Fafsa Treatment Of Unemployment Benefits In 2021 And Beyond

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

The American Rescue Plan Act made the first $10,200 of unemployment benefits tax-free per taxpayer for those with incomes under $150,000.

Newly Unemployed Uninsured May Be Eligible For Public Health Coverage

It all sort of came at one time, said Ramsey, 38, of Glenside. I lost my job. A couple days later the lockdown in Montgomery County happened. … I wasnt so concerned at first, but I quickly realized things were changing pretty rapidly.Coronavirus Coverage

Not only had Ramsey lost her job, her family lost their health insurance.

Newly unemployed and uninsured individuals may be eligible for a plan through the federal marketplace, healthcare.gov. Others may have low enough family incomes to qualify for Medicaid.

Even if you anticipate being rehired in a few months, its worth finding out if you are eligible for another insurance plan, said Antoinette Kraus, executive director of Pennsylvania Health Access Network , which helps people enroll in healthcare.gov plans and Medicaid.

You never know when you might get sick or need health coverage, she said.

How to get MedicaidMedicaid may be an option for people whose income has dropped to within 138% of federal poverty $17,618 a year for an individual and $36,158 a year for a family of four.

Unemployment pay counts as income, but the federal stimulus payments promised by the federal government do not.

Medicaid coverage is retroactive, but processing the application can take up to 30 days. If you have an urgent medical need, note that in your application state reviewers may expedite your case.

People who sign up now will have coverage that takes effect May 1.

Key Facts: Income Definitions For Marketplace And Medicaid Coverage

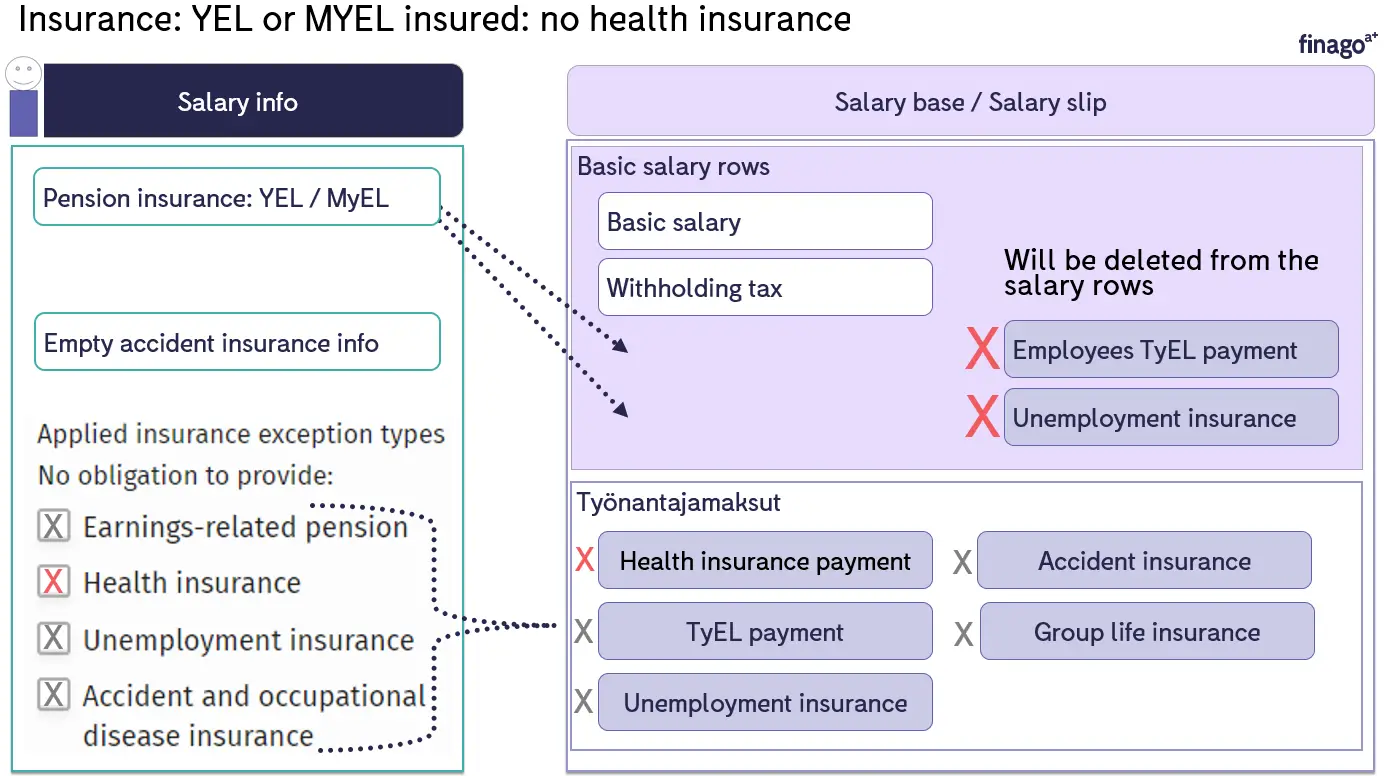

Financial eligibility for the premium tax credit, most categories of Medicaid, and the Childrens Health Insurance Program is determined using a tax-based measure of income called modified adjusted gross income . The following Q& A explains what income is included in MAGI.

How do marketplaces, Medicaid, and CHIP measure a persons income?

For the premium tax credit, most categories of Medicaid eligibility, and CHIP, all marketplaces and state Medicaid and CHIP agencies determine a households income using MAGI. States previous rules for counting income continue to apply to people who qualify for Medicaid based on age or disability or because they are children in foster care.

MAGI is adjusted gross income plus tax-exempt interest, Social Security benefits not included in gross income, and excluded foreign income. Each of these items has a specific tax definition in most cases they can be located on an individuals tax return .

| FIGURE 1:Formula for Calculating Modified Adjusted Gross Income |

What is adjusted gross income?

What types of income count towards MAGI?

All income is taxable unless its specifically exempted by law. Income does not only refer to cash wages. It can come in the form of money, property, or services that a person receives.

Table 1 provides examples of taxable and non-taxable income. IRS Publication 525 has a detailed discussion of many kinds of income and explains whether they are subject to taxation.

Whose income is included in household income?

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Modified Adjusted Gross Income

When determining eligibility for certain Medicaid programs, MDHHS will look at your households size and its Modified Adjusted Gross Income . MAGI is often the same amount as the Internal Revenue Services number for Adjusted Gross Income. MAGI is used to determine eligibility for tax credits for people who get their insurance through the insurance marketplace for HMP. MDHHS also uses MAGI when determining eligibility for certain TM categories.

Some examples of groups of people MAGI applies to are:

- Childless adults between 19 and 64

- Pregnant women

- People who are parents or are a caretaker of a dependent child

Some examples of groups of people that MAGI does not apply to are:

- People 65 or older, blind, or disabled

- People getting long-term care services

- People eligible for or who get Medicare

If you have concerns about how your MAGI is being calculated, you can speak with someone at the Michigan Medicare/Medicaid Assistance Program . MMAP is a free, state-wide counseling service designed to help people with questions about health care.

Your local legal services office may also be able to help you. Use the Guide to Legal Help to find a legal services office near you. Even if they are not able to represent you, they could still offer you advice and other help.

Self-Employment and MAGI

How Is Income Verified

Washington Healthplanfinder uses Social Security data and other electronic data available from various federal agencies to verify household income provided on an application. In cases where the information entered cannot be verified, more information will be requested. To keep your coverage, youll need to submit the requested information in the specified time frame.

Had a life change recently?

It is important to keep you application information current.

You May Like: Do Starbucks Employees Get Health Insurance

Medicaid Chip And Insurance Plans Through The Marketplace

When you fill out a Marketplace application, youll find out if you qualify for any of these types of coverage:

- A Marketplace insurance plan. You may qualify for premium tax credits and savings on deductibles, copayments, and other out-of-pocket costs based on your household size and income. Some people with low incomes may wind up paying very small premiums. Learn about getting lower costs on a Marketplace insurance plan.

- Medicaid. Medicaid provides coverage to millions of Americans with limited incomes or disabilities. Many states have expanded Medicaid to cover all people below certain income levels. Learn more about Medicaid and how to apply.

- Childrens Health Insurance Program . CHIP provides coverage for children, and in some states pregnant women, in families with incomes too high for Medicaid but too low to afford private insurance. Learn more about CHIP.

After you finish your Marketplace application, youll get an eligibility determination that tells you what kind of coverage you and others in your household qualify for.

Enrollment Window Is Opportunity To Take Advantage Of Subsidies

From now through August 15, Americans can take advantage of an enrollment window thats part of the Biden administrations efforts to address the ongoing COVID pandemic . So if youre uninsured and receiving unemployment benefits , you can sign up for health coverage through your states marketplace and take advantage of the financial assistance provided by the American Rescue Plan.

In nearly every state, people who are already enrolled in a health plan through the marketplace can also use this window to switch plans.

But what if youre in a state with a state-run marketplace that is only allowing people who dont already have marketplace coverage to enroll during the COVID-related enrollment window? You should still be able to switch to a Silver plan , as becoming newly eligible for cost-sharing reductions is a qualifying event that will allow you to replace your existing non-Silver plan with a Silver plan that includes cost-sharing reductions.

Recommended Reading: What Insurance Does Starbucks Offer

No Repayment Of 2020 Excess Premium Subsidies

Premium tax credits are the key to keeping individual/family coverage affordable. Ever since the marketplaces debuted for 2014 coverage, a large majority of enrollees have been eligible for premium tax credits.

Unlike other tax credits, you dont have to wait to claim the premium tax credits on your tax return. You can do that if you like, but most people who are subsidy-eligible cannot afford to pay full price for their coverage throughout the year and then claim the full tax credit on their tax return.

Instead, most people take the tax credit in advance: The marketplace calculates it based on projected income and then sends it to the persons insurance company each month, offsetting the amount that the enrollee has to pay themselves.

This works well, except it all has to be reconciled with the IRS after the year is over. If a premium tax credit was paid on your behalf during the year, you have to complete Form 8962 when you file your taxes. By then, youll be using your actual income, as opposed to your projected income.

Depending on whether your income ended up being more or less than you projected, you might get additional money from the IRS at tax timeor you might have to repay some or all of the tax credit that was paid on your behalf.

In late 2020, insurance commissioners from several states sent a letter to incoming President Biden, asking him to address this issue and ensure that people would not have to repay excess premium tax credits from 2020.

Childrens Health Insurance Program

CHIP stands for the Childrens Health Insurance Program, and it works closely with Medicaid. This program provides low-cost health insurance for children whose family incomes are too high to qualify for Medicaid. Like Medicaid, the program differs per state, and in some states, CHIP also provides coverage for pregnant women.

Under CHIP, routine medical and dental check-ups are covered, but there may be copayments for other medical services. CHIP may also have a monthly health insurance premium in some states. Know, though, that its never higher than five percent of your annual family income.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

No Payback Of Excess Marketplace Subsidies

When: 2020

Who benefits: People who earned more money last year than they estimated when they signed up for marketplace coverage.

Under the ACA, people estimate their income for the upcoming year, and the marketplace estimates how much in premium tax credits can be advanced to them every month. At tax time, people reconcile their actual income with their projected income, and if they received too much in tax credits, they generally must pay it back to the government.

The new Covid-19 relief bill eliminates that requirement for 2020. The provision could help people who received unforeseen income last year such as hazard pay or perhaps were laid off and hired back as a contractor at higher pay but without benefits, experts said.

Unfortunately, because of the timing of the new law, income tax forms and tax filing software dont reflect these changes, said Sabrina Corlette, a research professor at Georgetown Universitys Center on Health Insurance Reforms.

A lot of people are going to think they owe money but theyre not going to, she said.

Steps to take now:

When: April through September 2021

Who benefits: People who lost their employer-sponsored coverage and want to stay on that plan.

For people undergoing treatment for a medical condition, it can be important to keep their coverage and existing providers. And switching plans midyear can leave people on the hook for a brand-new deductible.

Steps to take now:

Does My Stimulus Payment Count As Income Under Obamacare

Q. Does the federal stimulus count as income when applying for health insurance through the Obamacare marketplace? I recently became unemployed.

Needing insurance

A. Its a great question.

Your portion of the premium is determined by your income and is ultimately determined when you file your tax return for the year in question.

When applying for the insurance, you must provide an estimate of your expected household income and your premium savings, or Advance Premium Tax Credit, is based on that estimate, said Laurie Wolfe, a certified financial planner and certified public accountant with Lassus Wherley, a subsidiary of Peapack-Gladstone Bank, in New Providence.

Then, when you file your tax return, the actual income determines the final premium tax credit, she said.

If you estimated your income too low, then you will owe any difference when you file your tax return, Wolfe said. If you estimated your income higher than what you ultimately make, then you may see a return of premiums paid. In the end it is all reconciled right on your tax return.

The answer to your question about whether the stimulus payment is counted as income can be found on the healthcare.gov website.

There is a chart which goes through different types of income and whether they are includable in income, Wolfe said.

The starting point for income is called Modified Adjusted Gross Income, or MAGI, something thats not a line on your tax return, she said.

Email your questions to .

Read Also: Starbucks Insurance Part Time

New Agi Exclusions For Unemployment Benefits

As a result of the ARPA, up to $10,200 of unemployment benefits are now excluded from income for single taxpayers. For married taxpayers, up to $20,400 of unemployment benefits can be excluded if both received unemployment benefits and filed a joint income tax return.These changes can affect the FAFSA treatment of unemployment benefits on the 2022-23 FAFSA as it’s based on 2020 income. Applicants began filing the 2022-2023 FAFSA on October 1, 2021.Since ARPA was signed into law on March 11, 2021, some taxpayers may have already filed their federal income tax returns beforehand and reported the unemployment benefits as part of their adjusted gross income . The IRS is sending these taxpayers a refund.But taxpayers who filed their returns after this date won’t have the unemployment benefits reported as income on their tax returns. So their returns will report a lower AGI than taxpayers who filed their federal income tax returns before the change.

How The Federal Cares Act May Affect Your Health Coverage

Congress passed and the President signed a $2 trillion federal relief package that will provide some immediate help to many Americans facing health and economic shortfalls during the COVID-19 pandemic. The CARES Act, as its called, included Recovery Rebates for Individuals as well as extended and enhanced federal Unemployment Insurance. While many Californians will receive this needed assistance, much more help will be needed to get us through this public health crisis. We will be need your help to advocate for that assistance as it develops.

If you have been or become uninsured during this crisis, including if you lost employer-based coverage, Medi-Cal and Covered California are important options to provide you with peace of mind, more economic security, and access to care including the testing and treatment for the coronavirus.

While Health Access continues to analyze the CARES Act for its impacts in California, we wanted to highlight some information on how income will calculated which may affect a persons eligibility for Medi-Cal or for affordability assistance in Covered California.

| Type of federal relief |

Recommended Reading: Starbucks Medical Insurance

Makes Coverage More Affordable For Many Americans

On March 11, 2021, President Joe Biden signed H.R.1319, the American Rescue Plan Act, into law. This sweeping piece of legislation is designed to provide widespread relief to address the ongoing COVID-19 pandemic. It includes a vast range of provisions.

Among the most widely known are the third round of stimulus checks, enhanced child tax credits, and the extension of additional federal unemployment compensation.

But the legislation also includes several important provisions that make health insurance more affordable for millions of Americans. Lets take a look at how the provisions work and what consumers can expect:

- Subsidy cliff temporarily eliminated for marketplace enrollees

- Enhanced premium tax credits in 2021 and 2022 for people who are already subsidy-eligible

- Full premium tax credits and cost-sharing reductions for people receiving unemployment compensation in 2021

- Six months of COBRA subsidies

- Excess premium subsidies from 2020 do not have to be repaid to the IRS

How Coronavirus Stimulus Payments Affect Your Household Income

The federal governments economic impact payments and the states new stimulus payment may have you wondering how to calculate your household income, whether you want to apply for health insurance right now during special enrollment or report a change to your income.

There are a few different types of stimulus payments: federal stimulus payments, Pandemic Unemployment Compensation , and the Golden State Stimulus payment. Its important to understand which payments you need to include while calculating your household income because this determines which programs you qualify for and how much financial help you get.

Read Also: Starbucks Benefits For Part Time

What Is Considered Income For Obamacare Subsidies

Do you qualify for Obamacare Subsidies ? Government-sponsored health care savings are based on your predicted household income for the following year . Household means that , you, your spouse, and any dependents who live in your household are included, even if your family members dont need insurance. Household income includes taxable wages, tips, self-employment money, unemployment income, most Social Security benefits, retirement or pension, alimony and child support, capital gains, and investment income. Gifts, Social Security Income , veteran disability payments, workers compensation, and gains from loans are not included in your household income.

If your income changes at any point, its important to report that to your insurance agent or update your application in healthcare.gov so that you dont miss out on any cost savings you may be eligible for.