Primary Prevention And Screening Services

Finding: Uninsured adults are less likely than adults with any kind of health coverage to receive preventive and screening services and less likely to receive these services on a timely basis. Health insurance that provides more extensive coverage of preventive and screening services is likely to result in greater and more appropriate use of these services.

Finding: Health insurance may reduce racial and ethnic disparities in the receipt of preventive and screening services.

These findings have important implications for health outcomes, as can be seen in the later sections on cancer and chronic diseases. For prevention and screening services, health insurance facilitates both the receipt of services and a continuing care relationship or regular source of care, which also increases the likelihood of receiving appropriate care.

Screening Services. The U.S. Preventive Services Task Force recommends screening for the following conditions in the general adult population under age 65: cervical cancer , breast and colorectal cancer , hypertension

The Consequence Of Not Having Health Insurance

According to a study conducted by National Health Accounts, the total out-of-pocket expenses on health care stood at 58.7% in 2016-17. As per the Public Health Foundation of India report, 55 million people were drawn to poverty in 2017. Here are some challenges faced by people who don’t have health insurance coverage.

-

Bearing the expenses related to hospitalization

-

Cost of ancillary services like ambulance charges, diagnostic tests

-

No value-added services like free health-checkup, telemedicine, free fitness monitoring apps, etc.

-

No renewal or other loyalty discounts

These challenges increase out-of-pocket expenses. The costs increase multi-fold when the family contains children and elderly people.

Health insurance is a solution to such challenges. One can claim costs like hospitalization expenses, ancillary services, value-added services, and get discounts on health insurance policies. The financial burden is greatly reduced when a good health insurance company is providing the backup.

Also, read:Pitfalls of Not Buying Health Insurance Plan

Employee Health Benefits Statistics

1. Health insurance is the most commonly offered benefit at 58%.

The importance of health benefits to employees makes this the most offered option by far. Other benefits that feature prominently in company offerings include employee assistance initiatives , company discounts , parking subsidization , caregiver time off , gym memberships , and discounts on recreational activities .

2. 39% of all employees say their personal and professional lives are negatively affected by money concerns.

Employee benefit statistics reveal companies that offer subsidies or programs to help out financially are far more likely to have a happy and productive workforce. Money problems are one of the biggest sources of stress for people from all walks of life. These concerns significantly impact employee wellbeing, and subsequently, their performance.

3. Employees who experience severe financial stress levels lose between 29 and 39 workdays every year to attend to concerns.

Employee wellbeing can take a quick dive because of stress which affects peoples ability to be productive and even present at work. Voluntary benefits statistics suggest that any financial assistance as part of a benefit plan can give employees the stability they need to perform.

4. 91% of Generation Z and 78% of millennials believe that every company should implement a mental health policy for employees.

5. 77% of Generation Z and 78% of millennials agree that mental health should be a topic of discussion in the workplace.

Recommended Reading: How Much Does Individual Health Insurance Cost In California

Should Small Businesses Offer Group Health Insurance In Their State

Although offering small business health insurance is optional for small businesses with less than 50 full-time equivalent employees, there are several reasons you may consider providing group health insurance to your employees based on market and industry trends in your state or neighboring states.

- Your small business could begin by looking at the percentage of people in your state who have employer-sponsored health insurance coverage.

- Depending on the situation and competition, if a high percentage of similar businesses are offering group health insurance in your state, you may want to consider doing so too.

- Employer-sponsored health insurance is highly prized among employees, and offering insurance coverage as a benefit may help you stand out as a desirable employer of choice.

- If a relatively low percentage of businesses in your local area offer group health insurance, then providing employer-sponsored coverage to your workers may lend your company a competitive advantage by being better able to recruit and retain quality employees.

While the practices of competing and neighboring local or state businesses are only one of many important factors to take into account while considering employer-sponsored health insurance, they nevertheless may serve as a helpful starting point for your decision-making process.

Extensiveness Of Insurance Benefits

The type of health insurance and the continuity of coverage have also been found to affect receipt of appropriate preventive and screening services. Faulkner and Schauffler examined receipt of physical examinations, blood pressure screening, lipid screening for detection of cardiovascular disease, Pap test, CBE, and mammography and identified a positive and statistically significant âdoseâ responseâ relationship between the extent of coverage for preventive services . Insurance coverage for preventive care increased men’s receipt of preventive services more than it did that of women. Men with no coverage for preventive services were much less likely than men with complete coverage for such services to receive them . Women with no preventive services coverage also received fewer of these services than did women with full coverage for them .

Ayanian and colleagues used the 1998 BRFSS data set to analyze the effect of length of time without coverage on receipt of preventive and screening services for adults between ages 18 and 65. Those without coverage for a year or longer were more likely than those uninsured for less than one year to go without appropriate preventive and screening services. For every generally recommended service , the longer-term uninsured were significantly less likely than persons with any form of health insurance to receive these services .

Read Also: What Health Insurance Does Cvs Accept

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if its not required, you might decide to offer health insurance to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

Families That Get $280000 And Upwards Do Not Qualify For Rebates

Rebates is the amount the government pays towards the cost of your private hospital health insurance premiums. The amount depends on your income and family status. Thus, singles who earn $90,000 or less, like video game designers and tour guides, could get between 24 and 32% , while families or couples that make more than $280,001 are not entitled to any rebates.

Recommended Reading: Do Doctors Get Health Insurance

You Only Have 2 Days Left To Order Your Free At

Free COVID-19 tests from COVIDTests.gov are coming to an end in just days.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Time is running out to get your free at-home COVID-19 test kits because the US federal government is ending its program soon. USA Today first reported on Aug. 26 that the decision was made due to a limited supply of tests. This comes just as the fall season approaches and as students start the new school year.

Over the weekend, US Postal Service with an announcement that says the “order for free at-home COVID-19 tests program will be suspended on Friday, September 2, 2022.”

The last day to order free COVID tests is Friday, Sept. 2.

In January, the government launched CovidTests.gov, a website that let households order four free rapid antigen COVID-19 tests shipped by the US Postal Service. The site added four more free tests in March, and then another eight more in May.

New Reports Show Record 35 Million People Enrolled In Coverage Related To The Affordable Care Act With Historic 21 Million People Enrolled In Medicaid Expansion Coverage

Uninsured rate approached an all-time low by end of 2021

Today, the U.S. Department of Health and Human Services, through the Office of the Secretary for Planning and Evaluation , released a report showing new estimates for coverage related to the Affordable Care Act , concluding that the total enrollment for Medicaid expansion, Marketplace coverage, and the Basic Health Program in participating states has reached an all-time high of more than 35 million people as of early 2022. The ASPE findings build on a report from the Centers for Medicare & Medicaid Services showing a record-breaking 21 million people in more than 40 states and territories gained health care coverage thanks to the ACA’s expansion of Medicaid to low-income adults under 65. More than two million people gained coverage as a result of Medicaid expansion under the Biden-Harris Administration, ensuring health care coverage for underserved communities during the COVID-19 Public Health Emergency.

The ASPE report also describes new estimates from the National Health Interview Survey, showing that the uninsured rate in the fourth quarter of 2021 was at nearly an all-time low of 8.8% for the full population , compared to 10.3% in the fourth quarter of 2020.

Read Also: How Much Is Health Insurance For Self Employed

More People Have Health Insurance Compared To Last Year

Many people lost their employer-sponsored health insurance due to COVID-19-related layoffs. But there are signs that employer-covered insurance may now be more available.

In December, the nationwide unemployment rate was at its lowest since the COVID-19 pandemic began. In our survey, we found that there was a 2% increase from last year in individuals enrolled in health insurance through their employer, and a 1% decrease in the overall uninsured rate compared to last year.

Private Health Insurance Companies

You can visit the websites of major health insurance companies in your geographic region and browse available options based on the type of coverage that you prefer and the deductible that you can afford to pay.

The types of plans available and the premiums will vary based on the region where you live and your age. Its important to note that the plan price quoted on the website is the lowest available price for that plan and assumes that you are in excellent health. You wont know what youll really pay per month until you apply and provide the insurance company with your medical history.

Pricing and the type of coverage can vary significantly based on the health insurance company. Because of this, it can be difficult to truly compare the plans to determine which company has the best combination of rates and coverage. It can be a good idea to identify which plans offer the most of the features that you require and are within your price range, then to read consumer reviews of those plans.

If you are choosing a family plan or are an employer who is choosing a plan that youll provide to your employees, then youll also want to consider the needs of others who will be covered under the plan.

Recommended Reading: How Much Do You Pay For Health Insurance Per Month

Is It Ok To Use A Test Kit That Was Left Outside

According to the FDA, manufacturers have ensured that the tests remain stable at various temperatures, “including shipping during the summer in very hot regions and in the winter in very cold regions.”

But a test may be damaged by being left outdoors in freezing temperatures or being used immediately after being brought inside from freezing temperatures.

The ideal temperature to store rapid antigen COVID-19 test kits is between 59 and 86 degrees Fahrenheit.

The FDA has warned about the effect of extreme heat on COVID tests, saying that, “long exposure to high temperatures may impact the test performance,” but also recommends simply confirming the test line on the kit.

“As long as the test line appear as described in the instructions, you can be confident that the test is performing as it should,” the FDA site says.

Uninsured Rates By State

The United States Census Bureau regularly conducts the Current Population Survey , which includes estimates on health insurance coverage in the United States. The data is published annually in the Annual Social and Economic Supplement . The data from 1999 to 2014 are reproduced below.As of 2012, the five states with the highest estimated percentage of uninsured are, in order, Texas, Nevada, New Mexico, Florida, and Alaska. The five states/territories with the lowest estimated percentage of uninsured for the same year are, in order, Massachusetts, Vermont, Hawaii, Washington, D.C., and Connecticut. These rankings for each year are highlighted below.

Percent uninsured by state, 1999â2014| Division |

|---|

| 12.0 |

Also Check: How Long Can I Get Cobra Health Insurance

How To Choose The Best Health Insurance Policy

Mohit Kumar, 30 yrs, NoidaFamily: Existing health cover: Recommended cover: Cost of additional insurance:Health insurance is a necessity

How much cover do you need

Veerendra Kumar, 34 yrs, Chennai

Family: Existing health cover:Recommended cover:Cost of additional insurance:

Use a top-up policy

Read More

Dropped By Your Existing Insurer

Although the ACA prevents insurers from canceling your coverageor denying you coverage due to a preexisting condition or because you made a mistake on your applicationthere are other circumstances when your coverage may be canceled. Its also possible that your insurance may become so expensive that you cant afford it.

Also Check: What Happens If I Have A Lapse In Health Insurance

Health Insurance Coverage In The United States

| This article is part of a series on |

|

|

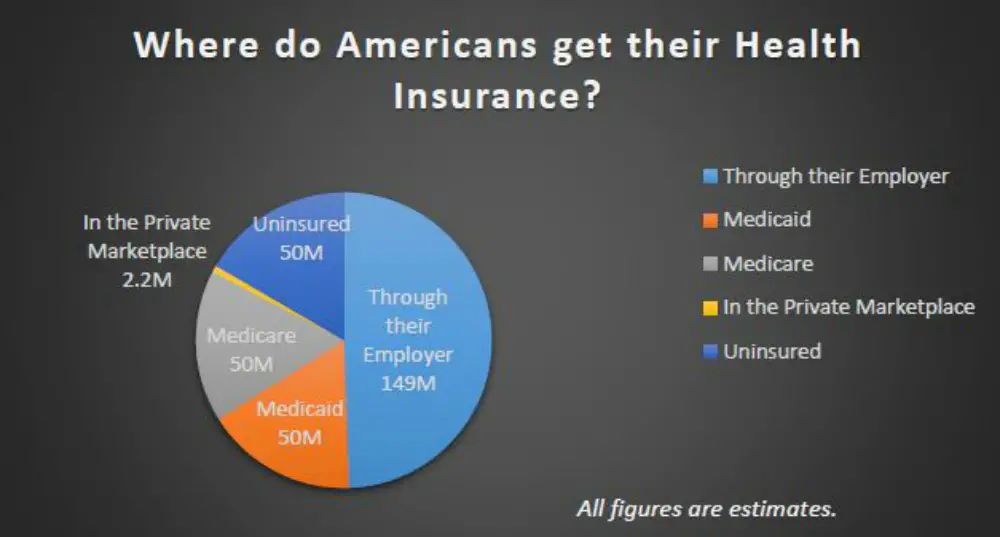

Health insurance coverage in the United States is provided by several public and private sources. During 2019, the U.S. population overall was approximately 330 million, with 59 million people 65 years of age and over covered by the federal Medicare program. The 273 million non-institutionalized persons under age 65 either obtained their coverage from employer-based or non-employer based sources, or were uninsured . During the year 2019, 89% of the non-institutionalized population had health insurance coverage. Separately, approximately 12 million military personnel received coverage through the Veteran’s Administration and Military Health System.

Despite being among the top world economic powers, the US remains the sole industrialized nation in the world without universal health care coverage.

Prohibitively high cost is the primary reason Americans give for problems accessing health care. At approximately 30 million in 2019, higher than the entire population of Australia, the number of people without health insurance coverage in the United States is one of the primary concerns raised by advocates of health care reform. Lack of health insurance is associated with increased mortality, in the range 30-90 thousand deaths per year, depending on the study.

Why The Reforms Are Needed

More than half the Australian population about 13.6 million people have private health insurance, but many people dont fully understand what they are getting for their money and what they are covered for.

Australians have told us they find private health insurance complex and hard to understand what different policies cover and what they do not.

We want to make private health insurance simpler and easier for you to choose the cover that best suits you and your family.

Recommended Reading: Does Health Insurance Cover Dental Anesthesia

What Impacts The Rate Of Uninsured People In The Us

At the moment, it is widely believed that Government-sponsored policies represent the main factor of influencing health insurance rates both in the US, but also in most of the worlds countries.

4. An overview of the Affordable Care Act, or Obamacare

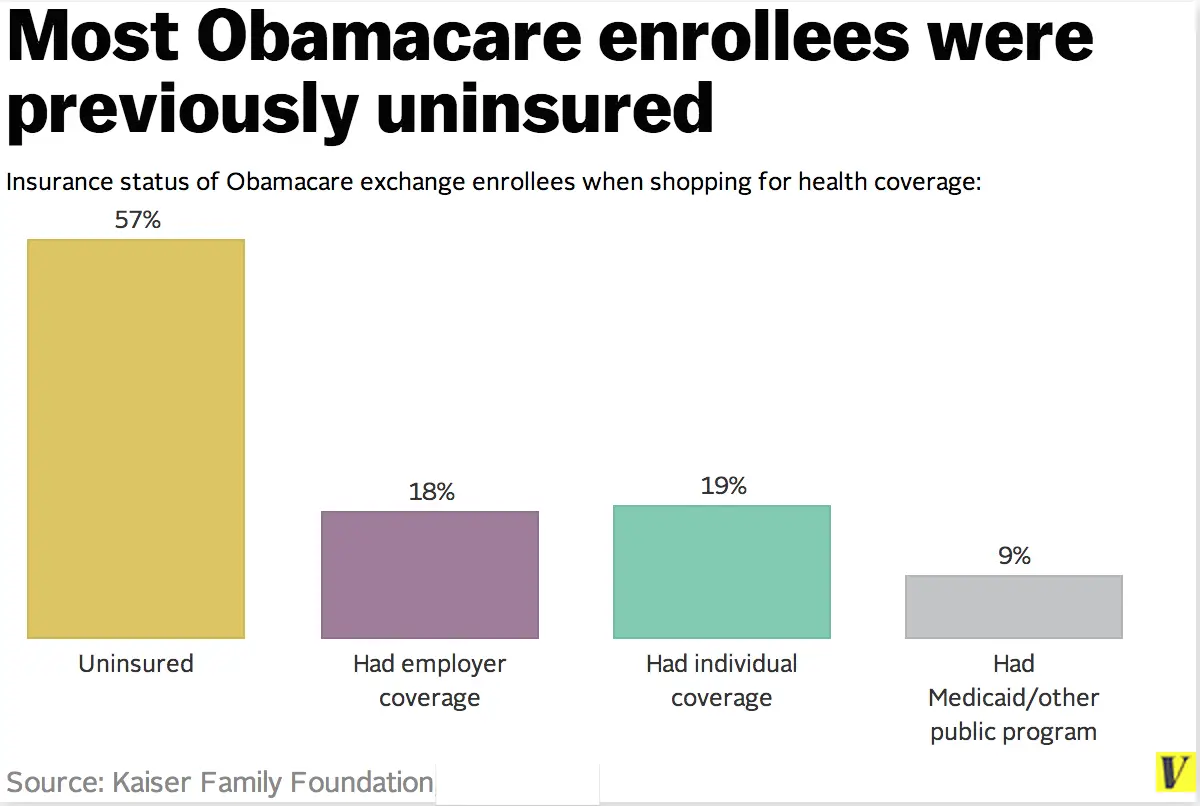

With this in mind, its worth noting that the overall number of uninsured Americans first started improving back in 2011. As such, the most recent and most significant policy change was made in 2010 when President Obama fought to get the Affordable Care Act signed into law. The official version of the act is 906 pages long hence why we will try to offer a brief overview of the law, outlining its main goals, how it plans to achieve them, while also offering several Obamacare statistics. Before anything else, it is important to keep in mind that Obamacare was incredibly successful in increasing the rates of insured Americans and it has managed to achieve such an impact within only a few years.

5. The main goals of Obamacare

Us Health Insurance Industry Overview

To this day, the US lacks a uniform healthcare system, making it quite unique when compared to other developed countries. From a theoretical standpoint, the US health insurance market is a hybrid system since healthcare funding comes from numerous sources and there is no standard across the 51 states.

This hybrid status makes the US healthcare and health insurance markets highly-inefficient , leading to the appearance of numerous challenges. For instance, millions of US citizens currently lack insurance due to the high cost of insurance premiums. State-sanctioned policies have been adopted to help reduce the number of uninsured theyve had some success, yet the battle is far from over.

So, how many health insurance companies are there in the US?

In 2017, the number was estimated to be at around 907 health insurance companies. In total, there were 5,654 health insurance companies registered throughout the US.

Read Also: Can I Have More Than One Health Insurance