Aetna Medical Plans And Coverage Costs

On the Aetna Medicare solutions page, you can search specific coverage information for your location. Youll realize that coverage costs vary by location and some plans may not be available in certain counties or states.

Your out-of-pocket expenses will also depend on the specific Aetna plan you have.

For example, the Aetna Medicare Dual Preferred Plan is one of the coverage options for Alabama residents. In this state, the plan is only available in five counties, including Montgomery, Dallas, and Mobile.

HMO D-SNP covers multiple medical issues, including eye care, and it costs up to $27.2 in monthly premiums. With this plan, you can pay up to $7,550 out of pocket per year.

Youll usually pay nothing or 20% of eye exams under this plan. These tests include diabetic eye and glaucoma screening.

If you live in certain counties in Texas, for example, your coverage options include the Aetna Medicare Choice II Plan . As with most other Aetna plans, only a handful of counties in this state offer this package, including Austin, Brazos, and Grimes.

The monthly premium for the PPO is $15 and the maximum out-of-pocket amount for the year is $7,550. This plan pays the full cost of glaucoma screening, but diabetic eye exams may cost you up to $40.

A routine eye exam is free under this plan, but only once per year. So, youd have to pay out of pocket for any additional routine checkup.

The Above Policy Is Based On The Following References:

Contact Lenses For Masking Irregular Astigmatism Associated With Keratoconus And Other Corneal Disorders

Aetna considers services that are part of an evaluation of keratoconus or other corneal disorders associated with irregular astigmatism medically necessary. This includes the general examination, advanced corneal topographic modeling, and fitting of contact lenses or scleral lenses.

Note: Most Aetna medical benefit plans exclude coverage of contact lenses and other vision aids. Please check benefit plan descriptions for details. These benefit plans do not cover contact lenses or scleral lenses for correcting astigmatism associated with keratoconus or other corneal disorders under medical plans that exclude coverage of contact lenses and eyeglasses. This includes corneal contact lenses and scleral lenses that may be prescribed for masking irregular astigmatism associated with corneal ectasia , post-operative astigmatism , corneal scarring , and anterior corneal dystrophies . Contact lenses and scleral lenses provided to members with keratoconus and other corneal disorders associated with irregular astigmatism are covered under the provisions of the member’s vision care plan only.

Read Also: How To Become A Health Insurance Broker In California

Why Wont My Insurance Cover Lasik

The simple answer is that LASIK is not covered because its an elective procedure. To your insurance company, LASIK is comparable to facelifts or tummy tucks. Elective procedures like LASIK are not necessary for a patients health.

Contacts and glasses may be frustrating, but they provide ample vision correction. The best option is to inform yourself. While no insurance coverage may seem insurmountable, there are plenty of options.

Depending on preferences, some options include bank loans, zero-interest credit cards, and financing. Before making a decision, do some research to find out whats best for you.

You dont have to save up $5,000 before getting LASIK! Instead, many LASIK practices, including Loden Vision Centers aim to make it affordable. With financing, you can pay off your procedure over time and make LASIK fit your budget.

What Will I Pay

-

- $95 premium progressives tier 1

- $105 premium progressives tier 2

- $120 premium progressives tier 3

Tier 4 Premium Progressives are also available at various copays

Call us at 877-459-6604 to find out what tier your progressive lenses are.

- How are anti-reflective lens coatings covered?

-

We categorize or tier our premium anti-reflective lens coatings. Tiers reflect choice, value and technology. Higher tiers reflect increased technology. Popular brands, like Crizal®, are included in various tiers.

If you choose the High Plan:

- $20 copay for standard antireflective lens coatings

- $32 copay for premium antireflective lens coatings tier 1

- $43 copay for premium antireflective lens coatings tier 2

- 20% off premium antireflective lens coatings tier 3

If you choose the Standard Plan:

- $45 copay for standard antireflective lens coatings

- $57 copay for premium antireflective lens coatings tier 1

- $68 copay for premium antireflective lens coatings tier 2

- 20% off premium antireflective lens coatings tier 3

Call us at 877-459-6604 to find out what tier your anti-reflective coating is.

Also Check: What Does No Cost Share Mean In Health Insurance

Does Insurance Cover Lasik

That depends on your insurance provider. Some health insurance plans, unfortunately, deem LASIK and laser vision correction procedures elective meaning not medically necessary. For this reason, health insurance companies can limit or deny coverage for LASIK and generally offer benefits to cover some of the expenses related to glasses and contacts. It pays to read the fine print before relying on your traditional health plan. However,if you have a vision plan, that may be of some additional help.

Vision insurance plans, such as VSP or EyeMed, are slightly different from standard medical or health insurance vision plans are designed to help patients with eye care, including vision correction devices like glasses and contacts. Depending on the plan, benefits may include additional services and savings for those who are interested in laser vision correction as an option.

Understanding How Much Your Aetna Plan Will Pay For

The precise amount of coverage you get will depend on your Aetna plan. Some people have a plan with copays or coinsurance. A copay is a set amount of money you pay for each doctors visit or prescription medication. Coinsurance is similar, but instead of being a specific dollar amount, it is a specific percentage. Typically, you have to pay at least some of the cost for mental health care until you reach the deductible for your plan. Once all of your healthcare costs for the year reach the deductible amount, Aetna will cover the rest of your care.

Keep in mind that some Aetna plans may not have a copay or coinsurance for mental health care. In these cases, the costs still go towards meeting your deductible, and Aetna will cover costs after your deductible is reached. Furthermore, Aetna has special deals with many healthcare providers, so your out-of-pocket costs per visit is still less than an uninsured person would pay. Since costs vary so much depending on what plan you have, it is important to go over your plan carefully. To find out the exact cost of treatment, you should login to your Aetna account. They have anonline cost estimator tool that lets you know how much coverage your plan gives for various treatments.

Read Also: How To Sign Up For Health Insurance

Read Also: How Much Is Private Health Insurance In Spain

How Much Does Lasik Cost

Whether youre insured, underinsured, or totally without coverage, the costs of LASIK surgery will likely end up being paid out-of-pocket .

In 2020, the average cost for LASIK surgery was around $3,000 per eye. Costs vary greatly, however, and LASIK can run anywhere from $1,000 to $4,000 per eye. Beware of providers offering LASIK surgery for extremely low charges such as $300 often youll be hit with hidden costs later.

As we said, vision insurance most likely wont cover LASIK surgery. Most plans offer eye exams and glasses at a fixed rate, but no major vision plans have listed fixed rates for refractive LASIK surgery. A few employers may offer some coverage for LASIK if your need is a result of an injury. Ultimately, for the majority of individuals, the final price will depend on your current prescription, as well as your doctor. .

Some surgeons advertise a flat, fixed price for a single-day LASIK procedure that treats both eyes. Beware. The FDA does not recommend such deals for fear doctors will cut corners, like not providing proper follow-up care. To help avoid receiving such inadequate care, the FDA encourages patients to compare multiple doctors before trying LASIK.

Read Also: 8448679890

Can I Claim Medisave For Cataract Surgery

While it is a day surgery procedure, cataract surgery is Medisave claimable, subject to the approved surgical limit. In addition, if you have an Integrated Shield Plan, you can claim part or all of your cataract surgery cost, depending on your private insurance coverage, for both private and public hospitals.

Read Also: How Do I Know Which Health Insurance I Have

Whats Covered Through The Usc Ship/aetna Plan

SHIP/Aetna 3 Tiers of coverage:

- Tier 1, USC Designated Preferred Care Providers 90% Coverage

- Keck Medicine of USC

- USC/Norris Comprehensive Center and Hospital

- Las Encinas

Copays: $20 copay for all primary care and behavioral health visits with Tier 1 and Tier 2 providers $50 co-pay for all walk in clinic visits/urgent care visits to insurance-based urgent care centers.

Is Lasik Worth It

Financially speaking, many people break even on the cost of Lasik within 10 years. The average Lasik cost of $4,500 for two eyes is about the same as the 10-year cost for both eyeglasses and contact lenses, assuming you spend $300 per year on contacts and $150 per year on eyeglasses. If you use an insurance discount program to reduce your Lasik surgery costs, you can break even in less than five years.

Read Also: Is Health Insurance Mandatory In California 2020

But Seriously How Can I Get Insurance To Pay For Lasik

While we are grateful to these wonderful companies for providing insurance that covers LASIK, most of us still have to pay out of pocket. Fortunately, there is a wonderful government benefit available to everyone who is employed that can reduce the LASIK price significantly. That benefit is an HSA or FSA account that you can set up through your employer. Take this example: if the cost of laser vision correction is $4000, and your tax bracket is 25%, you must earn $5333 to pay for it without an HSA. If you have an HSA, then you must earn $4000 to pay for LASIK, and save $1333.

- LASIK/PRK cost: $4000

- Without HSA: If you earn $5333, you have $4000 after taxes to spend on LASIK or PRK

- With HSA: If you earn $4000, you can spend $4000 on LASIK or PRK, and save the taxes

- Total savings: $1333 of your hard earned dollars. Now you can buy those designer sunglasses, a tank of gas, dinner out, and still have $500 left over. And your vision is clear and crisp without any glasses or contacts to buy again. Hows that sound as a LASIK lifestyle upgrade?

Saving Your Insurance Card On Your Mobile Device

If you are enrolled in the UR Student Health Insurance Plan , you can save a copy of your insurance card on your mobile device by going to the Aetna Student Health web site and clicking on Get Your ID Card. You will be able to print your card and/or save it digitally. We recommend that you save your card on your mobile device. The instructions on the site will tell how to download the Aetna mobile app to view your ID card on your mobile device. Insurance cards are no longer being mailed to students by Aetna Student Health.

Don’t Miss: Do I Have To Have Health Insurance In Texas

Does The Aetna Student Health Plan Cover Online Therapy

Yes, the Aetna Student Health Plan offers coverage for online therapy. This opens the doors for many clients who arent able to physically attend therapy sessions each week, whether for a physical limitation or because of the constraints of a busy student schedule.

Your coverage for therapy costs will remain the same, whether you visit your therapy in-person or online. This includes the same copayments or coinsurance rates.

Recommended Reading: Starbucks Dental Insurance

Flexible Spending Arrangements Or Health Savings Accounts

Some employers offer access to an FSA or HSA to allow employees to set aside tax-free money that can later be used for a qualified procedure such as LASIK. For 2022, the U.S. Internal Revenue Service currently caps contributions to health savings accounts at $3,650 for an individual HSA or up to $7,300 in a family HSA plan. The IRS limits the pre-tax contributions to an FSA for 2022 to $2,850 for the tax year. Importantly, there are new rules governing how account holders can use their 2021 account funds which potentially gives you access to even more money. Check with your benefits manager for details.

You May Like: How Much Is My Health Insurance Worth

Lasik Stands For Laser Assisted In Situ Keratomileusis

LASIK stands for laser-assisted in situ keratomileusis. It is a type of eye surgery that permanently corrects vision in people who are nearsighted, farsighted or have astigmatism. LASIK is a form of laser eye surgery that involves creating a small flap on the surface of the cornea, then reshaping it with a laser.

LASIK is one type of refractive surgery, which includes other types of laser and intraocular lens procedures.

In laser-assisted in situ keratomileusis, a flap created in the cornea is pushed aside, and then pulses from an excimer laser remove very tiny bits of tissue beneath it.

In laser-assisted in situ keratomileusis, a flap created in the cornea is pushed aside, and then pulses from an excimer laser remove very tiny bits of tissue beneath it.

- The flap is cut using an instrument called a microkeratome. The flap is then pushed aside, exposing the deeper layers of the cornea.

- The laser is used to remove microscopic amounts of tissue in the cornea, changing its shape and improving vision for those with nearsightedness, farsightedness or astigmatism.

The excimer laser uses ultraviolet light to precisely remove tissues.

Laser surgery is a precise surgical procedure, but it is also very dangerous. Ultraviolet light can damage the human body. Even just a little bit of UV light can cause skin cancer and cataracts. Thats why doctors wear protective glasses when theyre doing laser surgery.

Lasik is a form of laser eye surgery that has been around for 20 years

Important Facts Regarding Lasik Prices

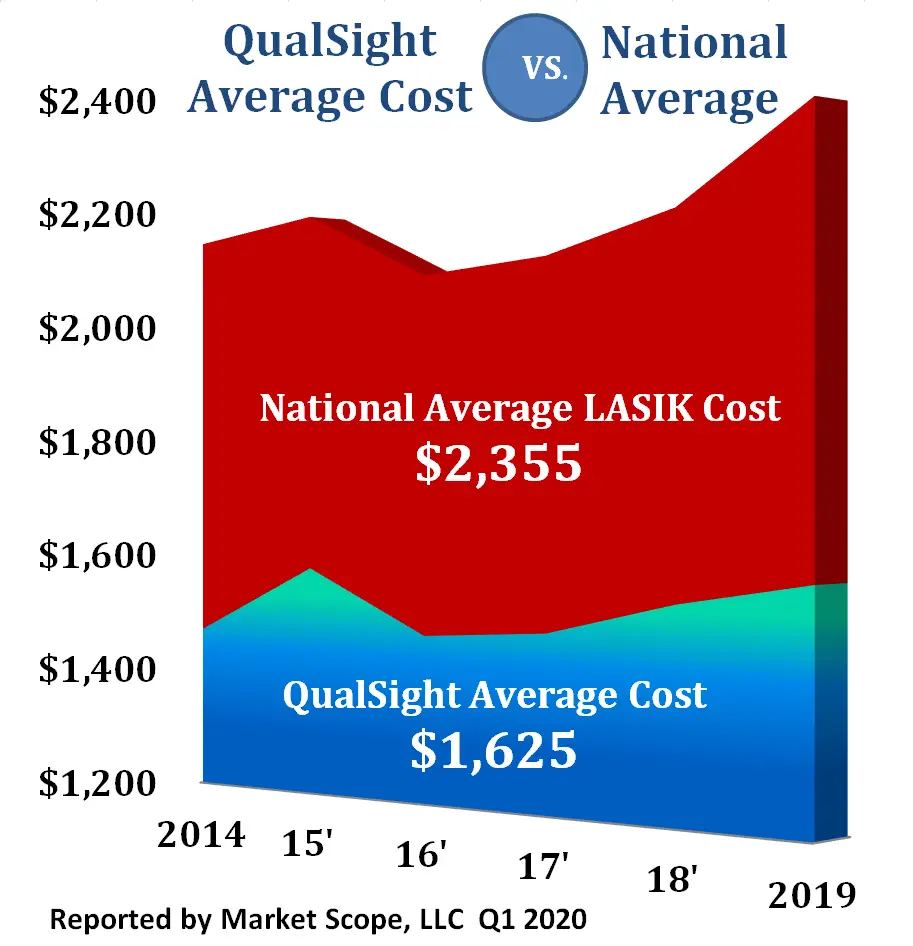

While most insurance does not cover the cost of LASIK, beware of bait and switch pricing! Often an extremely low LASIK cost of $399 or $695 per eye significantly increases based on your prescription or astigmatism. QualSight’s low cost of LASIK never increases based on your prescription or astigmatism.

Many LASIK doctors only perform one type of LASIK eye surgery at the most expensive rate. Our network of more than 800 locations contains quality doctors that collectively offer every FDA-approved technology which allows for broader price ranges to meet your budget. In addition, your local optometrist may receive part of your LASIK eye surgery fees to refer you to a local LASIK surgeon. This co-managed fee is often passed to you in the form of higher pricing. Our price is set, regardless of whether or not an optometrist is involved in your LASIK care.

Don’t Miss: How Can A College Student Get Health Insurance

What Does Aetna Vision Cover

With the Aetna Vision Savings plan, you can get discounts through your standard Aetna health insurance on vision-related needs. This includes discounts on eye exams, glasses, contact lenses, and even laser in-situ keratomileusis .

The Vision Preferred program partners with 77,000 vision providers across the U.S., ranging from independent neighborhood providers to large chains and big-box stores like Target Optical or LensCrafters.

As an Aetna Vision Preferred member, you can get discounts on:

- Second pairs of glasses.

- LASIK eye surgery.

- Retinal imaging.

Vision wellness through your regular Aetna health insurance helps you get regular eye exams, which are vital for diagnosing and treating serious eye diseases like glaucoma or cataracts before they lead to vision loss. The Vision Preferred plan covers routine and important vision care like:

- One annual routine eye exam to diagnose any eye changes. There is no charge unless you need pupil dilation, which requires a $10 copay.

- Eyeglasses frames with a $150 allowance and 20 percent discounts on several frame options.

- Eyeglass lenses with a $10 copay.

- Lens options.

- $15 discounted fee for ultraviolet light treatment.

- $15 discounted fee for tint, solid or gradient.

- $45 discounted fee for reflective coating.

- Between $95 and $120 discounted fee for most premium progressive lenses.

- $75 discounted fee for photochromatic or transition lenses.

- Up to 40 percent off either a second pair of glasses or prescription sunglasses.

How We Chose The Best Health Insurance For College Students

To identify the best health insurance for college students, we looked at multiple options, including Medicaid, Health Insurance Marketplace plans, school-offered insurance, short-term policies, and insurance offered by private companies. In total, we looked at 17 different options and evaluated them based on their total annual cost, availability, provider network, and financial stability rating. Because college students are typically on a tight budget, particular attention was paid to plans that offered low premiums and comprehensive coverage.

Don’t Miss: How Do I Change Health Insurance