How Do I Get Free Healthcare In Florida

Residents of Florida can apply for a variety of assistance programs and medical services if they do not have health insurance or have restricted coverage. The state collaborates with local governments and non-profit groups to guarantee that low-income families and the economically disadvantaged have access to health and dental services, including free health insurance coverage. Some resources are geared at meeting the medical requirements of Floridas senior residents.

Patients who meet specific criteria, such as financial limits, Medicaid eligibility, and so forth, are eligible for the programs. Some are aimed towards youngsters, while others may treat specific medical diseases like cancer. Although there are no promises, these numerous options can help offer health care and pharmaceuticals to thousands of families across the state at a low cost, if not completely free.

Uninsured and underserved people in Florida can get HIV/AIDS medications through the Florida AIDS Drug Assistance Program to satisfy specific financial requirements. This federally supported program covers several FDA-approved HIV/AIDS-related drugs. There is usually a long waiting list however, exceptions can be made recently based on need and other criteria. 800-352-2437

GoHealth, for example, combines cutting-edge technology with good old-fashioned helpful experience to compare hundreds of plans and discover the best one for you.

Types Of Healthcare Insurance Plans In Florida

Furthermore, Florida is among the leading states with a high number of residents and therefore are required by the FEDERAL AFFORDABLE CARE ACT to have their health insured.

Again, there are types of healthcare insurance plan options available for Floridians. These includes:

- Short term health insurance plan:

This is a temporary medical insurance plan which covers your health insurance temporarily until you get another that is suitable and longer. The short-term health insurance company may provide budget-friendly monthly payments.

- TriTerm medical insurance:

TriTerm medical insurance is another short-term health insurance that covers preventive care, doctor office visits, and also prescriptions. After 12months on this plan, the expenses of any eligible preexisting illness will be covered.

- Hospital and Doctor insurance plan:

This offers the kind of coverage that pays cash for eligible medical services like surgical procedures, doctors visits, and any emergency medical care. There are no deductibles or co-pays to pay first.

- Accident and critical illness insurance plan:

The insurance gets you covered at the time of unforeseen circumstances like accidents and critical illness.

Instead of wiping off your funds, it saves you the financial headache by paying cash to cover the illness or injuries sustained from the accident. Preexisting conditions may be covered with this plan.

- Florida dental and vision plan:

What Is Health Insurance For The Self

Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where you are required to cover the cost of your own employee benefits, including health insurance. You may have a couple of options for buying coverage, such as purchasing health insurance directly from a provider or through your states exchange or Heathcare.gov. You may apply during open enrollment which happens once per year every fall or after a qualifying life event.

Depending on your income, you may qualify for a discount through cost-sharing reductions, which may lower the cost of your deductible, co-payments, or co-insurance. To qualify, you must sign up for one of the Marketplace plans.

If your income is low, you may also see if you qualify for Medicaid, which could offer free or inexpensive health insurance. You may apply for Medicaid through the Marketplace or through your states Medicaid agency.

Also Check: Do You Legally Have To Have Health Insurance

How To Calculate Your Medical Insurance Costs

The first step toward finding the best insurance plan for you is to determine your expected medical expenses for the year. This will give you a ballpark figure to work with, but remember to take into account any co-pays or other out-of-pocket costs. If you use a doctor regularly , you may want to consider getting continuous coverages. This would allow you to pay for any service that you or a doctor identifies as necessary, but it would dramatically increase your insurance costs.

Who Qualifies For Cost

Families earning between 100% and 250% of the FPL can have the health insurance provider lower or cover more out-of-pocket costs when health services are received. In 2021, that means individuals earning between $12,760 to $31,900 per year. For a family of four, that would be between $26,200 and $65,500.

Cost sharing reductions are available only to qualified people who purchase silver plans.

Don’t Miss: Does State Farm Sell Health Insurance

Cheapest Plan In Florida With An Hsa

Health Savings Accounts serve a double purpose for buyers who dont have a lot of health expenses but would like to have medical coverage. If youre in good health, opting for an HSA plan can be beneficial in the long term. Asides from having lower premiums, you can also make pre-tax contributions that allow you to earn savings. Should you have a medical emergency, you can use it to pay for costs.

In Florida, Expanded Bronze, Silver and Gold plans have HSA options. The most affordable health insurance plans in Florida for these metal tiers are:

- Expanded Bronze: Gym Access IND Bronze HMO HSA 5065 by Florida Health Care Plans cost an average of $358 per month.

- Silver: Ambetter Balanced Care 25 HSA by Ambetter by Sunshine Health costs an average of $536 per month.

- Gold: Gym Access IND Gold HMO H.S.A. 9010 by Florida Health Care Plans cost an average of $473 per month.

If you opt to get an HSA plan, you have to be ready for the possibility that a portion of your savings may be used for medical expenses.

Frequently Asked Questions About Florida’s Aca Marketplace

Florida uses the federally run exchange, so residents enroll through HealthCare.gov. Florida has the highest exchange enrollment of any state in the country, with more than 2.7 million people enrolling during the open enrollment period for 2022 plans almost 19% of the entire countrys exchange enrollments.

The open enrollment period for 2022 coverage ran from November 1, 2021 to January 15, 2022.

Outside of that window, enrollments and plan changes for 2022 coverage are only possible if you qualify for a special enrollment period. In most cases, special enrollment periods are linked to a qualifying life event, although there are some special enrollment periods that do not depend on a specific qualifying event.

As of 2022, there are 14 insurers offering plans in Floridas marketplace, including four new insurers . As is the case in most states, insurer participation varies from one area of the state to another:

- AvMed

- Blue Cross Blue Shield of Florida

- Bright Health Insurance Company

- Capital Health Plan

- Ambetter/Celtic

- Coventry/Aetna-CVS

- Florida Health Care Plan Inc

- Health First Health Plans

- Florida Blue HMO

- Sunshine State Health Plan

- UnitedHealthcare

Also Check: Does Health Insurance Cover Dermatologist

Who Is Eligible For Medicaid In Florida

To qualify for Florida Medicaid health services, you must be a resident of Florida, a U.S. national, citizen, permanent resident, or legal alien. Individual income must not exceed $16,971 per year. A family of 4 must not exceed $34,846 per year. In addition, you must also be at least one of the following:14

- Pregnant

- Responsible for a child 18 years of age or younger

- Blind

- Have a disability or a family member in your household with a disability

- Be 65 years of age or older

For more information, visit the Florida Medicaid website.

Is Health Insurance Worth It

Its very rare to find a scenario where health insurance isnt worth the cost. You never know when youll become sick or get injured, and its significantly cheaper to pay for health insurance than to incur large medical bills. Doctors visits, hospital stays, and ambulance rides can add up to hundreds of thousands of dollars. Its better to pay for health insurance than risk getting stuck with those bills.

Read Also: How Can I Check My Health Insurance Status

How Much Do These Plans Cost

The amount you pay monthly for your coverage will vary depending on where you live, the size of your household, your income, and other factors.

Nine out of ten people get financial help when enrolling in a plan through the Affordable Care Act4, and 43% pay less than $10/month after federal assistance.*

Learn more about health care subsidieshealth care subsidies

The Cheapest Health Insurance In Florida By County

Your address also has an impact on the cost of health insurance in Florida. Some states have rating areas, which insurance providers use to set premiums. Counties within a rating area calculate for rates using the same method.

In Florida, each county has a different rating area. Of Floridas 67 counties, Miami-Dade is the most populous, where the most affordable Silver plan is Super Silver 50 + Dental. Its offered by Bright Health for an average monthly premium of $445.

You can use the table below to find the cheapest health insurance plan in Florida available in your county for all metal tiers.

These premiums are for a sample profile of a 40-year-old male in Florida looking for available health plans in that county.

Cheapest Health Insurance Plans in Florida by County

Sort by county:

Don’t Miss: How To Pick A Health Insurance Plan

Is The Average Cost Of Health Insurance Rising

ACA compliant Florida Blue and other health plans first came onto the insurance market in the 2013 open enrollment period for the 2014 plan year. Before that the average monthly cost for individual health insurance was $159. Since then the numbers have steadily increased – by 123%. For family plans the increase is even higher, coming in at 174% higher from 2013 to 2018 according to healthcare research.

In 2018 the average cost of an individual ACA plan was $440 per month. That comes out to $5,280 a year, which is a lot of money for anyone, no matter their income. In fact, ACA plans are completely out of reach for many individuals who are not eligible for the subsidy to even consider buying now. To help make it more affordable, many people rely on government subsidies as well as Medicaid programs for those below 138% of the Federal Poverty Level in states that expanded Medicaid. Florida did not expand Medicaid so it will be below 100% of FPL.

When You Can Buy Florida Aca Health Insurance

If you are a U.S. citizen living in the state, you can purchase a Florida Affordable Care Act plan during the Open Enrollment Period,3 which runs from November 1 through December 15.4

But, there is some flexibility when you can enroll depending on certain circumstances. You can enroll in a plan anytime if you have a qualifying event, which includes but is not limited to:5

- Getting married or divorced

- Becoming a U.S. citizen

You May Like: How Does Corporate Health Insurance Work

Best For Preventative Care: Kaiser Permanente

Kaiser Permanente

We included Kaiser Permanente on our list of top health insurance plans for the self-employed because of its notable emphasis on preventative care.

-

Emphasis on preventative care and overall health

-

Strong customer satisfaction reviews

-

Only available in 8 states

-

History of skimping on behavioral healthcare

Kaiser Permanente is another health insurance company with a strong reputation. The company was founded in 1945 and it doesnt have a rating with AM Best. Kaiser Permanente earned high scores of at least 3.5 and up to 5.0 from NCQA with a majority of plans scoring 4.5 or better. Additionally, Kaiser received standout rankings in the J.D. Power 2022 U.S. Commercial Member Health Plan Study, including first place in several regions.

Kaiser Permanente has faced some scrutiny from the state of California, though. The company has been subject to several state sanctions and fines for skimping on behavioral healthcare. Some members were still struggling to get care at the end of 2019, according to the Los Angeles Times. More recently, the company has continued to face criticism of this nature.

Kaiser Permanente offers health insurance in Washington, D.C., and eight statesCalifornia, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washingtonfor 12.6 million members. The companys network includes 39 hospitals, 734 medical offices, 23,656 physicians, and 65,005 nurses.

Best For Customer Service: Oscar

Oscar

- No. Policy Types: Varies by location

- No. States Available: 22

If youre looking for a health insurance provider with excellent customer service, then Oscar is a good option. Oscar features a dedicated team of guides and nurses to answer your questions and help you save money.

-

Free virtual primary care and free 24/7 access to virtual urgent care

-

Dedicated team of guides and nurses to answer your questions

-

Easy to use mobile app

-

Only available in 22 states

-

Less established than competitors

Oscar is a technology-driven health insurance startup and is the youngest company on our list. Established in 2012, Oscar has been making waves with its unique approach to customer service. The company doesnt currently have a rating with AM Best and has earned rankings of 2.5 to 3.0 from NCQA.

Although the company has limited availabilityArizona, Arkansas, California, Colorado, Florida, Georgia, Illinois, Iowa, Kansas, Michigan, Missouri, Nebraska, New Jersey, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Tennessee, Texas, and Virginia. The company currently offers health insurance and Medicare plans to over 1 million members.

You may get quotes or sign up for a plan through Oscars website or by phone. You may also shop through your states exchange or Healthcare.gov. The pricing will vary based on where you live, type of plan, your age, tobacco usage, and family size.

Don’t Miss: How Far Back Does Health Insurance Cover

Florida State Health System Ranking

Ever wonder how your state stacks up when it comes to quality healthcare? The Commonwealth Fund published a report in 2020 on State Health System Performance. They took into consideration the access to quality care, health outcomes, and disparities in all 50 states. The scores for the Florida Health System are listed below:

- Florida: Overall Ranking: 44 of 51

- Florida: Overall Performance: Worse than Average

- Florida: Access and Affordability: 47

- Florida: Prevention and Treatment: 44

- Florida: Avoidable Hospital Use and Cost: 49

- Florida: Healthy Lives: 31

- Florida: Health Care Disparities: 32

Find Affordable Health Insurance in Florida

What Is The Difference Between Hmo And Ppo

Health maintenance organizations or HMOs, Pre-paid medical plans, or PPOs are two types of managed care plans. These types of plans control the cost by providing limited benefits to patients. With HMO, patients must choose a primary care physician who coordinates all specialty referrals. With PPO, out-of-network coverage is allowed, but physicians have to agree in advance to accept the insurance terms.

Read Also: Where To Go If No Health Insurance

How Much Is Health/medical Insurance In Florida

If youre looking for the best health insurance plan in Florida, the Florida health insurance marketplace offers a variety of affordable options. For a 40-year-old in 2020, the average cost of health insurance in Florida will be $554 per month.

For a large medical individual health insurance plan, the average cost of health insurance across all age categories is around $203 per person. Prices will vary, and if you are in good health, your rates may be decreased.

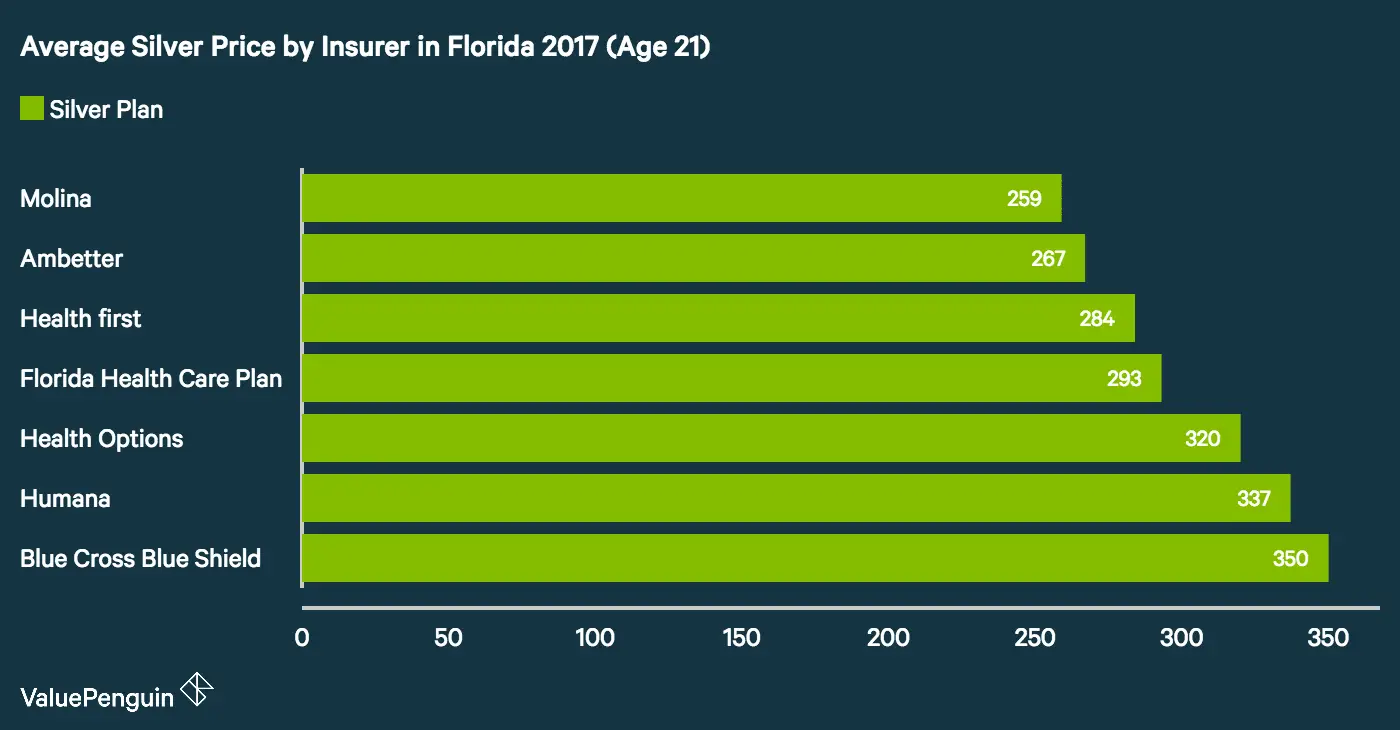

In the entirety of Florida, Blue Cross Blue Shield and Cigna now have the best rates and are offered in practically every county. Consumers looking for a Silver plan in Florida can consider the BlueOptions Silver 1410, a program that provides the lowest premiums in most counties.

Best Health Insurance Companies In Florida With Hmos

Some health insurance companies in Florida offer HMO plans. HMO plans are generally low-cost but restrict your coverage to a group of in-network providers. They also require referrals from your primary physician to see specialists for covered services .

You should consider HMOs if you dont have any provider preferences or substantial health care needs. In Florida, the average cost of an HMO plan is $560 per month for a 40-year-old policyholder.

The Best Health Insurance With HMO Options

COMPANY HIGHLIGHTS

MoneyGeek selected Florida Health Care Plans as the best health insurance company offering HMO plans in Florida. It has the cheapest HMO plan and boasts above-average ratings on customer service and plan options. The average maximum out-of-pocket cost for an HMO plan with this company is $6,299.

If you want to peruse other Florida health insurance providers offering HMO plans, the following companies also scored well:

- AvMed: Average maximum out-of-pocket: $6,921

- Florida Blue HMO : Average maximum out-of-pocket: $7,212

Each of these companies earned above-average scores for customer service and plan options, making them commendable runners-up for providers offering HMOs in Florida.

Knowing the difference between a Health Maintenance Organization and Preferred Provider Organization can help determine which health insurance plan best suits your needs.

Don’t Miss: How Much Are Health Insurance Premiums

Private Health Insurance On The Florida Marketplace

Private plans in the Florida Health Insurance Marketplace are categorized into metal tiers. Although these dont impact the quality of care you receive, they determine your premiums, coverage and more.

There are advantages and disadvantages for every metal tier.

You may be able to get lower rates or increased coverage depending on your income. Your annual income can even qualify you for premium tax credits. Households whose income falls between 100% to 400% of the federal poverty level are eligible. In Florida, this applies to two-person households that earn between $17,420 to $69,680 each year. Calculate for possible premiums using the healthcare.gov calculator.

You can renew your existing plan or purchase a new one during open enrollment, which typically happens between November and December of each year. However, due to the current COVID-19 pandemic, enrollment dates have been expanded.

Your plans deductible, copayments or coinsurance and out-of-pocket maximums can be lowered if you qualify for cost-sharing reductions. These are available for households whose income falls between 138% and 250% of the federal poverty level and have a Silver plan, making it possible to have coverage similar to a Gold plan while having Silver plan costs. In Florida, a two-person household earning $24,040$43,550 may be eligible for these reduced rates.