Qualified Small Employer Hra

A QSEHRA is for small employers with fewer than 50 full-time equivalent employees. Its designed to reimburse employees, tax-free, for their medical expenses, including individual health insurance premiums up to a set contributed allowance amount.

With the QSEHRA, all reimbursements are free of payroll tax for the employer and free of income tax for employees as long as their health insurance policy provides minimum essential coverage . The critical thing small employers need to remember is that with a QSEHRA is that all employees must be reimbursed at the same level and you cant offer a QSEHRA alongside a group health insurance plan.

Accommodation Or Utilities Provided By The Employer

If you provide accommodation or utilities free of charge, it is a taxable benefit to your employee. The method you use to determine the value of the benefit depends on whether or not the place in a prescribed zone has a developed rental market.

Places with developed rental markets

Some cities and towns in prescribed zones have developed rental markets. When that is the case, you base the value of the benefit for any rent or utility you provide on its fair market value.

The cities and towns in prescribed zones that have developed rental markets are:

Cities and towns in prescribed zones that have developed rental markets| Dawson Creek |

| Yellowknife |

Places without developed rental markets

In places in prescribed zones without developed rental markets, you have to use other methods to set a value on the housing benefit. The method you use depends on whether you own the residence or rent it from a third party.

If you provide both rent and utilities and can calculate their cost as separate items, you have to determine their value separately. Add both items to get the value of the housing benefit.

If your employee reimburses you for all or part of their rent or utilities, determine the benefit as explained below. Subtract any amount reimbursed by your employee and include the amount that remains in their income.

Accommodations you own

If you own a residence that you provide rent-free to your employee, report as a benefit whichever of the following amounts is less:

Note

What Can I Deduct Besides Insurance Premiums

To determine if you can deduct any of your portion of employer-paid premiums, you need to determine if you have eligible expenses. The basic rule of thumb is that if you paid for it, you can deduct it. If the insurer paid it, you cant deduct it.

There is a long list of typical medical insurance expenses that can be deducted on many websites. Here is one.

Some eligible expenses that are often overlooked:

- Transportation to and from medical care

- Wellness programs

- Weight-loss programs for a specific disease, as diagnosed by a physician

- Guide dogs for the blind or deaf

Recommended Reading: What Is Sidecar Health Insurance

Maybeif Your Healthcare Costs Are High Enough

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

A Tea Reader: Living Life One Cup at a Time

Health insurance is one of their most significant monthly expenses for some Americans, leading them to wonder what medical expenses are tax-deductible to reduce their bill. As healthcare prices rise, some consumers seek to reduce their costs through tax breaks on their monthly health insurance premiums.

If you are enrolled in an employer-sponsored health insurance plan, your premiums may already be tax-free. If your premiums are made through a payroll deduction plan, they are likely made with pre-tax dollars, so you would not be allowed to claim a year-end tax deduction.

However, you may still be able to claim a deduction if your total healthcare costs for the year are high enough. Self-employed individuals may be qualified to write off their health insurance premiums, but only if they meet specific criteria. This article will explore tax-deductible medical expenses, including the requirements for eligibility.

Related: Small Business Guide To Offering Health Insurance

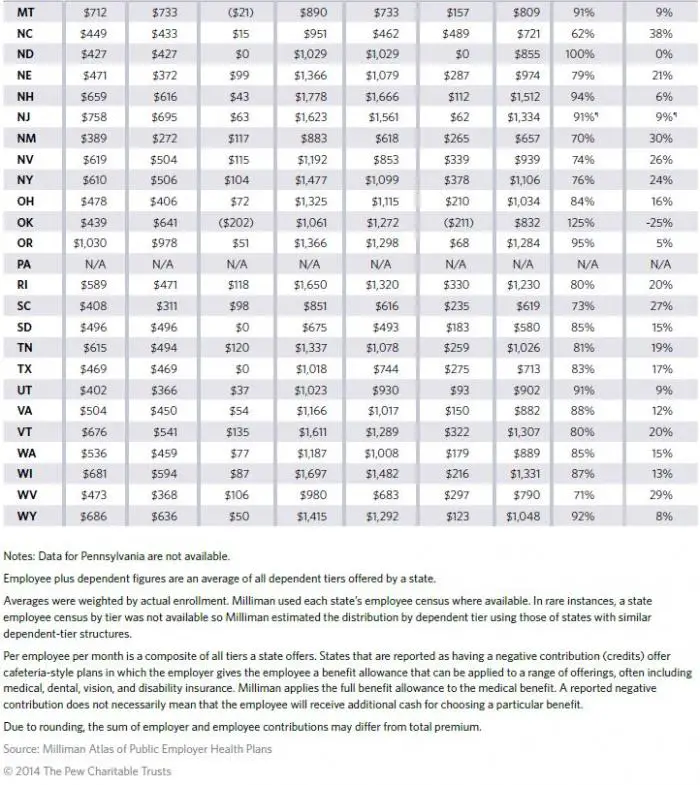

Kaiser Family Foundation reported in their 2020 Employer Health Benefits Survey: In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage.

In terms of premiums, the report found that most covered workers contribute to the cost of the premium for their coverage .

Specifically, for covered employees at small firms, the average premium for single coverage is $7,483 and $20,438 for family coverage. The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, the report continues.

When it comes to deductibles, the KFF report says, Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,644.

With this comprehensive scope, you may now have an idea of how much employees have to pay for health insurance, but, as we initially mentioned, many other variables affect the final dollar amount for both employee and employer. Lets take a closer look.

Also Check: How To Get Medication Without Health Insurance

Property Acquired Before 1991 Or From A Non

If you acquired property before 1991, you did not pay the GST/HST. Also, you do not generally pay the GST/HST when you acquire property from a non-registrant. As a result, you cannot claim an ITC under these circumstances. However, if you make this property available to your employee and the benefit is taxable for income tax purposes, you may still be considered to have collected the GST/HST on this benefit.

Example

You bought a passenger vehicle from a non-registrant and made it available to your employee throughout 2021. The passenger vehicle is used more than 90% in the commercial activities of your business. You report the value of the benefit, including the GST/HST and if applicable, the PST, on the employee’s T4 slip. For GST/HST purposes, you will be considered to have collected the GST/HST on this benefit even if you could not claim an ITC on the purchase of the passenger vehicle.

Examples for remitting GST/HST on employee benefits

The following examples will help you apply the rules for remitting the GST/HST on employee benefits.

Automobile benefit See examples in the section on Automobile benefits standby charges, operating expense benefit, and reimbursements.

HST considered to have been collected on the motor vehicle benefit = $5,100 × 14/114 = $626.32

Note

The calculation of the amount of GST/HST you are considered to have collected on the motor vehicle benefit differs from that of an amount calculated on an automobile benefit.

Group Term Life Insurance Policies Employer

This section applies to current, former, and retired employees.

Note

Premiums you pay for employees’ group life insurance that is not group term insurance or optional dependant life insurance are also a taxable benefit.

A group term life insurance policy is one for which the only amounts payable by the insurer are policy dividends, experience rating refunds, and amounts payable on the death or disability of an employee, former employee, retired employee, or their covered dependants.

Term insurance is any life insurance under a group term life insurance policy other than insurance for which a lump-sum premium has become payable or has been paid. Life insurance for current employees would usually be term insurance, although it is sometimes provided for retired employees.

A lump-sum premium is a premium for insurance on an individual’s life where all or part of the premium is for insurance for a period that extends more than 13 months after the payment of the premium .

Calculating the benefit

If the premiums are paid regularly and the premium rate for each individual does not depend on age or gender, the benefit is:

- the premiums payable for term insurance on the individual’s life

plus

- the total of all sales taxes and excise taxes, excluding GST/HST that apply to the individual’s insurance coverage

- any provincial insurance levies or sales tax that employers have to pay on some insurance premiums

minus

Reporting the benefit

Note

Read Also: How Much Is A Family Health Insurance Plan

Private Health Services Plan Premiums

If you make contributions to a private health services plan for employees, there is no taxable benefit for the employees.

Note

Employee-paid premiums to a private health services plan are considered qualifying medical expenses and can be claimed by the employee on their income tax and benefit return.

Include the amounts that the employee paid on a T4 slip in the “Other information” area under code 85. The use of code 85 is optional. If you do not enter code 85, we may ask the employee to provide supporting documents.

Use the T4A slip to report these amounts for former employees or retired employees. Enter the amount under code 135, “Recipient-paid premiums for private health services plans,” in the “Other information” area at the bottom of the T4A slip.

For more information on private health services plans, go to Private Health Services Plan and see Interpretation Bulletin IT-339R, Meaning of private health services plan .

Effect Of Health Insurance Reform On The Social Security Tax Base

We now assess how the ACA will affect average employer health insurance contributions and the distribution of those contributions across wage levels. The analysis focuses on shifts in the distribution of compensation by component that may result from reform, and in turn on the shifts in the amounts of wages covered by Social Security. The simulation results reflect the effects of the Supreme Court’s June 28, 2012, ruling on the constitutionality of the ACA. As we discuss below, that decision affected the federal government’s ability to compel states to expand their Medicaid programs in order to provide coverage to a larger fraction of low-income Americans.

Don’t Miss: Does Health Insurance Have To Cover Birth Control

What Happens If I Miss A Payment

You must pay the monthly premium and applicable premium surcharges for your PEBB retiree health plan coverage when due. They will be considered unpaid if one of the following occurs:

- You make no payment for 30 days past the due date.

- You make a payment, but it is less than the total due by an amount greater than an insignificant shortfall . The remaining balance stays underpaid for 30 days past the due date.

Registered Retirement Savings Plans

Contributions you make to your employee’s RRSP and RRSP administration fees that you pay for your employee are considered to be a taxable benefit for the employee. However, this does not include an amount you withheld from the employee’s remuneration and contributed for the employee.

If the GST/HST applies to the administration fees, include it in the value of the benefit.

Payroll deductions

Contributions you make to your employee’s RRSPs are generally paid in cash and are pensionable and insurable. Deduct CPP contributions and EI premiums.

However, your contributions are considered non-cash benefits and are not insurable if your employees cannot withdraw the amounts from a group RRSP before the employees retire or cease to be employed.

Although the benefit is taxable and has to be reported on the T4 slip, you do not have to deduct income tax at source on the contributions you make to your employee’s RRSPs if you have reasonable grounds to believe that the employee can deduct the contribution for the year. For details, see Chapter 5 of Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Administration fees that you pay directly for an employee are considered taxable and pensionable. Deduct CPP contributions and income tax. These are considered a non-cash benefit, so they are not insurable. Do not deduct EI premiums.

Read Also: How To Get My Health Insurance Card

Municipal Officer’s Expense Allowance

A municipal corporation or board may pay a non-accountable expense allowance to an elected officer to perform the duties of that office.

For 2019 and later tax years, the full amount of this non-accountable allowance is a taxable benefit. Enter it in box 14, Employment income, and in the Other information area under code 40 at the bottom of the employees T4 slip.

Can I Pay For Employees Health Insurance Directly

When the Affordable Care Act was implemented, employers were not allowed to reimburse employees for the cost of individual or family health insurance coverage. Pay raises were permitted, but there was no way to provide the money on a pre-tax basis or require that it be spent on health coverage.

Paying for individual coverage without a stipend, HRA, qualified spending account, or other formal health benefit is considered an employer payment plan, leading to Employee Retirement Income Security Act violations for being out of compliance with the ACA.

Don’t Miss: What Is Oscar Health Insurance

Deductions For Qualified Unreimbursed Healthcare Expenses

However, you may be able to deduct some of your premiums if you purchase health insurance on your own using after-tax dollars. For the 2021 and 2022 tax years, youre allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself, your spouse, or your dependentsbut only if they exceed 7.5% of your adjusted gross income .

AGI is a modification of your gross income. It includes all your sources of incomewages, dividends, spousal support, capital gains, interest income, royalties, rental income, and retirement distributionsminus any number of allowable deductions from your income, including retirement plan contributions, student loan interest payments, losses incurred from the sale or exchange of property, early-withdrawal penalties levied by financial institutions, among others.

Expenses that qualify for this deduction include premiums paid for a health insurance policy, as well as any out-of-pocket expenses for things like doctor visits, surgeries, dental care, vision care, and mental healthcare. However, you can deduct only the expenses that exceed 7.5% of your AGI.

Board And Lodging Allowances Paid To Players On Sports Teams Or Members Of Recreation Programs

You can exclude up to $377 per month from income for a board and lodging allowance for a participant or member of a sports team or recreational program if all of the following conditions are met:

- you are a registered charity or a non-profit organization

- participation with, or membership on the team or in the program is restricted to persons under 21 years of age

- the allowance is for board and lodging for participants or members that have to live away from their ordinary place of residence

- the allowance is not attributable to any services, such as coaching, refereeing, or other services to the team or program

Do not report the excluded income on a T4 slip.

Don’t Miss: Is Christian Healthcare Ministries Health Insurance

Can I Offer An Individual Coverage Hra Along With Traditional Group Coverage

You can offer certain types of employees a traditional group health plan and other types of employees an individual coverage HRA. But you cant offer the same type of employees a choice between a traditional group health plan and an individual coverage HRA, and you cant combine an individual coverage HRA with a traditional group health plan or with SHOP coverage. For example, you can offer full-time employees a traditional group health plan and offer part-time employees an individual coverage HRA.

There are certain requirements if you offer an individual coverage HRA to one type of employee and traditional group health plan coverage to another type of employee. If you offer an individual coverage HRA only to certain employees, in some cases, there are size requirements for certain classes of employees that get an individual coverage HRA offer:

| Size of employer | |

|---|---|

|

10% of the total number of employees |

|

|

200+ employees |

20 employees |

If you don’t offer a traditional group health plan to any of your employees, these class size minimums dont apply.

Taxes And Health Care

How does the tax exclusion for employer-sponsored health insurance work?

The exclusion lowers the after-tax cost of health insurance for most Americans.

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is typically excluded from taxable income. The exclusion of premiums lowers most workers tax bills and thus reduces their after-tax cost of coverage. This tax subsidy partly explains why most American families have health insurance coverage through employers. Other factors play a role though, notably the economies of group coverage.

ESI Exclusion is worth more to taxpayers in higher tax brackets

Because the exclusion of premiums for employer-sponsored insurance reduces taxable income, it is worth more to taxpayers in higher tax brackets than to those in lower brackets. Consider a worker in the 12 percent income-tax bracket who also faces a payroll tax of 15.3 percent . If his employer-paid insurance premium is $1,000, his taxes are $254 less than they would be if the $1,000 were paid as taxable compensation. His after-tax cost of health insurance is thus $1,000 minus $254, or $746. In contrast, the after-tax cost of a $1,000 premium for a worker in the 22 percent income-tax bracket is just $653 . Savings on state and local income taxes typically lower the after-tax cost of health insurance even more.

ESI Exclusion is costly

Read Also: How To Check If You Have Health Insurance

Q2 Is There Transition Relief Available From The Excise Tax Under 4980d For Certain Employers Who Offered Their Employees Health Coverage Through Arrangements That Would Constitute An Employer Payment Plan As Described In Notice 2013

Yes. On February 18, 2015, the IRS issued Notice 2015-17PDF, which provides transition relief from the excise tax under § 4980D for failure to satisfy the market reforms in certain circumstances. The transition relief applies to employer healthcare arrangements that are employer payment plans, as described in Notice 2013-54, if the plan is sponsored by an employer that is not an Applicable Large Employer under Code § 4980H and §§ 54.4980H-1 and -2 of the regulations S corporation healthcare arrangements for 2-percent shareholder-employees Medicare premium reimbursement arrangements or TRICARE-related health reimbursement arrangements .

Notice 2015-17 provides temporary relief from the § 4980D excise tax for failure to satisfy the Affordable Care Act market reforms such as the prohibition on annual limits. Under the notice, small employers with employer payment plans get relief for 2014 and up to July 1, 2015. Small employers are employers that are not Applicable Large Employers under § 4980H .

Notice 2015-17 also clarifies that S corporations may continue to report reimbursements of health insurance of 2 percent shareholders pursuant to Notice 2008-1. Until further guidance is issued, and in any event through the end of 2015, the excise tax under Code § 4980D will not be asserted for any failure to satisfy the market reforms by a 2-percent shareholder-employee healthcare arrangement.