How Does Not Having Coverage Affect Health Care Access

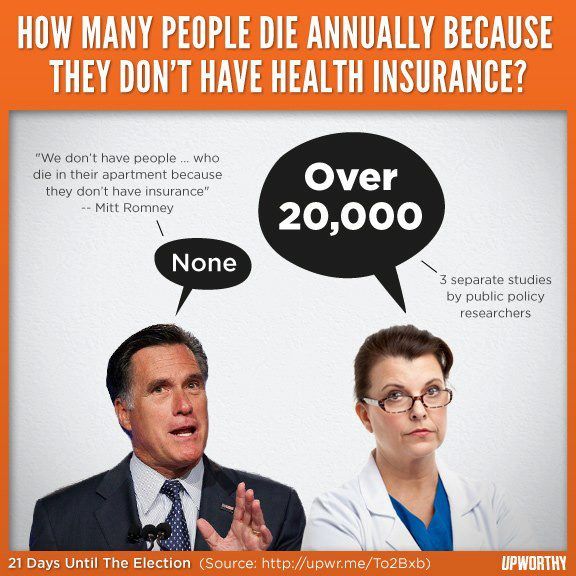

Health insurance makes a difference in whether and when people get necessary medical care, where they get their care, and ultimately, how healthy they are. Uninsured adults are far more likely than those with insurance to postpone health care or forgo it altogether. The consequences can be severe, particularly when preventable conditions or chronic diseases go undetected.

Key Details:

- Studies repeatedly demonstrate that the uninsured are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.8,9,10,11 More than two in five nonelderly uninsured adults reported not seeing a doctor or health care professional in the past 12 months. Three in ten nonelderly adults without coverage said that they went without needed care in the past year because of cost compared to 5.3% of adults with private coverage and 9.5% of adults with public coverage. Part of the reason for poor access among the uninsured is that many do not have a regular place to go when they are sick or need medical advice .

Figure 8: Barriers to Health Care among Nonelderly Adults by Insurance Status, 2019

- More than one in ten uninsured children went without needed care due to cost in 2019 compared to less than 1% of children with private insurance. Furthermore, one in five uninsured children had not seen a doctor in the past year compared to 3.5% for both children with public and private coverage .

Shorts Retreat Ahead Of Netflix Earnings

According to Tom Torre, Bend Financial cofounder and CEO, people may feel comfortable navigating how to get care and from whom, but they get stuck on financial aspects of care.

Theyre often confused with the details surrounding health insurance and the payment end of healthcarehow insurance works, what it covers and how much it pays for, the differences in types of coverage, and how payments are actually made, Torre said.

The survey tested respondents knowledge of health insurance components and financing tools. Though almost half guessed they had gotten most or all of the questions right, the survey revealed several misunderstandings.

Sixty-one percent incorrectly defined a health insurance premium as the amount paid to cover healthcare services before the insurance plan starts to pay, which is actually the definition of a deductible.

Only 20% of respondents could correctly identify all life events that would allow someone to sign up health insurance outside of open enrollment, and 59% of respondents incorrectly said that its illegal to have more than one health insurance plan at a time.

Asked what element of health insurance confuses them most, 52% of respondents said figuring out what counts toward their deductible, 47% said what procedures are covered, and 47% said what constitutes in- or out-of-network care.

Confusion comes at a costfinancially and clinically.

Medical costs can pile up unnecessarily.

Dont settle for the status quo, he said.

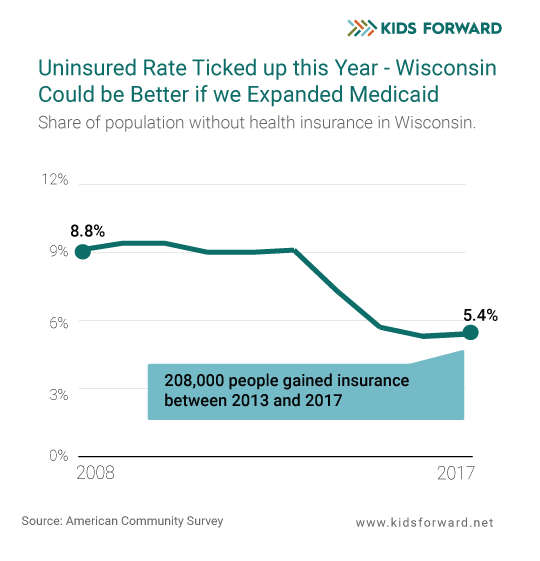

How Has The Number Of Uninsured Americans Changed Over The Years

The uninsured rate in the country increased until 2010. Since then, the introduction of the Affordable Care Act has caused a decline. The most significant drop was in 2016. The provision changes in the ACA triggered it, and the numbers were at their lowest at 10%.

Unfortunately, the number of people without health insurance began climbing again in 2017 and peaked in 2019. The downward trend has continued and sat at 9.2% in 2021.

You May Like: How To Get Health Insurance For Just My Child

How Many Americans Get Health Insurance From Their Employer

In 2021, the number of people covered by health insurance from their employer sits at around 156 million, or 49% of the countrys population. The average annual premium for employer-sponsored health insurance is around $7,739 for an individual and $22,221 for a family.

Employer-sponsored health insurance coverage of the U.S. population by state percentage

Source: The Kaiser Family Foundation.

According to the Kaiser Family Foundation, in small businesses, 29% of the employees with employer-sponsored health insurance have their entire premium covered by their employer for individual coverage, while in larger companies, only 5% have this benefit. On the other hand, 31% of covered employees in small businesses have to contribute more than half of their premiums for a family health plan, while only 5% of employees working in larger companies have to do so. These statistics on employer-sponsored health insurance show that for small businesses, employers tend to offer coverage that focuses on the employees individual care. It is important to find the right balance and offer health insurance plans that suit your business and employees.

Coverage Improves Access To Care

- Adult Medicaid enrollees are five times more likely to have regular sources of care and four times more likely to receive preventative care services than individuals without coverage. Children with Medicaid coverage are four times more likely to have regular sources of care and two to three times more likely to receive preventative care services than uninsured children.2 In addition, low-income children with parents covered by Medicaid are more likely to receive well-child visits than those with uninsured parents.3

- A higher proportion of individuals in Medicaid expansion states have a personal doctor than those in nonexpansion states.4

- Individuals with coverage are more likely to obtain access to prescription drug therapies. Individuals in states that expanded Medicaid have improved access to diabetes and asthma medications, contraceptives, and cardiovascular drugs.5,6,7

- Individuals with coverage are more likely to obtain an early diagnosis and treatment, which may ultimately contribute to improved health outcomes.8

- Individuals in Medicaid expansion states have higher rates of diabetes diagnoses than those in states that did not expand.9

- They receive more timely, and therefore less complicated, care for five common surgical conditions.10

- Medicaid expansion is associated with access to timely cancer diagnoses and treatment.11,12,13,14,15

Recommended Reading: How Do Subsidies Work For Health Insurance

Uninsured By Race And Ethnicity

You can also look at uninsured rates from the angle of race and ethnicity. MoneyGeek’s guide includes four groups: Hispanics, Non-Hispanic Whites, Non-Hispanic Blacks and Non-Hispanic Asians. The data spans three years from 2019 to 2021 showing how numbers may have changed over time.

However, these numbers only focus on adults aged 18 to 64. It excludes people covered by public health programs like CHIP, Medicare and Medicaid as they are plans that are available contingent on age.

Source: Centers for Disease Control and Prevention

Out of the four groups, Hispanics are most likely to be uninsured at 30.1%. At 14.1%, Non-Hispanic Blacks have an uninsured rate at almost half of the uninsured rate of Hispanics. Non-Hispanic Whites and Non-Hispanic Asians have single-digit rates of 8.7% and 6.3%, respectively.

If you observe how uninsured rates shifted within three years, only Hispanics show an increase from 2020 to 2021. All other groups, including Non-Hispanic Whites and Non-Hispanic Blacks, display a decrease.

Assisting Programs For Uninsured

| This section relies largely or entirely upon a single source. Relevant discussion may be found on the . Please help improve this article by introducing citations to additional sources. |

People without health insurance in the United States may receive benefits from patient-assistance programs such as Partnership for Prescription Assistance. Uninsured patients can also use a medical bill negotiation service, which can audit the medical bill for overcharges and errors.

On April 3, 2020, President Donald Trump announced that the federal government would use funds from the CARES Act to pay hospitals for treatment of uninsured patients infected with the virus that causes coronavirus disease 2019.

You May Like: How Long Can You Have Cobra Health Insurance

How Does Having Health Insurance Affect Peoples Access To Healthcare

The uninsured are less likely to catch potentially damaging health conditions early. Since they don’t maximize preventive care services like screenings and labs, their health is usually in worse shape by the time doctors make a diagnosis. If they can’t afford treatment, they’ll delay it until their finances improve. Worst-case scenario, they won’t get treated at all.

All these factors lead to more negative health outcomes.

What Impacts The Rate Of Uninsured People In The Us

At the moment, it is widely believed that Government-sponsored policies represent the main factor of influencing health insurance rates both in the US, but also in most of the worlds countries.

4. An overview of the Affordable Care Act, or Obamacare

With this in mind, its worth noting that the overall number of uninsured Americans first started improving back in 2011. As such, the most recent and most significant policy change was made in 2010 when President Obama fought to get the Affordable Care Act signed into law. The official version of the act is 906 pages long hence why we will try to offer a brief overview of the law, outlining its main goals, how it plans to achieve them, while also offering several Obamacare statistics. Before anything else, it is important to keep in mind that Obamacare was incredibly successful in increasing the rates of insured Americans and it has managed to achieve such an impact within only a few years.

5. The main goals of Obamacare

Read Also: What Insurance Does Oak Street Health Accept

Coverage Supports Appropriate Health Care Utilization

- Coverage can help direct individuals to the most appropriate site of care. Young adults who could stay on their parents health plan experienced decreases in non-emergent emergency department visits.33 Expansion populations in some states also experienced a decrease in ED visits and an increase in outpatient visits.34,35,36

- Coverage facilitates use of preventive care and management of chronic conditions. Individuals in expansion states saw significant increases in screening for diabetes, glucose testing among patients with diabetes, and regular care for chronic conditions.37

Drawbacks Of Offering Group Health Insurance

There is also the possibility that your employees will have worries and concerns about employer-sponsored health insurance. They may be in fear of discontinuation, so if you decide on offering a group health plan, it is important to be consistent. There is also a lack of individual control for their plans, so it may be beneficial to look for a plan that has a lot of flexibility.

Read Also: Should I Add My Spouse To My Health Insurance

Fewer People With Individual Market Coverage Have Health Issues

Given insurers incentives to exclude people with pre-existing conditions from individual insurance in most States, it is not surprising the proportion of enrollees with health issues in this market tends to be lower than that in other markets. We estimate that 14 to 43 percent of enrollees in the individual market have a pre-existing condition one-third to one-fifth less than the prevalence of pre-existing conditions among those with employer-sponsored insurance. This is consistent information from the industry one insurer, for example, reported that nearly 15 percent of its enrollees in 2010 had a rider that limited covered or increased deductibles for certain medical conditions.15

Currently, there is very little coverage of children with pre-existing conditions in the individual market 1 to 8 percent of children enrolled in this type of coverage has a pre-existing condition, accounting for at most 140,000 out of a total of 1.9 million children enrolled in this market. In part, this results because Medicaid and the Childrens Health Insurance Program help low-income and sick children get needed health care. However, despite coverage offered by Medicaid and CHIP, up to 2 million children with pre-existing conditions are uninsured. The new health law prohibits insurers from denying coverage to children based on a pre-existing condition.

Economy Bears Little Resemblance To That Of Today

Since the declaration on March 13 of a national coronavirus emergency, the nation has endured the deepest recession since the 1930s, fundamentally altering the economic landscape and making the 2019 findings an inaccurate gauge of current circumstances. The official unemployment rate, 3.5 percent in February, peaked above 14 percent in April and still exceeded 8 percent in August. Some 35 million people were either officially unemployed or lived with an unemployed family member in August, including 9 million children. This figure rises to 61 million workers and family members when one includes those not officially unemployed but nonetheless sidelined from the labor market, including workers with an unpaid absence from their job due to illness, caretaking responsibilities, or other reasons, as well as those who want a job but arent actively seeking work given the state of the labor market and the risks the pandemic poses.

In addition, millions of renters are behind on rent, and data suggest the number climbed higher over the summer.

Also Check: Does Health Insurance Cover Mental Health

Up To 86 Percent Of Older Americans Have A Pre

Not surprisingly, as people age, their likelihood of having or having had a health condition increases. Looking only at pre-existing conditions used in determining eligibility for high-risk pools, the percentage of Americans with these health conditions ranges from 5 percent of children to 48 percent of people ages 55 to 64. Adding in common conditions that major insurers generally use in medical underwriting raises the risk to 24 percent for children, increasing to 86 percent for people ages 55 to 64 .

Translating these percentages into numbers of people, there are 4 to 17 million children under age 18 with some type of pre-existing condition. Already, due to the new health reform law, insurers cannot deny coverage to children under the age of 19 based on a pre-existing condition a protection that would be revoked without the health reform law.

Where Americans Are Least Likely To Have Health Insurance

Southern states dominate the top of the list with the highest uninsured rates. Mississippi, Texas, Oklahoma and Georgia have all boosted their insured ranks during the pandemic, yet they still have a far higher percentage of uninsured people than the national average of 8.0%, with Mississippi leading at 14.4%.

Texas, which had the highest uninsured rate in the U.S. as the pandemic took hold with more than 1 in 5 people uninsured follows at a now-slimmer 13%. Oklahoma and Georgia are almost neck-in-neck in their proportion of uninsured citizens both now and at the beginning of the pandemic 12.4% and 12.0%, respectively, in 2022.

There are 23 states, mostly in the South, Midwest and West, where the uninsured rate is above the 8.0% national average, according to the Census data analyzed by ValuePenguin.

One reason that some Southern states could have lower insured rates is that they havent expanded their Medicaid programs to working people who otherwise cant afford a health insurance plan, according to a U.S. Department of Health and Human Services report from February 2022.

A study published earlier by the Journal of the American Medical Association in July 2021 found that people in the South also had the highest amount of medical debt, which can also be attributed to the Souths general lack of expansion of Medicaid to those who might need it because their salaries arent high enough to otherwise pay for insurance.

You May Like: How Can Undocumented Immigrants Get Health Insurance

Improving Insurance Design And Protecting Consumers From Medical Debt

The primary purpose of health insurance is to help people get health care in a timely fashion and protect them from catastrophic costs in the event of serious illness. Insurance fills these needs when coverage is continuous and comprehensive. While the ACA helped the U.S. make great strides toward better health coverage, the job is not done.

With this years survey, the Commonwealth Fund introduces a new baseline. Historically, the Commonwealth Fund Biennial Health Insurance Survey was conducted exclusively using phone administration via stratified random-digit dial phone sample. This year, however, we shifted to a hybrid sample design that utilized stratified address-based sample , combined with SSRS Opinion Panel, and prepaid cell phone sample. Other changes include expanding the survey to include all adults age 19 and older and making refinements to how we calculate poverty status and determine underinsurance for borderline cases. Collectively, these changes affect year-to-year differences in our trend questions. For that reason, this years brief does not report on trends.

This brief focuses on adults under age 65. The resulting weighted sample is representative of approximately 196.7 million U.S. adults ages 19 to 64. The survey has a maximum margin of sampling error of +/ 1.7 percentage points at the 95 percent confidence level for this age group.

Health Insurance Claim Denial Statistics

15. Over 19% of the insurance claims submitted via in-network services in 2017 were denied by insurers.

This statistic sheds some light on claim denial by US health insurers, which seems to be quite prevalent. It is, however, important to mention that denial rates are based on a series of factors, including the medical conditions stipulated in the contract, alongside health care availability and funding.

Recommended Reading: How Much Does It Cost To Get Private Health Insurance

The Impact Of The Affordable Care Act

Since its enactment in 2010, the Affordable Care Act has had a major impact on the number of uninsured Americans. The ACA has expanded access to health insurance through the introduction of state and federal marketplaces, subsidies, and Medicaid expansion. Furthermore, the law prohibits insurers from denying coverage to individuals with preexisting conditions.

As a result of these changes, the number of uninsured Americans has dropped significantly. According to the CDC, the rate of uninsured adults aged 18-64 fell from 20.4% in 2013 to 12.7% in 2018. This decrease in the number of uninsured citizens is largely attributed to the ACA.

Us Health Insurance Statistics

1. Around 49% of the countrys total population receive employer-sponsored health insurance .

Health insurance coverage statistics show this to be the case and most of the group insurance may include life, health or some other type of personal insurance coverage.

The highest percentage of state residents that benefit from group insurance are currently working in the northeast and midwest regions. Utah and North Dakota top this list with more than half of their residents being covered by group insurance.

Additionally, California, Texas and New York respectively have the highest number of individuals receiving employer-sponsored health insurance in the United States. This is primarily because these are large and economically strong states, with almost half of their populations having group insurance.

2. In 2019 most US states eliminated the individual mandate penalty.

This is part of the many health care economic issues faced by the country today. People were concerned about paying penalties, which is why at the end of 2018, the penalty was reduced to $0 and will remain so throughout 2021.

There are, however, penalties in 2021 for not being insured in the states of New Jersey, California, Massachusetts, Rhode Island and the District of Columbia, unless you are eligible for an exemption. The penalties everywhere else are removed but the original individual mandate still exists.

5. Roughly 21% of Americans were insured by Medicare in 2019.

Statista

Statista

Jama Network

Recommended Reading: Does Short Term Health Insurance Cover Pregnancy