What Counts As An Emergency

Your health insurance plan might cover emergencies, but not all insurers share a definition of “emergency.” A lot of people end up paying for expenses when the insurer decides that the case was not an emergency. Ask your insurer for the exact definition. It will help you decide whether you need to buy supplemental coverage, like health or medical travel insurance.

Blue Cross Blue Shield Coverage In Other States

If you have Blue Cross Blue Shield health insurance, you may be wondering if your coverage will extend to another state. The short answer is: it depends.There are three main types of Blue Cross Blue Shield plans:-Blue Cross Blue Shield PPO plans offer the most flexibility when it comes to seeing out-of-network providers. As long as the provider accepts Blue Cross Blue Shield insurance, you can receive coverage for your care.-Blue Cross Blue Shield HMO plans require you to see in-network providers only. If you need to see a doctor or specialist out of state, you will need to get a referral from your primary care physician first.-Blue Cross Blue Shield EPO plans are similar to HMO plans in that you must use in-network providers only. However, there is no need for a referral from a primary care physician in order to see an out-of-state specialist.If you have a Blue Cross Blue Shield PPO plan, your coverage will likely extend to another state. However, its always best to check with your insurance company before you travel to make sure that your specific plan offers out-of-state coverage.If you have a Blue Cross Blue Shield HMO or EPO plan, your coverage may not extend to another state. In this case, you may want to purchase temporary travel health

Purchase A Travel Supplemental From Your Existing Health Insurance Provider

Many health insurance providers offer supplemental packages that extend their coverage to foreign countries. For example, Blue Cross Blue Shield offers a supplemental package called GeoBlue to U.S. customers traveling overseas.

The advantage of a plan like this is that it requires little thought to set up you merely need to arrange the details with your insurance provider. Since youre already purchasing insurance from this company, youll know what to expect when dealing with them.

The downside to supplemental insurance is that it can be costly due to the expense of coordinating health care across multiple countries. If youre planning an extended trip overseas, these costs can add up.

Additionally, if you opt for a supplemental insurance plan, youre limited to the services your existing health insurance company provides.

Some providers dont offer travel health insurance at all, or they only offer it in limited ways, such as only extending it to certain countries or covering a limited set of circumstances. Check with your existing insurance provider to see if they offer supplemental overseas coverage, and if they do, what it covers. If your existing insurance company cant meet your needs, youll have to look elsewhere.

Don’t Miss: Can I Get Health Insurance Without A Job

What Is Meant By Medical Necessity

Medical necessity means health care services that are consistent with the generally accepted principles of professional medical practice as determined by whether the service:

- Is the most appropriate available supply or level of service for the insured in question, considering potential benefits and harms to the individual

- Is known to be effective in improving health outcomes, based on scientific evidence, professional standards, and expert opinion or

- Can be justified for use based on scientific evidence.

How is medical necessity determined? A doctors attestation that a service is medically necessary is an important consideration. Your doctor or other provider may be asked to provide a Letter of Medical Necessity to your health plan as part of a certification or utilization review process. This process allows the health plan to review requested medical services to determine whether there is coverage for the requested service.

Emergency services may be reviewed retrospectively to see if the care was appropriate to your diagnosis and medically necessary for an emergency level of care. The standard for making this coverage decision is made on the prudent layperson standard, which allows that a precertification is not necessary if a prudent layperson would believe that an emergency condition existed and that a delay in treatment would worsen that condition.

My Kids Are In College In Another State Whats The Best Coverage For Them

As long as your children are under age 26, you can cover them through your healthcare plan under the Affordable Care Act, even if they live in another state. Your adult child can even get married and still be covered under your ACA plan.3 Just make sure there are in-network healthcare providers close to where your child is living and going to school.

Recommended Reading: What Health Insurance Covers Gastric Sleeve

How Do You Apply For Healthcare In Canada

You can apply for a healthcare card from the provincial government in which you reside. Its important to be able to prove that you live in that province for at least 135 days a year. This is very important since you cant use an Ontario Health Insurance Plan card, for example, anywhere else in Canada but in the province of Ontario.

Step 1: Book an appointment with the healthcare service center in your area.

Step 2: You will need to complete a Health Coverage Form.

Step 3: You must have 3 original documents that prove that you:

1) Are a citizen, permanent resident or valid visa holder of Canada

2) Reside full-time in that province and

3) Are who you say you are .

Note: There may be a 3-month waiting period for eligible visa holders and new residents before their healthcare card is activated. It is strongly recommended to apply for private health insurance during this interim. However, due to COVID-19, many provinces have chosen to waive the waiting period.

Also Check: When Does Health Insurance Renew

Can I Live In A Different State Than My Parents And Still Be Covered On Their Health Insurance

May 30, 2014

Yes, you can live in a different state and still be covered on your parents health plan up until age 26.

However, keep in mind most health insurance plans distinguish between in-network and out-of-network care.

If you live in another state, you may not be able to easily access in-network providers for your medical care. Out-of-network care is typically much more expensive than in-network care, often with its own separate deductible. This may make staying on your parents plan prohibitively expensive and inconvenient and you may want to consider having your own coverage.

to read about options for young adults looking for health insurance coverage.

You can also give our office a call and well be glad to help! Phone: 1-800-867-0800 or email: .

Also Check: How Important Is Health Insurance

Health Insurance And Moving Out Of State

Congratulations! You decided to move to another state to fulfill your dream. Does your current insurance cross state lines with you? It may or may not. However, there are things you can do to make sure you keep your coverage or pick up new coverage to avoid gaps. Dont be the person who breaks a leg or gets diagnosed with a serious illness while uninsured just to save a few bucks. Health insurance is expensive. Getting caught without it can cost you even more.

Is Individual Health Insurance The Right Option

Individual health insurance is one of several health coverage options for Washington residents. Most Washington residents get health insurance through an employer or government source instead. If you have other coverage options, you may not need to buy individual insurance. For example:

- Employer-Sponsored Insurance. If you have affordable insurance available through an employer, you still can buy individual insurance as supplemental coverage, but you may not qualify for government financial assistance.

- Medicaid . If you are eligible for Medicaid, called Washington Apple Health, you do not need to buy individual insurance. Apple Health provides free coverage to individuals and families with annual incomes below 138% of the Federal Poverty Level .1 There are higher income levels for children, pregnancy/postpartum, and certain other circumstances see here for an overview and here for details. If you are eligible, you can keep employer or other coverage that you have and still get Apple Health.

- If you are over the age of 65 or have qualified for Social Security Disability Insurance benefits for more than two years, you are probably eligible for Medicare. You may want to consider supplementing that policy since you are still responsible for some costs. However, Medicare enrollees do not need to purchase full individual insurance.

Learn more about these and other coverage options here.

Also Check: How Much Is Health Insurance In Kansas

Since The Aca Law Passed Moving To Anotherstate Is A Qualifying Trigger For Specialenrollment Which Allows You To Enroll Outside Ofopen Enrollment

You must enroll within 60 days ofmoving to the new State.

Otherwise, you will probably need to wait till Open Enrollment but call us at800-320-6269 or email us at as there are some avenues to enroll.

Your effective date depends on when inthe month you enroll.

If you enroll from the 1st to the 15th of a month, you can get the next 1stof the month. If you apply after the 15th, your effective date may move tothe next 1st of the month .

If You’re Leaving A Job

If youre leaving your job and moving to a new state you can extend your coverage through COBRA, short for the Consolidated Omnibus Budget Reconciliation Act of 1985. As your existing health insurance ends, you can get coverage extended another 18 to 36 months , which could tide you over in the new state. But this only works if the insurer has a network in the new state that makes it feasible to get treatment.

Although this is a great benefit, you’ll face a bit of sticker shock. Under COBRA coverage, you pay the full cost of premiums, which brings awareness to how much your employer paid for their share of your coverage.As part of the American Rescue Plan Act of 2021, the federal government paid COBRA insurance premiums for individuals who lost their job as a result of the coronavirus pandemic from April 1 through Sept. 30, 2021.

Recommended Reading: How To Keep Health Insurance After Quitting Job

Insurance Shopping In Your New State

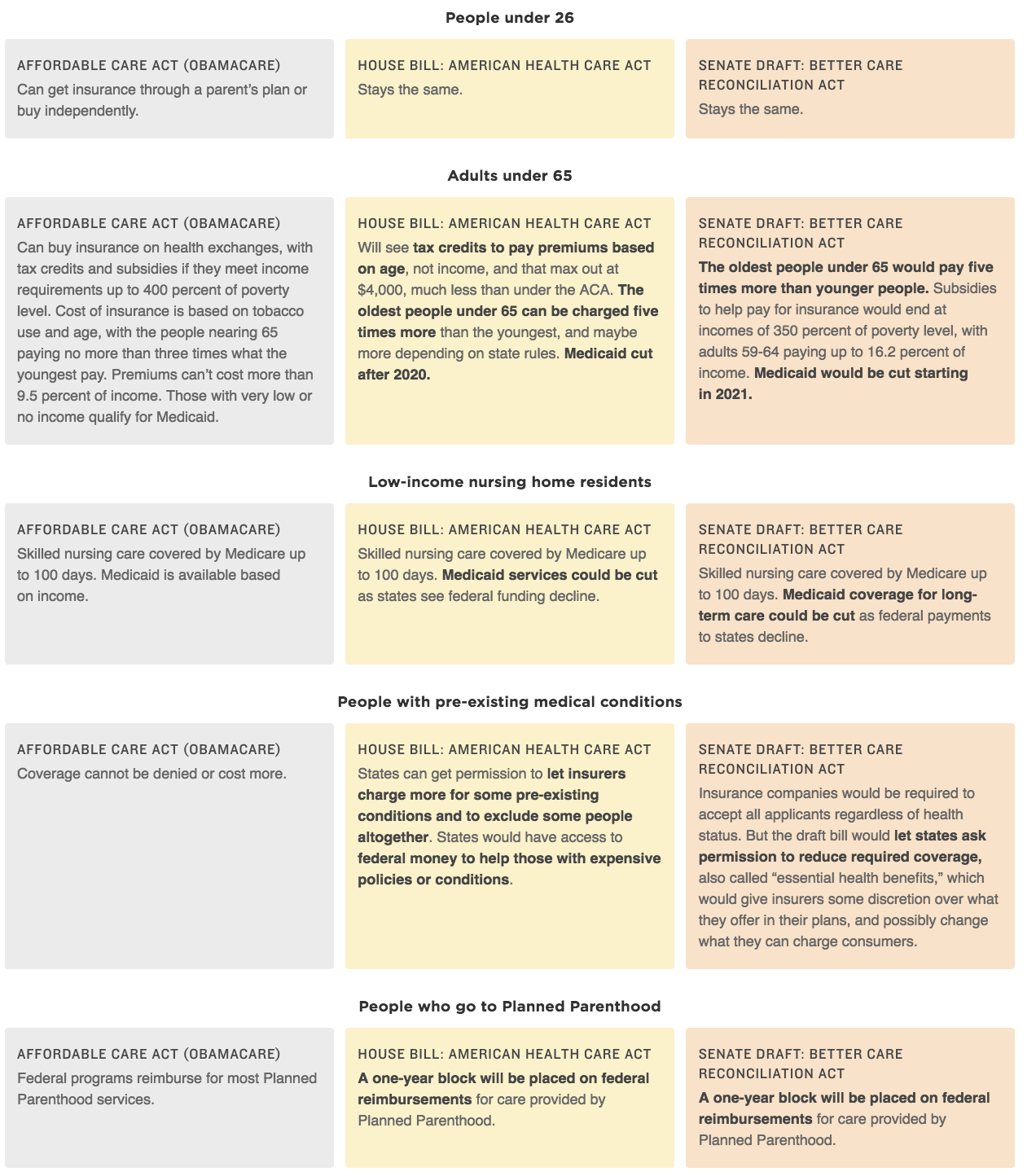

If you need to buy insurance in the new state, the Affordable Care Act makes the process easier. Under the 2010 health insurance law coined as “Obamacare,” you can move and become eligible to buy insurance in the new state. Moving triggers a special enrollment period, allowing you to select a plan right away. If your state doesnt run an exchange, you can use the federal exchange . The Affordable Care Act has many essential benefits.

Much of the uncertainty of moving to a new state has vanished with provisions of the new law. If you move to a new state but dont immediately have a permanent home, you are still eligible to get insurance in your new state as long as you intend to remain there.

Is Health Insurance Effective In A Different State

It depends. All healthcare plans will cover the cost of any emergency services that are offered at any medical facilities within the United States, no matter where the policy was purchased . It should be noted, however, that the treatment does need to be considered life-threatening in order for coverage to work if it is, then treatment will be covered in-network, even if the hospital where you received care is not within the network of your plan. That being said, however, there may be some restrictions, so its important to speak with your health insurance company to find out the details related to coverage in other states.

Health insurance plants will not provide out-of-state coverage for any medical procedures that are not considered emergencies. Therefore, if you receive treatment for something that is not life-threatening, you will likely have to pay for healthcare out of your own pocket. For instance, if you are suffering from a cold while youre traveling and go to the doctor in a different state, you may have to pay for the care you receive yourself. But, there are caveats, as the definition of emergency differs from insurance carrier to insurance carrier.

You May Like: Can Undocumented Immigrants Get Health Insurance

You Can Run Yourhealth Plan Quote Hereto View Rates And Plans Side By Side From Themajor Carriersfree

Again, there is absolutely no cost to youfor our services.

20 years of experience in the California health insurance market has taught usonething… Competent and experienced guidance is INVALUABLE

We are licensed Covered Ca agents with in-depth knowledge of their plans,process, andtax credits.

LINKS

How Health Insurance Works When You Live In Multiple States

You may find yourself needing more than one policy

If you live in more than one place, how does your health insurance coverage work? Thats a question that you might not think of until youre contemplating the possibility of having homes in multiple states, but its worth considering well in advance, as it can be complicated. This article will explain what you need to know to ensure that youll have adequate coverage in each location.

If you have employer-sponsored health insurance and you have to move back and forth between two or more locations due to your job, your employer has probably already worked out the details. If they have employees in that situation, they likely have a plan with a nationwide network and coverage in all the areas where their employees live and work.

But what if you buy your own health insurance or are covered by Medicare or Medicaid? The specifics vary depending on the coverage you have and where you live.

Having homes in two states isnt just reserved for retirees seeking beautiful weather. It also includes college students who spend the school year in a different state, people who relocate on a seasonal basis for work, and a variety of other situations.

You May Like: Are You Required To Have Health Insurance In Texas

Summary Of Benefits And Coverage

Your health plan’s Summary of Benefits and Coverage will show you what is classified as an emergency by your health insurance provider. The SBC is a snapshot of your health planâs cost, benefits, covered health services, and other features that are important to your care. The SBC also includes coinsurance, co-pay amounts, and what is considered an emergency.

You can find your SBC by googling SBC. For example, Oscar Healthâs SBC defines an emergency as something that:

- Puts your life in serious danger

- Puts you baby or childrenâs life in serious danger

- Puts yourself or other in serious danger

- Impairs how your body functions

- Caused serious disfiguration

What To Know About Out

Most insurance plans restrict out-of-state coverage to emergencies and life-threatening injuries only. In the case of out-of-state emergencies, your medical expenses will be billed as âin-networkâ regardless of the hospital you go to.

For example, If you get in a car accident and an ambulance takes you to the nearest hospital that doesnât normally accept your insurance, you will be billed as if you were treated at an âin-networkâ facility.

Recommended Reading: Do You Need Health Insurance To See A Dermatologist

Will My Health Insurance Policy Cover Me In Another State

When traveling across state lines, youve probably wondered, Will my health insurance work in another state? The answer to that question is insurance plans cover emergency care at any U.S. hospital, regardless of your policys coverage area . Therefore, your health insurance will provide you with coverage in any hospital and regardless of your location if a medical emergency is deemed life-threatening. However, there are some limitations. Each health plan comes with a network of specified healthcare providers. When you seek medical care outside this network, you typically shoulder a larger portion of the resulting healthcare costs.

Is Florida Blue The Same As Blue Cross

Blue Cross and Blue Shield of Florida, Inc. is now Florida Blue. The new name, new logo and tagline In the pursuit of health are all part of the companys transition to a health solutions company with an overarching mission to help the people of Florida and their communities achieve better health.

Also Check: Does State Farm Sell Health Insurance

How Insurance Works Out Of State

Every insurer negotiates discounted prices with a network of healthcare providers. When you are treated by someone in this group, you receive in-network care, and your insurance will help pay the bill. On the other hand, out-of-network care is not normally covered by insurers.

Because insurers negotiate costs on a state-by-state basis, most care away from home is considered out-of-network. How youll be billed depends on your plan, but here are the basics:

-

Life-threatening emergencies are covered. Emergency services are covered in every state. If you have a life-threatening emergency, your hospital care will be billed as in-network. For example, if you get in a car accident and an ambulance takes you to a hospital that doesnt normally accept your insurance, youll still be billed as if you were treated at an in-network facility.

-

Routine care is NOT always covered. Depending on your network type, your insurance plan may not cover non-emergency care, like doctor checkups, if it is out-of-state.

Generally, PPOs cover you better when you travel out of state. But they also tend to cost more. Depending on how much you use your insurance and how much you travel, an HMO might still be the right choice for you.

Want to compare 2022 health plans and how they might cover you while traveling? Enter your zip code below.