Long Term Care Insurance

The Federal Long Term Care Insurance Program provides long term care insurance to help pay for costs of care when you can no longer perform everyday tasks for yourself like eating, dressing and bathing, due to a chronic illness, injury, disability or aging. If youre eligible for the Federal Health Benefits Program, then youre also eligible to apply for FLTCIP. Certain medical conditions, or combinations of conditions, will prevent some people from being approved for coverage. You must apply to find out if youre eligible to enroll.

Learn more about the long term care insurance plan.

First Do Employers Have To Offer Health Insurance

It may surprise you to know that we get asked this question all the time. Health insurance is a big expense. The good news is that you may not have to offer it.

The requirements for offering health insurance differ based on your size.

- Small Employers: If you have less than 50 full-time equivalent employees, youre not required to offer health insurance.

- Large Employers: If you have 50 or more employees, you technically dont have to provide health insurance however, if you dont, the Affordable Care Act requires you to pay a tax penalty. In 2020, the penalty amount is $2,750 for each full-time employee if you fail to offer coverage to 95% of full-time workers and their dependents and any worker receives coverage from an ACA marketplace.

There may be other situations that may require you to offer health insurance. For example, if an employees employment contract or union agreement guarantees it.

However, even if youre not required to provide health coverage, you may want to offer it on a voluntary basis for a number of reasons:

Temporary Continuation Of Coverage

If the FERS determines that you are ineligible for health benefits, you and certain family members may have the option to enroll for up to 18 months of Temporary Continuation of Coverage . You should also look into TCC if you plan to stop working before you are able to retire but want to have FEHB during retirement. TCC may be able to serve as a bridge to cover you until your retirement, when you would then re-enroll into FEHB.

You will not be able to obtain TCC if you have been terminated for gross misconduct.

Also Check: Insusiance

What Is The Cost In Retirement

One of the advantages of having FEHBas compared to private health insuranceis that the cost of health insurance remains the same for federal employees after they retire. The government keeps paying a portion of your health insurance for you. This can amount to big savings on health care costs, since FEHB pays 72-75% of the cost.

This is a big advantage over private employer coverage. For example, a private employer will often pay for part of your health benefit costs while you’re employed, just like the FEHB. However, once you retire in the private sector, you most often can not keep your employee health benefits. Instead, you must transition to an individual health insurance plan or to Medicare if you are old enough. This change could mean that your cost of health insurance will increase after you retire.

One primary difference for those with FEHB is that because your retirement annuity is paid monthly, you might see a shift in the payment frequency or amounts. However, you should not pay more in total.

Your spouse, domestic partner, or other family members could also save money on their health insurance if they are also eligible for coverage under your FEHB. If you have been divorced and are on good terms with your ex-spouse, you could check to see whether they might be able to get access to your FEHB.

How Much Does An Employer Pay For Health Insurance

Employer health insurance is often more affordable than individual health insurance, thanks to the group discounts that accompany multiple policies.

KFF reports that employers paid an average of 83% of single premiums in 2020. The average employee spends an average insurance premium of $1,243 per year for single coverage with employers picking up an average of more than $6,200 annually.

Job-based plans are hugely affordable, compared to paying more than $5,000 annually for the average individual premium. Family plans could cost more than double or more.

Here are the average costs for employer group health insurance, according to Kaiser Family Foundation.

| Plan type |

|---|

| $21,342 |

Still, premiums continue to rise each year, with an average of 3% increases for single plans and around 5% for family coverage. Deductibles and out-of-pocket costs continue to increase, as well.

In addition to standard health insurance coverage, employers may also offer other benefits and perks that can increase the value of your healthcare.

Read Also: Does Uber Have Health Insurance

Employers Pay 83% Of Health Insurance For Single Coverage

In 2020, the standard company-provided health insurance policy totaled $7,470 a year for single coverage. On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.

For family coverage, the standard insurance policy totaled $21,342 a year with employers contributing, on average, 73%, or $15,579. Employees paid the remaining 27% or $5,763 a year.

Can Employers Receive A Tax Credit For Paying Premiums

As a small business owner offering health coverage, you might be eligible for a small business health insurance tax credit. The percentage of health insurance you pay plays a role in whether you can receive the credit.

To be eligible, you must meet the following requirements:

- Pay premiums under a qualifying arrangement

- Have fewer than 25 full-time equivalent employees

- Pay average annual wages of less than $50,800 per full-time employee

- Buy coverage through the SHOP Marketplace

The maximum credit amount is 50% of your contribution towards the employee premiums . The credit is available for a maximum of two years.

The size of the tax credit is based on a sliding scale. Those with lower employee wages get a larger credit.

The SHOP Marketplace can calculate an estimated credit that is paid to your insurance company. The advanced tax credit lowers the amount you pay on monthly premiums. You can also choose to receive the entire tax credit when you file your tax return.

If the credit amount is more than your tax liability, you receive a refund for the difference. If you received an advanced tax credit and your allowable credit is less than estimated, you pay the difference or subtract it from your refund.

Patriots online payroll software helps you accurately deduct premiums from employee paychecks. Take advantage of our free setup and support. Then, complete payroll in three easy steps. Try it for free today!

Don’t Miss: Starbucks Health Insurance Cost

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

What Are The Us Federal Governments Retirement Benefits

Federal employees receive generous retirement benefits. Many people know that federal employees receive a pension. However, few people understand the full complement of federal retirement benefits. Employees in the federal employee retirement system, also called FERS, receive three benefits. A retirement annuity . A supplemental pension from ages 57-62. A continuation of their FEHB plan into retirement. Previously, I have written extensively about all of the benefits of federal employment. Today Ill try to explain federal employee health insurance benefits after retirement.

Read Also: Kroger Health Insurance Part-time

Myth #: You Cannot Add Family Members To Your Fehb Plan Once Youve Retired

Retirees are allowed to add family members during open seasons , or at other times during the year if they experience a qualifying life event like getting married, divorced, the death of a spouse, or the birth or adoption of a child.

An important note: Family members are only permitted to be added to FEHB while the retiree is still living. Occasionally, we will find that the spouse of a federal employee has a great employer-sponsored health plan that ends up being better than FEHB maybe for a period of time.

For example, some employer-sponsored plans are free while that spouse is still working for that employer. But oftentimes the premiums are expensive for that employer-sponsored plan once that person no longer works for that employer, or its even possible that the employer wont allow the coverage to continue once that person no longer works for them.

While it might seem reasonable to be on two separate health plans the federal employee under the FEHB program and the rest of the family on another plan if the ultimate goal is for the spouse and any eligible children to be covered under FEHB long-term, we would want to make sure that they are added prior to the federal employees death. Again, family members cannot be added to the FEHB plan after that retiree dies.

Dropping or Cancelling FEHB Coverage

What Requirements Must You Meet To Keep Fehb After You Retire

A federal employee retiree had to have been enrolled in FEHB with active coverage at the date of their retirement to qualify for FEHB in retirement. And they must have been covered by the FEHB program for five years before retiring.

Those with less than five years of coverage may still qualify if they were continuously covered by the FEHBor enrolled as a family memberfrom the first time they qualified to enroll in the program.

Most federal employees are eligible for FEHB, but you must elect for coverage.

If you were not continuously enrolled in your own FEHB program, but a family member was continuously enrolled, you may qualify under that family member’s plan. The five-year rule still applies, but the time spent on the family member’s plan may count toward the five years.

If you had a break in service during the five-year vetting period, be sure to ask about your eligibility. Breaks in service may not prevent you from meeting the the five-year rule.

If you are unsure whether you can receive FEHB coverage, check out the eligibility website set up by the U.S. Office of Personnel Management that lists categories of workers who are included and excluded. For example, you are not eligible if you were first employed by the government of Washington, D.C., unless one of four specific exceptions applies. You are also not eligible if you are paid on a fee or contract basis.

You May Like: Substitute Teacher Health Insurance

How Is The Premium Paid

You pay the health premium if you are a resident of Ontario and your employment or pension income is more than $20,000 a year. In most cases the premium is automatically deducted from your pay or pension. It is included as part of the income taxes deduction on your pay stub.

If you dont have taxes automatically deducted from your pay or pension, the premium is paid when you file your annual personal income tax and benefit return with the Canada Revenue Agency .

If your income is $20,000 or less, you dont need to pay the health premium.

Why Your Health Insurance Network Matters

Your job-based insurance plan includes a network of providers. This is a group of health care providers that your insurance company has partnered with to provide care.

Some plans, such as a PPO, will let you go out of network to seek care, although it typically comes at a greater cost.

Other plans like an HMO restrict the number of providers that you can see, potentially creating issues if you have a preferred provider that is not on the list.

Read Also: How To Cancel Evolve Health Insurance

Types Of Health Insurance Plans

There are several different types of health insurance plans available today. Some are more common than others, with Kaiser Family Foundation reporting the prevalence of each in todays group life insurance plans.

| Plan Name | |

|---|---|

| You want the option of both a PPO or HMO | 8% |

Your employer may choose from any of these, although its most likely that PPOs will be at least one choice. A 2020 Insure survey of 1,000 people found that 48% of respondents said their company only offers one health insurance plan. Forty-six percent said their job provides two or three options and only 7% provide different types.

Public Service Loan Forgiveness Program

Through the Public Service Loan Forgiveness Program, the government forgives the remaining balance on eligible student loans for people who have worked in a public service job for at least 10 years.

To qualify, program applicants must have already made 120 monthly payments and be employed full time in AmeriCorps, the Peace Corps or another public service organization such as:

- The federal government or a state or local government.

- A public child or family service agency.

- A 501 nonprofit organization.

- A private organization that provides public safety, public interest law services, public health, law enforcement or another a public service.

Also Check: Starbucks Health Coverage

How Can I Lower My Companys Health Insurance Costs

If youre like most employers, the high cost of insurance premiums is a big concern. You may be wondering if theres anything you can do to help control your expenses. Fortunately, there are some strategies that can lead to lower costs:

- Encourage those 65 and older to enroll in Medicare. By having qualified workers secure Medicare coverage, it will lower the average age of your group.

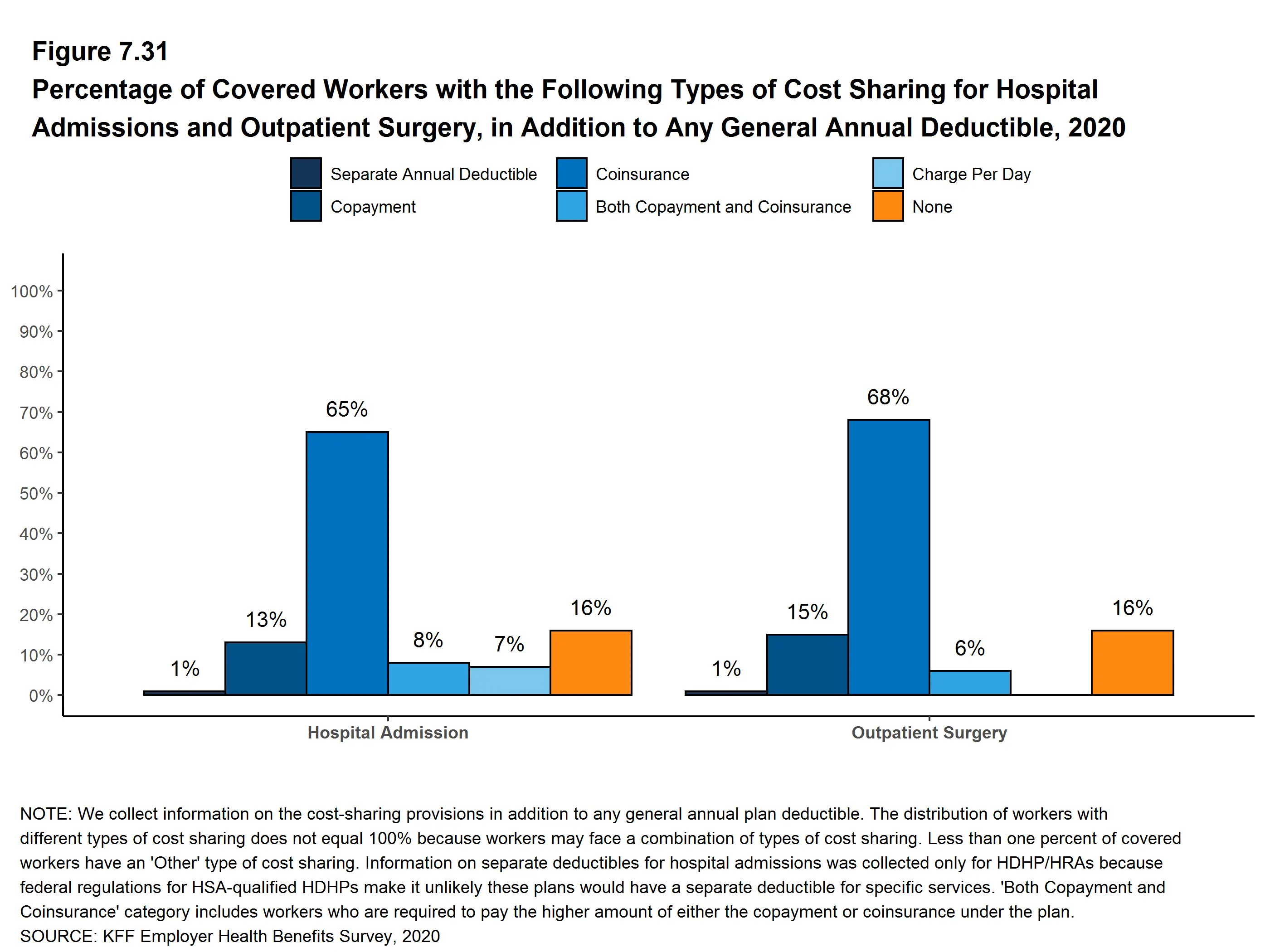

- Increase deductibles. To lower your premiums, shifting more costs to employees by raising deductibles can lower the employer portion of health insurance costs.

Requirements For Surviving Family Members

For your surviving family members to continue your health benefits enrollment after your death, all of the following requirements must be met:

- You must have been enrolled for Self and Family or Self + 1 at the time of your death and

- At least one family member must be entitled to an annuity as your survivor.

All of your survivors who meet the definition of “family member” can continue their health benefits coverage under your enrollment as long as any one of them is entitled to a survivor annuity. If the survivor annuitant is the only eligible family member, the retirement system will automatically change the enrollment to Self Only. Your surviving spouse should follow up with OPM to insure this action was taken. If it wasn’t, your spouse will be paying considerably higher Family Option premiums.

Under FERS, your surviving spouse who is entitled to a basic employee death benefit, or your surviving children whose benefits are offset by Social Security, may continue your health benefits enrollment by paying premiums directly to OPM.

When your surviving spouse will not receive any survivor benefits because your former spouse has a court-ordered entitlement to a survivor annuity, your surviving spouse can continue FEHB coverage if you had a Self and Family enrollment. The retirement system will notify your surviving spouse of his/her options and take whatever actions are requested.

Read Also: Asares Advanced Fingerprint Solutions

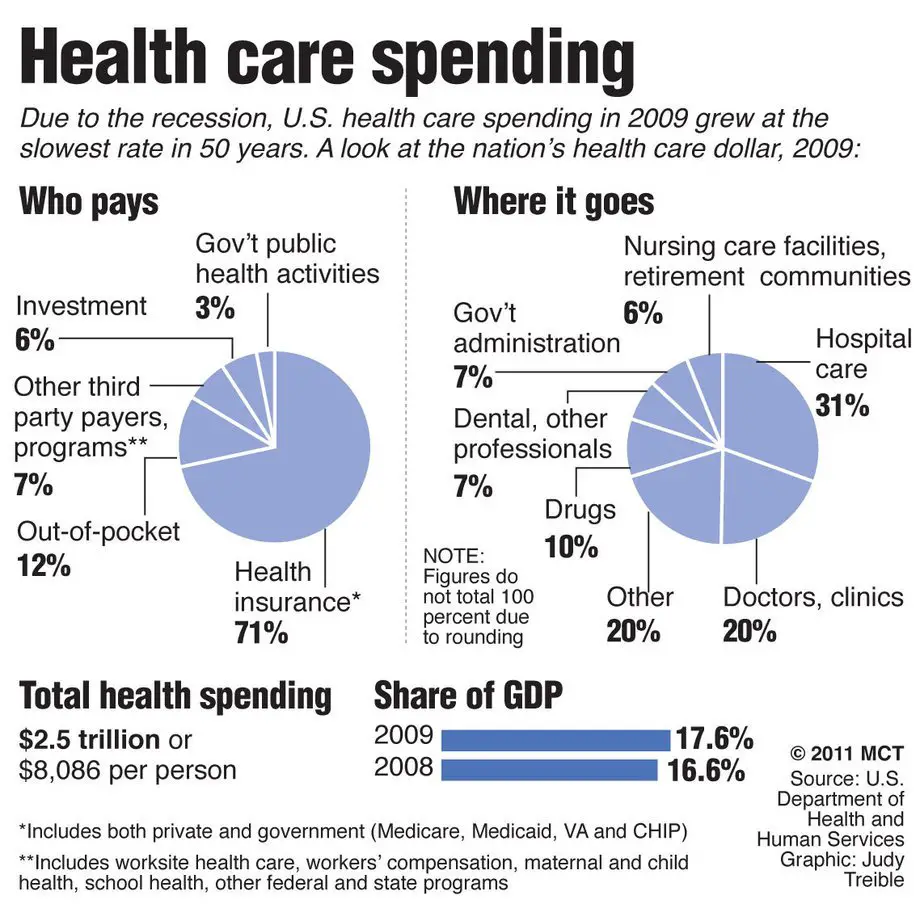

Why Is Health Insurance Important

Almost 2/3rds of bankruptcies in the United States were caused by medical bills. Health insurance is not just insuring your health it insures your wealth. Even after the passage of the Affordable Care Act, most people in the US receive their health care through their employer. Insurance can be difficult to obtain if you retire before youre eligible before Medicare. The ability to have access to any sort of coverage between retirement and Medicare is a huge benefit. Not just for federal employees, but also their spouses, and family members.

How Much Does Health Insurance Cost A Company Per Employee

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

The actual amount youll pay is based on a number of different factors, which well cover next.

You May Like: Evolve Health Insurance

You Like The Price But Wait

Lets say you wanted to pay for your health insurance privately. Or simply use the government provided plan. Youre out of luck if your employer offers health benefits. According to health law in Canada, youre legally obligated to get with the program. You can purchase supplemental health coverage privately, but the only way to opt-out of your company plan is to physically not be there by leave of absence such as disability or maternity.

The only other exception is spousal/common-law coverage. If your spouse pays less out of pocket with access to more services and lower deductibles, you can opt-out of your companys plan in favor of your spouses employers plan.

I leave you with this to ponder. Ask about your contribution and your employers contribution when you are ironing out the details of your hire. If youre passed that stage, read your pay slip and ask questions.