Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

How Much Does Average Expat Health Insurance Cost In Different Countries

Your location is one of the key factors in calculating a premium. The cost of private healthcare varies dramatically in different countries, even when theyre geographically close to one another. For example, the average cost of health insurance in Singapore is US$5,458, nearly double the cost compared to its not-too-distant neighbor Thailand, where expat health insurance costs on average US$2,728. We look into what influences the costs of healthcare and health insurance in the USA, a nation where per capita health spending is almost twice the average seen in other wealthy countries. You can also check the cost of claims abroad and see the most common and expensive health insurance claims across the world.

Because the prices vary so drastically we use a sophisticated pricing model that weights countries according to how much private healthcare costs there. We have over 100 different country weightings, which means we can provide members living in diverse countries an accurate and fair premium for their private health insurance in that country.

What Counts As Obamacare

When people say Obamacare insurance, they are typically referring to individual and family plans bought on the health insurance Marketplace created to help implement the Affordable Care Act. The ACA was created to expand healthcare access and reduce associated costs. All Obamacare plans include essential health benefits such as free preventive care and mental health services.

Don’t Miss: Which Health Insurance Company Is The Best For Medicaid

How Much Does Life Insurance Cost

Individual life insurance quotes depend on many factors, which influence your risk. A healthy 35-year-old male getting a term life insurance policy can expect to pay about $30.42 in monthly premiums for a 20-year, $500,000 policy as of April 2022, while a 35-year-old female with the same term length and policy amount may pay $25.60. Generally, term life insurance is more affordable than whole life insurance because whole life lasts longer and has an additional savings feature.

More than 50% of Americans overestimate the cost of insurance and put off buying a life insurance policy as a result. In a study by LIMRA, a research, consulting, and professional development organization for financial services, and Life Happens, a nonprofit focused on providing unbiased education around insurance options, 44% of millennials estimated that a 20-year term policy would cost $1,000 or more per year. By contrast, the actual cost of the policy was approximately $165/year.

The following are sample rates of a 20-year policy for a 35-year-old male non-smoker with a Preferred health rating in other words, somebody with a very good health or minor health conditions.

To see up-to-date life insurance pricing trends month over month, check out our price index.

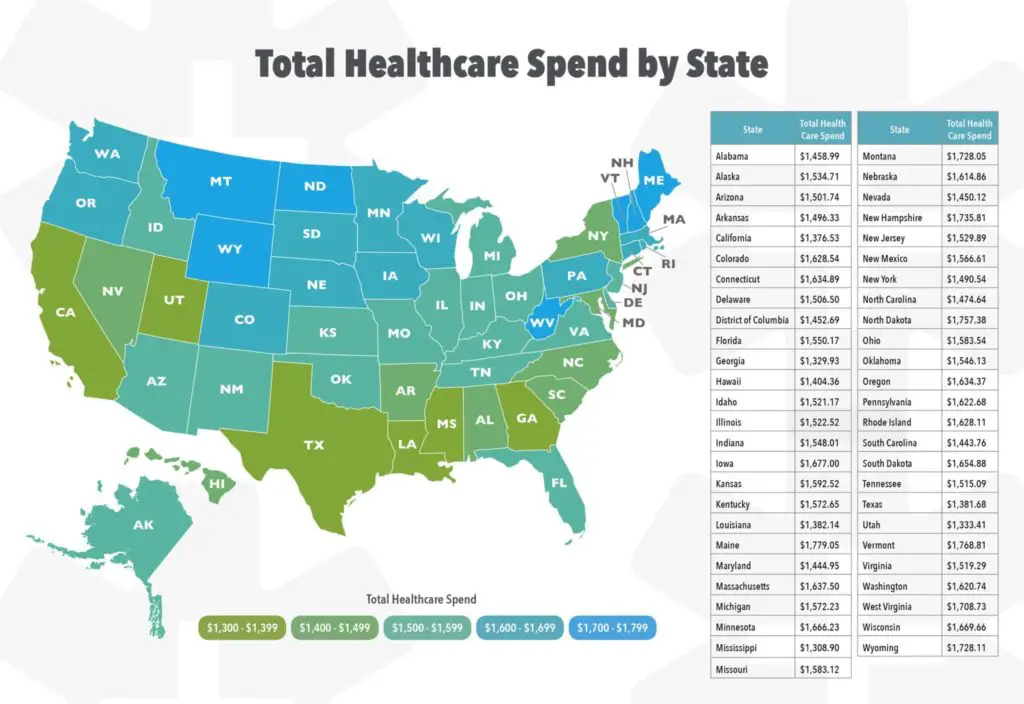

Average Health Insurance Cost By State

Residents of different states can see some pretty stark differences in the average cost of health insurance. Which states have the highest premiums, and which ones have the lowest?

Using ValuePenguin data on certain states, the state with the highest monthly rates is Alaska at $426 for a 21-year-old. Multiplying for someone who is 30, that becomes $483.51. It becomes $544.43. for a 40-year-old, and a whopping $1,156.16 for a 60-year-old. The second-highest rate is in Wyoming at $366. Doing that math again, for those who are 30, 40 and 60 that figure turns into $415.41, $467.75 and $993.32, respectively.

These are particularly extreme examples, but even states that aren’t quite as high compared to the average rates can have monthly premiums not everyone can afford. The average health insurance premium for a 21-year-old in Florida is $285 not as large as Alaska or Wyoming, but still a lot, especially as a person gets older .

Still, there are states where premiums aren’t as expensive as these. Utah, for example, has an average cost of $180. While $180 can still be quite a lot of money per month for someone working in Utah at 21 , it is still a lesser figure than other states. In Montana, the average health care premium for someone at 21 is $210 per month. Check your state for more details, because the range of premiums can vary even more wildly than you may expect. ValuePenguin’s list did not include every state, such as Massachusetts.

Also Check: Do I Have To Offer My Employees Health Insurance

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see whether you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Health Spending Average By Age

It turns out being born is somewhat expensiveand childhood costs peak when you’re under five years old. Healthcare costs arelowest from age 5 to 17 at just at $2,000 per year on average. From then onit’s a steady increase, however, with costs rising to over $11,000 per yearwhen you’re over 65 years old.

The costs of your care may be mostly coveredby private insurance or Medicare, but not all costs are always covered and anunexpected bill can have devastating effects on your finances. As one seniorcitizen relates on their traumaticexperience with health insurance:

“My bankruptcy started with back surgery. I had several medical tests that my insurance did not cover. This caused me to fall behind in my medical payments. The next thing I knew, the bills began piling up. I got to the point I owed more than I was making on Social Security.”

Healthcare costs are not evenly distributed. You could be among the tragically unlucky with much higher costs. But not only that, but healthcare spending varies substantially by gender and demographic.

At each stage of life, health care spending for women is substantially higher than for men. The need for more gerontology nurse practitioners and in the coming years will be vitally important to the success of healthcare programs.

You May Like: What Insurance Does Health First Accept

What Does Medicare Cost And What Does It Cover

Medicare is a government health insurance program available to Americans aged 65 and older. But even with Medicare, retirees face significant out-of-pocket costs because the program doesnt cover all health care needs.

Medicare offers three parts A, B and D and private supplementary plans, including Medigap plans and Medicare Advantage plans available for purchase under Part C.

Services such as long-term care, dentures and acupuncture are not covered by the program. In addition, several Medicare services have copays, premiums and other costs.

Retiring At 62 Or Before 9 Ways To Cover Your Health Costs For An Early Retirement

There are a lot of hurdles to overcome when figuring out how to retire early before 65. However, early retirement health care is one of the most fiscally challenging. Medical care is going to be expensive no matter when you retire, but the picture is more serious for those who retire early, by choice or otherwise.

Medicare isnt available until age 65 and self-insurance in your 40s, 50s, and 60s can be prohibitively expensive. Never mind that you typically face more health challenges as you age and are therefore more likely to use health care.

Use the NewRetirement Retirement Planner to find out now if you can afford an early retirement and explore the following 9 possibilities for how to cover early retirement health care costs:

Dont Miss: How To Apply For Low Cost Health Insurance

Don’t Miss: Are Daca Recipients Eligible For Health Insurance

Why Is Health Insurance Expensive

Healthcare can cost a lot to carry out. Even straightforward procedures can be surprisingly expensive, and well beyond most peoples budgets, if billed directly for the NHS or private healthcare they receive. For example, a total knee replacement costs an average of £12,530 3. Insurers need to take account of this, among a number of things, when they work out premiums.

In the UK, you don’t have to take out private health insurance, so make sure you could afford to pay the monthly premiums. But bear in mind that with flexible cover, you can reduce your options to whats affordable for you.

Monthly Cost Estimate By Age

The cost of health insurance may also vary based on your age. Per the eHealth data, the average cost by age is:

$278 for the 18 through 24 age group

$329 for the 25 through 34 age group

$411 for the 35 through 44 age group

$551 for the 45 through 54 age group

$784 for the 55 through 64 age group

These numbers are for both men and women, but they give a sense of how your costs may vary.

Don’t Miss: How To Set Up Small Business Health Insurance

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

Student Health Plans: Private Insurance Plans That Are Good For Students

Student health plans represent another way for college students to access health insurance. Some insurance companies offer these plans for students between the ages of 17 and 29, allowing students to pay premiums annually, or semiannually in some instances. Unlike a school-based plan, these plans travel with you wherever you study in the United States.

If you start at one university and then transfer to another university, the coverage transfers with you.

You May Like: What Do You Need To Get Health Insurance

Per Capita Lifetime Expenditure For The Average Life Table Person

The per capita lifetime expenditure at a given age a, projected from birth b , estimates the lifetime expenditure remaining after age a for the average life table person at birth. Implicit in this conception is the fact that some members of the original cohort of 100,000 people will have died before this age a, but they are still counted in the denominator . We calculate LEb,a by dividing the aggregate lifetime expenditure of the remaining cohort at age a by the size of the original birth cohort . Using standard demographic notation,

Lx=the person years lived by the cohort in the age interval

Cx=per capita expenditure at age x .

Relative lifetime spending at age a, RLEb,a, is the proportion of total lifetime expenditure, calculated from birth, incurred by the average life table person after age a. RLEb,a equals LEb,a divided by LEb,0, the latter representing total lifetime expenditures for the average member of the birth cohort. RLEb,a is interpreted as follows: If RLEb,65=50 percent, half of the average cohort member’s total lifetime expenditures will result from health care utilized during or after age 65. This is equivalent to saying that half of the entire cohort’s lifetime expenditures will result from health care utilized during or after age 65.

What Impacts Expat Health Insurance Cost

The cost of expat health insurance varies so dramatically because there are so many factors affecting how we calculate premiums. The most important factors are:

- Where you need cover Private healthcare is more expensive in certain countries and regions.

- Your age Generally speaking, the older you are the more healthcare youre likely to need. Premiums get more expensive as you get older.

- Medical history Health insurance doesnt typically cover pre-existing medical conditions. Sometimes, you may need to pay an additional premium to get cover for such conditions.

- Optional extras Perhaps you need cover for complex dental treatment or temporary cover in the USA.

Unlike other providers, your claims history while youre a member with William Russell wont affect your renewal premium. Unlike other providers, we dont think its fair to penalise members based on legitimate claims theyve made in the past. Further, it discourages people from receiving the medical treatment they need because they are concerned about the cost of their renewal premium.

Weve published a full guide on how we calculate premiums for health insurance.

Worried about the cost of health insurance?

Get 15% off your first-year premium with William Russell!

Read Also: How To Find Health Insurance In Colorado

What Influences Aca Plan Costs

Individual health plans and plans on the Affordable Care Acts Health Insurance Marketplace request key information from people when determining health insurance costs.

“Health insurance costs will vary significantly depending on your age, geography, family status and tobacco use,” notes Brian Martucci, a Minneapolis-based personal finance expert with Money Crashers.

Plans cant reject you or charge higher rates because of pre-existing conditions. The ACA ended that practice.

“Generally speaking, young, healthy non-smokers enjoy the lowest health insurance premiums, while older adults pay more — especially on the individual market,” says Martucci.

Chris Orestis, the president of Life Care Xchange and a nationally recognized health care expert, echoes those thoughts.

“Our current system rewards people for being younger and healthier in both group or individual coverage. But the differences are much starker for individual coverage,” says Orestis.

The ones who tend to pay the most overall are older folks who don’t yet qualify for Medicare – such as 64-year-olds, Darr says.

Franke says individual plan insurers can only charge an older person three times what it charges a younger person.

“For instance, in Seattle, a 64-year-old will pay 300% more than a 21-year-old for a Silver plan. That could mean the difference between paying about $900 per month versus $300 per month, respectively,” Franke adds.

How Your Circumstances May Affect The Cost Of Health Insurance

Your personal circumstances play a part in deciding your premiums. An insurer might consider:

- Your age: the cost of cover may increase with age, as you may be more likely to need to make a claim the older you are.

- Where you live: private healthcare costs more in some areas of the UK than others, so your location may play a part. Its things like the facilities, accommodation and equipment that affect this, along with specialists fees

- Your claim history: the number of past claims youve made on a policy may impact your premiums at policy renewal time

You May Like: Do You Have To Get A Physical For Health Insurance

Average Cobra Insurance Rate

As a covered employee, the company covers the 90% of the insurance plan and the remaining 10% is deducted in the monthly salary. Under COBRA, the covered employee must pay the 100% COBRA health insurance premium plus the 2% administrative charges. Therefore, the COBRA insurance can be expensive to continue but there are a lot of available options in the insurance market to choose from.

Under a private insurance company, the average employer-sponsored coverage is around $1,137 per month for family coverage and $410 per month for an individual coverage which is according to the report provided by the Kaiser Family Foundation . Meanwhile, if the employee is subsidized, the average COBRA insurance rate is at $398 per month for a family plan and $144 for an individual plan.

But on their 2017 employer health benefits survey, the average annual premiums for employer-sponsored health insurance is about $6,690 for single coverage and $18,764 for family coverage . For the overall average for all plan types, the average annual premium is around $6,024 for single coverage and $17,581 for family coverage.

Meanwhile, for employers with low-income workers, the average annual premium is around $1,213 for single coverage and $5,714 for family coverage. Also for the deductibles, according to the survey, covered employees pay an out of the pocket during claim with an average of $1,505.

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Read Also: Do You Still Get Taxed For Not Having Health Insurance