How Does Employee Health Insurance Work In Usa

Employers and employees typically share the cost of health insurance premiums. Employers and employees share the premiums. There are also major tax advantages to participating in employer health plans employee contributions, for example, can be made pre-tax, reducing federal and state taxes on the employee end.

Cost Of Health Insurance In The Netherlands In 2023

When you move to the Netherlands, its vital to check out the health insurance policies available in the country and how much they cost. Unexpected things can happen to us wherever we are. We can get sick, or worse, be involved in an accident. Having health insurance will protect us from unexpected and towering medical costs.

The Netherlands has public health insurance available for all residents. In 2023, it costs an average of 126.83 per month. To qualify, you need to have a Dutch residence permit.

The Netherlands is one of the most appealing countries to relocate to. Its one of the top ten places with excellent quality of life and one of the best to live and work in. Their universal healthcare is one of the best in Europe.

Reading until the end of the article will help you navigate all about health insurance in the Netherlands. Comparing quotes and knowing what they will cover will help you decide which is the best you should choose.

How Do I Go About Adding My Newborn To My Insurance

Your baby wont automatically become a part of your policy. Fortunately, learning how to get insurance for a newborn is rather simple.. You just need to contact your insurance provider once you have the baby to add him or her to the plan. If you went through a work insurance company, you can add a newborn to your insurance by simply reaching out to your works HR department.

As a general rule, your provider will require you to add your baby within 30 to 60 days after his or her birth. The policy is retroactive, meaning itll cover your childs care going back to birth, so dont panic if youre a tired parent and your child is now three weeks old with no insurance.

You May Like: How Do You Get A Tax Credit For Health Insurance

Why Is It Important To Have Health Insurance For Newborn Babies

Adding a newborn to your insurance or creating a new policy for your little one will decrease the amount of out-of-pocket expenses youll pay for them. For one, as soon as your baby is born, there are certain tests and vaccinations given. After you take your baby home, youll also want health insurance for a newborn to cover the expenses of wellness visits. You bring a newborn baby to the doctor a lot during their first year of life, so you definitely want health insurance to cover that.

Once your baby is one year old, its recommended your child visit the pediatrician once per year. This is to ensure your baby is growing normally and to keep them up-to-date on his or her immunizations.

Keep in mind that if your tot has any issues, youll have the added expense of extra appointments. Not to mention, you may need to meet with specialists, and your little one may need to undergo certain procedures or take medications. All of these appointments and immunizations can quickly amount to a lot, but health insurance can help to significantly reduce these costs.

How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average familys health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

Recommended Reading: How To Obtain Health Insurance License

Prescription Drug Coverage And Shingles Treatment

Your doctor may prescribe antiviral drugs such as famciclovir, valacyclovir, and acyclovir. These drugs can help the rash heal more quickly and reduce the chance youll suffer serious side effects. If your pain is severe, your doctor may also write you a prescription for pain medications.

Medicare prescription plans typically cover both antiviral and pain medications, though the specifics will depend on your plan. You may have to pay a deductible or copay.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Your doctor may also suggest over-the-counter remedies such as lidocaine patches and Tylenol. Prescription plans dont cover over-the-counter medications, even if your doctor recommends them.

Read Also: Does Tj Maxx Offer Health Insurance

How Much Is A Herniated Disc Worth In A Car Accident In Ny

There is some good news here: the median jury verdict in a disc herniation case is $75,000, which may appear to be a good number for many clients, but keep in mind that this is a very low figure. As a result, a few herniated disc injury cases have received very large jury verdicts, but the majority have been less than $100,000.

The High Cost Of Herniated Disc Treatment

Wil herniation, also known as a herniation, can cause significant pain and difficulty in moving the affected area. A disc herniation may require the use of medications such as epidural steroids to treat it. Surgery may be required in some cases. The higher settlement value that comes with this type of treatment could influence your decision.

Don’t Miss: How Much Can Health Insurance Cost

Factors Affecting The Health Insurance Costs

What amount does medical coverage cost? Over the United States, Americans pay extremely high expenses month to month or yearly for medical coverage. While these charges are not controlled by sexual orientation or prior medical issue, on account of the Affordable Care Act, various different components sway what you pay. Numerous components that influence the amount you pay for medical coverage are not inside your control. In any case, its acceptable to have a comprehension of what they are. Given below are these factors to assist you with figuring out the amount you may pay for medical coverage in 2020 and why. Here are some key factors that influence how much medical coverage charges cost:

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

You May Like: How To Cancel Health Insurance Healthcare Gov

What Can Be Done For 3 Herniated Discs

Image by https://pinimg.com

There are a few things that can be done for 3 herniated discs. First, you can try to manage the pain with over-the-counter or prescription pain medication. You can also try physical therapy to help strengthen the muscles around the discs and help with pain management. In some cases, surgery may be necessary to remove the herniated discs.

The treatment of a herniated disc is primarily focused on relieving pain and other symptoms that may result from it. Patients are advised to begin with conservative care as soon as possible before deciding to have surgery. A few rare conditions necessitate an immediate surgical intervention. Conservative treatments for cervical and lumbar herniations are typically required for four to six weeks after an operation. Finding the right combination of treatments is frequently dependent on trial and error. Surgery may be an option for patients who experience severe pain and a significant loss of function as a result of the pain.

When you have chronic back pain, you should seek medical attention as soon as possible. If you have a diagnosis and a treatment plan, you will be able to recover from your injuries.

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

Don’t Miss: Can Substitute Teachers Get Health Insurance

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

How Much In Monthly Premiums Can You Expect To Pay With Obamacare

What you pay each month also depends on the plan you select. A Kaiser Family Foundation national analysis of marketplace plans for a 40-year-old person found that the average premium for a benchmark silver plan in 2022 is $438. The price ranges from $309 in New Hampshire to $762 in Wyoming.

Thanks to the American Rescue Plan Act of 2021, there is new financial assistance for ACA premiums in 2022. These savings will make ACA healthcare plans more affordable than ever. Generous subsidies mean that 4 out of 5 people will be able to find a plan that costs $10 or less per month.

The KFF analysis applied nationwide to all metal tiers, except platinum, found:

Average 2022 marketplace premium for a 40-year-old without subsidies

| Plan Category | |

|---|---|

| Average lowest-cost gold premium | $462 |

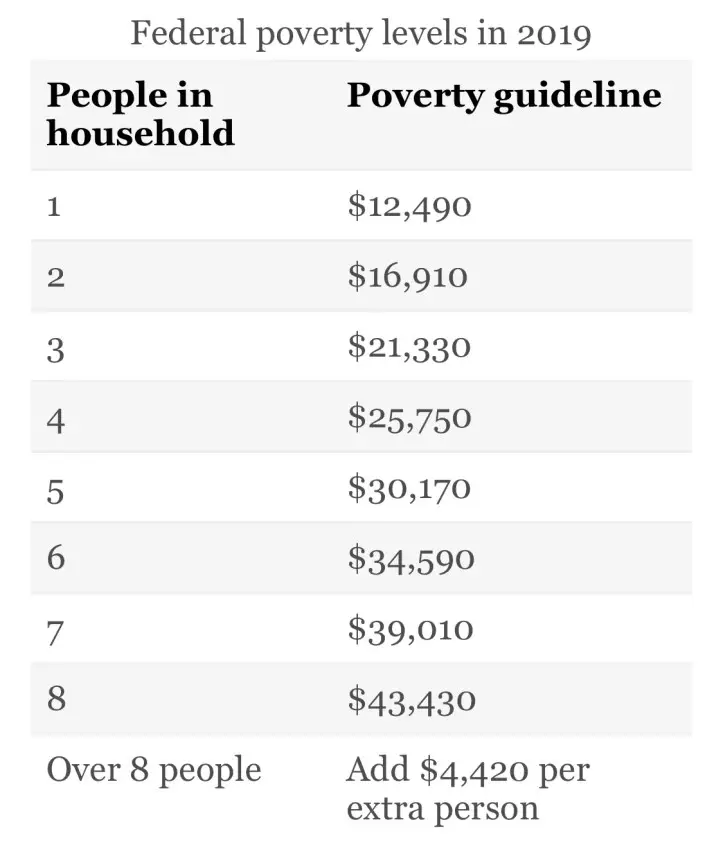

Families earning 100% to 400% of the federal poverty level and sometimes more will qualify for savings on monthly premiums.

According to KFF, the 2022 subsidies fully cover the cost of a benchmark silver plan for consumers with incomes up to 150% of the federal poverty level. These consumers also receive extra savings that greatly reduce deductibles and copays to costs similar to platinum plans.

A subsidy also known as premium tax credit is based on your estimated income in a coverage year. If your actual income is higher or lower, your premium tax credit could be adjusted.

You can estimate your costs using this ACA Health Insurance Marketplace Calculator.

Don’t Miss: Can You Buy Out Of State Health Insurance

How Do I Get Health Insurance

You can get it through:

- your job or your spouse’s job, if the employer offers it.

- your parent’s plan until you turn 26.

- a government program like CHIP, Medicaid, or Medicare.

- your college if they offer a student plan.

- a membership association, union, or church.

- an insurance company or agent.

- the federal health insurance marketplace.

$1 Million Term Life Insurance Rates By Policy Amount

Our analysis looked at rates for $1 million policies compared to $500,000 to $2 million policies.

Is a $1 million term life policy right for you? You need to settle on what you want life insurance to cover , but pricing out policies in different payout amounts will also help you determine which best fits your budget.

Here is a look at a 20-year term policy for a 30-year old male and female for varying payout amounts.

| Policy amount |

|---|

| $624 |

We found that:

- A $750,000 policy costs 32% more for males and 14% more for females than a $500,000 policy.

- Increasing a policy from $500,000 to $1 million costs 60% more for males and 38% more for females. That doubles your policy amount but doesnt double your premium with either gender.

If youre thinking of going even higher:

- A $2 million policy compared to a $500,000 one costs 192% more for males and 148% more for females.

- A $2 million policy compared to the cost of a $1 million policy is 83% more for males and 79% more for females.

Recommended Reading: Will I Get Money Back From Health Insurance

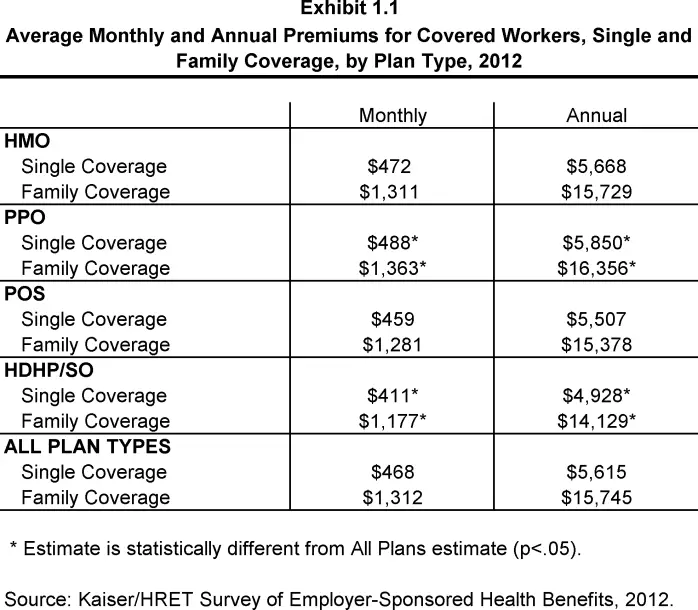

Would Insurance Be Cheaper Through An Employer

Its no surprise that employer-sponsored health insurance is often cheaper than marketplace plans.

According to the Kaiser Family Foundation, covered workers kick in 17% of the cost of single coverage. That works out to an average of $101 for HMO plans and $111.25 for PPO plans. Compare that to the eHealth data, which showed that the average cost for a single person of any gender was $456.

Costs vary from state to state. For instance, in Hawaii, the average is $718 per year for the worker, but in Massachusetts, the worker may pay $1,793 per year. This is at the high end of the cost scale. Below is the state-by-state breakdown from the Kaiser Family Foundation to see the differences by region.

Per the Census, 55.4% of Americans got their insurance through their employer in 2019.

How Can I Buy Health Insurance

Health insurance companies cant decline you for coverage or charge you soaring premiums because youre sick or have a health condition, such as diabetes and heart disease. Before the ACA, people with health problems coped with higher premiums to cover a pre-existing condition or couldnt be eligible for an individual health plan at all.

Moreover, you may meet the criteria for premium discounts in the form of tax credits or subsidies to reduce your out-of-pocket health insurance costs if your income is low or moderate.

The ACA provides tax credits to assist you in paying for a marketplace plan for people who are up to 400% of the federal poverty level. Thats $51,040 for a single person, $68,960 for a couple, and $86,880 for a three-person family.

Subsidies can spare you hundreds of dollars a month. The Centers for Medicare and Medicaid Services estimated a 27-year-old at 150% of the federal poverty level would pay on average $57 per month for the lowest-cost Silver plan. Thats a savings of more than $300 per month if the plan didnt have subsidies. People with incomes below 138% of the federal poverty level may be eligible for Medicaid. Thats $17,609 for an individual and $36,156 for a family of four. The ACA permitted states to expand Medicaid for more people. Thirty-eight states have extended the program, which lets more people get Medicaid.

Read Also: Is It A Law To Have Health Insurance

Read Also: How To Apply For State Health Insurance

How Do You Get 3 Bulging Discs

There is no one definitive answer to this question as discs can bulge for a variety of reasons. However, some common causes of bulging discs include: -Lifting something heavy -Sudden impact or trauma -Aging -Degenerative disc disease If you are experiencing pain or other symptoms as a result of a bulging disc, it is important to see a doctor or spine specialist for proper diagnosis and treatment. Treatment options may include pain medication, physical therapy, and in some cases, surgery.

Because the Bulge can pressure the surrounding nerve roots, it can cause pain to spread down the back and other areas of the body. A bulging disc could be the result of herniation, or it could be the result of a partially or completely broken disc in the intervertebral discs. Scave Scarps can form in the legs caused by Bulges, causing numbness, tingling, and weakness. As pressure builds in the inner portion of the cervical discs, the outer layer of the intervertebral discs bulges out due to excess weight. When the discs of the cervical spine bulge, they cause pain, numbness, and weakness to radiate through the neck, shoulders, arms, hands, and fingers. Here are some of the symptoms of a bulging disc. You may not be aware that a bulging disc is more common than you think, especially as the outer layer of the disc ages.