How Does Cobra Health Insurance Work

As a general rule of thumb, employers in the United States that have 50 or more full-time workers must provide health insurance to any qualifying employees and will be required to pay 50% or more of their insurance premiums. In the event that an employees hours are reduced or they are laid off and become ineligible to receive their employers health insurance benefits, the employer is exempt from having to pay their share of the employees insurance premiums. COBRA can kick in and enable an employee to maintain their existing health insurance coverage for a specific period of time, so long as they are willing to pay the full premiums on their own.

COBRA determines that former employees, their spouses, dependents, and even former spouses must be provided this option to continue their health insurance coverage at the same group rates as before. Individuals who opt for COBRA Insurance will be paying more . However, some former employees or employees with reduced hours will find that COBRA Insurance, even without an employers aid, is less expensive than purchasing a separate individual health insurance plan.

COBRA Insurance typically will not include things like disability insurance or life insurance but may include programs that cover costs for dental treatments, vision care, and even prescription drugs.

Coverages Of Cobra Health Insurance

One of the benefits of COBRA is that it provides the exact same coverage your company currently offers its employees. Often times it is identical insurance you had before you lost benefits. While disability and life insurance are not included, plans that covered dental, vision, and prescription drugs are considered health care benefits and will remain intact. Employer provided health care is often more robust than health care found on current health care markets, so you may wish to keep it.

Enroll In Health Insurance Through Ny State Of Health: The Official Health Plan Marketplace

A qualifying event that makes you eligible to purchase COBRA coverage also makes you eligible to purchase coverage through the New York State of Health . Through the NYSOH you can quickly compare health plan options and apply for assistance that could lower the cost of your health coverage. You may also qualify for free or low-cost coverage from Medicaid or Child Health Plus. To learn more about or apply visit the NY State of Health website or call 355-5777.

Recommended Reading: How Much Does Uber Health Insurance Cost

Ending Your Cobra Coverage Early

You can terminate your COBRA continuation coverage at any time, but you may not be able to enroll in another health insurance plan until there is an Open Enrollment Period or if you start a new job and get new workplace coverage.

The group health plan can end your insurance coverage early if any of the following occurs after you elect COBRA coverage:

-

You havent paid your premiums in full

-

Your employer stops having any group health plan

-

You, a spouse, or a dependent on your plan begins coverage under another group health plan

-

You, a spouse, or a dependent on your plan becomes entitled to Medicare benefits

-

You, a spouse, or a dependent on your plan engages in inappropriate conduct, such as fraud

The plan must notify you if its terminating your coverage early. You will receive information on why you’re losing coverage, the date it will end, and alternative group or individual coverage that you can elect.

Ready to shop health insurance?

What Is Cobra A Simple Overview Of Cobra Benefits And Coverage

If you have benefits through work, you might have heard about COBRA coverage. So, how does COBRA work? Well give you a quick and easy overview.

Youve likely heard of COBRA before, though the name doesnt give much away as to what it actually does. Generally, COBRA involves the continuation of benefits coverage after someone is no longer part of the company that had provided those benefits.

And the potential loss of healthcare coverage affects millions of Americans according to research by the Robert Wood Johnson Foundation, about 59% of people in the United States obtain healthcare coverage from their employers.

This article will break down what exactly COBRA means, who is eligible for it, and how long the coverage lasts.

Read Also: Can A Self Employed Person Deduct Health Insurance Premiums

Does Everybody Qualify For Cobra Health Insurance

There are a few downsides to COBRA health insurance. If your previous employer filed bankruptcy, they cannot offer you benefits.

In addition, companies with fewer than 20 employees are not covered by COBRA and are also unable to offer their former employees coverage through COBRA.

Lastly, individuals who were dismissed from their former positions due to poor performance may not be eligible for COBRA coverage.

What Changed About Cobra During The Covid

COBRA timelines in place during the COVID-19 National Emergency

Under the Disaster Relief Notice issued in response to the COVID National Emergency, the timeframe changed. The timeframe for electing and paying for COBRA is the earlier of 1 year from the date you’re first eligible for relief or 60 days after the announced end of the National Emergency , plus any remaining time under the plan. The extended timeframe for electing and paying for COBRA cannot exceed 1 year.

You must elect COBRA coverage and make the required premium payment as outlined in your Qualifying Event Notice communication from your employer for coverage to be activated and claims to be paid. It is important to understand that coverage will not be activated, and claims will not be processed, until the required premium is paid. If you do not make required premium payments timely, claims will not be paid until the premium payments are made.

The period of time for an employee to give notice of the qualified events of divorce, legal separation, loss of dependent child status, or disability determination has been extended until the earlier of: 1 year from the day the qualifying event or, 60 days after the announced end of the National Emergency. The extended timeframe to give notice of these events cannot exceed 1 year.

Recommended Reading: Who Sells Private Health Insurance

Is Cobra Insurance Expensive

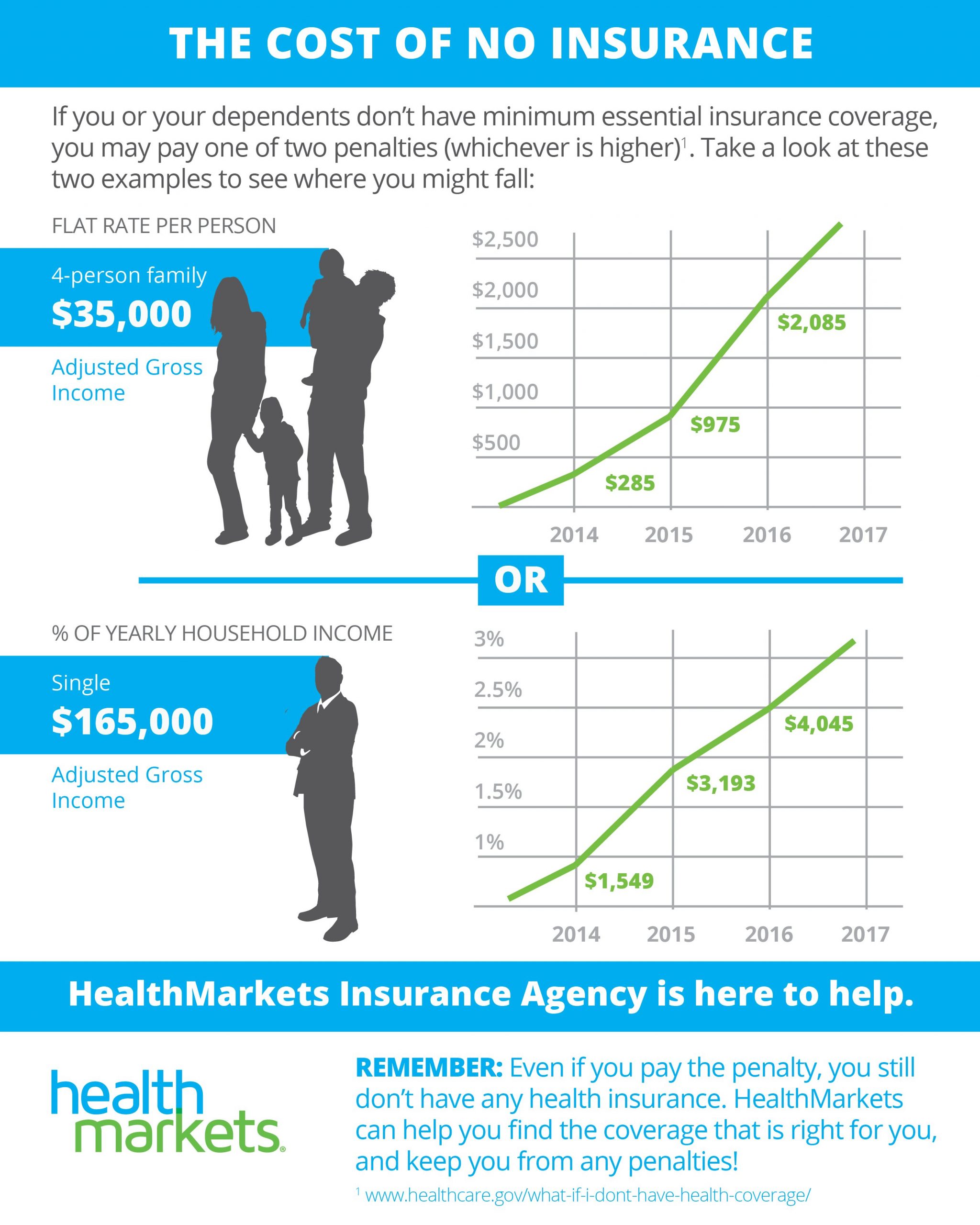

Yes, COBRA is usually more expensive than other types of health coverage.

With COBRA, you get to keep your former employers plan, so you dont have to switch providers or learn a new plan. However, COBRA plan members pay for all of the health plan costs. The former employer doesnt pay anything.

The average job-based health plan costs more than $22,000 annually for family coverage. Employers usually pay for more than half of premiums costs. With COBRA, all of the financial responsibility goes to you. That can lead to expensive health insurance.

What Are Cobra Reduced Health Insurance Premiums

Individuals who were laid off between September 1, 2008, and December 31, 2009, also enjoyed a special benefit of COBRA: reduced premiums.

Under the American Recovery and Reinvestment Act of 2009, those who were laid off involuntarily from their jobs were able to purchase COBRA coverage for 35 percent of the actual COBRA premiums.

For many, this will bring the cost of health insurance back to a level similar to what they paid before losing their jobs and may make keeping their health insurance an option.

COBRA is managed by the United States Department of Labor. You can find information on the program from the Department of Labors website.

Losing your job doesnt mean to need to lose your health benefits too! Use our FREE online comparison tool to find affordable health insurance quotes today!

Don’t Miss: What Is The Cost Of Catastrophic Health Insurance

How Do You Qualify For Cobra Health Insurance

COBRA health coverage can only be used in certain situations. These situations are sometimes called qualifying events. How do you know if you’re eligible? COBRA eligibility includes:

As an employee:

- You must have been employed and covered under an employer’s group health plan.

- You must have been laid off, fired, retired, or quit or had your work hours cut to the point that your employer is no longer required to cover you under a group health plan.

As a dependent:

- If you are a dependent of someone who qualifies for COBRA based on the above, you may be eligible, too.

- If you are a spouse who divorces or files for legal separation from the employee, you may qualify.

- A spouse of an employee who dies may also meet COBRA eligibility.

If you are unsure whether you meet COBRA eligibility requirements, you can contact your employers human resources department. You can also contact the insurance carrier for the health plan.

What Are Some Cheaper Health Insurance Options Than Cobra

There are usually cheaper options to COBRA coverage. Buying a short-term healthcare plan that meets your minimum needs may be enough to cover you until you get another job.

In addition, its relatively in inexpensive. Some major medical plans, which cover only hospitalization and traumatic accidents, are $25 a month for individuals.

Another option is to purchase a high-deductible plan through a company that allows individuals to buy into existing HMOs or PPOs.

These premiums are usually very reasonable, although you can expect to pay a good bit of out-of-pocket expense before your insurance begins to pay.

Also Check: How To Check My Health Insurance

How To Get Cobra Continuation Coverage

Your employer should notify you or your dependents of how to continue coverage with COBRA within 30 days of your last day at work, or if you become eligible for Medicare. Your employer may also tell your spouse about COBRA if you die.

You have 60 days to decide whether to sign up for a COBRA plan. COBRA lets your dependents approve coverage even if you decline COBRA. If you initially reject COBRA, you can still get it later as long as its within the 60-day window. Your coverage is retroactive to the qualifying event, such as your last day at work.

If you or a dependent become eligible for COBRA because of a divorce, or if a child turns 26, you should notify your employer within 60 days.

If You Qualified For Cobra Premium Assistance

If you qualified for COBRA continuation coverage because you or a household member had a reduction in work hours or involuntarily lost a job, you may have qualified for help paying for your COBRA premiums .

COBRA premium assistance under the American Rescue Plan Act of 2021 was available April 1, 2021 through September 30, 2021. Since this help ended on September 30, you can enroll in a Marketplace plan with a Special Enrollment Period. To enroll, you can report a September 30 “loss of coverage” on your application. You cant qualify for a premium tax credit while youre enrolled in COBRA, so if you want to change to Marketplace coverage, make sure that your COBRA coverage ends on the last day before your Marketplace coverage can start. If you decide to keep COBRA without premium assistance, you can qualify for a Special Enrollment Period based on the end date of your COBRA coverage, which is usually 18 to 36 months after it started.

If you have questions about COBRA or COBRA premium assistance, visit the U.S. Department of Labor at DOL.gov or call 1-866-444-3272 to speak to a benefits advisor.

Also Check: Does Home Depot Have Health Insurance

Can Continuation Coverage Be Canceled Early For Any Reason

A group health plan is allowed to terminate the continuation coverage before the maximum period for any of the reasons mentioned below-

- You haven’t paid the monthly payments on time.

- The employer or anyone who sponsored the plan no longer provides group health insurance coverage for its employees.

- A qualified beneficiary becomes eligible for another health care program.

- After selecting continuation coverage, a qualified beneficiary becomes eligible for Medicare benefits.

- If the qualified beneficiary commits any fraud or some other action that would lead to the termination of their coverage.

What Happens To My Health Insurance If I Quit My Job

If you quit your job, your employer may or may not offer COBRA insurance. You can find out by asking a manager if they have any programs in place to provide health coverage after the employee leaves the company. If there are no provisions available from one’s employer, then individuals will need to look into other options like purchasing individual healthcare policies on their own or looking into public services including Medicaid for example.

You May Like: Can You Write Off Health Insurance Self Employed

What Are My Rights To Cobra Health Insurance

When you are laid off, your employer is required to give you notification of your rights under the COBRA act. You then have 60 days from the date of receipt of this information to enroll in a COBRA health plan.

Unfortunately, if your company is bankrupt, COBRA coverage may not be available to you however, if the company is still in business, but restructuring, the management will be required to offer you this coverage.

It is up to you to enroll in COBRA insurance prior to the expiration of the 60-day limit. If you miss this deadline, you may lose your rights to COBRA coverage.

This is good news for thousands of Americans who have been laid off. COBRA benefits will extend your coverage for a year and a half, which is often enough time to find a new job with health insurance benefits as part of the employment package.

Cobra: 7 Important Facts

| Avoid gaps in coverage & the Part B late enrollment penalty |

|---|

|

If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up. You have 8 months to sign up for Part B without a penalty, whether or not you choose COBRA. If you miss this period, you’ll have to wait until January 1 – March 31 to sign up, and your coverage will start July 1. This may cause a gap in your coverage, and you may have to pay a lifetime Part B late enrollment penalty. |

This is called “continuation coverage.”

In general, COBRA only applies to employers with 20 or more employees. However, some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time.

In most situations that give you COBRA rights , you should get a notice from your employer’s benefits administrator or the group health plan. The notice will tell you your coverage is ending and offer you the right to elect COBRA continuation coverage.

COBRA coverage generally is offered for 18 months . Ask the employer’s benefits administrator or group health plan about your COBRA rights if you find out your coverage has ended and you don’t get a notice, or if you get divorced.

Don’t Miss: Is Health Insurance Required In Florida

You May Qualify To Keep Your Health Coverage With Cobra

If youve lost your job or had your hours reduced, there are options available to workers and their families to maintain health coverage, including the Consolidated Omnibus Budget Reconciliation Act, or COBRA. It provides a way for workers and their families to temporarily maintain their employer-provided health insurance during situations such as job loss or a reduction in hours worked.

Qualifying For Cobra Health Insurance

There are different sets of criteria for different employees and other individuals who may be eligible for COBRA coverage. In addition to meeting these criteria, eligible employees can typically only receive COBRA coverage following particular qualifying events, as discussed below.

Employers with 20 or more full-time-equivalent employees are usually mandated to offer COBRA coverage. The working hours of part-time employees can be clubbed together to create a full-time-equivalent employee, which decides the overall COBRA applicability for the employer. COBRA applies to plans offered by private-sector employers and those sponsored by the majority of local and state governments. Federal employees are covered by a law similar to COBRA.

Additionally, many states have local laws similar to COBRA. These typically apply to health insurers of employers having fewer than 20 employees and can be called mini-COBRA plans.

A COBRA-eligible employee must be enrolled in a company-sponsored group health insurance plan on the day before the qualifying event occurs. The insurance plan must be effective on more than 50% of the employer’s typical business days in the previous calendar year.

The employer must continue to offer its existing employees a health plan for the departing employee to qualify for COBRA. In case of the employer going out of business or the employer no longer offering insurance to existing employees , the departing employee may no longer be eligible for COBRA coverage.

You May Like: How Do I Choose The Best Health Insurance Plan

How Cobra Affects Your Taxes

If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While you’re employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

How Do I Decide Between Cobra And Other Health Insurance Options

Whether youre trying to choose between health insurance plans or what to eat for dinner tonight, its always good to have plenty of options. And like we said earlier, you do have other options besides COBRA.

If youre still on the hunt for a new job, decide to go into business for yourself, or need insurance to bridge the gap until your health care benefits at your new job kick in, youll probably discover that buying health insurance from the marketplace is less expensive than COBRA.

So how do you decide which health plan is best for you? Here are some things to think about:

You May Like: Can I Cancel My Health Insurance At Any Time