Does Coinsurance Vary If I Go To An In

Yes, almost all health insurance plans require the patient to pay more for an out-of-network service. Check your certificate of insurance, certificate of coverage, or summary plan description to understand what portion of a given medical expense you will be responsible for paying.

Some plans might not cover a service provided by an out-of-network. Others may require the covered individual to pay the difference between charges from an in-network and an out-of-network provider.

Coinsurance Differs From Your Other Healthcare Costs

In addition to coinsurance, there are other costs that you have to pay for your healthcare coverage, and it helps to know the difference between coinsurance and your other costs.

- Premium: Your health insurance premium is the amount of money that you pay to be covered by your health insurance. If you are getting employer-sponsored health insurance, you can usually elect to have your premium deducted from your paycheck, and this money is not counted as your taxable income.

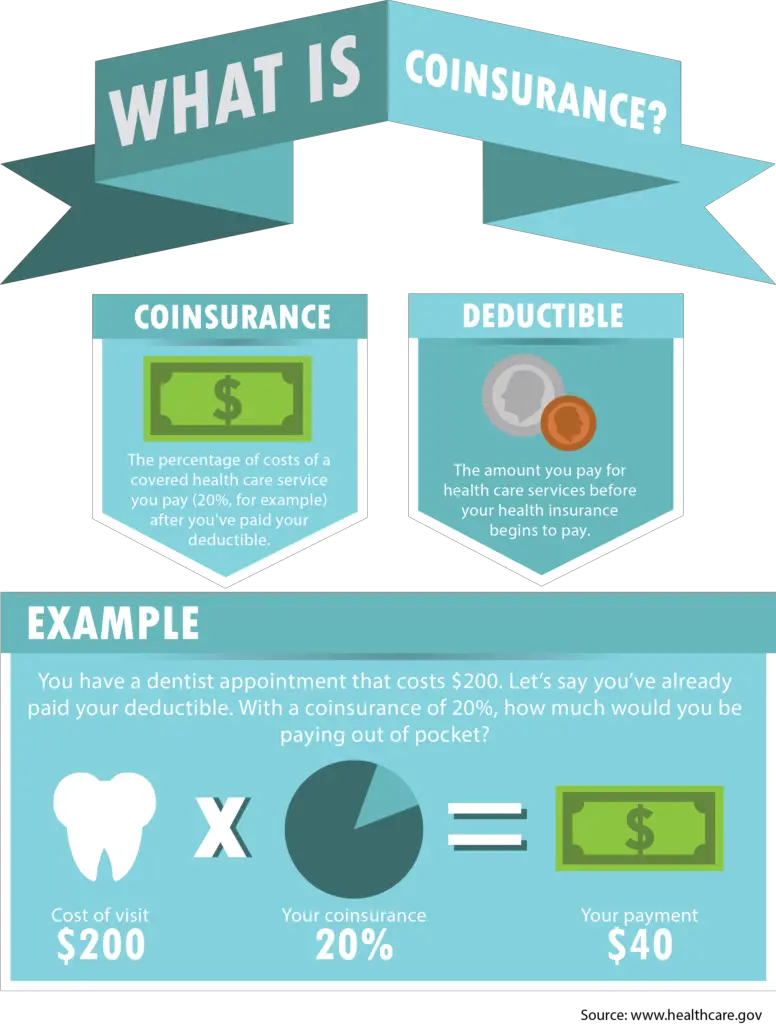

- Deductible: A deductible is a pre-determined amount of money that you must pay towards your own healthcare services before your health insurance starts to cover the cost of your health care.

- Copay: Copay is a set amount of money that you must pay for some or all of your medical visits and care.

Coinsurance differs from these other costs because your coinsurance cost is usually a percentage of your care, while the other costs are a set amount. For example, your premium may be $500 per month, your deductible may be $1500 per year, and your copay may be $30 per office visit. Your coinsurance is usually a percentage of the cost of your healthcare servicesso you may be required to pay 25 percent of the cost of your X-ray and surgery.

When Does Coinsurance Go Into Effect

Your health insurance company doesnt start splitting any claims with you until you meet your deductible, and the same is true for coinsurance. Coinsurance goes into effect only after your annual deductible has been met, and even then, youll still have to pay a portion of all your claims until your out-of-pocket maximum is met.

You May Like: Evolve Health Products

What Does Coinsurance Mean In Health Insurance

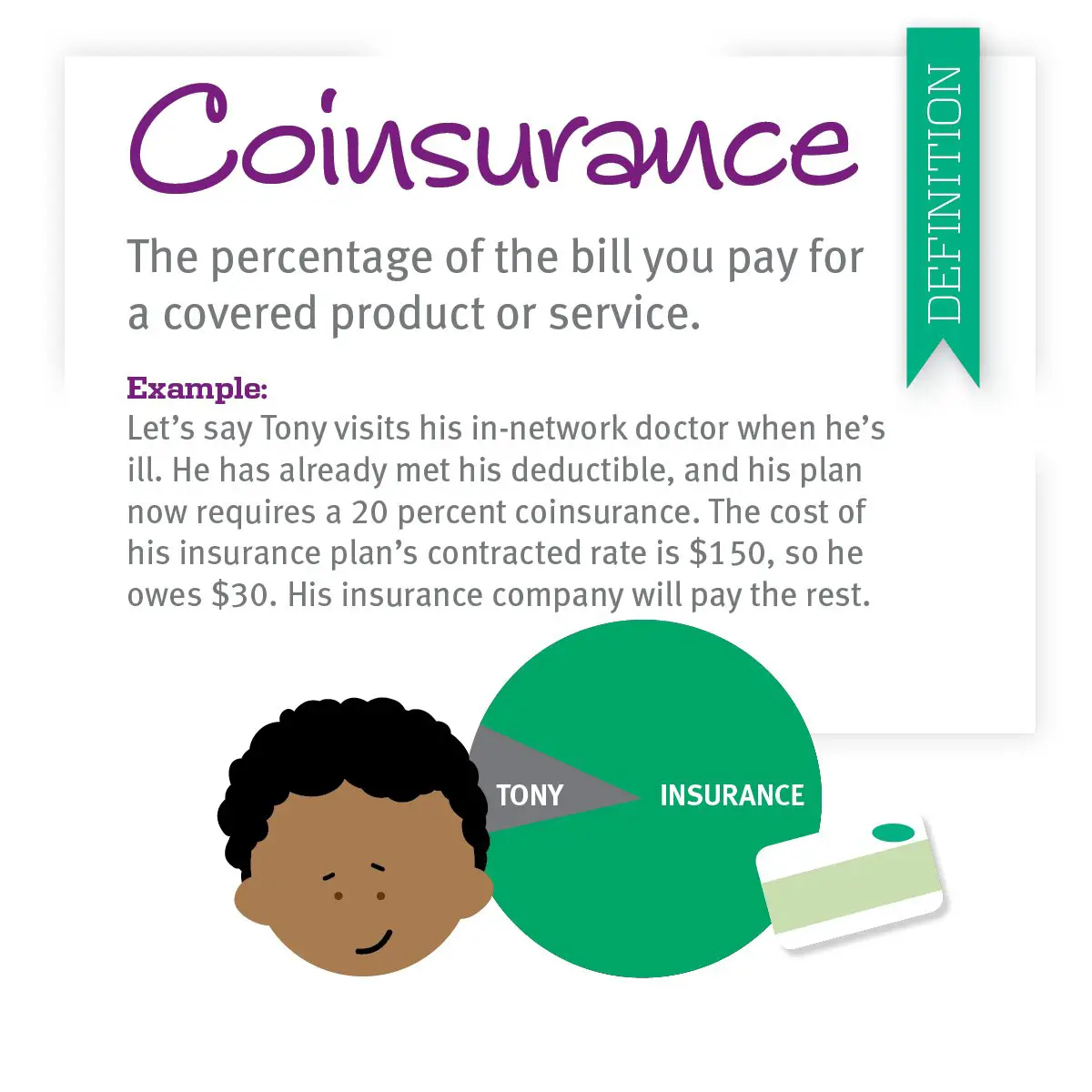

Coinsurance is the percentage of medical expenses that you owe after you have paid your deductible. For example, if your coinsurance is 20%, you would owe that percentage of your plans allowed amount for a specific medical service after your deductible is paid.

If you receive $100 worth of services during a visit and you have 20% coinsurance, you would owe $20. Health insurance picks up the rest.

The amount you owe in coinsurance cant exceed your plans out-of-pocket maximum in a given year.

Whats The Difference Between Coinsurance And Copays

Coinsurance and copays are two different ways insurance companies pass on service costs to you. Generally speaking, a copay is a flat rate you pay at the time of service for care, and it applies immediately. Coinsurance usually begins after you have met your deductible.

To explain, heres an example:

When you visit the doctor, you pay a flat rate called a copay. For example, while a primary care visit may cost $180, you only pay your copay amount for the visit. If your copay for a primary care visit is $20, you pay $20 instead of the $180.

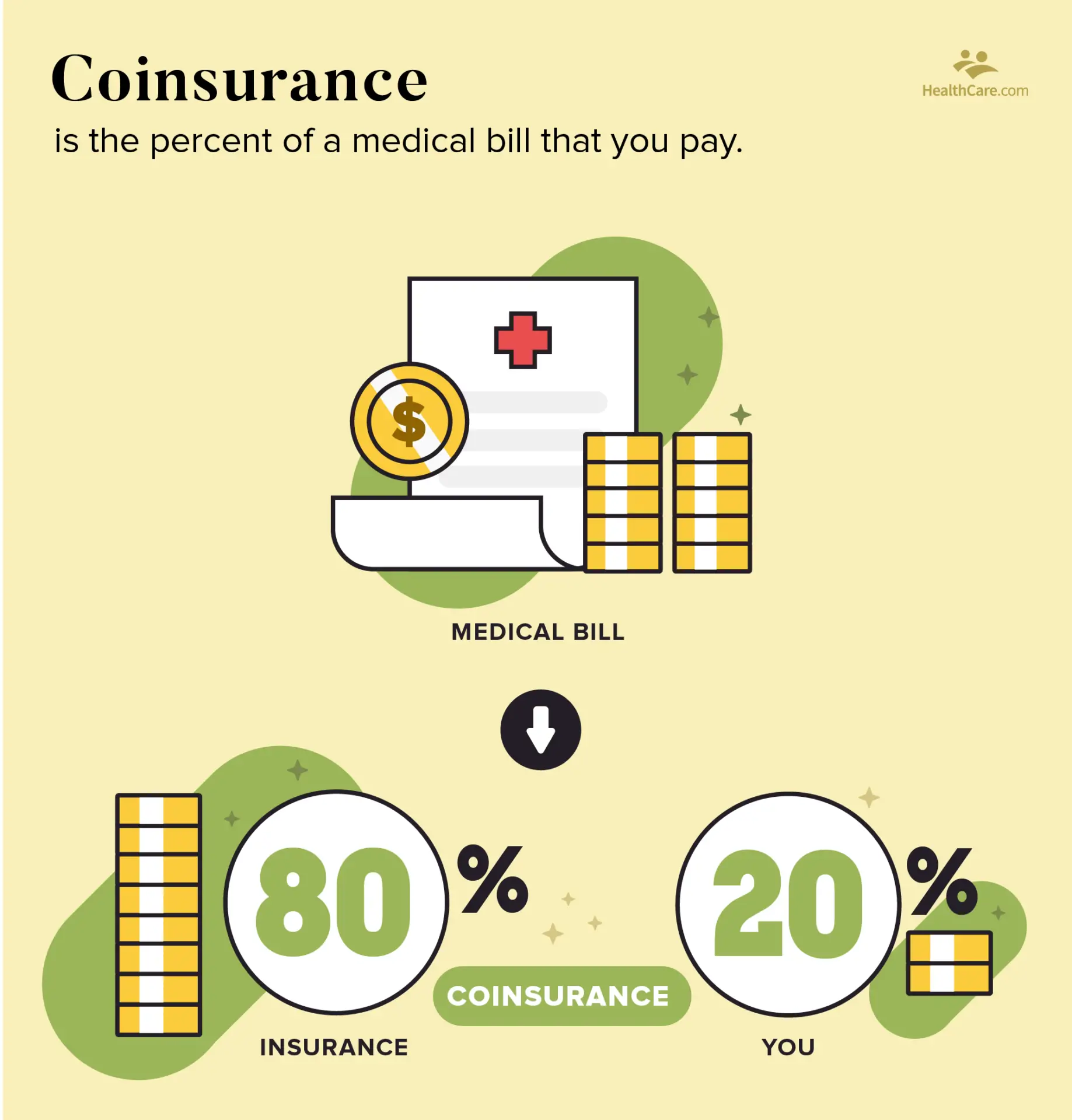

Coinsurance is a percentage split in the cost between you and your insurance company. This takes effect after youve met your deductible. For example, if your deductible is $1,000, you pay 100% of your costs until you reach $1,000. After you reach $1,000, you may only be responsible for 20% of your costs . This means, after your deductible, you pay 20% and insurance pays 80%.

To explain, lets use an easy example. If you have a $20 copay and 80/20 coinsurance for a doctor visit that costs $180:

- Your copay would be $20

- Your coinsurance would be $180 before your deductible is met, and $36 after your deductible is met

Are you eligible for cost-saving Medicare subsidies?

Recommended Reading: Starbucks Insurance For Part Time Employees

Coinsurance Is The Coverage For Benefits

Coinsurance is the agreed percentage of a covered cost that the insurer and the policyholder must pay. Coinsurance is the agreed insurance coverage called for in the plan, such as 80 percent of medical services costs.

The consumer must first reach the deductible threshold or minimum to get these benefits from the policy. Coinsurance varies with whether the patient uses network resources.

What Does Coinsurance Mean

In the simplest terms, coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year. With coinsurance, youre splitting the cost of medical services with your health insurance until you reach your out-of-pocket maximum.

In the simplest terms, coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year.

When you look at your policy, youll see your coinsurance shown as a fractionsomething like 80/20 or 70/30. Most folks are used to having a standard 80/20 coinsurance policy, which means youre responsible for 20% of your medical expenses, and your health insurance will handle the remaining 80%. This is your coinsurance after you reach your deductible.

Now, its important to remember that your coinsurance ratio directly affects your monthly premium. Heres how it works: health plans with higher coinsurance usually have lower monthly premiums. Thats because youre taking on more risk. So youll find that most health plans with 70/30 coinsurance have lower premiums than an 80/20 plan.

So, if youre mostly healthy and have a good emergency fund in place, it might be a good idea to look for a health plan with higher coinsurance.

Also Check: Can You Add A Boyfriend To Your Health Insurance

Want To Know More About Your Insurance Plan And Save Money

Make a habit of calling your insurance company before every medical appointment. Let them know what service youre having, who will be providing it, and where youre having it done.

The phone number is usually on the health insurance ID card that you carry in your wallet. You can also look on your written policy or on their website.

Do you know someone who is looking for health coverage? Maybe theyve gotten a new job or relocated. Send this page to them.

Which Health Insurance Plans Have Copays

Many health insurance plans have copayments. Theres a good chance that your plan is among them.

Copayments most often pop up in managed care plans, such as HMOs. Insurers that offer these plans negotiate fixed fees for essential health care services with health care providers. Because these fees are fixed, its easier for the insurer to forecast actual costs and to zero in on a copay that works.

Other types of plans such as PPO plans also may have copays.

Fristoe says many people have gotten used to paying a copay. But choosing a health insurance plan based solely on copays isnt always in the consumers best interest. This is especially true for people who rarely use health care services.

It doesnt make sense to pay an extra $50 a month in premiums so you can have a $20 copay when you go to the doctors office, Fristoe says.

Some people who dont need many health care services may benefit from a plan with higher deductibles and lower premiums.

There are certain things that arent appropriate to try to transfer to a health insurance contract, and that may include two or three simple office visits per year, Fristoe says. Buy insurance for the reason it was meant to be purchased, and thats for the catastrophic health care event that is going to be multiples of thousands of dollars.

Recommended Reading: Kroger Associate Discounts

Whats The Difference Between Coinsurance And A Copay

One more term many people confuse with coinsurance is the copay. The copay is a predetermined amount you owe each time you have a specific service.

For example, if your insurance requires a $40 copay when you see your primary care physician and a $50 copay when you see a specialist, youd pay those amounts each time you see the doctor.

A copay doesnt count toward your deductible its a separate cost. You pay them every time you go to the doctor even if youve met your deductible.

Some plans have a co-pay and coinsurance amount for the same services. For example, you may have a $40 copay to see the doctor plus 80/20 coverage.

Finding And Calculating Your Coinsurance

Youll need two things to calculate your coinsurance payment for a specific medical visit.

The more complex that a medical procedure is, the less likely you are to know an estimated bill before going in. Hospitals should be able to give you price estimates, but final prices will be determined by a billing department over weeks or months. This is especially true for inpatient care or emergency room treatment.

Some medical conditions will come with a mix of copayments, coinsurance, and even free preventive care. Coinsurance is still a good way to estimate your full costs in these situations, since larger bills tend to be paid with coinsurance.

Your health insurance plan can tell you whether a procedure will be subject to coinsurance or a fixed copayment.

Don’t Miss: Starbucks Benefits Package

The Costs Concepts In Health Insurance

When trying to determine the costs of healthcare, it is not enough to consider the monthly premium. The true costs of the insurance include the amounts that the consumer must pay.

Copays and coinsurance are usually a big part of the expenses. Out-of-pocket costs for medical services and some other expenses count toward the deductible amount required in the plan. The deductible is important because it turns on the insurance payments.

Coinsurance And Actuarial Value

How do you measure the true worth of a health insurance plan? You can look at copays, coinsurance, deductibles, out-of-pocket maximums, and so forth. But how does it all add up?

The answer is in the actuarial value. Actuarial value is a way of measuring a plans overall value to the consumer. The higher the actuarial value, the more generous the plan.

While coinsurance is a fixed percentage of post-deductible expenses, actuarial value is a calculation of the coverage level of a plan after all benefitscoinsurance, copayments, deductibles, and out-of-pocket maximumshave been applied.

Also Check: Burger King Health Insurance

What Is Coinsurance In Health Insurance

by Shannon Kennedy | Aug 30, 2021 | Uncategorized

Many people wonder what is coinsurance in health insurance and how does it work? Is it the same as a deductible and who has to pay it?

We know it can seem confusing all the terms you hear with health insurance, but when you break it down, its easy to understand and choose the right insurance for you and your family.

Coinsurance Vs Copays: Whats The Difference

Youve probably also heard the term copay thrown around while youre shopping for health insurance during open enrollment.

Like coinsurance, copays are just another way health plans split medical costs between you and your health insurer. But there are some differences.

Instead of paying a percentage of your medical expenses, copays are a flat fee for health services like doctors visits, prescription medications and trips to the emergency room. Your health insurance plan sets those copay fees for different types of health services.

Lets say you get sick, take a trip to your doctors office, and the cost of the visit is $150. If you have a $50 copay for doctors visits, thats how much youll payand your health insurance pays for the other $100. With an 80/20 coinsurance plan, youd pay $30 for the visit . In this case, coinsurance is better.

But then, two weeks later, you need to go to the emergency room and, this time, you get hit with a $2,000 price tag. With a $250 copay for emergency room visits, thats how much youll owe. With 20% coinsurance, your share of the cost is $400. In this case, copay is better.

So, which is better overall: Coinsurance or copays? It really all depends on a number of different factorsincluding your familys overall health needs, how much the premiums cost, and how much you anticipate spending on medical care in any given year.

Read Also: Starbucks Insurance Plan

You Pay Based On The Discounted Rate Not The Billed Rate

Most health plans negotiate discounts from the healthcare providers in their provider network. Both your deductible and your coinsurance are calculated based on the discounted rate, not on the retail rate that the medical provider bills.

For example, lets say the retail rate for an MRI scan at your local imaging center is $800. Your health plan negotiates a discounted rate of $600. When you get an MRI, if you havent yet met your deductible, you pay $600 for the MRI. That $600 is credited toward your yearly deductible. If youve met your deductible already but owe a coinsurance of 20%, you owe $120 . The other $200 gets written off by the imaging center, and doesn’t figure into the amount you owe or the amount you still have left to pay towards your out-of-pocket maximum.

This is why it’s important to wait to pay your medical bills until after they’ve been sent to your insurer for processing .

Your insurer will process the bill and determine how much should be written off, how much should be paid by youtowards your deductible or as your coinsurance portionand how much, if any, should be paid by the insurer. This information will be sent to the medical provider and to you, in the explanation of benefits. You should then receive a bill from the medical provider based on the insurer’s calculations.

How To Calculate Coinsurance Payments

With a copay, it’s easy to know how much you can expect to pay for a certain type of service or treatment. But because coinsurance is a percentage of the service, it can be harder to predict your out-of-pocket costs.

The first thing you should do when trying to determine your coinsurance payment is to find out your plans coinsurance rate for the service needed.

Some plans offer the same rate for all services. But other plans come with different coinsurance rates for different services. For example, you might be asked to pay 20% for a visit to your primary care physician, 30% for a specialist, 40% for an emergency room visit, and 15% for medication.

Next, find out if your coinsurance rates vary based on whether you visit a physician inside or outside of a preferred network. Some plans, such as PPOs, may allow you to see an out-of-network provider, but may charge higher coinsurance rates.

Finally, calculate your coinsurance rate by first converting the percentage to a decimal. A 20% coinsurance would be .20 and 35% would be .35. The calculation then looks like this:

Coinsurance rate x total cost of the bill = your required payment

So, if your coinsurance rate is 20% and the total cost of your doctor visit is $150, your required coinsurance payment would be $30 .

You May Like: Does Medical Insurance Cover Chiropractic

Whats The Difference Between Coinsurance And A Copay Which One Is Better

While coinsurance is the amount of the session or appointment bill that you pay for, a copay is a set rate that you pay to access services. A copay might look like paying $25 each time you see your therapist. It is possible to have both a copay and owe coinsurance – check your Summary and Benefits to see if this is the case for you.

How Does Health Insurance Work

Whether you secure health insurance from your employers group plan or you get it from the Marketplace yourself, it works the same.

Youll pay a premium for the insurance. This is the monthly cost you must pay to have coverage. If you miss your premiums, you dont have coverage.

Besides the premiums, youll have a deductible, copays, and coinsurance. The deductible is the amount you pay first before insurance covers anything and your copay is what you pay for health care service outside of your deductible.

But what is coinsurance in health insurance? Its something most people dont understand but that plays an important role in your choice of health insurance.

Recommended Reading: Does Costco Offer Health Insurance For Members

How Does Coinsurance Work

If your doctor visit costs $100 and youve met your deductible, your coinsurance payment of 20% would be $20 out of pocket. Your insurance would then pay the rest of the allowed amount . Keep in mind, your coinsurance benefit doesnt apply until after youve reached your deductible. Until then, youll need to pay 100% of the cost.

Choosing A Health Insurance Plan Based On Costs

When deciding on a health plan, you want to review all costs. Dont just look at copays. Youll want to also take into account a plans deductibles, coinsurance and out-of-pocket maximum.

Also, think about how much health care youll likely need over the next year. Some questions to ask yourself:

- Do you have a health issue that requires regular doctor visits?

- Do you need surgery over the next year?

- Do you have children or dependents who may need health care?

- Do you have a child on the way?

Answering the questions will help you compare health plans. All of those situations increase your out-of-pocket costs and will play a factor in choosing a health plan.

Youll want to run the numbers — copays, deductibles and out-of-pocket costs. Once you do that, you can see if it would be better to go with higher premiums or higher out-of-pocket costs.

Also Check: What Insurance Does Starbucks Offer