Whats The Difference Between Public And Private Health Insurance

Public health insurance such as Medicaid is offered by the federal government and has requirements to get coverage, such as your age and household income. A private health plan, including an ACA marketplace plan or a group health insurance, is sold by a private entity rather than a state or federal government and it doesnt have income or age requirements found in programs like Medicaid and Medicare.

Where Can I Buy Private Health Insurance

If youre not eligible for private health insurance from an employer, and also not eligible for public health insurance , you can purchase private health insurance in the marketplace/exchange in your state.

Alternatively, you can choose to buy it directly from a health insurance company, but premium subsidies and cost-sharing reductions are not available if you go that route.

Employer Vs Individual Health Insurance Plans

In the past, most people had employer health insurance. Their company did all of the research, chose the insurance company and picked plan options for employees. This is also called group coverage or group insurance. But, a lot has changed in recent years.

- Challenging economic times have forced many employers to cut costs.

- Rising healthcare costs have made it difficult for companies to pay for health insurance.

- New and more expensive technologies, treatments and drugs have emerged, adding costs.

Due to these factors and others, a growing trend is for individuals to either partially or fully pay for their own health insurance. Even if employer-based group health insurance is still an option for you, you may wonder if you should purchase health insurance on your own, buying what is called Individual Health Insurance, or Personal Health Insurance.

To help you understand your options, well look at both individual and employer-sponsored plans, explaining and comparing them.

Read Also: Does Health Insurance Cover Tooth Extraction

How Do I Choose A Private Health Insurance Plan

Choosing the right private health insurance plan for you and your family is an important decision, so take your time and consider your options. Consider all of the following steps as you figure out which plan is right for you.

What Is An Irs Qualifying Life Event

An IRS qualifying life event, or QLE, is a change in your circumstances that will require changes to their health insurance. A QLE allows you to make changes or purchase new health insurance policies outside the Open Enrollment Period. These time-periods help ensure you can maintain the coverage they need throughout the year.

Also Check: Is Dental Insurance Health Insurance

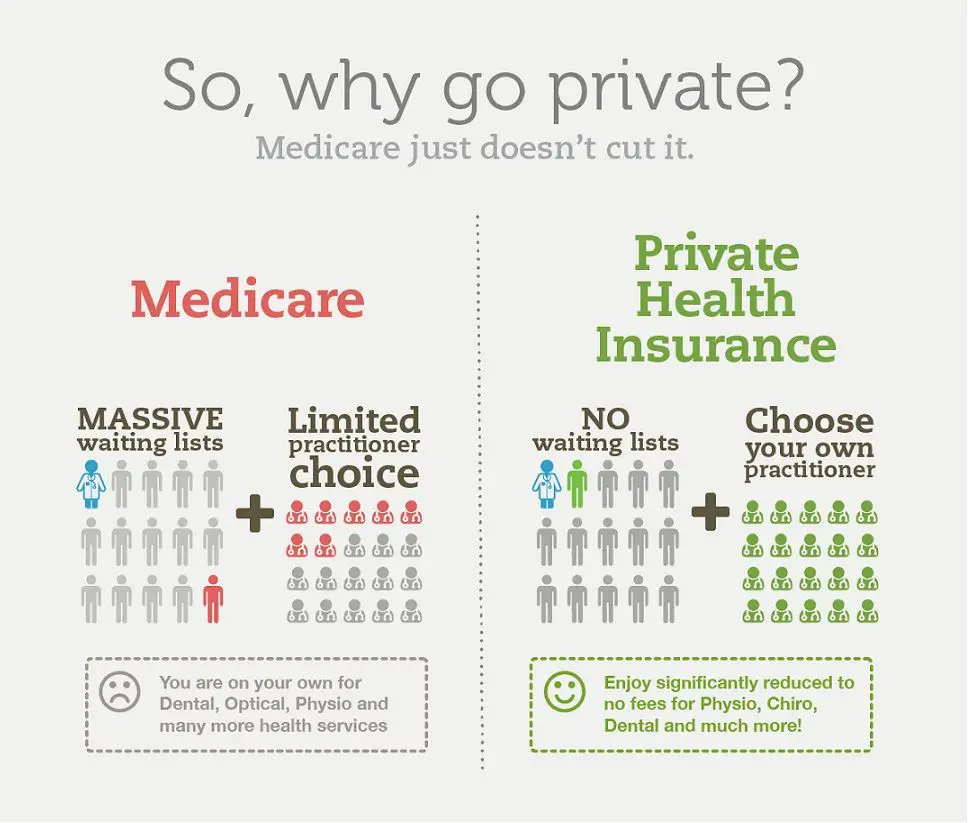

Pros Of Private Health Insurance

-

It allows you to choose your doctor depending on the type of insurance cover.

-

Quick medical attention as most private healthcare facilities are less busy compared to public hospitals.

-

It provides the best comfort. Unlike the public hospitals that are overcrowded and at times, underfunded, private facilities are well maintained and provide all the needed amenities.

-

Most private facilities provide private rooms that allow you the needed privacy.

-

Most private insurance plans allow you unrestricted visiting hours that will enable your family and friends to visit at your convenience.

-

Many plans will offer health insurance perks for taking personal preventative health measures to keep you healthy.

How Can You Get Cheap Commercial Health Insurance

Employer-sponsored plans are often the cheapest because the rates are shared among the employer and the insured. But you could qualify for cheaper health insurance if youre eligible for tax credits and subsidies via the ACA. Under the ACA, you can earn subsidies when your income falls between 100% and 400% of the federal poverty level. Exactly how much you pay depends on the size of your family.

Short-term health insurance is another option, but it will only cover you temporarily and coverage will be minimal. Catastrophic health insurance may also be a possibility for people under 30 and those facing financial hardships. Those plans also have high out-of-pocket costs when you need care, but theyre comprehensive health insurance that offer the same coverage as a standard ACA plan.

Recommended Reading: Where To Get Short Term Health Insurance

Pros Of Public Health Insurance

-

A public health insurance policy is an affordable alternative to private health insurance. You donât have to co-pay or remit any deductibles. They are also accruing lower administrative costs.

-

You can combine more than one insurance plan when using public policies that will come in handy for extra expenses.

-

Apart from the health expenses, you can still get help with other out-of-pocket costs if you have public health insurance.

Health Maintenance Organization :

HMOs are a type of managed healthcare plan that limits coverage to doctors, clinics and hospitals that are part of the HMO contract.

- It will not cover out-of-network care unless it’s an emergency situation,

- Youll need to have a primary care provider and need a referral to see a specialist.

- HMOs generally have lower monthly premiums than other types of coverage.

Also Check: How Long Can A Child Be On Parents Health Insurance

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if its not required, you might decide to offer health insurance to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

You May Like: What Are Some Good Health Insurance Plans

Differences Between Private And Public Insurance In The United States

The United States is well known for its exorbitant medical costs. So much so that even international health insurance plans, which cover virtually every country in the world, often exclude America due to its high costs. While around 60% of the US population has private health insurance to take care of their health needs, the debate over whether public vs. private insurance is more economically efficient seems endless especially since the institutional reform of the Affordable Care Act in 2010. In this Pacific Prime article, we look at the differences between public and private hospitals in the United States.

Understanding Quality Of Care

If you have a private health insurance plan, the quality of care you receive is typically related to two factors:

- The type of plan you have.

- The amount you pay for your monthly premium.

If you do not have health insurance, or you have a basic plan, you will get very little, if any, treatment.

Those who have exclusions on their policy may not get access to the care they need unless theyre able to pay for it on their own. On the other hand, if youre fairly healthy and have an expensive policy, the quality of treatment you receive will be higher. If you want better-than-adequate treatment, its not a good idea to go with a policy because it has lower premiums than another.

Public health insurance plans allow citizens access to adequate care. However, any quality of healthcare that goes above and beyond that may be lacking. Countries which offer public health insurance only often have waiting lists for certain types of medical procedures, and some of those lists can be very long. Overall, this can lead to poorer health for many.

You May Like: How Much Is Health Insurance For A 65 Year Old

Health Insurance Plan Features

Public health insurance is designed so that beneficiaries will not have to pay out of pocket for crucial medical services. It doesnt matter whether you have pre-existing conditions or not, the cost of your healthcare plan remains affordable without barriers.

Private health insurance has a wider variety of options, but those options affect your premiums. With the passage of the ACA, you cannot be denied coverage if you have a pre-existing condition, but private companies may choose whether or not they cover certain issues. If you have a chronic illness or require care for a long-term debilitating injury, youll likely end up paying a very high premium for your insurance.

What Is Considered Private Insurance

Private health insurance is any health care coverage that is offered by a private company or entity as opposed to state or federal health care coverage, such as ACA, Medicare, CHIP, Medicaid, etc.

For the most part, private health insurance plans cover the minimum essential coverage requirements of ACA plans. Private insurance also offers more choices than public plans. Private insurance can also offer shorter wait times at doctors offices and medical centers, and better-specialized attention. One of the disadvantages of private health insurance can be the costs. Private plans for individuals as well as family plans are typically more costly than ACA plans. Another main difference is eligibility.

Read Also: Which Best Describes The State Of Health Insurance In Texas

The Different Types Of Private Health Insurance

There are many different types of private health insurance available in the United States, and the type of plan you choose will likely depend on your budget and your needs. Some of the most popular types of plans include PPOs, HMOs, and POS plans.

PPOs, or Preferred Provider Organizations, offer more flexibility than HMOs or POS plans, as you can see any doctor you want without a referral from your primary care physician. However, PPOs often have higher premiums and out-of-pocket costs than other types of plans.

HMOs, or Health Maintenance Organizations, are often more affordable than PPOs but require you to see doctors within their network. POS plans, or Point-of-Service plans, are a mix of HMOs and PPOs and usually offer the most flexibility when it comes to choosing a doctor.

What Types Of Coverage Are Not Private Health Insurance

More than a third of the American population is covered by government-run health insurance, as opposed to private coverage. This includes Medicare, Medicaid, CHIP, Indian Health Service, and VA coverage.

To be clear, many people who have Medicare, Medicaid, or CHIP are covered under managed care plans that are run by private health insurance

The same is true for Medicare Advantage plans: the insurers have contracts with the federal government to offer Medicare benefits through a plan administered by a private health insurance company. As of 2018, more than two-thirds of the countrys Medicaid enrollees were covered under private Medicaid managed care plans, and nearly 46% of Medicare beneficiaries were enrolled in private Medicare Advantage plans as of early 2022.

However, these managed care plans are in contracts with the federal government to offer the public health benefits that theyre providing, and the funding for these plans still comes from the government . But it can be a bit confusing, since many of the insurers that contract with the government to offer Medicaid managed care coverage or Medicare Advantage plans are the same insurers that offer private health insurance to individuals and employers.

Medicare beneficiaries can also purchase Medigap and/or Medicare Part D plans. These are considered private health insurance, but they are heavily regulated by the federal government.

Don’t Miss: What Jobs Give You Health Insurance

What Are My Civilian Insurance Plan Options

Good news: If you lost your health coverage after returning from military service, this qualifying event opens a special enrollment period for you. In an effort to make your transition into post-military life smoother, let us help you find a health insurance plan that gives you the coverage you need.

What Is Public Insurance

Public health insurance is government-sponsored. The federal government, state government, or a combination of state and federal government runs these health insurance programs. Public health insurance programs are funded largely from tax-payer dollars put in trusts that are used to pay eligible medical expenses and or the cost of prescription drugs. Public health insurance is available to some U.S citizens and permanent legal aliens. In addition to military and Native American Indian health insurance, the three of the most common public health insurance options include:

- Medicare, a federal insurance program available to people age 65 or older, younger people with disabilities, and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant.

- Medicaid, a state-run public healthcare assistance program for low-income individuals and their families. People enrolled in Medicaid pay significantly reduced amounts when they receive care from providers who participate in Medicaid.

- The Childrens Health Insurance Program , a state-run insurance program that provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid but not enough to buy private insurance. In some states, CHIP covers pregnant women.

Also Check: Can Substitute Teachers Get Health Insurance

Exclusive Provider Organization Plan

The exclusive provider organization plan requires you to stay inside the plans network unless its an emergency. Its similar to an HMO in that way.

But an EPO also doesnt require you to get a referral to see a specialist, so its more like a PPO in that respect.

EPO premiums are typically similar to HMO costs.

Who may want an EPO:

- You dont want to pay as much as youll likely pay for a PPO but still want more flexibility than an HMO.

- You would rather not have to get referrals to see specialists.

- Your providers are part of the plans network and the network is wide enough that you wont need out-of-network care.

Whats The Difference Between Obamacare And Private Health Insurance

Obamacare, also known as the Affordable Care Act, is federal law that created the marketplace and stipulates minimum coverage requirements. ACA plans are private health insurance, but only a small percentage of Americans have ACA plans. The most common type of private health plan is employer-sponsored health insurance.

Don’t Miss: What Is The Federal Health Insurance Marketplace

Who Do You Contact

If you work in a non-centralized agency, please contact your Agency Benefits Coordinator for assistance in making changes to your benefits. If you work in a centralized agency whose benefits are administered by the State Personnel Department Benefits Division, contact the Benefits Hotline at:

1-877-248-0007 toll-free outside the 317 area code

Read Also: How To Extend Health Insurance

Public Vs Private Health Insurance: The Big Debate In The United States

One of the biggest debates regarding healthcare in the United States as of late has been over the accessibility of health insurance for all. The cost of private health insurance has risen a great deal in the past several years, which has led leaders in Washington to discuss health insurance reforms. A public healthcare option has been a constant on the table.

Currently, there are some states that offer public insurance plans in addition to the option of private health insurance. If you dont live in a state that currently offers public health insurance, you still have options. Enter your zip code into our FREE plan finder below to begin comparing health insurance plans today!

Don’t Miss: How Do I Get Health Insurance Without A Job

What Is Considered Protected Health Information Under Hipaa Law

If you work in healthcare or health insurance, or are considering doing business with clients in these industries that involves the disclosure of health information, you will need to know what is considered protected health information under HIPAA law because under HIPAA law only certain uses and disclosures of protected health information are permitted, while it is also necessary to implement safeguards to ensure the confidentiality, integrity, and availability of protected health information while it is in your possession.

Violate any of the provisions in the HIPAA Privacy, Security, or Breach Notification Rules and you could be financially penalized. There are even criminal penalties for HIPAA violations and claiming ignorance of the Rules is not a valid defense if you are found to have failed to protect health information under HIPAA law.

Who Is Covered By Private Insurance

Private health insurance includes employer-sponsored plans, which cover about half of the American population reports the Kaiser Family Foundation. Another 6% of Americans purchase private coverage outside of the workplace in the individual/family health insurance market, both on and off the marketplace/exchange.

Recommended Reading: How Much Do Employers Cover For Health Insurance