How Much Does It Cost To Become A Licensed Insurance Agent

To become a licensed insurance agent costs between $30 to $200, plus a background check that could run around $30.

Depending on the state you apply in, you may be required to complete an insurance education course, and these courses can vary in price and content. Even if your state doesn’t require an education course, many employers require it.

Top Skills For Health Insurance Agents

Now that you know the steps needed to become a Health Insurance agent, your ability to hone Health Insurance skills has to be on par with the vast technical knowledge youve acquired to gain a competitive edge.

From using people skills to stir up excitement in your clients to displaying a sense of urgency to help them fulfill their needs or simply proving to your employer that you are capable enough, specific skills help you thrive in your career.

What Is An Fmo

FMO is an acronym for Field Marketing Organization which is a company approved to distribute health insurance plans on behalf of various insurance companies. An FMO will help you get appointed to sell with multiple insurance companies.

Once contracted with a wholesaler , these are the products you will be approved to sell:

When you get your health license, simply sticking a I sell Medicare Insurance sign on your office window wont get you off to a fast start. You must become appointed with various insurance carriers to be able to sell their products, negotiate commission agreements, and get the marketing support from an experienced team to help you maximize your results.

Below are some questions I always suggest you ask before committing to any FMO:

- What kind of Medicare sales training do you provide ?

- What carriers are you appointed with?

- Will I be paid directly from the insurance company or will my commissions be assigned to the FMO?

- Do you provide E& O insurance?

- How can you help me with Medicare leads and getting in front of interested prospects?

Brandons Suggestion: Speak to multiple Medicare FMOs to determine the best fit for you. Simply taking the biggest commissions is a grave mistake. Be patient, talk to numerous FMOs and go with the one that your gut tells you is the right work environment for you.

Also Check: How Can I Add My Parents To My Health Insurance

What Is A Health Insurance Agent

A health insurance agent is an insurance professional who is responsible for selling health insurance to clients and helping them settle claims with the insurance company. Health insurance can help insured people cover part or all of their medical expenses, including the cost of surgical procedures, prescription drugs and more. Health insurance agents can work as independent brokers or work as part of insurance companies. Often, health insurance agents can earn commissions for selling health insurance plans from insurance companies that they represent.

Health insurance agents usually form strong relationships with their clients so they can help them make the best possible decisions, choose the right policy and settle claims with the insurance company. Good health insurance agents are honest, and they care for the needs of their clients.

Related:Insurance Jobs: Types, Salaries and Duties

Online Courses For Health Insurance Agent That You May Like

In this course, youll learn about the key components of health care, and the economics behind their principles and pricing strategies. Professors Ezekiel Emanuel of Penn Medicine and Guy David of the Wharton School have designed this course to help you understand the complex structure of the health care system and health insurance. Through study and analysis of providers and insurance through an economic lens, youll learn how basic economic principles apply to both principles and payment…

COURSE 1 of 7. This course is designed to introduce you to the concept of value-based care . While the information you will explore is general, it will help you establish a solid foundation for continued learning and future thinking about the concept of VBC. Through a historical lens, you will explore the creation of Medicare and Medicaid and the evolution of commercial insurance, TRICARE, and the Veterans Health Administration. While history is an important filter for understanding…

Read Also: Does State Farm Offer Health Insurance

Is Selling Insurance Hard

On the bright side, selling life insurance offers a few benefits difficult to find in other careers. First, life insurance sales jobs are abundant and easy to find. However, even when you locate a good prospect, the product itself is hard to sell. People are loath to discuss or even acknowledge their own mortality.

Gather What You Need To Take Your Exam

On the day of your exam, you must bring two forms of identification deemed acceptable to the test center . If you dont, you will not be allowed to take the examination and will forfeit the examination fee.

Recommended Reading: Can A Health Insurance Company Refuse To Insure You

What Are Some Of The Most Important Skills Needed To Succeed In This Career

Agents need to be highly analytical so they can assess their client’s needs. They should be excellent communicators to discuss which policies meet client’s needs and why. They need to be self-starters and actively find new clients and build a book of business to keep commissions flowing. Lastly, they need to have the self-confidence to call potential clients and discuss the benefits of buying new or additional lines of insurance.

Pass Your State Exam And Get Your License

After the pre-licensing course, you can study your specific area of focus. Then youll sign up to take your states insurance license exam in that specific field, so you can fulfill the licensing requirements.

Once you pass the state examination, you can make license application through the state. Insurance licensing exams cost from $40 to $150, depending on the type of insurance.

You have to pass the state exam before you can sell insurance.

Recommended Reading: Can You Get Health Insurance As A Real Estate Agent

Combining Health And Life Insurance Training

Some insurance training includes life insurance along with health insurance training. This is because many people choose to get their certification in both health and life insurance. They may be planning to sell with a company that offers both products, or they may just want to be able to sell both. This is fairly common.

Just remember that life insurance has nothing to do with health insurance, and you will have to take separate tests when you apply for your insurance licenses.

Top 10 Insurance Agent Associations & Groups

Membership in insurance agent associations and industry trade groups can help insurance agents in numerous ways. These organizations offer opportunities for professional development, help agents stay abreast of important industry news and events, and provide an important voice of advocacy in legislative and regulatory issues. They also can lead to key networking opportunities, which is an important business development tool for insurance agents and brokers relationship building has long been a key tenet of the insurance industry.

Insurance agents should consider membership or attending the national conferences of one or more of the following organizations:

-

American Agents Alliance

Founded in 1962 in Southern California, this member-driven organization is dedicated to serving the needs of independent brokers and agents. Membership benefits include access to industry insurance, government advocacy, continuing education, and networking opportunities at local meetings and the AAA national convention.

There are many other specialty insurance and related trade associations in the U.S. as well. The Insurance Risk Management Institute offers a comprehensivelist of insurance organizations on its website.

Don’t Miss: When Can I Apply For Health Insurance

Best States For A Health Insurance Agent

Some places are better than others when it comes to starting a career as a health insurance agent. The best states for people in this position are Alaska, New Hampshire, Washington, and South Dakota. Health insurance agents make the most in Alaska with an average salary of $69,582. Whereas in New Hampshire and Washington, they would average $64,464 and $64,307, respectively. While health insurance agents would only make an average of $61,903 in South Dakota, you would still make more there than in the rest of the country. We determined these as the best states based on job availability and pay. By finding the median salary, cost of living, and using the Bureau of Labor Statistics’ Location Quotient, we narrowed down our list of states to these four.

1. Washington

$64,307

2. Wisconsin

$61,532

3. Alabama

$60,297

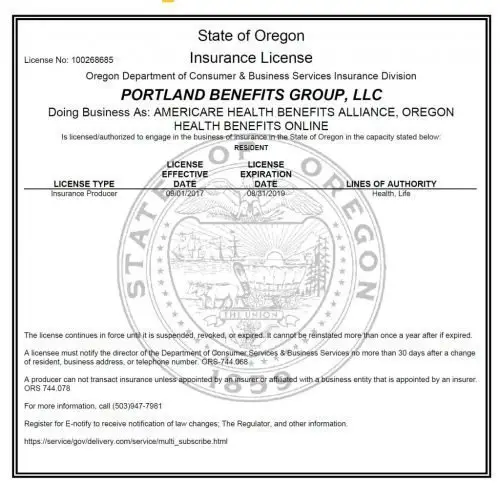

License Application And Background Check

Each state has its own license application process. These applications can generally be filled out online and have a fee ranging from $30 to $200. Some states require this before your exam, and some after, so be sure to check your individual states steps.

All states will run some form of a background check while reviewing your application. Some will also require fingerprint data to be taken prior to licensing. This is normally run through a third party and carries a fee of around $30, give or take.

If you have questions about the background checks or any other detailed license questions, you can find your states Department of Insurance contact information on your states license page.

You May Like: Does Usaa Have Health Insurance

How Do I Get A Title Insurance License In Virginia

How Much Does It Cost To Become An Agent

The pre-licensing courses may cost from $200 to $2000. Courses and study materials for each type of insurance may cost from $60 to $300. And the fee for each state examination may cost from $40 to $150.

After you pass a specific examination, the fee for your application to the state for licensure may cost from $30 to $200. Background check fees may cost from $30 to $100.

Are you running a calculator for this? Dont forget to add in the cost to obtain a college education.

Remember that these costs vary by state.

You May Like: How Much Subsidy For Health Insurance

Get Appointed With Insurance Companies

Once youre set up under a marketing organization, you can get appointed with the health insurance companies youd like to work with. They all have their own requirements in terms of paperwork, but some services exist that allow you to contract with multiple insurance companies at once ask your marketing organization about this. Once youre officially appointed with health insurance companies, you can legally help people with health insurance. You can also receive commissions at this point.

The Rolling Stone Culture Council is an invitation-only community for Influencers, Innovators and Creatives. Do I qualify?

Can I Work As A Pos Person From Home

At Digit Insurance, we primarily sell insurance policies online. This means, you as a POSP can work from home and use our online processes to sell and issue policies. Apart from having a smartphone, a good internet connection, and the required 15-hours training, theres nothing else you need to become a POSP.

At Digit Insurance, we primarily sell insurance policies online. This means, you as a POSP can work from home and use our online processes to sell and issue policies. Apart from having a smartphone, a good internet connection, and the required 15-hours training, theres nothing else you need to become a POSP.

Recommended Reading: Can You Change Your Health Insurance Plan Mid Year

The 100 Best Albums Of 2022

Smaller or regional health insurers may allow you to contract with them directly. But, if youre going to contract with a marketing organization for other carriers, you might want to contract through them even for carriers that you could, theoretically, contract with directly this could help simplify your business.

Why Should I Become A Health Insurance Agent

Become your own boss

One of the primary advantages of being a POSP is the freedom to work as per your convenience. You can now be your own boss!

No time constraints!

You can decide whether youd like to work fulltime or part-time and craft your own working hours accordingly.

Work from home

At Digit Insurance, we primarily sell insurance policies online. This means, you as a POSP can work from home and use our online processes to sell and issue policies.

Only 15 hours of training

To certify as a POSP, one of the main criteria’s is to complete the 15-hours compulsory training offered by the IRDAI which isnt much to be honest! All it is going to take you is 15 hours of investment to get on board!

High earning potential

Your earnings dont rely on number of hours worked but on the number of policies you issue. To have a better understanding of the same.

Zero Investment

Apart from having a smartphone, a good internet connection, and the required 15-hours training, theres nothing else you need to become a POSP. So, theres almost no monetary investment required from your end, whilst the earning potential is high.

Read Also: How Long After Quitting Job Health Insurance

Insurance License Applicant Information

Which Types Of Insurance Licenses Do You Need

There are two licenses that insurance agents attain:

- Life & Health Insurance License Life Insurance, Annuities, Health Insurance, etc

Most general insurance agents choose to get both of these licenses. Some agents dont have any plans on selling car or homeowners insurance, and therefore only need the Life and Health Insurance License.

We recommend finding which license you need first, working on that one alone, then coming back to get the other license at a later date.

Recommended Reading: How Much Does Decent Health Insurance Cost

When Do I Have To Renew It

It depends on state law, but a two-year renewal period is typical. You will probably have to demonstrate compliance with continuing education requirements when renewing. Our exam prep health insurance classes will give you the state specific knowledge to pass your continued education requirements.

How Do I Get An Insurance Agent Exam

IRDA 2021 Exam Application Form

You May Like: How Much Is Health Insurance In Texas

What Does An Insurance Broker Do

As a representative of the consumers, brokers are responsible for helping insurance buyers evaluate their risks and match them with the right policies based on their risk profiles and financial resources.

Some states in the US impose fiduciary duties on these professionals, meaning they are legally required to act only in the best interest of their clients. They are likewise expected to guide consumers through the entire insurance-buying process.

Customers may encounter three types of insurance brokers on their way to finding the right policies. These are:

- Retail insurance brokers: Working closest with the insurance buyers, these client-facing professionals assist clients in finding the best possible coverage, often dealing with less complex policies that cover common risks.

- Wholesale insurance brokers: These brokers offer more specialized products and rarely have direct contact with insurance buyers. Instead, retail brokers go to them for policies that cover more complex risks.

- Surplus lines insurance brokers: These professionals hold special licenses that allow them to access products for highly complex risks that standard insurers are not willing to cover. They can act as either retail or wholesale brokers and offer products from surplus lines specialists, also referred to as non-admitted insurers.

Here is a summary of the duties and responsibilities of an insurance broker.