What Is The Cost Of Cancer Treatment Without Insurance

Having cancer is enough to make anyone feel anxious about the uncertain road ahead. So any unwelcome medical costs will only add to those stress levels if you are uninsured. And, unfortunately, the costs for treatments in the U.S. \come with a high price tag. Nearly breaking the million-dollar mark is a bone marrow transplant. It could cost more than an eye-watering $900,000+. Prices start at a still pretty extortionate $638,000.

Brain cancer treatment costs anything from $50,000 to a lofty $700,000+, while breast cancer costs range from $48,500 through to $300,000+. The price it takes to tackle pancreatic cancer starts from $31,000 through to $200,000+. And melanoma treatment can be anywhere from $1,700 to $152,000+.

Related: Small Business Guide To Offering Health Insurance

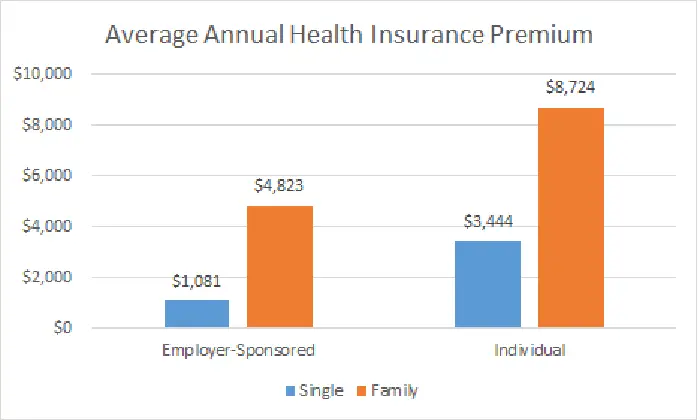

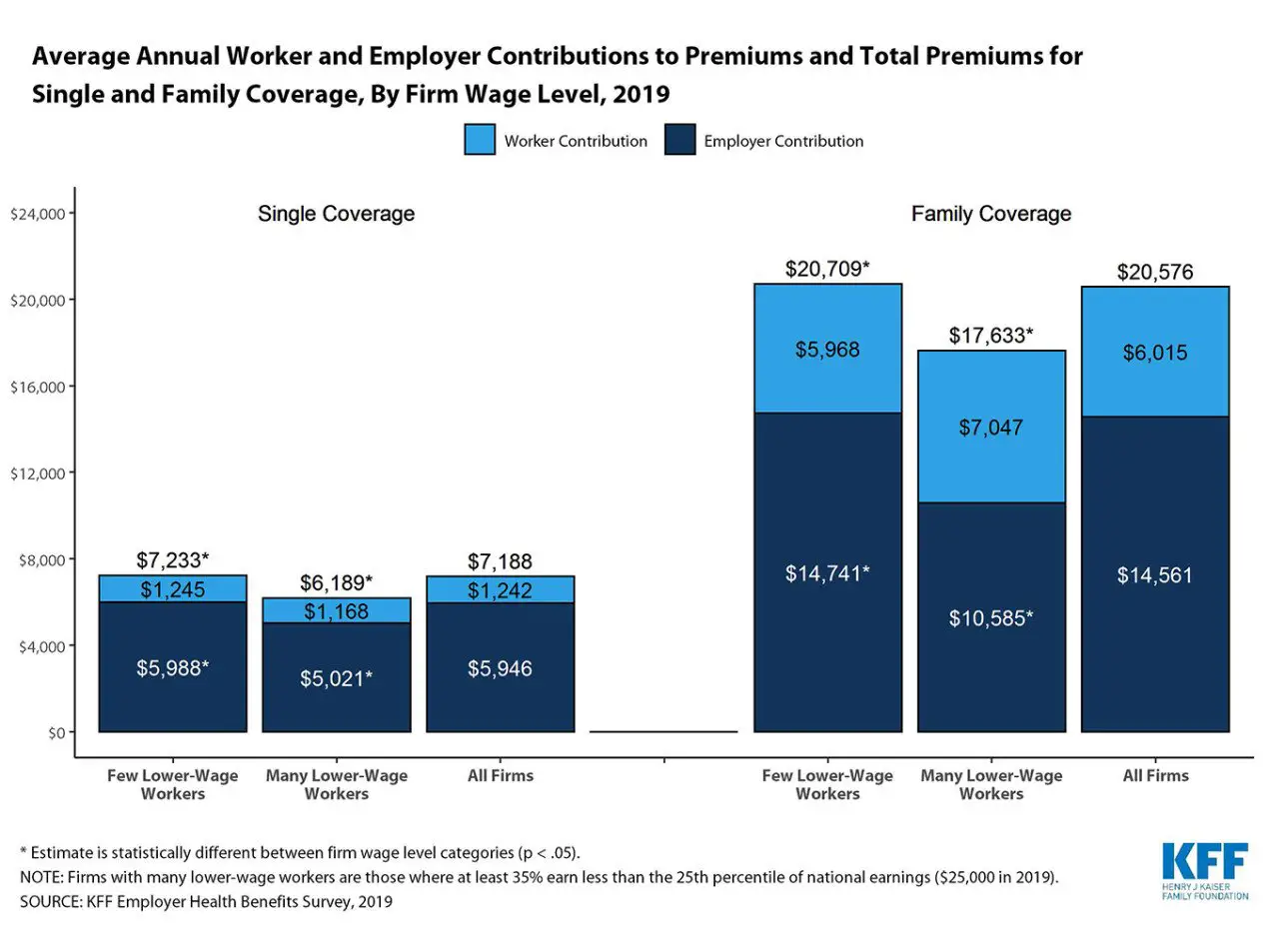

Kaiser Family Foundation reported in their 2020 Employer Health Benefits Survey: In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage.

In terms of premiums, the report found that most covered workers contribute to the cost of the premium for their coverage .

Specifically, for covered employees at small firms, the average premium for single coverage is $7,483 and $20,438 for family coverage. The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, the report continues.

When it comes to deductibles, the KFF report says, Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,644.

With this comprehensive scope, you may now have an idea of how much employees have to pay for health insurance, but, as we initially mentioned, many other variables affect the final dollar amount for both employee and employer. Lets take a closer look.

How Much Us Residents Spend On Health Care

According to BLS, U.S. residents in the country’s lowest income decile spend 35% of their pre-tax incomes on health care, compared with 3.5% of U.S. residents in the country’s highest income decile. However, individuals in the highest income decile spend the most dollars on health care, at an average of $8,720, compared with an average of $2,119 among individuals in the lowest income decile.

A separate Kaiser Family Foundation analysis published this month showed how health care payments as a percentage of one’s income can change based on health. For example, the analysis found U.S. residents with the lowest incomes who are enrolled in employer-sponsored health plans spend an average of about 13% of income on premiums and out-of-pocket costs if everyone on the plan is healthy. However, the number rises to nearly 20% if everyone on their plan is not healthy.

Meanwhile, research from the Commonwealth Fund found that the number of U.S. adults with employer-sponsored health plans who are deemed underinsured tripled between 2003 and 2018, and families who spent enough on health care to meet their deductibles saw those expenses almost double as a percentage of their incomes over the past decade.

Sara Collins, vice president of health care coverage and access at the Commonwealth Fund, said these trends “are driven by health care costs rising a lot faster than the median income.”

Recommended Reading: How Much Does Health Insurance Cost In Wisconsin

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Cumulative Health Spend By Age

However, there is a lot of reason to believethis estimate of $414K spent on your healthcare is being conservative. First ofall, it’s for the “average” person. If you have a health catastrophe, yourhealthcare spending may be tremendously higher. Second, the above figuresassume that healthcare costs in the future increase as the same rate asinflation to arrive at the $414K spending in today’s dollars.

There is a lot of data to suggest thathealthcare costs in the United States have been increasing much faster thaninflation. One estimate is that over the last two decades, healthcare costshave increased twice as fast as inflation.

Since projecting future healthcare costs is an impossible task to pinpoint with any accuracy, let’s show how much the cost of your healthcare will be under various assumptions about healthcare cost growth rates. The following chart shows how much your lifetime healthcare spending will be if healthcare spending grows at the same rate as inflation versus if it grows slightly faster.

Read Also: How To Apply For Low Cost Health Insurance

Health Spending Average By Age

It turns out being born is somewhat expensiveand childhood costs peak when you’re under five years old. Healthcare costs arelowest from age 5 to 17 at just at $2,000 per year on average. From then onit’s a steady increase, however, with costs rising to over $11,000 per yearwhen you’re over 65 years old.

The costs of your care may be mostly coveredby private insurance or Medicare, but not all costs are always covered and anunexpected bill can have devastating effects on your finances. As one seniorcitizen relates on their traumaticexperience with health insurance:

“My bankruptcy started with back surgery. I had several medical tests that my insurance did not cover. This caused me to fall behind in my medical payments. The next thing I knew, the bills began piling up. I got to the point I owed more than I was making on Social Security.”

Healthcare costs are not evenly distributed. You could be among the tragically unlucky with much higher costs. But not only that, but healthcare spending varies substantially by gender and demographic.

At each stage of life, health care spending for women is substantially higher than for men. The need for more gerontology nurse practitioners and in the coming years will be vitally important to the success of healthcare programs.

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

You May Like: What Health Insurance Is Available In Nc

How Much Does The United States Spend On Healthcare

The United States has one of the highest costs of healthcare in the world. In 2020, U.S. healthcare spending reached $4.1 trillion, which averages to over $12,500 per person. By comparison, the average cost of healthcare per person in countries in the Organisation for Economic Co-operation and Development is only about one-third as much. The COVID-19 pandemic exacerbated the trend in rising healthcare costs. In 2020, the year-over-year increase in national healthcare costs as a share of gross domestic product was over 2 percentage points the largest increase since 1960. However, healthcare spending had been increasing long before COVID-19 began. Relative to the size of the economy, healthcare costs have increased over the past few decades, from 5 percent of GDP in 1960 to 18 percent in 2019 and 20 percent in 2020.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2021 | The average William Russell international health insurance premium in 2021* |

|---|---|

| Individual cover |

Also Check: How Much Does Usps Health Insurance Cost

Relative To Prior Years

The Congressional Budget Office analyzed the reasons for healthcare cost inflation over time, reporting in 2008 that: “Although many factors contributed to the growth, most analysts have concluded that the bulk of the long-term rise resulted from the health care system’s use of new medical services that were made possible by technological advances…” In summarizing several studies, CBO reported the following drove the indicated share of the increase from 1940 to 1990:

- Technology changes: 38-65%. CBO defined this as “any changes in clinical practice that enhance the ability of providers to diagnose, treat, or prevent health problems.”

- Personal income growth: 5-23%. Persons with more income tend to spend a greater share of it on healthcare.

- Administrative costs: 3-13%.

- Aging of the population: 2%. As the country ages, more persons require more expensive treatments, as the aged tend to be sicker.

According to Federal Reserve data, healthcare annual inflation rates have declined in recent decades:

- 1970-1979: 7.8%

On Average Other Wealthy Countries Spend About Half As Much Per Person On Health Than The Us

Comparing health spending in the U.S. to other countries is complicated, as each country has unique political, economic, and social attributes that contribute to its spending. Because health spending is closely associated with a countrys wealth, the remaining charts compare the U.S. to similar OECD countries those with above median national incomes and above median income per person . Health spending per person in the U.S. was $11,945 in 2020, which was over $4,000 more expensive than any other high-income nation. The average amount spent on health per person in comparable countries is roughly half that of the U.S.

Also Check: Does Health Insurance Pay For Assisted Living

What Is The Cost Of A Broken Bone Or Sprain

It could be an innocent tumble on the sidewalk, right through to a dramatic sporting injury. Whatever the scenario, breaks and sprains happen all the time and they are expensive for the uninsured.

A hip fracture starts at $16,000 for treatment, and goes up to $53,000+. A sprained or broken ankle could cost $300+ if surgery is not needed. But it soon jumps to a rather more unpalatable $17,000 to $20,000+ if a trip to the operating room is involved. A sprained or broken wrist costs $500+ on a non-surgical basis and leaps to $7,000 to $10,000+ if surgery is required. The resulting physical therapy will also cost you, coming in at $120 to $350 per session.

The American Treatment Cost Gap And Health Insurance Cost

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

Recommended Reading: What Is No Cost Sharing In Health Insurance

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

The Most And Least Expensive States For Homeowners Insurance3

| Most Expensive | |

|

5. Kansas |

5. Wisconsin |

Now, if youre renting, youre not off the hook. You need enough renters insurance to replace your stuff if it gets stolen or destroyed in a fire or some other disaster. Without it, youll have to replace everything on your own dime. And since renters insurance only costs roughly $15 per month, theres really no excuse for you not to have it!4

Recommended Reading: Why Is Health Insurance So Expensive In New York

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

How Much Should Your Employees Pay For Health Insurance

From the insurance plan your company chooses to your employees health conditions, many factors affect how much employees pay for health insurance. Before detailing these items, lets take a look at some facts that reflect, on average, what these payments look like in America. This data is from the 2020 National Compensation Survey by the U.S. Bureau of Labor Statistics :

- The average cost for health care per employee-hour worked was $2.64 for private industry workers.

- 86% of workers participated in medical care plans with an employee contribution requirement, where employees paid $138.76, and employers paid $459.70 per month.

- 72% of workers participating in single coverage medical plans with contribution requirements had a flat-dollar premium, and the median amount was $120.06.

You May Like: Do Employers Pay For Health Insurance

The Changing Cost Of Healthcare In The Us

U.S. healthcare spending grew annually at 9.7% in 2020, reaching a record $4.1 trillion, or $12,530 per person. As a share of the nation’s gross domestic product , health spending accounted for 19.7%. These numbers are staggering. What are Americans getting for their money?

Learn more about the factors impacting the cost of healthcare in the U.S. and the changes over recent years.

Achieving Medicare For All

Of course, moving to this kind of system will not be easy and will not happen overnight. This is why every serious proposal for Medicare for All contemplates a significant transition period.

In the weeks ahead, I will propose a transition plan that will specifically address how I would use this time to begin providing immediate financial relief to struggling families, rein in out-of-control health care costs, increase coverage, and save lives. My transition plan will take seriously and address substantively the concerns of unions, individuals with private insurance, hospitals, people who work for private health insurers, and medical professionals who worry about what a new system will mean for them. It will also grapple directly with the entrenched political and economic interests that would spend freely, as they havethroughout modern American history, to influence politicians and try to frighten the American people into rejecting a plan that would save them thousands of dollars a year on premiums and deductibles while making sure they can always see the health care providers they need with false claims and scare tactics.

But thereâs a reason former President Barack Obama has Medicare for All a good idea. Thereâs a reason the American people support it. Itâs because when it comes to the cost of health care, we are in the middle of a full-blown crisis.

As President, Iâll fight to get it done.

Also Check: Can You Put Your Parents On Your Health Insurance