Health Insurance Scams To Avoid This Year

Numerous health insurance scams have been reported lately. With the rise of illegitimate providers and the advancement of technology, it is challenging to spot all the red flags typical of insurance scams. However, its not impossible thats why we are publishing this article.

Our aim with this short guide is to present various forms of health insurance fraud, how to notice it, and prevent scammers from taking your money. We will also show you what to do if you are already a victim of health insurance fraud.

Some readers have asked us about companies such as Harvard Pilgrim Health Care, AARP United, or Oxford United Healthcare. They are real, so we are focusing on scrupulous ones.

Recommended Read: Top 10 Life Insurance Scams

Know A Health Care Scammer When You Hear One

When you hear about the risk of identity theft today, most of the time its in the context of cybersecurity scammers hacking into peoples email or online bank accounts to steal private information such as credit card numbers and passwords.

While the biggest risks may have moved online, identity theft over the phone is still alive and well, and scammers and fraudsters continue to adapt their schemes to take advantage of confusion and fear with the lingering COVID-19 pandemic.

One of their most popular targets? Seniors.Older adults may be at home more often to answer telephone calls and many have saved up a nest egg, both of which make them more attractive to con-artists.

These fraudsters are after more than just credit card or bank information. The Washington, D.C.-based Coalition Against Insurance Fraud says health care-related scams are by far the most common type of insurance fraud in the United States, with billions lost each year to a variety of false reimbursement and billing schemes. Medicare fraud alone is estimated to cost $60 billion every year.

It is bad enough that fraud is on the rise generally but to prey on peoples fears and hopes during the pandemic is unconscionable, said Ben Kehl, vice president of member experience, UnitedHealthcare Medicare & Retirement. Thankfully, new scams are consistently being exposed. The first step in protecting yourself and your family is to stay informed.

What To Do If Youre A Victim Of Health Insurance Fraud

If you feel youve been the victim of a health insurance scam, know that youre not alone. Youre not the first one to fall victim to their lies but with your help, you can be one of the last. In the event of a scam, take the following steps to reduce the damage as much as possible:

Read Also: What Is Long Term Health Insurance

Get Our Top Investigations

Like much of what happens behind the scenes in the health insurance industry, the insurers tepid response to fraud typically goes unexamined. But this year, I dove into the crazy tale of a Texas personal trainer who didnt have a medical license but was easily able to claim he was a doctor and bill some of the nations most prominent health insurers for four years walking away with $4 million. David Williams, who was also a convicted felon, discovered stunning weaknesses in the system: that when he applied for a National Provider Identifier, the number required to bill health insurance plans, no one would verify whether he was a doctor and that when he billed insurers as an out-of-network doctor, they wouldnt check either and would keep paying him even long after they learned of his fraud. He was later convicted of health care fraud and is now in federal prison.

Williams scam raised the eyebrows of even my most jaded health care sources. It prompted a half-dozen Democratic senators to write to the federal agency that administers the NPIs and ask what it was doing to plug the loopholes.

But it also got me thinking: As journalists, we are peppered with press releases touting the fraud enforcement successes in Medicare and Medicaid, the government health plans. The federal Department of Justice and state Medicaid Fraud Control Units file thousands of criminal and civil cases a year . Clearly, their goal is to let folks know they will be prosecuted.

Is That Health Insurance A Health Product Or A Scam

Looking for health insurance can be confusing. But if you run across a company that deliberately tricks you into signing up for insurance or health products that dont deliver , its even harder.

According to the FTC, Benefytt Technologies, Inc. and its partners did just that tricking people into believing they could get Affordable Care Act -compliant health insurance, or health products with the same benefits as ACA insurance.

But wait, theres more. The FTC says Benefytt also often charged peopleseparate fees for add-on health productswhich people didnt know about or want. And hadnt agreed to buy. And if they called to cancel the not-really-ACA-compliant health insurance or product, manystill kept getting bills for those add-on products.

So, what if you bought insurance from Benefytt and now need a real, ACA-compliant plan? Well, as part of the settlement, Benefytt must tell its customers how to cancel their plan and tell customers how to take advantage of a special enrollment period to sign up for real, ACA-qualified health insurance. So, if you know someone who has a Benefytt product, please pass this news on to them.

Before signing up for health insurance:

If you spotted a health care scam, tell the FTC at ReportFraud.ftc.gov. Then, report it to your state attorneys general office.

Read Also: Is Health Insurance Worth It

Complaints We Can Look Into

Issues we can look into include:

- health insurance benefits

- membership issues such as policy cancellation or premium payments

- application of waiting periods, including pre-existing condition assessments

- incorrect information or advice about your private health insurance

- government incentives, for example if your Lifetime Health Cover loading or Government Rebate has not been correctly applied by your insurer

- contract issues between insurers and hospitals

- complaints about doctors, hospitals and healthcare providers if it involves a private health insurance arrangement such as gap fees

- complaints about Overseas Visitors Health Cover and Overseas Student Health Cover if the insurer is an Australian registered provider.

What Is Healthcare Fraud

Healthcare fraud is a federal crime under most criminal codes, consisting of intentional deceit for the purpose of illicit gains. Healthcare abuse is similar activity or behavior where knowing intent to obtain an unlawful gain cannot be established. Some examples of healthcare fraud and abuse include:

- Phantom claims for services or supplies that were never provided

- Using someone elses medical insurance information to obtain services or supplies

- Falsifying signatures or medical records to support misrepresented services or supplies

- Unbundling services from a group to unlawfully increase medical payment

- Misrepresenting the location where services or supplies are provided

- Rendering medical care without a license

- Duplicate claim submissions

You May Like: How To Enroll In Health Insurance

When To Report Suspected Fraud

- Someone other than the insurance company youâve chosen contacts you about health insurance and asks you to pay â or asks for your financial or personal health information.

- Someone you donât know contacts you about getting health insurance and asks you to pay â or asks you for your personal financial or health information.

- Someone contacts you and claims to be from the government or Medicare â and asks you to pay for a new âObamacareâ insurance card.

- You give your personal health, bank account, or credit card information to someone who calls you and says theyâre from the government.

Ing Health Insurance: Our Verdict

- ING’s accidental injury benefit gives you Gold Hospital cover for 90 days after an accident even if you’re on a lower-tier product.

- You’ll get access to nib’s First Choice network of providers to receive competitive fees, discounts and prescription glasses with no gap.

- Outside of a small benefit for gym memberships and health programs, you may find ING lacking if you’re looking for a robust lifestyle program.

Recommended Reading: How To Get Proof Of Health Insurance

Mental Health Sessions Fraud

People who belong to the mental health community people are especially vulnerable to scams. Fraudsters typically take advantage of these people by billing them and their insurance companies for needless services.

There were reports that therapists provided a 15 minutes session, but insurance companies were billed for one-hour therapy sessions. The therapists actually billed patients for recreational services. And, these services included starting a film to watch.

We would also like to emphasize that mental health fraud can also be related to patients medications.

In many cases, providers took bribes for using certain services. All in all, mental health patients, in most cases, do not even notice or understand that they are being fooled, making them easy prey for these criminals.

Ing Health Insurance Review

Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it!

ING is relatively new to the health insurance game but, in nib, its policies are underwritten by a major brand. ING offers a comprehensive suite of hospital and extras policies with some solid features and benefits. You can choose your own provider or use one in its network for lower fees and additional discounts plus, get Gold member treatment regardless of tier if you have an accident.

Read Also: What Is Gateway Health Insurance

What To Watch For

There are myriad clues that you’ve been targeted for the Health Insurance Marketplace scam:

- A caller says, “I’m from the government.” No, he isn’t. The government will not call you about your health insurance, and no one from the government will ask you to verify your Social Security number or divulge credit card information.

- You receive a robocall. Robocalls are illegal. Unless you gave the caller written permission to call you, a robocall is illegal.

- A phone recording asks you to press 1. Don’t press that buttonor any button. Pressing a number to connect to an operatoreven if you intend to tell them never again to call youonly verifies that you’re a live respondent and puts you at risk for receiving more calls. Scammers will put your number into a queue to target later.

- The operator asks you for personal information. If you do speak to an operator who asks you for personal information, hang up.

Types Of Health Insurance Scams

A common tactic is to offer a stripped-down insurance policy that doesnt meet the laws requirements for covering major illness. These policies are cheap because they make you pay for most of your own health care. By the time you find out you have a serious illness it may be too late to get real coverage.

Another way is to offer a medical discount card or discount plans that give you minor discounts but leave the big payments up to you. Sales people might call this coverage or protection, but its neither. They may also mislead you into thinking that you get a percentage of discounts for healthcare services. Discount plans are NOT health insurance. They often have monthly fees and a limited provider network. Discount plans also exclude routine health services such as surgery, chemotherapy, imaging tests, radiation, preventive care.

Some others mayoffer completely fake health insurance. The sales person takes your money and gives you a piece of paper. They may promise lower rates if you buy right now. They may say that theyre required to offer this great, low-cost coverage by the Affordable Care Act or Obamacare. Sometimes scammers say that its government-sponsored insurance or that they work for the government. Or theyll use a well-known insurance companys name, even though they dont work for the company.

Don’t Miss: Does Health Insurance Cover Vision

How To Protect Yourself From Healthcare Fraud

Although healthcare fraud is committed by a very small minority within the healthcare system, no one can assume it won’t happen to them. We encourage you to take these steps to avoid becoming a victim of healthcare fraud:

- After care, review your statement to verify accuracy.

- Ask your doctor to explain the reason for services.

- Report any discrepancies to your health insurance plan or payer.

- Beware of “free” medical services, as illicit entities use this lure to obtain information.

- Safeguard your insurance member ID card.

- Report instances where co-payments or deductibles are waived.

- Dont give your insurance number to marketers or solicitors.

- Never sign a blank insurance form.

If you suspect, experience or witness healthcare fraud, you should report the information to your local Blue Cross Blue Shield company by calling the number on the back of your member identification card. If you are not a BCBS member you can or call the report fraud hotline 1-877-327-BLUE . If you are a federal employee or retiree, you can report potential healthcare fraud by calling 1-800-337-8440.

The report fraud hotline cannot address medical benefit questions, individual payment disputes, expiration of benefits or other administrative concerns.

Types Of Health Insurance Fraud

Fraud can occur at any step of the health insurance process, from buying coverage to receiving care. Here are some of the most common types.

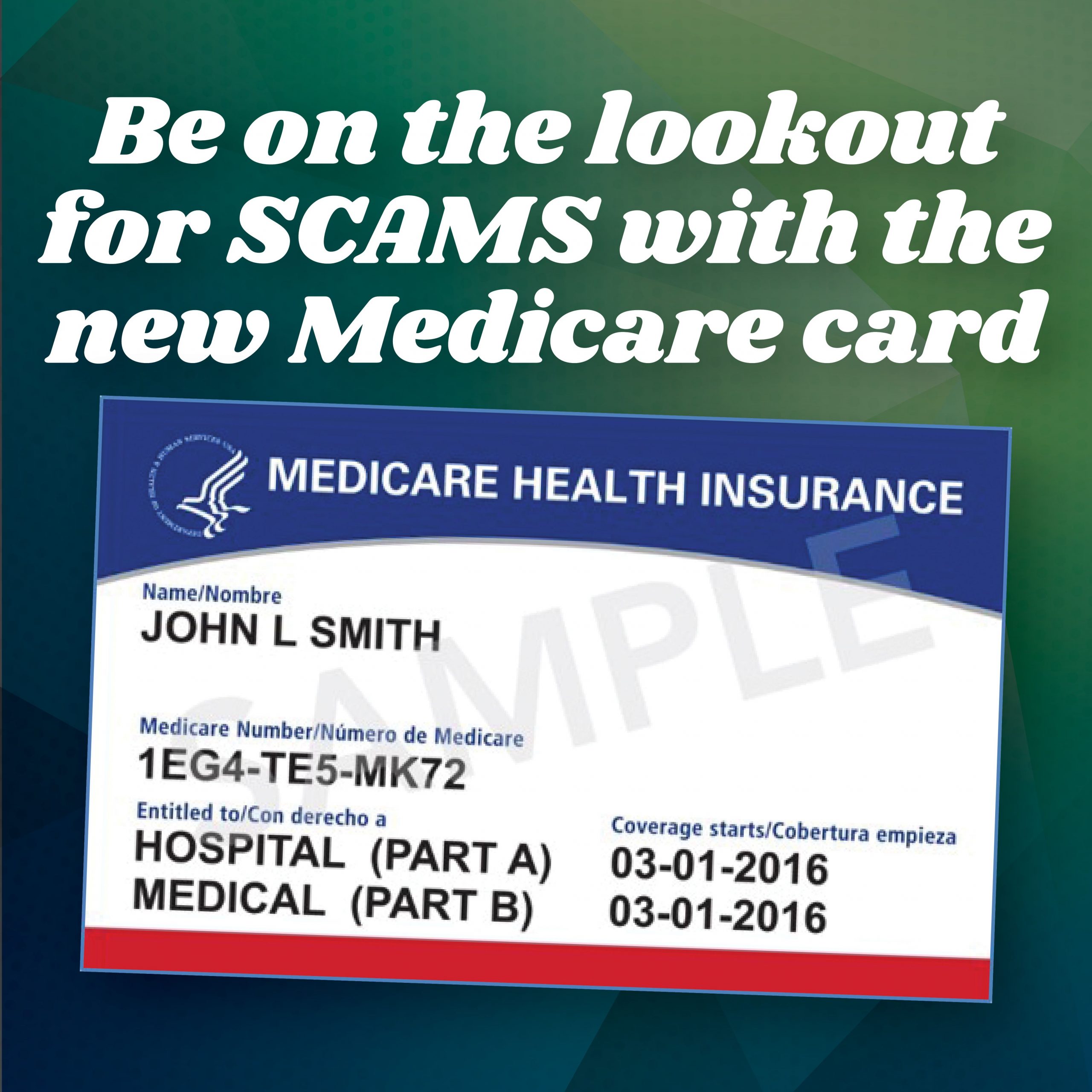

1.) Medicare/Obamacare Fraud

Because Medicare is paid out through the government and not through a private insurance company, some scammers take advantage of the program’s size and complexity by trying to slip fraudulent claims past Medicare administrators. In 2014 alone, it was estimated that Medicare improperly paid out $50 billion. The U.S. Government Accountability Office explains that Medicare is a high-risk fraud program because it’s difficult to navigate, making it easy for fake claims to slip through the cracks and go undetected.

Medicare fraud can happen at any pointwhen an insurance agent imposter tries to sell you a fake Medicare insurance plan, when a provider bills you incorrectly for health services that you may or may not have received or when a scammer calls you to verify personal information for your Medicare plan and uses that data to steal your identity. Open enrollment season is a common time for scammers to try to steal personal information from vulnerable Medicare users because if any changes are made to a plan, the user may not question someone calling to “verify” information.

2.) Ambulance Fraud

3.) Community Mental Health Fraud

4.) Medical Identity Theft

5.) Offers of Discount Plans and Cards

6.) Marketing Scams

7.) Equipment and Supply Coverage Fraud

Recommended Reading: How To Transfer Health Insurance From One State To Another

What This Means For You

People in rural areas can help by choosing health plans that adequately reimburse their local hospital for the care it provides.

This story may be outdated. We suggest some alternatives.

The content contained in this article is over two years old. As such our recommendation is that you reference the articles below for the latest updates on this topic. This article has been left on our site as a matter of historic record. Please contact us at with any questions.

This Is A Critical Message About Your Health Insurance Coverage

There is nothing like a little fear, uncertainty and doubt to make the average consumer fall victim to a scam. Especially in relation to healthcare insurance. The scam is a straightforward threat: you need to buy insurance or else face a fine or jail time. The goal is to either 1) phishing scam to secure your personal and financial information, or 2) have you pay hundreds of dollars of upfront fees.

Don’t Miss: Can You Use Hsa To Pay For Health Insurance

Reasons Health Insurance Is A Scam

I was on social media the other day and saw a video trend where people were talking about things that felt like a scam. One of the prime examples, repeated over and over was health insurance in America. I scrolled through the comments, and it became clear how many people agreed. The more I thought about it, the more I could see exactly how people feel like health insurance in America has grown to feel like a scam that offers little real benefit to them.

There are three main points that lead many people to feel like health insurance is a scam.

First up, the big one, the cost of the monthly premiums. Health insurance has gotten so expensive. Families can spend nearly as much on their health insurance as they do on their mortgage these days. Whats even more frustrating is that the already high cost seems to go up each year, even if youre generally healthy and take care of yourself. We all know when we get in a car wreck that we should expect our car insurance premiums to go up. But thinking about that example, why do our health insurance premiums keep rising so fast even when we havent needed any major healthcare? It just doesnt make a whole lot of sense.

For more information or to ask questions, contact us!

How To Report A Suspected Health Insurance Scam

Reach out to your local law enforcement via the non-emergency line in your area. Also, report the scam to your states Department of Insurance. Reporting scams and forming a paper trail for the authorities to follow can make all the difference when it comes to catching and prosecuting the perpetrators. Getting the word out to the proper authorities also makes it harder for the scammers to catch someone else in the same trap. Law enforcement and the FTC will give you all the steps to follow in reporting the fraud.

Recommended Reading: Why Is Private Health Insurance So Expensive