Nonexpansion Of Medicaid Would Negate Beneficial Effects For The Lowest

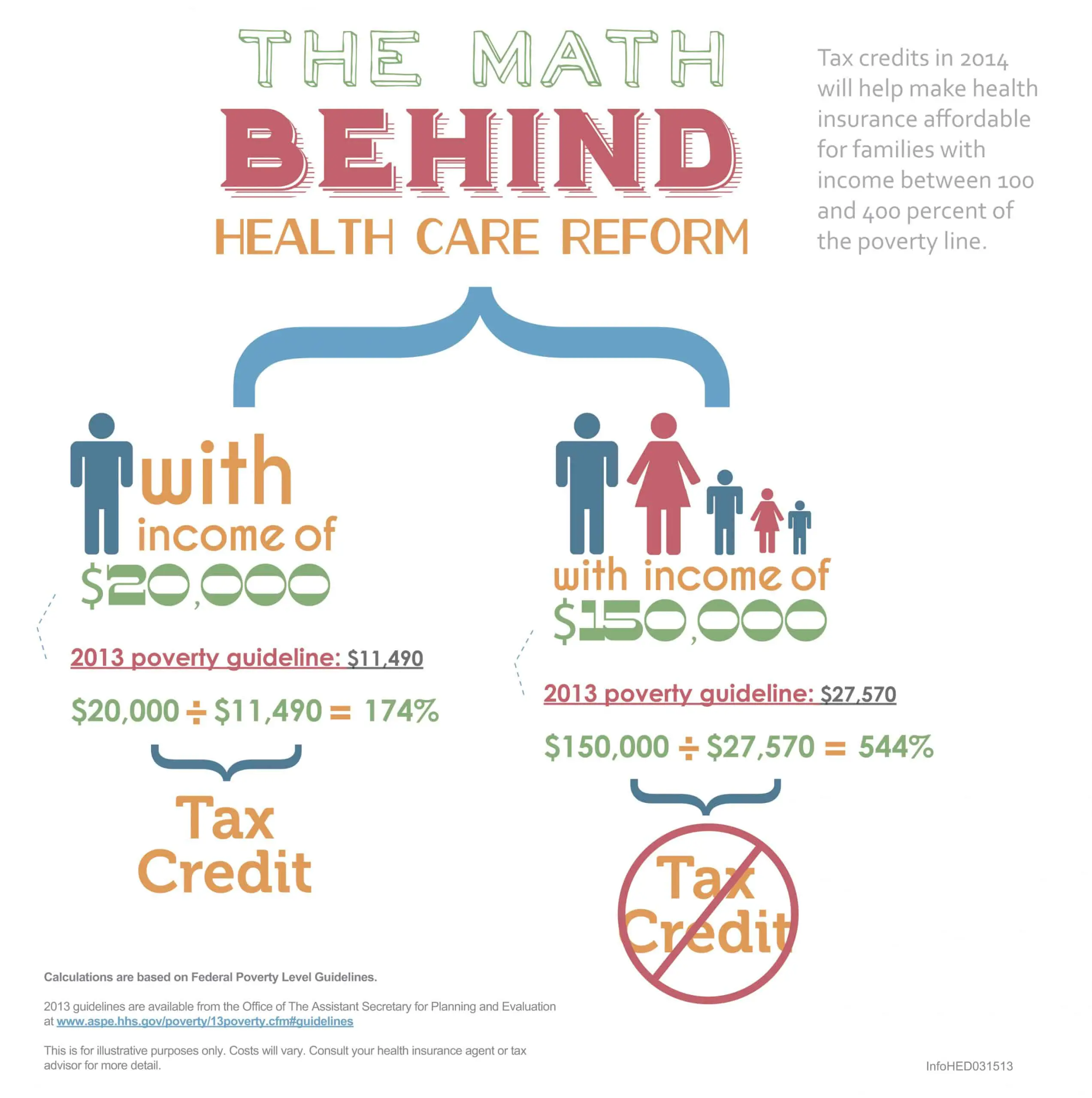

To examine the effects of Medicaid expansion on consumer spending, RAND researchers conducted a more-granular analysis focused on two states: Texas and Florida. Both states have decided not to expand Medicaid eligibility. As originally enacted, the ACA envisioned Medicaid eligibility for people with incomes up to 138 percent of FPL. The law assumed that those with incomes below 100 percent of FPL would be covered by Medicaid, while those with incomes between 100 and 138 percent of FPL could buy subsidized coverage in the regulated individual market if they were ineligible for Medicaid. Therefore, the law allows subsidies in the individual markets only for those with incomes above 100 percent of FPL. However, the Supreme Court ruling of 2012 made Medicaid expansion optional for states. Thus, if a state chooses not to expand Medicaid, consumers with incomes over 100 percent of FPL are eligible for subsidies on the individual exchanges, but those with incomes below 100 percent of FPL are not. In many states, including Texas and Florida, eligibility for Medicaid is below 100 percent of FPL for some participants, such as childless adults. Therefore, many in this income range will face large out-of-pocket spending or a high risk of catastrophic health care costs or both if Medicaid is not expanded.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Continuation Coverage. The page links to information about COBRA including:

How To Sign Up For Affordable Care Act Health Insurance In West Virginia

CHARLESTON, WV Its that time of year again where people can sign up for health insurance under the Affordable Care Act.

Open enrollment for whats commonly called Obamacare begins Tuesday Nov. 1, 2022, and runs through Jan. 15, 2023. New rules this year will make many more people eligible than in the past. There are a variety of health plans to choose from, and most people who apply will be eligible for government subsidies to pay for much of the cost of the coverage.

We know that having health coverage is one of the most important things that you can do for you and your family to remain healthy. It helps you establish a relationship with a doctor. You can catch small problems before they turn into large problems, and turns into heart attacks and cancer, said Jeremy Smith, WV Navigator Program Director.

Between 150,000 and 200,000 West Virginians have signed up for Obamacare since the program began 10 years ago. On Tuesday there will be a free sign-up event at H.I.M.G. in Huntington, sponsored by Mountain Health Network. Its on Highway 60 near the I-64 interchange, between noon and 7 p.m.

Health care officials tell me other free sign up events like the one in Huntington Tuesday, will be held all over the state in the coming weeks. For more information check out the website:

Copyright 2022 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Recommended Reading: How To Register For Health Insurance

Extending Eligibility For Premium Tax Credits Is The Best Option For Helping Middle

Even when premiums are similar, individual market plans are generally less affordable for middle-income consumers than employer plans. Employees typically pay only a portion of premiums out of pocket, with their employers paying the rest. In addition, middle-income families with employer coverage receive a tax subsidy averaging over $5,000, covering close to 40 percent of premiums.

In contrast, the roughly 6 million individual market consumers with incomes too high to qualify for premium tax credits pay the full sticker price of their plans out of pocket. The result is that some middle-income individual market consumers especially those with incomes only modestly above 400 percent of the poverty line, those who are older, and those who live in high-cost areas face premiums that exceed 15 or even 20 percent of their income.

A straightforward solution to making coverage more affordable for middle-income consumers would be to make them eligible for the ACAs premium tax credits. For people with incomes below 400 percent of the poverty line, premium tax credits are calculated as the difference between sticker price premiums for the benchmark plan and a set share of income for example, 9.86 percent of income for people with incomes between 300 and 400 percent of the poverty line. Premium tax credits cover the remaining cost of the plan.

Federal Regulatory Steps That Can Assist States And Consumers

In 2018, the Trump administration released guidance that replaced the Obama administrations 2015 guidance on Section 1332 waivers.39 The new guidance encouraged states to submit waivers that would undermine the ACAs consumer protections.40 Using this guidance, the Trump administration approved a waiver from Georgia that would have, among other provisions, removed the state from HealthCare.gov.41 Prior to the end of the Trump administration, the 2022 Notice of Benefit and Payment Parameters adopted the 2018 interpretation of Section 1332s guardrails.42 The Biden administration then issued a regulatory freeze that covered the final rule, as well as an executive order revoking the 2018 guidance.43 The Biden administration subsequently issued a proposed rule to rescind the Trump administrations 1332 regulation.44 The proposed rule is largely consistent with the Obama administrations 2015 guidance.

In addition, the Biden administration can act within its existing authority to fix the so-called family glitch. Fixing the glitch would allow family members of a person with employer-sponsored insurance to qualify for subsidized marketplace coverage if the job-based coverage is unaffordable for the entire family.47 Changing this would eliminate another affordability challenge facing states and potentially increase the amount of a states pass-through payment.

State-specific assessments

Also Check: What Is The Best Individual Health Insurance In Florida

People Are Also Reading

We are really excited that for 2023, we are going to see the enhanced affordability measures again, which means that many Montanans will get a bigger tax credit to make their monthly, MTPCA Director of Population Health and Coverage Olivia Riutta said.

The affordability measures, originally part of the 2021 American Rescue Plan Act, prompted a 14% increase in enrollment in Montana, Riutta added.

For folks that have maybe applied in previous enrollment periods, if they found it unaffordable, were really encouraging people to try again, she said.

Another tool to reduce the cost of those plans is a new tax credit that will make family health insurance plans more affordable. Individual workers who have been able to obtain affordable coverage for themselves were often unable to find comparatively affordable family plans, Riutta said. The tax credits aim to bridge that gap for family coverage.

The associations navigator website, covermt.org, includes links to applications to determine eligibility for the new tax credits, as well as calculators to determine eligibility for plans and affordability options.

Visitors to the website can also find contact information for navigators and other counselors who can answer questions and guide them through the process.

For more information or help with the enrollment process, contact the Cover Montana help line at 844-682-6837 or by visiting covermt.org.

To reach regional navigators

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

You May Like: How To Cancel Florida Blue Health Insurance

Annual Costs And Premiums

The first thing youll likely notice when purchasing health insurance is the monthly premium. Generally what you pay varies depending on your insurance company, your deductible, where you live, which plan you choose, how many people are covered, your age, whether you smoke and your household family size and income.

Opting A Longer Policy Term Health Insurance Cover Affordable

The cost of health insurance coverage depends upon your age, medical condition, city, and budget. The premium for the health insurance policy might refrain you from opting for an adequate sum insured or deferring your decision to buy. We will learn about Health Insurance Cover Affordable.

The usual health insurance policy is basically an annual insurance policy that needs to be renewed yearly to avail its benefits and coverage on a continuous basis. But there are insurance companies which offer a health insurance plan for a policy term of 2 years and 3 years respectively.

Don’t Miss: Can You Go To The Health Department Without Insurance

What If I Have Questions About My Specific Situation

In each state, people known as navigators provide free consultations to help you choose a health insurance plan. The program is supported by public funding. You can search for local help in your state on HealthCare.gov. Agents and brokers are also available to help. They do charge fees but typically provide their services for free to consumers and charge the insurance companies instead.

Seitz reported from Washington.

Explainer: How To Navigate Affordable Care Act Enrollment

NEW YORK The vast majority of Americans will find multiple options for health insurance coverage for 2023 on HealthCare.gov after open enrollment began Tuesday under the Affordable Care Act.

People searching for plans on the government marketplace should consider their budget, health, doctors and a variety of other factors before picking a plan.

Currently, more than 14.5 million people get their health insurance through the ACA, commonly known as Obamacare. The number swelled during the coronavirus pandemic after Congress passed generous subsidies to make coverage more affordable.

While most people have three or more options, about 8% of participants will choose from only two insurance carriers, a number that drops to one in rural counties across Alabama, Alaska, Arizona and Texas.

According to the Biden administration, 80% of consumers should be able to find a plan for $10 or less per month after tax credits.

Heres a look at navigating the Affordable Care Act marketplace:

HOW DOES THE MARKETPLACE WORK?

The ACA marketplace is geared toward people who dont have health insurance through their job, Medicare, Medicaid, the Childrens Health Insurance Program or another source.

You can use the HealthCare.gov calculator to determine what savings are available to you.

Know the deadlines for coverage in 2023: Dec. 15 for coverage that starts on Jan. 1 and Jan. 15 for coverage that begins Feb. 1.

WHAT TO LOOK FOR IN CHOOSING A PLAN

Most Read

You May Like: How Much Is Temporary Health Insurance

What To Look For In Choosing A Plan

Shop around, even if youre currently covered under the ACA.

First, youll want to see what the monthly premium the amount you pay for coverage will be.

Next, check on the plans deductible thats what you pay up front for health services before your insurance begins to share some of the remaining costs for the year.

Look into the plans copayments or coinsurance. Those are the the fees you pay every time you visit the doctors office or go to an urgent care clinic, for example. Plans with coinsurance can be trickier to budget for because you pay a percentage of the service cost, instead of a set fee.

And make sure to know the out-of-pocket maximum. After you hit that number, your insurance will cover 100 percent of costs. Youll want to keep that number in mind if you might have big health expenses a major surgery, childbirth or ongoing therapy or treatment in the upcoming year.

Consider whether you are going to have an expensive year, said Kelly Rector, an insurance broker and president of Missouri-based Denny and Associates Inc. If you know youre going to be hitting that out-of-pocket max no matter what, maybe you look at the lower premiums and higher deductible plan.

How A Personal Option Can Solve Americas Health Care Dysfunction By Providing More Affordable Health Care Solutions

Americans enjoy one of the best health care systems in the world. Our researchers lead the pack with new lifesaving therapies and state-of-the-art technologies. We boast short surgery wait times and cancer survival rates thought impossible just a generation ago.

But American health care has its share of problems. Onerous federal mandates slash the number of options available to those who need them. We are often left with worse health care outcomes, despite what our advanced system has on offer.

There is no single, simple cure for what ails American health care. But one thing is certain: a government takeover of our health system would only make things worse. Doubling down on the failed status quo would be a terrible mistake.

Instead of a public option, America needs a personal option. We need a set of sensible, principled reforms a personal option that would provide Americans greater access to better quality health care options and more affordable health care solutions.

Fortunately, recent steps taken to give Americans more control over their health care decisions demonstrate whats possible.

Recommended Reading: How Much Is Health Insurance For A Family Of 3

How Do I Choose The Best Affordable Health Insurance Company

As you prepare to compare health insurance quotes to identify the best, affordable health insurance, keep the following in mind:

- Total cost of the health plan: Look at the premium, deductible, coinsurance, copay and out-of-pocket maximum.

- The type of plan: If you want the most affordable health plan benefit design, you may want to go with a health maintenance organization or exclusive provider organization plan. Those plans require you to stay in the plans provider network, but they have lower premiums than a preferred provider organization plan. A PPO gives you more flexibility, but that comes with a higher price tag.

- Your anticipated health care needs: If you dont expect to need much health care, you may save by going with a high-deductible health plan. But if you expect to need more care, choosing a plan with a slightly higher premium but lower deductible may save you money over the year.

- Your health care providers: Make sure that your providers accept a health insurance plan before you buy it. Check with your providers to confirm they take that specific insurance plan and dont rely on the health insurance companys online provider directory, which can be incorrect or out of date.

- Your health insurance options: Getting added to another persons health plan may cost less than buying your own health insurance. Review all of your health insurance options, including a spouses or parents health plan, before choosing a plan.

Hhs Announces New Policy To Make Coverage More Accessible And Affordable For Millions Of Americans In 2023

New measures will help consumers compare health insurance plan choices

Today, the Department of Health and Human Services , through the Centers for Medicare & Medicaid Services , announced new measures that will allow consumers to more easily find the right form of quality, affordable health care coverage on HealthCare.gov that best meets their needs. These measures set the landscape for the upcoming HealthCare.Gov Open Enrollment Period, which will begin on November 1, 2022, and are part of the Biden-Harris Administrations ongoing effort to strengthen and build on the Affordable Care Act .

The Affordable Care Act has successfully expanded coverage and provided hundreds of health plans for consumers to choose from, said Health and Human Services Secretary Xavier Becerra. By including new standardized plan options on HealthCare.gov, we are making it even easier for consumers to compare quality and value across health care plans. The Biden-Harris Administration will continue to ensure coverage is more accessible to every American by building a more competitive, transparent, and affordable health care market.

To view the final rule in its entirety, please visit:

To view the final rule Fact Sheet, visit:

Read Also: Does Aetna Health Insurance Cover Fertility Treatments

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Make Healthcare More Affordable

Where does your healthcare dollar go?

Healthcare spending exceeds $2.6 trillion annually and strains America’s families and businesses, as well as federal, state and local governments that finance programs such as Medicare and Medicaid. The price of medical care, wasteful practices and payment systems, an aging society and personal behaviors are among the factors contributing to rising healthcare costs.

The facts behind this healthcare spending spiral are clear:

- Prescription medications can prevent and treat illness and improve quality of life, but today the cost of developing a new drug is higher than everabout $1.3 billion.

Despite all this spending, patients often dont get the quality care they deserve. And our nation isnt as healthy as it should be.

Blue Cross and Blue Shield companies are helping to improve quality and keep costs down by working with medical professionals to find new ways of providing higher-quality care, better managing the care of patients with chronic conditions, and encouraging everyone to make healthier choices to prevent disease.

Every one of us has the power to help reduce healthcare costs. You and your family can take many steps to improve your own health and save on health and medical expenses. From quitting smoking to losing weight and making good choices about how you purchase medical care, you can lower your own costs and help reduce overall healthcare spending.

Read Also: What Is Difference Between Health Insurance And Medical Insurance