How Premiums Are Determined

Each year, insurers calculate the cost of paying for healthcare for their covered lives as well as their operating costs. Even non-profit entities pay their executives and staff, and these salaries are all part of their operating costs. Your premium is the income that health insurers bring in to cover all of these costs.

What Is The Least Expensive Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats right for everyone. But finding the right plan for your needs can be easy with HealthMarkets. You can shop online, compare healthcare plans, and apply in minutes. You can also call 986-2752 to speak with a licensed insurance agent.

46698-HM-0222

How Premium Costs Have Changed In Recent Years

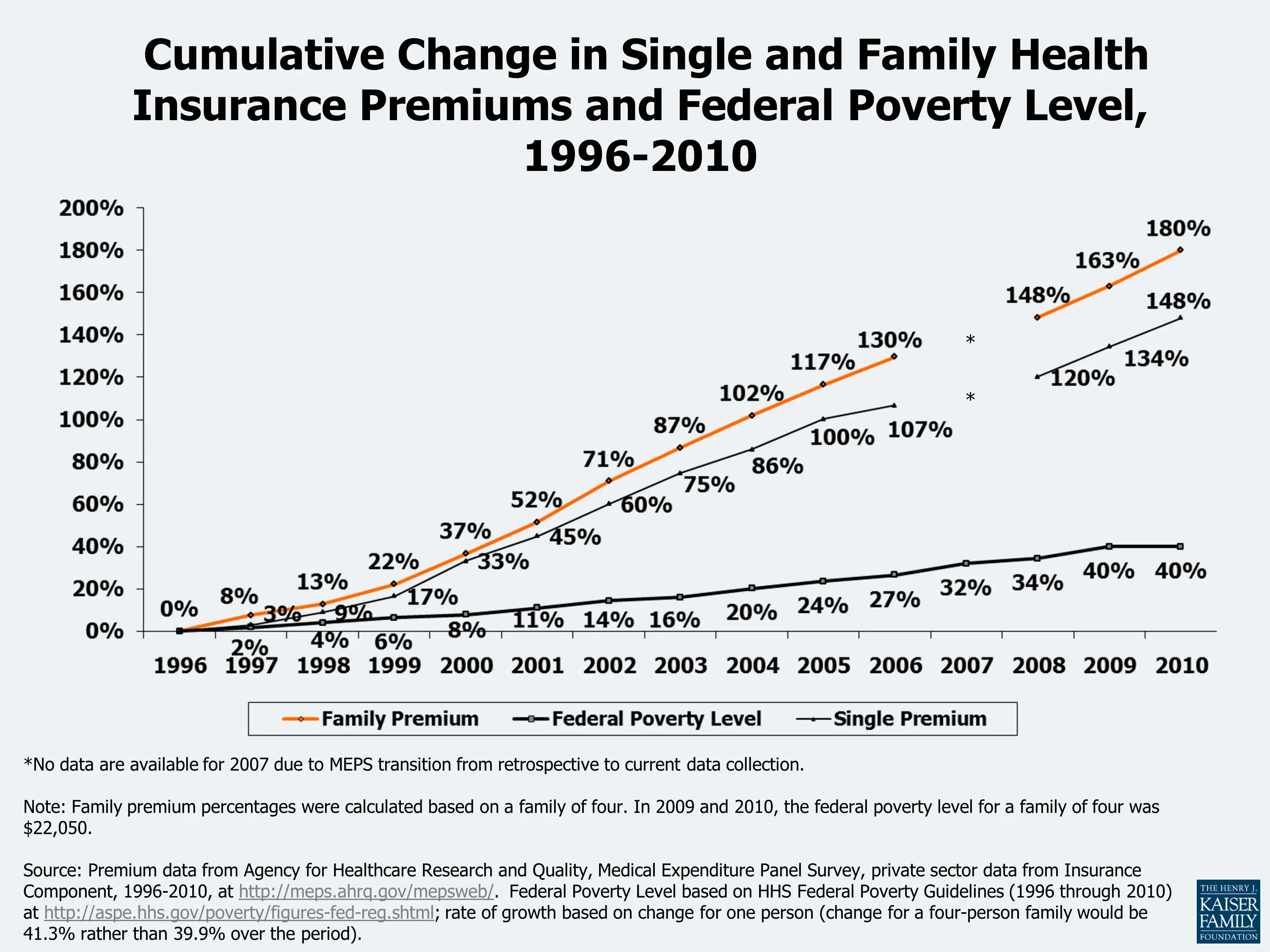

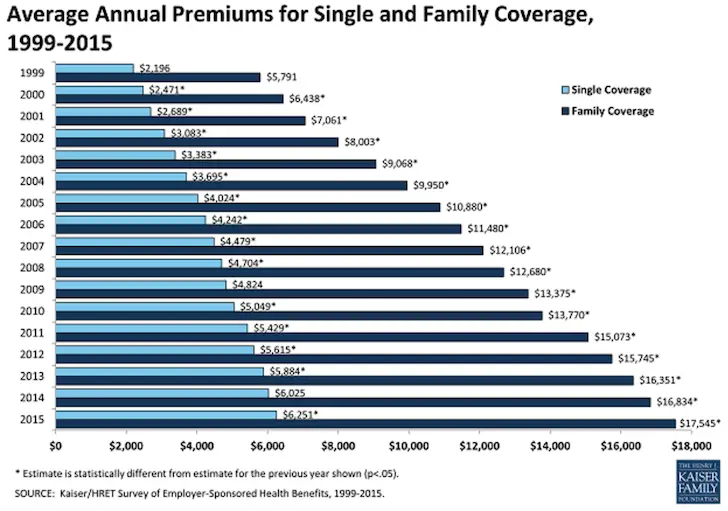

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by more than 25% since 2015, and it’s increased by over 60% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, 50% increase compared to the $4.1 trillion spent in 2020.

Read Also: What Level Of Health Insurance Do I Need

What Is Health Insurance In Canada

Under the Canada Health Act, provinces and territories must provide health insurance plans that meet certain criteria and conditions. This ensures that individuals in Canada are able to access necessary medical services.

Each province or territory determines which services are considered medically necessary for insurance purposes. This is done by extensive consultation with physician colleges and groups. If a service is deemed not medically required, the provincial or territorial health insurance plan doesnât need to cover it.

This is where supplemental health insurance comes in. Supplemental or private health insurance is purchased individually or provided through your place of employment. These plans cover additional services and fees, thereby reducing your costs. Some insurance providers will require you to pay the fee for services and insured items upfront, then reimburse you while others will cover the cost directly.

Early Retirement Health Insurance Are You Eligible For Cobra

In certain circumstances, if you lose your job, you can still be eligible to benefit from your companys group health plan for a limited period of time. Using the Consolidated Omnibus Budget Reconciliation Act , you can expect to be paying about 2% more than the full cost of health insurance on your old companys plan, says founder and CEO of Northwoods Financial Planning, Corey Purkat.

It is going to be more expensive than if you were still employed at a company, but it will still be less expensive than paying for your health insurance on your own, He says. The only way someone wouldnt be eligible for COBRA would be in situations where there was a very good reason a person was let go, such as a criminal investigation.

Continuation coverage under COBRA is typically available for a relatively short period of time, typically 18 to 30 months.

Read Also: Does Health Insurance Cover Funeral Costs

What Are The Factors Contributing To The Growth In Health Insurance Companys Profits

There are several reasons for the growth in health insurance profits. Many people are more aware of the costs of their health insurance. Therefore, they arent going to the doctors office unless they have a real medical emergency.

Because of this, health insurance companies arent paying out as much for benefits. There are many people who switched to new health insurance plans, choosing to pay for plans with lower premiums. Usually when there are lower premiums involved the copayments and deductibles are higher.

Because of changes in employer health insurance benefits and coverage, many U.S. citizens dont want to pay out the additional health care costs or cant afford them. Deductibles are increasing, and so are copayments for employees. This makes it more cost effective to delay health care than to take on the added costs of the health insurance.

Best Health Insurance For Retirees Of 2022

- Best for Supplementing Medicare: Humana

- Best for Low-Income Seniors: Medicaid

- Best for Under 65: Cigna

- Providers in Network: 1.3 million

- No. States Available: 34

UnitedHealthcare is one of the leading providers of Medicare Advantage plans and our pick for the best overall provider because of its robust coverage options, expansive provider networks, and covered services, such as 100% of immunizations and preventive care.

-

Coverage when traveling outside the country

-

Additional services covered

-

Immunizations and preventive services 100% covered

-

Only available to those eligible for Medicare

-

Additional premium may be required

-

Potential location limitations

While Medicare is a valuable insurance option, it has limitations. It doesnt include prescription drug coverage, medical care received outside of the United States, or dental or vision care. If you want those services covered, you can opt for a Medicare Advantage Plan, also known as Medicare Part C.

UnitedHealthcare is the largest provider of Medicare Advantage Plans, with 27% of Medicare Advantage beneficiaries enrolled in the companys plans. It also has an A+ rating from AM Best.

- Hearing aids

- Medical transportation

- Meals

If you are eligible for Medicare, enrolling in a Medicare Advantage Plan from UnitedHealthcare is a good way to ensure you have a complete health insurance plan that goes beyond Medicares covered services.

Also Check: Do You Need A Ssn To Get Health Insurance

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, were better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history not to mention whether the person is a smoker can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

Also Check: How To Stop Health Insurance

Reasons For Increased Healthcare Premiums

Health insurance premiums go up with inflation, but they also regularly increase out of proportion to inflation. This is due to a number of factors.

New, sophisticated, and costly technology helps in the diagnosis and treatment of health conditions, while specialized medications can prolong lives from diseases like cancer. The high price of these diagnostic and treatment options raises the cost of health insurance for everyone. And people are living longer, even with diseases that used to be considered deadly, which means that people with medical illnesses consume more healthcare dollars.

Recommended Reading: Do You Still Get Taxed For Not Having Health Insurance

Planning Ahead Can Help You Save Money

Consider both the monthly premium and the yearly cost estimate

To find the most cost-effective plan, it helps to consider more than just your monthly premium. Other parts of the plan can affect how much you pay for healthcare during the year. The plan with the lowest premium may not be the cheapest plan after you add up all the other costs you have. Our Quick Cost and Plan Finder tool allows you to compare both monthly premiums and the yearly cost estimates based on the information you provide.

Stay in network

Select a plan that includes your doctor as in-network at the location you prefer. If you go to a doctor or facility out of network, you will likely be charged the full bill, and those costs will not count toward your deductible or out-of-pocket max.

Consider generic medications

Ask your doctor if they recommend taking thegeneric version of a medication you are taking. Generic medications cost lessand are covered by a larger number of plans which means you have more options.

Use our Quick Cost and Plan Finder tool to compare plans and prices including finding plans that cover your doctor and medications.

Want some advice?

One of our certified brokers can answer questions while theyhelp you choose a plan based on your specific needs and budget.

How Much Is Health Insurance For A Family Of 3 Or 4

Discover how much is health insurance for a family of 3 or 4, as the cost of healthcare varies significantly depending on various circumstances.

When it comes to caring for your family, family health insurance is something that you have most likely given some thought to before making a decision.

Having a family health insurance coverage would ease the stress of preserving your familys health and protecting your resources from the financial strain of unforeseen medical expenditures.

Protecting your familys health is crucial, but so is preserving your bank account from unexpected medical expenses as well.

Family health insurance protects your familys well-being and your money. Suppose a person in the family has a medical emergency while uninsured. In that case, you may be forced to pay for the hospital bills and other related expenses out of pocket, which might put a strain on anyones financial situation.

The cost of health insurance for families will vary based on various factors such as the kind of plan, the quantity of coverage, the number of dependents, and your geographic location nonetheless, the average cost of family plans can serve as a useful reference when comparing rates.

You May Like: How To Get Health Insurance Without Social Security Number

How Age Factors In

Young people, who are expected to benefit from lower premiums should the GOP repeal-and-replace efforts succeed, already pay the least. But even their costs can be considerable, depending on where they live. In 2016, the financial data siteValuePenguin found that the average costs for coverage for a 21-year-old go from $180 a month in Utah, plus a $2,160 deductible , to $426 a month in Alaska, with a $5,112 deductible .

As a reminder, 72 percent of young millennials, aged 18-24, have less than $1,000 in their savings accounts and 31 percent have nothing saved at all.

Section : Cost Of Health Insurance

The average annual premiums in 2021, are $7,739 for single coverage and $22,221 for family coverage. Over the last year, the average premium for single coverage increased by 4% and the average premium for family coverage increased by 4%. The average family premium has increased 47% since 2011 and 22% since 2016.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time:

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2021

Figure 1.2: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Firm Size, 2021

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2021

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2021

Figure 1.5: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2021

Figure 1.6: Average Annual Premiums for Covered Workers With Single Coverage, by Firm Characteristics, 2021

Figure 1.7: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2021

Figure 1.8: Average Annual Premiums for Covered Workers, by Firm Characteristics and Firm Size, 2021

PREMIUM DISTRIBUTION

PREMIUM CHANGES OVER TIME

Don’t Miss: What Is On Exchange Health Insurance

Should I Purchase A Life Insurance Policy

Life insurance premiums go up as we age. Nevertheless, if you are in good health, you can get reasonably affordable quotes for term life insurance. So, if you did not purchase a policy in your 40âs or 50âs but are in decent health, term life insurance is worth considering. This is especially true for seniors who are still working or have a few years left on their home loan.

Permanent life policies without cash value can be a smart option if you support an adult child with disabilities, want to leave an inheritance, or wish to preserve the value of your estate. While these policies are more expensive than term life, the premiums might still be within your budget. However, permanent life insurance with cash value is generally not recommended for seniors, as premiums are prohibitively expensive.

If you want a small policy to cover funeral expenses or have underlying health issues, consider guaranteed life insurance. Acceptance to such policies is guaranteed, though the coverage is usually more expensive.

Affordable Family Health Insurance Options

Suppose a conventional, major medical family health insurance policy is not what youre searching for. In that case, there are some cheap options that may be a better fit for your familys needs and circumstances.

Short-term health insurance is an option for families that do not want to commit to a standard health insurance plan.

Generally speaking, short-term health insurance policies do not provide the same degree of coverage as major medical insurance plans, and insurance providers can refuse short-term coverage if the applicant has a pre-existing disease.

Although you will not be receiving the same benefits as you would with long-term coverage, you will most likely be paying a far lower premium, making short-term health insurance an attractive alternative if cost is a concern. Please remember that not all states have choices for short-term planning.

You May Like: How Much Is The Average Health Insurance Per Month

How Much Is Health Insurance Per Month For One Person

Monthly premiums for Affordable Care Act Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan without subsidies in 2022 is $438.1

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

Aca Premiums Were In Line With Employer Premiums Prior To Trump Actions

Discussions about affordability challenges for middle-income individual market consumers often start from the assumption that premiums in the ACA individual market are far higher than in other health insurance markets due to severe adverse selection. This impression was reinforced by large premium increases in 2017 .

But in fact, as of 2017 after these premium increases ACA individual market premiums were roughly in line with premiums for employer coverage with similar out-of-pocket costs , a reasonable proxy for the cost of providing private coverage to a broad cross-section of the population. For example, about 60 percent of ACA marketplace consumers lived in states where benchmark premiums for ACA coverage were below or equal to employer premiums, and another 17 percent lived in states where they were no more than 10 percent higher, according to an Urban Institute analysis. Individual market plans often have narrower networks than employer plans, which lowers prices, and so similar premiums indicate that the individual market risk pool was likely modestly weaker, on average. But the data contradict claims that healthy people have largely exited the ACA marketplaces or that the structure of the ACA inherently leads to very high premiums.

Recommended Reading: Can I Apply For Medicaid If I Have Health Insurance

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and whats offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a persons income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

What Newlyweds Should Know About Health Insurance

Navigate your new health insurance options and set yourself up for a lifetime of happiness and health.

Congratulations on your new marriage ! Besides a lifetime of domestic bliss, there is another exciting, if not exactly romantic, benefit to your new status: The option to enroll in health insurance coverage or change your health plan.

In most cases, individuals and families can only purchase a new health plan once a year during open enrollment. However, marriage or domestic partnership is considered a qualifying life event. That means you and your new partner â as well as any children in your new family â can now qualify for a special enrollment period to get or change coverage.

Understanding Your Choices

If one of the members of the couple already has health insurance through an employer, you may be able add a spouse, partner or dependents to that employer-sponsored plan. Remember: Small businesses and part-time employers are not legally required to offer health insurance. Large employers are legally obligated only to offer coverage to employees and their dependents â but not their spouse or partner.1

Keep in mind that if your household size or income has changed due to your union, your eligibility for financial help may also change. As with any other life change, if you are already enrolled in a health plan through Covered California, youâll need to report it.

Consider All Your Options

You May Like: Can I Stop My Health Insurance Anytime

Read Also: What Does Health Insurance Not Cover

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.