How Much Does Health Insurance Cost

A Forbes Advisor analysis of unsubsidized ACA marketplace premiums found that the average monthly cost of health insurance on the ACA marketplace is:

- $365 for individual coverage for a 21-year-old person

- $386 for a 27-year-old

- $655 for a 50-year-old

- $994 for a 60-year-old

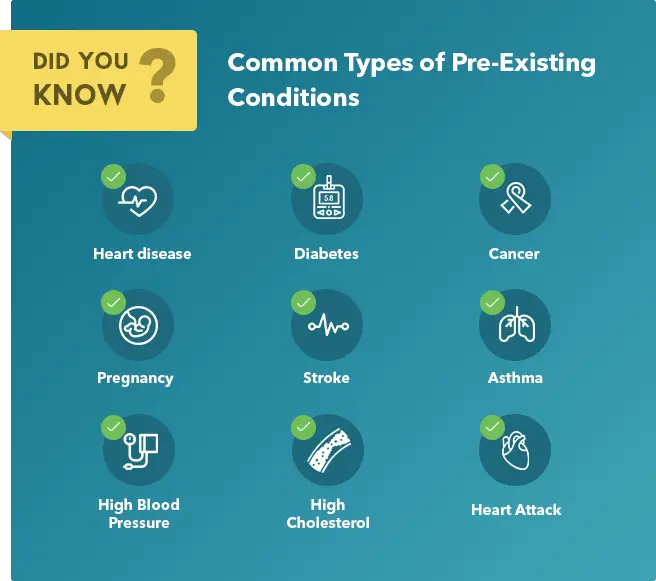

The exact cost for an ACA plan varies by age, type of benefit design, metal tier and how many people are covered on the plan. Health insurance companies cant use your health status or pre-existing conditions when setting rates for health insurance.

Can You Buy Health Insurance Now

- Open enrollment for 2022 health coverage ended January 15 in most states, but continues after that in some states.

- If you have a qualifying event or are Native American, you can buy ACA-compliant coverage today, but probably will have to wait until at least the start of next month before the coverage is in force. A new year-round special enrollment period has also been added for households that are subsidy-eligible and have income up to 150% of the poverty level.

- Consumers in most states can buy short-term coverage at any time during the year and coverage can be effective within days often by the next business day.

- People with modest incomes in New York, Minnesota, and Massachusetts can enroll in health programs year-round.

The mere fact that youre reading this article suggests that you need to buy health insurance coverage soon. So what are your options for buying a health plan in the individual health insurance market today, tomorrow, or at any other point during the year?

Preventive Services Must Be Provided For Free

Federal law requires health plans to cover many preventive services at no cost to you. You might be able to get free check-ups, blood pressure and diabetes testing, contraceptives, mammograms, cancer screenings, and flu shots. Visit HealthCare.gov’s Preventive Health Services page to see the full list of free services. You must go to a doctor in your network to get the free services.

Read Also: What Jobs Give Health Insurance

What Health Plans Cover

Coverages vary by plan. Coverage requirements are different for plans you get at work and those you buy directly from an insurance company. Even among plans you get at work, the requirements are different depending on whether you work for a small employer or a large one. If you ask, your plan must give you a Summary of Benefits and Coverages.

Federal law requires individual and small-employer plans to cover 10 types of health care services, called essential health benefits. In addition, Texas requires some plans to include certain health benefits. Some plans might cover more services, like adult dental and vision care and weight management programs.

Learn more: How to get help with a mental health issue | Watch: How to get help with a mental health issue

With A Special Enrollment Period

You can enroll in a Marketplace plan for the rest of the year if you qualify for:

- A Special Enrollment Period due to a recent life event, like losing other coverage, moving, getting married, or having a baby

- A new Special Enrollment Period based on estimated household income

Before you apply, you can preview 2022 plans with estimated prices based on your income.

You May Like: How Do I Choose The Best Health Insurance Plan

How Do I Get Health Insurance If I Am Self

If you dont have access to a spouses or parents health insurance plan, self-employed people can get coverage through multiple avenues.

Self-employed health insurance is available through the Affordable Care Act marketplace or directly from a health insurance company. You can also get coverage through Medicare or Medicaid, if youre eligible.

Private Vs Public Health Insurance

Private health insurance, offered through the ACA federal marketplace or directly from private health insurance companies, is different from public health insurance Medicare or Medicaid.

âMedicare is generally more cost-effective for Americans over age 65, the vast majority of whom qualify for Medicare,â Martucci says. âMedicaid, on the other hand, is a free or very low-premium health insurance option for low-income Americans and is a very good deal for those who qualify. But eligibility requirements vary significantly by state and in many places are restrictive to the point of excluding all but the most vulnerable people.â

Don’t Miss: Does Health Insurance Cover Surrogacy

How Do I Get Insurance For My Family

You can add your family to a work health plan. If you buy from an insurance company or the marketplace, you can buy a plan that also covers your family.

You can keep your dependent children on your plan until they turn 26. They dont have to live at home, be enrolled in school, or be claimed as a dependent on your tax return. You can keep married children on your plan, but you cant add their spouses or children to it.

If you have dependent grandchildren, you can keep them on your plan until they turn 25.

Can You Sign Up For Health Insurance Outside Of Open Enrollment

It is possible to obtain health insurance or change your Marketplace plan after the open enrollment period only if you experience at least one life event that qualifies for a Special Enrollment Period.

Its important to note that you may not qualify for cost assistance if youre enrolling in health coverage after the annual open enrollment period. Individuals who do not qualify for coverage in 2021 through a Special Enrollment Period can enroll in health insurance during regular ACA open enrollment for 2022 starting Nov. 1, 2021.

Medicare also has a list of qualifying events for a Special Enrollment Period. However, unless you have low income , a late enrollment into any part of Medicare B may result in a higher premium, according to medicare.gov. If you qualify for one of these low-income programs, you may be able to expand your eligibility for certain parts of Medicare, as well, outside of the usual enrollment periods described above.

Don’t Miss: How To Get Health Insurance Outside Of Open Enrollment

Can I Change Medicare Advantage Plans During My Initial Enrollment Period

The first time you may be eligible to sign up for a Medicare Advantage plan may be during your Initial Enrollment Period. During this period, you can both enroll in a Medicare Advantage plan and switch from one plan to another. Maybe you first sign up for a plan that seems attractive but then decide you want the same coverage your spouse has. You can change Medicare Advantage plans anytime during your Initial Enrollment Period.

If you qualify for Medicare by age, your Initial Enrollment Period starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. If you qualify for Medicare through disability, this period starts 3 months before your 25th month of getting Social Security or Railroad Retirement Board benefits, includes the 25th month of getting disability and ends 3 months after your 25th month of getting disability benefits.

Cheap Health Insurance: Find Low Cost 2022 Plans

With Blue Shield, you can find affordable coverage for you. Blue Shield also offers financial assistance, and if you qualify, you can get help paying for your coverage through Covered California.

With these great benefits, its no wonder so many Californians choose Blue Shield as their health plan provider.

U.S. Among the health plan providers in India, Blue Shield was the first to offer coverage for life-saving surgeries and the first to offer catastrophic coverage. Today, Blue Shield of California offers quality health insurance plans.

The individual and family plans offered at Blue Shield fit different budgets, so members have options. Members can enjoy many benefits including telemedicine services through Teladoc and NurseHelp 24/7.

Recommended Reading: How Much Is Kaiser Health Insurance

Changing Health Insurance During The Yearly Open Enrollment Period

Open Enrollment is the time of year when anyone can change their health insurance plan, for any reason. It typically runs from November 1 to December 15, yet is sometimes extended. Medicare Open Enrollment periods may vary.

This is the time when you can accept your current plans health insurance renewal, or you can shop around to find a better fit for you and your family. The plan you choose will begin January 1, or February 1, depending on when you enroll.

Want to shop around? Here are a couple ways to make the experience a little simpler:

- If you want to look at new plans with your same insurance provider, you can usually compare plans online or call their team. At HealthPartners, its easy to review health insurance plans online or get personal help by calling .

- If you want to see options from different health insurance providers, you can either contact them directly, call your broker or use the health insurance marketplace.

On the health insurance marketplace, you can see plan information from many different companies all at once. You can also find out if you qualify for financial assistance. In Minnesota, get started at MNsure.org. In Wisconsin, go to healthcare.gov.

When Is Medicare Enrollment

Turning 65 or retiring in the near future? It could be time to choose your Medicare coverage. There are a number of different Medicare enrollment periods. One key Medicare enrollment period for changing your coverage is called the Annual Enrollment Period . This happens from October 15 to December 7 every year. During AEP, you can join, switch or drop a plan. If you dont make any changes during AEP, your current plan will automatically renew the next year.

You May Like: How To Apply For Kaiser Health Insurance

Does My Current Health Insurance Status Affect Whether I Can Get Va Health Care Benefits

No. Whether or not you have health insurance coverage doesnt affect the VA health care benefits you can get.

Note: Its always a good idea to let your VA doctor know if youre receiving care outside VA. This helps your provider coordinate your care to help keep you safe and make sure youre getting care thats proven to work and that meets your specific needs.

Changes You Can Make Online

During open enrollment you can make certain changes online using PEBB My Account. You can:

- Change your medical and dental plans.

- Remove dependents from your coverage.

Note: Please print or save your confirmation page when youve completed your changes. Check back in two business days to verify the coverage you selected and your spouse or state-registered domestic partner coverage attestation is correct.

When you submit an online plan change, please wait two business days to make any additional online plan changes.

You May Like: Where To Shop For Health Insurance

Is There A Penalty For Cancelling Health Insurance

Yes, usually you can cancel your health insurance without a penalty. However, if you reside in a state that has its own coverage mandate, you may face a tax penalty. Your cancellation may take effect beginning the day you cancel, or you may set a date in the future, such as when your new coverage will start.

Recommended Reading: Whatâs The Cheapest Health Insurance In California

Can I Cancel My Health Insurance Without A Qualifying Event

You can cancel your individual health insurance plan without a qualifying life event at any time. But it is important to remember that once you cancel your policy, you cannot enroll again until the next open enrollment period. During this time you will have no health insurance coverage, which could be costly if you happen to get injured.

On the other hand, you cannot cancel an employer-sponsored health policy at any time. If you wanted to cancel an employer plan outside of the companys open enrollment, it would require a qualifying life event. Under Section 125 of the Internal Revenue Code, if you do decide to cancel without a QLE, then you and your employer will incur tax penalties.

Recommended Reading: Why Is Health Insurance So Expensive

Also Check: Can I Go To The Er Without Health Insurance

Is There An Open Enrollment Period For Medicaid

Medicaid, a federal program, was designed to help people with limited income get access to health coverage. There is no open enrollment period for Medicaid programs, including the Childrens Health Insurance Program .

In some states, Medicaid covers all low-income adults below a certain income level. In all states, Medicaid provides health coverage to:

- Low-income families and children

Donât Miss: Why Is Teacher Health Insurance So Expensive

Private Plans Outside The Marketplace Outside Open Enrollment

some limited cases

Any health insurance that meets the Affordable Care Act requirement for coverage. The fee for not having health insurance no longer applies. This means you no longer pay a tax penalty for not having health coverage.

- The Marketplace doesnât list or offer these plans. The only way you can enroll in a health plan through the Marketplace outside Open Enrollment is if you qualify for a Special Enrollment Period.

- You can find these plans through some insurance companies, agents, brokers, and online health insurance sellers. If you buy a plan outside the Marketplace any time, during Open Enrollment or not, you canât get premium tax credits or other savings based on your income.

- Insurance companies can tell you if a particular plan counts as minimum essential coverage. Each planâs

Read Also: Does Health Insurance Cover Hernia Surgery

Can I Buy Health Insurance At Any Time

Private health insurance coverage must be purchased during open enrollment like other types of health insurance. If you experience a qualifying event, you have 60 days to apply for a qualified health insurance policy. You may find a policy that you like outside of the open enrollment period, but if you dont have a qualifying event, you cant actually purchase it. Some agencies may allow you to choose a policy and pay a portion of the private health insurance cost to lock in the premium amount. The coverage wont take effect, however, until after the open enrollment period.

There are established windows of opportunity for consumers looking to purchase Obamacare-compliant health insurance for themselves or for their family. Everyone has the chance to purchase health insurance or change health insurance plans purchased on the exchange during the Open Enrollment Period, or OEP. OEP is an annual event, and in most cases, it runs 24 hours a day, 7 days a week, from November 1 to December 15. This date can vary a bit by state so be sure to check the OEP dates for your state.

The annual OEP is the time to buy ACA-compliant, Qualified Health Plans without complication. You will need to evaluate your choices and apply for coverage before the end of the OEP. But there are circumstances in which you can get those plans outside of open enrollment periods, like if youre eligible for special enrollment due to a qualifying life event.

Enroll During The Annual Open Enrollment Period

Open enrollment for 2022 coverage began November 1, 2021. In most states, it ended on January 15, 2022 , although there are several state-run exchanges where the open enrollment period for 2022 coverage has been extended past January 15. The following state-run exchanges have later deadlines to sign up for 2022 coverage:

And Colorado is offering a special enrollment period through March 16, uninsured residents affected by the Omicron COVID surge or the Marshall Fire.

During open enrollment, individual/family health insurance can be purchased by nearly anyone. The enrollment window applies both on-exchange and off-exchange, although subsidies are only available to eligible applicants who enroll through the exchange. There is no requirement that you have a qualifying event or have maintained prior coverage. And as is always the case with ACA-compliant coverage, your medical history will not be taken into consideration when youre enrolling in a new plan or switching from one plan to another.

Read Also: How Can I Add My Parents To My Health Insurance

What Happens If I Miss Open Enrollment

The Affordable Care Act no longer requires everyone to have health coverage. You will not have to pay a tax penalty if you missed open enrollment and dont have coverage for 2020. However, going without health insurance could leave you at risk for high unexpected medical bills. Your options could include a special enrollment period, Medicaid and/or the Childrens Health Insurance Program , short-term health insurance, and supplemental insurance.

Do You Need Supplementary Health Or Dental Insurance

If you are young and healthy, you might not need to buy supplementary health or dental coverage. It depends to an extent on what you are covered for under OHIP, a group plan or a parents group plan. For example, starting in January 2018, OHIP provides prescription drug coverage to youth 24 and under who are not covered by private benefits. Those children and youth are able to get more than 4,400 prescription medicines for free by showing their health card and prescription. Coverage is automatic, with no up-front costs. Read the news release to find out more. Check what you are covered for, take a look at your individual situation, and make a decision on whether what you have now is sufficient.

You May Like: Can I Take Myself Off My Parents Health Insurance

Special Enrollment Periods And Qualifying Life Events

Certain life events qualify you for a Special Enrollment Period. A Special Enrollment Period is a period of time during which you can buy a health plan, even if its outside the normal Open Enrollment Period. The events that trigger a Special Enrollment Period are called qualifying life events.

Qualifying life events include:

- Losing your health coverage through a life event

- Examples include: Getting a divorce, losing your job, losing your Medicaid or CHIP eligibility, or expiring COBRA coverage

- Please note: If you voluntarily quit your health plan or are terminated because you didnt pay your premiums, you are not eligible for a Special Enrollment Period

Health insurance Special Enrollment Periods typically last for 60 days after the date of your qualifying event. During this time, you can shop for health insurance on a private or public exchange. Youll have the same plan options as you would during the Open Enrollment Period, like copay and Health Savings Account compatible plans. You may also have choices for dental and vision plans.