What Deductible Plan May Be Right For Me

If you dont anticipate needing many medical expenses for the upcoming plan year, a high deductible health plan may be the most economical one for you. If you do anticipate upcoming medical expenses, a low deductible plan might help you get the most mileage out of your plan.

| High deductible health plans may appeal to those who: | Low deductible health plans may appeal to those who: |

|---|---|

| Are young and generally healthy | Are 65 or over |

What Is The Best Health Insurance

The Best Health Insurance Providers Aetna is the best Medicare Advantage plan. Blue Cross Blue Shield is the best option for nationwide coverage. Cigna is the best for global coverage. Humana is the best option for umbrella coverage. Kaiser Foundation Health Plan is the best option for HMOs. United Healthcare is the best option for the tech savvy. HealthPartners is the best option for the Midwest.

What Counts Towards The Out

Three types of out-of-pocket expenses count towards your out-of-pocket maximum:

-

Annual deductible

Your monthly premium does not count towards your out-of-pocket maximum. Even if you hit your out-of-pocket limit, you still need to continue to pay your premium.

The out-of-pocket maximum also excludes services that arent covered by your health plan. For example, if health insurance doesnt cover an emergency room visit, then it wont begin to do so even after you reach the out-of-pocket limit.

Similarly, whether or not the cost of preventive services and prescription drugs count towards the out-of-pocket maximum will depend on how your health plan covers this type of care to begin with.

And check out our study on where people pay the most for an Obamacare health plan.

You May Like: Are Glasses Covered By Health Insurance

How Much Is A Typical Deductible

The average health insurance deductible is between $1,902 and $4,786 for plans purchased on the health insurance marketplace. Those who get their health insurance through an employer typically have lower deductibles, and the average deductible is $1,644 for covered workers.

However, there is a full range of possible plans with different deductible amounts. On one end, there are no-deductible health insurance plans where the cost-sharing benefits of your insurance policy begin right away. In contrast, high-deductible health plans mean that you’re responsible for a large portion of your health care costs before the insurance company contributes.

Deductibles can also vary based on the number of people in the household who are covered. In these cases, deductibles are tracked both by individual and by family. If an individual reaches their deductible, the cost-sharing benefits begin for that person only. If the family deductible is reached, cost-sharing benefits begin for everyone in the household.

Counts toward your deductible

- Amount spent on covered doctors, treatments and health services

- What you spend on copayments or coinsurance

Excluded from your deductible

- Amount spent on monthly insurance bills

- Spending for out-of-network services or other uncovered health services

What Happens When You Meet Your Out

When you hit your out-of-pocket maximum, you should not be billed for covered care or services received during the remainder of the plan yeareven at the point of sale. It is conceivable that you may be billed prior to the insurance companies systems being fully updated, in which case you should save receipts for incurred costs to attempt retroactive reimbursement.

Also Check: How To Retire Early And Get Health Insurance

What Is Considered A High Deductible Health Plan 2021

Will vary depending on the plan and the employer, but are normally lower. In an HDHP, the out-of-pocket maximum is greater. For 2021, the individual plan maximum is $7,000, while the family plan limit is $14,000. For 2022, the individual plan maximum is $7,050, while the family plan limit is $14,100.

What Costs Dont Count Towards Meeting The Out

- Premiums: monthly plan premiums dont go towards your maximum out-of-pocket costs. Even after youve met your out-of-pocket maximum, youll keep paying your monthly premium unless you cancel your plan.

- Non-covered services: medical services that arent covered wont count towards your out-of-pocket maximum. This might include out-of-network services if your plan requires you to use network providers. Youll most likely have to pay for these costs out of pocket.

- Balance billing: if your provider charges above the allowed amount your insurance will cover, you may have to pay the difference.

Read Also: What Is The Cheapest Health Insurance Plan

Is It Better To Have A Higher Deductible Or Out

Its better to have a lower OOP maximum. Its nice to have a lower deductible, but the trade off is likely higher premiums. So it depends on how much care you receive during the year. If you use few healthcare services and are pretty healthy, it may be better to have a higher deductible and lower premiums.

This Number Is Pretty Important It Is The Most You Have To Pay For Covered Healthcare Services In A Year This Figure Does Not Take Into Account Services You Receive That Are Not Covered Under Your Healthcare Plan Or Your Monthly Premium However It Does Include Your Deductible Copays And Coinsurance Payments For The Year Out

Lets say you need to have a surgery that will cost $20,000.

Your plan specifications are as follows:

You pay the first $5000 of covered medical expenses towards your deductible.

Now, you owe your coinsurance amount on the rest of the medical costs of $15,000 for a total of $3000.

This brings you to a total of $8000. However, your out-of-pocket maximum is $7150. Therefore, you will only owe $2150 in coinsurance because that will get you to your out-of-pocket maximum amount of $7150. At this point, any additional covered medical costs you incur throughout the rest of the year will be covered by your insurance 100%. However, you are still required to pay your monthly healthcare premium as that is not included in your out-of-pocket maximum.

There we have the basics of healthcare costs incurred with healthcare coverage and medical visits. Next month we will explore what it means to be covered under more than one plan, or Coordination of Benefits.

Recommended Reading: How To Get Gap Health Insurance

All Information About Medical Insurance Out Of Pocket

At dayofdifference.org.au you will find all the information about Medical Insurance Out Of Pocket. We have collected a lot of medical information. Check out the links below.

- https://www.policygenius.com/health-insurance/out-of-pocket-expenses/#:~:text=What%20are%20out-of-pocket%20expenses%20in%20health%20insurance%3F%201,expenses%20count%20towards%20the%20deductible%20More%20items…%20

- none

What Is A Health Insurance Deductible

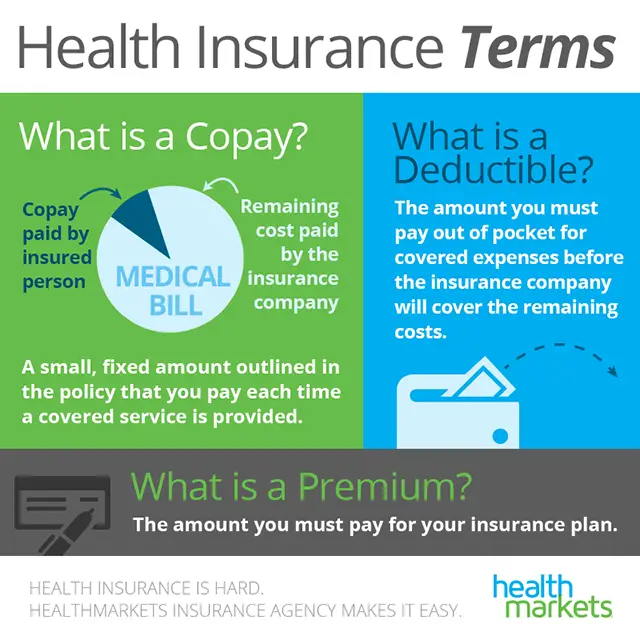

An annual deductible is the amount of money you must spend on covered health care services before your health insurance plan begins to cover any of the costs. This is in addition to the monthly premium just to be on the plan. Typically, higher premiums translate to low deductibles, while lower premiums tend to mean a higher deductible. Most insurance plans have a deductible including individual and employer health insurance. Although, some health maintenance organization plans have a low deductible or no deductible at all.

Don’t Miss: What Is Average Cost Of Health Insurance For A Family

Maximum Out Of Pocket Information

To find your maximum-out-of-pocket limits, 1, select “Benefits” from the left navigation menu, and view your Summary of Benefits under “Health Plan Documents.”

Most Optima Health plans limit the dollar amount you will have to pay during your plan year. The maximum-out-of-pocket amount or limit is the total amount you and/or your dependents will pay out of pocket for Copayments, Coinsurance, and Deductibles during a plan year. Your specific maximum amount is determined by your plan benefits and can be found on your Optima Health FaceSheet or Schedule of Benefits in your Evidence of Coverage or Certificate of Insurance.

Depending on your health plan, Copayments, Coinsurance, and Deductibles you pay for certain services count toward this amount. Your specific plan may have separate maximum amounts for in-network services and out-of network services. Some out-of-pocket expenses do not apply to the maximum amount. A list of health services that do not count toward your maximum amount is listed on your FaceSheet or Schedule of Benefits. For those services, you will still have to pay your Copayments, Coinsurance, and Deductibles even after you have reached your maximum amount.

Should you have any questions or believe you are entitled to a refund for an overpayment against your maximum amount, please contact member services at the number on the back of your member ID card.

1Registration is required to access your account features.

Which Healthcare Costs Count Toward Your Out

Policyholders can think of their out-of-pocket limit as their deductible + coinsurance + copayments up to a total dollar amount. Your premium, which you must continue paying to maintain your insurance coverage, doesnt count toward your out-of-pocket limit.

Here is an overview of healthcare expenses which DO count toward your out-of-pocket maximum:

- Deductibles,

- Any out-of-pocket healthcare expenditure for care and services qualifying as essential health benefits.

These healthcare expenses DO NOT count toward your out-of-pocket maximum limit:

- Monthly premiums

- Balance billing charges for non-network providers

- Out-of-network services. If you see a doctor who is not in-network, the cost of your visit cannot count toward your out-of-pocket maximumeven if your plan includes out-of-network coverage

- Elective or cosmetic services. Elective procedures like cosmetic surgeries are not considered medically necessary. Read through your plan carefully to find out whats covered by your insurer and whats not

- Any money spent on non-essential health benefits and

- Adult dental or vision care, as most healthcare plans do not cover these services.

Some healthcare expenses may or may not count toward your out-of-pocket maximum, depending on the scope of your plan coverage. If youre unsure whether an expense counts toward your annual out-of-pocket maximum, refer to your policy summary or call your insurance providers customer assistance line.

Also Check: How Much Is Health Insurance For A 65 Year Old

Do All Health Insurance Plans Have An Out

Not all health insurance plans have deductibles, but all health insurance plans do have out-of-pocket maximums. The Affordable Care Act made sure your health plan has that built-in form of consumer protection. Now, every health insurance plan has an annual cap on how much an individual consumer can spend on in-network care.

Is It Better To Have A Lower Deductible Or Lower Out

Premiums are often higher for plans with low deductibles and out-of-pocket limitations. If you think youll need a lot of help in the future, these plans could be a good idea. If you dont use much health care, on the other hand, a larger deductible/out-of-pocket limit may help you save money overall.

Don’t Miss: How Long Does It Take To Enroll In Health Insurance

What Happens When You Reach Your Deductible

After spending enough to hit the deductible, your insurance company generally starts to split costs with you through copayments or coinsurance. A copay works as a fixed cost for a specific service, like $15 every time you fill a prescription for a brand-name drug. Coinsurance is the percentage of the cost that you and your insurer each have to pay. For example, a 20% coinsurance means you will have to pay 20% of the final medical bill and the insurance company pays 80%.

Once a new year starts, your spending resets and you will need to reach the deductible anew for your insurance to cover costs.

Related: States where Obamacare plans cost the most

Does The Deductible Apply To The Out

First, its important to understand how to meet your deductible. Preventive care services like annual checkups are often provided without an additional consumer cost via health plans, and therefore dont contribute toward meeting your deductible. Although it varies by plan, prescription drugs might count toward a separate prescription benefit deductible. Costs of hospitalization, surgery, lab tests, scans, and some medical devices usually count toward deductibles.

In-network, out-of-pocket expenses used to meet your deductible also apply toward the out-of-pocket maximum.

The monthly premium does not apply to either the deductible or out-of-pocket maximum, meaning that even if you reach your out-of-pocket maximum, youll still have to continue paying the monthly cost of your health plan to continue receiving coverage from your insurance company.

Services received from out-of-network providers also dont count toward the out-of-pocket maximum, nor do some non-covered treatments and medications. Once the out-of-pocket maximum is met, policyholders should not have to pay any costswhether thats copayments or coinsurancefor any and all covered in-network medical care.

| Deductible vs. out-of-pocket maximum: What counts? | |

|---|---|

| Counts | |

|

|

|

Recommended Reading: Can I Add My Boyfriend To My Health Insurance

How Do Deductibles Work

Chronic conditions Low deductible plan]

On the other hand, if you typically need regular health care, have a large family or chronic condition, you may prefer a low deductible plan.

ON-SCREEN TEXT:

You’ll pay more for your premium each month, but less for your health care expenses with your lower deductible. Paying more each month can help you save on out-of-pocket costs and may help you better manage your budget. Now that you know more about deductibles, you can make the most of your benefits with the type of plan that best fits your needs.

ON-SCREEN TEXT:

So you can experience what care can do for you.

Health Insurance What Is Out Of Pocket Maximum

The maximum amount you must pay for covered services in a given plan year. After youve spent this much on deductibles, copayments, and coinsurance for in-network treatment and services, your health plan pays for all eligible benefits.

Similarly, Does insurance cover 100% after max out-of-pocket?

Once youve reached your out-of-pocket maximum, your plan will cover all covered services at 100% of the allowable amount. If you have a family plan, you may have a family out-of-pocket maximum as well as individual out-of-pocket maximums.

Also, it is asked, What is not covered by out-of-pocket maximum?

Out-of-network services balance billing costs for non-network suppliers. Even if your plan covers out-of-network coverage, if you see a doctor who is not in-network, the amount of your visit will not count against your out-of-pocket limit elective or cosmetic procedures.

Secondly, Whats the difference between deductible and out-of-pocket maximum?

In essence, a deductible is the amount a policyholder must spend on eligible healthcare expenses through copays, coinsurance, or deductibles before the insurance plan begins to cover any costs, whereas an out-of-pocket maximum is the amount a policyholder must spend on eligible healthcare expenses through copays, coinsurance, or deductibles before the insurance plan begins to cover all costs.

Also, Can you pay more than your out-of-pocket maximum?

People also ask, Why is Max out-of-pocket higher than deductible?

Also Check: Can I Change My Health Insurance Plan After Open Enrollment

Definition And Examples Of An Out

An out-of-pocket maximum limits what you can spendon top of your premiumsfor covered medical services during a policy period. Once you reach your spending maximum, your health plan pays 100% of the cost of covered benefits. Your out-of-pocket maximum resets at the start of the following policy period. You can spend your out-of-pocket maximum on deductibles, copayments, and coinsurance.

- Alternate name: Out-of-pocket limit

- Acronym: OPM or OOPM

Lets say youre enrolled in a health insurance plan with a $1,500 deductible, a $3,000 out-of-pocket maximum, and 20% coinsurance. Heres how your out-of-pocket maximum will apply if you need knee surgery that costs $10,000:

Your total cost would be $3,200 , which exceeds your out-of-pocket maximum of $3,000. In this case, your insurer would pay for all covered benefits above $3,000 for the knee surgery and any covered medical care you receive during the rest of the plan year.

An out-of-pocket maximum doesnt include your premium, balance-billed charges, or medical services that your health insurance plan doesnt cover.

How High Can Out

Although deductibles and out-of-pocket maximums vary by plan, all plans that meet Affordable Care Act standards set a yearly limit on how high out-of-pocket maximums can go. This year, the IRS defines high deductible health plans as those having a deductible of at least $1,400 for individuals or $2,800 for families. For 2022, out-of-pocket maximums cant surpass $7,050 for an individual plan and $14,100 for a family plan. Costs incurred for out of network health care services do not count towards these figures.

You May Like: Can You Deduct Health Insurance Premiums

Is 7000 A High Deductible

In reality, in 2021, the maximum out-of-pocket exposure on an HDHP is $7,000 for an individual and $14,000 for a family, but the maximum out-of-pocket exposure on non-HDHPs is $8,550 for an individual and $17,100 for a family (assuming the plans arent grandfathered or grandmothered such.

Coinsurance Is Your Share Of Costs For Healthcare Services Coinsurance Usually Kicks In Once Youve Met Your Deductible

Lets say your plan has a $5000 deductible, which youve hit. Now, you are going in for an office visit that costs $200.

For the sake of this example, lets say your plan does not require a copay. And lets also say that your coinsurance amount is 80/20, meaning once youve hit your deductible, your insurance covers 80% of the cost of the visit/procedure and you cover 20%.

Deductible = $5000paid in full

Coinsurance = 80/20

Office Visit Cost = $200

Amount due = $40

In this example, you should receive a bill for $40 and your insurance will pick up the rest. So this means that even though you have reached your deductible, you will still incur medical costs. That is, until you reach your out-of-pocket maximum.

Read Also: Do You Need Health Insurance To See A Therapist