If You Are Planning For A Planned Hospitalization As A Policyholder You Need To Inform The Insurer About The Forthcoming Claim In The Case Of Emergency Hospitalization The Insurer Should Be Informed About The Upcoming Claim Within 24 Hours

The main aim of a health insurance policy is to provide/settle the claim for the policyholder during hospitalization. Policyholders can make insurance claims either through the cashless mode or reimbursement mode. While some hospitals offer the cashless facility to policyholders , other hospitals do not offer the cashless hospitalization facility. In such cases, the policyholder needs to pay the dues to the hospital and get the expenses reimbursed by submitting a claim to the insurer.

Here is how to do it:

Inform your insurer If you are planning for a planned hospitalization, as a policyholder you need to inform the insurer about the forthcoming claim. However, in the case of emergency hospitalization, the insurer or third-party administrator should be informed about the upcoming claim within 24 hours.

Documents needed If it is a not networking hospital, wherein you pay the bills from your own pocket and the insurance company reimburses it later you need to collect all the documents needed for reimbursement from the hospital. Do so before leaving the hospital, collect all important documents such as the discharge summary, bills, prescriptions, copy of investigation reports, and pharmacy receipts.

Keep in mind to retain old health insurance papers, as at times copies of old insurance papers might also be required when making reimbursement claims.

Tips To Help Get Your Health Insurance Claim Approved

To boost your odds of getting a claim approved:

- Keep detailed records. Whenever you contact anyone involved, write down:

- The date of the call, email or letter

- The name of the person you spoke to or wrote to

- What was said or the response you received

Health Insurance Claims On Multiple Health Policies

There could be scenarios where you may have two or more active health insurance policies covering your medical bills. The most common such scenario is an existing personal health cover in addition to an employer-provided health insurance plan. Then there is the option of buying more than one health policy from the same insurer, for added benefits. The IRDAI allows a policyholder to claim for a medical event from more than one policy. Taking this into consideration, you may deem it appropriate to buy an additional health policy to expand your sum assured even further.

However, you cannot claim the same hospital bill from two policies simultaneously. Here are a few things to keep in mind if you plan to raise multiple health insurance claims against the same medical expense.

Also Read:Heres how your health insurance claim gets paid

Also Check: Can I Have Health Insurance In Two Different States

Cashless Procedure For Planned Hospitalisation

Here are the steps for the cashless claim process in case of a planned hospitalisation.

-

Choose from the list of network hospitals as specified in the policy document.

-

Approach the hospitals insurance help desk at least 72 – 48 hours before admission and provide your policy card to initiate the claim process.

-

Fill the pre-authorisation form and other forms as required.

-

If the case is found admissible, ACKO will settle the hospital bills up to the approved amount as per the terms and conditions of the policy.

If a cashless claim is not sanctioned, you can pay the bills and file for reimbursement of the medical expenses.

Am I Covered For Routine Medical Check

If you have a Silver or Gold plan we offer benefits for vaccinations, and preventive health and well-being for adults, after you have been insured by your plan for a continuous period of 6 months.

These benefits can be used towards routine or preventive health checks or vaccinations, including an annual eye examination.

There is also a Well Child benefit for children insured as dependents under the Silver and Gold plans, after they have been insured for a continuous period of 12 months.

If you are claiming for health checks, vaccinations or optical tests, simply scan and email us your itemised invoices and receipts, and a summary of what you are claiming for, and how you wish to be reimbursed.

Read Also: Who Pays First Auto Insurance Or Health Insurance

Check For Pre And Post

Check if your medical policy covers pre- and post-hospitalization expenses. If so, submit the medical prescription, reports, and other documents within 30 days to your insurer.

Keep in mind that you will need to pay for all expenses not covered by the policy on your own to the hospital. Also, if opting for a planned hospitalization, contact the insurer and submit the pre-authorization form in advance.

Can Ehealth Help You With Your Health Insurance Claims

Yes, eHealth agents can help beyond just finding a health insurance plan. They can assist you with your health insurance plan in a variety of ways. First of all, eHealth can assist you with understanding your claim, because even though the claim should be detailed and explain why youre being charged for what, it can be difficult to understand. eHealth can explain the invoice to you in a manner that you can understand, so you will know exactly why youre being charged what.

eHealth can also assist you when it comes to how to handle a health insurance claim that is incorrect. In most cases, you will be advised to file an appeal, but if youre not sure how to go about filing an appeal, eHealth staff can walk you step-by-step throughout the process to ensure youre filing the appeal correctly.

Also Check: How Much Is Cobra Health Insurance

Corporate Or Personal Cover For Claim

This situation arises when you have both covers active at a time.

If you are choosing between a corporate health cover and your personal cover for making a claim, always choose the corporate one so that no claim record in the personal cover stays intact. After all, the corporate cover will cease once you switch jobs or retire but the personal cover will stay for life.

You will be able to get good customer service as well from your company HR and the relevant TPA.

below

How Does The Health Insurance Appeal Process Work

The first step in the appeal process is an internal appeal . An internal appeal is usually initiated by notifying your health insurance company in writing. Either complete all required forms from your health insurer, or send them a letter explaining your situation along with your name, claim number and health insurance ID. Include supporting documents, such as a letter from your doctor that may help your claim. You must file this claim within 180 days of receiving notice that your claim was denied. Once filed, the insurance company is required to review its decision.

- If you have not yet received care and your health concern is urgent, you will be notified of your internal appeal result within 4 days, and you also have the option to file an external claim review at the same time.

- If you have not received care and the medical situation is not urgent, you will be notified of their coverage decision within 30 days.

- If you have already received treatment, you will be notified of the internal appeal decision within 60 days.

Also Check: Does Oregon Have Free Health Insurance

Got Multiple Health Insurance Policies Heres How To Make Claims From Multiple Health Insurance Policies

- Date : 04/10/2022

Mediclaim process in case of multiple health policies

There could be scenarios where you may have two or more active health insurance policies covering your medical bills. The most common such scenario is an existing personal health cover in addition to an employer-provided health insurance plan. Then there is the option of buying more than one health policy from the same insurer, for added benefits. The IRDAI allows a policyholder to claim for a medical event from more than one policy. Taking this into consideration, you may deem it appropriate to buy an additional health policy to expand your sum assured even further.

However, you cannot claim the same hospital bill from two policies simultaneously. Here are a few things to keep in mind if you plan to raise multiple health insurance claims against the same medical expense.

Also Read:Heres how your health insurance claim gets paid

How Long Do You Have To File A Health Insurance Claim

Dont wait until the end of the year to file your international health insurance claims! In many cases, you must submit your claim within a specified amount of time to receive reimbursement. The amount of time you have to file your claim varies from insurer to insurer. Consult your plan documents for further information. Some examples:

- Cigna requires all claims to be submitted within one year of service.

- GeoBlue requires customers to submit claims within 90 days of service.

- IMG Global requires customers to submit claims within 90 days.

- William Russell recommends that customers submit their claim within six months but will also pay for older claims.

- Integra Global requires customers to submit their claims within 180 days of treatment.

Read Also: What Is Considered Private Health Insurance

Do You Have Questions About Your Insurance

Health insurance is complicated and can drive just about anyone up the wall. If youre shopping for insurance or you dont like your current health plan and youre looking for something else, our independent insurance Endorsed Local Providers can help! Theyll navigate the different options and help you choose whats best for you and your family.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How Long Will It Take To Assess My Claim

We aim to assess your claim within 5 working days.

This means that, within 5 working days, we aim to have determined if we have enough information to process your claim and to proceed to settlement, or if we need to ask you for further information.

If we do need to ask you for further information, or if we need to contact your doctor, we will let you know and we will keep you fully informed about our progress.

Recommended Reading: What Is No Cost Sharing In Health Insurance

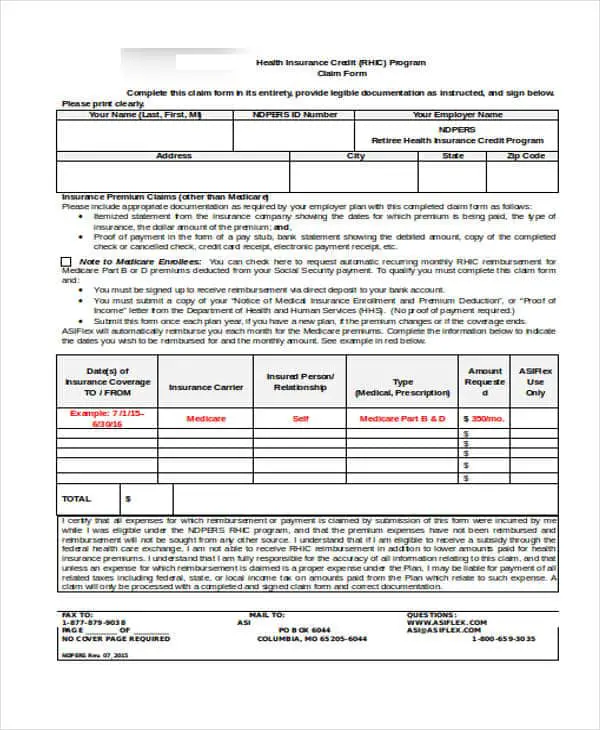

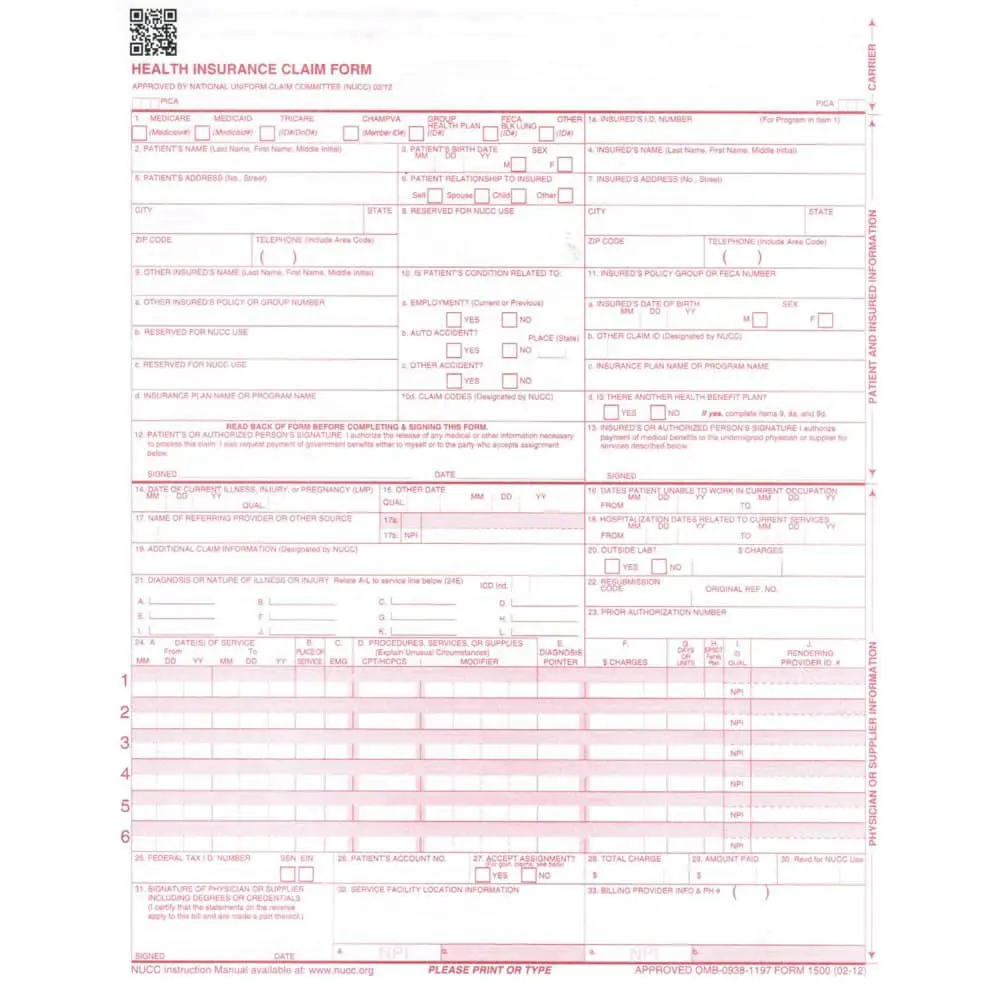

What Are The Documents Required To Make A Claim

Here is the list of common documents required while making a claim against your health insurance policy. However, documents may differ depending on the case.

Duly filled health insurance claim form.

Discharge summary of the patient

First Information Report or Medico-legal Certificate in case of an accident

Copy of the insurance policy

Original medical bills

Canceled cheque in case of reimbursement claims

How To Check The Status Of A Health Insurance Claim

As previously mentioned, there are two types of claims in health insurance, Cashless and Reimbursement Claims.

For cashless claims, you can check the status of your claim by approaching the insurance help desk of the hospital. They will initiate, process, provide details of deductibles and settle the claim by coordinating with ACKO.

On the other hand, for reimbursement claims, you can check your health insurance claim status by writing to us at

How to claim health insurance from multiple insurers

It is ideal for securing yourself and your family with adequate health insurance to mitigate the rising medical expenses. You may have employer health insurance and a personal health insurance policy, or you may have taken two different private health insurance policies. You may be wondering if you can raise a claim from multiple insurance companies. The answer is yes.

All you need to do is make a claim with the first insurer against the medical care expenses. Then, you need to procure the summary of the claim settlement from the first insurer, get the hospital bills and receipts attested by the hospital, and approach the second insurer to settle the balance of your medical expenses.

Also, read:How to claim medical insurance from multiple insurers

Recommended Reading: Should I Add My Spouse To My Health Insurance

Understand Your Health Insurance

An ounce of prevention is worth a pound of cure when it comes to health insurance claims. To help ensure your health insurance claims are approved:

- Read your policy to determine what’s covered.

- Understand how much the insurance company pays and what your responsibility is.

- Use in-network health care providers whenever possible.

- Obtain necessary preapprovals before getting health care.

Following your health insurance policy’s rules can prevent an unexpected medical bill. By managing your health care costs, you’ll keep your bank account in good health too.

Documents Needed For Health Insurance Claims

You need the following documents for a medical insurance claim:

-

Duly filled claim settlement form

-

Medical certificates, attested by the consulting doctors

-

Summary of the discharge

-

Original bills of the hospital and pharmacy

-

FIR copy, if any

-

Legal documents

Keep all the documents ready when you file your claim. This will smoothen and hasten the process and you will get your health insurance claim easily.

In conclusion

To ensure you get your claim, you first have to be honest and discreet when you apply for your health insurance plan. Never lie on your claim form and be open about your pre-existing illnesses, past health records, etc. If needed, opt for a critical illness insurance cover and stay protected in a comprehensive manner. Submit the correct documents and your claim will surely be processed without too many issues whatsoever.

Explore More:

IRDAI Registration No: 157

Category: Non-Life Insurance

The use of images and brands are only for the purpose of indication and illustration. ACKO claims no rights on the IP rights of any third parties. The ratings are derived from reviews and feedback received from Google and Facebook users on their respective platforms. | *Save Rs. 45,000 has been calculated on IDV of 20,00,000, 0% NCB and select add-ons. Amount saved is in comparison to Acko’s F& U filing. Product name: Private Car Policy – Bundled | UIN: IRDAN157RP0014V01201819 |

Don’t Miss: Can I Get Health Insurance

Filing A Claim As Soon As Possible Is The Best Way To Facilitate Prompt Payment

It’s best to submit claims as soon as possible. If you’re unable to file a claim right away, please make sure the claim is submitted accordingly.

Error loading table data.

Loading data…

If services are rendered on consecutive days, such as for a hospital confinement, the limit will be counted from the last date of service.

As always, you can appeal denied claims if you feel an appeal is warranted. Remember: Your contract with Cigna prohibits balance billing your patient if claims are denied because they were not submitted within the time frame outlined above.

How To File A Reimbursement Claim For A Health Insurance Policy

To file a claim settlement request under reimbursement claim, you must follow the below-mentioned steps:

- Collect your hospital bills – You must have all the hospital bills like medical bills, receipts, discharge documents, invoices, lab reports, X-rays, etc. in the order of occurrence to claim a reimbursement claim settlement process. You are supposed to submit these documents with the claim settlement form to the insurer to confirm the amount spent on your medical treatment.

- Fill the reimbursement form – A form provided by the insurer, either online or offline, has to be duly signed and carefully filled by the policyholder to make a reimbursement claim. The form should be submitted by post, fax, etc. to the insurance company along with the hospital bills collected. You must always keep a copy of these documents.

- After the form is submitted, the insurer will contact you regarding the claim request. It can be accepted or rejected based on the mentions in the health insurance policy. Therefore, you must carefully go through the fine print of your purchased policy to avoid any confusion.

- Once the documents are verified and the request is processed, your claimed amount will be transferred to your bank account.

Read Also: Is Health Insurance Really Worth It

Have Everything In Order

Filing a health insurance claim is an effort in futility if you dont have all of your paperwork in order. When going to your health care provider, be sure to receive an outlined and itemized bill detailing the services you received. Private insurance companies will ask that you attach original itemized invoices to the claim form for a full understanding of what the claim is related to. Be sure to review these bills to check for any errors in personal information or medical coding before preparing the documents for your health insurance company.

Your health insurance coverage should provide access to a claim form through their website or be able to mail it to your home. Depending on your health insurance plan, claim forms may have additional instructions about what other information you may need to get from your care providers.

As previously mentioned, health insurance companies will need the original documents for review, so be sure to make copies of everything for your personal records. This will allow your health plan to move forward with the claim process with greater ease. It will also help in the event you need to re-file your health insurance claim to seek a second look or in the event, your claim gets lost in the system.