What Is The Shingrix Vaccine

Shingrix is the U.S. Food and Drug Administrationapproved vaccine aimed to prevent shingles infection in individuals older than 50 years and adults aged 18 years and older who are or who will be at increased risk of shingles due to a disease or therapy that can compromise the immunity.

The Herpes Zoster virus is the same virus that causes chickenpox in children. The virus may remain dormant in the persons nerve roots and become active when the immunity wanes .

The reactivated virus causes shingles or Herpes Zoster, a painful condition characterized by painful red blisters over the body, rash, and/or fever.

- A particular complication of shingles is postherpetic neuralgia, which persists for months after the infection subsides.

- It is characterized by extreme pain at the former site of rash and lesions.

- This pain may or may not respond to strong medications hence, a vaccine against shingles is required.

The Shingrix vaccine works by exposing the body to small doses of the inactive herpes virus. This stimulates the bodys immune system and helps the body to develop an immunity to herpes zoster or shingles.

Also Check: Transportation From Orlando Airport To Rosen Shingle Creek

How Long Does Shingrix Last

The Shingrix vaccine can remain effective for at least four years in most people and even longer in others. You must get the entire series to be protected against shingles, which includes two separate shots. Even if you have had the infection, getting vaccinated can still offer benefits because it may help reduce the risk of developing PHN.

Shingrix may not protect everyone, but it provides broader protection for older adults whose immune systems are declining with age or disease.

You May Like: How Does One Catch Shingles

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Also Check: How To Enroll In Health Insurance

Time To Show You Our Research On Private Medical Insurance

Let the research begin. When still living in the US, we researched many options and found it to be overwhelming. Many US insurance companies wouldnt insure us outside of the United States for an extended period of time. Others wanted a thorough head-to-toe examination and proof that we were over the top healthy.

We received many online quotes from your standard US Insurance companies and many quoted $5000 $12,000 per year for our family of 4. What?! I thought that was crazy and continued to do research. They will tell you that you are covered in Spain, but beware!

Many of these companies are not accepted or known in Spain.

After living in Spain for 1 year, it was time for us to apply for our Spanish resident card renewal. As part of this process, we needed to again show proof of finances as well as Medical Coverage.

What To Know About Health Plan Costs

This 5-part series covers health plan costs, including setting a budget, tips for saving money, and understanding medical care costs. Up first: the costs of a health plan.

What you pay for health care isnt a set number each year. Here are a few basic health plan terms to help you understand your health care costs and choose the right health plan for your goals and budget.

Know what youll pay every month

Your monthly membership fee, often called a premium, is what keeps your health coverage active. If your employer provides your coverage, this fee will come out of your paychecks. If you purchase a plan yourself, youll need to pay this fee each month.

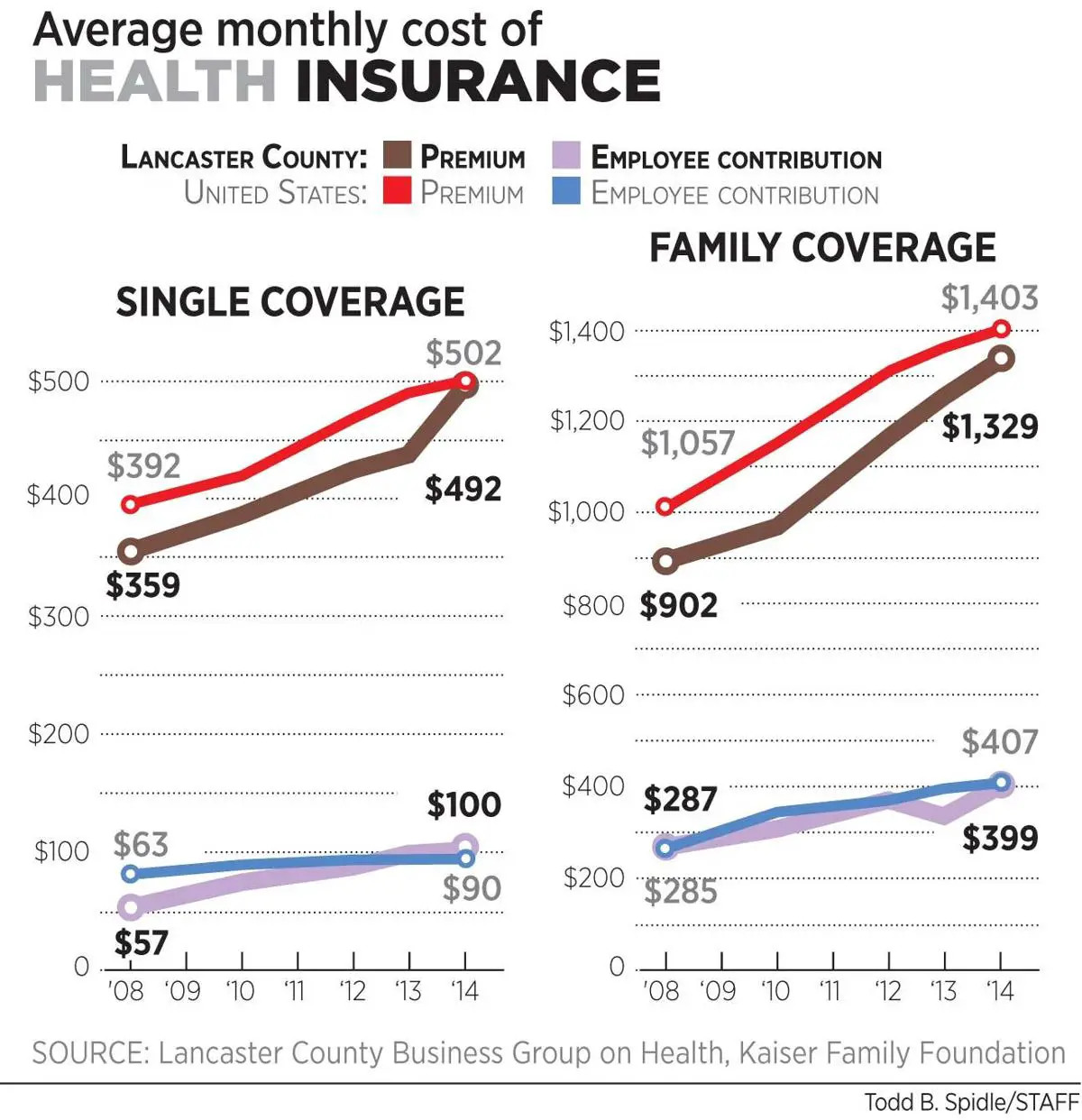

What can you expect to pay for your monthly fee? Each plan is different, but from 2018 to 2021, the average monthly cost of health coverage for an individual in the U.S. was between $340 and $525, depending on plan type and location.1

Your monthly payment affects what youll pay for care throughout the year. Generally, the higher your monthly fee is, the more your plan covers for medical care. Lower monthly fees may mean youll pay more of the costs for your care.

Know what youll pay for care

Deductible:

The amount youll need to spend on health care services each year before your plan covers any costs. Its possible you wont reach your deductible especially if you dont get a lot of care but you should be prepared to pay up to that amount.

Copay:

Coinsurance:

Out-of-pocket maximum:

One moment

Don’t Miss: How Far Back Does Health Insurance Cover

Private Vs Public Health Insurance

Private health insurance, offered through the ACA federal marketplace or directly from private health insurance companies, is different from public health insurance Medicare or Medicaid.

Medicare is generally more cost-effective for Americans over age 65, the vast majority of whom qualify for Medicare, Martucci says. Medicaid, on the other hand, is a free or very low-premium health insurance option for low-income Americans and is a very good deal for those who qualify. But eligibility requirements vary significantly by state and in many places are restrictive to the point of excluding all but the most vulnerable people.

Read Also: How Do I Get Health Insurance Outside Of Open Enrollment

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2022 is $438, according to the Kaiser Family Foundation.1 A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.1

You May Like: Why Is Private Health Insurance So Expensive

Is It Possible To Get Free Private Health Insurance

There is no such thing as free insurance in the private sector. Its vital to remember that free healthcare isnt necessarily free. Citizens indirectly fund the healthcare provided by government agencies. All government activities, including healthcare, are supported by their taxes. However, affordable private health insurance is available.

Is everyone eligible for private health insurance?

If you have a pre-existing condition, you may lose your eligibility for some private health insurance plans. Although, there are private health insurance companies that will accept everyone, so there will most likely be a private health insurance option for you.

Where can you buy private health insurance?

Private health insurance can be purchased through the health insurance marketplace, or outside the marketplace. Unless you are enrolled in a public health insurance plan like Medicaid or Medicare, you can safely assume you are enrolling in private health insurance.

Is private health insurance always more expensive?

No, private health insurance isnt always more expensive. In fact, if you dont qualify for government subsidies, buying private health insurance outside the marketplace can save you money.

Why You Should Purchase Health Insurance

If you find yourself in one of the above situations and lack health insurance coverage, its important to enroll in an individual plan as soon as possible.

Even though youre not required to have insurance, you cannot predict when an accident will occur that will require medical attention. Even a minor broken bone can have major financial consequences if youre uninsured.

If you purchase insurance through the Health Insurance Marketplace, you may be eligible for income-based premium tax credits or cost-sharing reductions. The marketplace is a platform that offers insurance plans to individuals, families, and small businesses.

The ACA established the marketplace as a means to achieve maximum compliance with the mandate that all Americans be enrolled in health insurance. Many states offer their own marketplaces, while the federal government manages an exchange open to residents of other states.

While you may not be able to afford the same kind of plan that an employer would offer you, any amount of coverage is more advantageous than none. In the event of a major accident or a long-term illness, you will be prepared.

Read Also: Can You Change Your Health Insurance Plan At Any Time

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

Directly From A Health Insurance Company

Some people can find plans that better fit their specific needs or budget by shopping directly with health insurance companies. These plans may meet ACA requirements or you may find a cheaper plan that doesnt offer as comprehensive coverage thats found on the ACA marketplace. Purchasing a health plan outside of the marketplace removes the opportunity for premium tax credits or other subsidies that are available through the marketplace.

You May Like: How Much Does Health Insurance Cost In Wisconsin

Average Premium Costs And Tips For Saving

AJ_Watt / Getty Images

Open enrollment for health insurance planswhether it’s an employer-sponsored plan or an Obamacare plan you buy through a federal or state healthcare exchangegenerally takes place in the last two or three months of the year. Unless you have a qualifying life event such as getting married or losing your job at a different time of the year, open enrollment is the time to shop around to ensure that youre paying the best price for the right coverage.

It helps to first understand what average premiums are, how the rates have changed over the past few years, and ways you can reduce your monthly premium.

How Does Employee Health Insurance Work In Usa

Employers and employees typically share the cost of health insurance premiums. Employers and employees share the premiums. There are also major tax advantages to participating in employer health plans employee contributions, for example, can be made pre-tax, reducing federal and state taxes on the employee end.

You May Like: How Much Is Health Insurance For Independent Contractors

What Is Open Enrollment

Footnotes

Prescription Drug Coverage And Shingles Treatment

Your doctor may prescribe antiviral drugs such as famciclovir, valacyclovir, and acyclovir. These drugs can help the rash heal more quickly and reduce the chance youll suffer serious side effects. If your pain is severe, your doctor may also write you a prescription for pain medications.

Medicare prescription plans typically cover both antiviral and pain medications, though the specifics will depend on your plan. You may have to pay a deductible or copay.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Your doctor may also suggest over-the-counter remedies such as lidocaine patches and Tylenol. Prescription plans dont cover over-the-counter medications, even if your doctor recommends them.

Also Check: Do You Have To Go To The Doctor For Shingles

Read Also: Does Tj Maxx Offer Health Insurance

Overseas Student Health Cover

If youre in Australia on a temporary visa, you should consider buying insurance to cover the costs of medical treatment. Find out more about health cover for overseas visitors and overseas students.

International students who havent been able to return to Australia due to COVID-19 should contact their private health insurer to find out about options for extending, or suspending, their cover. Some may offer a period of suspension, but they are not required to do so.

Read our collection of resources for international students.

A collection of resources about overseas student health cover for the general public and private health insurers.

Why Do You Need Shingles Shot

For older Americans, the shingles vaccine is an important way to protect against the herpes zoster virus. The virus can cause a painful rash and blisters. It can also lead to serious complications, such as pneumonia, brain damage, and even death.

It is recommended that adults over the age of 60 get the vaccine. If you are over the age of 60, talk to your doctor about whether the shingles vaccine is right for you and let an insurance broker find the best Medicare shingles vaccine plan.

Read Also: Does My Health Insurance Cover Lasik

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

Do I Need A Prescription For A Shingles Vaccine

Once you have a Medicare insurance plan that covers the shingles vaccine, youll need to find out whether a prescription is necessary. This is dependent on where you get vaccinated. You wont need a prescription if you get vaccinated at your doctors office.

Some pharmacies that provide vaccines do so under the standing order of a supervising physician. This is convenient for patients because it saves them a trip to the doctors office to acquire a prescription before receiving the vaccine. You may need to call your pharmacy to see how they handle shingles vaccine orders.

If your pharmacy requires a prescription, youll need to contact your medical provider first. They may want to see you in the office beforehand, but not always. Sometimes, the doctor may give you the shingles vaccine at your appointment.

Once you have the prescription in your possession, the remaining steps are pretty straightforward. Take the prescription to a pharmacy in your plans network to be filled. A pharmacist will administer the vaccine in their clinic area.

Its possible to save money on shingles vaccines with a SingleCare pharmacy savings card. SingleCare coupons can help uninsured or underinsured patients get shingles vaccines at a discounted price.

RELATED: Find a pharmacy near you

Also Check: When Does Health Insurance End After Leaving Job

You Both Have Employer

If youre both employed by a company or companies that contribute to your health insurance premiums, maintaining your individual coverage with your respective employers is almost always the cheapest way to go.

Thats because employers typically require very low contributions from their employees to the plan cost even if it feels like a lot coming out of your paycheck. According to the Kaiser Family Foundation , employees pay only 17% of the premiums on individual plans on average, which you can do if you both have that option, and 27% on family plans.

In 2020, that breaks down the average health insurance costs you can expect to pay for an individual or family plan:

Again, the cost of a family plan may vary depending on how many people youre adding to the plan. Also, its important to note that the cost of your premium will also depend on where youre located and the amount to which your employer is able and willing to contribute to your health insurance costs.

In some cases, an employer may pay the full amount, but most employees can pay at least some of the cost.

Speak with your human resources representative about how much it would cost to combine health insurance coverage with your partner into a single plan, and have your spouse do the same. Note that you can add your spouse to your plan within 60 days of getting married. Otherwise, youd need to wait until open enrollment.