Minimum Medical Loss Ratio

The medical loss ratio is the percentage of premium dollars that a health insurer spends on health care costs and quality improvement. The ACA sets a minimum amount for the MLR.

For large group plans, the MLR must equal at least 85 percent of premiums. Taxes and fees are deducted before making this calculation. The MLR must be at least 80 percent for small group plans and individual plans. Some states have higher MLR minimums.

To calculate the MLR, we first place policyholders into pools. Theres a pool for each insurance market in a state and for each legal entity that issues coverage. We calculate an MLR for each pool. We dont calculate MLR separately for each customer or group.

If we dont meet the minimum MLR for any pool, we send out rebates. Fully insured medical plans are eligible for rebates. Self-insured plans are not. Most plans dont get rebates.

If a rebate is due for a given year, youll receive a notice on or before September 30 of the following year. In most cases, we send the rebate check to the employer. For individual policies, we send the rebate to the person who bought the health plan.

The federal government set guidelines that employers are required to follow when using rebate dollars.

Group Health Insurance Vs Employer Health Insurance

Group health insurance is an insurance plan that covers a group of people who are employees of a company or part of an organization. The employer purchases the plan and employees are often given a small discount. Although it is not required to be on your employer’s group plan, many people choose to be covered by group insurance for several reasons.

Group Insurance Explained

Generally, there are three types of health plans your employer may offer: HMO , EPO , POS , and PPO .Depending on the level of cost-sharing, most employers pay anywhere between 50-70% of your health plan.

Many group insurance plans can cover immediate family members, or dependents, such as a spouse and children. Additionally, the premium rates for all employees are determined by the insurer, and part of the employeesâ premiums are paid for by the employer.

When Can I Enroll In My Employer Health Plan

Usually, you can sign up for health benefits when you are first hired. Most employers also have an annual open enrollment period, or open season, when you can sign up for coverage or change your enrollment to a different health plan. In addition, there are special circumstances, called qualifying events that trigger a special enrollment opportunity outside of the normally scheduled annual open season. These qualifying events include loss of eligibility for other coverage and certain life events such as marriage, or the birth or adoption of a child. In general, you must be offered a special enrollment opportunity of at least 30 days following these qualifying events to enroll in your job-based health plan.

Read Also: Can I Buy My Own Health Insurance

Employer Shared Responsibility Payment

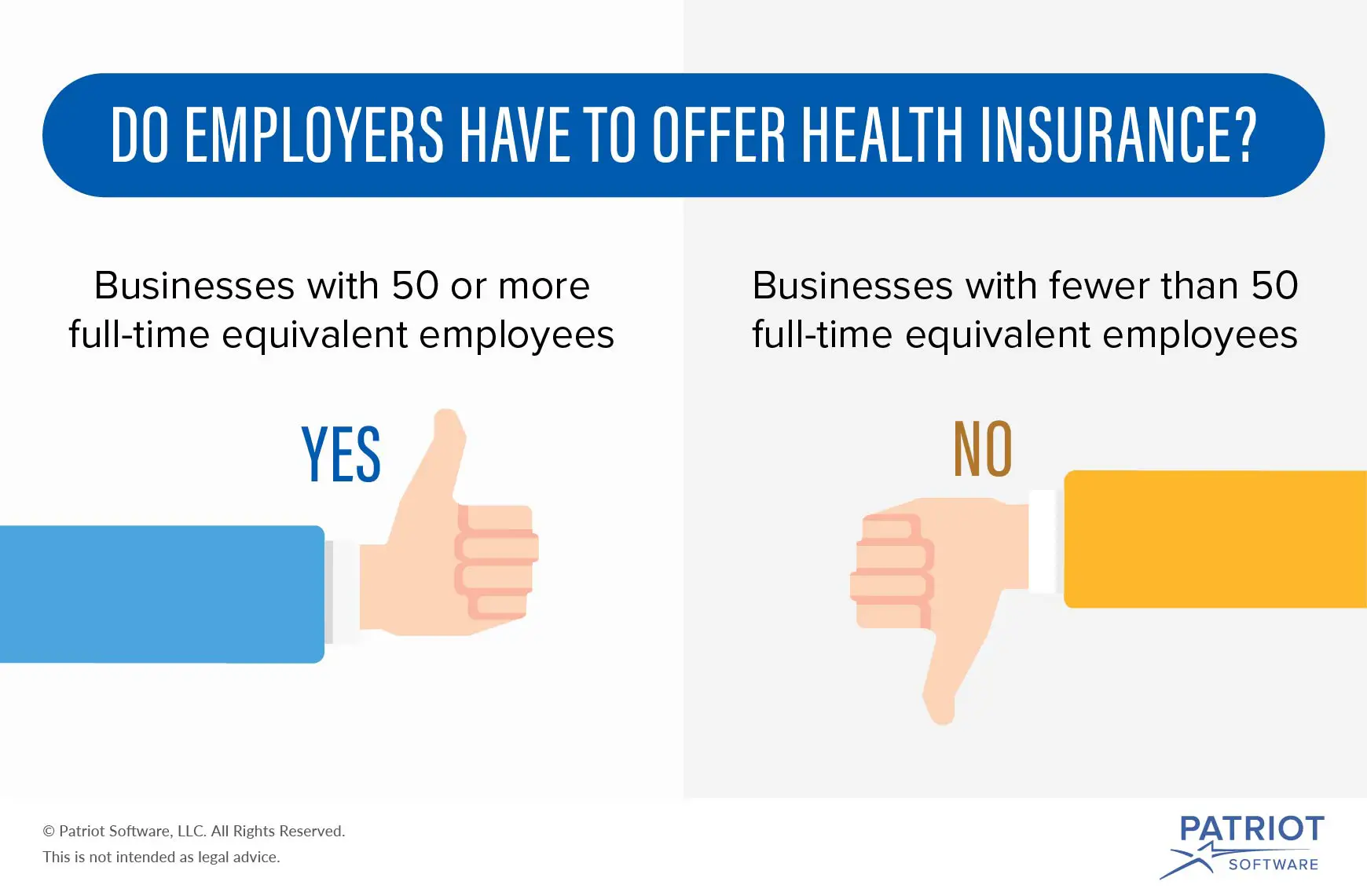

Certain businesses with 50 or more full-time and full-time equivalent employees that don’t offer insurance that meets certain minimum standards may be subject to the payment. Learn more about the Employer Shared Responsibility Payment from the IRS.

IMPORTANT: No small employer, generally those with fewer than 50 full-time and full-time equivalent employees, is subject to the Employer Shared Responsibility Payment, regardless of whether they offer health insurance to their employees.

If I Decide To Enroll In A Marketplace Plan Will I Be Eligible For Subsidies/savings

First, your employer may contribute to your health insurance costs when you enroll in an employer-sponsored plan. Sometimes they even contribute 100%. But if you opt-out of your employer-sponsored plan for an Obamacare plan, they wont. Want to opt-out of an employers plan? Youll be handling the costs of your monthly premiums on your own and paying full price.

Second, if you turn down an employer plan and enroll in an Obamacare plan, you probably wont get any subsidies/savings. The only ways you can qualify for a subsidies are:

More on these minimum standards here.

To make this process a little easier, weve created a free guide you can save and refer back to later.

Read Also: Does Starbucks Have Health Insurance

You May Like: How To Get Health Insurance Without A Job

Is Health Insurance Mandatory In 2020 In California

Effective January 1, 2020, a new state law requires California residents to maintain qualifying health insurance throughout the year. This requirement applies to each resident, their spouse or domestic partner, and their dependents. Get information about financial help to lower the cost of qualifying health insurance.

Overview Of The Employer Mandate

Starting in 2016, the employer mandate will be enforced for businesses with 50 or more FTE employees. A business may have to pay a per-employee, per-month fee called the Employer Shared Responsibility Payment if the business:

- Does not offer coverage that complies with specified reforms under the Affordable Care Act.

- Does not offer coverage that meets minimum value. .

- Does not offer coverage that is affordable. .

If a business does not offer coverage, the Employer Shared Responsibility Payment penalty is triggered when an employee who is not offered coverage purchases health insurance on an exchange and receives a federal subsidy to help pay for that coverage. The penalty is assessed monthly and is equal to the number of FTE employees multiplied by one-twelfth of $2,000.

If a business offers coverage, but that coverage does not meet minimum-value and affordability requirements, the penalty is triggered when an employee rejects offered coverage and purchases health insurance on an exchange and receives a federal subsidy to help pay for that coverage. The payment is assessed monthly and is the lesser of: one-twelfth of $3,000 per FTE employee receiving federal subsidies through the exchange, or one-twelfth of $2,000 per full-time employee .

You May Like: Where Can I Get Health Insurance

What Small Businesses Need To Know About The Employer Mandate

Under the Affordable Care Act , businesses with 50 or more full-time equivalent employees that do not offer health coverage, or that offer health coverage that does not meet certain minimum standards, may be subject to a financial penalty, referred to as the Employer Shared Responsibility payment. The Employer Shared Responsibility provisions, often referred to as the âemployer mandate,â have been in effect since 2015 for businesses with 100 or more FTE employees. But, starting in 2016, the employer mandate will become effective for businesses with 50 or more FTE employees. The purpose of this summary is to provide a brief overview of the employer mandate provisions, and to inform your business about how you may be impacted by changes to the provisions made in 2016.

Myth : Employers Must Pay At Least 70 Percent Of Employees Health Insurance Premium Costs

Busted. Although the Affordable Care Act does not specify a set amount that employers are required to contribute, some insurance carriers or states require employers to cover at least 50 percent of the premium for employee-only coverage. Employers can choose to cover more as a strategy to attract and retain quality employees, and many do. In 2017, the average employer contribution was 82 percent for employee-only coverage.2

Don’t Miss: What Does Cobra Health Insurance Cover

Employer Health Insurance Requirements

As a small business employer, you may be wondering what your health insurance requirements are. What are the criteria your small business needs to fulfill in order to offer health insurance, and what are your insurance obligations toward your employees?

Continue reading to learn about small business employer health insurance contribution and participation requirements.

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employees Individual/family Plans Ask Us How It Works

Many California employers still contribute to employees individual planswithout the QSEHRA andtheyre running a risk by doing so.

Its highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And heres what I heard from one of our clients about offering insurance:

Read Also: What Do You Need To Get Health Insurance

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employee’s Individual/family Plans Ask Us How It Works

Many California employers still contribute to employee’s individual planswithout the QSEHRA andthey’re running a risk by doing so.

It’s highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And here’s what I heard from one of our clients about offering insurance:

Plusthe Equivalent # Of Part

For example, if we have two parttime employees who work an average of 15 hours, that’s the equivalent of 1 full time employee.

What does this mean?

For one, you can’t drop all your full time employees down to part time andavoid requirements.

Also, you could have a lot of part-time employees and still trigger therequirements for coverage . We’ll discuss thislater.

Recommended Reading: Can You Put A Girlfriend On Your Health Insurance

What Is The Role Of The Employer

You might be wondering what the role of an employer is within employee insurance plans. Often, a plan is sponsored by the employer. A group insurance provider is typically hired to provide insurance for the members of the plan and manage the program, including paying any claims that are made. Benefit plan consultants can also be hired to offer support to the plan sponsor regarding the selection process.

It is also possible to select an administrative services-only plan. This approach involves the employer paying claims submitted by employees themselves. It also involves paying a group insurance provider or another organization to settle claims and report to management.

Should Small Employers Offer Health Insurance

Even though they are not required to offer health insurance, there is a strong argument to make that small business should offer health insurance to their employees, if possible, since it is such a strong added value for employees over the long run.

Since so many companies do offer health insurance, not doing so can put your business at a disadvantage when trying to attract highly skilled talent to your organization.

You May Like: Can I Get On My Girlfriends Health Insurance

How Can You As An Employer Improve The Health And Wellbeing Offering To Expat Staff

For international companies particularly, and those with remote and mobile workers, providing the right benefits is a powerful way of attracting and keeping talent. Benefits can also act as an incentive for companies looking to relocate staff overseas, reassuring employees that theyll be looked after in their new home.

International health insurance ensures employees can access high-quality healthcare while theyre living and working away from home. But some plans go beyond this, offering additional wellbeing benefits like:

Worried about the cost of health insurance?

Get 15% off your first-year premium with William Russell!

When Am I Required To Provide Health Insurance To Employees

As you likely know, the Affordable Care Act added requirements for employers to provide health insurance to employees if employing a certain number of full-time employees. According to various provisions of the ACA, a full-time employee is defined as anyone working around 30 hours per week. You do need to look at part-time employees as well since they can add up to full-time employees.

If you have over 50 employees, you are considered a Large Employer and are required to provide health insurance benefits. In this case, we recommend speaking to an agent to discuss the specific requirements that must be adhered to under the ACA.

Employers with less than 50 full-time employees are considered Small Employers. Small Employers are not required but are encouraged to offer health insurance benefits to their employees. Small Employers have access to the Small Business Health Options Program and can check their eligibility online.

If your business has under 25 full-time employees, you may qualify for the Small Business Health Care Credit to lower premium costs.

If you provide health insurance benefits to your employees, this information needs to be reported on your employees W-2 forms along with any other benefits.

TL DR: Health insurance is a complicated area if you employ close to 50 full-time employees. If you are under 50 full-time employees than you arent required to provide coverage, but there are programs available to help you do so.

Recommended Reading: How Do Early Retirees Get Health Insurance

In Addition To Health Insurance What Other Types Of Coverage/benefits Can I Offer My Employees

There is a plethora of additional benefits available for small groups such as: dental insurance, long-term care insurance, short-term disability, long-term disability, life insurance, flexible spending arrangements , health savings accounts , health reimbursement accounts , vision insurance, etc. The number and type of benefits offered is up to the small business owner.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

If My Employer Does Not Provide Health Insurance Benefits Or If I Am Working Only Part

Yes. Several programs are available for people without insurance in California.

Medi-Cal is Californias joint federal-state Medicaid program that provides free or low-cost health coverage. In general non-elderly adults with household income up to 138 percent of Federal Poverty Level , pregnant women with household income up to 213 percent of FPL, and children from birth through age 18 with household income up to 266 percent of FPL qualify for Medi-Cal. You can also get Medi-Cal if you fall within certain categories. To see if you are eligible for Medi-Cal, contact the Department of Health Care Services.

Childrens Health Insurance Program may provide health coverage to children in families that do not qualify for Medicaid. Similarly, Medi-Cal Access Program may provide health coverage to pregnant women with household income more than 213 percent of FPL.

Covered California Health Exchange is the California agency offering subsidized health insurance plans in accordance with the Affordable Care Act . Covered California helps individuals and families obtain health coverage that includes the minimum essential benefits required by Obamacare. If your household income is at or below 400 percent of FPL, Covered California may qualify you for subsidized plans with reduced premiums. If your household income is between 138 percent and 250 percent of FPL, Covered California may qualify you for extra discounts that reduce their cost for medical services .

Also Check: How Much Is Kaiser Health Insurance In California

Where Can Employers Get Health Insurance For Employees

Finding out how to access this program and offering a health insurance plan to your workers requires work. However, these online resources can help you on your journey:

Key takeaway: Smaller businesses that offer health insurance via SHOP may be eligible for tax credits of up to 50% of their portion of employee premium costs. To qualify, your company must have less than 25 full-time-equivalent employees who have an average salary of $50,000 or less. Qualifying businesses must also pay at least half of their employees premium costs.

Are California Employers Required To Provide Health Insurance

Under the Affordable Health Care Act , companies employing 50 or more full-time employees that do not offer health insurance or offer health insurance that does not meet certain minimum standards may be subject to a financial penalty, known as payment for shared responsibility of the employer. Are California employers required to provide health insurance?

There is currently no state law obliging employers to offer group health insurance to employees, but most employers provide this benefit. If your employer provides health insurance, California insurance law requires policies that cover certain benefits and give employees the right to continue group insurance under certain circumstances if the employee leaves the group. Additional information about follow-up requirements is available.

Read Also: Does Health Insurance Cover Lasik

What Do Employers Typically Contribute To Health Insurance

While many employers choose to offer spousal and family health insurance, most of them opt to pay a smaller portion of the premium. According to the 2017 Kaiser Family Foundations Health Benefits Survey, employers contribute an average of 82 percent of the premium for self-only coverage, but only 70 percent of the premium for family coverage.

The study doesnt get into the breakdown of employer versus employee contributions for employee plus spouse, nor employee plus dependent coverage, but its also common for employers to contribute a smaller percentage of those premiums as well. If youre looking for an average contribution to those plans, its a safe bet to stick between 70 and 82 percent.

Health Insurance Coverage As A Voluntary Benefit

Many smaller companies offer health insurance as a benefit, even if they aren’t required to by law. In fact, the majority of Americans have health insurance coverage through an employer. A study by the Urban Institute reported that 83.1% of all workers were offered health insurance through an employer in the first quarter of 2016.

In other words, you are likely to receive health insurance through your company, but it’s perfectly legal for employers of any size to refuse to provide it.

Recommended Reading: Can I Cancel My Health Insurance Without A Qualifying Event