What Does Copay Stand For

The copay is the amount of money that a patient has to pay out-of-pocket for certain medical treatments or procedures, such as surgery and doctor visits. Copay is short for co-payment. It is a payment requested from your insurance provider for a medical service or prescription drug that requires a co-payment.

Copay can vary depending on the plan and may be required before the service or medication is provided. It may also be used to cover the cost of other services or medications. Copay is a pricing term that refers to the cost of an item in relation to the number of items purchased.

The copay amount is typically charged per purchase in order to create a tiered arrangement. For example, a customer might be charged $50 for the first visit and $25 for the second visit. “Copay” is a term that’s used to describe the amount of money that you have to pay each time you go to the doctor.

If your doctor charges a copay, then you simply need to pay the copay fee each time you visit. Copay or co-pay is a reimbursement term used by health insurance providers to describe the amount of an uncovered medical expense that must be paid out-of-pocket prior to coverage beginning.

If a person pays part of the cost of their medical treatment, the payment is considered copay. Copay is an amount of money that the insured person will pay before insurance coverage can be obtained. For example, if a doctor charges $100 for a consultation, then the copay would be $2.

Related Articles :

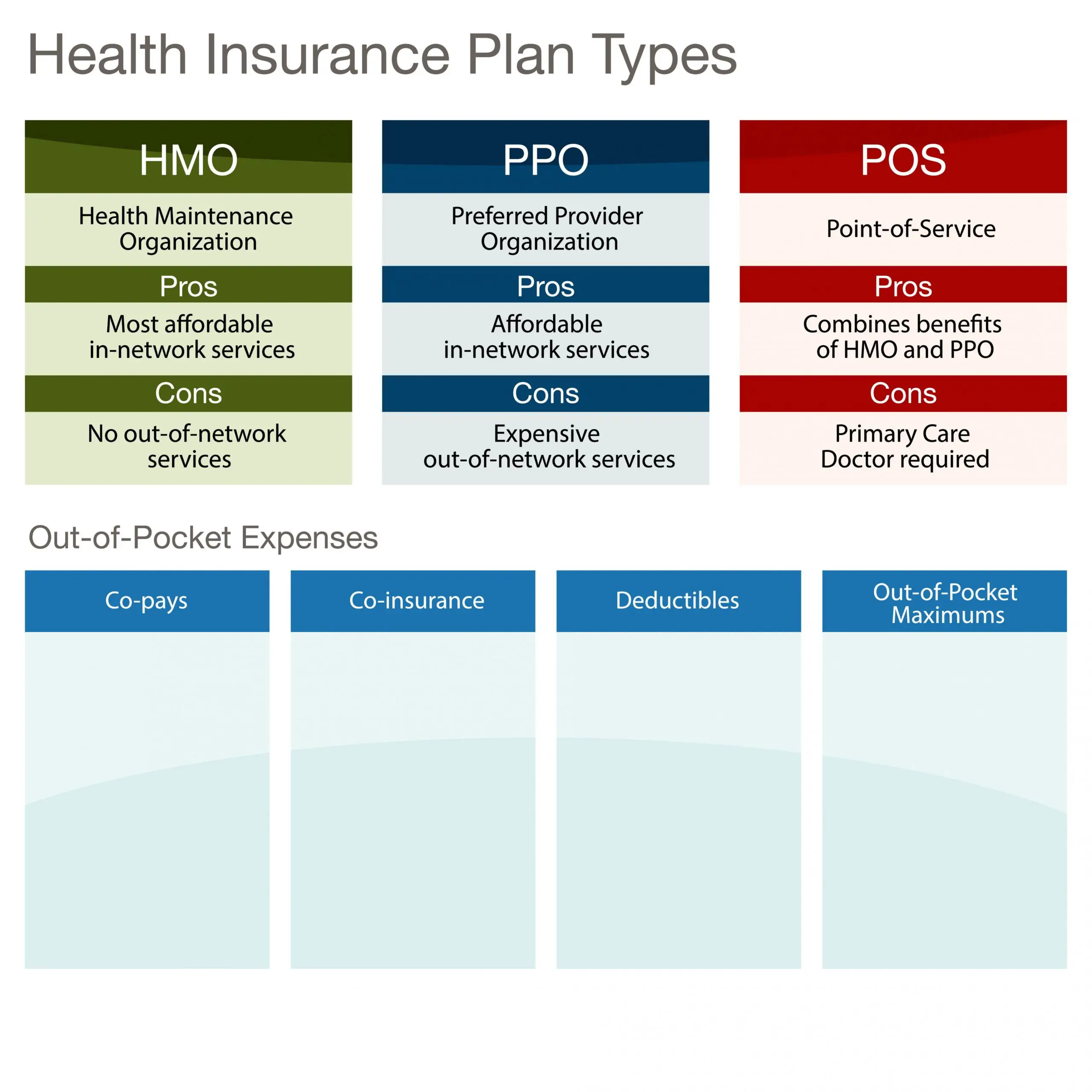

The Difference Between A Ppo And Other Types Of Health Insurance

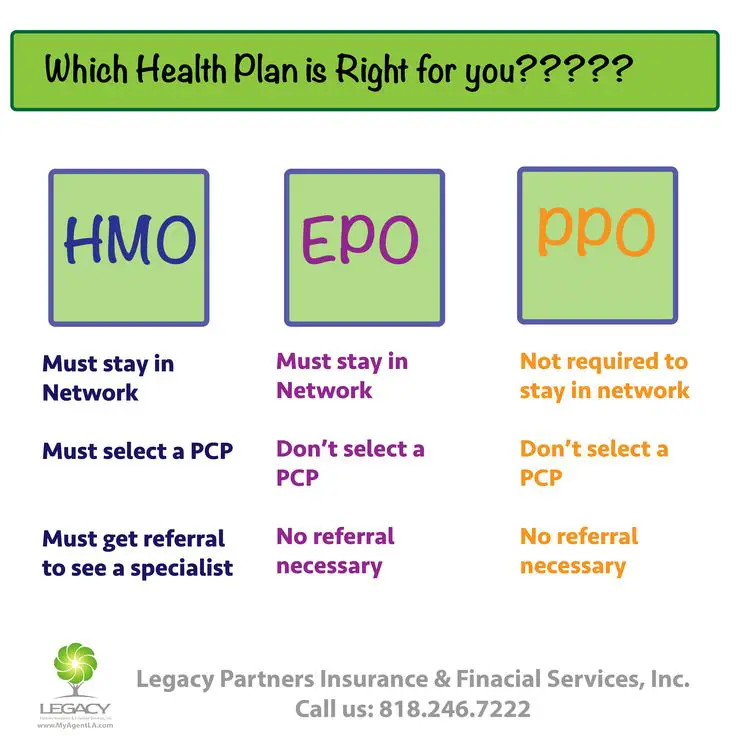

Managed-care plans like HMOs, exclusive provider organizations and point-of-service plans differ from PPOs and from each other in several ways. Some pay for out-of-network care some don’t. Some have minimal cost-sharing others have large deductibles and require significant coinsurance and copays. Some require a primary care physician to act as your gatekeeper, only allowing you to get healthcare services with a referral from your PCP others dont.

In addition, PPOs are generally more expensive because they give you more freedom of choice in terms of the medical providers you can use.

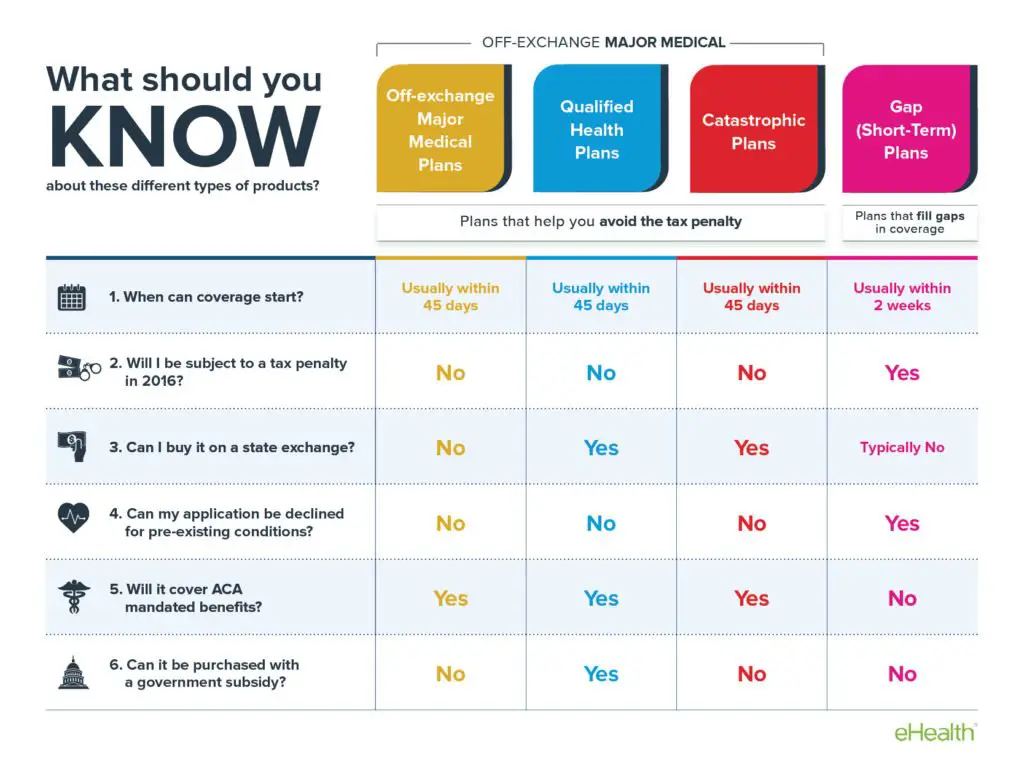

Types Of Marketplace Plans Using Ppo

The four types of Marketplace plans use actuarial value to group them. The type of managed care is also an important similarity. Many consumers can decide that they prefer PPO plans for the greater range of choices rather than HMO for the slightly lower costs. The Marketplace offers the below-described types of PPO plans

Platinum PPO plans offer high degrees of coverage for network resources. The deductibles are reachable ad the overall limits are within usual ranges. The division of cost sharing is ninety percent to ten percent for the customer. Platinum PPOs have a potential for increasing consumer costs because they treat outside resources with lower cost sharing, and they do not count outside network spending towards the deductible and expense limits.

Gold PPO plans offer high premiums and moderately low deductibles. The cover 80 percent of the costs of essential benefits leaving twenty percent for the consumer. They do not count spending on outside resources in the network deductible and network out of pocket Limit.

Consumers may have to apply for reimbursement, get permissions for expensive work, and process paperwork to get coverage on outside specialists.

Bronze PPO plans have low premiums and high deductibles. The cost sharing ratio of a sixty percent to forty percent division. They can qualify for HSA pairs if the Marketplace rates them on all points including the high deductibles and the high out-of-pocket maximum.

You May Like: Where Can I Go For Health Care Without Insurance

What Network Should You Pick

Everyone is looking for something slightly different out of their health insurance, so this is really a question you have to answer for yourself. But there are a few pointers you can keep in mind:

- Before you start looking, make note of your need to haves and want to haves in terms of your provider network and benefits. Also, list any doctors or hospitals you want access to. Keep that information at hand while you shop.

- Check the networks youre considering for doctors, hospitals and pharmacies near to you before making any decisions, especially if easy access to care is important.

- If your doctors already in-network, or youre flexible about where you get care and can easily stay in-network, then choosing an HMO or EPO may mean a lower cost for you each month.

- If you need the freedom to go outside a narrow network and still get some benefits from your coverage, then look at PPOs or a more flexible POS plan.

What Is An Lppo Insurance Plan

Generations Advantage Select is designed for those looking for a health care plan with more flexibility. With this plan, you get complete medical, hospital, and Part D Prescription Drug coverage and you can see out-of-network doctors for all covered medical services, though you pay less for in-network doctors.

Recommended Reading: What Happens If My Health Insurance Lapses

Why Do Hmos Have A Bad Reputation

There are a few limitations for those covered under HMOs, which is the reason why these plans have a bad reputation. For example, HMOs only permit insured parties to see people in their own network, which implies that they are answerable for the full amount of a visit to any specialist or doctor outside this group. The plan may likewise expect people to live in a specific region. This implies that somebody who gets clinical benefits out of the HMOs network should pay for it themselves. The plans additionally expect people to pick a primary doctor who decides the type of treatment patients need.

What Happens When You Take Out Of Pocket Money

When you take out money from your pocket, that money is not counted as an income. When you pay for health insurance with a credit card or through a loan, the insurance company will count it against your income. Payers will deduct the amount of the payment from your paycheck.

So if you are paid $333 every two weeks, and you take out $100 in cash, that would be deducted from the paycheck of $333When you take out-of-pocket money, your health insurance will cover the cost. This means that you shouldn’t try to save on your health insurance premium by skimping on other expenses.

Some people want to know what happens when you take out your health insurance and use it to pay for a doctor. When the money is taken out of your account, the spending is counted as taxable income. Before Obamacare, people were charged more for health insurance and the penalty for not having it was egregious.

With the Affordable Care Act, people with low incomes can now qualify for a subsidy that reduces their monthly premium costs. But make sure you compare HERE plans to find the best one for you and your family. When looking at premiums, hospital networks, out-of-pocket costs, and prescription drug coverage make sure you’re comparing apples to apples.

It’s not just about what you spend on health care, but what your insurance does for you. For example, if you need to visit a specialist, your insurance might cover the cost of the office visit.

Also Check: Does American Family Have Health Insurance

Hmo Epo And Ppo Frequently Asked Questions

Whats the difference between in-network coverage and out-of-network coverage?

Each time you seek medical care, you can choose your doctor. You have the choice between an in-network and out-of-network doctor. When you visit an in-network doctor, you get in-network coverage and will have lower out-of-pocket costs. Thats because participating health care providers have agreed to charge lower fees, and plans typically cover a larger share of the charges. If you choose to visit a doctor outside of the plans network, your out-of-pocket costs will typically be higher or your visit may not be covered.

What if I need to be admitted to the hospital?

In an emergency1, your care is covered. Requests for non-emergency hospital stays other than maternity stays must be approved in advance or pre-certified. This allows Cigna to determine if the services are covered by your plan. Pre-certification is not required for maternity stays of 48 hours for vaginal deliveries or 96 hours for caesarean sections. Depending on your plan, you may be eligible for additional coverage.

Who is responsible for getting pre-certification?

Your doctor will help you decide which procedures require hospital care and which can be handled on an outpatient basis. If your doctor is in the Cigna network, they will arrange for pre-certification. If you use an out-of-network doctor, you are responsible for making the arrangements. Your plan materials will identify which procedures require pre-certification.

How Do Health Insurance Networks Work

Health insurance plans allow policyholders to access medical care at a lower cost than they would pay out of pocket if they were uninsured, as long as they use services and healthcare providers that are covered under the plans network. Insurance companies make agreements with healthcare providers to ensure patients pay less for care than if they were uninsured. In return, physicians and specialists have a dedicated base of clients because policyholders must stay within the insurers network to receive the lower care costs.

For example, a health insurance plan might list 4 local PCPs as in-network providers. If you make an appointment with one of these physicians, your insurance may cover some or all of the cost, depending on the details of your deductible and copayment terms. However, if you choose another physician outside of these 4 in-network PCPs, your insurance may cover only a portion of the costs, alongside higher deductible and copayment requirements or provide no coverage at all.

You May Like: Is Health Net Good Insurance

How Do You Decide Between Hmo And Ppo

7 Differences Between an HMO vs.PPO

Make Sure You Understand Your Plans Coverage Of Out

Although a PPO or POS plan will cover out-of-network care, its important to understand how that works. Be aware of the deductible and the out-of-pocket exposure .

Also be aware of the fact that an out-of-network provider can and will balance bill you unless its an emergency or an out-of-network provider working at an in-network facility. .

This means that although your health plan may pay for some of the service , the provider can bill you for the portion of their charges that were above the amount the health plan paid.

Read Also: How Much Is Upmc Health Insurance

How Do I Access My Out

In a PPO plan, you can go to doctors and other providers that arent in the plans network, but you usually have higher copayments and deductibles and you may have to file the claim yourself.

PPOs can go outside of their plan network without getting a referral. However, that usually comes at a higher cost and may mean more work for the patient getting preauthorization for services and working with the health insurance company to file claims.

What Is Multiplan Ppo

When you enroll in a health insurance plan, you are usually given a specific network of doctors that contract with the insurance company, often with outlined specific rates and limits. There are different levels of this provision. One of these options is a PPO, otherwise known as a Preferred Provider Organization.

Don’t Miss: Can Illegal Immigrants Buy Health Insurance

Hmo Ppo Pos: What Do All These Acronyms Mean

Who is this for?

If youâre new to Medicare, this information will help you understand some common terms.

If youâve been shopping for Medicare Advantage plans, youâve probably noticed a lot of acronyms. HMO, POS, PPO all of these signify different plan types.

Well spell it out for you.

- HMO stands for health maintenance organization.

- POS stands for point of service.

- PPO stands for preferred provider organization.

All these plans use a network of doctors and hospitals. The difference is how big those networks are and how you use them.

Do You Stay Close To Home Or Do You Travel A Lot

If you travel frequently and are more likely to need care while away from home, especially if you are living with a chronic condition, or enjoy high-risk hobbies such as certain sports, you may need a PPO to provide the best coverage for your needs.

If you need a lot of specialist care, say you are managing a rare or chronic condition, you may also prefer the ease of choosing specialists and seeing them right away that you get with a HMO plan.

If you mostly get care in your home city or mostly from your family physician, an HMO is more likely to provide the right coverage for you.

Read Also: Do Doctors Get Health Insurance

The Consumer Decides When To Spend

The flexibility of the PPO permits consumer discretion, and the consumer decides when it is appropriate to spend additional funds for medical care. This is a great way to operate a health care plan.

Consumer preferences can mean a lot and can be a source of dissatisfaction when denied. High costs are a relative thing when consumers decide they will accept the costs of choice, then that is a good outcome- a satisfied customer.

How Does Ppo Reimbursement Work

The claims procedures can be very different for in-network vs. out-of-network providers.

For care received in-network, the provider and/or facility will bill the insurance carrier directly. The member is only responsible for their applicable cost share , says Hope.

For care received out-of-network, members are generally responsible for filing a claim form and submitting the form to the insurance carrier for benefit determination and payment to the provider and/or facility. In this instance, the member would be responsible for their applicable cost-share and potentially any difference between the maximum amount allowed for that out-of-network service by the insurance carrier and the provider or facilitys full billed amount, he says. The consumer protections for this balance billing can vary by state.

The onus shifts to the member when they elect to receive care at an out-of-network provider, says Hope. Members are responsible for filing claim forms, obtaining any necessary pre-certification and could be subject to balance billing. Additionally, deductibles and coinsurance are oftentimes higher for services received out-of-network. Financially, it is generally in the best interest of the member to receive care in-network.

Recommended Reading: Why Is It Important To Have Health Insurance

Q What Are The Main Differences Between An Hmo And A Ppo

A. There are two primary differences.

First, with an HMO you are allowed to see only a limited list of doctors within the plans provider network. If you see doctors outside the network, you will pay the full cost of any care or services. With a PPO, there is usually a larger network of doctors. And you can see doctors outside the network, but if you do, you will pay more, but still not the full cost.

The other difference is that with an HMO, you must have a primary care doctor who coordinates your care. If you want to see a specialist, such as a dermatologist, a cardiologist or a physical therapist, you need a referral from your primary doctor. With a PPO, you do not need a referral to see specialists. You can make appointments with specialists directly, on your own.

What Is The Difference Between An Hmo And A Ppo

- Patients in with an HMO must always first see their primary care physician . If your PCP cant treat the problem, they will refer you to an in-network specialist. With a PPO plan, you can see a specialist without a referral. .6

- With an HMO plan, you must stay within your network of providers to receive coverage. Under a PPO plan, patients still have a network of providers, but they arent restricted to seeing just those physicians. You have the freedom to visit any healthcare provider you wish.

So, whats the catch? Well, staying in your network with an HMO, you can expect the maximum insurance coverage for the services you receive according to your plan. Go outside of your network and your coverage disappears. With a PPO, you can visit doctors outside of your network and still get some coverage, but not as much as you would if you remained in your network.

So, because a PPO does not restrict you in your choice of physician, a PPO is the way to go, right? Not necessarily. There are many more things to consider when deciding between the two.

Lets discuss some of those now.

Read Also: What Is A Good Cheap Health Insurance

What Is Blue Shield Full Ppo

Full PPO Network This benefit plan uses a specific network of health care providers, called the Full PPO provider network. Providers in this network are called participating providers. You pay less for covered services when you use a participating provider than when you use a non-participating provider.

Which Insurance Is Best For Health

Best Health Insurance Plans in India Health Insurance Companies Health Insurance Plans Maximum Sum Insured Amount HDFC Ergo General Insurance My Health Suraksha Rs. 75 Lakh Care Health Insurance Care Policy Rs. 6 Crore Care Health Insurance Care Freedom Policy Rs. 5 Lakh Bajaj Allianz General Insurance Health Guard Policy Rs. 50 Lakh.

Read Also: How To Get Health Insurance In Nj

Ppo Puts Healthcare In The Members Hands

The PPO offers flexibility and places many decisions in the members hands. The PPO provides information about its network of doctors, specialists, hospitals, and other facilities.

The member can choose which, if any, he or she will utilize. For example, the PPO invites the member to use prevention and wellness services they remind members to get flu shots before the flu season, and to get regular checkups.

There is no primary care physician and no rule requiring approval for a specialists consultation.