Initial Or General Waiting Period

The initial cooling period or cooling period refers to the time period after which you can make a claim. During the initial waiting period, your policy is inactive. Unless there is a medical emergency, you cannot file for a claim in the initial cooling period.

Generally, the initial cooling period for health insurance is 30 days . This period may vary depending on the type of policy and your insurer. This is not applicable if you have a continuous insurance cover for more than 2 years.

Waiting Period For Bariatric Surgery

Some health insurance policies cover bariatric surgery too. Bariatric surgery is surgery on the stomach and/or the intestines that helps the patient with extreme obesity-related issues. The surgery is usually recommended to those with a BMI over 40 and those going through health issues due to the same.

Insuranceopedia Explains Waiting Period

Health insurance generally imposes three types of waiting periods. An employer waiting period requires an employee to wait a certain period of time, such as three months, before they can receive covered health services. This is to discourage an employee from filing a major claim and leaving the company shortly thereafter. Second, affiliation periods refer to exclusion periods that HMOs impose. The Health Insurance Portability and Accountability Act regulates this and does not allow it to exceed three months. Lastly, some group plans may have pre-existing condition waiting periods, as these plans are the only ones now required to provide insurance to those with a PEC. However, creditable coverage can help reduce or eliminate this wait period.

Also Check: How To Get Health Insurance Reinstated

Additional Information About Waiting Period

- The waiting period clause must be read carefully and thoroughly before buying insurance. Make sure to read the fine print in the document attentively.

- If a person is diagnosed with a disease during the waiting period, then it will not be considered as pre-existing disease.

- The waiting period is affected by certain factors like type of health insurance as well as medical history and age of the person.

- In some cases, the waiting period can be reduced by paying a higher premium. It is advisable to check with the policies of every company.

Hope you have understood about what is waiting period in health insurance. It is essential to buy a health insurance plan suitable to your needs. It will aid you and your family in times of need or emergency. Advisable is to take professional advice from different companies to land into a hassle-free and convenient health insurance policy.

Featured Articles

Types Of Waiting Periods In Group Health Insurance:

Broadly speaking, these are the different group health insurance waiting periods. These vary from policy to policy and insurer to insurer.

1. Initial:

Also known as the cooling period, itâs the amount of time you need to wait from the date of purchase until you can make any claim. Although the time varies from insurer to insurer, the standard waiting period for health insurance is minimum of 30 days to 90 days.

The one exception to the initial waiting period in group health insurance is accidental claims. Claims are approved if the insured meets with an accident and requires immediate hospitalization.

2. Pre-existing diseases waiting period:

A pre-existing disease is any disease, injury, ailment, or condition thatâs been in existence for about 48 months before you purchase the policy. Usually, itâs diseases like thyroid, high blood pressure, diabetes, etc.

So, if you have any pre-existing disease that falls under this umbrella, you will have to wait for a specific period before you make any claims related to medical expenses or hospitalization for that ailment. The standard health insurance waiting period for pre-existing conditions is four years. Again, this varies from insurer to insurer and the type of health insurance policy you purchased.

3. For a specific disease:

4. Maternity and newborn:

Recommended Reading: What Health Insurance Does Walmart Offer

Importance Of The Waiting Period In Health Insurance

Lets take an example to consider!

Mr. Ram, 40 years old, working as a software engineer has already been diagnosed with cancer. The doctor advised him to go through chemotherapies that he could not afford on his regular pay check. As a remedy to this problem, he purchased a health insurance plan without informing the company about his illness.

To avoid such unethical tactics, nowadays, health insurance companies have a waiting period before which the policyholder cannot receive any benefits from their health insurance plan. Therefore, a waiting period in health insurance is implemented to prevent individuals from claiming benefits under a health insurance policy with the wrong motive.

What Is A Waiting Period For Health Insurance

Pacific Prime explains what a waiting period is and whether you can file for claims during this time.

A term typically seen in maternity and a handful other insurance policies, ‘waiting period’ is a source of confusion for many. It protects insurers from clients who know full well that they have a medical cost coming up and file for claims immediately after their plan enrollment.

Below is a common question we receive regarding the waiting period for health insurance. In a nutshell, we’ll explain what a waiting period is and how it works. We also have a short video available if you prefer a visual explanation and a practical example for your reference.

You May Like: Can A Health Insurance Company Deny Coverage For Preexisting Conditions

Different Types Of Waiting Periods In Health Insurance

You can file a claim only after the minimum waiting period of the health insurance policyis over. However, there are different types of waiting periods for health insurance. You can avoid getting rejected by insurance providers if you make an informed claim. So, read the following to know more about the types of the waiting period in insurance.

Mental Health Waiting Period Exemption For Higher Benefits

If you are on a hospital policy which provides restricted benefits for psychiatric care, then to access higher benefits you usually upgrade and complete a two month waiting period.

However, from 1 April 2018, you can upgrade without having to serve this waiting period to access higher benefits for psychiatric care in a hospital or hospital substitute treatment.

This exemption applies only once per lifetime and can only be accessed if you have already completed an initial two months of membership on any level of hospital cover. For more information about accessing the exemption, please contact your health insurer.

For general information about the exemption, see the Department of Health and Aged Care website: waiting periods and exemptions.

General treatment waiting periods

The waiting periods for general treatment cover are set by individual health insurers.

Generally, waiting periods vary from two to six months for items such as general dental, optical and physiotherapy, and up to 12 months or more for major items such as orthodontics or hearing aids.

Brochures

Read Also: How Much Does Single Person Health Insurance Cost

Get A Free Insurance Quote Today

Still have questions about waiting periods or maternity insurance? Don’t hesitate to get in touch with one of our experienced insurance advisors at Pacific Prime. We work closely with top health insurers and partners to help you find the best plan by balancing your budget with your needs. Short on time? Get a free quote now with our online quotation tool!

For more practical insurance knowledge and trends, check out our host of articles and resources.

What Is Waiting Period

The waiting period in health insurance plans refers to the time you must wait before receiving insurance benefits. It starts on the day the policy is issued, and the insured is not eligible for health insurance benefits during this time. The duration of the waiting period, as well as its terms and conditions, differ from one company to the next.

For example, most health insurance companies include a waiting period of 2-4 years for the maternity cover. This simply means that you need to wait for 2-4 years before you can actually get benefits from your maternity cover.

Thus, a waiting period is a set amount of time that must pass before a claim may be filed under a health insurance policy. If you purchase health insurance on August 1 and it has a 30-day waiting period, you will be unable to file a claim during that time. You can file a claim only on the 31st of August.

You May Like: Does My Health Insurance Cover Therapy

Things To Know About Waiting Period In Health Insurance Policies

Every health insurance policy has a minimum waiting period before which it can be deemed active. But what does that mean for you as a customer? The waiting period can be defined as the minimum span of time you should wait for before your diseases start getting covered by the plan. The reason being, the insurance provider, cannot deny the health insurance claim or cannot reject the claim once it is made after the waiting period is over. It can be spread across various conditions, and it is necessary that one be aware of how the waiting period concept works before you buy an online health insurance plan.

When You Have Pre-Existing Diseases

Other Ailments or conditions such as maternity, infant and accident insurance.

How A Waiting Period Works

The waiting period or elimination period before the insured may make claims varies by insurer, policy, and type of insurance. For more extended waiting periods before coverage is active, the cost of a premium may reduce slightly. In health insurance, there are several types of waiting periods.

An employer waiting period requires an employee to wait a specified period, such as three months, before they may receive company-subsidized health services. Often a provision like this will be in place for a company that expects a high turnover rate in employees. Once an employee enrolls, they may have an additional waiting period before they may claim on the coverage.

Health Maintenance Organizations have affiliation waiting periods. The Health Insurance Portability and Accountability Act regulates affiliation wait periods and does not allow them to exceed two months .

A pre-existing condition exclusion period varies from one to 18 months. These wait times refer to specific health conditions an individual may have in the six months before enrolling in a health insurance plan. Coverage may be limited or excluded for the pre-existing condition. However, if the insured can prove uninterrupted insurance previous to changing policies, that coverage can count towards the pre-existing condition exclusion. Exemptions allow those who have at least one year of group health coverage at one job and a span of no more than 63 days to avoid this provision.

Also Check: Does Health Insurance Cover Ivf

Cooling Period Or Initial Waiting Period

This type of waiting period in health insurance refers to the period starting from the date of issue of your policy, for which you need to wait to start using the policy actively and avail of its benefits.

As an insurance industry standard, most health insurance plans have an initial waiting period of up to one month. However, it is not applicable to accidental hospitalization cases in general .

What If You Have Medicaid

If your application for Medicaid is approved, then coverage will begin on either the day that you applied or the first day of the month that you applied. The specific rules will depend on your state and should be explained in your application. If you are uncertain, go to your states Medicaid website.

What If You Have COBRA?

COBRA allows you to continue your health benefits provided by your employer with no break in coverage for a year or more, typically when you lose your job. Most likely, you will be required to pay your premiums and all medical bills on your own, since your old employer will stop contributing typically burdening you with hefty costs. But you still have continuous insurance coverage.

Also Check: How Long Can I Go Without Health Insurance

Private Health Insurance Waiting Periods: Your Questions Answered

Confused about waiting periods with private health funds? Get the lowdown on how they work and why they exist in this blog from HCF health insurance. Bonnie BayleyNov 2019

When you pay for a service, you want it to kick in immediately, right? Its true for your internet and electricity, but private health insurance is a bit different. You usually serve a waiting period before you can start claiming on your private health cover.

Heres why waiting periods exist and how they work regardless of your level of cover.

Why do private health funds have waiting periods?Having to wait to use some parts of your private health cover, like major dental, can be frustrating particularly if youve been a member for a while but theres solid reasoning behind this, says HCF team member Caeden Kalen Zaine.

If we didnt have waiting periods, someone could join private health insurance, make a high-cost claim, and then cancel their insurance, he says. Then the ones whod have to bear the cost of that claim would be all the other people who were consistently paying towards their insurance.

In short, waiting periods protect existing members and reduce the rate of premium increases in the long run.

How long are waiting periods for health insurance?The Australian Government sets the maximum hospital cover waiting periods.

Heres what the government decided is the maximum length:

When do waiting periods apply to hospital or extras cover?

Waiting periods apply if:

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

Affordable Care Act Open Enrollment Period Snapshot Survey Key Findings 44% of…

Updated: February 2nd, 2022ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Don’t Miss: Can You Buy Dental Insurance Without Health Insurance

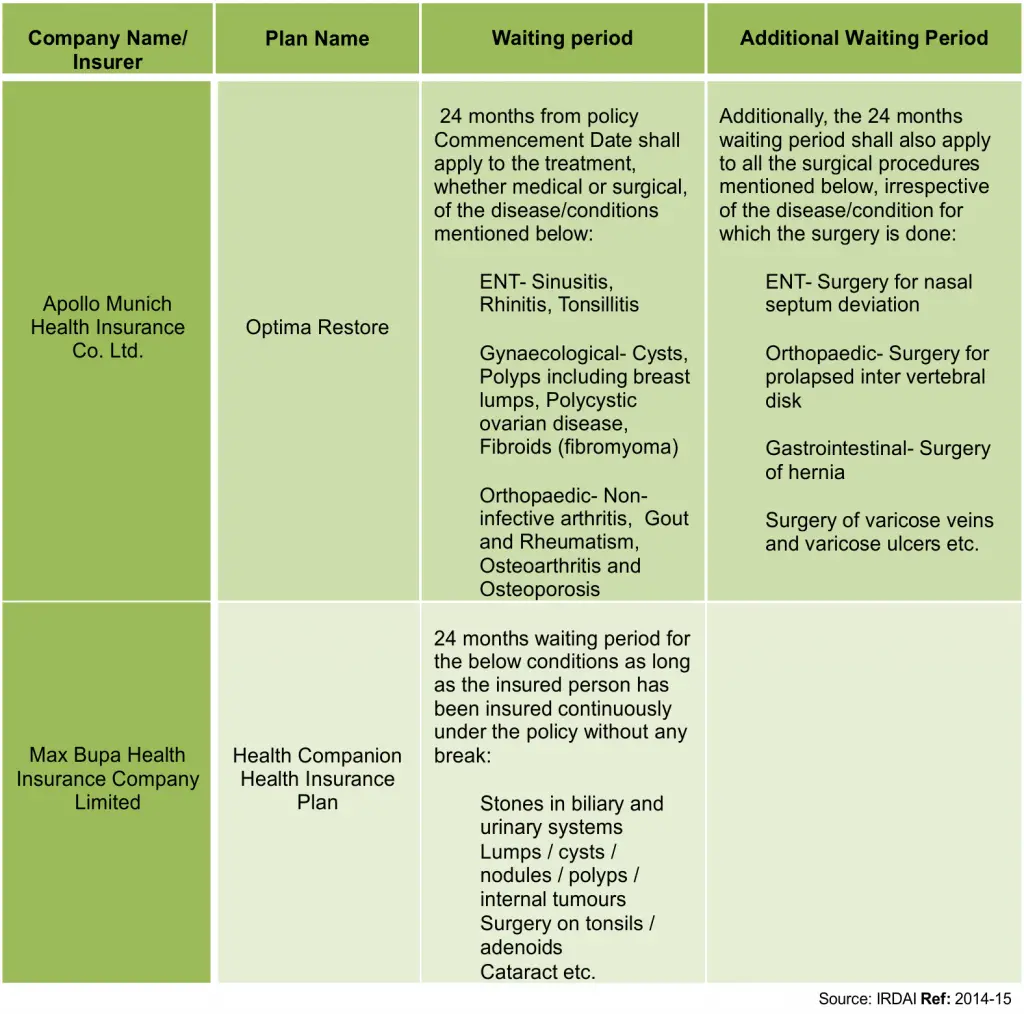

# Irdais Notifications On Waiting Period

The working group recommends that insurers may be allowed to incorporate waiting periods for any specific disease, condition to a maximum of 4 years. Further, waiting period for conditions namely, hypertension, diabetes, cardiac conditions may not be allowed for more than 30 days. With many people suffering from conditions such as hypertension, diabetes, this move will be of great help.

The Different Types Of Waiting Period In Health Insurance

In this time period, a person cannot claim the benefits from their health insurance policy in the case of sickness, except for accidents. Generally, the initial waiting period is for 30 days.

If a person already suffers from a disease before availing the policy, he/she will not get any benefits for those disease for a specified amount of time. Generally, the waiting period for Pre-existing diseases vary from 2 to 4 years. The lesser the waiting period, the better the policy for the customers.

In this scenario, the company does not cover expenses of hospitalization and medical expenses for a pre-specified illness or disease. This is also a type of short waiting period policy. The waiting period generally 2 years for problems like ENT problems, Cataract, tumor, hernia, osteoporosis etc. These are mentioned in the policy details.

Some health insurance companies give maternity cover in their policy with a waiting period ranging from 9 months to 36 months, so mothers can avail benefits under this time.

Also Check: Where Can I Get Health Insurance

Is It Possible To Reduce Waiting Period

There are several insurance companies offering health insurance plans that allow insured individuals to reduce the waiting period. But to avail of this benefit, the insured is required to pay an extra premium. Normally, there is no waiting period in health insurance plans offered by employers to their employees. Even in some cases if it exists, then the waiting period is shorter than a regular individual health insurance policy. But the Insurance Regulatory and Development Authority of India allows the employees who are a part of group health insurance plans to convert their group health insurance plan to an individual health insurance policy when leaving the employer. In this case, the individuals will be given the policy without any waiting period as they had spent waiting time in group health insurance cover provided by the employer.

Maternity Benefit And Newborn Baby Cover Waiting Period

As a part of most health insurance policies for individuals and families, theres an option to include a maternity benefit and newborn baby cover add-on.

Usually, the waiting period with most health insurance policies ranges from 1 year to 4 years.

The maternity benefit add-on covers delivery expenses and the baby for its first 90 days. Further, it includes all necessary vaccinations and other medical care required for the baby.

You May Like: How Much To Employers Pay For Health Insurance

Types Of Waiting Periods

Homeowner insurance wait periods will usually span 30 to 90 days before coverage is in effect. After the waiting period expires, policyholders may file claims against the policy. Wait periods will vary by the insurance provider. Also, in some regions, such as coastal zones, when a named storm is in the area, new policies will not go into effect until after the storm passes.

Some states may impose wait periods on other insurance products. As an example, Texas will place a 60-day wait on new auto insurance policies. This period gives the provider a chance to decide if the driver fits within their risk profiles. During the 60-day period, the company may cancel the auto policy if they have concerns about the risk profile or undisclosed issues.

Short-term disability coverage can have wait periods as short as a few weeks, but these policies will have higher premiums. Most short-term policies wait 30 to 90 days for coverage. Long-term disability wait periods can be between 90-days and a full year. As with other insurance products, during the probationary period, no benefits are payable. For Social Security, disability payments will also have a waiting period of five months.