Is There A Fine For Not Having Health Insurance

The Affordable Care Act, also called ObamaCare, went into effect in 2010. In the law, there was an Individual Mandate written in, which made it a requirement for all Americans to carry a health insurance plan or else theyd be penalized by the federal government during that years tax season. In December 2017, the new tax legislation repealed the tax penalty so that for the year 2019, there was no federal tax penalty. However, a few states had their own Individual Mandate in place and plan to have it in place next year too.

Read Also: Is Priority Health Good Insurance

Aca Goal: Insure Most Americans And Keep Them Insured

The overarching goal of the Affordable Care Act was to extend health insurance coverage to as many Americans as possible. In that regard, its had significant success. From 2010 through 2016, the number of people with health insurance in the U.S. increased by roughly 20 million. And although the uninsured rate has been increasing since 2017, it has been below 10% since 2015.

But while access to health insurance is important, its also important that people maintain their coverage going forward. Keeping as many people as possible in the risk poolespecially when theyre healthy and not in need of immediate carekeeps premiums affordable. And while health insurance coverage is certainly not cheap, it would be far more expensive if people could just wait to purchase coverage until they were in need of medical care.

Recommended Reading: How To Cancel Oscar Health Insurance

What If You Go Without Health Insurance

The federal tax penalty may no longer be a factor, but you may still want to obtain some level of coverage, such as a short term medical policy, to help pay for covered medical expenses should you experience an unexpected illness or injury.

Why? Well, evidence suggests that uninsured people are less likely to receive healthcare than their insured friends and family, and when they do, they pay more for it.

Specifically, Kaiser Family Foundation research found that:

- 24% of nonelderly adults without insurance postponed medical care due to cost compared to only 6% of those with private coverage and 9% of those on Medicaid or another public plan

- 20% of nonelderly adults without insurance went without needed care due to cost, compared with 3% of those with private coverage and 8% of those with public coverage

- Nonelderly adults without insurance for an entire year pay for 1/4 of their care out of pocket and hospitals frequently charge uninsured patients much higher rates compared to those paid by private health insurers and public programs

Find short term health insurance plans in your area to compare coverage options and costs.

Also Check: How Much Is Supplemental Health Insurance For Seniors

Tax Penalty For Not Having Health Insurance In Ca

December 27, 2021, by New City Insurance

Having health insurance is not just a recommendation in some states. In California, it is now a law. A new state law, effective January 1, 2020, requires all California residents to maintain a qualifying health insurance policy year-round. Residents who fail to maintain qualifying health insurance may owe a penalty when filing their state tax return unless they are granted an exemption.

Californians who did not previously qualify for federal health insurance may now qualify for a new state subsidy program which is expected to help more than 235,000 people. Learn more about this new health insurance mandate and why some individuals in California may face a hefty tax penalty at tax time.

Is There A Penalty For Being Uninsured

No, there is no longer a federal mandate but some states and jurisdictions have enacted their health insurance mandates.

However too often than not, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills.

For instance, if you get a broken leg from a trip and fall, hospital and doctor bills can quickly reach $7,500 and for more complicated breaks that require surgery, you could owe tens of thousands of dollars.

A three-day stay in the hospital might cost you about $30,000.

If you take a look at more critical illnesses including cancers and strokes, your bill might be running into the hundreds of thousands of dollars. So without a health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

So essentially, the Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills.

Below are the states that have mandates and penalties in effect for persons without a health insurance cover

- California

Recommended Reading: How To Cancel Health Insurance Aetna

Now The Second Question

As of 2021, there are no federal financial penalties for being uninsured. Just four states, Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia, enforce penalties non-compliance.

Vermont and Maryland have individual mandates but have not implemented any penalties.

If you are now seeking an ACA-compliant plan and did not have MEC coverage in 2018 , you may be liable for a tax penalty. It would be best if you did not regard this as a deterrent. The penalty is pro-rated and averages about $200-far less than the value of an ACA compliant policys tax and security benefits.

To insure or not to insure? That is the most critical question.

Over ninety percent of US citizens have health insurance coverage . Nearly half of us are insured on plans sponsored by our employers, and just one in three benefits from government programs such as Medicare and Medicaid.

Nearly 6% of the US population choose their insurance plans through the federal, state, or private health insurance exchanges. These exchanges are online and provide an important way to compare the thousands of plans on offer from hundreds of insurers and calculate your premium tax relief and other reliefs to which you may be entitled.

Of those uninsured, the first reason is that they believe health insurance is too expensive. Many are unaware that the subsidies are most significant for the least well-off or that up to 80% of insured individuals qualify.

What This Means For Your 2021 Health Insurance Options

The federal tax penalty may be a thing of the past, but thereâs no doubt that major medical insurance remains the best option for many people, especially those who:

- Need comprehensive benefits

- Need guaranteed issue coverage due to health history or pre-existing conditions

That said, if for one reason or another you want to explore other, non-ACA qualifying health insurance options and decide to enroll in one of them, you can do so without facing the federal tax penalty in 2020.

Just be aware that the options below are not considered minimum essential coverage under the ACA, which means they are not guaranteed issue and do not include comprehensive benefits.

Recommended Reading: Can You Buy Health Insurance Any Time Of The Year

What Are The Risks Of Being Uninsured

Being uninsured is much like a gamble. By saving some money on insurance costs, you risk losing a huge amount on any necessary hospital bills. If you remain perfectly healthy, you save money. If anything unexpected happens, you risk losing a significant amount.

The problem is that when it comes to unexpected healthcare, its just that: unexpected.

The most significant reasons for concern include:

Calculating Your Penalty Fees

For 2018 and earlier, you can calculate the the amount youll pay in penalty fees two different ways.

Youll pay whichever is higher. Using the percentage method, only the part of your household income thats above the yearly tax filing requirement is counted. Using the per person method, you pay only for people in your household who dont have insurance coverage.

If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you dont have coverage. If you do not have coverage for only 1 or 2 months, you dont have to pay the fee at all.

You can use the IRS penalty fee estimator to figure out how much you might owe from uncovered periods in 2018 and earlier.

Also Check: Is Dental Insurance Health Insurance

How Do I Get Affordable Coverage

If cost is what is keeping you from purchasing coverage, youwill be happy to know that there are Affordable Care Act subsidies that you mayqualify for.

Qualification for subsides is based off your yearly income andhow it compares to the federal poverty line . If you make between 100% ofthe FPL and 400%, you may qualify for some assistance in paying your monthlyinsurance premium.

You can still qualify for subsides if you choose to buy through an online brokerage like eHealth, as long as youre choosing an ACA-compliant plan that includes the 10 essential benefits required under the federal law. eHealth also allows you to compare plans that arent on the government exchanges, so that you can find the best health insurance for your budget and your needs.

At eHealth, we are committed to ensuring everyone gets the best health care coverage for their needs and budget. We feature licensed brokers in every state and once you are enrolled in a plan, we offer 24/7 support to help you manage and renew your plan as needed. Contact eHealth today to begin comparing plans in your state.

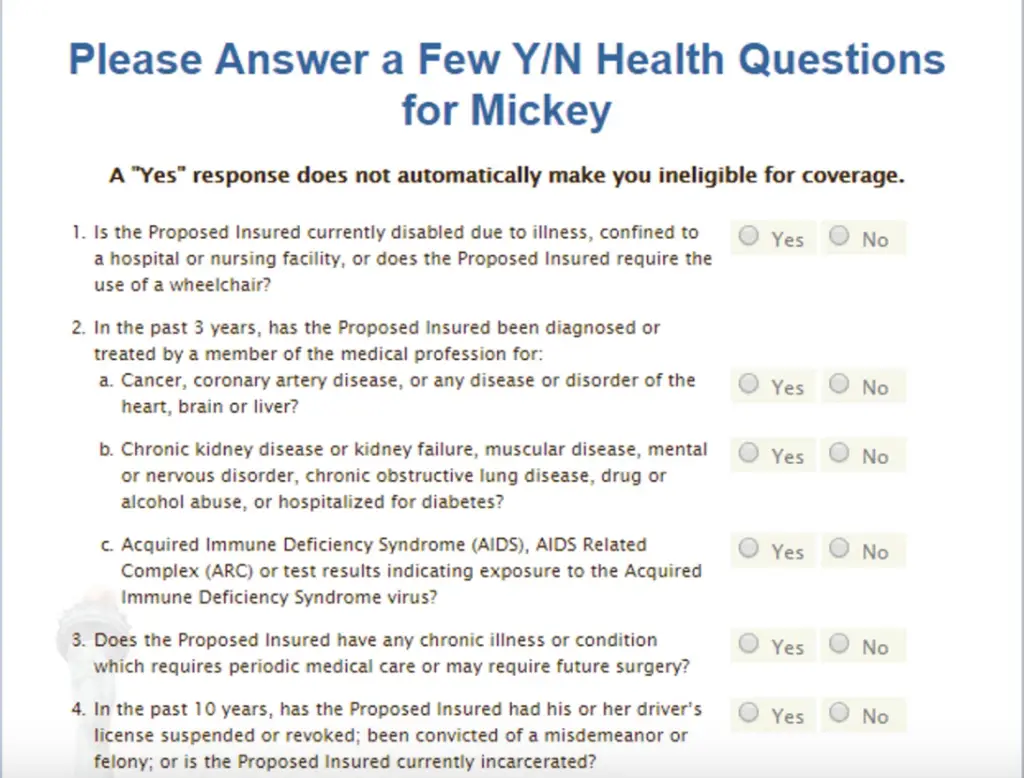

Who Does The Individual Mandate Apply To And Who Is Exempt

Almost all U.S. citizens who did not have health insurance between 2010 and 2018 may still owe a penalty fee next year or in the future based on the individual mandate. This fee comes in the form of an extra tax you must pay for the time you didnt have coverage. People who qualify for a health coverage exemption for past years includes anyone who:

- Was incarcerated.

- Had an income that was so low that filing a tax return was not a requirement.

- Were members of a Native American tribe.

- Had a religion that objects to having health insurance.

- Belonged to a healthcare sharing ministry.

- Was in the U.S. illegally.

- Qualified for a hardship exemption.

- Paid more than a certain percentage of their income to their health insurance. The IRS set the exact percentage each year.

You can also visit HealthCare.gov to learn more about exemptions from the individual mandate and how to apply for an exemption if you qualify.

Starting in 2019, though, you do not have to pay any kind of penalty fee or tax if you do not have coverage, regardless of whether or not you qualify for an individual mandate exemption. However, there are a few states that still enforce the individual mandate which well talk about below.

Don’t Miss: How Much Is Health Insurance When You Retire

How To Look Up Plan Premiums

1. Open MNsure’s plan comparison tool — on the first page, click the Continue button.

2. Under “Which Coverage Year” select the year for which you are seeking information. Note: if you pick a year prior to the current coverage year, a date picker will appear. Enter the start Date for your exemption.

43. Under “Where do you live” enter the ZIP Code of your residential address. Your county of residence will appear. If there is more than one county for your ZIP code, select your county of residence.

4. Under “Who is in your household and do they need coverage?” enter the following information for each person in your household applying for the exemption:

- Birthdate

- Tobacco Use. If you use tobacco, you need to enter your household information two separate times in order to search for the correct premium using the correct Tobacco Use status. To get the lowest cost bronze plan premium: check the box to indicate “Yes” for Tobacco Use. To get the second-lowest cost silver plan premium: leave the checkbox unchecked to indicate “No” for Tobacco Use.

- Leave Native American, and Pregnant? checkboxes unchecked as these cannot be used in this premium calculation.

- Make sure the Needs Coverage checkbox is checked.

5. Skip the financial help section and click Browse Plans button on bottom right.

6. Skip the Tell Us about Your Health Care Needs page and select Skip to View Plans button.

7. Under the “Health Plans” tab, the medical plans available to you will display.

Saving Money On Prescriptions When You Are Uninsured Or Underinsured

Most people who go without health insurance do so because of the cost, according to theKaiser Family Foundation. SingleCare can help you save money on your prescriptions. Many times, usingSingleCare provides you with lower prices than if you used your insurance.

It is easy to find out if you can save money this way. Use either theSingleCare website orapp and search for your medication to receive a list of pharmacies and digital coupons for the drug. These prices are based on partnerships between the pharmacies and SingleCare. You often can find your prescriptions for a lower cost than if you walked into the pharmacy without checking or through your insurance.

You May Like: How To Find Good Health Insurance

No Longer A Federal Penalty But Some States Impose A Penalty On Residents Who Are Uninsured

Although there is no longer an individual mandate penalty or Obamacare penalty at the federal level, some states have implemented their own individual mandates and associated penalties:

Vermont enacted legislation to create an individual mandate as of 2020, but lawmakers failed to agree on a penalty for non-compliance, so although the mandate took effect in 2020, it has thus far been essentially toothless . Vermont could impose a penalty during a future legislative session, but the most recent legislation the state has enacted calls for the state to use the individual mandate information that tax filers report on their tax returns to identify uninsured residents and provide targeted outreach to help them obtain affordable health coverage.

Also Check: Starbucks Part Time Insurance

How Is The Tax Penalty Calculated If I Only Had Health Insurance For Part Of The Year

The tax penalty is assessed for each month that a person is not covered. It is pro-rated, so that a person who is not covered for only a single month would pay 1/12th of the tax that would be due for the full year. For example, the minimum tax per person for failing to get coverage would be $7.92 for each month of 2014, $28.75 for each month of 2015, and $57.92 for each month of 2016, when fully phased in.

Also Check: Do Starbucks Employees Get Health Insurance

Health Insurance Financial Assistance

California will become the first state to offer financial assistance to middle-income residents who make between 400% and 600% of the federal poverty level. Thats about $50,000 and $75,000 a year for an individual and about $103,000 and $154,500 for a family of four.

The state-funded subsidy will help residents who have previously struggled to pay their health insurance premiums because they were not eligible for assistance.

Covered California estimates that the new subsidy, in conjunction with the new state tax penalty, will result in 229,000 newly insured Californians.

The revenue from the health insurance penalty, in addition to other state funds, will help pay for the subsidies for roughly 922,000 people who purchase insurance through Covered California. The new state financial assistance will be in addition to federal financial aid that some will receive through Covered California.

State residents whose annual household income is less than 138% of the federal poverty level will see premiums for specific plans lowered to just $1 per person, per month. The 2020 earnings cutoff for this level is $17,237 for an individual and $35,535 for a family of four.

Recommended Reading: What Type Of Health Insurance Do I Need

What Is A Consequence Of Not Having Health Insurance

The major risk of skipping health insurance coverage is medical debt. Health care is expensive. A broken leg can cost you up to $7,500, a three-day hospital stay can cost $30,000, and a cancer diagnosis can trigger hundreds of thousands of dollars of spending. Health insurance helps to cover these costs and reduces your chances of financial ruin.

You May Like: How Much Does Student Health Insurance Cost

The Future Of Individual Health Insurance Mandates

Over the past year, a few additional states have considered or are considering individual mandates, including:

- Connecticut

- Washington

However, so far, none of these states havemanaged to ultimately pass state individual mandates.

Lawmakers who push for individual mandate laws argue that its needed to incentivize people to get health insurance. The argument is that if not enough healthy people sign up for coverage, the pool of insured individuals will be made up mostly of sick people, and health premiums will rise for everyone. However, many states have attempted and failed to pass individual mandate legislation, and these laws remain politically controversial.

According to Forbes.com, the new Biden administration is expected to bring back the federal tax penalty for going without ACA-compliant health coverage. Its unclear yet whether he would do this through an executive order or legislative reform. Find out more on if it is okay to be uninsured.

What Is The Tax Penalty For Not Having Health Insurance

As of January 1, 2020, the state of California will require California residents to maintain minimum essential coverage or pay a penalty. The annual penalty is 2.5% of household income or a per person charge, whichever is higher. The per person penalty will be $695 per adult and $347.50 per child . The per person penalty amounts will be adjusted annually for inflation. The penalty cannot exceed the cost of the state average premium for the bronze level coverage offered through Covered Calfornia for the applicable household size or 300% of the per person charge, whichever is lower. For more details, please reference pages 6 & 7 of the FTB bill analysis.

Recommended Reading: Will I Get Money Back From Health Insurance