Know Your Medical Needs

Everyone is different. You and your familys medical needs probably wont be the same as the Joneses next door, so its important to know what you want and find a health insurance plan that makes sense for you.

For example, if you have any prescriptions, you should check whether or not they will be covered under COBRA or a marketplace insurance plan. Take a look at the overall coverage and provider network as well.

How To Sign Up For Cobra

Your employer or health insurance administrator must let you know you that you have a right to enroll in COBRA. You then have at least 60 days to decide if you want to sign up.

You must tell the plan sponsor if you think you qualify because of divorce, legal separation, or the loss of dependent/child status. You can elect to take COBRA even if the primary employee elects not to do so.

You must pay your first COBRA premium within 45 days of accepting your plan. Contact the administrator or your companys human resources department for help if you’re not clear about the process, or if you didn’t receive a letter of eligibility.

Money Saving Alternatives To Cobra Health Insurance

Theres no denying the fact that COBRA insurance can be expensive. These alternatives to COBRA provide similar coverage at a fraction of the price. Call us today for all your cobra health insurance questions and alternative options!

With over 27 million Americans on the verge of losing health insurance, its a great idea to understand the process of what comes next. Since health coverage may literally save your life, you need to know where to get it.

COBRA health insurance is a mandatory plan offered by your employer. People will seek these more affordable alternatives to COBRA due to the high cost.

You May Like: Starbucks Dental Coverage

All About Cobra Health Insurance

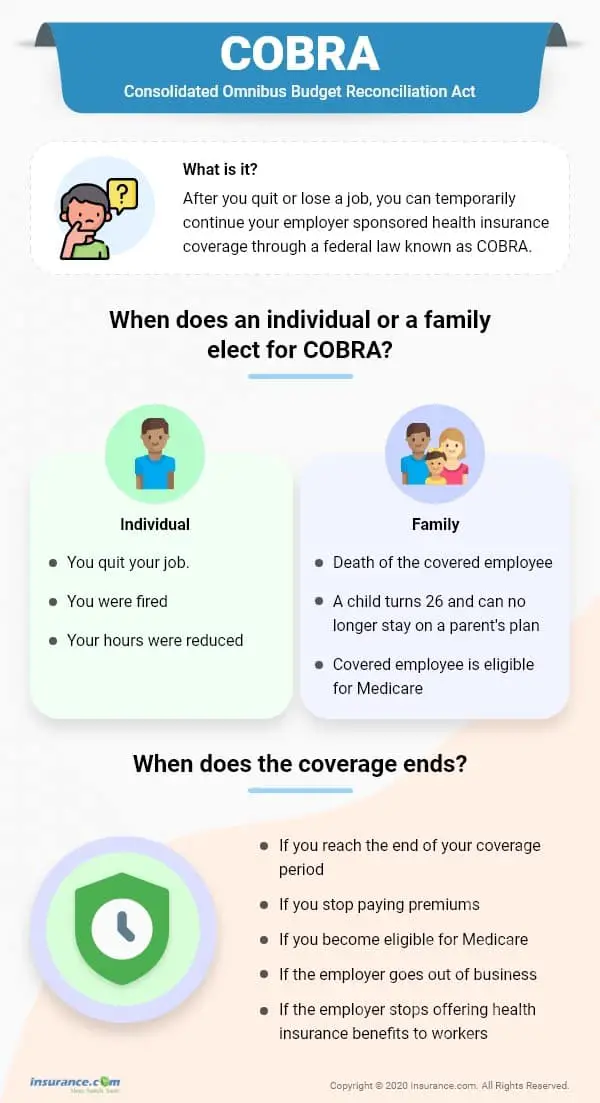

There are many situations in which a person may lose their health benefits if an employee loses their job, experiences reduced work hours, or is transitioning between jobs to cover the window of time before being eligible for coverage at the new job.

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, continuation of coverage helps cover those gaps and keep families covered.

COBRA requires large employers with more than 20 employees that offer group health plans to extend their health care where the coverage may end temporarily. This guide will cover what COBRA is, the coverage it provides, who is eligible, and other options available.

What Are Some Alternatives To Cobra

If you reject COBRA coverage, your health coverage options include your spouse’s health insurance plan, the federal government’s health insurance marketplace, your state’s health insurance marketplace, the government-backed Medicaid program, or a short term medical policy designed for gaps in health coverage. These alternatives may or may not cost less than COBRA coverage, so it pays to weigh all of your options.

One option that Szymanski doesn’t recommend: skipping health insurance altogether. “Electing to go uninsured is almost always a very unwise decision, with lots of potentially catastrophic downsides and very little upside,” he says.

Recommended Reading: Starbucks Insurance Plan

Whats Covered Under Cobra

With COBRA, you can continue the same coverage you had when you were employed. That includes medical, dental and vision plans. You cannot choose new coverage or change your plan to a different one. For example, if you had a medical plan and a dental plan, you can keep one or both of them. But you wouldnt be able to add a vision plan if it wasnt part of your plan before COBRA.

What If You Change Your Mind And Decide You Want Cobra

If you are entitled to elect COBRA coverage, you must be given an election period of at least 60 days. If you decline COBRA coverage during the normal 60-day decision period, you must be allowed to rescind your coverage waiver. However, you must reverse your decision during that period, and your final decision will become permanent after the 60-day window closes.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

What Happens If I Already Have Cobra Coverage Can I Switch To Aca Health Insurance

Yes and no. If you choose to enroll in COBRA, you can switch to ACA health insurance under the following circumstances:

- You have used up all of your COBRA coverage.

- You have another qualifying life event that makes you eligible for another Special Enrollment Period.

- It is the annual Open Enrollment Period.

You wont be able to switch to ACA health insurance outside of those situations. So consider your circumstances before discontinuing your COBRA coverage, or you may end up without health insurance coverage.

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Are The Alternatives To Cobra When I Leave My Job

COBRA isnt your only option when you lose your employer-sponsored plan. Depending on your situation, you may qualify for other health benefits:

- Join your spouse/partners employer-sponsored plan. Leaving your job triggers a special enrollment period that allows you to join your spouse/partners plan. Even if your spouse isnt enrolled in their employers plan, your job loss allows you both to sign up outside the usual open enrollment period within 30 days. Find out how qualifying life events, like marriage or having a baby, affect your health coverage.

- Choose a plan through the health insurance marketplace at healthcare.gov. You dont need to wait until Open Enrollment in the fall if you have a qualifying life event, such as leaving a job. You have 60 days to choose a plan, and your benefits will start the first day of the month after you lose your insurance.

- Enroll in a trade/professional group plan. You may be able to find plans with lower premiums through nationalorganizations that offer benefits for independent workers, such asthe National Association for the Self-Employed or the Freelancers Union . No proof of self-employed status is required.

- Low- and moderate-income families may be eligible for the Childrens Health Insurance Program . If you earn too much to qualify for Medicaid, you may be able to get your kids low-cost coverage through CHIP, which is jointly funded by states and the federal government. You can find more information on healthcare.gov.

Outsourcing Your Cobra Administration

Complying with COBRA can be a pretty taxing job. Even big companies save time and money by outsourcing administration to companies that specialize in doing it. The complicated issues involved, particularly if you have more than a few employees, are a very good reason to consider outsourcing your administration duties.

Read Also: Starbucks Health Insurance

Cobra Health Coverage Offers A Number Of Benefits:

Continuity in Coverage

Generally, your coverage under COBRA will be the same coverage you had while you were an employee. This is helpful if you would like to continue to see your same doctors and receive the same health plan benefits.

Coverage for Dependents

Your dependents are also eligible for COBRA coverage, even if you do not sign up for COBRA coverage.

Avoiding a Lapse in Coverage

COBRA can help those who need health coverage during the time between losing job-based coverage and beginning other health coverage.

Generous Time to Enroll

You have 60 days to enroll in COBRA once your employer-sponsored benefits end. Even if your enrollment is delayed, you will be covered by COBRA starting the day your prior coverage ended. You will received a notice from your employer with information about deadlines for enrollment.

Long-Term Coverage is Available

While COBRA is temporary, in most circumstances, you can stay on COBRA for 18 to 36 months. This coverage period provides flexibility to find other health insurance options.

However, the plan may require you to pay the entire group rate premium out of pocket plus a 2% administrative fee, so cost is an important consideration when exploring COBRA as a health coverage option.

Do I Qualify For Health Insurance After I Lose My Job What About My Family

Unless you work for the government or a church, and as long as you are employed by a business with 2 or more employees, you are a covered employee and eligible to continue your group health coverage. There is no requirement that you work for your employer for a certain amount of time. Your employer must also offer you a COBRA extension even if you are also covered by another policy, such as a spouses policy through his or her job.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Youre Covered Under A Group Health Plan

If you, your spouse and your children are covered under your workplace health plan, your whole family can get in on the COBRA action. But if you were the only person covered, then no one else in your family would qualify for COBRAjust you.

Your spouse or children covered under your old jobs plan will also be eligible for COBRA if:

- You pass away. Even though you obviously wont need health insurance anymore, your family can still stay covered under COBRA.

- You get divorced. If you and your spouse split up and theyre on your health plan, they can keep that same coverage with COBRA. The same thing applies if youre on their health plan.

- You move to Medicare. When you make the switch to Medicare, your family can extend their coverage under COBRA.

- Your kid grows up. Once your kid turns 26, theyre on their ownat least when it comes to health insurance! But while they hunt for their own insurance plan, COBRA can prevent a gap in coverage, if it comes to that.

Whats My Timeline To Choose Whether To Sign Up For Cobra Insurance

You have some time to think about opting into COBRA, but not much.

The clock starts ticking when you lose coverage or hear from your employer. When that happens, you qualify for a special enrollment period and have 60 days to choose COBRA continuation coverage or a marketplace plan. If you say “No thanks!” to COBRA, youll have to choose a marketplace plan.6

If you miss that window and dont sign up for COBRA or a marketplace health plan, youre putting yourself in a dangerous position.

First, once the initial 60 days are up, you wont be able to sign up for COBRA at all. And second, if you didnt sign up for any health insurance plan during that time, you might have to go uninsured until the next open enrollment period. Thats a big risk to take. What if you or someone in your family has a medical emergency and you dont have insurance?

It doesnt matter how young, healthy or wealthy you are. If youre alive and breathing , then you need health insurance. No exceptions! Medical bills are the number one cause of bankruptcies in the U.S.7 Dont roll the dice on your health or your finances. Its just not worth it.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

The Cost Of Cobra Insurance

When they participate in group rates for health insurance during an employees term, employers typically take on 80% of the coverage costs while the employee will take on the remaining 20%. With COBRA health insurance, the individual is required to pay the entire premium, including a potential 2% administration fee.

The cost for a former employee who chooses to participate in COBRA will see their insurances rates increase significantly compared to their priors health insurance costs. COBRA is a more affordable option compared to individual health coverage plans. Under the Affordable Care Act, a person should compare coverage to see which benefit works best for their budget.

Managing A High Cobra Premium

If you’re considering COBRA coverage but you’re concerned about the differences between the cost of insurance coverage through this program and the cost of insurance with the support of an employer, there are a number of important considerations to keep in mind.

When you lose your job, you generally lose your flexible spending account . If a job loss is threatened, you are allowed to spend your entire year’s contribution to the FSA before you become unemployed. If you were going to contribute $1,200 for the year but it’s only January, for example, and you’ve only had $100 withheld from your paycheck for your FSA, you can still spend all of the $1,200 that you were planning to contributesay, by seeing all of your doctors and filling all of your prescriptions immediately.

Upon choosing COBRA, you can change your plan during the employer’s annual open enrollment period and opt for a less expensive plan like a preferred provider organization , or health maintenance organization .

If available, a refundable tax credit called the Health Coverage Tax Credit can be utilized by qualifying individuals to pay up to 72.5% of qualified health insurance premiums, including COBRA continuation coverage. The HCTC program was due to expire on Dec. 31, 2020, but the Internal Revenue Service has extended the program through Dec. 31, 2021.

You can use your health savings account to pay COBRA premiums as well as medical expenses, which could significantly reduce the sting of losing benefits.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Do I Need To Know About Paying For Cobra

Your COBRA administrator should tell you within 14 days about the COBRA4 continuation coverage thats available to you.

If you qualify for ARPA there is a 100% subsidy, which means COBRA premiums are covered including the 2% administrative fee that health plans are permitted to charge for COBRA. This subsidy is available April 1, 2021 through September 30, 2021.

Under regular COBRA youd have to pay the full premium for your health care coverage, plus an administrative fee. When you were employed, your employer generally paid for some of the cost of your health insurance premium, and now you will responsible for the full amount. That means you may pay more for COBRA coverage.

Who Can Enroll In Cobra Health Insurance

If your employer-sponsored health insurance plan is covered under COBRA, youll get COBRA insurance as an option if you quit or lose your job. Youre also eligible if your hours are reduced. If you have a spouse or dependent children on your employer-based health insurance, theyll also be covered in those circumstances. In addition, they can also enroll in COBRA health insurance if you become entitled to Medicare, get a divorce or legal separation, or pass away.

Each qualified beneficiary is independent of others. That means each individual can make their own choices as to what sort of coverage to get under COBRA.

You May Like: Starbucks Employee Insurance

How Much Does Aca Health Insurance Cost

The cost of ACA health insurance depends on the type of plan you choose. They can range from catastrophic plans with low premiums and high deductibles. All the way to gold tier plans with higher premiums and more comprehensive coverage. Before subsidies, the average lowest-cost Bronze plan in 2020 was $331 per month and the average Silver plan was $$442 per month, according to the Kaiser Family Foundation. However, after subsidies, the average person in HealthSherpas study paid $47 because they received a subsidy of an average of $634. Although the sticker price of Obamacare plans can be high, 94% of people received a subsidy on HealthSherpa during 2020 Open Enrollment.

Enter your zip code below to find out how much you can save:

If you need help enrolling, you can call our Consumer Advocates at .

Cobra Is Available For 18 Or 36 Months

The good news for many people is that a COBRA health plan from their former employer satisfies the individual ACA mandate, while protecting their families health and wellbeing as they previously had. COBRA insurance coverage may last up to 18 months. Depending on your circumstances, you may be entitled to 36 months of continued coverage.

Read Also: Starbucks Employee Health Insurance

When Can I Enroll In Cobra Coverage

Typically you have at least 60 days after you lose your employer-sponsored health insurance to decide whether you want to enroll in COBRA health insurance.

COBRA coverage can also be retroactive, so no need to worry about a coverage gap during that enrollment window either. If you decide to pay for COBRA coverage and pay your premiums retroactively, your coverage will also be retroactive. That means any medical bills that would have been covered during your enrollment period will be reimbursed once youre enrolled.

An Affordable Alternative To Cobra Health Insurance:

Since a move to COBRA often means more money out of your pocket, signing up for coverage through the federal marketplace will be a much more affordable option for many. Blue Cross and Blue Shield of North Carolina® offers excellent insurance plans through the marketplace which often make available better coverage at a lower cost than COBRA coverage.

If you or a family member recently lost your job and are considering COBRA insurance, or if your current COBRA coverage eligibility is coming to an end, then you may qualify for a special enrollment period and will not need to wait for an annual open enrollment period in order to begin coverage. A few moments with a qualified agent at WNC Health Insurance / The Asheville Blue Cross and Blue Shield of North Carolina® Store to discuss your options will be time well invested!

You May Like: What Insurance Does Starbucks Offer