Why Is There A Penalty For Not Having Health Insurance

The Affordable Care Act wants everyone to have quality health insurance coverage, and the penalty encourages you to purchase a plan that meets the requirements of the law and offers you and your family robust coverage.

Since Obamacare allowed people with pre-existing medical conditions to sign up for health insurance, the insurance companies need to have a mix of healthy and unhealthy people, and younger and older people, in order to keep the cost of coverage in check for everyone.

If people only signed up for health insurance when they got sick, the cost of health insurance premiums would skyrocket. By creating a penalty and urging people to purchase an Obamacare plan, the costs of health insurance can be better balanced. Enrollees who are healthy are effectively subsidizing those who are sick. And when todays healthy people are sick in the future, the healthy people at that time will help pick up the tab for their health insurance coverage.

What Is The Fine For Not Having Health Insurance In Texas

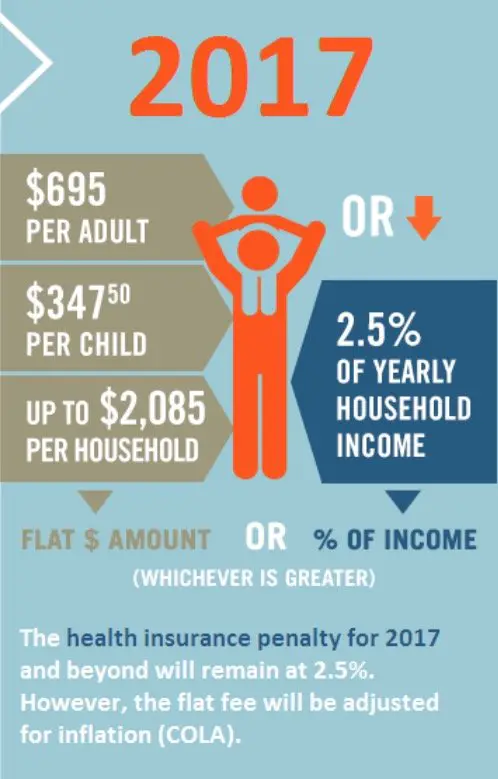

In 2015, the fines begin at $325 per adult and $162.50 per child, or 2 percent of your family income, whichever is greater. In 2016, the fines increase to as much as $695 per adult and $347 per child, or 2.5 percent of family income, whichever is greater. After 2016, the penalties will be adjusted based on inflation.

Other Reasons To Get Healthcare Coverage

Californias tax penalty is designed to incentivize getting health insurance. Without a policy, you can end up paying thousands of dollars in additional taxes. Beyond avoiding the extra fee, there are many reasons to purchase a health insurance policy:

- It protects you financially: Health care in the U.S. is expensive. For example, it can cost more than $7,000 to treat a broken leg. Depending on the insurance plan you have, your insurer will pay anywhere from 60 to 90% of the cost of the medical treatment you need.

- It helps you maintain your health: Under the ACA, preventative care treatments are fully covered by qualified insurance plans. That means your annual flu shot, wellness visit and health screenings are free to you. You dont have to pay a penny out of pocket. Getting preventative care helps you detect any health issues early or helps you avoid falling ill in the first place.

- It helps you if you get sick: Should you develop an illness or become injured, you can rest assured that your health insurance policy will cover some of the costs of your care. You can also feel confident going to the hospital or physician for treatment. Having health insurance gives you peace of mind that the care you need will be accessible when you need it.

Also Check: Is Umr Insurance Good

What Is A Special Enrollment Period

If you need health insurance and open enrollment is over, you may have options. A special enrollment period is available following certain life events. You can enroll in a new health insurance plan if any of the following apply to you:

- Youve recently moved to California: If you move to California outside of open enrollment, you can sign up for a health insurance policy during a special enrollment period.

- You left your job: If you are laid off or otherwise lose health insurance from an employer, you qualify for a special enrollment period. You might be eligible for Medi-Cal after a job change, depending on your circumstances.

- Your marital status has changed: You may need to purchase health insurance if you get married or divorce your spouse during the year. Youre also eligible for a special enrollment period if your spouse dies outside of open enrollment.

- You had a baby: You can sign up for a new health insurance plan or purchase a policy for your new arrival if you give birth to a baby or adopt a child during the year.

- You turned 26: Many people are covered by their parents plans until they turn 26. If youre approaching your 26th birthday and its not open enrollment, you qualify for a special enrollment period and can purchase a plan or apply for Medi-Cal.

- Your citizenship status changed: You can be eligible for a special enrollment period if you become a U.S. citizen or have another change to your residence status outside of open enrollment.

Health Insurance Penalty Options

Due to the fact that penalties were lower at first, some California residents may opted to simply pay the penalty and go without health insurance coverage, especially in the first couple of years. Another option some chose is to get cheap coverage and still pay the penalty. For example, if in tax year 2015 you were single, aged under 65, had a taxable income of $50,000, and you were uninsured the whole year, your penalty would be calculated as follows:

The greater of $395 or $50,000 income minus $10,150 Federal Minimum Threshold = $39,850 x 2% = $797 penalty. In this scenario, your tax penalty would be $797. If you remained uninsured in 2017, your penalty would go up to approximately $996 depending on the Cost of Living Adjustment and the Federal Minimum Threshold at that time. At $996 per year, that is still only about $83 per month. If you compare that penalty with paying a theoretical $375 a month for a Covered California plan, it may make sense to just pay the penalty for no health insurance.

* If you enrolled on your current plan before March 23, 2010 and have not changed coverage, then you may have grandfathered status. However, not all carriers in California are giving the option to maintain grandfathered status. Check with your insurance carrier to verify if your plan is on grandfathered status.

Don’t Miss: How Long Do I Have Insurance After I Quit

How To Avoid Paying A Penalty For No Health Insurance

If you want to avoid paying a penalty for not having a health insurance cover, your surest bet is to enroll in an accepted and credible health plan for your state.

The Affordable Care Act, also referred to as Obamacare, specifies an open enrollment window when people can enroll in plans offered through the federal or state health insurance marketplaces.

An open enrollment window is a set time when people can sign up for or change their plans. When you sign up for health insurance during the open enrollment, the insurer must provide you insurance. If you do not sign up during this time, you cannot sign up until the next open enrollment unless you experience certain life events.

In 2021, due to COVID, there was a Special Enrollment Period between Feb. 15 and Jun. 30, according to Cummins. During this time, over 1.5 million Americans signed up for new insurance coverage through healthcare.gov.

For 2022, open enrollment began on Nov. 1, 2021, and ended on Dec. 15, 2021.

Besides plans on the Marketplace, you can sign up for Medicare during three main periods in the year though, in states like New York, you can enroll in a supplemental plan year-round:

- Initial enrollment period

- Open enrollment period

- Special enrollment period

People are also allowed to enroll in health insurance plans offered on the state and federal exchanges during times other than the special enrollment period , if they experience life events which include but not limited to the following

Health Insurance: What To Expect When Filing Your Tax Return

Wondering whether you’ll owe a tax penalty for being uninsured? In most states, the answer is no. But if you’re in California, DC, Massachusetts, New Jersey, or Rhode Island, there is a penalty for being uninsured, which is assessed when you file your state tax return. Here’s an overview of how the individual mandate penalty has evolved over time:

Also Check: Does Uber Offer Health Insurance

Open Enrollment For Health Insurance In 2023

Open enrollment is when you can enroll in a health insurance plan through the. Coverage begins the first day of the month after you sign up. The open enrollment period for health insurance coverage in 2022 ended on January 15, 2022.

For states that use the federal Affordable Care Act exchange, the 2023 open enrollment period begins November 1, 2022 and ends December 15, 2022 in most states. States may have different date ranges.

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

Read Also: Minnesotacare Premium Estimator

Get Health Insurance Today With Help From Health For California

Whether its open enrollment or youre eligible for a special enrollment period, signing up for a health insurance policy means you can avoid paying the tax penalty in California. It also means youll have access to the health care and treatments you need without having to pay a lot out-of-pocket.

Health for California can help you decide which type of insurance plan is right for you and can help you get the subsidies youre eligible for. Contact us today for a quote.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Enroll In A Qualified Health Plan

Enrolling in a qualified health insurance plan is the best way to avoid penalties at tax time. Individuals have the option to purchase short-term health insurance or to sign up for a policy if they have a qualifying life event. Penalties will be reduced for each month that a person has insurance as they are calculated on a month-to-month basis. The more months that a person goes without health insurance, the higher the penalty.

Individuals who have health insurance should start preparing now for the 2021 tax season by gathering their health insurance coverage documents, such as Forms 1095-A, 1095-B, or 1095-C, which should arrive in the mail. Employees who receive healthcare coverage from their employer should receive a statement that indicates that they were covered for part of the year or the whole year.

Also Check: Evolve Health Insurance Company

Get Help Paying For Health Insurance

If the cost of health insurance seems out of reach, you have options. You can qualify for a subsidy if you earn up to 400% of the federal poverty level based on your household size. For a single person, that means you can earn up to $51,520 and qualify for financial assistance. If you have a family of four, your household income can be up to $106,000 annually to be eligible for assistance.

The lower your income, the more aid youre eligible to receive. If your household income is less than 138% of the federal poverty level, you qualify for Medi-Cal, Californias version of Medicaid.

To qualify for a subsidy, you need to provide proof of income, such as a tax return, pay stub or Form W-2. You can elect to receive the subsidy each month, paying less for your premium. You can also take the subsidy as a tax credit, reducing the amount you owe on your tax return or increasing your tax refund.

Will My Current Aca Health Insurance Plan Automatically Renew

If you are already enrolled in a health insurance plan through your stateââ¬â¢s Marketplace, your plan will automatically renew if available for the following year. Those who live in Maine, Kentucky, and New Mexico will need to claim their new accounts as those states transition away from Healthcare.gov, but auto-renewal is an option for all other enrollees.

Even if you are satisfied with your current plan, auto-renewal is not always the best option. During open enrollment, you should shop around to see if a health insurance plan better suits your needs for three main reasons.

Also Check: Starbucks Insurance Plan

Contact The Experts At New City Insurance

Tax penalties can come as a surprise for people who are not familiar with the 2020 changes to California health insurance coverage. To learn more about the tax penalty for not having health insurance in California or to request a consultation with an insurance professional, contact New City Insurance.

Is Health Insurance Required In Washington State

3.9/5Health InsuranceWashington Staterequiredhealth insuranceWashington Statecoverage

Correspondingly, what is the penalty for not having health insurance in Washington state?

2. You won’t face a tax penalty for going without health insurance in 2020but there are big downsides to being uninsured. Obamacare’s tax penalty went away in 2019.

Likewise, am I legally required to have health insurance in 2019? Health insurance coverage is no longer mandatory at the federal level, as of January 1, 2019. Some states still require you to have health insurance coverage to avoid a tax penalty.

Additionally, is health insurance required in Washington?

Health insurance in WashingtonWashington is working to create standardized health plans for the individual market and a public option that will involve the state contracting with a private insurer to offer plans starting in 2021. Open enrollment for 2020 coverage in Washington ended on December 30, 2019.

Does Washington State have free healthcare?

wa.gov) – Provides free breast, cervical and colon-cancer screening to low-income people in Washington state. Medicaid – Provides health care and prescription coverage to people who qualify based on their income, assets, health, disability, and family size.

Recommended Reading: Health Insurance For Substitute Teachers

Make Sure You Have Health Coverage

The mandate, which takes effect on January 1, 2020, requires Californians to have qualifying health insurance coverage throughout the year.

Many people already have qualifying health insurance coverage, including employer-sponsored plans, coverage purchased through Covered California or directly from insurers, Medicare, and most Medicaid plans.

Under the new mandate, those who fail to maintain qualifying health insurance coverage could face a financial penalty unless they qualify for an exemption.

Generally speaking, a taxpayer who fails to secure coverage will be subject to a penalty of $695 when they file their 2020 state income tax return in 2021. The penalty for a dependent child is half of what it would be for an adult.

The penalty is based on your state income and the number of people in your household.

Summary of possible penalties

| $140,200 | $2,085 |

To avoid a penalty, California residents need to have qualifying health insurance for themselves, their spouse or domestic partner, and their dependents for each month beginning on January 1, 2020.

The open enrollment period to sign up for health care coverage through Covered California is scheduled for October 15, 2019 through January 31, 2020.

How To Avoid The Penalty And Afford Insurance

You are no longer subject to a penalty for not having insurance, a provision of the Affordable Care Act that was struck down by a judge. However, insurance can help you access health care services and avoid major medical bills.

f paying for insurance is a struggle for you, you may be able to get help from the government. This money is called a subsidy. To get it:

For instance, you’ll likely be able to get money if you make up to about $50,000 a year for one person or about $103,000 for a family of four. These income amounts are based on the federal poverty guidelines and will change every year.

How much financial help you get depends on how much money you make a year. The less you make, the more help you get.

There are two subsidies available. They immediately lower your costs. You donât have to pay first and get the money later.

Show Sources

Recommended Reading: Uber Driver Health Insurance