How Is Large Employer Determined

If an employer has 50 or more full-time equivalent employees, the employer is considered an applicable large employer under IRS rules. Under the employer mandate, an ALE must offer health coverage to full-time employees and must also report coverage details to the IRS .

Full-time employees are defined as those who work at least 30 hours per week. Full-time equivalent means a combination of employees who each work fewer than 30 hours per week but whose combined hours would equal a full-time employee. HealthCare.gov has an FTE calculator that employers can use.

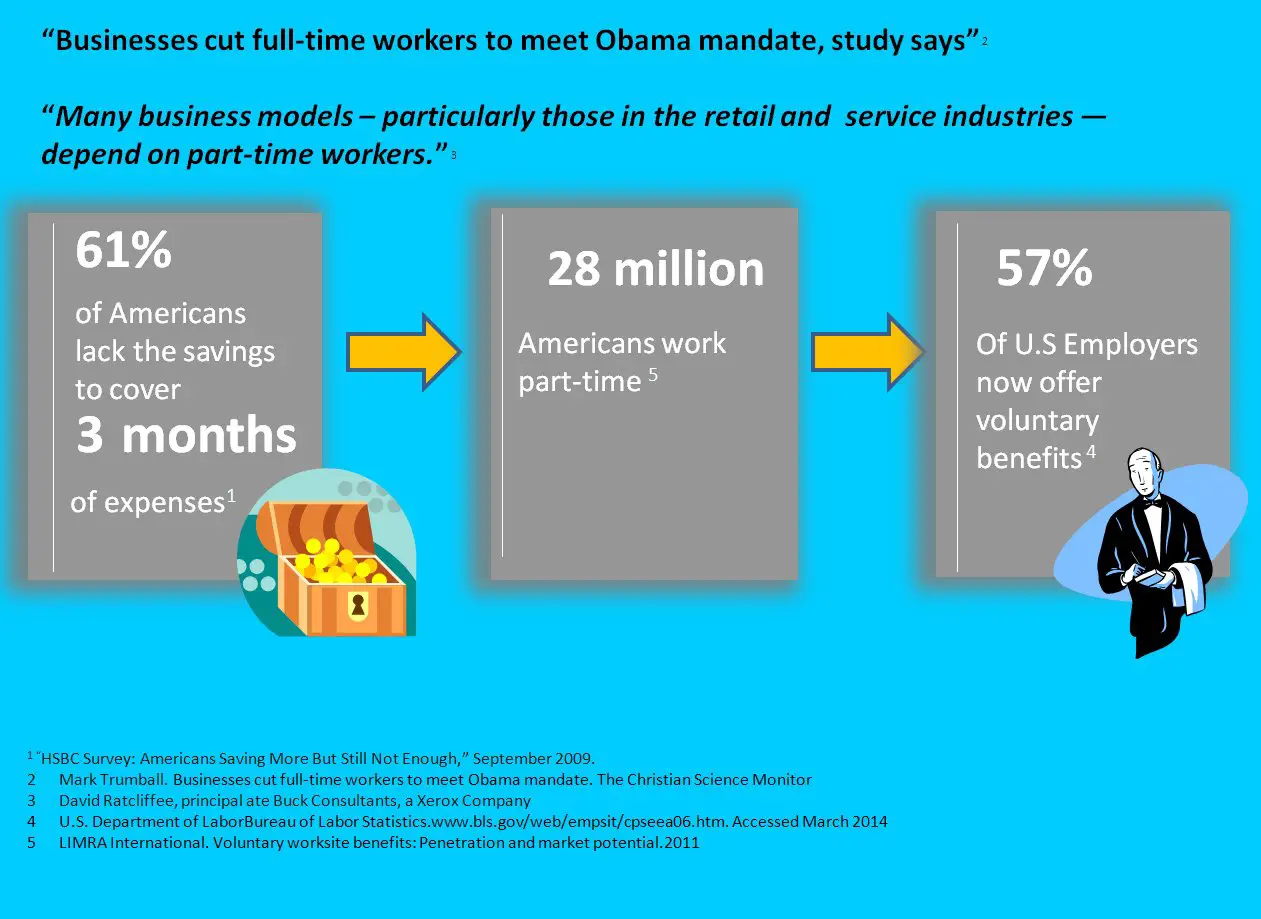

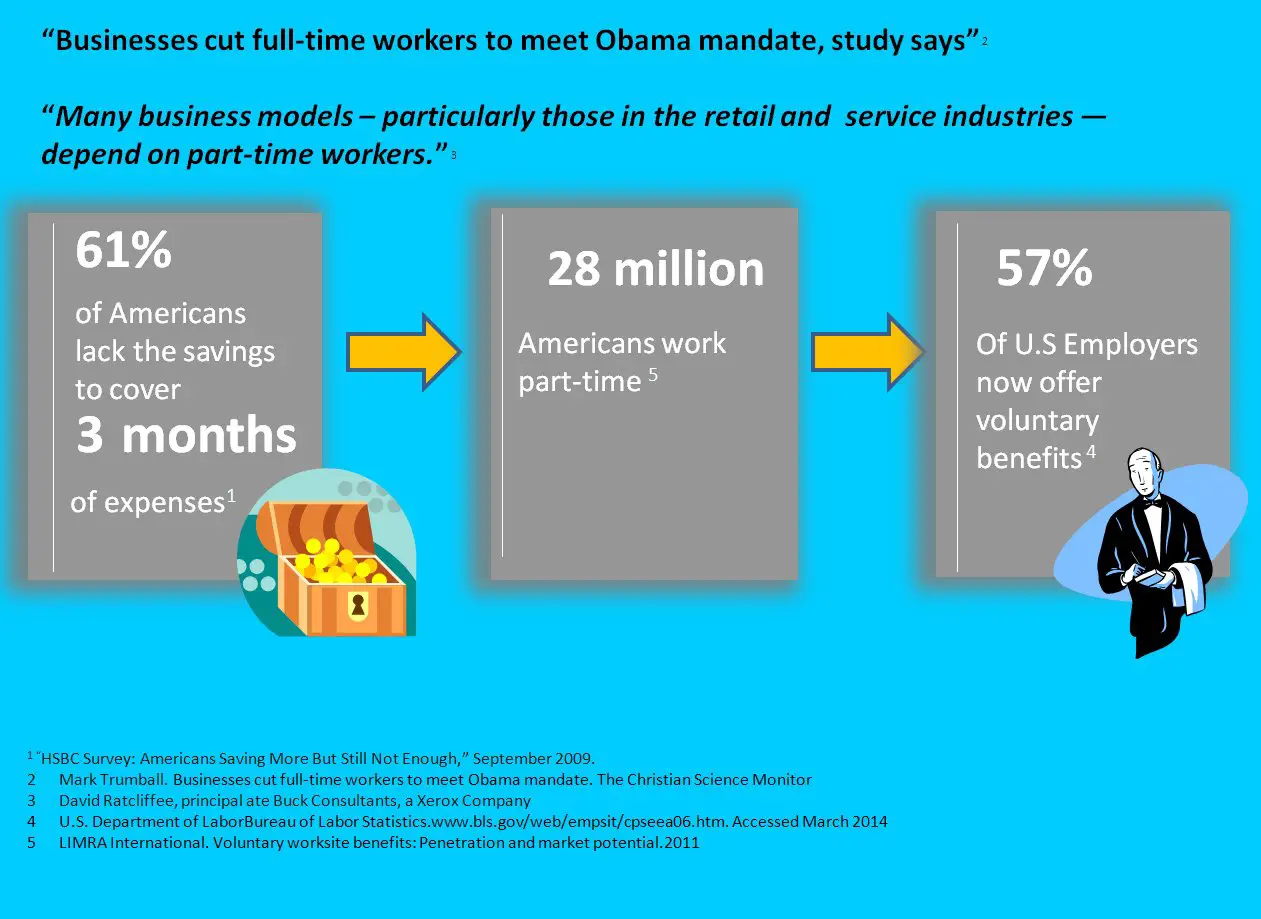

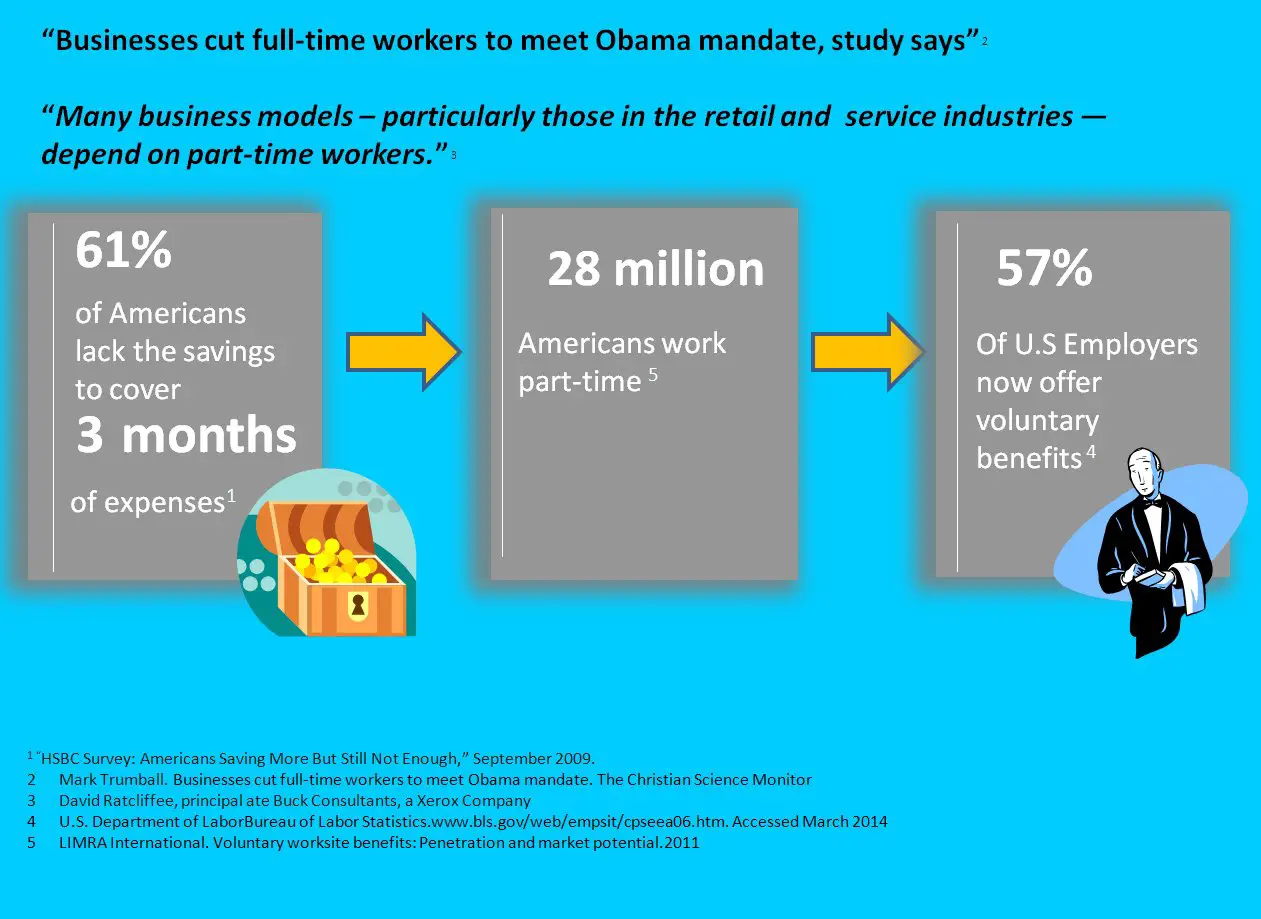

Since the ALE determination is based on full-time equivalent employees, a large employer cannot avoid being an ALE by employing a mostly part-time workforce.

Part-time employees do not have to be offered health coverage, but coverage would have to be offered to any full-time employees, and the ALE would have to report coverage offers and details to the IRS.

When Are Employees Eligible For Health Insurance

To sum it up

- Newly hired full-time employees may be subject to a waiting period of up to 90 days before they are eligible for health insurance

- There are some complications to this waiting period requirement if you are a variable hour employee or other extenuating circumstances

- Your job is not required to provide you with health insurance if you are a part-time employee

- Larger companies are required to offer health insurance to their full-time employees or they may be responsible for paying a penalty fine

How Can You As An Employer Improve The Health And Wellbeing Offering To Expat Staff

For international companies particularly, and those with remote and mobile workers, providing the right benefits is a powerful way of attracting and keeping talent. Benefits can also act as an incentive for companies looking to relocate staff overseas, reassuring employees that theyll be looked after in their new home.

International health insurance ensures employees can access high-quality healthcare while theyre living and working away from home. But some plans go beyond this, offering additional wellbeing benefits like:

Worried about the cost of health insurance?

Get 15% off your first-year premium with William Russell!

You May Like: Does Health Insurance Cover Eye Glasses

Health Share Plans As An Alternative To Health Insurance For Employers:

Health share plans, also referred to as health share programs, are organizations made up of individuals who share the cost of the group members health care. They are often used as an alternative to health insurance. Members of the health share plan define which medical expenses are eligible for coverage. Members are required to contribute a pre-set amount, usually monthly, in order to fund the health share plan.

Because health share plans must adhere to far fewer regulations than health insurance plans, health share plans are often able to charge their members lower premiums. The trade-off is that many of the expenses the health share plan has deemed ineligible for coverage will ultimately be borne by individual members. This is a pro if your employees are mostly young, healthy, and unlikely to experience any major health events.

What Contribution Level Or Premium Cost

Group health insurance plans are a form of employer-sponsored coverage. This means that a business is required to share the cost of group health insurance with employees. Typically, this cost-sharing element of health insurance requirements refers to a small business splitting monthly premium costs with workers. If you opt for a group health insurance plan, in most states, employers are required to contribute or pay at least 50% of each employees health insurance premium, although this may vary, depending upon the state in which your business is located.

Recommended Reading: Can I Buy Health Insurance After An Accident

The Health Care Reform: Whats An Employer Mandate

Under the Affordable Care Act, beginning in 2015, employers who employ 50 or more full-time workers will be required to provide health care coverage to employees. If employers do not provide coverage, they will have to pay a fine, called an employer shared responsibility payment . This provision may be referred to as an employers mandate.

Employer Health Insurance Continuation Laws

If your employer does offer group health insurance, you have the right to continue it after you leave employment. The federal Consolidated Omnibus Budget Reconciliation Act requires employers with 20 or more employees to allow their employees to continue health care coverage at their own expense.

If you quit, are laid off, or are fired for reasons other than gross misconduct, you can continue to receive your group health coverage, as long as you pay the full amount of the premium.

Also Check: How Much Is Temporary Health Insurance

Myth : Employers Must Pay At Least 70 Percent Of Employees Health Insurance Premium Costs

Busted. Although the Affordable Care Act does not specify a set amount that employers are required to contribute, some insurance carriers or states require employers to cover at least 50 percent of the premium for employee-only coverage. Employers can choose to cover more as a strategy to attract and retain quality employees, and many do. In 2017, the average employer contribution was 82 percent for employee-only coverage.2

Best Option If You Have Have To Offer Health Insurance To Employees

A couple of considerations before we jump into the option.

Okay…so based on those three points, here’s the plan.

We first run a quote across all carriers at the Silver or Bronze level to seewho is priced best for your company’s situation.

There are even skinny network options which can reduce premiums by 10-15%.

Once we have the best priced plan at a given level , we can runworksheets for each employee.

The worksheet will show the cost to them based on employer contribution of50% towards bronze plan.

The employee can then pick and choose from any of the levels and pay thedifference with pre-tax dollars.

They will pay with pre-tax money with the POP 125.

Average savings of 25% so the realcost is $150 for the employee. They avoid a separate penalty for not havingcoverage of 2.75% of income.

At $40K salary, that’s $1000/year or $80/month.

Also Check: Where To Find Individual Health Insurance

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employee’s Individual/family Plans Ask Us How It Works

Many California employers still contribute to employee’s individual planswithout the QSEHRA andthey’re running a risk by doing so.

It’s highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And here’s what I heard from one of our clients about offering insurance:

When To Seek Legal Help

If you are an employee and believe that your employer is not providing you with adequate insurance, you may need to seek the advice of a qualified health insurance lawyer or an employment lawyer. A qualified lawyer can help you understand your employers obligations and whether or not you may have a legal claim.

As an employer, you may need an workers compensation lawyer or labor lawyer to revise and update your compliance polices concerning the Affordable Care Act.

Recommended Reading: When Is The Deadline To Apply For Health Insurance

It Keeps Employees Happy

Offering health insurance benefits to your employees can keep them happy and help with employee retention. It can also help attract new employees to your company. According to a recent survey by Glassdoor, health insurance coverage is the most important benefit for employee satisfaction, ahead of vacation and pension plans.

Under The New Aca Law Rules A Company With 50+ Full Time Equivalents Has Tooffer Aca Compatible Coverage To Full Time Employees Or Face A Penalty

The penalty for not offering coverage is $2K per eligible employee.

What if you offer a scaled down health plan, sometimes called a MEC plan?

In this case, there’s a $3000 penalty for each employee that gets a taxcredit from the Exchange since your plan is not ACA compliant.

What makes the most sense…offer a MEC, ACA health plan, or no coverage ?

It completely depends on your company’s situation.

We can run the quote for your situation here:

What we consistently see as the best outcome financially and in terms ofemployee morale is the following.

Recommended Reading: What Is Health Insurance Through A Marketplace

Contact An Experienced Employment Law Attorney Today

If you believe that your employer has failed to provide required health coverage due to discrimination, your employment classification, or because an employment contract guaranteed you this right, an experienced employment law attorney can help. Legal issues surrounding employee benefits constitute an extremely complex, and constantly evolving area of law, and it is in your best interest to obtain legal counsel if you believe your rights have been violated in any way.

What Do Employers Need To Communicate To Their Employees If They Offer Small Business Group Health Insurance

If you decide to offer small group health insurance, you will need to provide your employees with specific information about the Marketplace health insurance offering:

- Who qualifies to participate in the companys group health plan. Small business employers are required to offer full-time employees the health coverage. Full-time means the employee works on average at least 30 hours per week. You are not obligated to offer coverage to employees family members but should disclose whether or not dependents may be covered by your companys plan.

- If you have new hires and you are uncertain whether they will work full-time, you are permitted to have a wait period, usually no more than 90 days from date of hire, to determine if the new hire is eligible to participate in the plan. Your employee communications should include a description of this wait period, if applicable.

- Benefits covered by your group health insurance plan. You must provide employees with a standard Summary of Benefits and Coverage form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options.

Also Check: How Much Does Health Insurance Cost In Idaho

What Are The Requirements For Offering Health Insurance To Part

Providing health insurance is one of the top employee benefits you can offer at your organization. But before you get started, eligibility for employees doing part-time work depends on federal and state laws, your insurance provider, and other factors.

Lets dive into the two main requirements for offering health insurance to your part-time employees in the sections below.

How Can Employers Save Money On Small Business Health Insurance Premiums

Smallbusinesses can still purchase group health insurance even if they do notqualify for a health care tax credit. For instance, small employers may stillbe able to deduct the cost of contributing to monthly employeepremiums from their federal taxes as a business expense.

Since group health insurance is employer-sponsored coverage, small businesses can also ask employees to pay for a portion of monthly premiums from their paychecks while still fulfilling employer cost-sharing requirements and ACA health insurance requirements. Browse affordable small business health insurance plans with eHealth to find the best options for your business.

You may also be able to offset some of the expense of providing group health insurance if you can capitalize on some of the small business incentives available from the American Rescue Plan Act of 2021, enacted to provide economic relief during the coronavirus pandemic. A variety of grants and loans, collectively valued at more than $22 billion, are set aside to assist small businesses struggling to recover from the economic effects of the pandemic.

Recommended Reading: Do Amazon Employees Get Health Insurance

When Does The Affordable Care Act Require Companies To Offer Health Insurance To Employees

The Affordable Care Act mandates that employers with fifty or more full-time employees must offer health insurance to their full-time employees. If your small business has grown to fifty or more full-time employees, the Affordable Care Act applies to you.

A full-time employee is defined by the Affordable Care Act as an employee who is working for the company for a minimum of 30 hours per week, or 130 hours per month for more than 120 days in a row. This is the same standard separating part-time from full-time employees that the IRS provides. If you have a group of employees who is not averaging 30 hours per week, or 130 hours per month for more than 120 in a row, you are not legally required to offer those employees health insurance, as they are considered part-time.

If an employer fails to offer health insurance to these individuals, they face the assessment of lofty fines and penalties from the federal government.

Pros Of Offering Health Insurance Benefits

In addition to attracting quality candidates, here are six other advantages to investing in healthcare insurance for your employees:

- Employee retention : Research from the Society of Human Resource Management found that employees are more likely to stay with an employer if they like their healthcare plan.

- Lower premiums: Group plans typically cost less than individual plans, even within the ACA framework.

- Pretax benefit for employees: In many cases, small business-provided health insurance can reduce employees tax burden, which provides your workers with more take-home income.

- Healthier and productive employees: When employees have access to healthcare, they, and their dependents, can more easily address health issues early on. This results in healthier employees, which reduces the number of days employees take off because of illness.

- Creating an employee-focused company culture: Few things boost company culture more than offering benefits that employees truly value. Having a solid benefit offering shows employees that the company cares about them. Health care insurance is one of those key benefits that a business can offer its workers that powerfully delivers this message.

- Possible employer tax credit eligibility: Although it is not required for small businesses to offer group health insurance, some employers may benefit from a tax credit through the ACAs Small Business Health Options Program .

Read Also: How Cheap Can I Get Health Insurance

Can I Start A Plan At Any Time During The Year

If you decide to begin offering health insurance to your employees, you can implement a plan at any time of year. Since health Insurance plans renew annually, many employers like to align their plans with the calendar or fiscal year, but its not required. In fact, it can be advantageous to have the plan start on an off-peak month to avoid the rush of renewals at peak times of the year and can make the process easier.

No matter when you start a plan, employees may have a waiting period between when they enroll in the plan and when coverage actually starts. For example, workers coverage may begin the first day of the next month.

Employers Required To Offer Health Insurance

Beginning Jan. 1, 2014, employers with 50 employees or more will be required to provide health insurance coverage to full-time employees or face paying a penalty. The requirement does not apply to employers with fewer than 50 employees. The annual penalty for not offering coverage is $2,000 for every full-time employee beyond the first 30.

Employers that offer coverage to employees may also be subject to penalties if any of their employees choose to buy coverage through the local health insurance exchange instead of participating in the employer’s plan. These employers will be required to pay a $3,000 penalty annually for each of their employees who opt for coverage through the health insurance exchange and receive a premium tax credit for doing so. However, employers will not be subject to penalties if the coverage they offer pays for at least 60% of covered health care expenses for a typical population and employees do not have to pay more than 9.5% of their household income for the coverage. For more information about who can purchase insurance through an exchange and who qualifies for a premium credit, click here. Employers will not be penalized for any employee insured through a spouses employer, Medicaid, or Medicare.

You May Like: How Much Is Health Insurance In Costa Rica

Are There Exemptions Or Complications Associated With This Waiting Period

There may be extenuating circumstances that affect this waiting period. For example, if your job does not offer health insurance until you have met certain other requirements, such as completing an actual orientation program, the 90-day waiting period may not necessarily apply under these conditions.

Another circumstance that may affect this waiting period is if you are considered a variable hour employee.

If you are hired as a part-time employee, but there is the potential or likelihood that you will become a full-time employee, your employer can wait up to a year before determining if you are a full-time employee and then proceed to offer you health insurance.

However, after the year of you being a variable hour employee has concluded, your employer cannot add the 90 days on to your waiting period after becoming a full-time employee.

Under these circumstances, your employer must offer you health insurance within 13 months after your start date.

Employers also have the option of setting hour of service requirements before even beginning the 90-day waiting period.

These service requirements cannot exceed 1,200 hours, are prohibited from being reapplied to an employee, and are only allowable for new hires.