Ongoing Regulatory Changes The Organization Must Track

For many small businesses, having a full HR staff to tackle the administrative tasks of offering a group health insurance plan isnt an option. That means an already busy employee must become the go-to person to educate staff on coverage options, who is eligible for coverage, what local facilities are in- or out-of-network, and what is covered under the type of planand stay on top of rule changes.

Without someone watching these regulations full-time, its easy for some rules to slip through the cracks, making your plan out of compliancewhich comes with hefty penalties up to thousands of dollars.

Average Cost Of Health Insurance For A Small Business

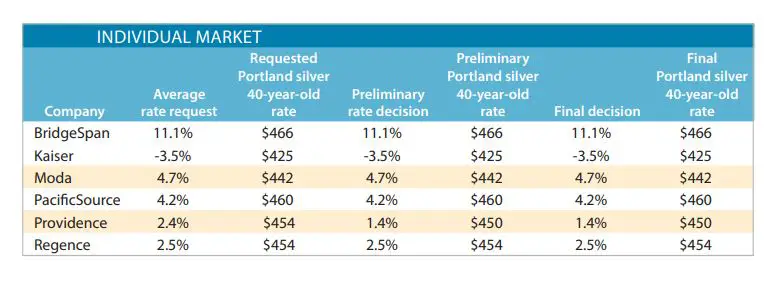

The cost of offering health insurance for a small business owner depends on the plan choice and how much the employer wants to pay. The average cost for small business owners is $400 to $500 per employee per month, says Jugan. If the business has a lot of older employees, then it might cost more, he adds.

How Much Does Small Business Health Insurance Cost

Health insurance can be costly and complex. Heres what you need to know about health insurance as a small business owner

No account yet? Register

As health insurance remains the #1 employee benefit, small business owners are growing increasingly aware of the need to incorporate health insurance in their benefits strategies.

The reality is that recruiting and hiring the best people vastly depends on whether the employer offers health insurance. Those that dont provide health benefits are more likely to lose their desired talent to the competition.

However, health insurance costs have been climbing for years. According to Enterprise Bank, small and midsize business owners are particularly concerned about:

- The effect of health insurance costs on their companys profitability

- Premium hikes making coverage unaffordable for their employees

- Health insurance costs restricting their ability to give bonuses and raises

These are legitimate concerns, as the cost of small business health insurance plans continues to soar.

Recommended Reading: How To Apply For Health Insurance In Arizona

Gms Health Insurance Plans

Based in Regina, Saskatchewan, GMS is a proud health insurance provider working to protect you against out-of-pocket healthcare costs and support wellness for you and your family. GMS health insurance plans complement your lifestyle and provide protection for everyday health needs and medical emergencies. And you can save money with the added bonus of receiving discount options to help make your benefit coverage go even farther!

Since 2014, GMS has

- helped generate more than $3 million to upgrade critical equipment for trauma care teams in Regina hospitals

- donated a state-of-the-art digital electrocardiogram testing file management and storage system at the GMS Cardiac Rhythm Device Clinic at Reginas General Hospital

- allowed for facility improvements to enhance patient comfort

- proudly sponsored support for pediatric services

How Much Does Marketplace Health Insurance Cost An Employer

To buy insurance on the marketplaces your small business has to cover at least 50% of the cost of health insurance for your employees On average, the premium for employees at small firms nationwide was $6,163 a year, which equals $513.58 a month, according to a Kaiser Family Foundation report earlier this year.

So if as the employer you covered half of that, your small businesss share would be about $260 a month per employee, which adds up to $3,100 a year, per employee. Compare that to the cost and 401 benefits for employers.

Read Also: How To Apply For Public Health Insurance

How Much Does Health Insurance Cost Small Business Owners

For small businesses that seek to take care of their employees and their family members, providing health insurance can be a major expense. So, what does health insurance cost small business owners? While the actual cost depends on a wide variety of factors, consider the following estimates and guidelines regarding small business health insurance costs:

- In 2018, the average cost per-person for small group health coverage was $409 a month. In comparison, the cost of an individual health plan in the same year was $440.

- In 2018, small group health insurance had an average yearly deductible of $3,140. In comparison, the yearly deducible for individual plans that same year was $4,578.

At this point, you may be wondering why individual coverage is more expensive than small business health insurance coverage. This largely has to do with the fact that the insurers risk is distributed between an entire group of people, meaning the bigger the group, the more spread out the costs are for health care. Or, in other words, the bigger the group, the more monthly payments the insurance company is receiving, and then the more money the insurer has when a member requires care.

Are You Legally Required To Carry Small Business Insurance

Most states will legally require small businesses with employees to have workers comp insurance. Depending on the state, other policies will be needed too. Here is a breakdown of when your small business might be legally required to carry it:

- Workers compensation insurance if your company has a team of employees

- Professional liability insurance if your company offers professional services

- Liquor liability insurance if your business sells or distributes alcohol

- Commercial auto insurance if your business has a company vehicle

Don’t Miss: Is Rehab Covered By Health Insurance

How Do Business Owners Get Health Insurance

As a sole proprietor, you can get life insurance that includes critical illness and disability insurance from any life insurance provider. If you have multiple employees, and want to get group coverage, speak with your broker to tailor your plan to fit your needs. You can include options like extended health care , dental and short-term and long-term disability insurance.

Average Cost Of Small Business Health Insurance

With the aforementioned ballpark numbers in mind, a 2020 Kaiser Family Foundation report found that the average yearly health insurance premium for small businesses was as follows:

- $7,483 for single coverage, where employers paid 84%, or $6,297.

- $20,438 for family coverage, where employers paid 67% or $13,618.

This report considered small businesses to be those with between three and 199 employees. Employers with less than 50 employees are not legally obligated to offer health insurance. Although it can be expensive, offering health insurance to your employees is an excellent way to attract and retain employees, enjoy a number of tax benefits, and stick out amongst the competition.

You May Like: How Much Does Health Insurance Cost For A Retired Couple

How To Save Money With A Business Owners Policy

A business owners policy, also referred to as BOP, helps a company cover the three critical factors of value, convenience, and insurance coverage. It enables a company to bundle commercial property insurance, business interruption insurance, and general liability insurance into a single insurance policy.

As a result, the company can pay an individual premium, save money in the long term, and secure the needed coverage. While this is an excellent option for a small business, it may not be the best option for a company that does not need all the insurance options in the bundle. When you consolidate these insurance packages, you could save around 20% on premiums if you selected them separately.

Health Insurance Plans For Small Businesses

Your provincial insurance plan may pay for medically necessary care, but it doesnt cover many other services that can threaten your health or your employees health, ultimately affecting your companys bottom line. For example, it doesnt cover the cost of prescription drugs, dental care, routine eye exams, glasses, contact lenses, hearing aids and other medical items or equipment. It also wont pay for certain preventive services and screening tests.

However, with our Small Business Health Insurance coverage, you can receive many of these services without having to pay out of pocket. This can leave you with more money in your budget to maintain and grow your business.

Special Benefits Insurance Services offers you access to many health insurance products. Our relationships with leading carriers means we can provide the right health insurance plan for your unique specifications.

You cant put a price on your health. However, health insurance for small businesses can make the cost of medical services more affordable.

With a Small Business Health Insurance plan from SBIS, you can:

- spend less time worrying about healthcare costs and more time managing your business

- conserve financial resources that could be better spent on building your business

- protect your business and employees from the financial burden of health care issues

You May Like: Can I Add A Friend To My Health Insurance

Choosing The Best Small Business Health Insurance Pays Off

Congratulations! Youâve successfully found and picked the absolute best small business health insurance out there for you, your employees, and your business. Ok, itâs not exactly the endâyou still have to fill out paperwork, apply, make payments, walk your employees through their own paperwork and choices.

But the hardest part is over. And by offering health insurance as part of your employee benefits package, you will end up gaining a competitive advantage, reducing employee turnover, and encouraging your employees to be healthy and happy.

Legal Accounting And Other Professional Fees

You can deduct the fees you incurred for external professional advice or services, including consulting fees.

You can deduct accounting and legal fees you incur to get advice and help with keeping your records. You can also deduct fees you incur for preparing and filing your income tax and GST/HST returns.

You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax, Canada Pension Plan or Quebec Pension Plan contributions, or employment insurance premiums. However, the full amount of these deductible fees must first be reduced by any reimbursement of these fees that you have received. Enter the difference on line 23200, Other deductions, of your income tax return .

If you received a reimbursement in the tax year, for the types of fees that you deducted in a previous year, report the amount you received on line 13000, Other income, of your income tax return of the current year .

You cannot deduct legal and other fees you incur to buy a capital property, such as a boat or fishing material. Instead, add these fees to the cost of the property. For more information on capital property, go to Claiming capital cost allowance .

For more information, go to Interpretation Bulletin IT-99, Legal and Accounting Fees.

Don’t Miss: Do I Get Fined For Not Having Health Insurance

Small Business Health Options Program

The Small Business Health Options Program helps businesses provide health coverage to their employees.

SHOP insurance is generally available to employers with 1-50 full-time equivalent employees . If you have fewer than 25 employees, you may qualify for the Small Business Health Care Tax Credit, if you buy SHOP insurance. Learn more about SHOP eligibility rules and the Small Business Health Care Tax Credit.

If you’re a sole proprietor or self-employed with no employees, you can get individual coverage through the Health Insurance Marketplace.

Location Of Your Business

Insurance premiums might differ depending on where your company operates. This is especially true for workers compensation insurance because state laws determine everything from coverage amounts to how you must obtain the policy.

Commercial auto insurance costs are also affected by location. Like workers comp, state governments also have minimum requirements that you must meet in terms of commercial auto insurance. Even then, premiums for commercial auto are usually higher in cities and locations with a high rate of accidents and claims.

Commercial property and liability insurance might also vary by state and zip code. Rural locations, for example, may have higher property rates than metropolitan areas. One factor contributing to this is that fire stations and fire hydrants are more difficult to reach in rural areas.

Similarly, a store in a city may have to pay extra for liability insurance. The higher cost comes from the fact that there are usually more people in cities than in rural areas. More people on your property means more risk.

Recommended Reading: What Is The Average Monthly Premium For Health Insurance

Can You Write Off Car Insurance As A Business Expense

Yes, if you use your vehicle exclusively for business, you can write off all related expenses including gas, maintenance, and insurance. As a small business owner, you may split your vehicle between business and personal use. If so, keep track of when youâre driving for business, and when itâs personal, and divide your receipts accordingly.

If You Have No Employees

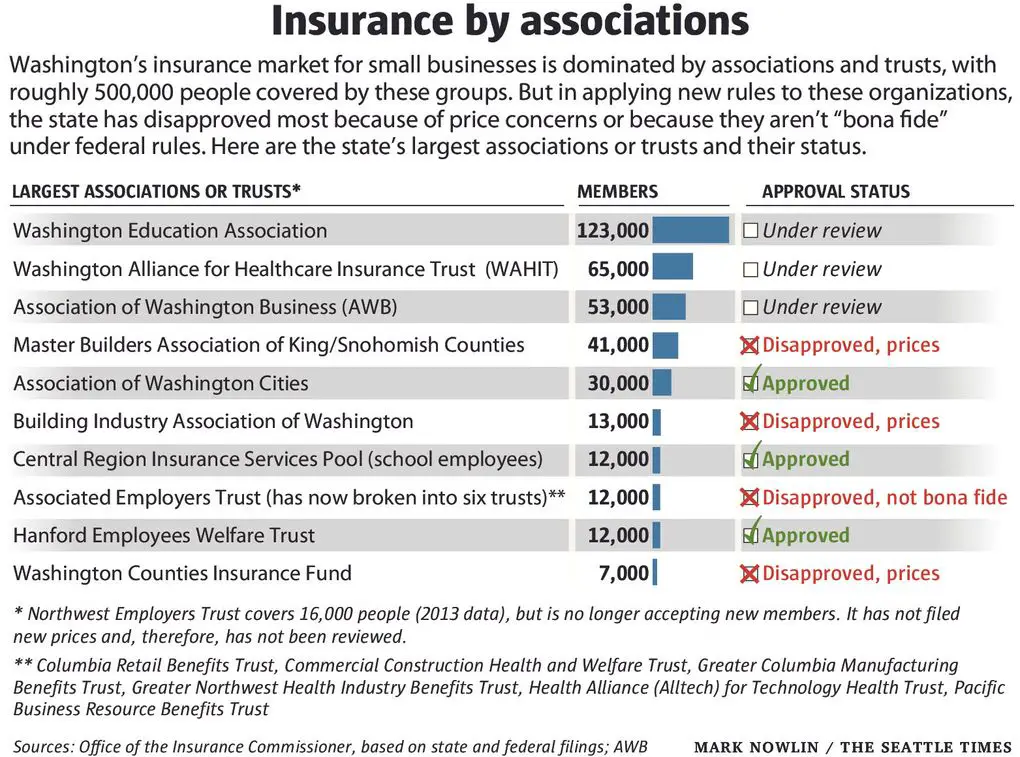

If youâre a consultant, freelancer, or sole proprietor, your options will vary based on which state your business is located in. Some states allow âgroups of oneâ to purchase group coverage if youâre registered as a business. New York, Florida, Washington, and a handful of other states allow non-employers to buy group health insurance.

If youre not in one of these states, youâll need to buy individual or family health insurance instead. These plans are offered through the Affordable Care Acts health insurance exchange in each state. Another option for the self-employed is to set up a Health Reimbursement Arrangement . An HRA is a tax-advantage account that lets you get reimbursed for qualified medical expenses, up to a certain limit each year.

Since youâre only getting health insurance for youâand, possibly, a spouse and/or dependentsâthe good news is that your choices are drastically simpler.

Here are some health-related factors youâll want to think about when browsing through the individual, family, or small business health insurance plans you can choose:

- Your medical history

- The prescription drugs you need

- How often you visit a general practitioner

- How often you visit a specialist

- Your familyâs medical needs and history

- Any plans you have for pregnancies, etc.

Recommended Reading: What Does Family Health Insurance Cost

Types Of Commercial Insurance Policies

There are many types of available business insurance coverages and the more you have, the more it will cost. Most businesses begin with general liability coverage to protect themselves against third-parties. As you grow, you may want to add more coverage for specific risks or perils, which would increase the amount it costs in exchange for more protection.

Hire An Insurance Broker

Hiring an insurance broker may be an expense, but it can save you significant amounts of time and effort in searching for an insurance plan that works for you and your business. An insurance broker will help you with paperwork, ensure your business is compliant with relevant laws, get you plans with up-to-date policies, and help with implementation and renewals.

Brokers will earn a commission once they find a plan that works for you, but they should not ask for money upfront avoid any brokers that do.

Recommended Reading: How To Transition From Private Health Insurance To Medicare

What Are The Premiums Deductibles Copays And Coinsurance Payments

Whewâthatâs a lot of jargon. In case youâre unfamiliar with these terms, weâll simplify them real quick:

Premiums are the monthly payments you make to your health insurance company. Generally speaking, higher premiums mean lower out-of-pocket costs for doctor visits .

Deductibles are amounts youâll have to pay before your health insurance kicks in. For example, you might have a $500 deductibleâwhich means that your health insurance provider wonât subsidize your health care until youâve paid off that first $500.

Copays are fixed amounts youâll pay when getting a certain health care service. When you go for a routine checkup, for example, you might pay a flat rate of $15 before your insurance pays for the rest.

Coinsurance is a similar ideaâout-of-pocket expenses for your visits, but executed differently. Instead of flat rates, coinsurance costs are percentages of the total cost of your medical service. For example, you might pay 10% of the total health care bill, while your insurance company covers the other 90%.

Understanding these terms, and how they relate, will help you figure out which plans are best for you.

Hereâs one general formula: Higher premiums mean lower copays and coinsurance payments, and vice versa. In other words, the more you pay each month, the less youâll pay per doctor visit.

Find the point along this spectrum that fits you and your employeesâ medical needs best, and youâll all be satisfied with your health insurance.

Interest And Bank Charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- the interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- the amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- the interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

Also Check: How To Put Someone On Your Health Insurance

Small Business Insurance Cost By Profession

Your business niche or profession is the most significant factor that influences your small business insurance cost. The following are some examples of policies for different industries, including what they cover and their prices.

Restaurant Insurance

Price range = $88 to $840 per month Average cost = $300 per month.

Restaurant insurance policies cover claims related to food-borne illness, customer harm, third-party property damage, personal property damage, and business interruption.

Plumbing Insurance

Price range = $39 to $89 per month Average cost = $89 per month.

Plumbing insurance covers lawsuits and other liabilities from injuries and damage to a client, third party, or their property while conducting installations, repairs, or any other service.

Price range = $39 to $49 per month Average cost = $49 per month.

Retail insurance policies protect your business from liabilities related to harm to customers and third parties and damage to your store.

IT Consultant Insurance

Price range = $39 to $289 per month Average cost = $89 per month.

IT consultant insurance protects your business against third-party injury and property damage and any mistakes you make that could harm a client and result in losses.