Why Are Car Insurance Rates Increasing

Car insurance rates are going up across much of the country. This is due to several factors such as inflation pushing up the cost of cars and car repairs, and an increase in accidents and claims from the lows seen during pandemic lockdowns.

How much your rate goes up will depend on a variety of factors as well as what car insurance company is writing your policy. Some insurers are already calling for rate increases. Allstate recently said it’s raising rates for many drivers by an average of 7.1%.

Health Insurance Costs And Inflation

This years modest premium increases are unusual because they trailed both overall inflation and employee wage gains, KFF says. In pre-pandemic years, the annual increase in health insurance premiums typically outpaced those factors by large margins. In 2019, for example, family premiums jumped 5% while wages rose 3.5% and annual inflation was at 1.6%.

Why did 2022 buck that trend? Employer costs for this year were largely set last year, before inflation became a major economic concern and after the COVID-19 pandemic led to a temporary slowdown in utilization of health care services, the report states.

Once 2023 insurance contracts are set, though, those price increases are expected to start rolling in, according to KFF. The premium hikes could affect the nearly 160 million Americans who rely on health coverage through their workplace. KFF did not estimate exactly how big it thinks premium hikes might be, but an above-average increase could be on the horizon.

As inflation continues to grow at relatively high levels, we could potentially observe a higher increase in average premiums for 2023 than we have seen in recent years, the report states.

How Often Do Rates Go Up

Most car insurance policies are in force for a year and then must be renewed. Once your renewal date comes up, there is a good chance your rates will change.

When your policy expires, your insurance company reevaluates your risk factors as well as other factors that impact their cost of doing business. If accidents, car thefts and claims have gone up in your general area, it could result in a premium increase.

And as inflation pushes up the cost to repair or replace vehicles, insurers will pass those costs on to their customers.

But rates dont go up for everyone. Because insurance rates take into account personal risk factors such as a good driving record and a vehicle that is loaded with advanced safety features your rates may stay the same or decline even if your car insurance company is raising overall rates.

The national average for a car insurance policy in 2020 was $1,904, according to our data. But that dropped 3% in 2021 to an average cost of $1,839. Last year was one of the few years where car insurance costs went down.

This was because they were experiencing far fewer claims as the pandemic changed driving habits, with many customers driving dramatically fewer miles.

Recommended Reading: Can You Lose Health Insurance While On Fmla

Premiums To Rise More Than 11% For Some Health Connector Shoppers

A year after cost increases that board members called “not sustainable” and “quite disappointing,” there was no opposition last week as the Massachusetts Health Connector board approved plan offerings for 2023 that will lead some consumers who buy their health insurance through the exchange to pay an average of 7.6% more.

The board’s vote last Thursday gave a final seal of approval to eight insurance carriers that submitted a total of 45 non-group and 57 small group qualified health plans for coverage starting Jan. 1, 2023. While the Health Connector approves the plans that it will offer for sale, the premium rates are filed with and reviewed by the Division of Insurance.

The average change to Health Connector premiums from 2022 to 2023 will be a 7.6% increase for the 85,474 members whose medical coverage is unsubsidized or who receive Advance Premium Tax Credits, Samuel Adams, a senior program analyst at the Health Connector, said. Two dental carriers submitted 12 qualified dental plans for sale on the exchange, and Adams said those plans will see a 0.1% decrease in the premium.

Increases among carriers range from a 5.5% jump for Tufts Health Plan, the lowest, to an 11.9% hike for Health New England, the highest. The average change for the 140,055 people who get coverage through ConnectorCare silver tier plans is a 4.6% premium increase.

Members of the Health Connector board were not alone in expressing their frustration with the premium rate hikes.

When Were Figuring Out The Price Of Your Health Insurance There Are A Few Different Factors We Need To Think About Some Of Them Are About You And Your Lifestyle And Others Are About The World Around Us And Whats Happening In The Insurance Market

Every insurer works out the cost of health insurance premiums in a slightly different way but overall, there are four things that make prices a little higher when its time to renew. They are, in no particular order: inflation, claims, age, and something called medical inflation. Below, well tell you all about each one and explain why they lead to your premium going up.

Recommended Reading: Do All Employers Have To Offer Health Insurance

In A Tight Job Market Employers Reluctant To Make Workers Pay More

Most large companies are self-funded and directly pay their workers’ medical claims, even if a private health insurer administers the plan. And some companies have been reluctant to make their workers pay a larger share for health insurance or pass along costs through higher deductibles.

Kaiser reported the average deductible for an individual is $1,763, up slightly from $1,669 last year. People must pay this amount with their own money before coverage kicks in.

MEDICARE:When does Medicare open enrollment take place?

“Going into this year, we were still in a tight job market,” Claxton said. “Recruiting employees is expensive upsetting your existing employees is not a good idea.”

But as employers absorb higher medical costs and the job market softens, companies might be more willing to raise premiums and deductibles, Claxton said.

Employees at companies with fewer than 200 workers already must pay a larger share of their medical costs. The typical deductible at a small company is more than $2,500, or about $1,000 more than at a large company.

Wondering How The Increase Might Impact Your Fehb Plan Choice Well Walk You Through It

Kevin Moss

OPM recently released a first look at the 2023 Federal Employees Health Benefits Open Season and employees and annuitants will, on average, pay 8.7% more in FEHB premiums next year, the largest percentage increase in the last decade. OPM cites the coronavirus pandemics impact on the healthcare industry as the primary driver for higher FEHB premiums in 2023.

So how will this increase impact your FEHB plan choice for the upcoming Open Season? Well walk you through the changes in popular plans, discuss which ones saw their premiums increase above and below the average, and provide an update for annuitants on Medicare Part B premiums for 2023.

How Premiums are Changing in 2023

While the average enrollee share of premium is increasing 8.7%, not all plans reflect this trend. For the 262 FEHB plans that were available in 2022 and are available again in 2023, premiums decreased in 56 plans, stayed the same in 9 plans, increased less than the 8.7% average in 119 plans, and increased 8.7% or more in 78 plans.

Percentage increase sometimes doesnt tell the full story on how higher premiums will impact your finances. Humana Health Plan High available in Illinois will cost enrollees 34.2% more, but because of the very high 2022 bi-weekly premium, the 2023 percentage increase has a greater impact. Next year, self-only enrollees in that plan will pay an extra $6,510.

Blue Cross Blue Shield

Self-Plus-One vs Self & Family Enrollment

Annuitants

The Final Word

Also Check: What Does Ppo Means In Health Insurance

How To Find Out If You Qualify For Marketplace Savings

Lower costs continue through 2025

The Inflation Reduction Act keeps these savings and lower costs through 2025. Your current Marketplace plan and premium wonât change for the rest of 2022. If you qualify for savings on 2023 coverage, youâll see the lower costs when you shop for plans, starting November 1.

When you apply for Marketplace coverage, youâll find out if you qualify for a

Mental Health Networks Fall Short

Employers also are focusing more on mental heath needs of their workers following the coronavirus pandemic.

The Kaiser survey said nearly half of large employers reported more workers are using mental health care services. Nearly 1 in 3 report more workers are requesting family leave to address mental health care.

But the survey also showed a longstanding shortage of mental health providers is making it difficult for workers to see a counselor or other specialist. About 30% of large employers say their networks do not have enough behavioral health doctors or counselors to get workers timely care. Those shortages persist even though more than 1 in 4 large companies expanded their network of in-person and remote telehealth mental-health providers.

Ken Alltucker is on Twitter at @kalltucker, or can be emailed at [email protected]

Recommended Reading: Will Health Insurance Pay For Wisdom Teeth Removal

Health Insurance Premiums And Rate Increases

Health insurance premiums are the monthly amount that you or your employer pay to an insurance company. The insurance company collects premiums from all of its policyholders and uses that money to pay medical claims. The insurance company can also use premiums to pay for administrative expenses and to earn a profit.

People Are Also Reading

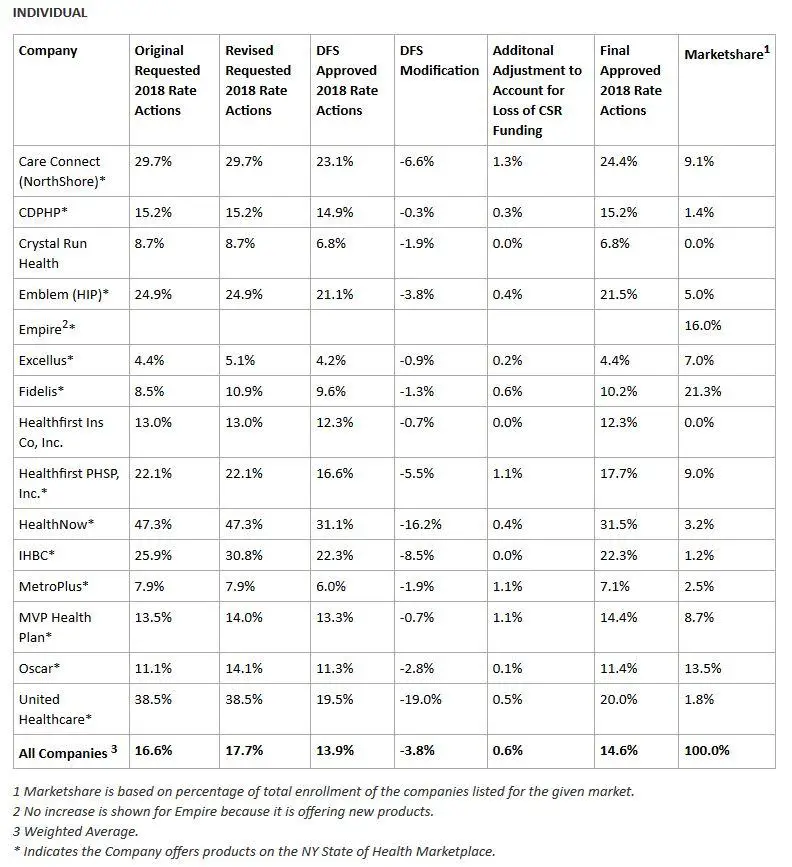

The rate adjustments affect people who buy individual commercial health insurance and small employers with 100 or fewer full-time workers, together comprising a small slice of members for the three big local insurers. The rate increases, which do not affect large employers with more than 100 workers, highlight how rising medical costs and inflation are putting upward pressure on premiums.

Don’t Miss: What Type Of Health Insurance Do I Need

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy is set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Overall Costs Of Healthcare

Healthcare costs have risen dramatically in the United States over the past several decades. According to a study by the Peterson Center on Healthcare and the Kaiser Family Foundation , U.S. healthcare spending rose nearly a trillion dollars from 2009 to 2019, when adjusted for inflation.

The study reported that U.S. healthcare spending during 2019 was nearly $3.8 trillion, or $11,582 per person. By 2028, these costs are expected to climb to $6.2 trillionroughly $18,000 per person.

Where does that money go? According to the U.S. Centers for Medicare and Medicaid Services , 2019 healthcare spending can be broken down into 10 categories:

- Disease prevalence or incidence

- Medical service utilization

The authors found that service price and intensity, including the rising cost of pharmaceutical drugs, made up more than 50% of the increase. Other factors, which comprised the rest of the cost increase, varied by type of care and health condition.

A more recent study by the Peter G. Peterson Foundation pinned the blame for rising prices on the same top three drivers identified by the American Medical Association : population growth, population aging, and rising prices.

Don’t Miss: Can I Have Dental Insurance Without Health Insurance

A Bump In Insurance Premiums: What It Means For 2022 And Beyond

Becky Seefeldt is VP of Strategy for Benefit Resource with 20 years dedicated to the education and advancement of consumer-driven benefits.

getty

In its 2021 Employer Health Benefits Survey, the Kaiser Family Foundation found that insurance premiums for employer-sponsored family health coverage rose 4% while workers wages increased by 5%. Meanwhile, inflation climbed slightly at 1.9%. While the pandemic has affected health coverage, the trend of premium increases outpacing inflation predates Covid-19. What does this mean for workers and employers in 2022 and even in the next five years?

A Look At Premium And Health Trends

For at least 20 years, employers faced the difficult challenge of increasing premiums. According to Kaiser Family Foundation Employer Health Benefits Annual Survey Archives , premiums for family coverage cost an average of $7,061 in 2001 and rose to an average of $22,221 in 2021. This is a 20-year increase of 215%. The cumulate rate of inflation during that same period was approximately 57%.

A Beginning With Extreme Premium Increases

Premiums rose 63%. Sixty percent of covered workers enrolled in a Preferred Provider Organization , and an average deductible for an individual in a PPO was $473 .

A Turning Point

Deductibles were being used more widely as a cost-controlling mechanism. With 81% of PPO plans in 2011 including a deductible requirement and enrollment in HDHP/SO options rising, overall premium increases began to come down from their peak.

Lowering The Cost Of Your Health Insurance Premiums

When you are fairly healthy or have access to more than one plan through your employer, you can have some control over the cost of your insurance, including the price you pay for premiums, deductibles, and co-pays.

Some tips for saving money on healthcare premiums:

- Each year during the health insurance enrollment period for the next year, or when you change jobs or insurance coverage, take some time to do the actual calculations to choose the best plan for you. Calculate the costs of your premiums, co-pays, co-insurance, and deductibles to see if you would save money with a plan with higher or lower premiums, co-pays, co-insurance, or deductibles.

- Pay attention to incentives, discounts, and wellness programs. Many health insurers offer discounts for people who don’t smoke, exercise regularly, or maintain a healthy weight.

- Consider high-deductible, catastrophic care insurance. These plans usually have lower premiums and may work well for people who are mostly healthy.

- Consider using a Health Savings Account, in which your employer puts aside a certain amount of money for your health expenses. This type of account can be a convenient way to make your health expenses tax-deductible.

- Even if you are employed, your income may be low enough to qualify you for government-run healthcare coverage. Find out whether you are eligible for a state-run healthcare subsidy program like Medicaid or others.

Don’t Miss: What Is The Health Insurance Portability And Accountability Act

Everything Else Costs More Why Are Health Insurance Prices Flat

This year’s health insurance premiums were set a year ago before inflation began to take off, according to Gary Claxton, Kaiser senior vice president and director of the health care marketplace project.

Claxton said the health care industry also is dealing with the effects of the coronavirus pandemic. People delayed doctor and hospital visits in 2020 when COVID-19 emerged, so insurers spent less money on routine care and non-emergency operations. Insurer profits doubled that year.

WATCH:Inflation may work in your favor this holiday season. Here’s why.

“Insurers are still making money,” Claxton said. “It’s not like they were struggling and really needed to raise premiums.”

The Kaiser report warned with inflation this year at 8% the highest rate since the early 1980s employers and consumers could see higher-than-average health insurance premium hikes next year. Other analysts agree. Benefits consultant Segal projects health insurance costs will jump 7.4% next year as employers and consumers absorb bills from doctors, hospitals and drug companies.

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month. Compare quotes in your state here.

Recommended Reading: Can You Get Health Insurance For Just Your Child

Fehb Premium Rate Charts From Opm

The charts below from the Office of Personnel Management provide information on biweekly and monthly premiums, including the total premiums, the amount the government pays, and the change in the enrollees portion of the premium compared to last year. All FEHB plans offer Self Only, Self Plus One, and Self and Family enrollment types.

Notice for USPS employees: In 2023, the employer contribution rate for FEHB plans is the same across all Postal labor unions and management associations, except for USPS non-career employees or where specified otherwise in a collective bargaining agreement. FEHB-eligible career USPS employees fall under the same rate category called Premium Rate.

These premiums do not apply to USPS non-career employees, to USPS annuitants, or where specified otherwise in a collective bargaining agreement. If you are a Postal service employee and have questions or require assistance, please contact USPS Human Resources Shared Service Center: 877-477-3273, option 5, Federal Relay Service 800-877-8339.

OPM notes that in some cases, the enrollee share of premiums for the Self Plus One enrollment type will be higher than for the Self and Family enrollment type. Enrollees who wish to cover one eligible family member are free to elect either the Self and Family or Self Plus One enrollment type.