Catastrophic Health Insurance Costs

The average monthly premium for a catastrophic health plan is $195. Thats much less than the premiums for individual health insurance and employer-sponsored health insurance.

However, catastrophic plans have a much higher deductible. A deductible is what you have to pay for health care services before your health plan kicks in money to pay for care.

Heres the average for other types of plans and how they compare with a comprehensive medical plan:

- Employer-sponsored health plan — $1,644

- High-deductible health plan offered by an employer — $2,303

- High-deductible Silver plan in the ACA marketplace — $4,879

- High-deductible Bronze plan in the ACA marketplace — $6,992

- Catastrophic health plan — $8,150

Unlike other health plans, catastrophic health insurance doesn’t have coinsurance once you reach your deductible. In other plans, you have to pay a portion of costs for health care services after you get to your deductible. Thats called coinsurance.

Catastrophic health insurance plans dont have coinsurance. Instead, the plans cover the rest of your health care services costs for the year once you reach the deductible. You still have to pay the premiums, but the plan picks up the costs when you receive care.

How To Buy Catastrophic Health Insurance

Before you can purchase catastrophic health insurance, you must apply through your state’s health insurance exchange. Enrollment for the hardship exemption includes an online application process where you describe your current hardship. If you believe that you experienced a hardship that was not listed above, we recommend you still fill out the application, as other hardships can be approved.

Once approved, you will receive an exemption certificate number and can enroll in the catastrophic health insurance plan of your choosing. If you are over the age of 30 and have not filed for this exemption, then you will not be able to apply for a catastrophic plan on your state’s insurance marketplace. Therefore, it is critical to file for this exemption if you want to purchase a catastrophic health insurance policy.

Pros And Cons Of Catastrophic Health Insurance

Catastrophic health insurance’s low premiums are meant for people who cannot afford the more expensive coverage plans. These policies’ basic coverage typically is only suitable when you are young, healthy and rarely find the need to see a doctor. So long as you don’t need medical attention, you would avoid having to pay for costs by yourself and would be able to save money by paying lower premiums. It would not be a good plan if you are a senior who regularly needs medical supervision or costly subscriptions.

If you need medical attention, catastrophic health insurance can become very costly due to the high deductible. For example, if you have one medical emergency, it would not be covered by the three initial primary-care visits. Then, if your total cost was less than $7,900 that entire amount would have to be paid for without the help of the insurance company.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: What Benefits Does Starbucks Offer Employees

Implement Strong Survivorship Guidelines

Unfortunately, prioritizing primary care at the front end cant prevent all catastrophic diagnoses. Your benefit plan would be well served by a good post-diagnosis strategy as well.

Enabling and encouraging insured members to follow post treatment survivorship guidelines for catastrophic diagnoses like cancer or organ transplant is another effective cost-containment strategy.

The costs of rehospitalization following cancer treatment or transplant can be astronomical. Once a patient has had cancer, for example, they are at greater risk than the general population of developing new cancers. For these reasons, patient education and follow-up screening are critical components of cost containment.

Cost-containment solutions for patients who have survived cancer or an organ transplant may take the form of patient management programs. These initiatives educate survivors about management guidelines and find coverage or incentive programs that encourage them to have follow-up visits and screenings as advised.

Whats A Catastrophic Health Plan

Catastrophic health plans have been around awhile as a low-cost alternative to health insurance. However, the ACA beefed up catastrophic health plans coverage while restricting plans to only two groups of people:

- People under the age of 30

- Anyone who qualifies for a hardship exemption

Catastrophic health plans offer the same comprehensive coverage found in regular health insurance plans, but with low premiums and high out-of-pocket costs when you need health care services.

Key Takeaways

- Catastrophic health plans are a low-cost alternative to health insurance, with much higher deductibles and lower premiums.

- It covers emergency medical costs, basic health screening and other routine check-ups.

- To quality for this type of health plan you must be under 30 years old or if over 30 had recent financial hardships.

- Hardships that can make you eligible for catastrophic health plans include: declared bankruptcy, suffered domestic violence, have disabled or aging family member, or face eviction or foreclosure.

- It may be a good option for people who can afford giant deductible and still have medical needs.

- ACA plan, Medicaid, CHIP and short-term health plan are alternatives to the catastrophic health insurance you can also look into.

Recommended Reading: Does Medical Insurance Cover Chiropractic

Illness Behavior And Utilization In Ias

Non-admission rate is defined as the percentage of patients needing treatment who are not treated in the two weeks before the survey. In IAs, households for which the household head is enrolled in the UEBMI have the highest prevalence rate and non-admission rate in the two weeks before the survey .

Fig. 1

Illness behavior and utilization in integrated areas. This figure explains the two-week prevalence, two-week visiting rate, and non-admission rate among different medical insurance enrollees in integrated areas. Non-admission rate refers to the percentage of patients needing treatment who are not treated in the two weeks before the survey

Basic Features Of Sample Families

Table reports the summary statistics of the households and the household heads characteristics. Both in IAs and NIAs, household heads are predominantly men, married, with junior high school education, and employed. The primary insurance scheme for the heads of household is NRCMS in NIAs and URRBMI in IAs. Households in IAs are mainly concentrated in the eastern urban areas. Compared with NIAs, households in IAs are more likely to attend non-primary medical institutions .

Table 1 Characteristics of households and household heads

Read Also: Shoprite Employee Benefits

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

How Do Catastrophic Plans Work

The difference with a catastrophic plan is that you must pay for all health-care costs until you meet a high annual deductible. Only after your out-of-pocket spending reaches the deductible does your plan begins to pay for most covered health-care services. The deductible doesnt apply to all benefits.

Don’t Miss: How Long Do Health Benefits Last After Quitting

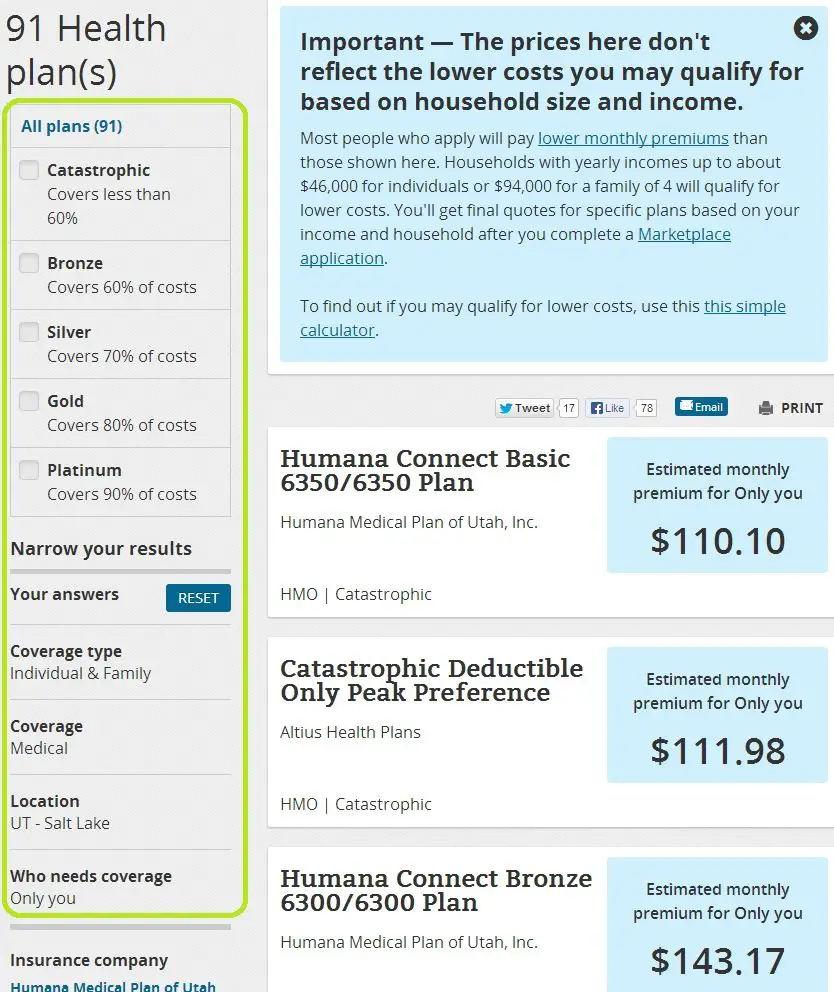

How Can I Get Catastrophic Health Insurance

You can purchase catastrophic health insurance plans through the Health Insurance Marketplace at Healthcare.gov, or you can purchase directly from a private insurance company.

To purchase a plan through Healthcare.gov, you need to be under 30. If you are over 30 and think you qualify for a catastrophic plan due to a hardship, you must apply for an exemption before selecting a plan. Applying through Healthcare.gov allows you to compare plans from multiple insurers so you can pick the best plan for your needs.

If you purchase directly through a company, you may purchase short-term insurancetemporary coverage against major accidents or illnesseswithout having to meet certain criteria or qualifying for an exemption. However, short-term plans dont cover pre-existing conditions.

Is A Catastrophic Plan Right For You

A catastrophic plan may be a good fit if you:

-

Just want protection in case of an emergency

-

Dont qualify for government subsidies or Medicaid

-

Dont need to go to a doctor or specialist very often

-

Can afford the occasional out-of-pocket medical expense

-

Have enough saved in case you need to pay your full deductible

Because catastrophic coverage is so limited, it makes getting care on a regular basis pretty expensive. We suggest opting for a different plan type if you:

-

Have children

-

Qualify for a government subsidy that helps you afford a plan with a lower deductible

-

Have a chronic health condition

-

Tend to go to a doctor or specialist often

Recommended Reading: Starbucks Health Insurance Deductible

What Defines A Catastrophic Health Plan

Catastrophic health insurance offered on the Affordable Care Acts health insurance exchanges :

- Limits who can enroll. Not everyone is eligible to buy a catastrophic plan.

- Premium subsidies can’t be used to help pay the monthly premiums.

- Has a very high deductible, equal to the maximum allowable out-of-pocket limit.

- Covers all of the essential health benefits, including certain preventive care with no out-of-pocket costs.

- Covers three non-preventive primary care office visits each year with a copay .

The deductibles on catastrophic health plans tend to be much higher than the deductibles on other plans, although it’s common to see bronze plans with similar out-of-pocket maximums and deductible that are nearly as high .

Once youve paid enough out of your own pocket to meet the deductible, your catastrophic health insurance plan will start paying for 100% of your covered health care expenses, as long as you stay in-network and follow the plan’s rules for things like referrals and prior authorization.

Comparison With The Startup Years: 1975

In the first years of operation, CHIP had a very low level of public visibility. Few individuals received benefits, in part, because few knew of its existence. In addition, by its very design, CHIP was the source of last resort for catastrophic medical expenses. It is frequently asserted that a new insurance company or a new insurance product must exist for several years before the book of business and the claims experience stabilizes. While it is arguable whether three years represents a sufficient time period for the program to mature, it is true that the level of public visibility had greatly improved by the beginning of the fourth year, 1978. Therefore, net benefits, benefit-cost ratios, and UDD were calculated for the startup years, 1975-77, and compared with those previously presented for 1978 and 1979.

Recommended Reading: How To Get Insurance Between Jobs

What’s A Catastrophic Plan

Catastrophic plans have low monthly payments but a high deductible. A deductible is the amount you pay for health care services before your insurance starts to pay. Once you meet your deductible, our Blue Cross® Value plans pay 100 percent for most services. Medical treatment for a serious illness or accident can cost thousands of dollars. So you can see how these plans protect you from catastrophic expensesand how they’re better than no insurance.

Here’s a few other things you should know about catastrophic plans:

- They cover the same essential health benefits as other plans, including preventive care.

- You can’t apply a subsidy to catastrophic plans.

- They don’t pair with a health savings account.

Distribution Of Program Benefits: 1978 1979

The net benefit and benefit-cost ratios for the years 1978-79 by income class are presented in Table 3. Examination of these redistributional measures for the pooled sample, columns 2 and 3, reveals a consistent pattern of net progressivity. Specifically, the lowest income class is an impressive net gainer. Both measures, the net benefit and the benefit-cost ratio, are highest for this income class indeed, they are approximately twice as large as those obtained for the second ranked income class. The next two lowest income classes, $3,000-3,999 and $4,000-4,999, are the second and third largest gainers respectively although, their net gains are essentially equal. While no straightforward inference statistics are available, the errors due to estimation suggest that these last two net gains cannot be viewed as significantly different. Moving to higher income classes, the extent of the gain generally declines until the $12,000-14,999 class is reached although, the decline is not smooth. All income classes above the $12,000-14,999 class are net losers, and the extent of the loss increases as income increases. To reiterate, the overall pattern suggests that CHIP is a generally progressive program.

Don’t Miss: Does Starbucks Have Health Insurance

How Much Does Catastrophic Health Plans Cost

The average cost of a catastrophic health plan in 2020 is $195. Thats signficantly less than the usual monthly costs in an employer-sponsored plan or an individual health plan.

One downside to catastrophic health plans is the deductible. Catastrophic health plans deductibles, which you have to pay for health care services before the plan chips in money, are much higher than other health plans. Catastrophic health plans deductible is $8,150. Thats significantly higher than other plans. For instance, high-deductible health plans average deductible is about $2,500 for single coverage. The deductibles in health maintenance organization and preferred provider plans are even lower.

However, once you reach your deductible in a catastrophic plan, the plan covers the rest of your health care costs for the year.

How Can I Purchase Travel Medical Insurance

You may be able to purchase travel coverage through your existing private insurer, a travel agent, or your credit card. If not, there are specialist companies.

If you are travelling, even for a short period, travel insurance is important. Outside of your province, your provincial medical plan may not cover your expenses. Outside of the country, it will not. Health care in other countries, like the neighbouring United States, can be extremely expensive. In some countries, you may even be denied critical care if you are unable to pay upfront.

Recommended Reading: Starbucks Benefits For Part Time Employees

If I Qualify For An Exemption Can I Get Catastrophic Health Insurance

If you are approved for either a hardship or affordability exemption, it means you may then get a catastrophic health insurance plan, if you choose.

Catastrophic health plans can help protect you from high emergency medical costs, while also covering some essential health benefits like an annual check-up, certain preventive services, and at least three primary care visits before you have met your deductible. However, if you anticipate costs associated with managing a chronic health condition, you may save more with another type of health plan.

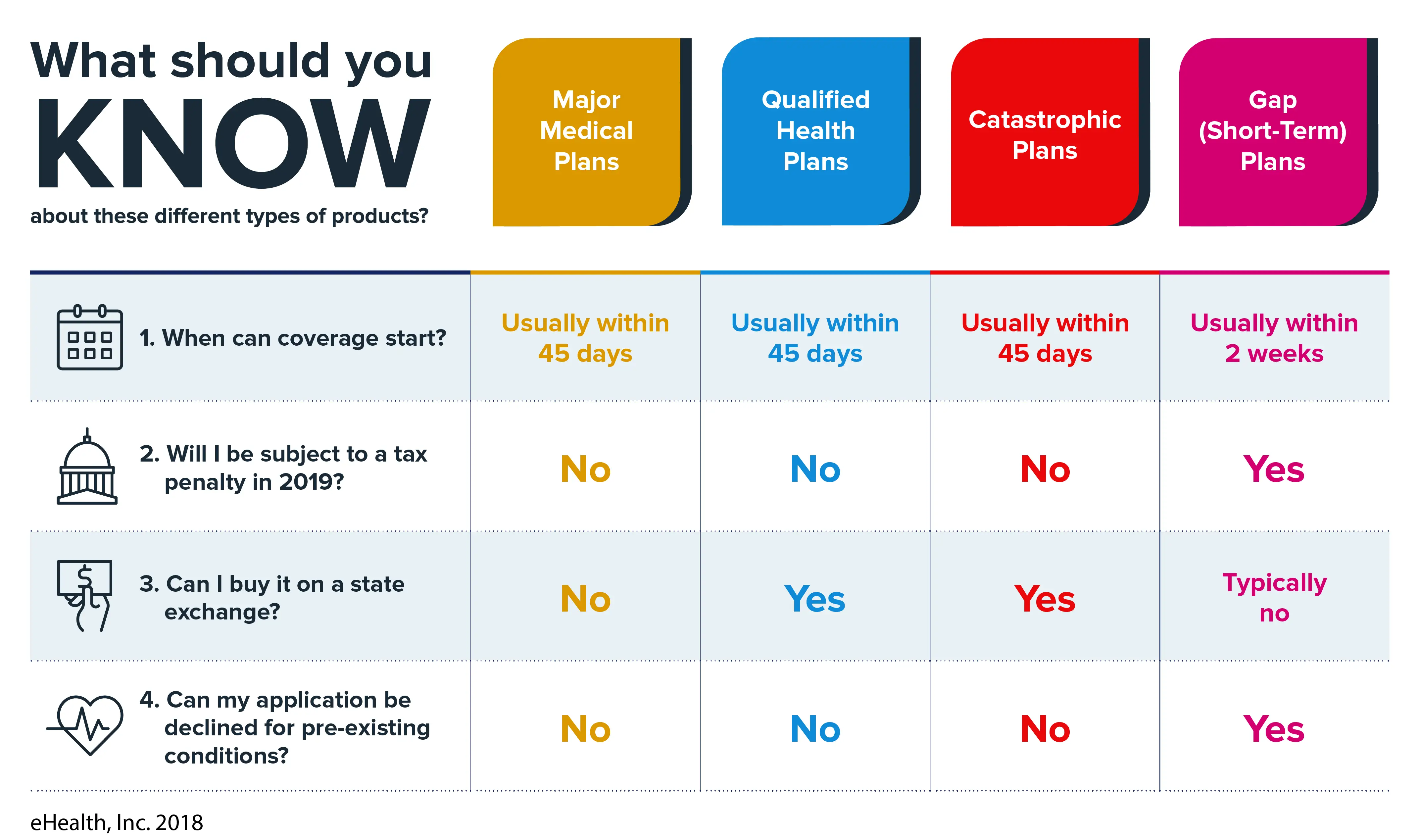

What Is The Difference Between Major Medical And Catastrophic Coverage

Major medical insurance is a term used to describe plans sold on the Health Insurance Marketplace that meet the Affordable Care Acts requirements. While major medical plans have different tier levelswith different premiums and deductiblesthey all cover the same preventative services and essential benefits.

Catastrophic plans are also sold through the Health Insurance Marketplace but have very high deductibles compared to major medical plans. Youll typically pay out of your own pocket for routine medical care a catastrophic plan only provides coverage once youve paid thousands and met the deductible.

Catastrophic plans arent available to everyone there are age and hardship restrictions.

Also Check: Does Costco Offer Health Insurance For Members

Why Should I Get A Private Health Insurance Policy

Key reasons to pay for private health insurance coverage include:

- Getting the treatment you need, when and where you need it.

- Being covered for a wider range of services and treatments.

- Affordability and cost-effectiveness.

- Saving on unexpected expenses.

- Not having to worry about how to pay for a large health care charge on top of your other expenses like car insurance premiums or mortgage payments.

What Is Catastrophic Health Insurance

Catastrophic health insurance is the cheapest metal tier insurance plan but also includes all of the same essential medical benefits as other health plans under the Affordable Care Act . This is a group of 10 different categories of benefits that all metal tiers of health insurance must provide coverage for and include:

- Ambulance services

- Preventive and wellness

- Pediatric services

Catastrophic plans also provide coverage for three primary-care visits every year and free preventive services. Primary-care visits include checkups and day-to-day care while preventive care includes screenings and immunizations. These two benefits are included with each catastrophic policy even if the deductible for the plan has not been met. However, once the three primary-care visits have been used, then it is your responsibility to pay for additional care visits until the deductible has been met.

Don’t Miss: Starbucks Health Insurance Options

Private Health Insurance In Canada

Private health insurance is health coverage that covers expenses not paid by the public system. It is either purchased by an individual or offered as a benefit by an employer. It typically reimburses a percentage of prescription drugs, dental care, supplemental health care, medical equipment and nursing, and vision care. There are basic, inexpensive plans that can help pay a portion of medical expenses. More complete, more expensive options offer greater reimbursement on a wider range of treatments. These plans may include services like access to therapists and chiropractors, semi-private hospital rooms, catastrophic drug, emergency travel, and orthodontic services.

We highly recommend getting a private insurance plan. It can help you access better care when you need it while saving you from large, unexpected expenses.

Balance your expected needs and your budget to find a plan that makes sense for you.

Popular private health insurance companies in Canada include:

- Physician services, surgery/anaesthesia, x-ray and laboratory services

- Accessories and medical devices bought in pharmacies

- Orthopedic shoes or podiatric orthotics

- Hearing aids

- Nursing care

Health care costs are split between you, the provincial insurer and the private insurer. Your provincial and private plans each pay a percentage. You covering the remainder.

Private health insurance can be a literal lifesaver

Start saving today!