How To Apply For Health Insurance In Iowa

In the old days, you used to have to run a battery of tests to apply for health insurance, meaning that pre-existing conditions could often result in higher premiums or being excluded from plans. If youre signing up through the Health Insurance Marketplace, all you need to do is make an account, fill in your relevant family data and financial status, and you should be able to enroll in the plan you choose.

Iowa Health Insurance Information Resources And Access To Online Health Insurance Quotes

As an Iowa resident you can choose from health insurance plans offered to individuals and groups by private insurance companies. Iowa plans to open its own healthcare exchange. Until then you may also purchase individual and family coverage from participating private insurers through HealthCare.gov, the federal exchange. If you are self-employed with no employees, you can also use the federal exchange to purchase coverage. You may also be entitled to certain state and federal programs such as Medicaid and COBRA.

Frequency Of Using Medical Services Other Than A Doctor Or Hospital

Non-doctor health care visits is a measure of how often people receive medical care without seeing a doctor. This type of care excludes patients that have been admitted to hospitals or other institutions. Examples of non-physician health care includes appointments or walk-in clinics to see a nurse, physical therapist, counselor for mental health appointments or other non-physician medical personnel.

Iowa residents insured with group, individual and Medicaid managed care insurance receive this type of medical care with a similar frequency as the average for the U.S. Medicare patients in Iowa use this type of health care with approximately a 20% lower frequency than the U.S. average.

Non-physician care tends to be an expensive form of treatment. The reason non-physician visits are expensive is that many times these are visits to outpatient facilities. Many outpatient facilities are owned and operated by hospitals. While hospital owned and operated medical facilities are less expensive than a hospital, oftentimes they are more expensive than a doctor visit.

Read Also: What Is The Age Limit For Health Insurance

Health Care Market Competitive Dynamics

Most states have laws requiring new health care facilities to be approved by special boards. These boards are known as certificate of need boards. The purpose of these boards is to certify there is need for new facilities. CON boards have the effect of reducing the level of competition, which results in higher prices for the services provided.

To quantify the effect of legislation that minimizes competition, ValChoice calculated the difference in health care cost between states with and without CON boards. Using a simple average calculation, states with CON requirements have an average cost for health care that is $664 more per person insured than states without CON requirements.

States included in the calculations as having CON requirements include the following: Alabama, Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire*, New Jersey, New York, North Carolina, Oklahoma, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, Washington, West Virginia and Wisconsin*. Other states do not have CON board certification requirements.

*New Hampshire and Wisconsin are included as having CON requirements for the reason the recent modifications in CON laws have not yet had a material impact on the cost of health care in the state.

Democratic Lawmakers Want To Allow Iowans To Purchase Medicaid As Alternative To Individual

In 2017, two Democratic lawmakers in Iowa informally proposed a public option that would allow people to purchase Iowa Medicaid, using ACA premium subsidies to offset some of the cost. The proposal had not yet been introduced as legislation at that point, but state Rep. John Forbes and Sen. Matt McCoy held a public meeting to discuss the possibility in June 2017.

The 2018 legislative session in Iowa convened in January, and two bills S.F.2035 and H.F.2002 were introduced to create the Health Iowans for a pubic option program. But neither bill advanced out of committee by the February deadline , rendering them effectively dead for the 2018 session.

It was already understood that a Medicaid buy-in program would face an uphill challenge in Iowas Republican-controlled legislature. And even if the legislation had succeeded in winning over Republican support in Iowa, it would also have needed approval from the Trump Administration.

Although no states currently allow residents who arent eligible for Medicaid to buy into the program, its an idea that been gaining traction in recent years in several states.

Read Also: What Does Hra Mean In Health Insurance

Iowa Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 447,724 enrollees and Individual insurance is based on 155,569 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

Health Services Use By Iowa Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 447,724 Individual insurance, 155,569 Medicaid managed care, 431,187 and Medicare Advantage, 84,674.

Also Check: Can You Buy Individual Health Insurance

Iowa Enacted Legislation That Allows Farm Bureau To Partner With Wellmark To Sell Non

The Iowa Insurance Division announced on November 1, 2018 that a non-insurance health benefit plan sponsored by the Iowa Farm Bureau, a non-profit agricultural organization, also begins enrollment today. Thats referring to the Farm Bureau plans that are allowed as a result of legislation that Iowa enacted in 2018. These plans have frequently been referred to as junk insurance in the media, but thats not really the case. Theyre less expensive than full-price ACA-compliant plans, but thats mostly due to the fact that they use medical underwriting .

The Farm Bureau coverage itself is similar in many respects to ACA-compliant plans, although theres a lifetime benefit cap of $3 million, whereas ACA-compliant plans dont have any benefit caps for essential health benefits. But unlike ACA-compliant plans, which cover pre-existing conditions and have to accept all applicants during open enrollment, regardless of medical history, eligibility for Farm Bureau plans is based on an applicants medical history . Farm Bureau plans will accept enrollees year-round, as long as they can pass the companys medical underwriting.

The Cheapest Health Insurance In Iowa With High Out

Young Iowa residents who have minimal healthcare costs but still want coverage can opt to get a low-cost plan with high out-of-pocket maximums. While you may be paying less per month, a policyholder will have to pay more in case of frequent doctor visits in a given year or a medical emergency.

Those looking for cheap health insurance in Iowa can opt for Medica, which offers the lowest-costing plan in the state for a high out-of-pocket maximum Inspire by Medica Catastrophic at an average of $219 per month for a 26-year-old.

Keep in mind that MoneyGeek classifies a high out-of-pocket maximum as one that is $8,250 or higher.

Medica Catastrophic

Medicas plan is in the Catastrophic tier which means only certain people are eligible. Only those under the age of 30 or who apply for a hardship exemption can get this plan.

Recommended Reading: What Causes Health Insurance Premiums To Increase

Best Cheap Health Insurance In Iowa 2022

Find Cheap Health Insurance Quotes in Iowa

People who live in Iowa can find cheap health insurance through their state exchange, but the best plan for you depends on where you live and your needs.

In Iowa, the average health insurance premium for a 2022 plan is $445 per month for a 40-year-old, just 1% higher than in 2021.

We researched all health insurance plans in Iowa and found that in the majority of the state, either the Wellmark Silver Traditional HMO or the **Silver Simple- Specialist Saver through Oscar ** were the cheapest Silver health insurance policies. Neither plan covers every county, but they offer the cheapest premiums where they are available. We also ran the numbers to find the cheapest plans for all other metal tiers.

Using The Iowa Marketplace For Private Health Insurance

Any states private health insurance market is divided into metal tiers. This does not decide the level of medical care. Instead, the cost distribution between an insurer and a policyholder is determined by each tier.

Iowa has 4 metal tiers: Catastrophic, Expanded Bronze, Silver, & Gold. The monthly premiums, out-of-pocket maximums, and deductibles vary significantly with every tier.

Points to ponder!

Getting cheap health insurance in Iowa is possible based on your income. You may qualify for premium tax credits if your income falls between 100 percent and 400 percent of the federal poverty level. Iowas two-person households make between $17,420 and $69,680 a year. To determine if you are eligible for premium tax credits and how much you can save, look at Healthcare.govs calculator.

Iowas private health insurance marketplace typically has an enrollment period when residents can apply for or even disenroll from health insurance. This usually falls between November and December, but COVID-19 has expanded the enrollment dates to provide residents with more flexibility.

Read Also: Does American Family Have Health Insurance

Iowa Additional Mandated Benefits

Iowa currently mandates that the following benefits, which exceed ACA requirements, must be provided or offered by private providers authorized to sell health insurance within the state:

- Skilled nursing facility coverage for care in hospitals for individual, small and large group plans

- Durable medical equipment coverage for prosthetic devices for small and large group plans

- Reconstructive surgery for small and large group plans

- Clinical trials coverage for cancer trials- for individual, small and large group plans

- Diabetes care management for individual, small and large group plans

- Prescription drugs other oral cancer medications for individual, small and large group plans

Facts About Aca Marketplace Insurance

-

Financial help is available.

-

Application help is available and free.

-

You cant be turned down for coverage for having a pre-existing condition.

-

The costs and benefits of each plan must be explained in easy-to-understand language with no fine print.

-

All health insurance plans have to cover important benefits, like doctor visits, hospitalizations, prescriptions, and more.

Read Also: Can You Lose Health Insurance While On Fmla

What To Know About Health Insurance In Iowa

The rates gathered by MoneyGeek are based on data from Iowas private health insurance marketplace but you may find even cheaper premiums once you actually apply. This is because you may qualify for certain discounts or even find that youre eligible for Medicaid or Medicare, which are cheaper options than anything on the private marketplace.

Iowa Available Standardized Plans

To help you more easily compare costs and benefits, ACA designates that all qualifying plans be one of four metals: Bronze, Silver, Gold and Platinum. Each is based on the average amount of healthcare costs the plan will cover shown as a percentage of what is covered by your insurance company and what is paid for by you. All insurers participating in the federal or a state healthcare exchange must offer , at minimum, Silver and Gold plans. All metal plans have a shared maximum out-of-pocket amount that you can be charged in any calendar year.

| Metal Plan | |

| 90% | 10% |

In addition, if you are under 30 or meet the criteria for a hardship exemption, you can purchase a catastrophic plan that is compliant with ACA requirements.

Also Check: How Much Is Health Insurance In Idaho

Find Answers To Your Questions

Learn about the parts of Medicare, when you’re eligible, and coverage options.

© 2023 Wellmark Inc. All rights reserved. Wellmark Blue Cross and Blue Shield of Iowa, Wellmark Health Plan of Iowa, Inc., Wellmark Blue Cross and Blue Shield of South Dakota, Wellmark Advantage Health Plan and Wellmark Administrators, Inc. are independent licensees of the Blue Cross and Blue Shield Association. Privacy & Legal | California Consumers Privacy Notice

You Have More Insurance Options For Your Health Than You Think Iowa

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in Iowa you might be looking for Affordable Care Act insurance, what’s often called Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

Also Check: Where Is Health Insurance Free

The Effect Of Insurance Deductibles On The Cost Of Health Care

IA residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $3,761 with a relatively common $6,000 deductible has an effective price of nearly $10,000, if they use their insurance.

Insurance For Individuals In Iowa

When youre purchasing a health care plan for yourself, your budget and your overall health are the two most important factors to consider. If you have minimal health concerns and dont require prescriptions, you may be better off looking for a plan that provides a low monthly premium but higher deductibles. If, on the other hand, you have a chronic health condition that requires regular visits to a doctor or a specialist, youll want to consider a plan that has a higher monthly premium but a lower deductible.

There are several different plans from which you can choose:

The main difference between a plan sold on Healthcare.gov and one purchased off-exchange is that ACA Marketplace plans offer premium tax credits if your income is between 100% to 400% of the Federal Poverty Level. Youre not eligible for these benefits with off-exchange plans. Plus, if you select a silver plan on the Marketplace, you may also qualify for additional cost-sharing reductions .

Read Also: How Much Is The Fine For Not Having Health Insurance

The Cheapest Health Insurance In Iowa With Low Out

If you expect to have higher medical costs than most, it may help to get a plan with high premiums and low out-of-pocket maximums. This way, you can reach the limit sooner and get your costs covered by insurance at an earlier rate.

The best health insurance in Iowa for individuals looking for low out-of-pocket maximums is the Wellmark Gold Modified HMO by Wellmark Health Plan of Iowa, Inc., which costs an average of $447 per month for a 40-year-old.

Note that MoneyGeek considers a low out-of-pocket maximum to fall under the $4,250 threshold. However, this plan has an out-of-pocket max of $5,250, which is the lowest in the state with the cheapest premiums.

Wellmark Health Plan of Iowa, Inc.

The Wellmark Gold Modified HMO plan falls under the Gold tier, the highest available option in the state. This means that it comes with expensive monthly premiums but has low out-of-pocket maximums, letting policyholders who have frequent medical expenses get covered sooner.

Cheapest Plan In Iowa With An Hsa

Iowa residents who are in good health and have minimal healthcare expenses can opt for plans with a health savings account option. They are more affordable plans where contributions are tax-free, letting you build up your savings for medical expenses or even non-medical expenses.

The cheapest and best health insurance in Iowa for all metal tiers with an HSA option is the following:

- Expanded Bronze: The Wellmark Bronze HDHP HMO plan by Wellmark Health Plan of Iowa, Inc., costing an average of $313 per month for a 40-year-old.

Note that plans with HSA options usually come with high deductibles, which can drain your savings in the event of any major medical costs.

You May Like: How To Cancel My Health Insurance

What Does Health Insurance Cover

The Affordable Care Act changed the structure of health insurance plans. It standardized the industry, and now every permanent insurance plan must have 10 essential benefits. Here are the benefits:

These 10 services make up the core of what every ACA-compliant plan must offer. Just remember that these minimum standards do not apply to short term health insurance plans.

Healthy And Well Kids In Iowa

HAWKI provides health care to uninsured children of working families. Many families pay nothing for the program however, no family will pay more than $40 a month. HAWKI has higher income limits than Medicaid, from $21,510 per year for a household of one to $134,874 for a household of eight.

Health care coverage includes:

Don’t Miss: How Cheap Can I Get Health Insurance

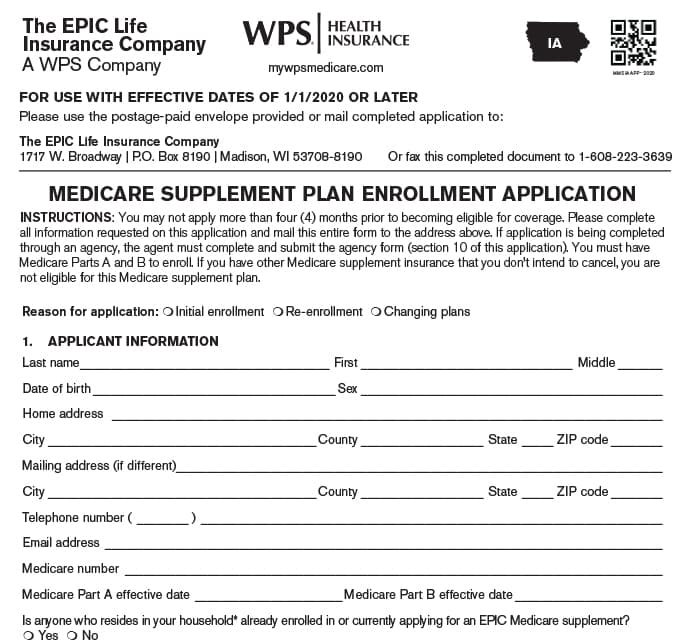

Retiree With Medicare Due To Disability

If you become eligible for Medicare, due to disability while enrolled in a State of Iowa health plan, Medicare Parts A and B will be your primary insurance. If the State of Iowa is paying any portion of your health insurance premiums either through the Sick Leave Insurance Program , please contact DAS-HRE at 866-895-2464 to inform them of your Medicare enrollment.

The Department of Administrative Services Human Resources Enterprise is providing this information about the State of Iowas benefits. The information on this web page is subject to change. Nothing herein shall be construed as a guarantee of benefits. This webpage is not a complete description of the State of Iowas benefit plans. Nothing on this web page supersedes or changes any of the terms and conditions of any plan documents, insurance policies, or other legal agreements. If the wording in this web page contradicts any plan documents, laws, regulations, administrative rules, insurance policies, or other legal agreements, the wording in the official documents and agreements will govern.

Reviewed 12/26/2019