How To Prepare To Leave A Job

Before quitting your job, review all of your options for health insurance. Remember that everyones medical and financial situations are different. You might benefit from continuing coverage via COBRA, or it may make more sense to join an individual plan through the marketplace.

Use these tips to make sure youre covered when your employer-sponsored insurance expires:

- Talk with your HR representative before you resign to learn how your employers insurance plan works and when youll lose coverage.

- Consider quitting earlier in the month if your company lets you keep coverage until the last day of the month. This could give you the time you need to get new coveragesuch as from a new employerwithout having to pay for COBRA.

- Gather any documents youll need to enroll in your new health insurance plan. For example, the marketplace offers a convenient checklist to help you apply for a plan.

Failure To Provide Coverage

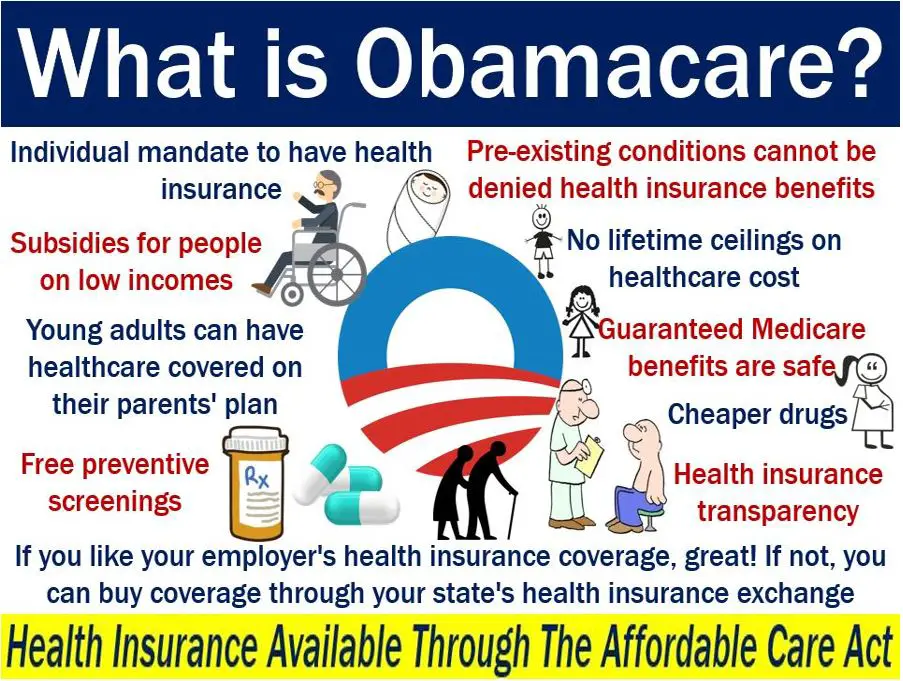

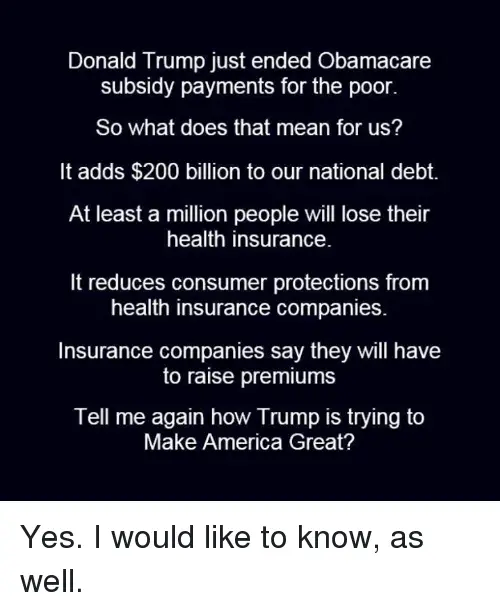

Employers that have enough workers to trigger the coverage requirement are referred to as applicable large employers or ALEs. The law calls for penalties on applicable large employers that fail to sponsor coverage as required, just as it fines individuals who fail to have basic health coverage.

Like many other elements of the Affordable Care Act, these penalties take effect over time. From 2016 and beyond, penalties will apply to those with 50 to 99 employees.

I Just Lost My Employer Coverage Can I Get A Subsidy For My New Plan

Its very likely that you can. To see how much of a subsidy youll receive, follow the steps above by first estimating your annual income. This can be hard to do after just losing a job, but remember, you can always update it throughout the year as your income changes. Just make sure you meet the requirements listed above to make sure you can receive your subsidy.

Read Also: Kroger Associate Discounts

What Else Do I Need To Know About How The Health Insurance Subsidy Works

If your subsidy is paid in advance, notify your health insurance exchange if your income or family size changes during the year. The exchange can re-calculate your subsidy for the rest of the year based on your new information. Failing to do this could result in getting too big or too small a subsidy, and having to make significant adjustments to the subsidy amount at tax time.

What Does Subsidies Mean In Health Insurance

Getting Coverage Health coverage available at reduced or no cost for people with incomes below certain levels. Examples of subsidized coverage include Medicaid and the Childrens Health Insurance Program . Marketplace insurance plans with premium tax credits are sometimes known as subsidized coverage too.

You May Like: Starbucks Health Insurance Options

Question: What Does Subsidy Mean In Health Insurance

A subsidy is financial assistance that helps you pay for something. Its not a loan you dont pay it back. There are two kinds of subsidies available from the federal government for individual health insurance plans. The Advanced Premium Tax Credit lowers your monthly health insurance payment, or premium.

How Much Do Cost

CSR reduces the maximum out-of-pocket exposure on a Silver plan for households with eligible incomes.

For 2022 coverage, the unsubsidized maximum allowable out-of-pocket limit for an individual is $8,700 . But as long as they select Silver plans, enrollees who are eligible for cost-sharing subsidies are automatically given lower out-of-pocket limits .

For people who arent eligible for CSR, the silver plans displayed on the exchange website will have their regular out-of-pocket maximums, which can be up to $8,700 for an individual in 2022. For those who are eligible for CSR, the Silver plans will have maximum out-of-pocket limits no higher than the following:

- For applicants with MAGI between 100% and 200% of FPL, the maximum out-of-pocket on a Silver plan in 2021 is $2,900 for a single individual and $5,800 for a family.

- For applicants with MAGI between 200 and 250 percent of the poverty level, the maximum out-of-pocket for Silver plans in 2021 is $6,950 for a single individual and $13,900 for a family.

- In both cases, plans can be offered with even lower out-of-pocket limits, but cannot exceed those limits.

Recommended Reading: Does Starbucks Provide Health Insurance

What To Do After Quitting Your Job

When you quit your job, you can temporarily continue your employer-sponsored insurance plan thanks to a federal law known as COBRA. Some adjustments take place, however. You end up paying the cost of your health insurance coverage, as well as a maximum of 2% for added administrative costs. This can be quite the shocker if you have been used to your employer paying your coverageâs premium.

Also Check: How Long After Quitting Job Health Insurance

Quick Answer: What Is Tax Subsidy For Health Insurance

A subsidy is financial assistance that helps you pay for something. Its not a loan you dont pay it back. There are two kinds of subsidies available from the federal government for individual health insurance plans. The Advanced Premium Tax Credit lowers your monthly health insurance payment, or premium.

Read Also: Does Starbucks Offer Health Insurance To Part Time Employees

Advance Premium Tax Credit

The advance premium tax credit is a tax credit that helps lower the costs of monthly health insurance premiums. You may qualify for the credit if your household income is between 100% and 400% of the federal poverty level.

The value of the APTC, as described in the previous section, is the difference between the premium of the second-lowest cost Silver plan and the premium cap your state has set for your income level. You can use the APTC for any plan available through the marketplace.

There are two ways to use the APTC: You can take it in advance or get a credit when you file your tax return.

If you opt to take the credit in advance, you can use it throughout the year by applying the credit directly to the payments you make to your insurance company. Then, when you file your tax return, you report the exact amount of subsidy you used throughout the year. You only need to provide an estimate of your annual income in order to qualify for a subsidy, so your tax return allows the government to check that you received the proper subsidy based on what your actual income was for the year.

You can also opt to receive the entire credit when you file your taxes. The biggest challenge with this option is that you will still have to pay the full premiums throughout the year, which may not be affordable for many of the people who qualify for subsidies.

What Is The California Tax Penalty

California enacted legislation to restore the individual mandate and tax penalty starting in 2020. Those who choose to go without coverage may be subject to a penalty as part of their annual state tax filing if they have access to affordable coverage within the cost limitations set by the state. There can be penalties of up to nearly $2,250 per family, which is based on 2.5 percent of household income or a minimum of $750 per adult and $375 per dependent child under 18 in the household, whichever is greater. The California Franchise Tax Board, which administers the state mandate, will assess the penalties for the coverage year when consumers file their taxes.

Californians can file for an exemption due to financial or other hardship. Visit Covered California to learn more or, for additional information, visit the California Franchise Tax Board.

If the federal individual mandate penalty is reinstated at any point, the state tax penalty will be adjusted.

Read Also: Do Starbucks Employees Get Health Insurance

How Long Do You Have Health Insurance After Leaving A Job

How long do you have health insurance after leaving a job? If you quit your job without another one with benefits lined up, its worth wondering how long you have health insurance after you resign. After leaving a job, you can have health insurance for up to 36 months with the COBRA health insurance option.

Lower Your Monthly Premiums With The Nj Health Plan Savings

On July 31st, 2020 Governor Phil Murphy signed into law legislation restoring a key funding source of the Affordable Care Act that will be used to make health coverage more affordable.

New Jerseyans now have access to a state subsidy called New Jersey Health Plan Savings that will lower the cost of health insurance. These new savings are only possible because New Jersey is now operating the Health Insurance Marketplace through GetCovered.NJ.Gov.

The New Jersey Health Plan Savings will decrease the costs of premiums for current Marketplace enrollees and for new enrollees. NJHPS began lowering premiums for coverage starting January 1, 2021.

Similar to the Advance Premium Tax Credit , New Jersey residents will qualify for these new savings based on income. Tax households with annual incomes up to 600% of the FPL will receive NJHPS. An individual with an income of up to $77,280 and a family of four who makes up to $159,000 can receive state subsidies to lower the costs of health coverage. These savings are in addition to federal financial help. Anyone who qualifies will be able to see a lower premium when using our plan comparison tool or after filling out an application.

How do I know if I qualify to receive these subsidies?

Will this affect my current Federal Subsidies ?

How can I figure out how much of the subsidy I would be qualified for?

Consumers can get estimates of financial help and health plan costs by using the GetCoveredNJ Shop and Compare Tool.

You May Like: How To Enroll In Starbucks Health Insurance

Private Firms And Competition

The Original Medicare is a federal program the rest of the civilian healthcare systems use private firms to deliver medical services.

Within Obamacare, there are subsidized premiums and cost sharing reduction assistance. Comparison shopping is an excellent way to find the best value in health insurance. The subsidies are important for lowering prices.

Medicare For All: Limited Expansion

There have been at least two bills that would generally give Americans the option of getting Medicare starting when theyâre 50.

- Debbie Stabenow introduced a âMedicare at 50â proposal.

- Some members of the House of Representatives introduced a Medicare Buy-In and Health Care Stabilization Act of 2019. It would include an option for employers to make pre-tax contributions toward employee premiums, according to Rep. John Larsson âs House web page.

You May Like: Starbucks Insurance Plan

What Health Benefits Can Be Paired With Aptc Without Risking Penalties

When offering a health benefit to your employees, you need to be careful. If they receive a healthcare subsidy, you could end up penalizing your employees at tax time if they take their APTC and the benefit. In some cases, your benefit could result in your employees losing their health insurance subsidy and having to pay back the APTC they received.

Applicable large employers with 50 or more full-time equivalent employees must provide a health benefit with minimum essential coverage . But, this doesnt mean that you have to offer a traditional group health plan.

If you decide to offer a group health plan, your employees will no longer be eligible for a premium tax credit subsidy. While this works in the employees favor since they no longer need their own individual health insurance policy, adding employer-sponsored coverage can be expensive and time-consuming. For most small businesses, offering group health insurance coverage isnt practical.

Thankfully, there are other alternatives for providing health benefits to your employees.

An HRA is a popular health benefit option for organizations that allows employers to reimburse their employees for healthcare expenses. However, depending on the type of HRA offered, employees may be required to reduce or waive their premium tax credits.

With a qualified small employer HRA , your employees must reduce their premium tax credit subsidy by the monthly allowance of the QSEHRA.

One Of These Health Insurance Subsidies Is The Premium Tax Credit Which Helps Pay Your Monthly Health Insurance Premiums

What does subsidy mean in health insurance. You dont pay it back. Subsidized health insurance is an insurance plan with reduced premiums. Put simply a health insurance subsidy helps you to pay for your health insurance.

Its not a loan. Some consumers between 200 and 400 of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums. Your eligibility is generally determined by your household income and family size.

Ad Compare 50 Medical Insurance Plans Designed for Expatriates. A health care subsidy is financial assistance from the government that you could be eligible for to help you pay for health insurance. Get a Free Quote.

Examples of subsidized coverage include Medicaid and the Childrens Health Insurance Program CHIP. Subsidized health insurance is an insurance plan with reduced premiums with health coverage thats obtained through financial assistance from programs to help people with low and middle incomes. Subsidy often goes to people or institutions in need but the subsidy is also a way of providing an incentive.

Some subsidies also help by lowering other costs like your copays. Health coverage available at reduced or no cost for people with incomes below certain levels. The premiums are reduced because of the involvement of an outside entity that is paying or subsidizing the premium payment.

Pin On Design

Dont Miss: Starbucks Medical Insurance

Also Check: Starbucks Health Insurance Part-time

What Are Premium Subsidies

The Affordable Care Acts premium subsidies technically premium tax credits were designed to help Americans purchase their own health insurance. They became available as of 2014, and for most people who enroll in coverage through the exchange/marketplace, the premium subsidies cover the majority of the monthly premiums.

- The ACA premium subsidies are tax credits, but they can be taken upfront, paid directly to your health insurance company each month, to offset the amount you have to pay in premiums . The premium subsidy is then reconciled on your tax return, to make sure that the correct amount was paid on your behalf.

- As of early 2021, 86% of all marketplace enrollees were receiving premium subsidies. The average full-price premium was $575/month at that point, and the average subsidy covered $486 of that.

- Premium subsidies became larger a few months into 2021, when the American Rescue Plan was enacted:

- Full premium subsidies became available in 2021 for people receiving unemployment compensation.

Medicare For All: Public Plan Options

These bills would make Medicare-based health plans available to more people according to Kaiser Family Foundation.

- The Choice Act would add a public health insurance option, similar to the plans available on the federal health insurance Marketplace exchange created by the Affordable Care Act . The plans would be ACA-compliant and may include other benefits besides those the ACA requires.

- The Medicare-X Choice Act of 2019 would make health insurance available in areas where there are very few health-care providers or health insurance plans, whether on or off the Marketplace. It would make more people eligible for premium tax credits.

- The Choose Medicare Act would expand Medicare eligibility to include businesses as well as individuals. Unlike some proposals, the Choose Medicare Act would involve private health insurance, in an effort to increase competition and reduce consumer costs.

You May Like: Evolve Health Insurance

How To Apply For Health Care

Whether or not you get a subsidy, signing up for a plan from the marketplace is the same. You have to wait until Open Enrollment in order to choose a new plan. For 2021 plans, thats the period from Nov. 1, 2020, to Dec. 15, 2020 . Whichever plan you choose will go into effect starting on Jan. 1 of the next calendar year.

The only way to sign up for a health plan outside of Open Enrollment is if you qualify for Special Enrollment. Special Enrollment is available to people who experience a qualifying life event . This is a major change to your life, such as getting married or divorced, having a baby, or starting work for a new employer.

Learn more about Special Enrollment and how you can qualify.

Cost Sharing Reductions Lower Your Other Costs

Cost sharing reductions lower the amount you have to pay out of pocket when you get care, costs like deductibles, copayments and coinsurance. To take advantage of these savings, you must qualify and enroll in a Marketplace Silver qualified health plan. There is no option to get cost sharing reductions by filing a year-end tax return. If you qualify for this type of aid, you pay less out of pocket for things like deductibles, copayments, and coinsurance when you get care.

Recommended Reading: How To Keep Health Insurance Between Jobs

How Do You Choose

Here are the five factors to weigh before you pick a plan:

1. How much premium can you afford each month?

Pick a plan with an affordable monthly premium. If you cant manage your premium each month,you wont have continuous coverage and will be at risk for potentially high medical bills.

2. How much can you afford to pay out of pocket, if you or your family needs a lot of medical services?

Ask yourself if you have enough savings to pay the plans entireout-of-pocket maximum if the worst happens. Otherwise, you will again face potentially unaffordable bills.

3. Do you travel outside of the plans service area?

For example, do you visit relatives in another state, or county, or even zip code that is out of the geographic area the policy covers? Know those boundaries. And double-check your policys definition of the emergency services the plan covers. Stuff happens.

4. Is your primary doctor in-network? If not, are you willing to change doctors?

If your primary doctor isnt in-network, you can ask that doctor what insurance he or she accepts and go from there. Or you could decide to shop around for a new primary doctor that youd be willing to see regularly.

5. Are your specialists in-network?

Your relationship with your specialist may be what is keeping you healthy. Its crucial to pick a plan that offers the best doctors for your conditions.

An HMO, also known as a Health Maintenance Organization, is one of the most common types of insurance plans.

Limited Network