What Happens If You Get Hit By Someone Without Insurance In Texas

If you are in a car accident with no insurance in Texas, the police will likely give you a ticket. They may have your car towed or ask you to arrange for someone with proof of insurance to drive it away from the scene. Some municipalities also have ordinances that allow police to impound your vehicle.

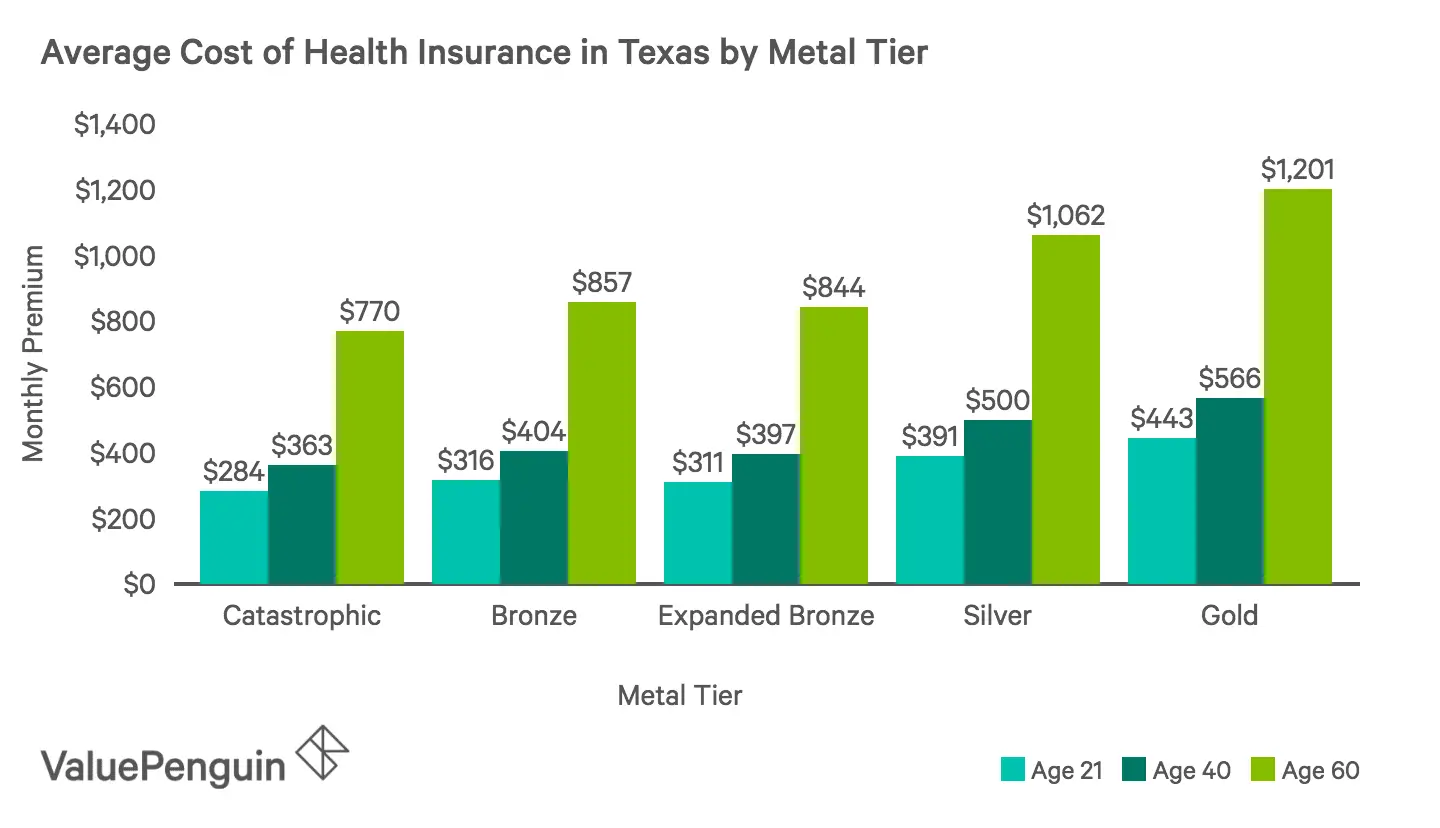

Texas Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 1,932,534 enrollees and individual insurance is based on 1,442,581 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

Cheapestepo/hmohealth Insurance Plan In Texas

Your healthcare preferences and needs can help you determine the type of plan to purchase. In Texas, most plans are Health Maintenance Organization plans. The state also offers Exclusive Provider Organization plans.

HMO plans usually require you to stay in your provider network to have services covered, but they often have lower premiums. EPO plans are similar to HMO plans, but unlike HMOs, they may not require a referral to see a specialist.

MoneyGeek found that the cheapest Silver plans for each plan type are:

- HMO: The MyBlue Health Silver 405 plan offered by Blue Cross and Blue Shield of Texas. The average 40-year-old will pay $390 per month.

- EPO: The Friday Silver plan offered by Friday Health Plans. The average 40-year-old will pay $431 per month.

Also Check: Does Insurance Cover Baby Formula

How Much Does Texas Health Insurance Cost

The average monthly premium for Obamacare Texas health insurance costs $436 in 2021.1 How much you pay for coverage will vary based on factors such as where you live, the plan type you choose, and the insurance company offering the plan. For 2020, a 21 year old in Dallas, TX earning $35,000 could get an Obamacare silver plan for $351 before subsidies and $145 after.2

How Much Does Health Insurance Cost Per Month In Texas

Tomorrow is October 1st, which means we are entering the fourth quarter of the year. The fourth quarter has always been a traditional time to evaluate household items like health insurance, but the Open Enrollment period has created an even larger demand for that evaluation. We begin fielding loads of health insurance questions during this time period and most of them center around a common theme. How much does health insurance cost per month in Texas? It doesn’t matter if you are self-employed, own a business, or work for a business the costs have escalated to crazy levels. We do have answers, but your age, location, and health can make a huge difference

You May Like: Why Do Doctors Hate Chiropractors

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Bronze And Catastrophic Plans Are Best For The Young And Healthy

The cheapest health insurance options are Bronze and Catastrophic plans. These plans, while having low monthly premiums, come with high out-of-pocket costs, often with deductibles and out-of-pocket maximums near the highest amount allowable by law. For 2022, this is $8,700 for an individual and $17,400 for a household.

You might find lower premiums very appealing, but these plans will generally cover nothing until you’ve paid thousands of dollars in bills first.

This could be problematic if you don’t have any disposable savings if you find yourself in need of moderate medical care. In such cases, you would effectively pay for the costs yourself. The Bronze and Catastrophic plans really help out in cases of significant emergencies where care will cost tens or hundreds of thousands of dollars.

Read Also: Do I Have To Have Health Insurance In Florida

Learn More About Health Care Costs

For those who can’t afford health insurance there are a few options to get help paying for health care costs, including:

Shop for health insurance and find out how to choose a health care plan that’s right for you.

How Does Chip Work

CHIP provides health care to children who qualify. If your child qualifies, you will need to select a health plan and the doctor you want for your childs health-care needs. Pick Texas Childrens Health Plan to select from our doctors.

Your childs doctor can help you find a specialist if your child needs one. The most a family will pay is $50 per year for all the children who qualify, but most families pay $35 per year or less. You will also need to pay additional co-payments for some services.

Recommended Reading: How To Keep Health Insurance Between Jobs

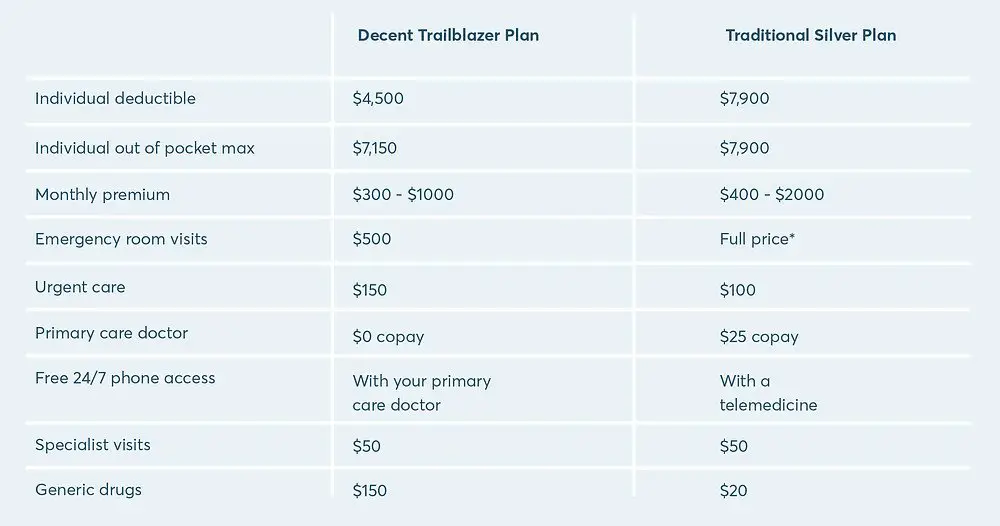

The Cheapest Health Insurance In Texas With Low Out

Individuals who anticipate having high medical costs may decide to purchase a plan with a higher monthly premium and lower out-of-pocket maximum. Youll pay more per month in premiums, but recurring medical expenses like doctors visits and prescription drugs will help you reach your maximum out-of-pocket limit relatively quickly. Once you reach this limit, your insurance company will start covering your medical costs.

In Texas, the cheapest option for a plan with a low out-of-pocket maximum is Ambetter Secure Care 15 from Ambetter from Superior HealthPlan. The average 40-year-old man can expect to pay a $646 monthly premium for this plan.

Typically, MoneyGeek considers any plan with maximum out-of-pocket costs below $4,250 to be a low out-of-pocket maximum plan. While the Ambetter Secure Care 15 plan has max out-of-pocket expenses that are slightly higher at $4,450 per year, it features the lowest out-of-pocket expenses in the state, as well as the cheapest average premiums.

Ambetter from Superior HealthPlan

The cheapest plan with the lowest out-of-pocket max in Texas is the Ambetter Secure Care 15 . This is a Gold plan, meaning it tends to have higher monthly premiums than Silver or Bronze plans. However, because it has a low out-of-pocket maximum, the plan will cover more of your medical costs once you reach its spending limits.

Individual Health Insurance Premiums On The Exchanges

The federal insurance plan marketplace at HealthCare.gov, aka Obamacare, is alive and well in 2021, despite years of its political foes’ efforts to kill it. It offers plans from about 175 companies. Some 12 states and the District of Columbia operate their own health exchanges, which basically mirror the federal site but focus on plans available to their residents. People in these areas sign up through their state, rather than the federal exchange.

Each available plan offers four levels of coverage, each with its own price. In order of price from highest to lowest, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is prices are going down a bit. According to the Centers for Medicare & Medicaid Services , the average premium for the second-lowest-cost silver plan decreased by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .

Don’t Miss: Does Medicare Pay For Maintenance Chiropractic Care

Texas Individual Health Insurance Options For 2020

Amy

Looking for 2022 individual health insurance options in Texas? We’ve updated the following guides for 2022. Check them out!

The major metros in Texas are poised for success with the individual coverage HRA, thanks to vibrant individual health insurance markets. We’ve even put together individual guides for each city to help employees in those cities determine their best options for individual health insurance where they live. Check them out!

Everything is bigger in Texas and health insurance is no different in the Lonestar state! Well over one million Texans enrolled in individual coverage in 2019. Since open enrollment can be a daunting time for many, our team at Take Command Health knew we needed to provide some BIG information to help you navigate the changes on the healthcare horizon. We want you to feel confident that you are choosing the best coverage available for you at the best price. Here’s what to expect.

Is Buying Texas Small Business Health Insurance Online A Good Idea

Purchasing Texas small business health insurance is a complex process and requires substantial knowledge of many issues. Online stores are generally automated to handle huge numbers of transactions, and therefore will try to simplify the choice for you, which may be very helpful. On the other hand, especially if this is your first time purchasing Texas health insurance, online stores may make you feel more like a number than like a client. This is especially true if you have unique medical needs, substantial preexisting conditions, or a complicated medical history.

If this is the case, see if the website has a phone number and try calling it. Ask the operator your questions and only purchase from them if you are pleased with their service.

Also Check: How Much Does Starbucks Health Insurance Cost

How Much Is Aetna Health Insurance

Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan, although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.In 2017, the last year Aetna sold ACA-compliant individual health insurance plans, premiums for plans not eligible for a subsidy averaged $525.07. Premiums plans that were eligible for a subsidy averaged $374.55, and the average cost of a dental insurance policy from Aetna averaged $64.40

| Year | |

| Obamacare/ACA Coverage without a subsidy | $525.07 |

| Obamacare/ACA Coverage with a subsidy | $374.55 |

Can I Get Dallas Health Insurance From Any Company Online

The insurer that you get from should be licensed in your state to provide health insurance. Not all online companies service all states – but most quote generators ask you for your state of residence to make sure you are covered.

You can check on their website which states they are licensed to do business in or you can fill out a quote form.

Read Also: Do Substitute Teachers Get Health Insurance

Other Cheap Health Insurance Plans In Texas

- Short-Term Health Insurance: Short-term health plans dont count as qualified insurance under the Affordable Care Act, but they usually cost half of major medical coverage. In 2021, a short-term plan for a 30-year-old woman in San Antonio costs about $67 a month.4

- Catastrophic Health Plans: Catastrophic health insurance premiums are usually much lower than other ACA-regulated plans, while their deductibles are very high. Catastrophic plans are designed to protect you from high out-of-pocket costs in case of a major accident or illness.

- Medicare Advantage Zero-Premium Plans: You can find Medicare Advantage plans for as low as $0 per month through several Texas insurance companies.5 You may qualify to enroll in a zero-premium plan if youre 65 or under 65 and have a disability.*

*You must continue to pay your Medicare Part B premium 6 when you enroll in Medicare Advantage. The Part B premium is $148.50 in 2021.7

Health Services Use By Arkansas Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 247,687 Individual insurance, 391,687 and Medicare Advantage, 125,442. Arkansas does not have a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Also Check: Starbucks Healthcare Benefits

Public School Employees Premium Plan

The Premium plan offers the lowest deductible for in-network services. Wellness benefits are available at no charge when obtained by a participating provider. This plan offers out of network coverage at a higher cost share. The plan allows medical and pharmacy copays, coinsurance, and deductible amounts to count towards the True Out-of-Pocket Maximum for cost sharing.

You May Like: Part Time Starbucks Benefits

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Recommended Reading: Uber Driver Health Insurance

The Cheapest Health Insurance In Texas By County

Health insurance costs in Texas can differ depending on where you live in the state. Texas is divided into rating areas, and health insurance carriers charge different rates in different regions.

Texas has 254 counties split into 26 rating areas. In Harris County, the most populous county in Texas, the average cheapest Silver plan is MyBlue Health Silver 405, offered by Blue Cross and Blue Shield of Texas at $381 per month.

Use the table below to view a list of the cheapest plans in each metal tier for your county.

Average premiums are for a sample 40-year-old male in Texas purchasing a health insurance plan in that county.

Cheapest Health Insurance Plans in Texas by County

Sort by county:

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

You May Like: What Benefits Does Starbucks Offer Employees

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Recommended Reading: Burger King Health Insurance

Texas Catastrophic Health Insurance If You Experiencing Financial Hardship

Catastrophic coverage usually requires you to be younger than 30. But if youre over 30 and experience hardship, such as eviction, high-medical debt, or bankruptcy, you can qualify for a hardship exemption to buy a catastrophic health plan.

Although these plans arent as comprehensive as standard Obamacare plans, they include all the ACA essential health benefits. Catastrophic plans are sold on Healthcare.govs individual Marketplace, so Texas open enrollment dates apply.