is not restricted to just one country but other countries and continent of the world. Here are some of the leading insurance brands in the insurance industry

- AXA Group

- Munich Re

Economic Analysis

No doubt when you decide to start an insurance company, you should be aware that you are stating a capital intensive business.

Aside from the money you would need to rent an office, get the business registered, obtain the required business permits and license and then make provision for the payment of your staff for at least 6 months or more, you should also be ready to meet the financial requirement / capitalization as stated by the insurance regulating body in your country.

Just like the banking industry, the insurance industry is yet another industry that you must have a certain amount of capital base before you can successfully swing into full operations usually the money required is in the range of several thousands of dollars.

This is so because one of the challenges insurance companies usually face is the inability to pay claims. So, in order to cub this challenge, anyone looking towards starting an insurance company must meet the set financial requirement / capitalization.

Are Your Providers In Network

Check the health plan’s network to make sure it has a good selection of hospitals, doctors and specialists. Look for your providers in the plans network.

This is especially true if you get an HMO. HMOs have a restricted network and wont pay for the care you receive outside of the network.

If you get a PPO, youll likely be able to get out-of-network care, but it can come at a higher price tag.

Read Also: Does Short Term Health Insurance Cover Pregnancy

Employers Eye Shifting Health Care Needs During Pandemicyour Browser Indicates If You’ve Visited This Link

Health care costs rise every year, but the nation’s biggest employers still see insurance coverage as an important benefit to provide. Mitchell’s nonprofit coalition is helping to sort all this out by working with some of the country’s largest employers â think Walmart and Boeing â on the benefits they provide.

YAHOO!News

Purchasing Health Care Coverage Through The Marketplace And Reporting Changes

Each year the Health Insurance Marketplace has an open enrollment period and special enrollment periods for eligible taxpayers. For information about enrollment periods, visit HealthCare.gov or contact your state-based Marketplace.

If you enrolled in insurance coverage through the Marketplace, you should report any changes in your circumstances like changes to your household income or family size to the Marketplace when they happen. Changes in circumstances may affect your advance payments of the premium tax credit. When you report a change in circumstances, you may become eligible for a special enrollment period, which allows you to purchase health care insurance through the Marketplace outside of the open enrollment period. Visit the Marketplace at HealthCare.gov for more information about reporting changes in circumstances and special enrollment.

To estimate the effect that changes in circumstances may have upon the amount of premium tax credit that you can claim – see the Premium Tax Credit Change Estimator on our Affordable Care Act Estimator Tools page.

Find out more about the Premium Tax Credit and other tax provisions of the Affordable Care Act at IRS.gov

Read Also: Can You Change Your Health Insurance Plan Mid Year

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Who Can Help Me Enroll In An Aca

Health insurance is complicated, and many people want or need personal assistance with the application process and with ongoing insurance utilization questions. To fill this need, there are a variety of assisters nationwide who are trained to guide people through the process of researching and enrolling in health plans, and some can provide ongoing support after the plan is purchased.

Health insurance navigators

The health insurance Navigator role was created for the purpose of providing impartial education and outreach about the exchanges and exchange health plans, helping applicants determine whether they qualify for subsidies or Medicaid, and assisting them in the enrollment process. Standards and regulations for the Navigator program are outlined in 45 CFR 155.210 and CFR 45 155.215.

In early 2016, HHS laid out enhanced requirements for Navigators most of which took effect for 2018 including targeted assistance for underserved and uninsured populations, as well as post-enrollment assistance . The enhanced requirements are detailed in 45 CFR 155.210.

In the guidelines for 2020, HHS reversed course somewhat on this, making those duties optional, rather than required, for Navigator organizations. But HHS has pivoted once again on this, with proposed rules for 2022 and beyond that would once again require Navigator organizations to provide assistance with post-enrollment issues like subsidy reconciliation and eligibility appeals.

Certified application counselors

Don’t Miss: Who Qualifies For A Tax Credit For Health Insurance

President Expands Affordable Care Act Special Enrollment Period

Americans have another chance to sign up for an ACA health insurance marketplace plan in 2021 after President Joe Biden signed an executive order to launch a special enrollment period.

The ACA marketplace special enrollment period is until that use the federal ACA marketplace. The other states set their own enrollment periods, but most followed Bidens lead and expanded the enrollment period.

Bidens move hopes to insure as many of the 15 million uninsured Americans as possible, including those who lost health coverage because of Covid-19. As of the beginning of May, the special enrollment period reportedly signed up about 500,000 more ACA plan members.

The ACA marketplaces open enrollment is usually from in most states. Thats the only time someone can get an ACA plan unless they qualify for a special enrollment during other parts of the year.

However, Bidens executive order means that people without insurance dont need to qualify for a special enrollment. Instead, anyone who isn’t eligible for other coverage, such as through an employer, can sign up for a plan until .

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Read Also: How Much Do I Have To Pay For Health Insurance

How Much Does It Cost To Buy Health Insurance On Your Own

Generally, the less you pay out of pocket for the deductible, copays and coinsurance, the more you spend on premiums.

Platinum plans charge harmer premiums than the other three plans, but you wont pay as much if you need health care services. Bronze, meanwhile, has the lowest premiums but the highest out-of-pocket costs.

When deciding on the level, consider the medical services you used over the past year and what you expect next year. For instance, if you plan on starting a family, consider how much out-of-pocket costs youll have to pay if you go with a Bronze plan.

eHealth reported the average monthly premium by metal level:

- Bronze — $448

- Gold — $569

- Platinum — $732

Bronze and Silver are the most popular plans — 42% have Bronze plans and 34% have Silver plans. Only 14% have Gold plans and 2% have Platinum plans.

Can I Get An Aca Subsidy To Help Cover The Cost Of My Health Plan

Premium subsidies are available in every state to make individual/family health insurance affordable. Eligibility is based on the applicants household income. Heres a detailed overview of how premium subsidies work, and a calculator you can use to see if youre eligible for a subsidy.

Use our calculator to estimate how much you could save on your ACA-compliant health insurance premiums.

For people with lower income, the American Rescue Plan also reduces the percentage of income they have to pay for the benchmark plan, as illustrated in this comparison. .

Heres how household income is calculated under the Affordable Care Acts rules. Its referred to as MAGI, for modified adjusted gross income, but its not the same as the general MAGI calculations you may be familiar with in other circumstances. There are also steps you may be able to take to reduce your MAGI and thus increase the amount of subsidy for which youre eligible.

Don’t Miss: How To Set Up Small Business Health Insurance

How Much Does Health Insurance Cost Without A Subsidy

Health insurance premiums have risen dramatically over the past decade in response to the rising cost of health care services. The ACA helped to make health insurance accessible to more Americans than previously through the creation of health insurance marketplaces or exchanges and by providing government subsidies to lower income Americans.

However, most middle-class Americans dont qualify for subsidies. Its important to understand if you qualify for subsidies. And, if not, the average cost for non-subsidized health insurance you can expect to pay. eHealth can help walk you through health insurance costs without a subsidy, and when youre ready, get you started with an individual or family health insurance plan that fits your needs and budget

Individual Health Insurance Subsidies

People who buy an individual health plan through the ACA exchanges may be eligible for subsidies that reduce the cost of premiums.

The ACA allows tax credits and subsidies. Only people with household income below 400% of the federal poverty level are eligible for subsidies.

However, the American Rescue Plan of 2021 included a provision that opens up subsidies and tax credits to everyone with an ACA plan for the next two years. People with an ACA plan will now pay up to 8.5% of their household income on ACA Plan premiums. The Centers for Medicare and Medicaid Services estimates the American Rescue Plan will temporarily save ACA members an average of $50per person per month and $85 per policy per month.

When you search for a plan through the ACA exchanges, the site provides cost estimates for plans with subsidies in mind.

Reminder: People with an individual health plan outside of the exchanges arent eligible for subsidies.

You May Like: How To Apply For Health Insurance As A College Student

Raise The Needed Startup Capital

It may be easier to raise startup capital if you choose to start an insurance brokerage firm, but the truth is that, starting a standard insurance company is usually not a business that an individual can go all the way alone, there is always need for you to invite business partners / investors that will pull cash together simply because the amount required for capitalization.

Here are some of the options you can explore when sourcing for start up capital for your insurance company

- Raising money from personal savings and sale of personal stocks and properties

- .

When Is Open Enrollment For 2022 Health Coverage

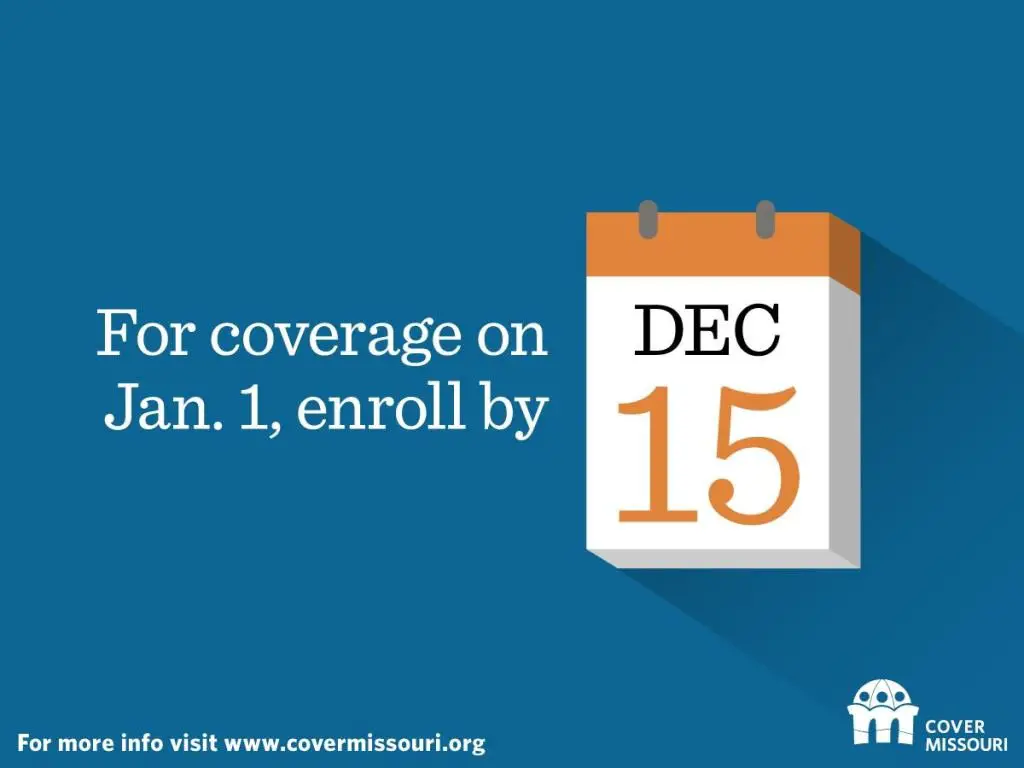

Open enrollment for 2022 health coverage will begin nationwide on November 1, 2021. And HHS has proposed an end date of January 15, 2022, although residents in most states will need to enroll by December 15, 2021 in order to have a plan that takes effect January 1 .

For most Americans, November 1, 2021 will be the next opportunity to enroll in a health plan without needing a qualifying life event. But there are some state-run health insurance exchanges where enrollment in 2021 health coverage is still open, with the following deadlines:

- California: Through December 31

- New York: Through December 31

- Vermont: Through October 1 for uninsured residents

- Medicaid or CHIP, for people who meet the eligibility requirements.

- Basic Health Programs in New York and Minnesota.

- The new Covered Connecticut program .

- The ConnectorCare program in Massachusetts .

Read our extensive list of frequently asked questions about enrollment.

Also Check: What Is Meridian Health Insurance

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

How Much Does It Cost To Starting An Insurance Company

When it comes to starting an insurance company, you should be aware that the cost is in the two fold the costs of setting up the office structure and of course your capital base / capitalization. In essence, the nature and size of the insurance company you are looking towards starting will determine the amount you are expected to raise.

As regard the cost of setting up the office structure, your concern should be to secure a good office facility in a busy business district it can be expensive though, but that is one of the factors that will help you position your insurance company to attract the kind of customers you would want to do business with.

When it comes to starting a small scale insurance business perhaps an insurance brokerage firm, then the following expenditure should guide you

- The Total Fee for incorporating the Business $750.

- The budget for insurance policies, permits and license $10,000

- The Amount needed to acquire a suitable Office facility in a business district with 6 months rent up front $50,000.

- The Cost for equipping the office $5,000

- The Cost of Launching your official Website $600

- Budget for paying at least 10 employees for 3 months and utility bills $200,000

- Additional Expenditure $2,500

- Capital Base 1 Million Dollars

- Miscellaneous $10,000

You will need over 5 Million U.S. dollars to successfully set up a medium scale insurance company in the United States of America.

Read Also: Does Your Employer Pay For Health Insurance