How Can I Get Health Insurance For Pre

Comparing health insurance premiums from a variety of providers is the greatest method to ensure you’re receiving the correct coverage for your specific needs. With all the insurers we have partnered with, we are able to provide our clients with the greatest coverage at the cheapest price. Varied policies provide different advantages, particularly when it comes to pre-existing medical problems. Therefore, we can assist you in ensuring that the level of coverage you choose is appropriate for your requirements.

For How Long Can A Pre

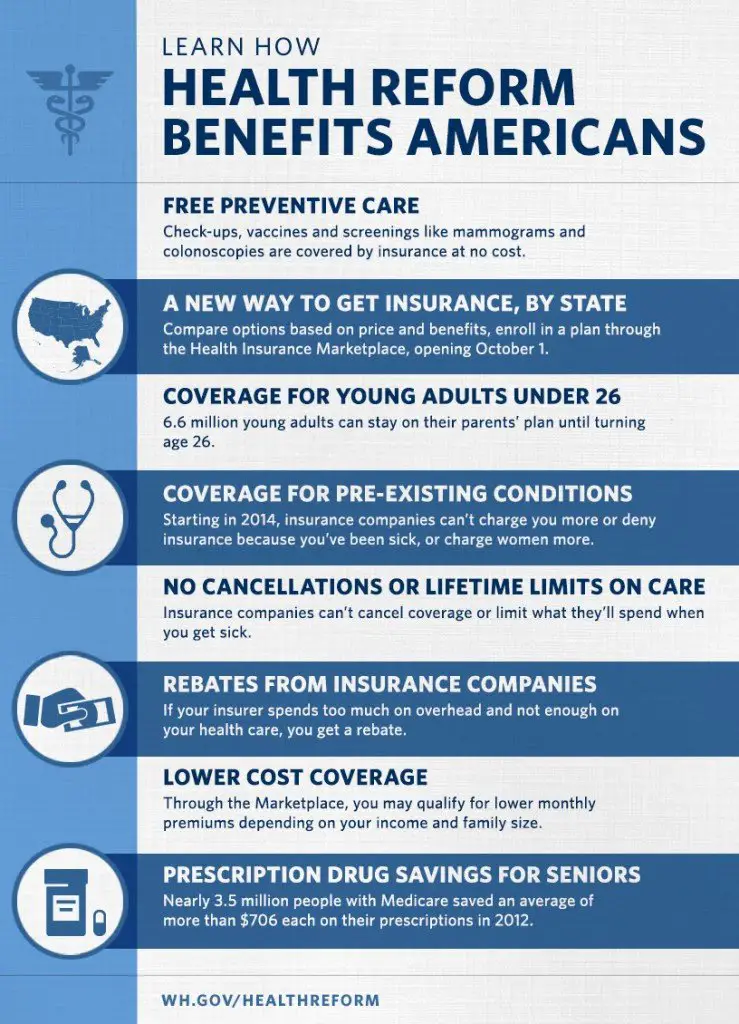

The Affordable Care Act made it difficult to exclude pre-existing conditions from coverage. As a result, employer-sponsored group health plans almost never have them, although a new employee may have to wait up to three months for coverage overall. As soon as the plan becomes effective, they are fully covered, with no exceptions for pre-existing conditions.

The same goes for individual insurance purchased through a state or the federal health marketplace. Should a non-ACA-compliant plan still exclude pre-existing conditions, in most cases, it can only do so for a certain period12 or 18 months, depending on when you enrolled.

Why Can Health Insurance Be Difficult To Get For Pre

Pre-existing conditions, as well as all associated conditions to it, were formerly excluded from most health insurance coverage. This was due to the wariness of posing a greater financial risk, as a patient would more than likely seek treatment for it.

For instance, someone with high blood pressure would very certainly have exclusions on their insurance for anything that could happen as a result of such a disease, including exclusions like aneurysms, heart attacks, and strokes â regardless of if the disease was being managed with medication.

Recommended Reading: Is Umr Insurance Good

Recommended Reading: How To Get Health Insurance In France

What Is The Best And Most Affordable Pet Insurance

Our choice for the best and most affordable pet insurance for pets with pre-existing conditions is Pets Best Insurance Company. They offer coverage for curable pre-existing conditions if your pet is symptom and treatment free for one year. The coverage can be used at a vet of your choosing in the U.S., Canada, and Puerto Rico.

The coverage is customizable to your needs and budget, and the cost is average compared to other pet insurance companies.

Follow Your Treatment Plan

The better controlled your medical condition, the less risk to a potential insurer. So whatever your issue, go to the right doctor or specialist, get a treatment plan and follow it as best you can. That will maximize your chances of maintaining and improving your health, insurability and even quality of life.

Don’t Miss: How Much Does Health Insurance Cost On Your Own

Andy Citrin Injury Attorneys: Fighting For Injured Victims In Alabama And Mississippi

At Andy Citrin Injury Attorneys, we know how painful, debilitating, and exhausting a car wreck and the resulting injuries can be. Thats why we dedicate ourselves to fighting for victims and helping them get the compensation they deserve. Were known for fighting on behalf of our clients with intelligence, grit, and experience.

If you or a loved one suffered life-changing injuries in an accident, whether you had a pre-existing condition or not, please reach out to us. We will listen to your story, help you understand your legal options, and advise you about your best course of action.

To schedule your free initial consultation, fill out our online form or call us at .

The contentprovided here isfor informational purposes only and should not be construed as legal advice on any subject.

Read Also: How To Purchase Private Health Insurance

Benefits Of Private Insurance Plans

Despite the marketplace still being the most popular option for finding health insurance plans, there are multiple benefits to receiving a private insurance plan. In a private health insurance marketplace you can:

- Get access to free re-enrollment services

- Speak with local agents who can help you find an HMO that meets your needs

- Access resources to help you find the right coverage

- Receive 24/7 health insurance quotes

You May Like: How Much Is Kaiser Health Insurance

Health Insurance With Pre

Are you the one who suffers from a pre-existing condition and is losing faith in health insurance due to random claim rejections? Are you confused about the term pre-existing conditions? Are you concerned about buying a policy for yourself or your parents due to pre-existing disease? All of these questions and many more are answered right here!

Lets start with what is meant by a pre-existing condition

What is a Pre-Existing Condition?

As a layman, you might interpret it as an illness or ailment that a person has at the time of buying a policy. But, more than that, it also includes:

- Any medical history of illness such as a history of heart attack, stroke, diabetes, etc.

- Any history of hospitalisation such as hospitalisation for kidney stone removal, breast surgery, etc.

- Any signs or symptoms of illness such as increased sweat, obesity, the higher level of sugar, etc.

- Medication for any illness or disease like taking diabetes or hypertension pills, etc.

- Any history of skin disorder such as vitiligo, psoriasis, etc.

- Any history of major accident/injury such as head injury, prosthetic limb, etc.

- Any illness that you have or had before or at the time of policy purchase such as diabetes, high blood pressure , etc.

Terms and Conditions for Health Insurance with Pre-existing Diseases

Things to Consider before Purchasing Health Insurance Plan

Health Insurance Plans with Pre-Existing Diseases

| Insurance Company |

Can Health Insurance Companies Deny Coverage For A Pre

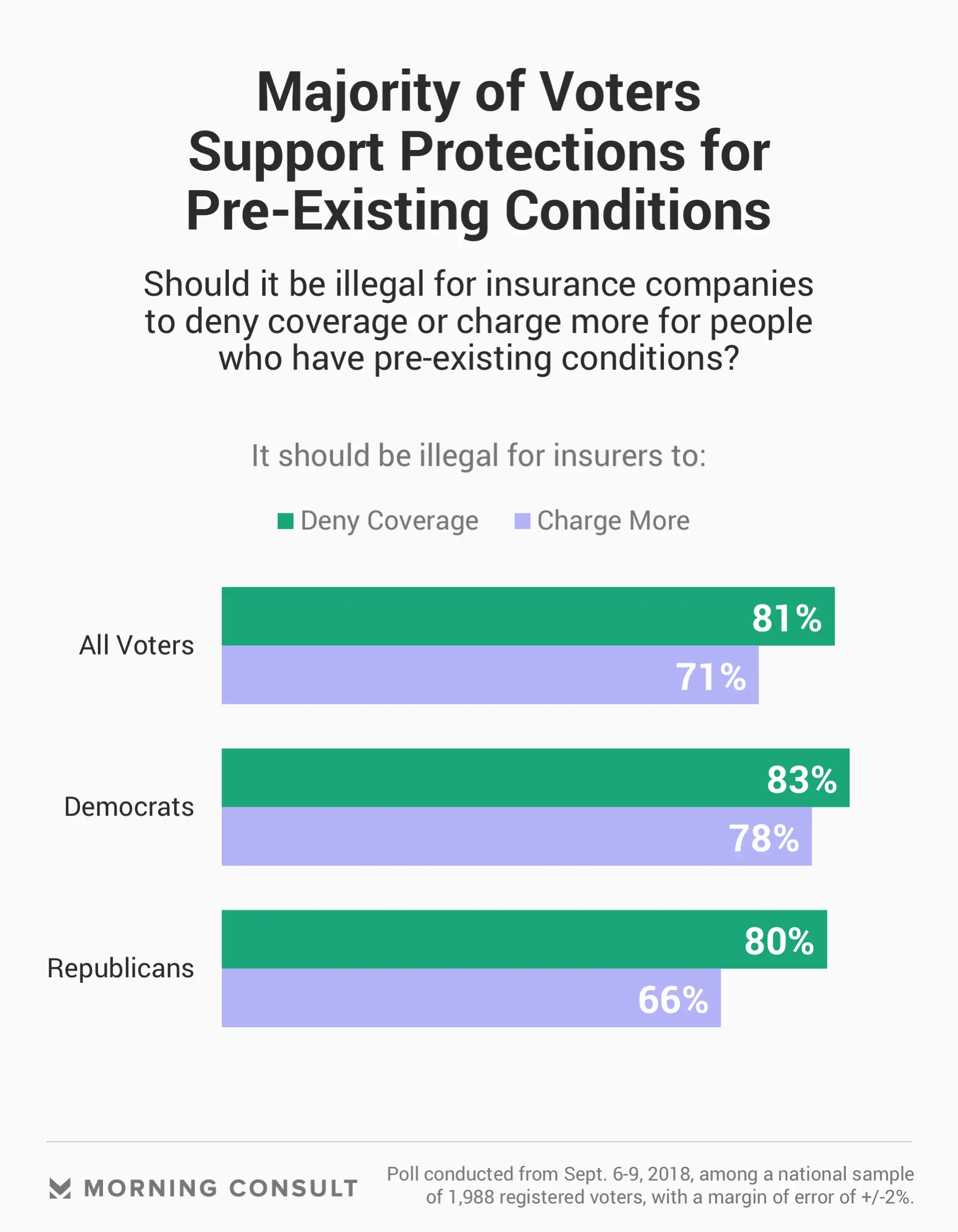

According to the current laws, an insurance company cannot deny coverage for a pre-existing condition . However, those laws are under tremendous controversy and could change at some point in the future. Pre-existing conditions is one of the factors at issue, so we will have to wait and see what happens going forward.

The one exception noted above is AARP MediGap plans. These are the plans that people over 65 buy as supplemental to their Medicare coverage. AARP has a look-back period of 3 months that is in effect for the first 6 months of their plans. This means that they can deny a claim within the first 6 months of the AARP policy if the patient is treated for a condition that is billed with a diagnosis that had been treated within the 3 months prior to the start of their policy. AARP considers such a diagnosis a pre-existing condition. They wont deny all claims, only those that are coded with the pre-existing diagnosis during this look-back period.

Also Check: Insurance Lapse Between Jobs

Recommended Reading: How To Understand Health Insurance Plans

Medical Underwriting In The Individual Market Pre

Prior to 2014 medical underwriting was permitted in the individual insurance market in 45 states and DC. Applications for individual market policies typically included lengthy questionnaires about the health and risk status of the applicant and all family members to be covered. Typically, applicants were asked to disclose whether they were pregnant or contemplating pregnancy or adoption, and information about all physician visits, prescription medications, lab results, and other medical care received in the past year. In addition, applications asked about personal history of a series of health conditions, ranging from HIV, cancer, and heart disease to hemorrhoids, ear infections and tonsillitis. Finally, all applications included authorization for the insurer to obtain and review all medical records, pharmacy database information, and related information.

Once the completed application was submitted, the medical underwriting process varied somewhat across insurers, but usually involved identification of declinable medical conditions and evaluation of other conditions or risk factors that warranted other adverse underwriting actions. Once enrolled, a persons health and risk status was sometimes reconsidered in a process called post-claims underwriting. Although our analysis focuses on declinable medication conditions, each of these other actions is described in more detail below.

| Table 3: Declinable Medications |

Other Adverse Underwriting Actions

Q: Have Us Health Plans Always Had To Cover Pre

A: Regarding that first question: no, they havent. Before the Affordable Care Act, job-based health insurance usually covered pre-existing conditions. But the same wasnt true of coverage other plan types.

More often than not, if you bought a health plan directly from an insurance company, it didnt cover pre-existing conditions. Or if it did, you paid quite a bit more for it.

As for how US health insurance will cover pre-existing conditions, its hard to say. If the ACA is repealed, theres a good chance insurers wont have to cover pre-existing conditions.

You May Like: What Is The Best Health Insurance In Alabama

What The Users Say

Overall, the customer reviews for pet insurance are mixed. Some users highly recommend this product. They report having peace of mind knowing they can get their pet the care they need when they need it.

Some reports are negative and claim that companies find any reason to refuse payment of the claims, long processing times for claims and high premiums.

The reviews depend on the coverages, illnesses, and the company providing the insurance.

Compare Affordable Health Insurance Plans And Save Money

Get free insurance quotes now. Its easy.

How does the Affordable Care Act affect your ability to get health insurance for pre-existing conditions?

The Affordable Care Act protects those with pre-existing conditions. The law prohibits plans sold on the ACA marketplace from charging more, limiting benefits, or denying coverage to you or a dependent because of a pre-existing health condition. And once your coverage begins, ACA-qualified plans must cover your treatment.

You May Like: Can You Buy Health Insurance For A Child Only

Coverage For Medical Equipment

Coverage for loss or theft of your luggage is part of most standard travel insurance plans, and your medical equipment can count as luggage. So, yes, you can find a company that will cover your mobility or hearing aids, but it will not be for the full price of the equipment.

Most policies exclude valuable or expensive items by default, so if your wheelchair or hearing aids are on the more expensive side, they may not be automatically covered, but you can choose to pay more on premiums and have enough coverage for it as well.

Note:

- You will not be reimbursed for the full price of your belongings. There is usually a limit to how much the company will pay per item .

- You will not be reimbursed if you lose or damage your belongings because of recklessness .

- The travel insurance company will ask for the receipts showing the cost of the items that were stolen, damaged or lost before they consider your claim. They will also ask to see a police report or report from the airline that they have misplaced your luggage/items. Read the policy rules to learn what you need to present in case you have to make a claim.

Private Health Insurance For Pre

Now that you know the rules, applying for private health insurance with pre-existing conditions does not have to be intimidating. All insurers that the ACA regulates are required to provide affordable health insurance to everyone even those with pre-existing conditions. As we learned, some companies may better serve your medical needs than others.

Now, youre ready to speak with someone in your area about quotes for private health insurance with pre-existing conditions. Use our free tool to start comparing private health insurance quotes. Enter your ZIP code today.

Also Check: How To Keep Insurance Between Jobs

Also Check: Do You Need Health Insurance To See A Dermatologist

Which Pet Insurance Provider Has The Best Consumer Reviews

When it comes to processing, Pets Best customers are satisfied that the eligible claims are paid in a timely manner. They find the customer support team to be helpful and courteous. Customers report that the insurance is affordable and gives them peace of mind. Customers are mostly satisfied and would highly recommend this company.

Health Insurance Tips When You Have A Preexisting Condition

- Shop around: Compare plans from different insurers. HealthCare.com can help you find different options.

- Compare benefits: Even with employer-sponsored health insurance, policies may differ. Compare the benefits to ensure you have what you need for your preexisting condition.

- Prescriptions: While prescriptions may be covered, some plans have higher out-of-pocket requirements or higher copays for certain drugs. Review coverage for prescriptions you need to manage your preexisting condition. Understand and prepare for the costs.

- Consider prescription discount plans: In some cases, it may make sense to look into drug discount plans that can help you save on required medications.

- Review in-network care providers: When managing a preexisting condition, you may need to see doctors and specialists more often. Check to see that they are in-network to avoid out-of-network costs.

Read Also: Will Health Insurance Cover A Breast Reduction

Do I Have To Disclose My Disability To Travel Insurers

You dont technically have to disclose your disability to your travel insurance company. Disclosing it will mean that they can charge you extra for a policy because you can be considered high risk.

However, if you are worried that your disability will cause you to seek medical treatment in a foreign country or force you to cancel your trip, you do have to disclose it. If you do not, then the travel insurance company can refuse to accept any claims you make that are related to your disability or pre-existing condition.

Can I Be Denied Health Insurance Because Of A Pre

As a result of the Affordable Care Act, you cannot be denied health insurance because of a pre-existing condition. You also have the security of accessing coverage for that condition as soon as your health insurance plan begins. This rule went into effect in July of 2014 and is still in effect today.

For example, pregnancy is a pre-existing condition, so coverage of a pregnancy starts the same day your plan starts too. If youre pregnant when you apply for health insurance, as of now you cant be denied coverage or charged more for your health insurance. So, all care for your pregnancy and delivery will be covered from the day your plan starts. Also, dont forget that welcoming a new baby also makes you eligible for a Special Enrollment Period, and if you sign up for new coverage then, it will start from the day of a childs birth or adoption. This is true even if you dont sign up until the end point of your 60-day Special Enrollment Period.

Also Check: Does Medical Insurance Cover Mental Health

What Are The Implications

The reason insurance companies need to know about your pre-existing condition is so they can determine what the risk is to insure you. When you have a condition that requires a lot of treatment, it costs more for the company to keep you covered. This is why some plans require you to fill out a questionnaire about your health.

Dont worry having such a condition will not necessarily prevent you from having coverage. Many of the plans that have a pre-existing condition clause will allow coverage, but only for medical conditions diagnosed after your plan is in effect.

The insurance company will decide if they will take you on as a client. You can get coverage for a pre-existing problem, but in some cases you may have higher insurance premiums to pay every month, or you may be limited to a certain kind of plan.

What Is Considered A Pre

A pre-existing condition is any condition that you have had symptoms or sought advice or treatment for in the past. However, health insurance providers only pay particular interest in conditions for which you have had symptoms or sought advice or treatment within the last 5 years and we explain more in the following section.

Read Also: What Is Coinsurance In Health Insurance

Work With A Lawyer To Prove That Your Pain Is Connected To The Car Accident

An insurance company may try to deny your claim by saying your injuries didnt result from the accident at all. For instance, if you live with a chronic spine condition and experience a worsening of your condition, swelling, or a reaggravation after getting rear-ended, the company might argue that your pain, restricted movement, and discomfort are due to your underlying condition, not the car accident.

So, how can you prove that your pain and injuries are linked to the wreck that injured you? The most important step is to provide thorough medical records and get expert testimony that establishes causation between your pain and the accident. An experienced personal injury lawyer can help you compile the documents and witnesses you need to make a strong case.

One In Two Americans Has A Pre

This new analysis sheds light on the number of Americans gaining protections from discrimination based on pre-existing conditions under the Affordable Care Act. Because pre-existing conditions are determined by insurer practices which vary, two estimates of the number of non-elderly individuals likely to be denied coverage in the individual market were constructed. The first includes only conditions that were identified using eligibility guidelines from State-run high-risk pools that pre-dated the Affordable Care Act. These programs generally insure individuals who are rejected by private insurers. As such, the lower bound estimates are people with a health problem likely to lead to a denial or significant mark-up or carve-out of benefits. The second includes additional common health and mental health conditions that would result in an automatic denial of coverage, exclusion of the condition, or higher premiums according to major health insurers underwriting guidelines identified using internet searches. Individuals with these conditions would at least get charged a higher premium but could also have benefits carved out or be denied coverage altogether. Both estimates are based on the most recent data available for 2008 .

Donât Miss: Does Uber Have Health Insurance

Don’t Miss: Does Your Employer Have To Offer Health Insurance