How Much Does Group Health Insurance Cost

About 157 million people are covered by employer-based health insurance. But how much do companies pay for employee health insurance?

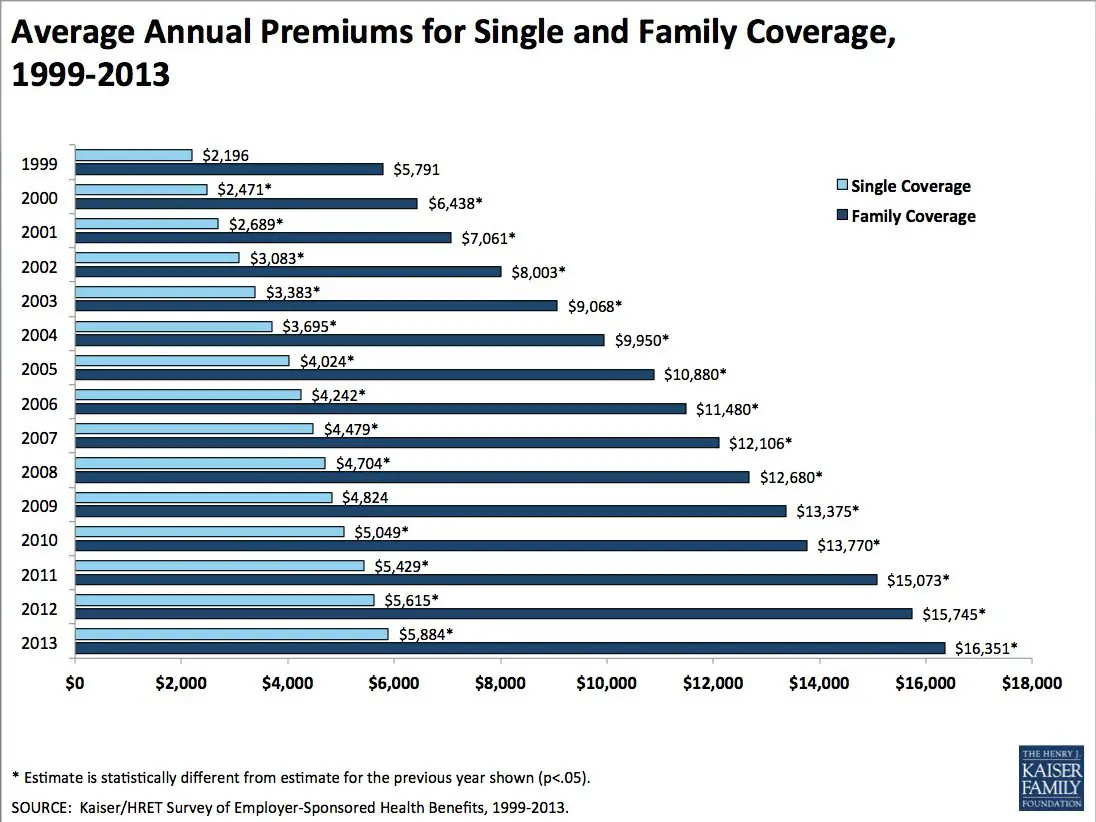

For a look into trends and costs over the years, the Kaiser Family Foundation conducts an annual survey.

In their recent findings, in 2020, the average monthly premiums for group health insurance increased from previous years to:

- $622 for individual coverage

- $1,778 for family coverage

Since 2019, average employer-sponsored individual premiums increased 4% and family premiums increased 4%. Moreover, the average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

The Effectiveness Of The Canadian Health Care System

The Canadian health care system receives higher marks from the OECD regarding overall international health care systems. After all, the colorectal and breast cancer survival rates are some of the highest in the world.

Canada also scores well in primary care, which can help to prevent costly admissions to the hospital due to chronic conditions such as uncontrolled diabetes and asthma.

Some of the areas where Canada doesn’t score as well as on the wait times. It’s reported that the wait times are longer than in other countries, especially for those who are seeing specialists or undergoing elective surgery.

In fact, it was shown in 2010 that over 59 percent of respondents to a particular study waited for over four weeks to receive an appointment with a specialist. This is more than double the number in the U.S.

Don’t Miss: Do Part Time Starbucks Employees Get Benefits

How Much Is Life Insurance In Canada Average Rates For 2022

The average cost of life insurance per month in Canada is about $13 for $100,000 in coverage if you’re a healthy 30-year-old requesting a 10-year term life insurance policy with PolicyMe.

If you’re a 60-year-old smoker, your premiums will be over $100 per month for the same amount of coverage.

How much life insurance costs in Canada depends on a few factors including gender, age, health status, family history and lifestyle choices .

If you’re of average health for your age and your risk factor is low, your premiums will be lower, too.

The chart below looks at term life insurance rates by age from five leading Canadian life insurers.

Pricing based on publicly-available rates as of March 2022. Terms and conditions may apply.

Curious to see what your price is? Get an instant quote online from PolicyMe.

Medium To High Level Pricing Plans

If you are in need of a plan that covers a little more but still within a certain budget, you can usually find something that is both affordable and fairly comprehensive. For instance, there are plans that will share the cost of prescription drugs and other treatments like physiotherapy.

There are plans that offer a lot of coverage as well, including prescription drugs, dental, massage therapy, medical equipment and much more, but expect to pay accordingly. If you need a lot of medical services, items or drugs, this may be the best option for you.

If you previously had a company group plan and wish to have an individual plan of your own, there are plans that will accept you, even with pre-existing conditions. You are guaranteed coverage if you apply within 6090 days of losing your previous coverage.

Recommended Reading: Starbucks Dental Coverage

Reducing Your Hospital List

Many insurers have tiers of hospitals in which you can have treatment. If you want access to the best facilities, such as those in Central London, youll pay more for your policy.

However if you decide to have a restricted list you could reduce the amount you pay each month. For example when using the details of our 43 year old, by restricting the hospital list where you can have treatment premiums reduced by up to 7%.

If you consider this option it is important to check the hospitals in your area to make sure you are comfortable with the limited options.

|

Restricted Hospital List |

|---|

|

7% Decrease |

Ways To Lower Health Care Costs

So, we talked about how much health insurance costs monthly. Now, lets look at five ways that you can keep health care costs in check:

How much you pay for health insurance varies by plan, but by doing your research and conducting best practices to contain health costs, you can find a plan that works for you and health insurance that doesnt break the bank.

Don’t Miss: Starbucks Health Care Benefits

Continue To The Full Article

The National Crowdfunding & Fintech Association is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

Read Also: Evolve Medical Insurance

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates — from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and what’s offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a person’s income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

Also Check: Kroger Employee Discount Card

What Are My Health Insurance Options

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

Recommended Reading: Starbucks Insurance Plan

Who What And How: Coverage Factors

When it comes to determining the average health insurance costs, most people are primarily concerned with the amount they must pay each month of their premium. If your insurance is provided through your employer, you will most likely be required to pay a large share of that premium while your employer pays the rest.

If you are self-employed or elect to go with an individual plan instead of your employers offered plan, you will likely be paying 100 percent of the monthly premium. Likely because those individuals in California who qualify for coverage through the state health exchange, Covered California, will only pay a portion of the actual premium, while the balance is paid through a tax subsidy program.

So, what is the average cost for health insurance?

In 2021, for a 40-year-old, the average national cost of individual health insurance across all metal tiers of coverage is $495 per month. This is roughly 2 percent lower than in the 2020 plan year.

In California, however, the same individual will be looking at a monthly cost of $588 and an annual cost of $7,056. This represents a cost that is 18.80% higher than the national average. On the plus side, our premium costs only increased 2.03% over last year.

However, not everyone is a single, 40-year old and the factors that help determine actual costs must be considered.

Countries With High Cost Of Medical Care

The United States has the highest cost of healthcare in the world, as the country spends significantly more per capita for its medical welfare than anywhere else in the world.

In Europe, Switzerland leads the way in terms of cost of care with the Netherlands and Germany close behind.

In Asia, Japan, China, Singapore, Hong Kong, and Korea have higher than average costs to treat medical conditions.

Check out the OECD website to know which countries spend high on health care. You can see how other countries in this list, including Iceland and Australia fare, compared to others.

Is there an underwriting process when applying for expatriate healthcare?

Medical underwriting, which pertains to the review of your medical history, is required by international healthcare companies when you apply for one of their global medical insurance plans.

If you are apply for an international family health insurance plan, all family members will have to provide their medical history.

For US citizens familiar with the benefits and protections provided by the Affordable Care Act , take note that it does not apply here. You can be turned down or denied coverage.

The underwriting process is generally done to obtain and review your medical history. It is not overly burdensome to do as most providers can complete the underwriting process in 3 to 5 business days. However, the process may take longer in case some unusual circumstances arise.

Also Check: Eligibility For Aarp

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

How Much Is Aetna Health Insurance

Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan, although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.In 2017, the last year Aetna sold ACA-compliant individual health insurance plans, premiums for plans not eligible for a subsidy averaged $525.07. Premiums plans that were eligible for a subsidy averaged $374.55, and the average cost of a dental insurance policy from Aetna averaged $64.40

| Year | |

| Obamacare/ACA Coverage without a subsidy | $525.07 |

| Obamacare/ACA Coverage with a subsidy | $374.55 |

You May Like: Starbucks Medical Insurance

Individual Health Insurance Premiums On The Exchanges

The federal insurance plan marketplace at HealthCare.gov, aka Obamacare, is alive and well in 2021, despite years of its political foes’ efforts to kill it. It offers plans from about 175 companies. Some 12 states and the District of Columbia operate their own health exchanges, which basically mirror the federal site but focus on plans available to their residents. People in these areas sign up through their state, rather than the federal exchange.

Each available plan offers four levels of coverage, each with its own price. In order of price from highest to lowest, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is prices are going down a bit. According to the Centers for Medicare & Medicaid Services , the average premium for the second-lowest-cost silver plan decreased by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

You May Like: How Long After Quitting Job Health Insurance