What Types Of Alternative Health Insurance Plans Like Cost

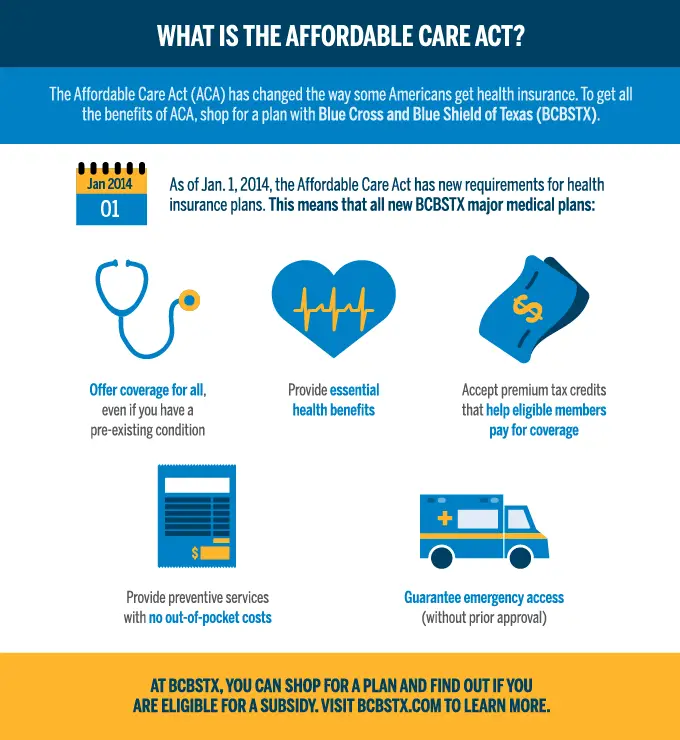

The most popular form of cost-sharing plan is a faith-based program. These plans share costs between members and are relatively inexpensive. You typically dont need to be a member of a particular denomination to sign up for a plan. Many of these plans dont cover pre-existing conditions or other essential health benefits guaranteed under ACA plans. Before you sign up for a cost-share program, make sure it provides coverage in the areas you need. Most cost-sharing plans arent legally obligated to pay out claims as the programs arent health insurance.

How Much Does Texas Health Insurance Cost

The average monthly premium for Obamacare Texas health insurance costs $436 in 2021.1 How much you pay for coverage will vary based on factors such as where you live, the plan type you choose, and the insurance company offering the plan. For 2020, a 21 year old in Dallas, TX earning $35,000 could get an Obamacare silver plan for $351 before subsidies and $145 after.2

How Do I Avoid The Individual Mandate Tax

To avoid this penalty and protect yourself from the potential financial burden of unexpected medical expenses, you can enroll in a health insurance plan during the open enrollment period. For 2021 coverage, the national open enrollment period will take place from November 1st 2020 through December 15th 2020. Some states have extended this period. To learn about your states open enrollment period, read our article, 2021 Obamacare Open Enrollment Dates by State.

If you lose your insurance in the middle of the year, you may qualify for a special enrollment period to purchase an ACA-compliant plan on the public exchange. You may buy an ACA-compliant plan outside the public exchange anytime. Depending on which state you live in, you may be able to enroll in short-term health insurance to help fill any coverage gaps you may experience throughout the year.

Your health and financial well-being are important to us. As the largest online health insurance broker, eHealth offers a variety of health insurance plans to fulfill your coverage needs, wherever you live in the United States. These include on and off exchange ACA-compliant plans, major medical insurance, and short-term health insurance. Let us help you explore your coverage options now. Simply click Individual & Family Health Insurance to find affordable insurance. Our licensed insurance agents are here to help you and share their expertise as you consider your choices.

You May Like: When Does Health Insurance Stop After Quitting Job

How Do I Enroll In Texass Health Insurance Marketplace

If you want to enroll in an ACA plan in Texas, youll need to visit Healthcare.gov. First, you must create an account for yourself and any family members. Youll provide personal information, including your address, phone number, Social Security number, marital status, household income, and the number of people in your household. Once youve completed this step, Healthcare.gov will determine your eligibility for Medicare or a premium tax credit. Youll then choose from available health plans and can compare as many as three at a time. There are currently 10 companies that offer health insurance coverage on the ACA marketplace in Texas:

- Blue Cross Blue Shield of Texas

- Celtic/Ambetter

- CHRISTUS

- Individual vs. family deductibles

Health Risks Unique To Deportees

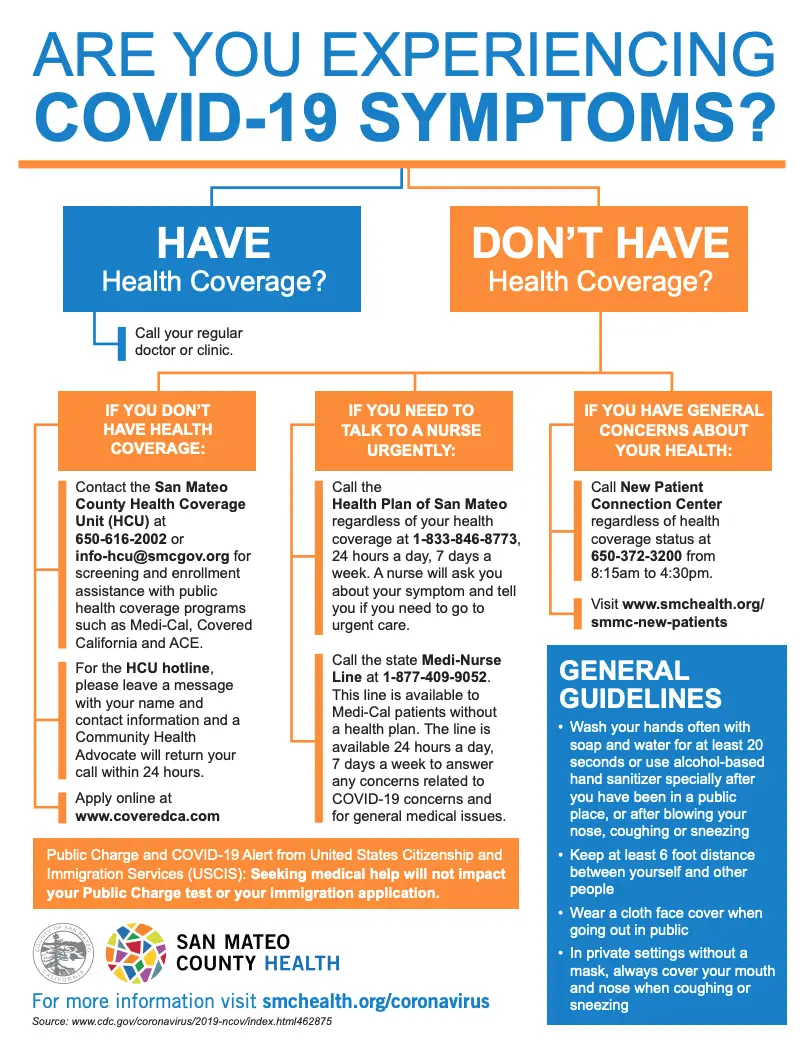

Immigrants probably came to the U.S. to get better access to basic services like health care. Sending them back to their birth countries only causes harm to their health. Not only do they have to make do with inferior health care but they also suffer emotionally and physically due to the mental and physical stress associated with going through deportation.

The U.S. Immigration and Customs Enforcement agency has policies in place that ensure immigrants are provided safe, secure, and humane confinement in cases of detention. But some controversy still surrounds the topic because of reported deaths of detainees.

Immigration facilities have been investigated and repeatedly found lacking the standards provided by the policies. Unfortunately, many centers are privately-run facilities that are not kept to the same standards which cause further concern for immigrants health.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

Does Texas Require You To Have Health Insurance

Thereâs no tax penalty for not having health insurance in Texas in 2021. However, itâs not recommended to go uninsured.

Obamacareâs tax penalty for not having health insurance went away in 2019. This means that you donât have to pay any tax penalty in Texas for going without health insurance in 2020 or 2021. Even though you are not bound by law to have health insurance in Texas, going without it isnât recommended. This article takes a keen look at everything that revolves around getting health insurance in Texas.

Itâs not mandatory to have health insurance in Texas. This is after the federal government removed the tax penalty in 2019. You can, therefore, go uninsured in Texas and not get fined. However, going uninsured isnât recommended as a medical crisis could do more damage than the tax penalty would.

The information used herein is derived from Texas Health Options, HealthCare.gov, and the Kaiser Family Foundation. Weâve thoroughly verified this information to ensure that itâs accurate and essential in getting coverage in Texas.

Why Have An Individual Mandate

These states have an individual mandate for the same reason the ACA originally did. Without an individual mandate, people would only buy insurance if they knew they were going to need it. Most often, this means the elderly and people with pre-existing conditions.

But those who use their health insurance the most are also the most expensive to insure. Before the Affordable Care Act, insurance companies would evaluate all applicants before enrolling them. Based on peoples age and medical history, the insurance companies would then deny them health care coverage, or charge them more for it. But the ACA made that kind of discrimination illegal. And then it took things one step further. An individual mandate is an incentive for everyone to get health insurance, even healthy people. That meant there was now a larger pool of people applying for health insurance. And with more healthy people getting health insurance, health insurance companies could lower premiums for everyone.

In other words, the individual mandate was meant to be one of the of cost-savings and consumer protections we associate with the ACA. It allows more people to be insured at a lesser rate per person. Even though there is no national individual mandate anymore, some states have passed their own mandates to help keep more people insured at lower costs per person. If the mandates help more people get insured, taxpayers in these states will have lower monthly premiums on average.

Don’t Miss: Starbucks Insurance Part Time

Can Daca Recipients Get Health Insurance In The Us

It may feel like the current administration is against you, but that doesnt mean you are exempt from basic services. You, as a DACA recipient, may get DACA health insurance in the U.S. Its a matter of looking for the right service providers and submitting your application.

Do you already have a few service providers in mind? If not, youre in luck. Well list a few options for your consideration.

Is There Free Healthcare In Texas

MEDICAID Texas is a free health insurance plan for the low income as well as uninsured. The program is paid for by the state of Texas as well as federal government. All sorts of care is provided by this free health insurance program, including vision, dental, immunizations, and more. Phone 800-925-9126.

Also Check: Does Costco Offer Health Insurance For Members

Exchange Enrollees Identified On Id Cards

At the end of May 2015, the Texas state senate passed House Bill 1514, and Governor Abbott signed it into law the following month. The law became effective in September 2015, and requires insurance carriers to label policy ID cards with QHP if the plan was purchased through the exchange.

The initial version of the House bill called for two different designations for exchange-purchased policy ID cards: QHP for plans purchased without a subsidy, and QHP-S for plans purchased with a subsidy . But the version that was ultimately signed into law dropped the S and simply calls for identifying all exchange enrollees with the QHP designation.

Many provider organizations were in support of HB 1514, because theres a 90 day grace period for subsidized exchange enrollees who fall behind on their premiums, as opposed to the 30 day grace period for plans purchased outside the exchange and for non-subsidized exchange plans. During that time, carriers have to pay claims from the first 30 days, but can retroactively deny claims from the following 60 days and can require the provider to refund payments made during that time.

Texas 2036 Health Coverage Policy Explorer

No matter our politics, increasing access to affordable health care should be a goal that all Texans share. Health insurance contributes to this goal, as Texans are more likely to access the healthcare they need when they have insurance. While increasing coverage is only one of the policy solutions to increasing access to affordable health care in Texas, it is critical because nearly 5 million Texans do not have health insurance today.

Texas 2036s Health Coverage Policy Explorer is a new online tool that allows Texans to explore the costs and benefits of more than 500 different possible policy combination scenarios available to Texas legislators during the 87th Legislative Session to address the high uninsured rate in Texas.

Don’t Miss: Starbucks Employee Health Insurance

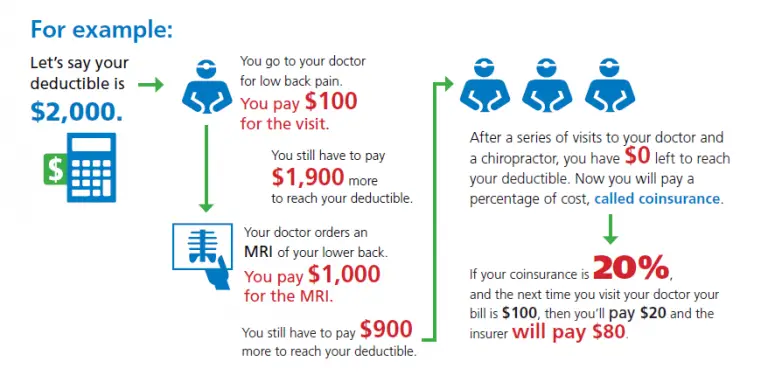

Insurance For Families In Texas

When selecting health care for your family, the questions become more complex. You may be healthy, but if your spouse or one of your children has a chronic health problem, its a bit trickier to balance how much you can pay for your health insurance and how much coverage youll receive. If your family is healthy and you dont make many trips to the doctor, consider a lower-cost premium with a deductible and max out-of-pocket you can afford in the event of a catastrophic medical issue. If a family member does have a chronic health issue, a plan with a higher monthly premium and a lower deductible might be a better option. Keep in mind that its possible to have separate policies for family members depending on their level of need for coverage.

Texas Health Insurance Facts

- Texans who got an unsubsidized ACA benchmark plan paid an average of $436 per month in 2021.

- Fourteen companies sell individual and family plans on the federal health insurance marketplace in 2022.

- 1.3 million Texas enrolled in an ACA plan in 2021.

- 4.3 million enrolled in Medicare or Medicare Advantage in 2020.

Also Check: Starbucks Insurance Benefits

How Do 1095 Forms Relate To My Tax Returns

If you used premium tax credits to pay for your marketplace health insurance costs, these would be listed on your Form 1095-A. An advance premium tax credit helps lower your monthly health insurance premium. The sum of the credits and related details are required when filing your tax return, as any differences between what you used and the amount you are eligible for would need to be reconciled.

To reconcile this information, check the 1095-A form:

- If you used more credits than you were due, then you would owe additional tax on the difference between the two amounts.

- If you used less than you were eligible for, then you would receive a tax refund on the difference.

However, you would not need to file a tax return solely because you received either the Form 1095-B or 1095-C. For instance, if you are enrolled in Medicaid, you would receive the 1095-B. If you had no other tax-filing obligations, then there would be no need to file a tax return.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

When Can I Enroll In Texas Health Insurance

The Texas Open Enrollment Period for Obamacare insurance typically starts and ends . If you miss the open enrollment deadline, you may have to wait until the following year to enroll. However, you may be eligible for a Special Enrollment Period to sign up for Texas health insurance if you have a qualifying life event, such as marriage or pregnancy. Special Enrollment Periods can take place year-round.

Read Also: Kroger Health Insurance Part-time

Do I Have To Get Health Insurance In Texas

Learn whether you must have health coverage under the Affordable Care Act in Texas.

Technically, the Affordable Care Act — aka Obamacare — still says that you must have health insurance. Practically, however, the federal tax penalty for going without health insurance has been zeroed out. That means youll still have to report your coverage status on your federal tax return, but you wont have to pay a penalty if you arent covered.

A few states have passed their own health insurance requirements, but as we approach open enrollment for 2022 health plans, Texas is not one of them.

If youre interested — or if the tax penalty comes back — heres what the Affordable Care Act still says about the kinds of health insurance Americans should have.

Why Do I Need Health Insurance

Its important to have health insurance even if you are young and in good health, because accidents and unexpected illness can have a serious impact on your finances. For example, a broken leg can cost you thousands of dollars, even if no surgery is needed. In addition, most health insurance plans give you access to preventive serviceslike shots or screening testsfor free.

Also Check: Evolve Medical Insurance

Who Can Get Obamacare In Texas

Eligibility for Obamacare in Texas is fairly far-reaching. You need to live in the United States and be a U.S. citizen, national, or legal resident. You can’t be in prison and get Obamacare you’ll have to wait until you’re released. The Texas Department of Criminal Justice has information about health coverage for prisoners.

Texans who have Medicare can’t use the Marketplace to get a health or dental plan. Find out about your Medicare health plan options.

Can I apply if I’m an immigrant?

You can apply, but only people in certain situations will qualify.

Here are just a few of the situations that may qualify you for Obamacare if you’re not a U.S. citizen.

- You’re a refugee.

- You have a green card .

- You’re a lawful temporary resident.

- You hold a certain visa, such as a student visa, or a H1, H-2A, or H-2B worker visa.

- You’re a member of a federally recognized Indian tribe.

- You have applied for asylum and have been granted employment authorization, or you’re under age 14 and applied for asylum at least 160 days ago.

Those are just some examples. For more information on applying if you’re not a U.S. citizen, here’s an official government website.

What if I have a pre-existing condition?

If you have a health problem, according to ACA rules, no insurer can deny you coverage solely because of that health problem. But if you smoke, you might have to pay a higher monthly premium.

The Importance Of Child Medical Insurance In Texas

A divorce agreement defines the responsibilities of co-parenting.

A divorce agreement will include the legal, financial and physical duties involved in who gains custody of a child and those of co-parenting.

As divorced co-parents, securing medical insurance for your child is not optional. Adequate medical for your child is required by federal and state laws, including the Texas Family Code and the Patient Protection and Affordable Care Act.

Read Also: Starbucks Benefits For Part Time

Health Marketplace: Buying Your Own Health Insurance

Insurance you buy from a company or the marketplace is individual insurance. Itâs sold to individuals, not to members of a certain group.

You can buy individual coverage through:

- An insurance company or health maintenance organization

- A licensed health insurance agent who has a relationship with one or more insurance companies

- Healthcare.gov, the online federal health insurance Marketplace

- Theâ¯Plan Finderâ¯on Healthcare.gov for individuals and small businesses

- Aâ¯Navigatorâ¯approved to help with Marketplace enrollment

Open Enrollment For Health Insurance In 2023

Open enrollment is when you can enroll in a health insurance plan through the. Coverage begins the first day of the month after you sign up. The open enrollment period for health insurance coverage in 2022 ended on January 15, 2022.

For states that use the federal Affordable Care Act exchange, the 2023 open enrollment period begins November 1, 2022 and ends December 15, 2022 in most states. States may have different date ranges.

Read Also: How To Get Insurance Between Jobs

What Are Texass Medicare Options For Seniors And People With Disabilities

If youre at least 65 or have a qualifying disability, you may be eligible to receive Medicare, the federal governments health care program for seniors and the disabled.

- The basic program in Medicare is Original Medicare. Its composed of two parts: Part A, which includes home care, skilled nursing care, hospice, and hospitalization, and Part B, which includes doctors visits, mental health care, durable health equipment, ambulance services. There are no out-of-pocket limits, and prescription drug coverage requires signing up for a Part D plan.

- Medicare Advantage Plans are private plans approved by Medicare that offer the same coverage as Original Medicare but with additional services. Medicare Advantage Plans offer vision, dental, and hearing, and many provide prescription drug coverage. These plans come in four basic types: HMOs, PPOs, Private Fee-For-Service plans, and Special Needs Plans . As of 2022, there were 337 Medicare Advantage Plans in Texas. You can only select a Medicare Advantage Plan thats available in your county in Texas.

A Medicare Supplement Insurance plan is a great way to deal with the extra costs associated with Original Medicare. It covers deductibles, copayments, and coinsurance. It can also provide coverage if youre traveling outside the U.S. It doesnt cover vision, hearing, or dental, nor does it cover any long-term care costs. Medigap doesnt work with a Medicare Advantage Plan.

Eligibility

Enrollment

Medicare Resources