Should I Use My Own Health Insurance After Being Injured In An Auto Accident In Virginia

Yes, you should use your personal health insurance to cover the costs of medical treatment after an accident. While many people believe that its unfair that they must use their own health insurance when the injuries were caused by someone elses negligence, you should always use your health insurance when you are being treated for an accident-related injury. There are several reasons why it is important to use your health insurance, such as:

Dealing With Insurance Company Delays Or Claim Denials

If a key issue like fault for the car accident is being disputed by the other driver’s insurance company, it might be a while before you receive a fair settlement. In that situation you’ll likely use your own health insurance coverage to pay for treatment for your car accident injuries. The same goes for situations in which the car insurance company is trying to deny your claim. Learn more about what to do if your car insurance claim is denied.

Health Insurance Policies Pay Second

Health insurance does pay for car accident injuries. However, claims should be filed through a personal injury lawyer or health insurance provider second. When a health insurance provider pays for medical bills first, they will simply turn around and file a claim against the car insurance company.

Hospitals, doctors, and ambulance services dont require upfront payments to treat serious or life-threatening injuries, but they do require insurance information to pursue reimbursement. When emergency medical care is provided immediately following a car accident to protect the patient from harm, care providers may work with the patients personal injury lawyer and the patients insurance providers to arrange necessary reimbursement for medical services provided. Reimbursement may be full payment or payment arrangements over a designated time period.

In some cases, accident victims suffer serious injuries from car accidents. Their medical bills can be extremely high, and they need to know how they are going to pay for them. They may askdoes health insurance pay for car accident injuries? The answer is yes. However, it only pays out after all available auto insurance policies have paid out. In some cases, even after all available insurance policies have paid out, accident victims still need additional help to pay medical bills and lost wages.

Does health insurance pay for car accident injuries? The answer is yes. However, which policy pays first varies from case to case.

Recommended Reading: When Does A Business Have To Offer Health Insurance

Pedestrian Gets $10k Limits After Car Hits Him In Miami

A pedestrian was walking in a crosswalk in Little Havana, Miami-Dade County, Florida. A driver of a car hit him.

An ambulance took him from the accident scene to the hospital. He was diagnosed with a head injury. He had stitches to his head.

United Auto Insurance Company insured the at fault driver with a $10,000 BIL insurance policy. United Auto paid us the $10,000 BIL limits to settle his personal injury claim.

Unfortunately, the driver wasnt driving for Uber or Lyft that would have given him more insurance coverage. Our client didnt own a car or live with relatives. Thus, he wasnt entitled to uninsured motorist insurance.

Medical Cost Coverage: Which Insurance Pays First

The answer to this often depends on the auto or health insurance policy. These policies contain language to determine how the insurance companies will coordinate between the various plans. Normally, the first payments for medical bills will come from your health insurance or your MedPay coverage.

Health insurance or MedPay coverage pays first because they are contractually obligated to make these payments. There is no need to determine who was at fault in the accident to trigger their obligation to pay.

Some policies will have Coordination of Benefits language, which will attempt to place an order on which insurance pays first. Some MedPay policies try to avoid duplicating payments made by your health insurance.

There are a lot of specifics on these issues that we cant cover in one article. However, the attorneys at Eng & Woods resolve this issue for clients frequently. You can start a chat with us in the lower right corner to get in touch.

Also Check: Does Health Insurance Cover Dental Braces

How Are Bills Paid In A No

A few states in the U.S. require drivers to carry no-fault auto insurance. Also known as personal injury protection, or PIP insurance, this coverage will pay for some or even all of the medical bills that a victim receives. The coverage triggers regardless of who was at fault for the crash, but limits when victims can file personal injury claims over a car accident. No-fault coverage pays for medical bills up to the auto insurance policys cap. Once the no-fault limit is reached, responsibility shifts back to the victim or to his or her health insurance company.

The following states use no-fault insurance to apportion the costs of a car crash, rather than personal injury claims:

$65k Car Accident Injury Settlement

Doug was vacationing in Miami Beach, Florida. While he crossed the street, a car hit him. GEICO insured the at fault car.

Doug broke his lower leg . Fortunately, he did not need surgery.

After the accident, Doug hired me as his lawyer. At first, GEICO offered only $14,780.15 to settle this case.

Ultimately, I settled Dougs case for $65,000.

Medicare, AARP , Farmers Insurance paid the bulk of his medical bills. Thus, he had to pay them back from the settlement.

The good news?

When it came time to pay them back from the total settlement, they all reduced their liens by my attorneys fees and costs. That is a big advantage to hiring a lawyer in a car accident claim.

After my attorney fees, costs and paying his out of pocket medical bills and liens back, Doug got $35,332 in his pocket.

Doug was thrilled with his car accident injury settlement.

He sent my paralegal flowers and this thank you card:

Don’t Miss: How To Apply For Health Insurance In Colorado

How Does Med Pay Work

Car insurance companies can offer supplemental coverage referred to as medical payments coverage or Med Pay. This coverage is optional and can be used to pay deductibles and copays that your health insurance has set up. When you settle your claim, you do not have to repay these benefits to the car insurance company. Keep in mind that Med Pay benefits follow the individual and not the vehicle. Many passengers fail to tap into these benefits since they do not think they can.

Another benefit of Med Pay is that it is not contingent on who was at fault during the accident. While this may sound beneficial, there is one downside to using Med Pay. Your health insurance provider will have contracts and agreements with various medical providers. These relationships mean that your health insurance provider will typically pay half of the going rate for services. Your car insurance does not have this privilege which means they will need to pay the full cost of services.

If this all sounds confusing, it often is for accident victims who have never faced these challenges. However, a car accident lawyer knows all of these coverage options and internal contracts. While your goal is to recover medically, we aim to ensure you pay your bills and obtain the compensation you are entitled to after an accident.

$20k Settlement For Florida Car Accident

In April 2019, Cesar was driving his minivan on his way to his condo in Brickell, Florida. Brickell is near Downtown Miami. Cesar was on the road outside of his condo and was about to enter the driveway.

A driver of a car crashed into the back of Cesars van. This impact sent him into a concrete wall at the entrance. This was a second impact. In sum, this was a heavy impact accident. The vans airbags deployed.

Here is what Cesars minivan looked like after the crash:

The driver of the car got a ticket for careless driving.

Paramedics arrived to the accident scene. They placed him on a backboard and put a C-collar on his neck. They transported Cesar to the hospital. At the hospital, he was placed on a rolling bed.

Here is a photo:

Don’t Miss: What Is The Best Supplemental Health Insurance For Medicare

When Should I Contact An Attorney

Some good times to contact a car accident lawyer include: If you suspect your health insurance claim may be denied If you believe you may have a personal injury claim against the at-fault driver and you wish to recover the full-value of your case, or If you have been served with a medical, hospital, or health-insurance lien.

You may contact The Millar Law Firm at 770-400-0000 for a free consultation. We are experts in car accident injury cases and health insurance law. Sometimes the only way to receive fair treatment and justice is to hire an attorney. Our firm charges no attorneys fees unless we recover money for you.

Does Health Insurance Pay For Auto Accident Injuries

Sep 6, 2019 | Auto Accidents, Insurance

If you are injured in an auto accident, your expenses may be piling up. Hospital bills, EMS bills, medical equipment, medication, and lost wages from the time you were unable to work are just a few examples.

But the at-fault driver pays these expenses, right? We file a lawsuit, they pay me, I pay my bills, problem solved. Right?

Except lawsuits take time. Even when we settle your case out of court, it takes time. At a minimum, even when liability is clear, you must know what your damages are before you send a demand letter, which means you cannot settle your case until you have finished treating or until we have an expert opinion on what your future medical costs will be.

Even then, the insurance company will take their time paying your claim time is money, and, when they do pay, they will not pay a dollar more than they are forced to pay. Not only that, but the insurance defense companys lawyers get paid by the hour. Do you think they are in a rush to recommend a settlement?

How do you pay your expenses before you reach a settlement or verdict in your auto accident case? Will your health insurance pay for auto accident injuries?

Read Also: Where To Apply For Health Insurance

Do I Need Pip Insurance If I Have Health Insurance

In short, yes, you must buy PIP coverage in New Jersey, regardless of whether or not you have health insurance. Depending on your situation, there may be many benefits to a high PIP coverage amount and choosing PIP as the primary insurer, even if you have health insurance, such as: Compensation for Lost Wages.

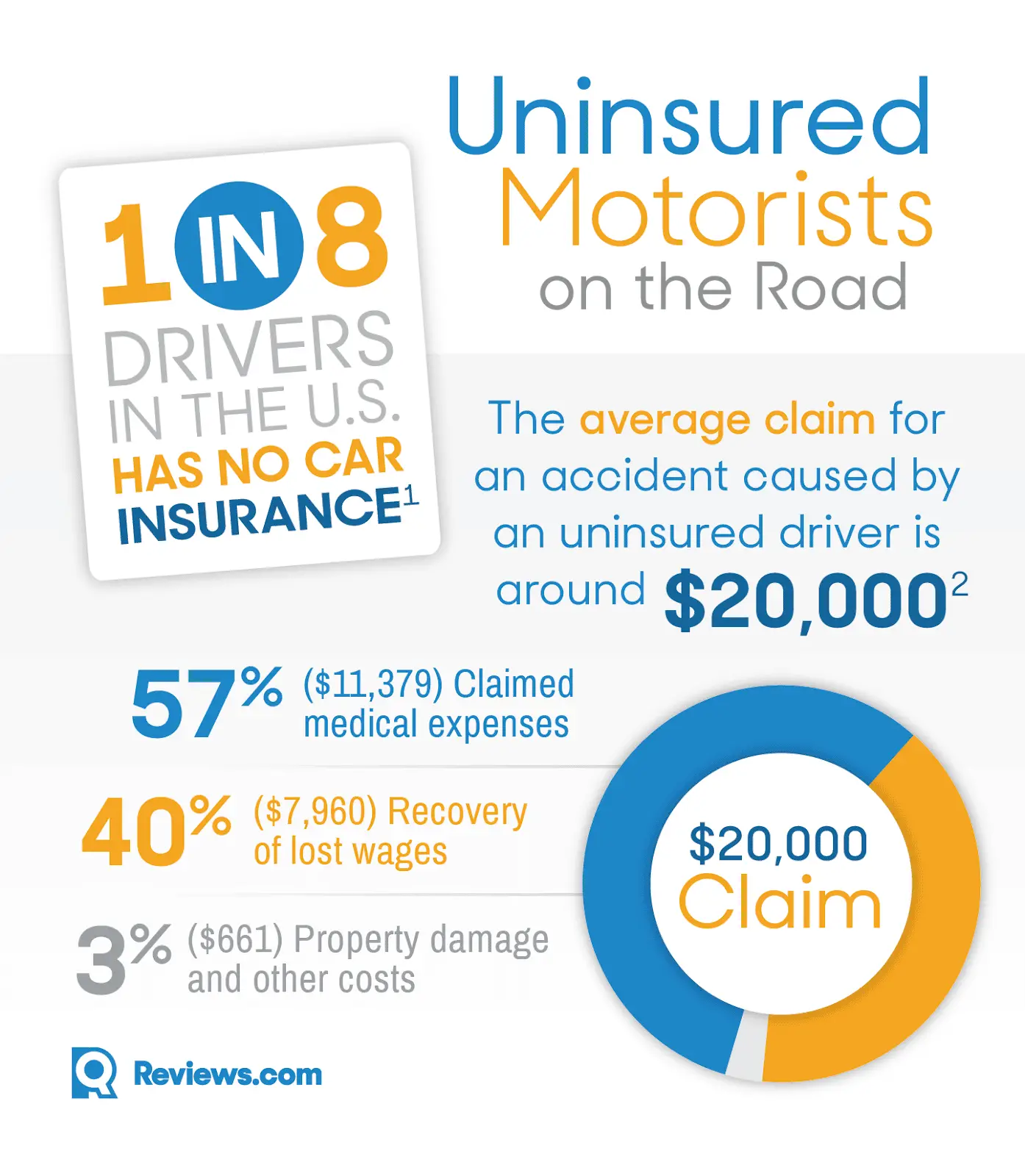

Uninsured Or Underinsured Motorist

To protect yourself if youre involved in an accident with an uninsured driver, add uninsured motorist coverage to your policy. Uninsured Motorist coverage will cover all damages that you can recover from an at-fault party.

Once youre using health insurance to pay your medical bills, you still have to pay:

- Your deductible

- Any charges your insurance policy doesnt cover.

Don’t Miss: How Much Is Health Insurance In Arkansas

What Are Personal Injury Protection Benefits

PIP benefits are compulsory insurance benefits provided to you by your own automobile policy. PIP coverage is optional on motorcycle insurance policies. These benefits are intended to help individuals pay for immediate medical treatment and lost wages suffered as a result of an automobile accident. Typically, your automobile insurer will pay the first $2,000 of medical bills and lost wages after an accident. If you have private health insurance , PIP will continue to pay any out-of-pocket medical expenses and lost wages up to $8,000. If you have public health insurance , PIP will pay all of your medical expenses and lost wages up to $8,000.

Why You Might Not Need To Add Pip Or Medpay

Not everyone should add PIP to their car insurance coverage, however, and the decision is ultimately up to you. Ask yourself the following questions:

- How likely am I to get in a car accident that requires medical care?

- How generous is my health insurance plan?

- Would I be able to afford the medical expenses of a car crash if my health insurance did not cover them?

- Is the additional expense worth the peace of mind it provides?

PIP and MedPay provide an assortment of financial protections that go beyond those provided by health insurance, but they only apply if you’re in a car accident. If you have comprehensive health insurance and have other insurance coverage like disability and/or life insurance that provide coverage redundant to PIP, adding additional PIP coverage may not be necessary. But if you don’t have these additional protections and are concerned about paying for medical care after a car crash, especially if you drive a lot, the peace of mind may be worth the extra expense.

Differences between health insurance, personal injury protection and medical Payments Coverage

| Health insurance |

|---|

Also Check: How Much Health Insurance Do You Need

Coverage Benefits Of Personal Accident Insurance Policy

Under the personal accident policy, you can avail of the following benefits.

-

Accidental Death cover

A death due to an accident can cause severe emotional and financial stress to a family. In such a case the entire assured sum is paid to the nominee mentioned in the policy document. The cover offered for death is usually applicable only within a specific time frame. Unusually, a death that occurs up to approximately 180 days after the accident is covered.

-

Total Permanent Disability Cover

Injuries caused by an accident can be of varying magnitudes. Total permanent disability refers to accidental injuries resulting in permanent or lifelong impairment. For instance, loss of limbs, loss of eyesight, etc. In such cases, a specified insured amount is paid to the insured.

-

Permanent Partial Disability Cover

Permanent partial disabilities refer to accidental injuries resulting in permanent partial impairment. For instance, hearing loss, loss of an eye, loss of a limb, back injuries, etc. In such cases, a certain percentage of the sum insured is paid to the insured.

-

Temporary Total Disability

Temporary total disabilities refer to accidental injuries resulting in temporary total impairment. This could prevent the insured from working and earning a living. In such cases, the insurer will compensate for the loss of income by providing a weekly allowance.

What Is Medicare Settlement

The recommended method to protect Medicare’s interests is a Workers’ Compensation Medicare Set-Aside Arrangement . A WCMSA is a financial agreement that allocates a portion of a workers’ compensation settlement to pay for future medical services related to the workers’ compensation injury, illness or disease.

You May Like: Does Aarp Offer Supplemental Health Insurance

Does Health Insurance Cover Car Accident Injuries The Same As No

No health insurance does not cover car accident injuries the same as No-Fault insurance. Subject to the No-Fault PIP medical benefits coverage levels, No-Fault insurance covers all medical care, medical treatment and medical services that are reasonably necessary to a victims care, recovery or rehabilitation. )

This means that medical insurance and auto No-Fault are definitely not the same. In regards to health insurance covering car accident injuries, it fails to cover many of the necessary medical treatments and services that No-Fault readily covers for people who desperately need certain types of medical care.

These limited and/or excluded medical treatments and services under medical insurance often include:

- Residential care

- Attendant care by an agency

- In-home attendant care

- Long-term speech and cognitive therapy

Does The State Of Georgia Have Pip

The State of Georgia does not require PIP on automobile insurance policies.

PIP protection is a type of no-fault insurance coverage that was in place at one time in Georgia. No-fault insurance provides medical coverage regardless of which driver was at fault for an accident. PIP coverage may be available from certain insurance companies and may be worth asking your insurance agent about.

Recommended Reading: Can My Son Put Me On His Health Insurance

$33k Car Accident Injury Settlement

On July 30, 2018, Shankeva was a passenger in her boyfriends car.

They were stopped at a red light in Holly Hill, Florida.

In the diagram below, Shankeva was in V3.

Terry was driving vehicle 1. Terry crashed head on into vehicle 2. Vehicle 2 then hit Vehicle 3.

Paramedics arrived at the scene.

You can see them taking Shankeva out of the car.

Below, is a photo showing the damage to the car within which Shankeva was a passenger.

The front of the car was wrecked.

You can see this was a heavy impact accident.

Here is a photo of Shankeva on a stretcher:

An ambulance took her to the hospital.

At the hospital, doctors took x-rays, a CT scan and a MRI of her hip.

The x-ray showed an acetabular fracture. Here is what the acetabulum looks like:

Since she had this fracture, they had her stay at the hospital.

They gave her a room.

While at the hospital, someone took a photo of her:

After she was released from the hospital, she had to use a walker to get around.

Here is a photo of Shankeva using a walker:

Ultimately, she made a great physical recovery. She was able to walk without needing any devices.

When Does Health Insurance Pay For Auto Accident Injuries

Health insurance is often used as secondary coverage when youre injured in a car accident. It will only pay for medical treatment once other types of available insurance have been exhausted. The primary insurance coverage, or first applied coverage, is either your own auto insurance policy or the auto insurance policy of the driver who caused the accident.

All states, excluding Virginia and New Hampshire, require drivers to possess an auto insurance policy, which will pay for auto accident injuries first, up to the policy limits. Once your medical bills exceed the auto insurance coverage limits, your health insurance policy will kick in to cover the remainder of your medical expenses.

Kentucky is a choice no-fault state, which means that drivers in Kentucky are required to carry Personal Injury Protection coverage on their auto policy by default. Most Kentucky accident victims will use PIP insurance as their primary coverage before health insurance is applied. States like Maine require drivers to carry similar medical payments coverage , which is considered primary coverage and will pay for accident injuries before health insurance.

Read Also: Is Kaiser A Good Health Insurance