High Medical Discount Plans

Medical discount plans often promise to save you money on items your insurance may not cover. You pay a monthly fee, and they offer slashed-price services. While there are some legitimate plans, if it seems too good to be true, it likely is. High-rate medical discount programs are often a red flag for fraud. Before you sign up for a medical plan, check the details and coverages carefully, make sure your doctor participate, and get the terms in writing.

These programs are eitherfake, dont cover the basic or essentials you need, or dont have the promised discounts, explains Shawn Plummer, owner and CEO of The Annuity Expert, representing over 50 insurance companies.

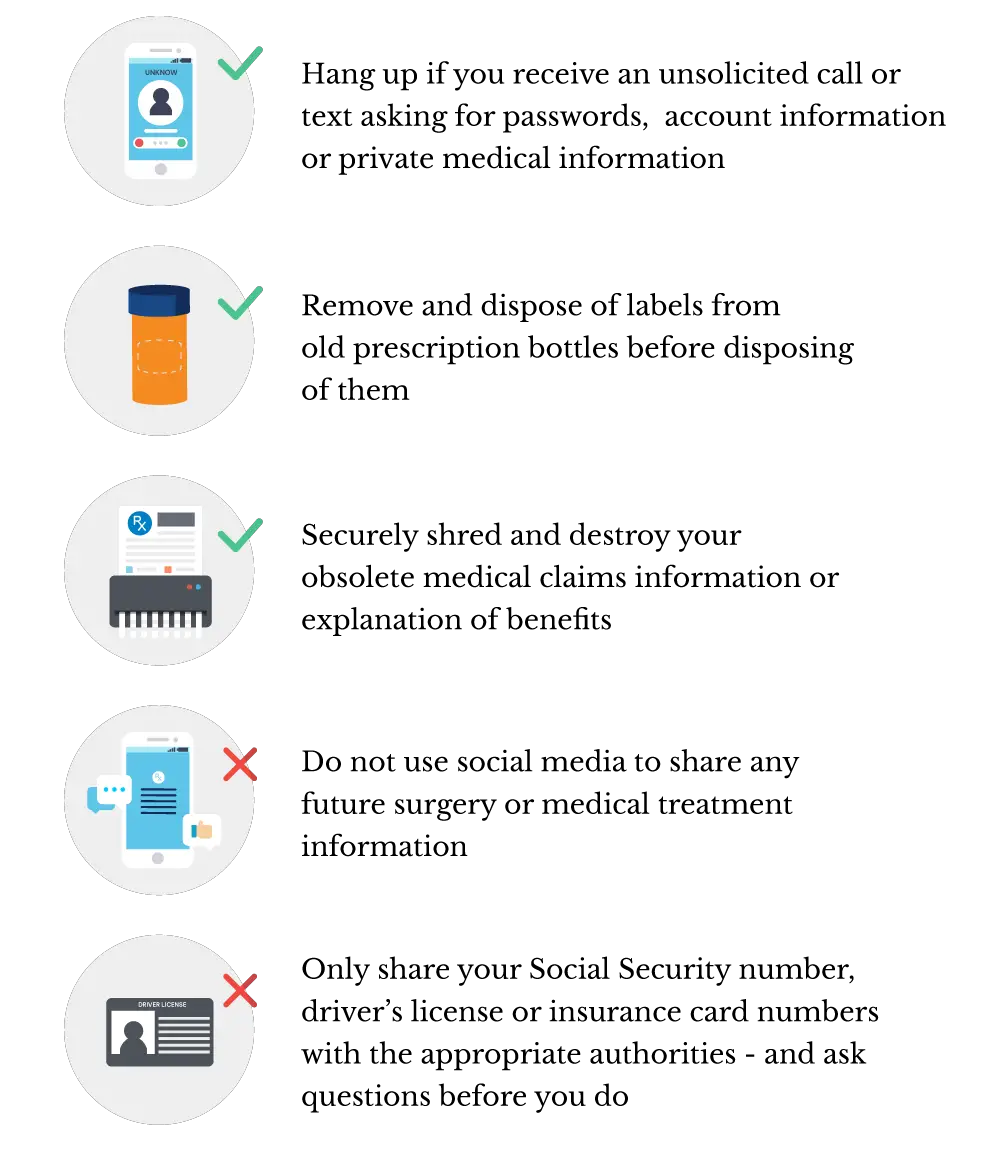

Protect Yourself Against Health Insurance Fraud

BCBS wants you to have the knowledge to protect yourself and your family against health insurance fraud. Follow these five simple tips to ensure that you dont become a victim of health insurance scams. Related Content: The Blue Cross Blue Shield companies partner with state and federal agencies, as well as advocacy organizations, to report, investigate and reduce the incidence of healthcare fraud.

Check Out Their Social Channels

It could be a good idea to look up the company on social media. Most companies these days have social channels, especially if theyre selling goods to the public. Check out whether they have an active Facebook, Instagram or Twitter profile, and how theyre interacting with customers. This can also be another good way to see what people are saying about the company.

Recommended Reading: What Is A Marketplace Health Insurance Plan

How To Protect Yourself

To avoid healthcare scams, you need to know how to identify reputable health insurance companies and agents, be aware of your rights as a consumer and understand how to protect your identity.

Determine Whether a Company or Agent is Reputable

The official marketplace of health insurance, www.healthcare.gov, lists several tips to advise consumers how to tell if a health insurance company is legitimate:

-

Browse some plans on the Marketplace site,

so you can become familiar with the types of insurance companies that are available. When you narrow down your choices, look for signs that a company is reputable, such as websites that end in “.gov,” which means they are associated with a governmental agency.

-

Check whether an insurance company is licensed in your state

-

If an offer sounds too good to be true, know that it probably is.

Know Your Rights

As a consumer, you have more rights than you may be aware of. If you purchase insurance through www.healthcare.gov, for example, you are entitled to a free, trained assistor who can provide state-specific advice on coverage. You also have the right to never give information out over the phone. Instead, request that the company or agent who is asking for the information send you an official letter in the mail.

Protect Your Identity

How to Tell You’ve Been Defrauded

The Federal Trade Commission lists signs to look for if you suspect that you’ve become a victim of health insurance fraud, including:

How to Report Fraud

How To Check If A Company Is Legitimate Real Or Scam

There are several important steps to successfully check and confirm that a company is legitimate. Frauds and scams are an ever-growing risk when working with new businesses. With massive cost implications, these potential threats can no longer be written off as errors or poor experience. Therefore, it is important to conduct thorough due diligence before working with a new company. As a small business owner, doing so is fundamental to protect your financials, compliance measures, and private company data. To help you get started, read on to learn about how to check if a company is legitimate.

This post will answer the questions:

- How do I find out if a business is legitimate?

- What are the best ways to verify a genuine company?

- How to know if a company is real?

- What does a legit company do?

- How to tell if a company is fake?

- How do I find out if a company is good or bad?

Also Check: What Health Insurance Companies Are In Florida

What If You’re Involved In An Automobile Accident

Report the incident to the police and obtain a copy of the Police Accident Report. Be suspicious if the driver of the other vehicle insists it is not necessary to contact the police. That drivers car may be uninsured or his/her insurance identification card may be fraudulent. Be sure to make note of the other vehicles license plate number and obtain important insurance information. If possible, take a photo of the damages.

How To Check Health Insurance Company

Verify your enrollment online Log in to your HealthCare.gov account. Click on your name in the top right and select My applications & coverage from the dropdown. Select your completed application under Your existing applications. Here youll see a summary of your coverage.

Recommended Reading: Does Farm Bureau Sell Health Insurance

Dont Be Fooled By Discount Health Plans Or Cards

Dont buy a discount health plan or card as an alternative to health insurance. Discount health plans may allow you to save money on some medical expenses, but they cannot pay toward your more expensive medical claims. These plans may look like cheap health insurance, but they are not health insurance and do not meet the Massachusetts standards or individual mandate requirement for health care coverage

Discount health plans and cards are not regulated by Massachusetts or federal law. Check with your doctor or local pharmacist to ask whether you will receive any real savings before you give your money or your personal information to anyone offering health care discounts.

How To Check If Insurance Company Is Legitimate

Today well be discussing how to check if insurance company is legitimate or not? This is something we cant afford to ignore while entering into insurance contract. If we dare to do so, wed end up with insurance fraud.

We buy a policy to tackle with unforeseen events. After paying premiums from our hard earned money, of course we wouldnt like to end up with a bogus policy and pay the reimbursement cost.

Small precautionary measures such as checking legitimacy of your insurance company can save you from future hassles.

We will be going over following topics:

Read Also: How Much Is Open Market Health Insurance

Check If Insurance Companys Name Is Correct

Once you know your insurance company is legitimate and has a valid license, next step is verify insurance company name. What actually happens is fake insurance agents approach potential victims on the behalf of a reputed insurance company, but on documents they slightly alter the name of the insurer.

Therefore, while reading policy brochure, verify whether name of the company is correct or not.

Pay Only For Services You Have Received

If you have received medical or dental treatment that is covered by a health care provider, you will receive an “Explanation of Benefits” statement listing the services for which benefits have been paid. Review it thoroughly to ensure that you have not been billed for services that were not rendered or for dates on which you were not treated. Check carefully to confirm that you were not billed for more expensive procedures than were actually provided, a practice known as upcoding. Contact your insurer immediately if you feel there are discrepancies.

Health care fraud translates into billions of dollars a year, resulting in higher premiums and increased costs for goods and services for all consumers. If you suspect fraud, contact the Department of Financial Services at 342-3736. An investigator will contact you for details and the matter will be kept confidential.

You May Like: How Much Is Health Insurance For A Child

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Search The Fca Register

If youre looking at a company that deals in financial services, theres a very simple way to check its credentials. All you have to do is look it up on the Financial Conduct Authority register.

This is a database which holds details of every financial company thats registered and regulated by the FCA. You can search for a company by entering its name and/or postcode.

If a financial services company isnt listed on the FCA register, avoid it at all costs. And remember to check any number on the website. The loans company mentioned above had an FCA registration number on its website, but that number didnt actually correspond to anything on the register itself.

Another good resource is the government’s Companies House website. You can use this site to search the millions of limited companies trading, or once registered in the UK, and listed in Companies House.

Search the Companies House website.

Recommended Reading: How Far Back Does Health Insurance Cover

If You Get A Call From The Marketplace

- Health Insurance MP

- To verify your identity, using information you provided on your application, including your full name and address.

- To provide or verify your Social Security Number, application ID, policy ID, user ID, date of birth, or phone number.

- To verify or provide income, household, and employment information, but NOT personal financial information, like a bank name and account number. They’ll never ask:

- About any personal health information, like your medical history or conditions.

- For your Marketplace account password or security code.

Where To Find Help

Choosing a health plan is one of the most important decisions you will make. If you think you may have fallen victim to a scam or if you have questions about a health plan, call the Attorney Generals Health Care Helpline at 830-6277, or the Division of Insurance Consumer Service Section at 521-7794.

Read Also: How Much Is Health Insurance In Idaho

Types Of Health Insurance Scams To Avoid

According to theFederal Communications Commission and Federal Trade Commission , health insurance scams tend to spike around open enrollment periods: Nov. 1 through Dec. 15 for the Affordable Care Act, and Oct. 15 through Dec. 7 for Medicare. This may be because people are most vulnerable to these scams when they are searching for affordable coverage for themselves and their families. Dont be a victim of these ploys! Watch out for these warning signs, and common scams.

Five Signs Of A Health Insurance Scam

Medicare and health insurance scams are common. Scammers are always looking for new ways to steal your money and your personal information, but they use familiar techniques. Here are five signs youre dealing with a health insurance scam:

1. Scammers say theyre from the government and need money or your personal information. Government agencies dont call people out of the blue to ask them for money or personal information. No one from the government will ask you to verify your Social Security, bank account, or credit card number, and they wont ask you to wire money or pay by gift card or cryptocurrency.

If you have a question about Medicare or the Health Insurance Marketplace®, contact the government directly:

- Medicare: Medicare.gov or 1-800-MEDICARE

- Health Insurance Marketplace®: HealthCare.gov or 1-800-318-2596

2. Scammers say you need to pay a fee for a new Medicare card or youll lose your Medicare coverage. But you never need to pay for a new card. And Medicare will never call out of the blue to say youll lose coverage. Those are scams. Read more about Medicare cards.

5. Scammers want you to pay for help with the Health Insurance Marketplace. The people who offer legitimate help with the Health Insurance Marketplace sometimes called Navigators or Assisters are not allowed to charge you and wont ask you for personal or financial information. Go to HealthCare.gov and click Find Local Help to learn more.

You May Like: How To Get Health Insurance In Dc

What Is Insurance Fraud

When someone or insurer deliberately defrauds policyholder by selling an unworthy policy, making false promises, or taking higher premiums with intention of not paying claims is termed as insurance fraud. Also, when policyholder willingly fabricates false claims, its also an insurance fraud.

Insurance fraud not only affects innocents but also insurance marketplace. Therefore, monitoring authorities make very stringent rules for insurers to curb such incidents. However, criminals still manage to fraud policyholders. The major reason behind insurance fraud is lack of awareness.

Protect Your Private Health Care And Financial Information

- Never give your financial information, like your banking, credit card, or account numbers, to someone who calls or comes to your home uninvited, even if they say they are from the Marketplace.

- Never give your personal health information, like your medical history or specific treatments youâve gotten, to anyone who asks you for it.

You May Like: Where Do You Go If You Have No Health Insurance

Be An Informed Consumer

Insurance premiums are a significant expense for most of us. The premiums you pay are based on your individual claims history and the degree of risk involved. Generally, the greater the risk, the higher the premium. For example, the theft premium for a Cadillac will be far higher than that of a Toyota because more Cadillacs are stolen each year. Similarly, a stock car racer will pay more for life insurance than a librarian, all else being equal.

Here Are Some Most Common Insurance Fraud Examples

Since this post is written to check if insurance company is legitimate, therefore, well be discussing frauds pertaining to policyholders from insurers side.

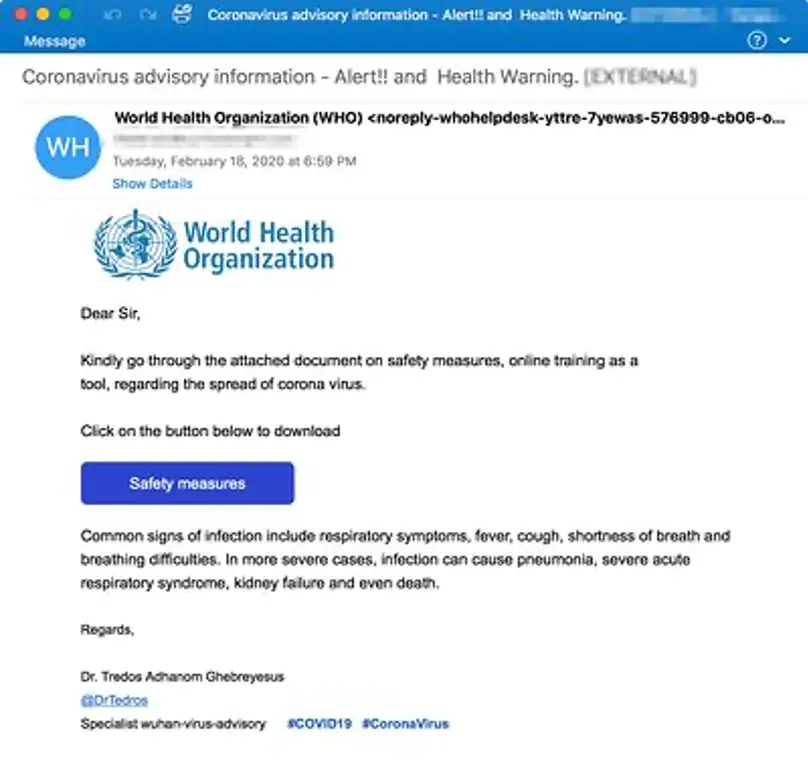

Fake insurance company: Its a very common insurance fraud and most people become victim of it. Many criminals use this trick to loot naive people. Usually, they target victims through emails, spurious calls or online advertisement by offering lucrative discounts on premiums.

They collect premiums from a policyholder but do not pay claims. After targeting a number of people, they disappear.

Legitimate insurer: Sometimes legitimate insurance company who is licensed to sell only general insurance products may mislead people and sell them life insurance products. Such insurers may show prospect their valid license, but they dont reveal that its for non-life insurance.

Health insurance business by unregistered companies: Its come to notice of many states authorities that some companies are doing health insurance business and collecting money without actually holding a valid license.

Fraud agents: In this type of insurance fraud, an unscrupulous insurance agent holding a valid license collects premiums from policyholders without delivering the same to insurance company for his/her personal gain.

Fake insurance agent: Sometimes scammers who impersonate to be agent of insurance companies approach customers and try to sell policy without holding a valid agent license issued by the concerned company.

Read Also: Is It Illegal To Have No Health Insurance

Insurance Fraud Takes Many Forms

- A driver and a body shop worker agree to inflate the auto damage claim and share the “profit.”

- A homeowner falsely claims that his home was burglarized and valuable items stolen.

- A doctor bills an insurer for services that were not provided.

- A driver stages a fake accident, and unscrupulous doctors and lawyers help “handle” associated medical claims and lawsuits.

- A worker collects workers’ compensation benefits while employed.

Fraud Committed By Patients And Other Individuals

- Bogus marketing: Convincing people to provide their health insurance identification number and other personal information to bill for non-rendered services, steal their identity, or enroll them in a fake benefit plan

- Identity theft/identity swapping: Using another persons health insurance or allowing another person to use your insurance

- Impersonating a health care professional: Providing or billing for health services or equipment without a license

You May Like: Which Health Insurance Company Is The Best For Medicaid

This Open Enrollment Season Look Out For Health Insurance That Seems Too Good To Be True

By Bram Sable-SmithNovember 1, 2022

We encourage organizations to republish our content, free of charge. Heres what we ask:

You must credit us as the original publisher, with a hyperlink to our khn.org site. If possible, please include the original author and Kaiser Health News in the byline. Please preserve the hyperlinks in the story.

Its important to note, not everything on khn.org is available for republishing. If a story is labeled All Rights Reserved, we cannot grant permission to republish that item.

Have questions? Let us know at

What To Do In Case Of Travel Insurance Scam

You must remember that scams have become more elaborate, creative, and challenging to spot lately with online travel insurance companies. So, sometimes no matter how careful you are, you might just fall prey to a scam. Contact the authorities and report the crime if you experience a travel insurance scam. Also, make sure to bring any documents, papers, or signed certificates related to your insurance purchase. Unfortunately, in most of these schemes, the money you paid is rarely retrieved, but the person responsible for the scam may be held accountable for their actions.

Read Also: Is Family Health Insurance Cheaper Than Individual

Know Your Agent Or Broker

Consumers can sometimes be victimized by unscrupulous agents or brokers and discover only after they file a claim that they are without coverage. If an uninsured home is damaged by fire, the owner is solely responsible for restoring it and paying back any mortgage holders. If a driver is involved in an accident while driving an uninsured vehicle, any personal assets are subject to forfeiture if that driver is sued for damages. Deal only with licensed agents and brokers. They must maintain proof of being licensed. Ask to see it.