What Is An Epo Plan

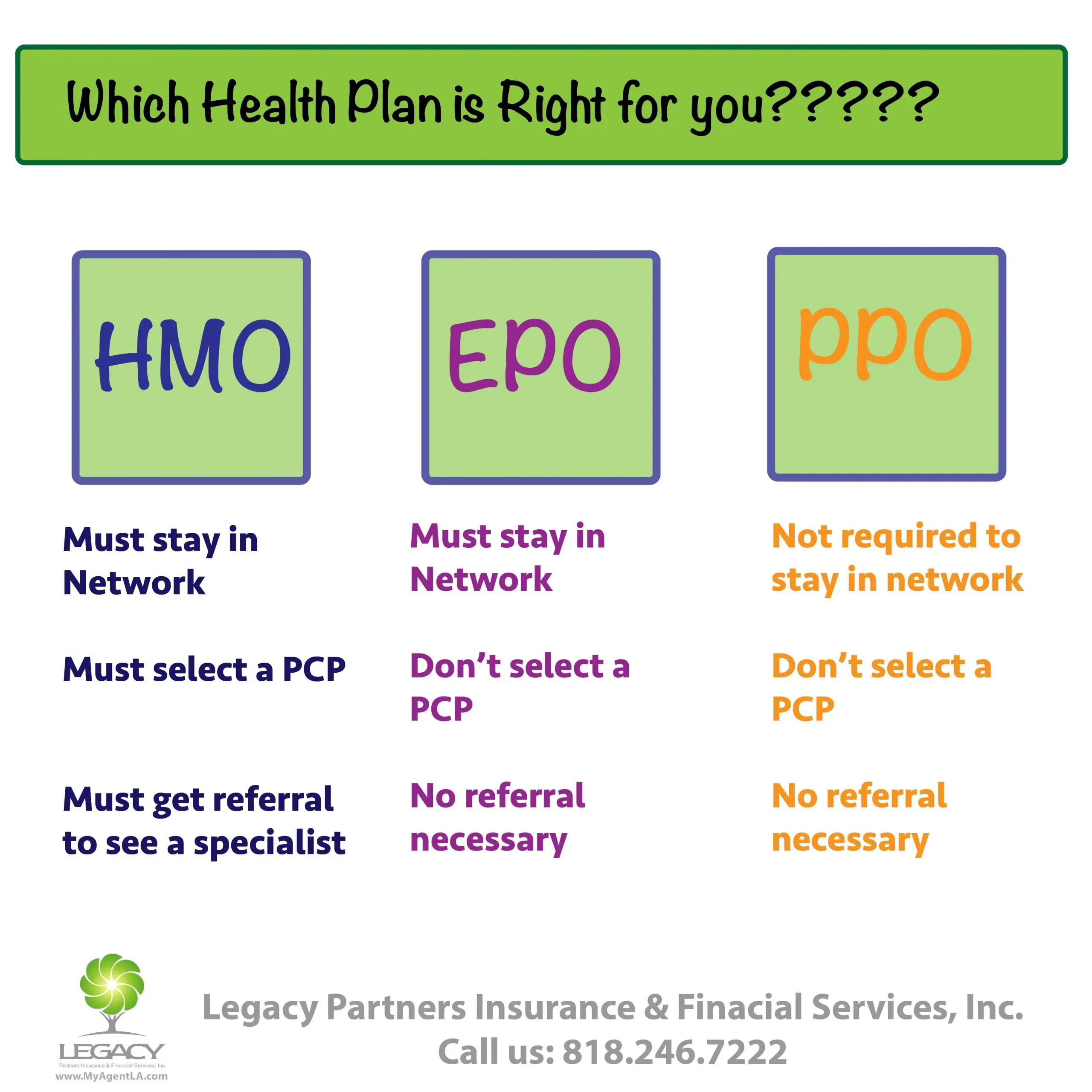

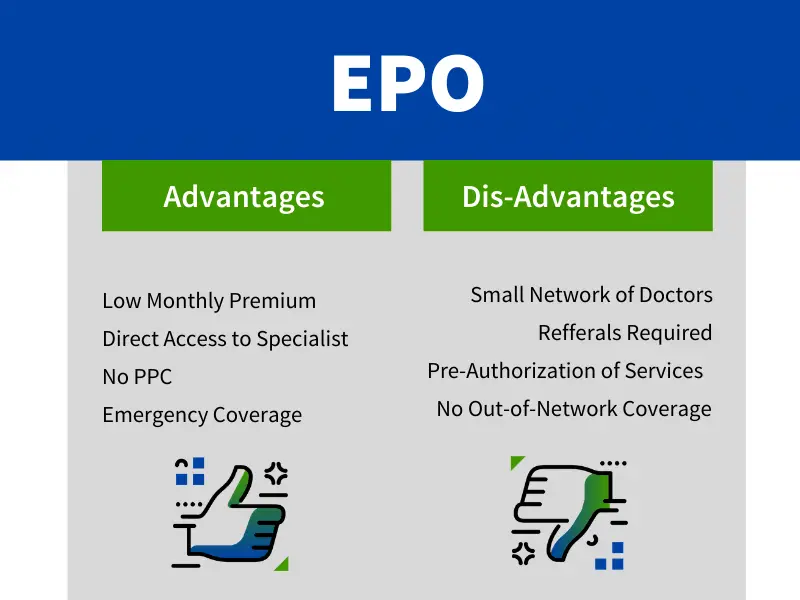

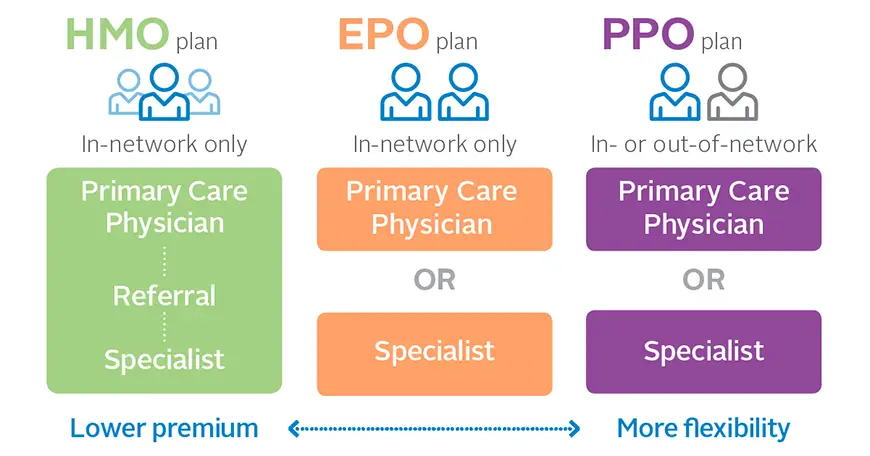

An EPO means Exclusive Provider Organization. This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan and typically do not have the out-of-network benefits of PPO plans. Generally, EPO plans cost more than an HMO, but less than a PPO.

Hdhp With Hsa: Offset Out

A High Deductible Health Plan has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account to cover medical expenses, saving you about 30%. And remember, depending on your age, services such as mammograms, colonoscopies, annual well visits and vaccinations may be covered free of charge, even if you havent met your deductible. Learn more about preventive care.

An HDHP can be an HMO, POS, PPO or EPO. People who are managing a health condition but cant afford higher monthly premiums may find that an HDHP saves them money in the long run.

Myron is a 60-year-old book editor in Philadelphia. He and his longtime boyfriend, Joseph, who maintain separate homes, love to travel. But lately, Myrons health issues, ranging from high blood pressure to weakened kidneys, have slowed them down. Myron is determined to get things back on track and that means keeping up with regular doctor visits. With that in mind, he switches to an HDHP.

Understanding Premiums Deductibles And Copays

Most people tend to focus on the monthly premium required for their health coverage and then on the copays needed for office visits and prescriptions. However, for many people, the details start to get a bit fuzzy when it comes to deductibles and out-of-pocket maximums.

In brief, your premium is the amount you pay for your health insurance every month.

The deductible, according to HealthCare.gov, can be defined as,

The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself.

After you pay your deductible, you usually pay only a copayment or coinsurance for covered services. Your insurance company pays the rest.

A copayment, or copay, is simply a fixed amount you must pay for a covered health care service after youve paid your deductible.

And one other important number is the out-of-pocket maximum, or ceiling. This is the maximum amount you have to pay for covered services during a plan year.

After you spend this amount on deductibles, copayments, and coinsurance for any in-network care and services, your health plan begins paying 100 percent of the costs of covered benefits.

Keep in mind that this out-of-pocket limit does not include:

- Your monthly premiums

- Anything you spend for services your plan doesnt cover

- Out-of-network care and services

- Costs above the allowed amount for a service that a provider may charge

Read Also: Does Medicare Pay For Maintenance Chiropractic Care

What Is Meant By Epo In Health Insurance

To sum it up

- There are many types of managed healthcare organizations

- The EPO is a type of managed care organization

- They all involve health care resources called networks

- They have different ideas about using health care resources

- They have rules concerning customers use of outside resources

The EPO or exclusive provider organization is a network of doctors, and medical service providers joined into a simple arrangement. Clients have access to all of the network resources but cannot get insurance coverage when they go outside of the network.

The goal of the EPO approach is to keep prices low for the customer and hold down out-of-pocket expenses. The Customer can clearly control when they wish to incur the costs of using a doctor or facility that is not in the EPO network.

Enter your zip in our free toolbox to compare multiple types of health insurance policies!

How To Acquire An Epo Health Insurance Plan

Today, business owners have a wide range of options when it comes to health insurance. Even smaller businesses that do not have the help of a massive HR department can acquire an EPO insurance plan for their employees. Hiring an insurance broker is an excellent option when shopping for health insurance. An experienced insurance broker can help a business compare health insurance options and provide advice on which plans are best based on cost and similar factors. Brokers act on behalf of their clients and possess extensive knowledge of different types of insurance products and their risks.

Read Also: Starbucks Health Insurance Eligibility

Seeing A Specialist With An Epo

You do not need a referral to see a specialist with an EPO. This can make it easier to get the care you need, whenever you need it. At the same time, make sure to visit a specialist who is in your network, because your insurance company may leave you with the bill if you go out of network. A specialist visit may also have a higher copay or coinsurance compared to visiting your primary care physician.

An Epo Plan May Be Right For You If:

- You do not want to get a referral to see a specialist.

- You want to receive a much lower negotiated rate with an EPO plan than you would with an HMO or PPO plan.

If you would like to apply for an EPO plan, but would like more details, please call one of our licensed agents at 1-877-731-9560.

*Definitions may vary by plan provider. Please read the provider’s Summary of Benefits.

Also Check: Insusiance

Is Epo Better Than An Hmo

When comparing an EPO and HMO, one plan isnt necessarily better than the other. It depends on your coverage needs, your doctors, and your budget. If you want the freedom and flexibility to see a specialist without a referral, choose an EPO. If you rarely see the doctor and want the cheapest policy, an HMO might be a better option.

How Managed Health Care Plans Work

Managed health care plans tend to be more cost-effective than traditional fee-for-service or indemnity health insurance plans because they share the medical cost financial risks between members, their insurance plans, and members of the managed care network. Employers who sponsor a managed health insurance plan will pay part of the annual premium. Employees pay the additional cost, which is often less. For example, in 2021, the average annual premium for family coverage was $22,221, with the employer paying $16,253 and the employee paying $5,969 per year.

Managed health care plans differ from FFS or indemnity plans because members usually must select a “primary care physician” from the network of doctors provided by the plan sponsor. Being part of a network will provide plan members access to services from network health service providers at set rates reducing the costs of the plan.

Also Check: What Insurance Does Starbucks Offer

Find Cheap Health Insurance Quotes In Your Area

An exclusive provider organization insurance plan contracts with a network of doctors, hospitals and other health professionals to provide services to its subscribers. An EPO allows for in-network specialty care without the need for a referral, but policyholders are responsible for payment of all out-of-network services except in emergencies.

Ppo: The Plan With The Most Freedom

A Preferred Provider Organization has pricier premiums than an HMO or POS. But this plan allows you to see specialists and out-of-network doctors without a referral. Copays and coinsurance for in-network doctors are low. If you know youll need more health care in the coming year and you can afford higher premiums, a PPO is a good choice.

Jenelle, 38, of Jacksonville, FL, has been married for five years. The couple is having difficulty conceiving and has seen a number of fertility specialists. When her employer offered three choices for health plans, Jenelle picked the PPO. She pays more for one fertility doctor whos out of network, but she doesnt mind: Her mission is to get pregnant.

Recommended Reading: Starbucks Part Time Health Insurance

Factors To Consider When Looking For Health Plans

It is important to consider the status of your health and of your familys health when choosing a health insurance plan. If you anticipate needing a lot of healthcare, then you will likely have to opt for a plan that offers a wide range of coverage. If you dont anticipate needing a lot of healthcare, then you can do without that wide range.

Another crucial factor to consider is your budget. How much is too much for a deductible? How much are you willing to pay in premiums? What about out-of-pocket expenses?Considering these money-related questions alongside the status of your and/or your familys health needs will help you select the right health care plan for you.

How To Use An Epo Plan

EPOs cover a wide range of healthcare services. To use your EPO coverage youll need to select a primary care physician . Typically, the list of approved providers includes GPs, internists, pediatricians, and DOs and others. If you needed to see a specialist, you typically do not need a referral and can schedule the appointment. Depending on the health insurance plan you choose you could pay a copay for your office visit or it may be subject to the deductible. Remember to use in-network providers as EPOs only cover out-of-network providers in emergency situations.

Don’t Miss: Starbucks Health Plan

Epo Vs Ppo Insurance: What To Know And Which To Buy

November 21, 2017 by Brandon Downs

Choosing your health plan is not a decision that you should make lightly. There are numerous types of plans that may sound similar but differ in their coverage options. Exclusive Provider Organizations and Preferred Provider Organizations are two such health plans that offer distinct benefits.

\Take the time to understand each type of health plan so that you can determine whether EPO or PPO insurance is best for your unique needs.

Contents

What Is An Hmo

An HMO, or Health Maintenance Organization, is a type of health plan that offers a local network of doctors and hospitals for you to choose from. It usually has lower monthly premiums than a PPO or an EPO health plan. An HMO may be right for you if youre comfortable choosing a primary care provider to coordinate your health care and are willing to pay a higher deductible to get a lower monthly health insurance premium.

Read Also: Does Insurance Cover Baby Formula

Pros And Cons Explained

When you have a managed health care plan, you have guaranteed access to a network of health care providers. And as long as you visit one of the in-network doctors or specialists, you’ll benefit from reduced rates, compared to if you went out-of-network.

When you visit doctors in-network, there’s a billing system that helps make the paperwork and claims process easier. This could speed up the process, too.

Physicians and providers also benefit from managed health care plans because they are likely to see more patients who are in the network. That gives them a steady stream of clients and consistent work.

However, compared to indemnity or FFS plans, there is less flexibility because you’re required to go to an in-network doctor, or risk paying more to see another health care provider. You may also need a referral to visit a specialist.

Point Of Service Plan

A POS plan is similar to HMOs but offers slightly more flexibility. POS does require you to name a PCP who is within the network, however, you are permitted to see someone outside of the network at a higher cost. This flexibility comes at a bigger price, but it is not as high as a PPO, making POS a good middle-ground choice.

Recommended Reading: Starbucks Medical Insurance

How Does It Compare To Other Insurance Plans

There are various types of insurance plans that offer different benefits to policyholders. Choosing the right type of plan requires you to consider your health, your preferred network of service providers, and how youd like to manage costs between monthly premiums and out-of-pocket expenses.

PPO

A Preferred Provider Organization plan refers to a health insurance plan that provides maximum benefits for in-network services, but still provides coverage for out-of-network visits. With a PPO plan, you do not have to commit to a PCP, and you can visit various health providers and specialists without a referral. PPOs offer individuals the most freedom and flexibility with their service providers and generally have higher premiums than other health plans.

POS

A Point of Service plan is a type of health insurance plan that provides different benefits depending on whether members use in-network or out-of-network healthcare providers. Similar to EPO plans, POS health plans require members to choose a designated PCP and get referrals before visiting specialists. The difference, however, is that members have the choice to use doctors, hospitals, and service providers outside of their provider network. POS plans will partially cover out-of-network visits but members will have to make higher copayments for services.

HMO

Epo: A Larger Network Makes Life Easier

An Exclusive Provider Organization is a lesser-known plan type. Like HMOs, EPOs cover only in-network care, but networks are generally larger than for HMOs. They may or may not require referrals from a primary care physician. Premiums are higher than HMOs, but lower than PPOs.

Karen, 35, manages a chain of restaurants with locations across the country. She has asthma, and usually sees her specialist a couple of times a year. Because she travels a lot on business, Karen chose an EPO with a large national network: If she ever needs care away from home, she knows shell be able to find an in-network specialist. Her EPO also doesnt require referrals, a convenience shes willing to pay a bit more for.

Recommended Reading: Starbucks Insurance Enrollment

The Differences Between Hmo Ppo Pos Hdhp And Epo Health Plans

HMO, PPO, POS, HDHP, and EPO are all acronyms for different types of health insurance plans. We know it can be overwhelming to try and decide between various plans and thats why this article will lay out the differences between the standard types of health insurance plans: to help you decide which plan is best for you and your lifestyle.

What Is Epo Insurance

Exclusive Provider Organization health plans are similar to Health Maintenance Organizations as they do not cover care outside of the plans provider network. The plan offers a local network of doctors and specialists in your area in which you can choose from.

One of the biggest perks of an EPO plan is that you do not always need a referral to see a specialist. EPO health plans are often more affordable than PPO plans if you choose a doctor or specialist in your local network. However, if you choose to get care out of your plans network, your medical care may not be covered. The one exception is emergencies which are often covered even if they are out of your network.

Don’t Miss: Kroger Health Insurance Part-time

Epo In The Obamacare Plans

Consumers can get EPO managed care in the four metal bands. These plans permit no outside resources and only use network doctors. They permit the use of outside resources in emergency situations. The below-listed descriptions show the basic cost sharing on Obamacare EPO plans.

- Platinum EPO plans cover about 90 percent of the benefits costs and leave ten percent for the consumer. The premiums are high, and the deductibles are low and reachable.

- Gold EPO Plans cover 80 percent of benefits costs and leave 20 percent for the customer. The Premiums for Gold plans are high and the deductibles in the lower end of the range. These are plans designed for those with a significant amount of medical care needs.

- Silver EPO plans cover 70 percent and divide the 30 percent balance for the consumer. Some silver plans have high-deductibles, and these are ideal for pairing with Heath Savings Accounts to reduce the impact of deductibles.

- Bronze EPO plans have low premiums and high deductibles. The divide costs with consumers on a 60 percent to 40 percent basis. The deductibles are unlikely to be reached unless a severe level of usage occurs. These plans are ideal for those whose needs are for annual physicals, preventive services, wellness, and periodic visits.

Epo Health Insurance Plan: What You Need To Know

by JC Lewis Insurance Services | Sep 28, 2020 | EPO, Health Insurance

Finding a suitable and affordable individual health insurance plan can be challenging.

There are so many options, it seems, and a bewildering number of factors to consider. That being said, it is also true that most people tend to gravitate towards either an HMO or PPO plan.

But those are not your only options.

Don’t Miss: Proof Of Va Health Insurance For Taxes

Epo Compared To A Ppo

PPOs offer members the most freedom to see providers both in- and out-of-network without referrals, whereas EPOs are limited to in-network providers. However, both types of plans provide members access to the BlueCard benefit. PPOs generally have the highest monthly of all the health plan types . Want to learn more? Check out What is a PPO?

The Cost Of Epo Plans

EPO plans generally offer middle-of-the-road premiums, but the exact costs will depend on where you live and the specific plan you have. In addition to the premiums, make sure to compare copays , coinsurance, deductibles, and out-of-pocket maximums, which is the maximum you will ever pay before insurance starts covering 100% of your costs.

If you need help paying monthly premiums, consider a health insurance subsidy.

Also Check: Substitute Teacher Health Insurance