Whats The Difference Between An Hmo Ppo Epo And Pos Plan

To a large degree, the differences involve access to providers. All HMO, PPO, EPO, and POS plans have networks of medical providers that have a contract with the health plan in which the carrier agrees to accept a negotiated price for the services they offer. Some plans will only pay for non-emergency care if you receive care from an in-network provider, while other plans may cover some of the bill if you see an out-of-network provider.

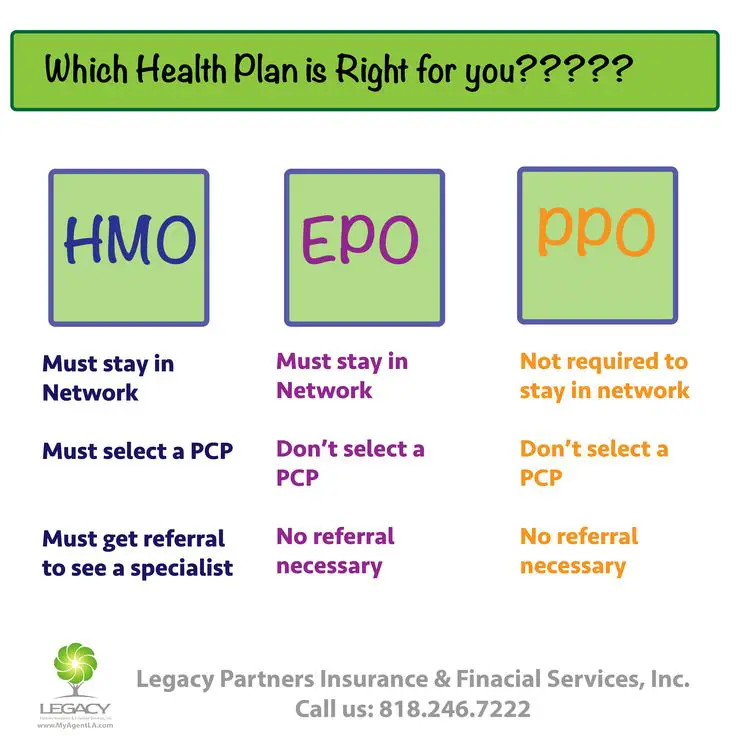

Youll often see simple comparison charts that show the rules for the different types of managed care. In a nutshell, theyll generally say that HMOs and POS plans require a referral from a primary care doctor in order to see a specialist, while PPOs and EPOs do not, and that PPOs and POS plans cover out-of-network care, while HMOs and EPOs do not. They will also often tend to say that HMOs have lower premiums, lower deductibles, and smaller provider networks, while PPOs have higher premiums, higher deductibles, and broader networks.

In reality, the lines tend to be more blurry, and these types of plan management have evolved over time. For example, this POS plan from Blue Cross Blue Shield of North Carolina does not require a referral to see a specialist. Neither does this HMO from Friday Health plans. And while its often true that employer-sponsored HMOs tend to have lower deductibles and premiums and potentially smaller networks, that does not hold true in the individual/family market.

What Is An Exclusive Provider Organization

An exclusive provider organization is a type of health insurance plan that only covers the cost of services from doctors, specialists, and hospitals in its network. If you go outside the network for care, your insurance usually wont cover your medical expenses, except in emergencies.

Heres what you should know about EPOs, including how they work, their advantages and disadvantages, and how they compare to the alternatives.

What Is A Health Maintenance Organization

An individual who needs to secure health insurance may find a variety of health insurance providers with unique features. One type of insurance provider that is popular in the health insurance marketplace is a health maintenance organization , an insurance structure that provides coverage through a network of physicians.

Read Also: What Is The Self Employed Health Insurance Deduction

Also Check: Can I Cancel My Health Insurance At Any Time

What Is An Epo Plan

An Exclusive Provider Organization is a type of health plan that offers a local network of doctors and hospitals for you to choose from. An EPO is usually more budget-friendly than a PPO plan. An EPO can have lower monthly premiums but require you to pay a higher deductible when you need health care.

Find a local Medicare plan that fits your needs

Pcps Can Coordinate Care

Perhaps the most valuable role primary care physicians fill is also the least understood by the general public. PCPs are experts at coordinating care.

If youre healthy, this wont mean much to you. But if you develop complicated medical problems, need multiple specialist physicians, or are in and out of the hospital, youll appreciate good care coordination.

In the role of care coordinator, your PCP is the team captain. She knows what each of the specialists is doing and makes sure theyre not duplicating tests or procedures that have already been done by another specialist. Your insurance company will also do this as part of their utilization review, but having your PCP coordinating it will help to avoid denied insurance claims and needless medical services.

Do you have 20 active prescriptions from different specialists? Your PCP makes sure theyre all absolutely necessary and compatible with each other . Recently hospitalized for heart problems and now ready to start cardiac rehab? Your PCP will help keep your arthritis and asthma under control so they dont prevent you from participating in the cardiac rehab program you need.

You May Like: How To See If I Have Health Insurance

What Is An Hmo

An HMO, or Health Maintenance Organization, is a type of health plan that offers a local network of doctors and hospitals for you to choose from. It usually has lower monthly premiums than a PPO or an EPO health plan. An HMO may be right for you if youre comfortable choosing a primary care provider to coordinate your health care and are willing to pay a higher deductible to get a lower monthly health insurance premium.

How To Get An Epo Insurance Plan

If youre receiving your health insurance through your employer, you can choose an EPO insurance plan if they offer one. If youre getting your health insurance through the marketplace set up by the Affordable Care Act, then youll be able to choose an EPO insurance plan during open enrollment. If youve had a qualifying life event like a birth or marriage, then youll be able to choose an EPO insurance plan during special enrollment.

Also Check: Where To Find Individual Health Insurance

What Is An Hmo Plan

HMO stands for Health Maintenance Organization. HMO plans contract with doctors and hospitals creating a network to provide health services for members in a specific area at lower rates, while also meeting quality standards. HMO plans require you to select a primary care physician and usually require a referral from your PCP to see a specialist or to have certain tests done. If you choose to see a provider outside of the HMOs network, the plan will not cover those services and you will be responsible for all charges.

What Is An Epo Health Plan And How Does It Work

An exclusive provider organization insurance plan is a type of major medical insurance that provides minimum essential coverage for illness, hospitalization and preventive health care. As managed care programs, EPOs contract with a network of primary care and other providers to deliver health services to their members.

EPO insurance manages costs by limiting care to doctors, specialists or hospitals within the plan network. If you use an out-of-network provider, you are responsible for the full cost, except in emergency situations.

While an EPO health plan requires the use of network providers, you don’t need referrals for specialist visits. However, you may be required to get prior authorization with EPO health insurance. This means that the EPO must review and approve the specialty visit first. We recommend that you contact your insurance company or health care provider to ask about coverage.

Listed below are some of the advantages and disadvantages of EPO plans.

You May Like: Can You Get In Trouble For Not Having Health Insurance

Should You Consider Managed Care Designation

When youre shopping for a health insurance plan either through the health insurance marketplace or off-exchange there are many factors to keep in mind. Weve covered some of them here, and also have a detailed summary of things to keep in mind when deciding which metal level is right for you.

So should the HMO, PPO, EPO, or POS designation matter when youre selecting a plan? Maybe, but itll depend on the specifics of the plans that are available to you and the coverage details that are important to you.

In general, youll want to have a general understanding of the different types of managed care, and understand whether your choice will include any coverage for out-of-network care . And youll want to make sure you understand whether your health plan will require referrals from a primary care provider. But as described below, there are several points to keep in mind as youre comparing plans.

Do Epo Plans Need A Referral

Most EPOs will not require you to get a referral from a primary care healthcare provider before seeing a specialist. This makes it easier to see a specialist since youre making the decision yourself, but you need to be very careful that youre seeing only specialists that are in-network with your EPO.

Also Check: When Does Health Insurance End After Leaving Job

Hmo Epo And Ppo Frequently Asked Questions

Whats the difference between in-network coverage and out-of-network coverage?

Each time you seek medical care, you can choose your doctor. You have the choice between an in-network and out-of-network doctor. When you visit an in-network doctor, you get in-network coverage and will have lower out-of-pocket costs. Thats because participating health care providers have agreed to charge lower fees, and plans typically cover a larger share of the charges. If you choose to visit a doctor outside of the plans network, your out-of-pocket costs will typically be higher or your visit may not be covered.

What if I need to be admitted to the hospital?

In an emergency1, your care is covered. Requests for non-emergency hospital stays other than maternity stays must be approved in advance or pre-certified. This allows Cigna to determine if the services are covered by your plan. Pre-certification is not required for maternity stays of 48 hours for vaginal deliveries or 96 hours for caesarean sections. Depending on your plan, you may be eligible for additional coverage.

Who is responsible for getting pre-certification?

Your doctor will help you decide which procedures require hospital care and which can be handled on an outpatient basis. If your doctor is in the Cigna network, he or she will arrange for pre-certification. If you use an out-of-network doctor, you are responsible for making the arrangements. Your plan materials will identify which procedures require pre-certification.

Ppo: The Plan With The Most Freedom

A Preferred Provider Organization has pricier premiums than an HMO or POS. But this plan allows you to see specialists and out-of-network doctors without a referral. Copays and coinsurance for in-network doctors are low. If you know youll need more health care in the coming year and you can afford higher premiums, a PPO is a good choice.

Jenelle, 38, of Jacksonville, FL, has been married for five years. The couple is having difficulty conceiving and has seen a number of fertility specialists. When her employer offered three choices for health plans, Jenelle picked the PPO. She pays more for one fertility doctor whos out of network, but she doesnt mind: Her mission is to get pregnant.

Recommended Reading: Why Is Florida Health Insurance So Expensive

So Which Plan Should You Choose

Each plan type has different benefits, so it depends on your health needs when choosing the right plan type. If you are looking for flexibility when choosing providers and locations, a PPO plan may better fit your needs. An EPO plan may be a better option if you travel often and want the flexibility of a larger network, but dont necessarily need out-of-network benefits. If you regularly seek care in a certain geographic area and are looking for a health insurance plan at a lower price point, consider an HMO plan.

To keep costs low, insurance carriers contract with providers and partner in plan members health to ensure quality care at the lowest cost. Whether you choose an HMO, EPO or PPO option, partnering with your health insurance carrier and your healthcare provider will help you receive the best care while controlling your out-of-pocket costs.

You Likely Don’t Have To Have A Primary Care Physician

Your EPO health plan generally wont require you to have a primary care physician , although getting a PCP is still a good idea.

But the “rules” for primary care under EPOs, HMOs, PPOs, and POS plans have evolved a bit over time, and tend to be somewhat fluid. Here’s an example of an EPO plan, offered in Colorado by Cigna, that does require members to have a PCP.

So the only real “rule” is that you need to pay close attention to the specific details for your own plan. It’s true that most EPOs don’t require you to have a PCP. But don’t assume that yours doesn’t!

You May Like: How To Qualify For Government Health Insurance

Should I Choose An Epo Plan

The choice between EPOs and other health plans often comes down to cost, choice and flexibility. An EPO is a “middle ground” plan with medium rates and the ability to go directly to a specialist without a referral. However, your specialist must be part of your EPO plan network for those services to be covered.

HMO plans are the cheapest option with the least flexibility. If you have few health concerns and don’t mind working with a PCP and staying within the plan network, an HMO could be a good option for you.

PPOs, as mentioned before, allow for both in-network and out-of-network care, but you’ll pay more for services received outside the network. Generally, PPO premiums are the highest of the four plan options.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Hdhp With Hsa: Offset Out

A High Deductible Health Plan has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account to cover medical expenses, saving you about 30%. And remember, depending on your age, services such as mammograms, colonoscopies, annual well visits and vaccinations may be covered free of charge, even if you havent met your deductible.

An HDHP can be an HMO, POS, PPO or EPO. People who are managing a health condition but cant afford higher monthly premiums may find that an HDHP saves them money in the long run.

Myron is a 60-year-old book editor in Philadelphia. He and his longtime boyfriend, Joseph, who maintain separate homes, love to travel. But lately, Myrons health issues, ranging from high blood pressure to weakened kidneys, have slowed them down. Myron is determined to get things back on track and that means keeping up with regular doctor visits. With that in mind, he switches to an HDHP.

You May Like: Can I Get On My Girlfriends Health Insurance

What Is A Ppo Plan

PPO stands for Preferred Provider Organization. PPO plans are often more flexible when it comes to choosing a doctor or a hospital. These plans still include a network of providers, but there are fewer restrictions on the providers you choose. PPO plans do not require you to select a primary care physician , giving you a broader network of providers.

Understanding Premiums Deductibles And Copays

Most people tend to focus on the monthly premium required for their health coverage and then on the copays needed for office visits and prescriptions. However, for many people, the details start to get a bit fuzzy when it comes to deductibles and out-of-pocket maximums.

In brief, your premium is the amount you pay for your health insurance every month.

The deductible, according to HealthCare.gov, can be defined as,

The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself.

After you pay your deductible, you usually pay only a copayment or coinsurance for covered services. Your insurance company pays the rest.

A copayment, or copay, is simply a fixed amount you must pay for a covered health care service after youve paid your deductible.

And one other important number is the out-of-pocket maximum, or ceiling. This is the maximum amount you have to pay for covered services during a plan year.

After you spend this amount on deductibles, copayments, and coinsurance for any in-network care and services, your health plan begins paying 100 percent of the costs of covered benefits.

Keep in mind that this out-of-pocket limit does not include:

- Your monthly premiums

- Anything you spend for services your plan doesnt cover

- Out-of-network care and services

- Costs above the allowed amount for a service that a provider may charge

Also Check: Do Restaurants Offer Health Insurance

Epo: A Larger Network Makes Life Easier

An Exclusive Provider Organization is a lesser-known plan type. Like HMOs, EPOs cover only in-network care, but networks are generally larger than for HMOs. They may or may not require referrals from a primary care physician. Premiums are higher than HMOs, but lower than PPOs.

Karen, 35, manages a chain of restaurants with locations across the country. She has asthma, and usually sees her specialist a couple of times a year. Because she travels a lot on business, Karen chose an EPO with a large national network: If she ever needs care away from home, she knows shell be able to find an in-network specialist. Her EPO also doesnt require referrals, a convenience shes willing to pay a bit more for.

What Are The Downsides Of Having An Epo

As with any insurance plan, there are also a few downsides to having a EPO insurance plan. Here are a few to keep in mind:

- Limited network. Your EPO plan has a predetermined list of providers, meaning you can only visit providers on that list, potentially limiting your care.

- No out-of-network coverage. Because your visits to an out-of-network provider will not be covered, seeing a specialist that isnt in-network could become pricey.

Recommended Reading: How Much Does Health Insurance Cost In Delaware

Narrowness Of Networks Varies

All four types of managed care plans can have broad, narrow, or mid-size provider networks. Dont assume anything. Instead, youll want to actively compare the provider networks of each plan youre considering, to see whether your specific providers are in-network.

If you dont currently have any providers, its a good idea to see whether each plan youre considering has in-network hospitals and medical offices that would be convenient if you ended up needing medical care.