How Much Does A Primary Care Visit Cost With Health Insurance

Preventative care means insurance often covers 100% of your annual checkup at the doctor. Outside of that visit, the average cost of visiting a doctor for a checkup with health insurance is a $10 to $40 copay. The rest of your visit will be covered by insurance for which you are paying the average $462 per month.

This means it costs more than $5,500 a year to see a doctor just once and copays for additional visits. Some insurance has deductibles, meaning you will pay out-of-pocket until you reach the limit. For example, if you have a $1,000 deductible, you will pay copays and additional costs until you reach that limit. After that, all costs are covered by the insurance company.

Individual Private Health Insurance

Individual private health insurance is a plan you purchase from a non-government exchange. Shopping on a private exchange, like eHealth, allows you to have more variety in your coverage options. You will also have the option of shopping for ACA-compliant plans, and youll even be able to apply for subsidies through eHealth by proxy.

Keep in mind that since the ARPA expanded qualifications for subsidies, you might now be eligible for assistance even if you did not qualify before. According to the new rules, enrollees now do not pay more than 8.5% of their income towards their insurance coverage, which has been reduced from nearly 10% under the prior limits. In addition, those earning more than 400% of the federal poverty level may now qualify for subsidies. In 2021, that includes individuals making about $51,000 or less annually and families of four making more than $104,800 annually.

If you find that subsidies arent an option for you, youll also be able to shop for alternative individual and family plans that may offer less benefits but be within in your price range. Short-term health insurance and catastrophic plans are two options that fall into this category.

Also Check: Www Njuifile Net Extension

What Is The Difference Between A Deductible And An Out

Both a planâs deductible and out-of-pocket limit represent points at which the insurance company pays for all or some of your care. However, they are two different things. Healthcare plans have two primary cost components: the premium and the deductible. Your deductible is the amount of money you have to pay yourself for covered medical expenses before your insurance company starts helping with costs. The out-of-pocket limit is the maximum amount of your own money you will have to pay for care during the year. The limit is the sum of your deductible plus coinsurance plus copayments up to a total dollar amount.

Recommended Reading: Starbucks Health Insurance Options

Bupa And Medicare Will Pay

If your specialist charges the MBS fee

Specialist charges

MBS fee covered by Bupa and Medicare

What you pay out of pocket

If only the MBS charge is applied, this should result in $0 out-of-pocket

This chart displays the range of out-of-pocket costs experienced by Bupa members in your state for this major surgical procedure item number. Your potential out of pocket cost for the specialist performing this major surgery/treatment is shown in blue on this chart.

These costs relate to your medical specialist only. Please check your hospital cover to see what youre covered for and ask your specialist about any other cost that may be associated such as an anaesthetist.

Please note that there may be variances to the range set out above. It is calculated on the basis of the most common outcomes. This is based on our internal data analysis of average outcomes experienced by Bupa members over the course of a 12 month period, and will vary from state to state.

If your specialist uses the Bupa Medical Gap Scheme

Specialist charges

Together, Bupa and Medicare pay

What you pay out of pocket

The costs you pay and how youre covered for things like your accommodation, use of the operating theatre, medication in hospital, or prostheses are separate. Please see our Important Information Guide, or Health System Guide for more information about this.

If your specialist doesnt use the Bupa Medical Gap Scheme

Specialist charges

MBS fee covered by Bupa and Medicare

What you pay out of pocket

Private Financing Of Health Care In Canada

Privatization, in numerous forms, is part of Canada health care. Private health care has been described as anything beyond what the public system will pay for. For example, if youre in hospital, public insurance will pay for the cost of your bed in a shared room, but if you have private insurance, or want to pay out of pocket, you can upgrade to a private room, for a price.

Private clinics have also opened in many provinces across Canada, offering services such as imaging, diagnostic tests and low risk surgeries, for a fee. Another significant area of private spending is on outpatient prescription drugs. Although some patients are covered by provinicial governements, many are not, and pay for medications through private insurance, out of pocket payments, or a combination of the two.

Derek Burleton, Deputy Chief Economist of TD Economics and author of a recent report on the sustainability of health care in Ontario says that when provincial governments try to contain costs and deal with deficits it will put pressure on the private sector to pick up the slack.

Don’t Miss: Does Starbucks Offer Health Insurance

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Find The Right Plan For Your Needs

Whatever the case, talking to a licensed insurance agent can help answer many of your questions, at no cost to you. Contact HealthMarkets to learn more about deductibles, out-of-pocket limits, and whether you may qualify for savings on your health plan. Our service is free to you and theres no obligation. Call to get started, or begin comparing plans online today.

48298-HM-0222

Also Check: Is Umr Good Insurance

I Am Now Unemployed How Can I Find Health Insurance

Health coverage options are available for people who have recently been laid off or lost their employer sponsored health insurance benefits:

- Granite Advantage Health Care Program: Medicaid Expansion coverage for no or low income individuals, ages 19-64

- Childrens Medical Assistance

Granite Advantage/Medicaid

You can enroll in the Granite Advantage Program or other Medicaid Programs if you are low or no income and need health coverage. There are also Medicaid programs available for children, pregnant women, and the medically frail.

- Learn more about the Granite Advantage Program

- Enroll in the Granite Advantage Program or Medicaid coverage through NH Easy or HealthCare.gov.

- There are several Medicaid Managed Care plans to choose from. Do your research to make sure that the plan you choose includes your preferred medical providers.

Health Insurance Marketplace

You can purchase medical and dental plans for yourself and/or your family on HealthCare.gov.

- How do I know if I qualify for the Marketplace outside of the Open Enrollment Period?

- HealthCare.gov provides Special Enrollment Periods for people who may have recently lost their employer sponsored health insurance coverage.

- You can apply for the SEP 60 days before they know their coverage will end and 60 days from the date you lost coverage.

- If you do not apply 60 days from the date your health insurance terminated, you will not be able to take advantage of the SEP.

Need Help?

Can I Get Dallas Health Insurance From Any Company Online

The insurer that you get from should be licensed in your state to provide health insurance. Not all online companies service all states but most quote generators ask you for your state of residence to make sure you are covered.

You can check on their website which states they are licensed to do business in or you can fill out a quote form.

Read Also: Do Substitute Teachers Get Health Insurance

Also Check: What Benefits Does Starbucks Offer

What You Should Know Before You Buy

The health insurance costs not covered by your plan must be paid by you, so make sure you know before you make an appointment or receive services.

- Ask about your premium amount and out-of-pocket costs .

- Understand how the claims process works, how your providers get paid and what portion you have to pay.

How Does Chip Work

CHIP provides health care to children who qualify. If your child qualifies, you will need to select a health plan and the doctor you want for your childs health-care needs. Pick Texas Childrens Health Plan to select from our doctors.

Your childs doctor can help you find a specialist if your child needs one. The most a family will pay is $50 per year for all the children who qualify, but most families pay $35 per year or less. You will also need to pay additional co-payments for some services.

Recommended Reading: How To Keep Health Insurance Between Jobs

Read Also: Starbucks Health Insurance Part Time

Cheapestepo/hmohealth Insurance Plan In Texas

Your healthcare preferences and needs can help you determine the type of plan to purchase. In Texas, most plans are Health Maintenance Organization plans. The state also offers Exclusive Provider Organization plans.

HMO plans usually require you to stay in your provider network to have services covered, but they often have lower premiums. EPO plans are similar to HMO plans, but unlike HMOs, they may not require a referral to see a specialist.

MoneyGeek found that the cheapest Silver plans for each plan type are:

- HMO: The MyBlue Health Silver 405 plan offered by Blue Cross and Blue Shield of Texas. The average 40-year-old will pay $390 per month.

- EPO: The Friday Silver plan offered by Friday Health Plans. The average 40-year-old will pay $431 per month.

Also Check: Does Insurance Cover Baby Formula

The Cheapest Health Insurance In Texas By County

Health insurance costs in Texas can differ depending on where you live in the state. Texas is divided into rating areas, and health insurance carriers charge different rates in different regions.

Texas has 254 counties split into 26 rating areas. In Harris County, the most populous county in Texas, the average cheapest Silver plan is MyBlue Health Silver 405, offered by Blue Cross and Blue Shield of Texas at $381 per month.

Use the table below to view a list of the cheapest plans in each metal tier for your county.

Average premiums are for a sample 40-year-old male in Texas purchasing a health insurance plan in that county.

Cheapest Health Insurance Plans in Texas by County

Sort by county:

Recommended Reading: Starbucks Dental Insurance

Texas Individual Health Insurance Options For 2020

Looking for 2022 individual health insurance options in Texas? Weve updated the following guides for 2022. Check them out!

The major metros in Texas are poised for success with the individual coverage HRA, thanks to vibrant individual health insurance markets. Weve even put together individual guides for each city to help employees in those cities determine their best options for individual health insurance where they live. Check them out!

Everything is bigger in Texas and health insurance is no different in the Lonestar state! Well over one million Texans enrolled in individual coverage in 2019. Since open enrollment can be a daunting time for many, our team at Take Command Health knew we needed to provide some BIG information to help you navigate the changes on the healthcare horizon. We want you to feel confident that you are choosing the best coverage available for you at the best price. Heres what to expect.

Whats The Average Cost Of Health Insurance

Health insurance costs can vary widely, depending on several factors, including how you get your health insurance.

Health insurance coverage is vital, regardless of your age or condition. But the truth is that insurance costs can vary widely, depending on several factors, including how you get your health insurance.

- To create the health insurance premium quotes, health insurance companies look into the average age and gender of the employee.

- Employer plan premiums tend to increase year-over-year based on the prior year’s expenses.

- Individual policies health insurance costs will vary significantly depending on your age, geography and family status.

- It is important to consider the type of insurance plan you want before signing up for one as it influences the costs, including premiums and deductibles.

Read Also: What Insurance Does Starbucks Offer

How Much Does A Primary Care Visit Cost Without Health Insurance

If you choose to forgo health insurance, you will have to pay the full fees for doctor visits. Perhaps you are healthy and only need an annual checkup? The average cost of visiting a doctor for a checkup without health insurance can cost between $200 and $300. A new patient office visit up to 30 minutes can cost upwards of $578, according to the Healthcare Blue Book.

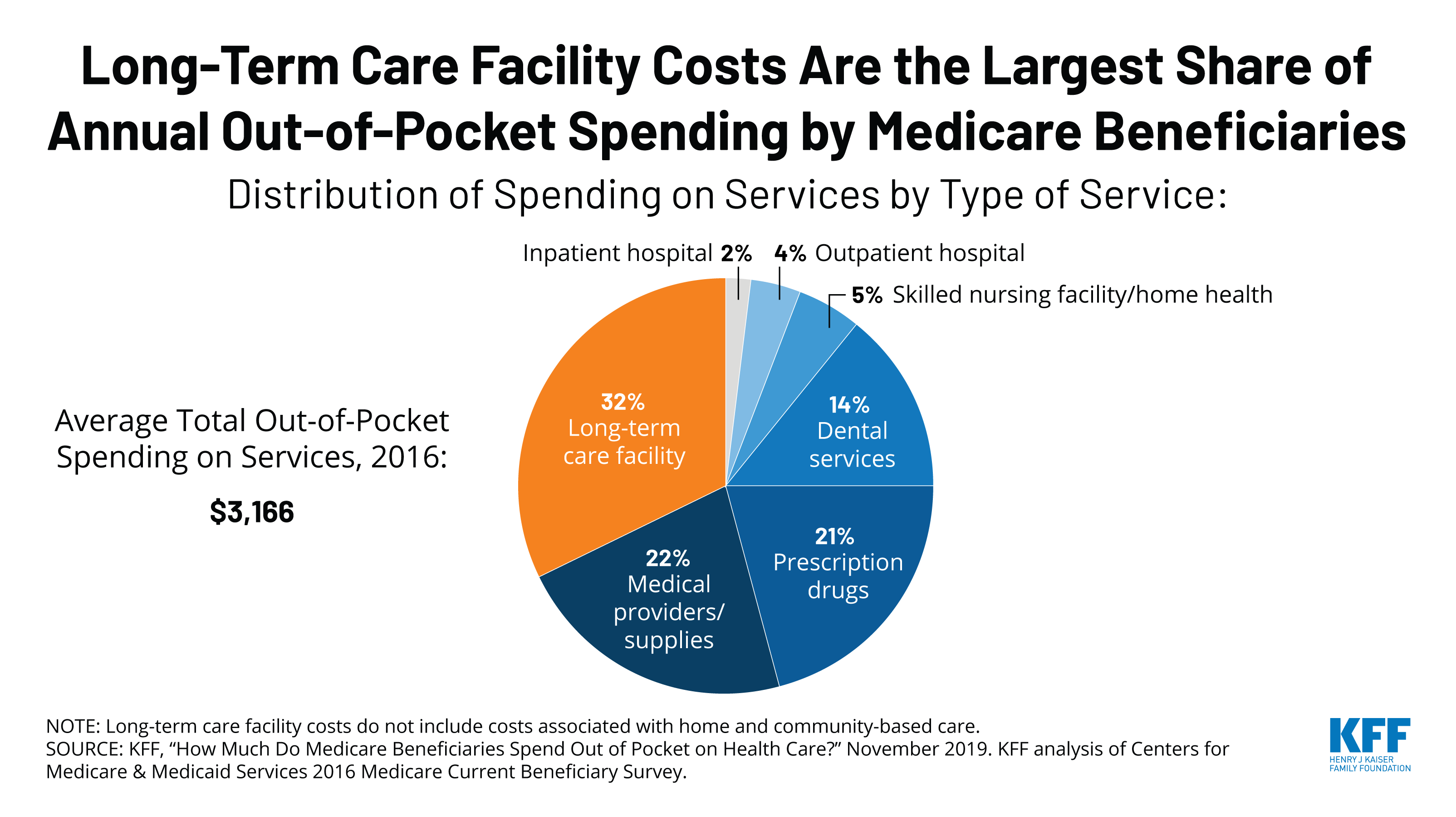

Health Care Costs In Retirement

Health care costs in retirement, including health insurance, are a significant concern for American workers. Losing your employer-sponsored health care coverage can leave you scrambling for a plan through the federal health insurance marketplace or a private insurer. Planning ahead and understanding your options will save you the stress of finding quality health care when you leave the workforce.

On This PageFact-Checked

Annuity.org partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

How to Cite Annuity.orgs Article

APASilvestrini, E. . Health Care Costs in Retirement. Annuity.org. Retrieved December 20, 2021, from https://www.annuity.org/retirement/health-care-costs/

MLASilvestrini, Elaine. Health Care Costs in Retirement.Annuity.org, 12 Jul 2021, https://www.annuity.org/retirement/health-care-costs/.

ChicagoSilvestrini, Elaine. Health Care Costs in Retirement. Annuity.org. Last modified July 12, 2021. https://www.annuity.org/retirement/health-care-costs/.

Recommended Reading: How To Enroll In Starbucks Health Insurance

How Much Does Managing Chronic Illnesses Cost Without Health Insurance

Because it can be so expensive to manage a chronic illness, those without insurance have been found to seek treatment far less than those with insurance. The ADA, for example, found 60% fewer doctor visits and 52% fewer medications in people with diabetes without insurance. But that comes with a price: 168% more visit to the ER than a person with insurance.

For those suffering from depression, the costs are just behind diabetes as the second most costly condition, according to the American Psychological Association. Another 21% of medical expenses are directed toward obesity-related illnesses. As you can see, chronic illnesses can be expensive.

The Average Cost Of Health Insurance By Age

Most people need more health care as they age, and health insurance rates go up for older people to cover those expected costs.

In MoneyGeeks analysis which does not account for tax credits or other subsidies the average premium for an 18-year-old was $324 per month compared to $642 for a 50-year-old and $970 for a 60-year-old. However, older people may be eligible for higher subsidies if they have low incomes, such as if theyve retired or scaled back their working hours.

Average Health Insurance Premiums by Age

Scroll for more

- $970

Don’t Miss: Do Starbucks Employees Get Health Insurance

How Much Does Managing Chronic Illnesses Cost With Health Insurance

The Centers for Disease Control found chronic and mental health conditions take up 90% of healthcare spending. For example, the American Diabetes Association finds the medical costs for a person with diabetes is $16,752 2.3 times higher than the expenses of a person without diabetes.

Having insurance doesnt mean cut-and-dry coverage, however. Insurance companies vary greatly in how much they will cover for a chronic illness and while you may only need to pay a copay for doctors visits, different lab work, testing, medications, and more means shelling out more dough financially.

Chronic conditions may be subject to government insurance under Medicare, with premiums up to $458 per month for Part A, which doesnt cover medications. For drugs, you will also need Medicare Part D, which averages $30 per month.

Work Out Your Hospital Admission Costs

As a private patient your total out of pocket costs will be the sum of all hospital charges, doctors fees and fees from other providers, minus any Medicare or private health insurance payments.

Example:

You have private hospital insurance for an operation in a private hospital. Your policy has a $750 excess and no co-payment.

Your surgeon charges $1,800. They do not have a gap cover arrangement with your insurer.

The MBS fee for the surgeons services is $1,000. Medicare pays $750. Your health insurer pays $250. This leaves an $800 gap you have to pay.

You also needed an anaesthetist, assistant surgeon, radiology and pathology tests. You can work out your out of pocket costs for them the same way you worked out the surgeons. For this example, assume their total fees were $3,500 and you must pay $600 out of pocket.

Your hospital charges are $8,500. Your insurer pays most of this cost but there is no Medicare benefit. You must pay an excess of $750.

The total costs of your treatment is $13,800. You pay $2,450, which is made up of:

- $800 for your surgeon and $600 for other providers

- your hospital charge excess of $750

Also Check: Starbucks Insurance Plan