Do You Qualify For Medicaid Based On Your Income Levels

In 38 states, whether you qualify for Medicaid is based solely on your income levels as a required part of Medicaid eligibility expansion. The income level differs depending on the size of your household but is the same in 36 of the 38 states. Qualification numbers for Alaska and Hawaii are different. Take a look at the table below to find the income level for your state and find out if you qualify for Medicaid.

State and Household Size Determine The Medicaid Cut-off

Scroll for more

Also Check: Does Cigna Health Insurance Cover Eye Exams

Where Can I Find Healthcare Insurance Are There Low Cost Health Care Facilities In My Area

The U.S. Department of Human Services administers three free or low-cost health insurance programs:

The Affordable Care Insurance Marketplace provides four basic ways to apply for health coverage through the Marketplace:.

- Apply online. Visit HealthCare.gov to get started.

- Apply by phone. Call 1-800-318-2596 to apply for a health insurance plan and enroll over the phone.

- Apply in person. Visit a trained counselor in your community to get information and apply in person. Find help in your area at LocalHelp.HealthCare.gov.

- Apply by mail. Complete a paper application and mail it in. You can download the paper application form and instructions from HealthCare.gov.

Medicare insurance is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . For information about Medicare, go to . On this site you can learn if you are eligible for Medicare.

Medicaid is for certain individuals and families with low incomes and resources. Eligibility and benefits vary considerably from State to State. To find information about Medicaid, go to.

State Children’s Health Insurance Program provides free or low-cost insurance for children in working families, including families with individuals with a variety of immigration statuses. For more information on SCHIP, visit your State’s SCHIP website.

How Do I Enroll In Kentuckys Health Insurance Marketplace

Because Kentucky doesnt have its own exchange, you can visit HealthCare.gov to enroll through the federal Health Insurance Marketplace. You need to create an account before you can browse available health plans, which is a simple and straightforward process. Provide your name and contact information, select a password and then choose your security questions. Make sure to remember your password and security information.

Youll need to provide the following information for everyone youre including on your policy:

- Each household members Social Security number

- How many people are claimed as dependents on your federal income taxes

Also Check: What Is A Good Price For Health Insurance

Don’t Miss: Can I Change My Health Insurance Outside Of Open Enrollment

Connect For Health Colorado Marketplace

Connect for Health Colorado may also help you meet the insurance requirement. Having health insurance can help protect your health and your financial future.

- If you dont have health insurance but make too much money for Health First Colorado, Connect for Health Colorado can help you learn if you qualify for federal financial assistance to help lower the costs of your insurance.

- If you do have health insurance, you still have the option to shop for a new plan at Connect for Health Colorado.

You may also be able to qualify for financial assistance through Connect for Health Colorado outside of open enrollment if you have experienced a qualifying life event such as losing your job-based coverage, getting married, or having a baby. Visit ConnnectforHealthCO.com for more information.

How Will I Know If Im Eligible For Assistance To Purchase Health Insurance Outside Of Va

VA cant make this determination. If you use the Marketplace, you will find out if you can get lower costs on your monthly premiums for private health insurance plans. Remember, if you are enrolled in a VA health care program, you dont need to take additional steps to meet the health coverage requirements under the health care law.

Also Check: Does Amazon Offer Health Insurance

Individual And Family Health Insurance Plans

Individual and family health insurance helps pay for the cost of health care, including medical emergencies, routine doctor’s appointments, preventative care, and inpatient/outpatient treatment. With a family insurance plan, you, your spouse or partner, and your eligible children under 26 years old are usually covered. You typically pay a monthly premium, plus a deductible or copayment.

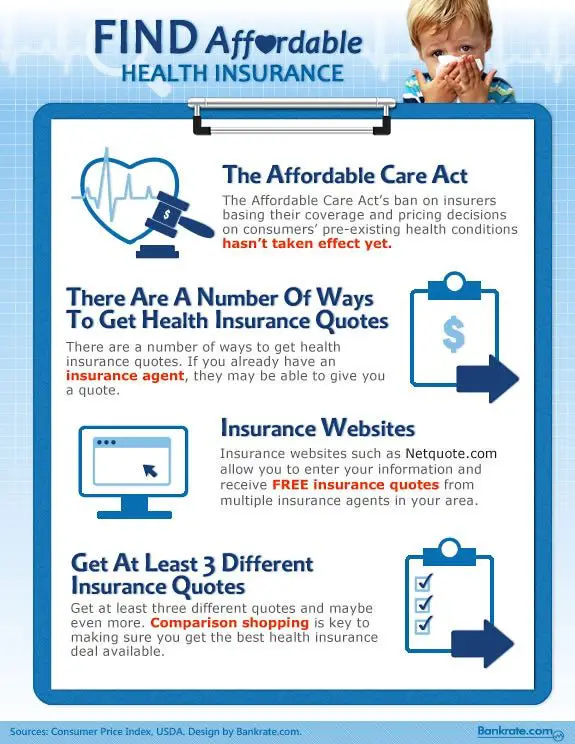

What Is The Best Affordable Health Insurance

Choosing the best affordable health insurance starts with determining your eligibility. Eligibility for health insurance is based upon several factors, including household income and household size. In addition, you must live in the United States and be a U.S. citizen, national, or lawfully residing in the country. You cant be denied insurance for preexisting conditions.

Read Also: How Much Is Health Insurance Out Of Pocket

Can You Get Short

Sometimes, short-term health insurance is necessary as a bridge for individuals between jobs or temporarily out of work and unable to access benefits from an employer. Short-term health insurance typically has lower premiums than comprehensive plans designed as a long-term solution. However, there can be limitations, exclusions, and other coverage restrictions. Most short-term individual insurance plans are low-cost but often do not adhere to ACA standards because they do not qualify for minimum essential coverage.

There are more short-term options available outside of HealthCare.gov, Starr points out. However, she notes that short-term policies from insurance companies often do not have staying power and are designed more as transition policies.

Many short-term policies still have exclusions or caps with limits per procedure or per incident, Starr says.

Short-term insurance offers some coverage for preventive care, doctor visits, urgent care and emergency care. Prescription coverage might be an option. But the key, as Starr emphasizes, is to review exclusions and limitations information.

How Do Claims And Payouts Usually Work

Lets say you choose an in-network doctor for a medical procedure. If that doctor is in your plan, he or she will submit the claim for you. Next, your doctor will send a bill to your insurance company for services he or she provided. A claims processor at the insurance company will check it for complete accuracy and coverage under the plan.

Depending on your benefits, the insurance company will process it and pay the amount agreed upon in your plan. You receive an explanation of benefits that goes over how the insurance company paid in your plan. Youll have to pay for any remaining coverage. The insurance company keeps tabs on your copay, deductible and out-of-pocket maximum .

Tip: Only pay your health care provider after you compare the services listed on the final bill with your EOB.

Read Also: What Is Free Health Insurance

Some Important Key Suggestions Regarding Your Health Insurance Plan

Unfortunately, there is no cut and dry solution to finding affordable health insurance. However, we do have a few suggestions that will make the search process a little easier. First of all, if you can receive financial assistance based on income you may be eligible for an individual marketplace plan.

When you choose a plan, it is also important to decide on the level of health insurance you need. Health insurance companies use a metal tier system to help you decipher between each plan. Additionally, it is also important to find an insurance company that matches the criteria you need in a health insurance plan. For example, doctor network, referrals, and prescription drug coverage.

Another option that will help you in a case of emergency or lapse of coverage would be to utilize a short-term plan.

What To Consider When Searching For Affordable Healthcare

Its easy to go for the lowest monthly price when selecting a health insurance plan, but there are a few things you should consider before doing so. Step back and assess you and your familys health care as a whole so it doesnt cost you more in the future. Look into annual costs and premiums, metal categories if considering ACA plans, health savings account or flexible spending account options and out-of-pocket costs.

Read Also: Can College Students Get Free Health Insurance

Health Insurance Plans On The Marketplace

Bronze Tier: A bronze-level plan is the cheapest health insurance plan available to individuals 30 years and older. This option offers the lowest premiums but with high deductibles and out-of-pocket costs.

Silver Tier: A silver tier plan is an affordable health insurance plan with comprehensive coverage. This option offers manageable rates with a mid-range deductible and fewer out-of-pocket costs.

Gold Tier: In contrast to the bronze plan, a gold tier plan has the highest rates, but the benefit is low or no deductibles and minimal out-of-pocket costs.

Catastrophic Tier: This tier is available for individuals 30 and younger. Under the catastrophic plan, you pay a minimal monthly rate and have coverage for a major health event, but not for most routine care.

The plan you choose depends on how much you want to pay each month versus the potential out-of-pocket expense if you are injured or become ill.

What You Should Know About Affordable Health Insurance Plans

If youre on a group employer plan, your premium cant cost more than 9.5% of your household income.

- Affordable is defined as no more than 9.5% of your household income: If youre on a group employer plan, your premium cant cost more than 9.5% of your household income. That doesnt include your spouse or dependents.

- Anyone can apply on the Health Insurance Marketplace: The Health Insurance Marketplace is your route to affordable insurance, whether youre shopping for individual coverage, want to apply for Medicaid, or need to compare your options against what your employer offers.

- You may qualify for government assistance: Through the Health Insurance Marketplace, you may qualify for a subsidy, which offsets the cost of your monthly premiums. Depending on your income and demographics, you may qualify for Medicaid or the Childrens Health Insurance Program . If youre 65 or older or have a qualifying disability, you may be eligible for Medicaid.

| Health insurance company |

|---|

| 4 |

Recommended Reading: What Does Health Insurance Not Cover

Best For Remote Workers: Blue Cross Blue Shield

Blue Cross/Blue Shield

Blue Cross Blue Shield made our ranking due to their healthcare options for individuals who work remotely and need to buy coverage on their own. This includes the option to buy coverage that works in all 50 states and global health insurance for short-term or long-term travel.

-

Long company history and strong reputation

-

Global coverage available

-

Widely accepted by doctors and specialists

-

There are plenty of third-party negative user reviews online across

Blue Cross Blue Shield was originally founded in 1929 and has since expanded to offer high-quality health insurance coverage across the U.S. The company provides coverage for 76 of America’s Fortune 100 companies, 6.9 million people who work for small employers, 17 million unionized workers, and millions of others.

Ultimately, however, we chose Blue Cross Blue Shield for our ranking due to its options for remote workers, including health insurance that works across the country or even worldwide.

Blue Cross Blue Shield lets you buy health insurance coverage that works in all 50 states, and it’s widely accepted by doctors and specialists nationwide. They also offer coverage on the Affordable Care Act marketplaces, which means eligible customers can get subsidies to make their health insurance premiums affordable. You can even buy worldwide health insurance coverage that works for short-term or long-term travelboth real possibilities if you can work from home or anywhere in the world.

Choose An Insurance Company

Once youve narrowed down the metal level and price point for your plan, now you have to pick between different insurance companies. This is where many consumers may get overwhelmed, especially in states that offer coverage from multiple providers.

Do a little research among the insurance companies. A good place to start is to read through the Summary of Benefits and Coverage.

You might also find starred ratings of insurance companies on your states marketplace. You should confirm how the ratings are developed: are they objectively applied by an independent or government agency or simply aggregated customer reviews ? Remember that starred ratings are indicative, not definitive. Whats best in terms of health coverage for one person may not be suitable for another.

Instead of relying on reviews, you can come up with a few deal-breaker questions or make a list of must-haves. Here are some common examples and criteria to consider when comparing different insurance policies:

Recommended Reading: Is It Illegal To Go Without Health Insurance

Tips For More Affordable Health Insurance

Help decrease your health care costs and save money using the following easy tips:

- Choose the right plan All plans provide the same set of essential health benefits, quality, and amount of care. Where they differ is on how the costs of the benefits are applied. Learn more.

- Know your plan All plans are different. Before you go for care, make sure you know how your plan works, whats covered and where to go. It may save you time and money. Learn More

- Stay in your network Health plans like HMOs and PPOs use a select group of doctors, hospitals and other health care professionals called provider networks. Choose doctors in your network to avoid paying higher out-of-network costs

- Prescriptions If you have prescription drug coverage, know the details of your plan. In some cases you can save on health care costs by going to certain pharmacies or by using mail order pharmacy services. Also, check to see if theres a generic version of your medicine.

- Use your member perks Look for member discounts on things like gym memberships and vision services. Check to see if there are special incentive programs for quitting smoking, losing weight, exercising and more.

- Stay Healthy Do your best to eat right, exercise and get regular health screenings. Encourage all family members to live a healthy lifestyle too.

Health Insurance And Market Place

When looking for affordable healthcare insurance, an individual should look first at two places. The first place is the health insurance marketplace, and the other is through employer. A health insurance marketplace is where people can shop around and purchase health insurance that is affordable to meet their needs.

Don’t Miss: How Much Is Health Insurance In Nj

What Medical Expenses Are Tax Deductible

Many people arent aware that some expenses can be deducted from your federal income taxes. Besides your health insurance premiums, other deductible medical expenses may include the following:

- Long-term care insurance premiums

- Equipment needed for a medical disability

- Mental health services

- Travel and lodging expenses for medical appointments

Its important to remember that you can only deduct the cost of qualifying medical expenses if the total amount you paid exceeds 7.5% of your AGI and you choose to itemize your deductions. You cant deduct the amount paid for by a health plan or employer.

Hunsaker explains that this tax deduction can be powerful for people with disabilities or chronic illnesses or who experience major medical events. But the deduction is hard to claim for those who visit the doctor only a few times per year for basic and preventive care.

Heres why: The 2020 U.S. Census says the median household AGI is $67,521 and 7.5% of that is $5,064.

That means you can only deduct expenses after the first $5,064 and, if you meet the criteria, it makes sense for you to itemize deductions, Hunsaker says.

Signing Up For Affordable Care Act Insurance Is Simple With Ehealth

Buying government health insurance online can be challenging. eHealth makes it easy to apply at no cost to you, providing an application guarantee and ensuring your application gets in on time. Plus, you’ll have access to the widest selection of plans available online, as well as tools that make sure your prescriptions are covered and your doctors are in network.

Get the latest updates on government health care.

Also Check: Does Health Insurance Cover Ivf

The Lowest Cost Health Insurance Available In Each State

Following the passage of the Affordable Care Act, often known as Obamacare, individuals and families suddenly had a new option for obtaining low-cost health insurance. The Health Insurance Marketplace exchange for private insurance now exists in every state. By state, coverage options differ. The greatest alternative for people without employer-provided insurance and those who dont qualify for Medicaid or Medicare is one of these health insurance plans.

If you are eligible for a premium tax credit, you can get health insurance at the lowest rates. You may still qualify even if your income is higher than the federal poverty line. To assist you in locating the least expensive health insurance provider and Silver plan in your state, MoneyGeek collected and evaluated the relevant data. A middle-of-the-road option, silver plans blend reasonable deductibles with reasonable healthcare expenditures.

To find low-cost health insurance plans in your area, click on your state from the list below. For additional information on the Bronze and Gold programmes, keep reading.

When Can I Purchase Cheap Health Coverage

Health insurance coverage can be purchased by anyone during the annual open enrollment period . During this period, you can access your state or federal health insurance marketplace and shop around for coverage from a variety of providers. If you need coverage outside of this time, then you may qualify for a special enrollment period , which allows you to still buy coverage. However, qualification usually only occurs if you have lost a job, had a child or recently gotten married.

Recommended Reading: How To Choose A Good Health Insurance Plan