Health Insurance For Babies: Documents Needed

Fortunately, it does not take a long time to get coverage for your newborn and you will only need a few documents:

Read More:How to Get a Birth Certificate for Babies Born Outside a Hospital

Many health insurance companies only request one but it is best to have both at hand when you call your provider or speak with your HR rep just in case.

You should have received your childs social security card in the mail after giving birth. If you have not received it yet and a reasonable amount of time has passed, contact the facility where you gave birth. Normally, parents fill the relevant forms there and then the facility submits them.

Your health insurance provider usually has access to the newborns birth records as they need information such as the place and date of birth, full name, hospital records, etc. If they do not have this information, you may need to give them a copy of your babys birth certificate.

Please note: different providers will have different processes in place to add a baby to the health insurance plan. While many companies allow you to add your child by phone, for others, you may have to fill out an enrollment form online or else. Please contact your provider in advance so that you know exactly what steps you need to take.

You May Like: What Is The Best Pacifier For A Newborn

The Mother And/or Father Has Health Insurance Through An Employer

If you have a group health insurance policy through your employer, start by talking to your human resources office. Here are a few questions you should ask:

- How much will it cost to add my newborn to my group plan?

- What are the benefits that are included in that price? Are there any specific to newborns?

- What paperwork do I need to fill out to add my newborn to my group plan?

- What is the deadline to have the paperwork submitted?

- When will the coverage start?

The mother and father of the baby should compare notes on how much it will cost to add the child to the group plan and should also review the benefits of each plan to determine the best value. If one parent has health insurance through an employer, and the other parent has an individual health insurance plan, review the cost and the benefits to see which policy is best for your newborn.

Can I Add Dependents To Either Medical Or Dental Insurance

Spouses and children can be included in both medical and dental insurance. They can be included during your initial enrollment, or at a later date if there is a life changing event. Life changing events are marriage, birth or loss of coverage. Fill out the application form and submit it to the Consortium office within 30 days of event. You can also add dependents during annual open enrollment which is the month of June for a July 1 effective date.

Don’t Miss: Starbucks Open Enrollment

How To Add Your Elderly Parent To Your Health Insurance

Adding a parent to your health insurance is not as simple as it sounds. Ideally, we would be able to add whomever we want to our plans, but unfortunately, thats not how our health insurance system works. Under the Affordable Care Act, it is mandated that children have the option to remain on their parent’s insurance until they reach 26 years of age. Parents, on the other hand, are not offered the same protection. If you are trying to add your mother to your health insurance policy, there are a few things you need to know first.

TL DR

Only a small number of insurers allow consumers to add their parents to their health insurance policies.

Newborn Insurance Coverage In California

There is so much to prepare when youre expecting a baby especially when its the first time. In the midst of setting up the nursery, making extra trips to the doctor for prenatal appointments and securely fastening your brand new baby car seat, its surprisingly easy to forget about getting a plan in place for newborn health insurance coverage. Whether you, as a parent, have health insurance, but dont know much about it, or dont have health insurance at all, navigating the process of getting your newborn health insurance coverage can be tough.

Unfortunately, health insurance for newborns isnt something that just happens on its own. While there is a short buffer period built in to give newborns coverage through his/her mothers insurance, the longer you wait to get newborn insurance coverage in California, the more you will end up having to pay. While the Affordable Care Act and California State Laws make it mandatory for health insurance companies to accept newborns to health insurance plans, theres no guarantee on pricing. If you fail to do your part to get your newborn on a health insurance plan, you could end up spending a significant amount of money.

You May Like: Starbucks Benefits Part Time

Can My Boyfriend Or Girlfriends Child Be Added To My Health Plan Does It Make A Difference If Were Living Together

A health plan may allow you to add a boyfriend or girlfriends child to your health plan but its unlikely.

Some individual health insurance plans allow unmarried couples to be on the same plan, along with any legal dependents, if theyre living together or theres a court order for the one partner to provide insurance for their child, says Colleen King, CEO of Colleen King Insurance Agency in Los Angeles.

Group health insurance also may allow the same, but it may vary by carrier and by employer, says King.

Insuring Mom: Can You Put Your Parents On Your Insurance

- Adult children of elderly parents may wonder: Can you put your parents on your insurance? Learn how to get comprehensive healthcare coverage for your parents.

Parents often keep their children on their health insurance plans until theyre well into their 20s and can reliably maintain their own coverage. But as children grow up and parents age, some kids begin to question: Can you put your parents on your insurance? The answer to the question depends on the company that provides your insurance.

Don’t Miss: Evolve Health Insurance Company

Get Your Parents Under Your Health Insurance Policyor Find Them

The va, for example, will permit you to add a parent to your health plan as long as the parent meets the proper income qualifications. It is available free to all the employees working in the organisation and the benefits remain the same for each of them. How can i put my mother on my health insurance?

Can I Stay On My Parents’ Health Insurance After I Turn 26

No, not in most states. There are a few states offering extensions beyond age 26 with certain limitations. For example, New Jersey allows kids to stay on a parents’ policy until age 31 if the child is unmarried and has no dependents. Learn more about age exceptions to dependent coverage in your state and how the Affordable Care Act applies.

Also Check: Does Insurance Cover Baby Formula

Are Young Adults Allowed To Stay On Their Parents Health Plan

The Affordable Care Act allows parents to keep their children on a health plan until the age of 26 as long as their employer allows for children to get health coverage.

However, if that young adult has their own child, the new child will likely not get covered by the grandparents plan. The young adult could stay on their parents plan, but the grandchild would need a different health plan.

Requirements For Adding Your Children As Dependents

If you have children, theyre probably the first people that come to mind when talking about dependents. Generally speaking, you can include any child who fits the following criteria:

- Age: Your child has to be under the age of 26.

- Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of. If your child has other sisters, brothers, half sisters, half brothers, or children of their own, you can also include them on your health insurance plan.

- Length of Residency: A child only qualifies as your dependent if they have lived with you for at least six months.

- Income Contribution: Although your child can be your tax dependent while working and contributing to their own expenses, they cannot be their own primary source of support. This means a childs income must be less than half of the cost of their support expenses to qualify as your dependent.

- Tax Filing: A child cannot be your dependent if they file a joint tax return that year.

- Other Claims: A child cannot be claimed as a dependent by more than one household. So, regardless of your relationship, if someone else claims your child as a dependent, you cannot.

Also Check: Is Umr Good Insurance

Q1: It Seems Like Plans And Insurers Can Terminate Dependent Child Coverage After A Child Turns 26 But Employers Are Allowed To Exclude From The Employee’s Income The Value Of Any Employer

Under the law, the requirement to make adult coverage available applies only until the date that the child turns 26. However, if coverage extends beyond the 26th birthday, the value of the coverage can continue to be excluded from the employee’s income for the full tax year in which the child had turned 26. For example, if a child turns 26 in March but is covered under the employer plan of his parent through December 31st , the value of the health care coverage through December 31st is excluded from the employee’s income for tax purposes. If the child stops coverage before December 31st, then the premiums paid by the employee up to the time the plan was stopped will be excluded from the employee’s income.

If I Get Married Can I Add My Spouses Child To My Health Plan Is There A Timeframe In Which Enrollment Must Take Place

A stepchild is an eligible health plan dependent up to the age of 26. If your coverage is through an employer group plan that provides benefits to children, you will be given at least 30 days to enroll the new dependent. An eligible child can be a biological child, adopted child, stepchild or foster child.

The federal rule states you have âat least 30 daysâ but an employer could give you a longer period of time, says Rich Gisonny, senior consultant at Towers Watson in White Plains, NY.

This gives employees a reasonable period of time to make a decision and complete the enrollment.

However, an employerâs plan doesnât have to cover children. Gisonny says thereâs no mandate that an employer must cover an employeeâs family.

Key Takeaways

- You can add your stepchild to your employer-based health insurance plan. For this, you will get 30 days to enroll the new dependent.

- Some individual health insurance plans let unmarried couples and any legal dependents be on the same health plan as long as they are living together.

- When a divorce takes place, one of the spouses is usually removed from the health plan by the other who carries the plan through work.

Also Check: Evolve Health Insurance

Can My Parents Kick Me Off Their Health Insurance Before I Turn 26

Yes, your parents can kick you off their health insurance. Once you turn 18, your health care bills are ultimately your responsibility, and so is having health insurance coverage. Getting your own policy through your employer or school may even be cheaper or offer better coverage than staying on a parents’ policy until you age out. Plus, the further you live from your parents, it’s more likely that your doctors will be out of network, so having your own health insurance can result in lower out-of-pocket costs.

Verify Your Family Member’s Eligibility For Benefits

UC requires all faculty, staff and retirees who enroll family members in their medical, dental and/or vision insurance plans to provide documents to verify their family members’ eligibility for coverage.

You will receive a packet of materials from UnifyHR to help you complete the verification process. Be sure to respond by the deadline shown on the letter or you risk disenrollment of your family members from UC benefits.

You can read more about family member eligibility verification here.

Also Check: Can You Add A Boyfriend To Your Health Insurance

Who Is Allowed To Buy A Policy On A Grandchild

As grandparents, you have the right to secure coverage for your grandkids. The simple fact that youre their grandmother or grandfather enables you to.

Also, bear in mind that you dont need the consent of the childs parents either. Grandparents buying life insurance for grandchildren can be done 100% without any childs parents involvement.

That said, life insurance companies wont grant just anyone the ability to buy coverage on a child.

You must be related to the child in one of the following ways:

- Grandparent

- Stepparent

- Legal guardian

If you are not related to a child in one of those ways, you cannot buy coverage on them.

You May Like: Are Employers In California Required To Provide Health Insurance

How Parents Can Switch Health Plans After The Birth Of A Newborn

In addition to making changes to their existing benefits plan, a qualifying event also permits parents to switch health plans entirely during the SEP. For example, a married couple who just had a baby may decide to move from the health insurance plan provided by one persons employer to the plan provided by the other persons employer.

Having a child is expensive. Employees may inquire about costs during this process, especially if theyre choosing between their current health plan and an alternative.

As HR, it can be helpful to ask employees the following questions to help them make their decision:

You May Like: How Long After Quitting Job Health Insurance

How You Can Buy Life Insurance For Grandkids In Minutes

Whether youre looking at Globe, Mutual of Omaha, or Gerber, you can fully apply with all of these companies 100% online.

You wont need to worry about an exam because exams are never required.

Heres all the information youll need to complete an application for whole life insurance for grandchildren:

The insured children:

- Beneficiary names

- Payment information

After you submit all the information and E-Sign , underwriting will process the application within a few days and mail you a policy if the kids are approved.

If applying online is not suitable for you, it is still possible to apply via paper. For example, both Gerber Life and Globe allow people to fill out and send back in a paper application.

While this process takes much longer and is prone to errors that may result in an application rejection, it can still do it that way.

May Group Health Plans Insurance Companies Or Hmos Impose Deductibles Or Other Cost

Yes, but only if the deductible, coinsurance, or other cost sharing for the later part of a 48-hour stay is not greater than that imposed for the earlier part of the stay. For example, with respect to a 48-hour stay, a group health plan is permitted to cover only 80 percent of the cost of the hospital stay. However, a plan covering 80 percent of the cost of the first 24 hours could not reduce coverage to 50 percent for the second 24 hours.

Also Check: How To Know If A Newborn Is Constipated

Don’t Miss: How To Keep Health Insurance Between Jobs

Care For Your Babys Smile Now

Dental care should begin soon after birth.Dentists recommend wiping your babys gums with a damp washcloth or soft infant toothbrush after meals. Once the first tooth erupts, start brushing gently with a soft, baby-sized toothbrush twice a day. Dentists also recommend that you schedule your childs first dental appointment by age 1.

As your baby gets bigger, teach good oral health habits. Simple preventive care, including brushing and flossing daily and regular dental visits, can help small smiles grow up healthy.

Also Check: How Much Should A Newborn Poop

Medical Underwriting Requirements And Limitations

One of the most common factors used to determine the face value of a life insurance policy is income replacement. Because children rarely generate an income, there are limits as to how much life insurance can be taken on a child. Insurance is generally evaluated on a case-by-case basis depending on the need and purpose that is demonstrated. While there is no fixed number for the benefit amount, the ceiling is often lower for a child than an adult due to the human life value, or lack of earning power a child has.

In most cases, grandparents only need to provide some basic facts like Social Security number and address of the child in order to purchase a policy. Each state has different requirements, and some require the consent or signature of a parent prior to taking out a policy on a child. For this reason, it may be a good idea to seek permission from a parent prior to starting the process.

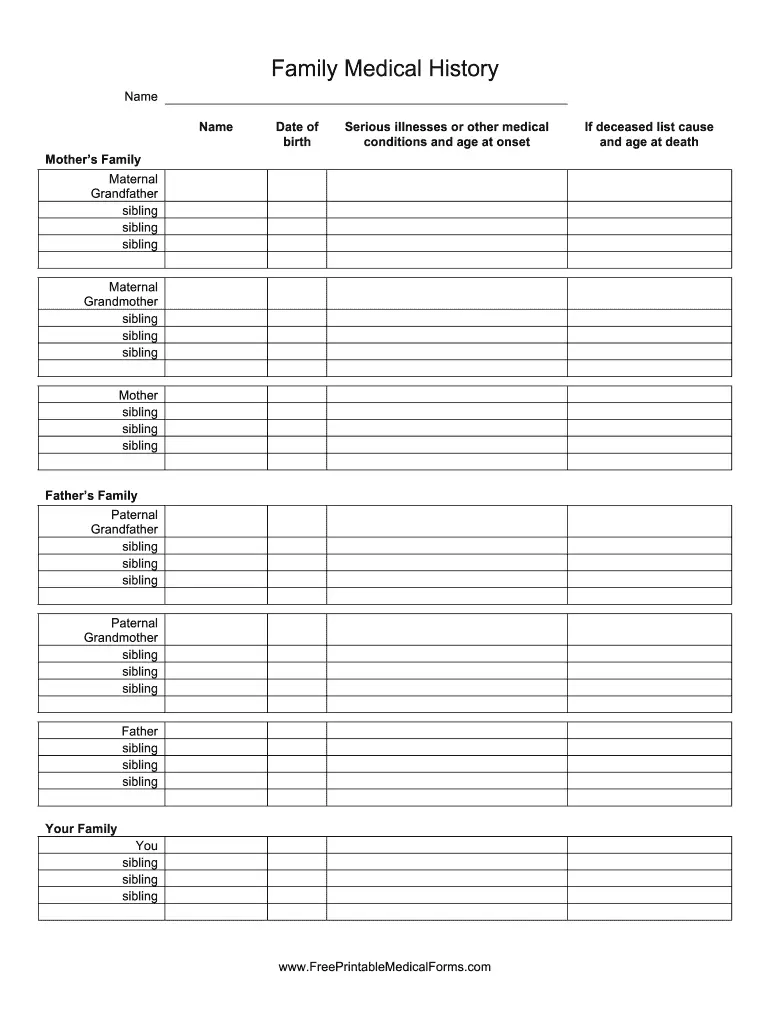

Generally, there is not much medical underwriting involved in a child policy. Usually children do not have to undergo a physical exam if they were born healthy and remain so. But the parent or guardian may be required to answer some questions regarding the childs present health and family medical history.

You May Like: Does Health Insurance Pay For Chiropractic