Uber Health App: How It Helps Riders Drivers And Healthcare

In the age where we think we have triumphed in the health sector, there is still one thing that stands between doctors and patients: Transportation barriers in the healthcare sector. Thousands of papers have been written about it to date. Millions of patients fail to attend their medical appointments. There was a need for a solution, which has arrived as the Uber Health App.

What is it? And how does it deal with this big transportation issue before healthcare access? Well know all about Uberhealth in this article.

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider. Our partnerships dont influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

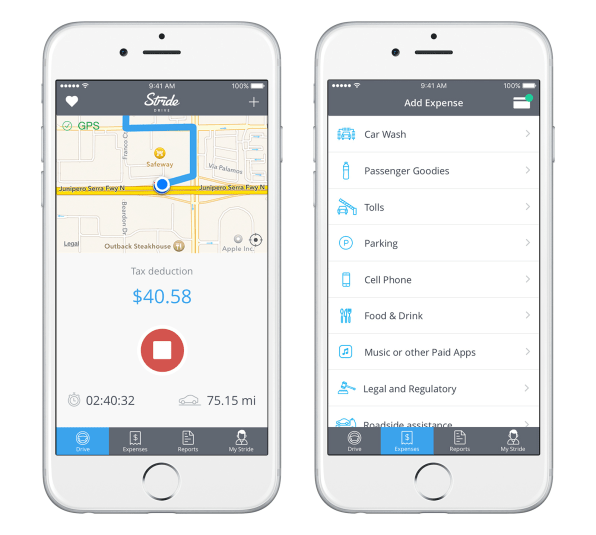

Daily Financial Savings For Independent Contractors

- Link your accounts for a consolidated view of income and automatically track your mileage and expenses

- Lower the cost to file your taxes with TurboTax, get IRS-ready reports, and free support from tax experts

- Browse 100,000+ exclusive local discounts on gas, car repairs, prescriptions, events, and more

4.8-star rating with more than 40,000 reviews

“Do not waste time with any other mile tracker other than Stride it’s phenomenal it will make tax season so easy and it’s free.”

Kelly K., Stride Member

You May Like: How To Cancel Health Insurance

Do You Already Have Coverage From Another Source

Thats great! Across the U.S., more than 75% of drivers on the Lyft platform already have health coverage from another source, like a primary job.* Lyft is also advocating with policymakers around the country for new policies that allow drivers to receive benefits while maintaining their independence. In fact, drivers in California are eligible to qualify for a healthcare subsidy from Lyft as part of a new law that Lyft supported.

Option : Individual Insurance Through A Marketplace Plan

Finding an affordable individual health insurance plan on- or off-exchange may be a great option. Most people find a plan in exchange on the Affordable Care Act or through their stateâs respective enrollment website. By law, all ACA plans must offer these ten essential health benefits with no annual limit on the benefit amount:

- Ambulatory outpatient services

- Mental health and substance use disorder services, including behavioral health services

- Rehabilitative and habilitative services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

Individual health insurance can be purchased from the health insurance marketplace during open enrollment each year, usually spanning the months of November through January. There are four different metal tiers or plans that you can choose between depending on your health coverage needs and budget. Individual health insurance can range from $221 to $839 per month.

Don’t Miss: Which Health Insurance Is Most Widely Accepted

What About Car Rental Services Like Turo

The rideshare and rental industry is constantly expanding. Some new services offer car owners to rent their vehicle without also being the driver. Your standard auto insurance policy will not cover any damage or claims during a rental for these types of services. This is considered a commercial use for the vehicle and requires a commercial auto policy.

Most of these services provide an insurance policy to owners choosing to rent their vehicle to strangers through an app. However, please keep some points in mind.

Offering your car through a rental service could be an easy way to make some extra money. However, before you get started, make sure you know the service inside and out.

- Address: 2745 Martin Way E #AOlympia, WA 98506

Are Optional Insurance Coverages Included On Uber Drivers Personal Automobile Insurance Policies Like Replacement Cost Or Reimbursement For Loss Of Use Covered Under The Uber Commercial Policy

The Uber commercial policy offered by Intact Insurance provides coverage from the moment drivers make themselves available to accept a ride request, until the moment passengers exit the vehicle. This policy does not provide any optional coverages, regardless of what is included on the customers personal auto policy, other than Comprehensive and Collision coverage. Comprehensive and Collision coverage, with a $1,000 deductible, is only made available to drivers who have this coverage on their personal auto policy. This policy also provides Third Party Liability coverage and Standard Accident Benefits coverage.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Read Also: How Much Does Health Insurance Cost By Age

You Can Enroll Anytime For Short

Though the benefits are not as robust as an ACA-compliant plan, Short Term Health Insurance can save you money. These plans are recommended for persons that are in relatively good health. Short-term health insurance plans may deny any claims considered as pre-existing conditions. They may pay for treatments for medical conditions you may have had before the plan started.

If you are just getting started owning your own business, getting an affordable Short-Term Medical Policy will help you control costs from the start.

What A Driver Should Do In Case Of An Accident

Know you know the basics and coverage of the insurance Uber provides. The insurance part is covered. But what should you do in case you are involved in an accident?

In case of an accident, try to be calm and do the following:

- Check the safety of everyone involved in the accident

- Contact Uber directly through the Driver app.

- To do so, just go to the Help section and select Trip Issues and Adjustments.

- After that, select I was in an accident

- Alternatively, you can also contact Ubers agent directly by selecting the Call Support option on the Help section

Also Check: Who Is The Largest Health Insurance Company

California Drivers: You May Qualify For A Healthcare Subsidy From Lyft Because Of Prop 22

Due in part to the overwhelming support of drivers, California voters passed Prop 22 last November. Under Prop 22, if you drive in California on the Lyft platform for at least 15 hours/week over the course of a quarter , and youre enrolled in a qualifying health plan, you could be eligible to receive a subsidy of up to $600 per quarter . For those drivers with at least 25 hours/week in California, this subsidy goes up to $1,200 per quarter .** For more details, see here.

More: New York Times Reporters And Other Staff Stage 24

“Our patients require a lot of time — weâre not only monitoring their recovery but teaching them how to physically recover from what theyâve been through, teaching them about their new medications, teaching them about lifestyle changes,” he said. “Weâve had to learn how to prioritize and because weâre working short, sometimes the quality suffers and thatâs very difficult to deal with.”

Montefiore said it is offering a 19.1% compounded wage increase over the next three years with pay increases for each level of experience.

What’s more, the hospital has also offered to add 115 registered nursing positions to the emergency department, 11 registered nursing to the labor and delivery department and 23 nurse practitioner positions.

Mount Sinai told ABC News in a statement it also offered a 19.1% increased wage proposal, but those nurses rejected the offer.

The nurses argue that the pay increase is not the main reason for the strike but rather the current contract does not address nurse-to-patient ratios

“Iâll be the first to say a nurse deserves a fair compensation,” Cantu said. “But itâs not about money, itâs about the allocation of that money in order to provide better care.”

He continued, “Itâs frustrating and heartbreaking when we fall short in areas not critical to their life but critical to the patients’ experience. These are human beings, not just a list of symptoms in front of us.”

Also Check: What Is Public Health Insurance

Does Uber Insurance Cover Rental Cars

No. Uber only provides liability insurance, and in some cases, comprehensive coverage. It does not reimburse drivers for a rental car if they are in an accident and need alternative transportation. In this case, you would need to check with your personal policy or separate rideshare policy.

—Satta Sarmah-Hightower contributed to this report.

Add A Rideshare Endorsement To Your Policy

First things first. If you’re a rideshare driver, you need to add a rideshare endorsement to your personal auto policy. Uber or Lyft will insure you while you’re on the app , but there are gaps in that coverage that you’ll want to fill with your own rideshare insurance. Also, Uber and Lyft coverages sometimes have hefty deductibles that a rideshare endorsement can help cover.

In most cases, your own auto insurance will be what’s called the “primary” policy. This means you must look to your insurance before you can collect coverage provided by Uber or Lyft, which is called “contingent” coverage. Stated a bit differently, before you can make a claim against the insurance provided by Uber or Lyft, you’ll first have to bring a claim against your own insurance.

Without a rideshare endorsement, as discussed above, your personal insurance carrier will consider you to be engaged in business activityand it won’t cover you. Worse yet, you’ll almost certainly wind up on the receiving end of a cancellation or nonrenewal notice.

All the major insurance companies offer rideshare endorsement coverage. Most of the companies that do will provide coverages for all three periods when you’re on the app, but some only cover Period 1. If your insurance company does not offer a rideshare endorsement, it might object to you buying a rideshare endorsement from another company. In that event, you might need to switch your personal auto policy to the company that sells you the rideshare endorsement.

Recommended Reading: Does Costco Have Health Insurance For Members

Highlights Of Rules For Uber And Taxis

There are many new rules that will apply to Uber drivers and other ridesharing services if they want to operate in Toronto and GTA. Some rules for taxis have also changed in efforts to help make things fairer. Below is a summary of some of the key changes.

Fares

- Uber : Can only book fares by using a smartphone app.

- Taxis : Can pick up curbside customers hailing and book fares via a smartphone app.

Background Checks

- Uber : Background checks are now required.

- Taxis : Background checks continue to be required.

Annual Licensing

- Uber : Annual licensing fee of $10 per driver and 20 cents per trip.

- Taxis : Annual licensing fee of $290 per driver.

Driver Licensing

- Uber : Must have a G license and a city permit.

- Taxis : Must have a Taxicab drivers license.

Vehicle Safety Checks

- Uber : Vehicles must now have 2 safety checks per year.

- Taxis : Taxis continue to require 2 safety checks per year.

Base Fair

- Uber : Must raise their base fare from $2.50 to $3.25 to be the same as taxis.

- Taxis : Taxicab base fare remains at $3.25.

Liability Insurance

- Uber : Need $2 million in liability and must show proof of insurance to the City of Toronto.

- Taxis : Need $2 million in liability protection.

Surge Pricing

- Uber : They apply surge pricing in high demand times.

- Taxis : Taxis can now apply surge pricing if rides are booked via a smartphone app.

Cameras And Emergency Lights

What’s The Problem With Rideshare Insurance

Rideshare companies and their drivers face a problem when it comes to auto insurance. First, personal auto policies specifically exclude coverage when you’re driving for a business purpose, and insurance companies consider driving for Uber or Lyft to be business use.

Second, most rideshare drivers don’t have business auto policies. Instead, they have garden-variety personal auto policies. Rideshare drivers don’t want to be saddled with high-cost business auto premiums. At the same time, most aren’t willing to risk financial disaster by driving for Uber or Lyft without adequate insurance coverage.

Read Also: Can I Add My Husband To My Health Insurance

Enrollment Extended: Drivers Can Now Sign Up For Health Care Through August

Did you know its not too late to sign up for healthcare coverage through the Affordable Care Act ? Earlier this year, President Biden announced that the Dept. of Health and Human Services would extend the Special Enrollment Period to apply for ACA coverage through . And this week, Lyft is joining HHS to help spread the word to drivers on the Lyft platform.

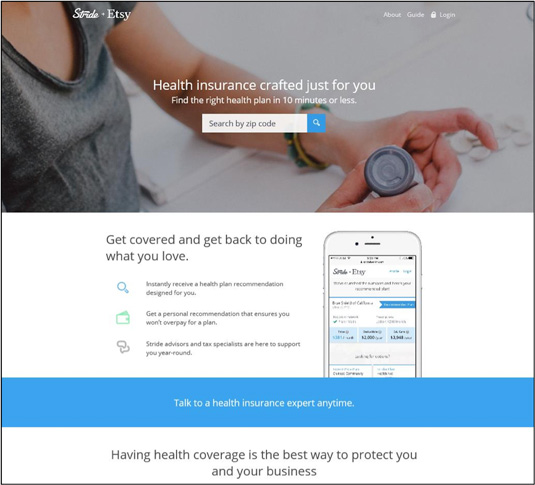

Affordable Health Insurance Made Easy

Dont spend hours on government sites. Well search all available plans and recommend the best one for you based on your medical and financial needs.

- Includes every plan available on HealthCare.gov at the same price no markups, no hidden fees

- Unlock savings and get the lowest price possible

- Enroll in 10 minutes or less

4 out of 5 Stride customers find plans for less than $10 per month.

“Stride delivers on three promises: It is easy, uncomplicated, and quick to pick a plan and get enrolled.”

Ashlee R., Instacart Shopper

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

The Affordable Care Act Individual Mandate

The Affordable Care Act has an individual mandate that all persons in the United States carry a federal certified major medical healthcare insurance plan. Having health insurance coverage for you and your family will provide security that you can get treated by doctors in hospitals and clinics, when you are on or off the road.

Where Can Uber Drivers Get Health Insurance

If you are already a 1099 employee , then you might already have health insurance through Obamacare. You would continue to use this insurance when you start to drive for Uber.

If youre making the transition from a full-time employee with benefits to an independent contractor, then you have two options. The first option is to see if youre eligible for COBRA continuation coverage. COBRA is a federal law that states employees can stay on employee health insurance plans for a period of time after they leave the company. Coverage varies, but it could be as long as 18 months.

Your other option is to get health insurance through the government marketplace. While the open enrollment period is a limited amount of time, there is a Special Enrollment Period . If you were to lose your job, you would qualify for the SEP and be able to get health insurance through Obamacare.

Also Check: What Area Of Group Health Insurance Is Regulated Under Erisa

Should You Get Commercial Insurance

The answer will depend in large part on your states requirements which in most cases may be changing soon. When you consider the overall cost of commercial insurance for your vehicle, it should be compared to the amount of money you make from being an Uber driver. The difference between profits and price should be the determining factor when it comes to selecting commercial insurance.

Until the requirements change, you may be best served by obtaining ride-sharing insurance that is available from various insurance companies. It bridges the gap between commercial insurance and standard car insurance while still being quite affordable.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

|

Jessica Sautter has a Bachelors Degree from Eastern Michigan University in Elementary Education with a Major in Reading and a Minor in Mathematics. |

Where To Get Ride

Many insurance providers offer add-on ride-share insurance. It is always a good idea to check with your current provider. However, if they increase your rates too much, you might consider switching providers. The following insurance providers offer ride-share coverage:

USAA will usually have the best rates. However, this provider is only available to active military members and their families. Insurance provider availability may vary depending on your location.

Also Check: Do I Have To Get Health Insurance Through My Employer

Health Benefit Options As An Uber Driver

Uber Drivers are referred to as gig-economy workers. You are not provided with health benefits as a gig-economy worker, also referred to as an independent contractor or 1099 worker. 1099 workers are not classified as traditional âemployeesâ and therefore do not receive the same benefits as W-2 employees.

There are many things to consider when choosing a health insurance plan, and it is crucial to evaluate your health needs to anticipate accurate costs. Some questions ThinkHealth recommends asking yourself include:

- Do I have any pre-existing chronic conditions?

- Do I need a plan that will cover my specific prescription drugs?

- How often do I go to the doctor?

- Am I anticipating another life change, such as a marriage or the birth of a child?

- Do I have any surgeries coming up?